Notícias do Mercado

-

23:27

Currencies. Daily history for Dec 4’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2378 +0,56%

GBP/USD $1,5671 -0,09%

USD/CHF Chf0,9712 -0,64%

USD/JPY Y119,77 -0,01%

EUR/JPY Y148,26 +0,54%

GBP/JPY Y187,7 -0,09%

AUD/USD $0,8382 -0,25%

NZD/USD $0,7781 +0,30%

USD/CAD C$1,1384 +0,18%

-

23:00

Schedule for today, Friday, Dec 5’2014:

(time / country / index / period / previous value / forecast)

05:00 Japan Leading Economic Index October 105.6

05:00 Japan Coincident Index October 109.8

07:00 Germany Factory Orders s.a. (MoM) October +0.8% +0.6%

07:00 Germany Factory Orders n.s.a. (YoY) October -1.0%

08:00 Switzerland Foreign Currency Reserves November 460.4

09:30 United Kingdom Consumer Inflation Expectations November +2.8%

10:00 Eurozone GDP (QoQ) (Revised) Quarter III +0.2% +0.2%

10:00 Eurozone GDP (YoY) (Revised) Quarter III +0.8% +0.8%

13:30 Canada Trade balance, billions October 0.7 0.4

13:30 Canada Employment November 43.1 5.3

13:30 Canada Unemployment rate November 6.5% 6.6%

13:30 U.S. International Trade, bln October -43.0 -41.2

13:30 U.S. Average hourly earnings November +0.1% +0.2%

13:30 U.S. Nonfarm Payrolls November 214 225

13:30 U.S. Unemployment Rate November 5.8% 5.8%

13:45 U.S. FOMC Member Mester Speaks

15:00 U.S. Factory Orders October -0.6% -0.2%

19:45 U.S. FED Vice Chairman Stanley Fischer Speaks

20:00 U.S. Consumer Credit October 15.9 16.5

-

22:31

Australia: AiG Performance of Construction Index, November 45.4

-

16:42

Foreign exchange market. American session: the euro rose against the U.S. dollar after the European Central Bank's press conference

The U.S. dollar traded lower against the most major currencies after the number of initial jobless claims from the U.S. The number of initial jobless claims in the week ending November 29 in the U.S. fell by 17,000 to 297,000 from 314,000 in the previous week, in line with expectations. The previous week's figure was revised to 314,000 from 313.000.

The euro rose against the U.S. dollar after the European Central Bank's (ECB) press conference. The ECB President Mario Draghi said at a press conference on Thursday that the central bank will decide early next year whether to add further stimulus measures to boost inflation in the Eurozone.

Draghi pointed out that the central bank had discussed various options of quantitative easing (QE).

The central bank kept its interest rate unchanged at 0.05%.

The ECB cut its inflation and growth forecasts. Inflation forecast for the Eurozone was lowered to 0.5% in 2014 from the previous estimate of 0.6%, to 0.7% in 2015 from the previous estimate 1.1% and to 1.3% in 2016 from the previous estimate 1.4%.

The ECB also cut its economic growth forecast for the Eurozone. The growth was lowered to 0.8% 2014 the previous estimate of 0.9%, to 1.0% in 2015 from the previous estimate of 1.6% and to 1.5% in 2016 from the previous estimate of 1.9%.

The British pound traded higher against the U.S. dollar. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Halifax house price index for the U.K. rose 0.4% in November, after a 0.4% decline in October.

On a yearly basis, the Halifax house price index for the U.K. climbed 8.2% in November, after a 8.8% rise in October.

The Canadian dollar traded lower against the U.S. dollar despite the better-than-expected Canadian Ivey purchasing managers' index. Canada's seasonally adjusted Ivey purchasing managers' index rose 56.9 in November from 51.2 in October. Analysts had expected the index to increase to 53.2.

The New Zealand dollar increased against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded lower against the greenback due to stronger U.S. currency.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie fell to 4-year lows against the greenback despite the better-than-expected economic data from Australia. Retail sales in Australia rose 0.4% in October, exceeding expectations for a 0.1% increase, after a 1.3% gain in September. September's figure was revised up from a 1.2% rise.

Australia's trade deficit narrowed to A$1.32 billion in October from A$2.24 billion in September. September's figure was revised up from a deficit of A$2.26 billion. Analysts had expected the trade deficit to decline to A$1.81 billion.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports from Japan.

-

15:48

Canada’s Ivey purchasing managers’ index rose 56.9 in November

Canada's seasonally adjusted Ivey purchasing managers' index rose 56.9 in November from 51.2 in October. Analysts had expected the index to increase to 53.2.

A reading above 50 indicates a rise in the pace of activity.

-

15:23

European Central Bank President Mario Draghi: the ECB will decide on further stimulus measures early next year

The European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday that the central bank will decide early next year whether to add further stimulus measures to boost inflation in the Eurozone. He added that the ECB could adjust the size, pace and composition of the current stimulus measures if needed.

Draghi pointed out that the central bank had discussed various options of quantitative easing (QE). QE could be implemented without the unanimous support of ECB's governing council, Draghi said.

The ECB president also said that the central bank has discussed purchasing all assets with the exception of gold.

-

15:00

Canada: Ivey Purchasing Managers Index, November 56.9 (forecast 53.2)

-

14:58

European Central Bank cut its inflation and growth forecasts

The European Central Bank (ECB) released its new economic forecast figures on Thursday. Inflation forecast for the Eurozone was lowered to 0.5% in 2014 from the previous estimate of 0.6%, to 0.7% in 2015 from the previous estimate 1.1% and to 1.3% in 2016 from the previous estimate 1.4%.

The ECB also cut its economic growth forecast for the Eurozone. The growth was lowered to 0.8% 2014 the previous estimate of 0.9%, to 1.0% in 2015 from the previous estimate of 1.6% and to 1.5% in 2016 from the previous estimate of 1.9%.

The ECB warned that new inflation forecasts did not take into account the recent decline in oil prices.

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2265(E639mn), $1.2300(E477mn), $1.2350(E950mn), $1.2400($E1.9bn), $1.2450(E2.0bn)

USD/JPY: Y119.00($1.0bn), Y119.75($350mn), Y120.00($3.0bn)

EUR/JPY: Y146.75(E450mn), Y148.50(E350mn)

AUD/USD: $0.8400(A$275mn)

USD/CAD: Cad1.1365($670mn), Cad1.1400($1.36bn)

USD/CHF: Chf0.9640($210mn), Chf0.9900($381mn)

EUR/CHF: Chf1.2030/40(E560mn)

NZD/USD: $0.7725(NZ$525mn)

-

13:30

U.S.: Initial Jobless Claims, November 297 (forecast 297)

-

13:15

Bank of England kept its monetary policy unchanged

The Bank of England (BoE) released its interest rate decision today. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will delay its interest rate hike until the second half of 2015 because of low inflation, weak wages growth in the U.K. and a slowdown of the economic growth in the Eurozone.

Investors are awaiting the minutes of the monetary policy committee (MPC). The minutes of the meeting will be released on December 17.

Two MPC members voted in November for the fourth consecutive month to raise interest rates to 0.75% from 0.5%.

-

13:00

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar ahead the European Central Bank's press conference

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail sales (MoM) October +1.3% Revised From +1.2% +0.1% +0.4%

00:30 Australia Retail Sales Y/Y October +5.7% +5.7%

00:30 Australia Trade Balance October -2.24 Revised From -2.26 -1.81 -1.32

08:00 United Kingdom Halifax house price index November -0.4% +0.4%

08:00 United Kingdom Halifax house price index 3m Y/Y November +8.8% +8.2%

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims from the U.S. The number of initial jobless claims in the U.S. is expected to decline by 16,000 to 297,000.

The euro traded mixed against the U.S. dollar ahead the European Central Bank's (ECB) press conference. Investors speculate that the ECB' President Mario Draghi's will announce further stimulus measures to boost the economy and inflation in the Eurozone. Inflation in the Eurozone declined to an annual rate of 0.3% in November.

The ECB released its interest decision today. The central bank kept its interest rate unchanged at 0.05%.

The British pound traded slightly lower against the U.S. dollar after the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Halifax house price index for the U.K. rose 0.4% in November, after a 0.4% decline in October.

On a yearly basis, the Halifax house price index for the U.K. climbed 8.2% in November, after a 8.8% rise in October.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian Ivey purchasing managers' index. The index is expected to increase to 53.2 in November from 51.2 in October.

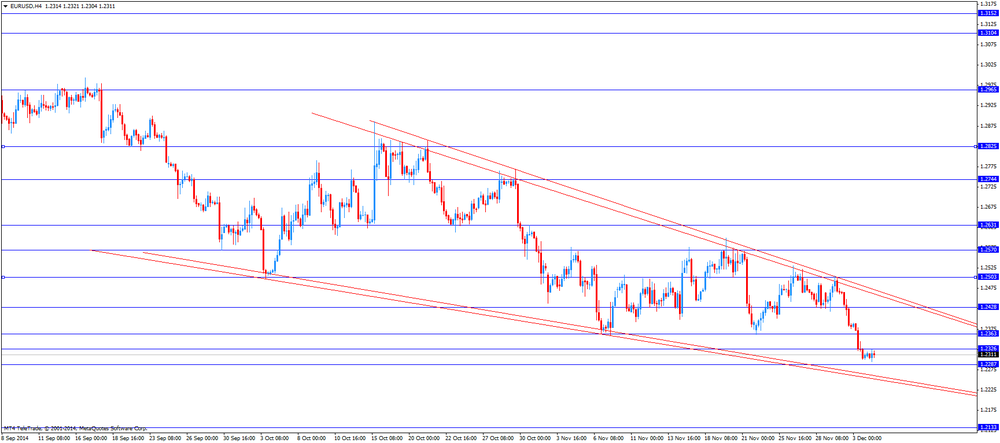

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5659

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Eurozone ECB Press Conference

13:30 U.S. Initial Jobless Claims November 313 297

13:30 U.S. FOMC Member Mester Speaks

15:00 Canada Ivey Purchasing Managers Index November 51.2 53.2

17:30 U.S. FOMC Member Brainard Speaks

-

12:45

Eurozone: ECB Interest Rate Decision, 0.05% (forecast 0.05%)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

12:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

10:32

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2265(E639mn), $1.2300(E477mn), $1.2350(E950mn), $1.2400($E1.9bn), $1.2450(E2.0bn)

USD/JPY: Y119.00($1.0bn), Y119.75($350mn), Y120.00($3.0bn)

EUR/JPY: Y146.75(E450mn), Y148.50(E350mn)

AUD/USD: $0.8400(A$275mn)

USD/CAD: Cad1.1365($670mn), Cad1.1400($1.36bn)

USD/CHF: Chf0.9640($210mn), Chf0.9900($381mn)

EUR/CHF: Chf1.2030/40(E560mn)

NZD/USD: $0.7725(NZ$525mn)

-

09:20

Press Review: Fed's Fischer says government bond buys by ECB would have positive effects

REUTERS

Fed's Fischer says government bond buys by ECB would have positive effects: La Repubblica

(Reuters) - The European Central Bank should follow the example of the U.S. Federal Reserve and buy government bonds to prop up the tottering euro zone economy, the Fed's vice chair Stanley Fischer was quoted as saying in an Italian newspaper.

"The same arguments in favor of quantitative easing (bond purchases) that demonstrated their effectiveness for the U.S. economy are valid for Europe too. If the ECB moves in that direction, it will have positive effects," Fischer told La Repubblica daily in an interview.

Source: http://www.reuters.com/article/2014/12/04/us-fed-fischer-ecb-idUSKCN0JI0I820141204

REUTERS

Euro zone risks return to contraction, China outlook smoggy

(Reuters) - The euro zone economy may face another contraction after business activity grew less than expected in November, although more upbeat data in Asia and the United States suggested global growth should remain intact in the final quarter.

Firms across the euro zone cut prices again, which may be a topic of concern for the European Central Bank at a policy meeting on Thursday.

However, China's services sector picked up some pace in November and JPMorgan's Global All-Industry Output Index, produced with Markit, held above the 50 mark dividing growth from contraction.

Source: http://www.reuters.com/article/2014/12/04/us-global-economy-idUSKCN0JI00B20141204

BLOOMBERG

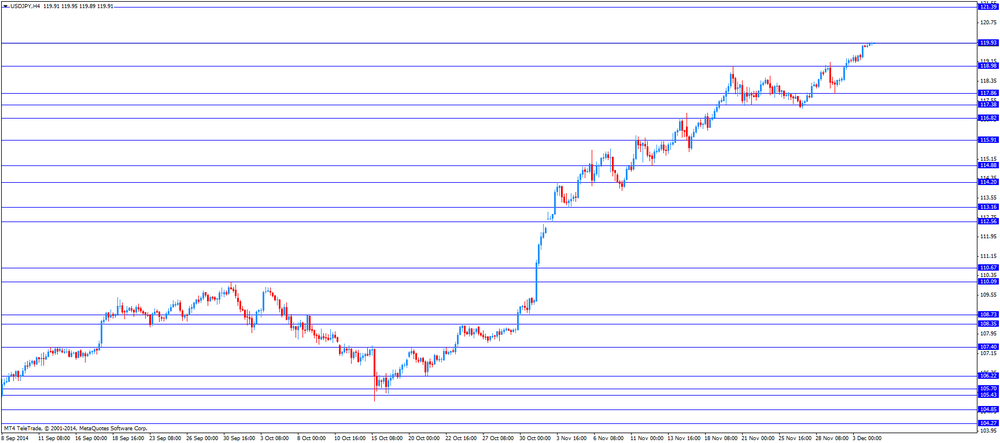

Yen's Drop Seen Bounded by Government Rhetoric as Vote Looms

The yen's slide to much beyond 120 per dollar will have to wait until after the Dec. 14 general election -- at least if the Japanese government has its say.

Officials are likely to continue verbal intervention to prevent excessive yen declines, according to Nomura Holdings Inc. strategist Yunosuke Ikeda, after the currency tumbled from about 109 per dollar in late October to a seven-year low of 119.95 today. Finance Minister Taro Aso warned on Nov. 21 that the yen was falling too fast, as it raced to its biggest monthly drop since the start of 2013, spurred by an unexpected expansion of Bank of Japan stimulus on Oct. 31.

-

08:05

United Kingdom: Halifax house price index, November +0.4%

-

08:05

United Kingdom: Halifax house price index 3m Y/Y, November +8.82%

-

07:30

Foreign exchange market. Asian session: the greenback traded stronger against its Asian and European counterparts

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Retail sales (MoM) October +1.3% [Revised From +1.2%] +0.1% +0.4%

00:30 Australia Retail Sales Y/Y October +5.7% +5.7%

00:30 Australia Trade Balance October -2.24 [Revised From -2.26] -1.81 -1.32

The greenback traded stronger against its Asian and European counterparts after the upbeat ISM Service sector data stoking hopes that economic growth in the wold's largest economy will further pick up pace. The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index rose to 59.3 in November from 57.5 in October, beating expectations for a decline to 57.1. The FED's beige book showed job gains across the U.S. Market participants are awaiting Initial Jobless Claims being due at 13:30 GMT followed by speeches of FOMC member Mester and Brainard.

The Australian dollar traded weaker against the greenback and extended its four-year low after Goldman Sachs Australia Chief Economist Tim Toohey predicted it will slide to 83 U.S. cents in three months and 79 U.S. cents in the next year. Positive data on Retail Sales, reading +0.4% in October beating forecasts by +0.3% and a less negative trade balance for the same month, showing a deficit of AUD1.3 billion, lower than the AUD1.81 billion expected and below the AUD2.3 billion deficit in September, were no real support.

The New Zealand dollar further weakened against the U.S. dollar falling near a three-week low after yesterday's decline in milk prices. At the Fonterra Cooperative Group Ltd. auction prices fell to USD2,229 per metric ton, less than half the early February price of USD5,005.

The Japanese yen fell for a third consecutive day against the U.S. dollar trading at new seven-year lows at USD119.88, the weakest since August 2007 three days after Moody's downgraded Japan's sovereign debt rating. Polls for the upcoming election on December 14th show that Prime Minister Abe will be able to boost his majority and will be able to continue his Abenomics - a policy that led to a hefty decline in Japan's currency.

EUR/USD: the euro declined against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded lower against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 United Kingdom Halifax house price index November -0.4%

08:00 United Kingdom Halifax house price index 3m Y/Y November +8.8%

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Initial Jobless Claims November 313 297

13:30 U.S. FOMC Member Mester Speaks

15:00 Canada Ivey Purchasing Managers Index November 51.2 53.2

17:30 U.S. FOMC Member Brainard Speaks

22:30 Australia AiG Performance of Construction Index November 53.4

-

06:28

Options levels on thursday, December 4, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2429 (3674)

$1.2372 (684)

$1.2338 (136)

Price at time of writing this review: $ 1.2303

Support levels (open interest**, contracts):

$1.2282 (7010)

$1.2264 (5807)

$1.2239 (6244)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 120479 contracts, with the maximum number of contracts with strike price $1,2800 (6272);

- Overall open interest on the PUT options with the expiration date December, 5 is 112671 contracts, with the maximum number of contracts with strike price $1,2250 (7394);

- The ratio of PUT/CALL was 0.94 versus 1.01 from the previous trading day according to data from December, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.5900 (1367)

$1.5801 (1120)

$1.5704 (1874)

Price at time of writing this review: $1.5681

Support levels (open interest**, contracts):

$1.5598 (2741)

$1.5499 (815)

$1.5400 (980)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 43280 contracts, with the maximum number of contracts with strike price $1,5850 (2002);

- Overall open interest on the PUT options with the expiration date December, 5 is 41405 contracts, with the maximum number of contracts with strike price $1,5600 (2741);

- The ratio of PUT/CALL was 0.96 versus 0.98 from the previous trading day according to data from December, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:31

Australia: Trade Balance , October -1.32 (forecast -1.81)

-

00:30

Australia: Retail sales (MoM), October +0.4% (forecast +0.1%)

-

00:00

Currencies. Daily history for Dec 3’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2309 -0,59%

GBP/USD $1,5685 +0,32%

USD/CHF Chf0,9774 +0,56%

USD/JPY Y119,78 +0,48%

EUR/JPY Y147,46 -0,10%

GBP/JPY Y187,86 +0,79%

AUD/USD $0,8403 -0,48%

NZD/USD $0,7758 -0,58%

USD/CAD C$1,1363 -0,37%

-