Notícias do Mercado

-

23:00

Schedule for today, Thursday, Dec 4’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Retail sales (MoM) October +1.2% +0.1%

00:30 Australia Retail Sales Y/Y October +5.7%

00:30 Australia Trade Balance October -2.26 -1.81

08:00 United Kingdom Halifax house price index November -0.4%

08:00 United Kingdom Halifax house price index 3m Y/Y November +8.8%

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Initial Jobless Claims November 313 297

13:30 U.S. FOMC Member Mester Speaks

15:00 Canada Ivey Purchasing Managers Index November 51.2 53.2

17:30 U.S. FOMC Member Brainard Speaks

22:30 Australia AiG Performance of Construction Index November 53.4

-

16:37

Foreign exchange market. American session: the Canadian dollar increased against the U.S. dollar after the Bank of Canada's interest rate decision

The U.S. dollar traded mixed against the most major currencies after the mixed economic data from the U.S. Private sector in the U.S. added 208,000 jobs in November, according the ADP report on Wednesday. October's figure was revised up to 233,000 jobs from a previous reading of 230,000 jobs. Analysts expected the private sector to add 223,000 jobs.

The Institute for Supply Management's non-manufacturing purchasing managers' index for the U.S. rose to 59.3 in November from 57.5 in October, beating expectations for a decline to 57.1.

The euro declined against the U.S. dollar. Eurozone' final services purchasing managers' index (PMI) fell to 51.1 in November from a preliminary reading of 51.3. Analysts had expected the final index to remain at 51.3.

Germany's final services PMI remained unchanged at 51.1 in November, in line with expectations.

France's final services PMI fell to 47.9 in November from a preliminary reading of 48.3. Analysts had expected the final index to remain at 48.3.

Retail sales in the Eurozone rose 0.4% in October, missing expectations for a 0.6% increase, after a 1.2% drop in September. September's figure was revised up from a 1.3% decline.

On a yearly basis, retail sales in the Eurozone surged 1.4% in October, exceeding expectations for a 0.9% gain, after a 0.5% increase in September. September's figure was revised down from a 0.6% rise.

The British pound rose against the U.S. dollar. The U.K. services PMI increased to 58.6 in November from 56.2 in October, exceeding expectations for a rise to 56.6.

The UK's Autumn Statement was released on Wednesday. The UK's gross domestic product forecast was raised to 3% in 2014 from 2.7% in March.

The Canadian dollar increased against the U.S. dollar after the Bank of Canada's interest rate decision. The Bank of Canada kept its interest rate unchanged at 1.00%. This decision was expected by analysts.

Canada's central bank said that the nation's economy "is showing signs of a broadening recovery".

The BoC Governor Stephen Poloz is expected to comment on the decision at 22:30 (GMT0).

The Swiss franc traded lower against the U.S. dollar after the Swiss gross domestic product (GDP). Switzerland's GDP rose 0.6% in the third quarter, beating expectations for a 0.3% increase, after a 0.3% gain in the second quarter. The second quarter's figure was revised up from a 0.2% gain.

On a yearly basis, Switzerland's economy grew at 1.9% in the third quarter, missing expectations for a 1.4% rise, after a 1.6% increase in the second quarter. The second quarter's figure was revised up from a 1.4% rise.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded slightly lower against the greenback due to stronger U.S. currency.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie dropped against the greenback after the release of Australia's GDP. Australia's GDP climbed 0.3% in the third quarter, missing expectations for a 0.7% gain, after a 0.5% rise in the second quarter.

On a yearly basis, Australia's GDP rose 2.7% in the third quarter, missing forecasts of 3.1% increase, after a 2.7% gain in the second quarter. The second quarter's figure was revised down from a 3.1% rise.

The Japanese yen declined against the U.S. dollar in the absence of any major economic reports from Japan.

-

15:58

ISM non-manufacturing purchasing managers’ index rose to 59.3 in November

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index rose to 59.3 in November from 57.5 in October, beating expectations for a decline to 57.1.

The ISM's new orders index climbed to 61.4 in November from 59.1 in October.

The ISM's business activity/production index increased to 64.4 in November from 60.0 October.

The ISM's employment index fell to 56.7 in November from 59.6 in October.

-

15:37

Bank of Canada kept its interest rate unchanged at 1.00%, the economy “is showing signs of a broadening recovery”

The Bank of Canada (BoC) announced its interest rate decision today. The BoC kept its interest rate unchanged at 1.00%. This decision was expected by analysts.

Canada's central bank said that the nation's economy "is showing signs of a broadening recovery". "Stronger exports are beginning to be reflected in increased business investment and employment", the BoC said.

Lower oil and certain other commodity prices will weigh on the economy in Canada, the BoC pointed out.

The BoC noted that inflation "has risen by more than expected" but remains below 2%. The central bank added that falling oil prices are a downside risk to inflation.

Canada's central bank pointed out that the current monetary policy "is appropriate".

The BoC Governor Stephen Poloz is expected to comment on the decision at 22:30 (GMT0).

-

15:30

U.S.: Crude Oil Inventories, November -3.7

-

15:04

Switzerland's GDP rose 0.6% in the third quarter

Switzerland's State Secretariat for Economics (SECO) released gross domestic product (GDP) figures on Wednesday. Switzerland's GDP rose 0.6% in the third quarter, beating expectations for a 0.3% increase, after a 0.3% gain in the second quarter. The second quarter's figure was revised up from a 0.2% gain.

The increase was driven by private consumption and exports of chemical and pharmaceutical products. Private consumption rose 0.6% in the third quarter, while exports climbed 4.7%.

On a yearly basis, Switzerland's economy grew at 1.9% in the third quarter, missing expectations for a 1.4% rise, after a 1.6% increase in the second quarter. The second quarter's figure was revised up from a 1.4% rise.

-

15:00

U.S.: ISM Non-Manufacturing, November 59.3 (forecast 57.1)

-

15:00

Canada: Bank of Canada Rate, 1.00% (forecast 1.00%)

-

14:53

Autumn Statement: UK’s economy is expected to grow 3% in 2014

The U.K. Chancellor George Osborne said in his Autumn Statement on Wednesday that the gross domestic product (GDP) forecast was raised to 3% in 2014 from 2.7% in March. The U.K. economy is expected to grow at 2.4% in 2015, so Osborne.

Unemployment in the U.K. is expected to fall to 5.4% in 2015, according Autumn Statement.

Inflation is expected to 1.5% in 2014 and 1.2% in 2015.

The Autumn Statement is a report containing future tax and spending plans, and the state of the UK's finances.

-

14:45

U.S.: Services PMI, November 56.2 (forecast 56.3)

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2375(E501mn), $1.2400(E393mn), $1.2430(E567mn), $1.2450(E325mn), $1.2500(E924mn)

USD/JPY: Y118.00($900mn), Y118.30($1.4bn), Y119.00($340mn), Y119.50/60($500mn)

USD/CAD: Cad1.1290($610mn), Cad1.1375($1.53bn)

USD/CHF: Chf0.9600($1.0bn)

EUR/GBP: stg0.7820, stg0.7850

EUR/CHF: Chf1.2025(E450mn)

NZD/USD: $0.7700(NZ$700mn), $0.7800(NZ$711mn), $0.8000(NZ$1.5bn)

-

13:37

ADP report: private sector added 208,000 jobs in November

Private sector in the U.S. added 208,000 jobs in November, according the ADP report on Wednesday.

October's figure was revised up to 233,000 jobs from a previous reading of 230,000 jobs.

Analysts expected the private sector to add 223,000 jobs.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate will remain unchanged at 5.8% in November. The U.S. economy is expected to add 225,000 jobs in November.

-

13:15

U.S.: ADP Employment Report, November 208 (forecast 223)

-

13:00

Foreign exchange market. European session: the euro fell against the U.S. dollar the mostly weaker-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Gross Domestic Product (YoY) Quarter III +3.1% +3.1% +2.7%

00:30 Australia Gross Domestic Product (QoQ) Quarter III +0.5% +0.7% +0.3%

01:00 China Non-Manufacturing PMI November 53.8 53.9

01:45 China HSBC Services PMI November 52.9 53.0

06:45 Switzerland Gross Domestic Product (YoY) Quarter III +1.6% Revised From +1.4% +1.4% +0.6%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III +0.3% Revised From 0.2% +0.3% +1.9%

08:48 France Services PMI (Finally) November 48.3 48.3 47.9

08:53 Germany Services PMI (Finally) November 52.1 52.1 52.1

08:58 Eurozone Services PMI (Finally) November 51.3 51.3 51.1

09:30 United Kingdom Purchasing Manager Index Services November 56.2 56.6 58.6

10:00 Eurozone Retail Sales (YoY) October +0.5% Revised From +0.6% +0.9% +1.4%

10:00 Eurozone Retail Sales (MoM) October -1.2% Revised From -1.3% +0.6% +0.4%

12:30 United Kingdom Autumn Forecast Statement

The U.S. dollar traded mixed against the most major currencies ahead of the economic data from the U.S. The U.S. economy is expected to add 223,000 jobs in November, according to the ADP employment report.

The ISM non-manufacturing purchasing managers' index is expected to decline to 57.1 in November from 57.5 in October.

The euro fell against the U.S. dollar the mostly weaker-than-expected economic data from the Eurozone. Eurozone' final services purchasing managers' index (PMI) fell to 51.1 in November from a preliminary reading of 51.3. Analysts had expected the final index to remain at 51.3.

Germany's final services PMI remained unchanged at 51.1 in November, in line with expectations.

France's final services PMI fell to 47.9 in November from a preliminary reading of 48.3. Analysts had expected the final index to remain at 48.3.

Retail sales in the Eurozone rose 0.4% in October, missing expectations for a 0.6% increase, after a 1.2% drop in September. September's figure was revised up from a 1.3% decline.

On a yearly basis, retail sales in the Eurozone surged 1.4% in October, exceeding expectations for a 0.9% gain, after a 0.5% increase in September. September's figure was revised down from a 0.6% rise.

The British pound traded higher against the U.S. dollar after the better-than-expected services purchasing managers' index (PMI) from the U.K. The U.K. services PMI increased to 58.6 in November from 56.2 in October, exceeding expectations for a rise to 56.6.

The UK's Autumn Statement was released on Wednesday. The UK's gross domestic product forecast was raised to 3% in 2014 from 2.7% in March.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Bank of Canada's interest rate decision. Analysts expect that the Bank of Canada will keep unchanged its interest rate at 1.00%.

The Swiss franc traded lower against the U.S. dollar after the Swiss gross domestic product (GDP). Switzerland's GDP rose 0.6% in the third quarter, beating expectations for a 0.3% increase, after a 0.3% gain in the second quarter. The second quarter's figure was revised up from a 0.2% gain.

On a yearly basis, Switzerland's economy grew at 1.9% in the third quarter, missing expectations for a 1.4% rise, after a 1.6% increase in the second quarter. The second quarter's figure was revised up from a 1.4% rise.

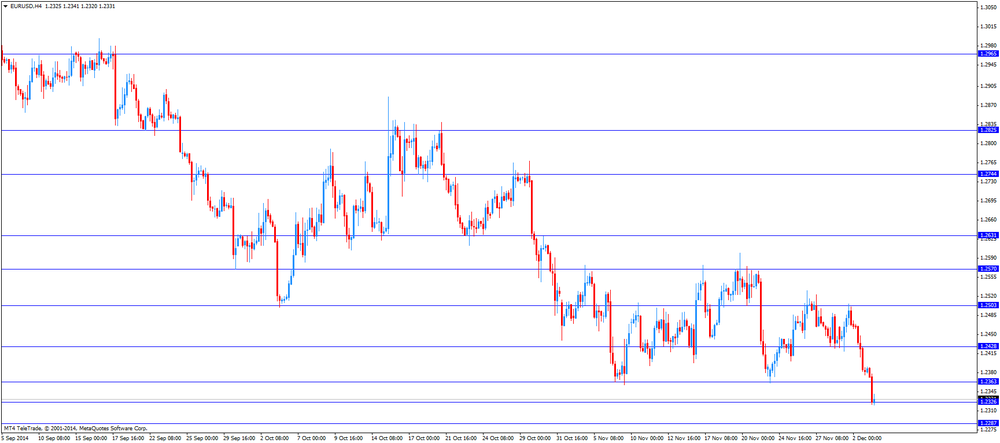

EUR/USD: the currency pair fell to $1.2320

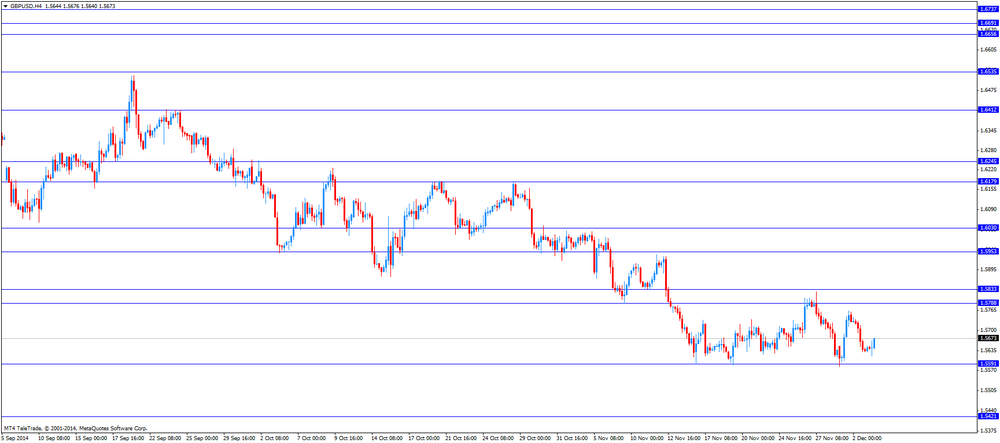

GBP/USD: the currency pair increased to $1.5676

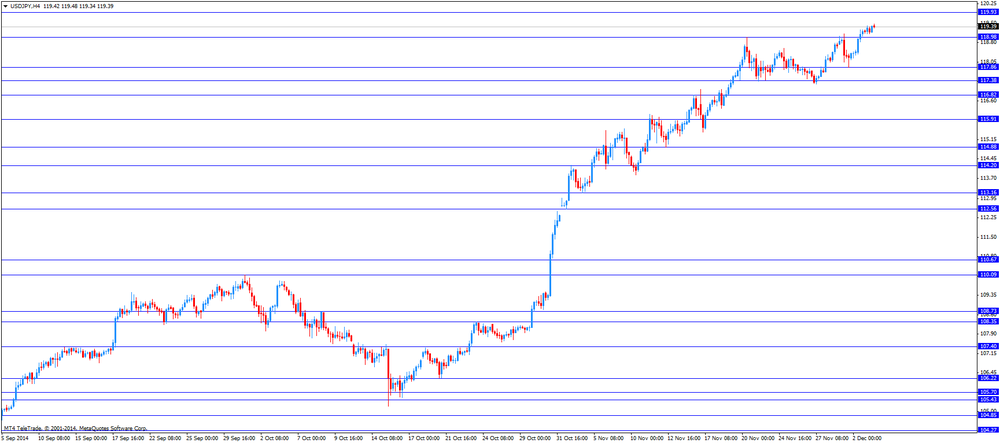

USD/JPY: the currency pair rose to Y119.48

The most important news that are expected (GMT0):

13:15 U.S. ADP Employment Report November 230 223

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter III +2.0% +2.2%

15:00 Canada Bank of Canada Rate 1.00% 1.00%

15:00 Canada BOC Rate Statement

15:00 U.S. ISM Non-Manufacturing November 57.5 57.1

17:30 U.S. FOMC Member Charles Plosser Speaks

19:00 U.S. Fed's Beige Book

19:00 U.S. FOMC Member Brainard Speaks

22:30 Canada BOC Gov Stephen Poloz Speaks

-

12:48

Orders

EUR/USD

Offers $1.2450, $1.2410, $1.2400, $1.2355/60

Bids $1.2320, $1.2300, $1.2250, $1.2225, $1.2200

GBP/USD

Offers $1.5780/00, $1.5750, $1.5700

Bids $1.5610/00, $1.5550, $1.5520, $1.5500

AUD/USD

Offers $0.8580/00, $0.8540/50, $0.8500, $0.8450

Bids $0.8380, $0.8350, $0.8300, $0.8250

EUR/JPY

Offers Y148.50, Y148.00, Y147.60/65

Bids Y147.00, Y146.50, Y146.20/00

USD/JPY

Offers Y120.50, Y120.00, Y119.50

Bids Y119.00, Y118.70/60, Y118.50, Y118.25/20, Y118.00

EUR/GBP

Offers stg0.8000, stg0.7980, stg0.7950, stg0.7900

Bids stg0.7860/50, stg0.7820, stg0.7750

-

10:19

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2375(E501mn), $1.2400(E393mn), $1.2430(E567mn), $1.2450(E325mn), $1.2500(E924mn)

USD/JPY: Y118.00($900mn), Y118.30($1.4bn), Y119.00($340mn), Y119.50/60($500mn)

USD/CAD: Cad1.1290($610mn), Cad1.1375($1.53bn)

USD/CHF: Chf0.9600($1.0bn)

EUR/GBP: stg0.7820, stg0.7850

EUR/CHF: Chf1.2025(E450mn)

NZD/USD: $0.7700(NZ$700mn), $0.7800(NZ$711mn), $0.8000(NZ$1.5bn)

-

10:00

Eurozone: Retail Sales (MoM), October +0.4% (forecast +0.6%)

-

10:00

Eurozone: Retail Sales (YoY), October +1.4% (forecast +0.9%)

-

10:00

EUR/USD: Euro trading at 27 month-low against the greenback, British pound steady

Today the euro traded at its weakest since late August 2012 one day before the ECB's policy makers meeting in Frankfurt, where new stimulus measures could be announced by the ECB. France's Services PMI published today declined to 47.9, 0.4 below forecasts whereas Eurozone's Services PMI declined to 51.1, 0.2 weaker than predicted by analysts. Eurozone's Retail Sales for October increased by 0.4%, 0.2% below forecasts whereas Retail Sales on a yearly basis increased 1.4%. Analysts' forecasts predicted a growth of 0.9%.

The British pound is trading slightly stronger after upbeat data on the Purchasing Manager Index on Services. The index rose from 56.2 last month to 58.6 in November beating forecasts of 56.6.

EUR/USD

GBP/USD

-

09:31

United Kingdom: Purchasing Manager Index Services, November 58.6 (forecast 56.6)

-

09:20

Press Review: Ruble Slides as Russia Slowdown Signs Fuel Worst Rout Since 1998

BLOOMBERG

Ruble Slides as Russia Slowdown Signs Fuel Worst Rout Since 1998

The ruble extended its worst rout in 16 years as a slump in Russian business activity showed the economic slowdown is worsening, undermining central bank attempts to shore up the currency.

The ruble sank 1.7 percent to 54.78 versus the dollar by 11:01 a.m. in Moscow, after touching a record-low for a fifth straight day. The currency has fallen 18 percent in the past seven days, the most since October 1998. The Bank of Russia said today it sold $700 million on Dec. 1, its first intervention since moving to a free float almost a month ago.

REUTERS

Euro hits 27-month low vs. strong dollar on ECB easing bets

(Reuters) - The euro slid to a 27-month trough against a buoyant dollar on Wednesday, a day ahead of a crucial European Central Bank meeting that could pave the way for more easing measures in the euro zone.

The greenback also hit a seven-year peak against the yen, boosted by comments from U.S. Federal Reserve officials who painted an upbeat picture of the U.S. economy despite falling oil prices, prompting a ramping up of expectations of a mid-2015 interest rate rise.

Source: http://www.reuters.com/article/2014/12/03/us-markets-forex-idUSKCN0JG15720141203

REUTERS

Exclusive: New U.S. oil and gas well November permits tumble nearly 40 percent

(Reuters) - Plunging oil prices sparked a drop of almost 40 percent in new well permits issued across the United States in November, in a sudden pause in the growth of the U.S. shale oil and gas boom that started around 2007.

Data provided exclusively to Reuters on Tuesday by industry data firm Drilling Info Inc showed 4,520 new well permits were approved last month, down from 7,227 in October.

Source: http://www.reuters.com/article/2014/12/03/us-usa-oil-permits-idUSKCN0JG2C120141203

-

09:00

Eurozone: Services PMI, November 51.1 (forecast 51.3)

-

08:55

Germany: Services PMI, November 52.1 (forecast 52.1)

-

08:50

France: Services PMI, November 47.9 (forecast 48.3)

-

07:30

Foreign exchange market. Asian session: the greenback traded broadly stronger against its major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Gross Domestic Product (YoY) Quarter III +3.1% +3.1% +2.7%

00:30 Australia Gross Domestic Product (QoQ) Quarter III +0.5% +0.7% +0.3%

01:00 China Non-Manufacturing PMI November 53.8 53.9

01:45 China HSBC Services PMI November 52.9 53

06:45 Switzerland Gross Domestic Product (YoY) Quarter III +0.6% +1.4% +0.6%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III 0.0% +0.3% +1.9%

The U.S. dollar traded stronger against its major peers after construction data beat forecasts. Yesterday The Federal Reserve Vice Chairman Stanley Fischer said at a forum in Washington on Tuesday that the Fed could delay its interest rate hike if inflation declines. He added that interest rate hike would be driven by the economic data and that low oil prices are a boon to the U.S. economy. The Federal Reserve Chair Janet Yellen said nothing about current economic situation and monetary policy on Tuesday. Markets are awaiting the ADP Employment Report, Nonfarm Productivity, the ISM Non-Manufacturing Index and speeches of FOMC members later in the day.

The Australian dollar drooped against the greenback and declined to a four-year low after the country's GDP data showed an increase of +0.3% quarter on quarter well below the expected +0.7% and oil price increased. China's Non-Manufacturing PMI for November rose to 53.9 from a previous reading of 53.8 and the HSBC Services PMI added 0.1 to 53.0. China is Australia's number one trade partner. Yesterday the Royal Bank of Australia announced to keep interest rates at a record low of 2.5% to boost the economy facing a high currency and declining export prices.

The New Zealand dollar weakened against the U.S. dollar after a decline in milk prices. At the Fonterra Cooperative Group Ltd. auction prices fell to USD2,229 per metric ton, less than half the early February price of USD5,005.

The Japanese yen lost against the U.S. dollar trading at seven-year lows at USD119.43, the weakest since August 2007 two days after Moody's downgraded Japan's sovereign debt rating. The yen has been under pressure since BoJ's unexpected stimulus program from late October.

EUR/USD: the euro declined against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded unchanged against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:48 France Services PMI (Finally) November 48.3 48.3

08:53 Germany Services PMI (Finally) November 52.1 52.1

08:58 Eurozone Services PMI (Finally) November 51.3 51.3

09:30 United Kingdom Purchasing Manager Index Services November 56.2 56.6

10:00 Eurozone Retail Sales (YoY) October +0.6% +0.9%

10:00 Eurozone Retail Sales (MoM) October -1.3% +0.6%

12:30 United Kingdom Autumn Forecast Statement

13:15 U.S. ADP Employment Report November 230 223

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter III +2.0% +2.2%

14:45 U.S. Services PMI (Finally) November 56.3 56.3

15:00 Canada Bank of Canada Rate 1.00% 1.00%

15:00 Canada BOC Rate Statement

15:00 U.S. ISM Non-Manufacturing November 57.5 57.1

15:30 U.S. Crude Oil Inventories November +1.9

17:30 U.S. FOMC Member Charles Plosser Speaks

19:00 U.S. Fed's Beige Book

19:00 U.S. FOMC Member Brainard Speaks

22:30 Canada BOC Gov Stephen Poloz Speaks

-

06:45

Switzerland: Gross Domestic Product (YoY), Quarter III +0.6% (forecast +1.4%)

-

06:45

Switzerland: Gross Domestic Product (QoQ) , Quarter III +1.9% (forecast +0.3%)

-

06:27

Options levels on wednesday, December 3, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2462 (1736)

$1.2421 (252)

$1.2398 (129)

Price at time of writing this review: $ 1.2373

Support levels (open interest**, contracts):

$1.2356 (6514)

$1.2319 (7209)

$1.2292 (5405)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 113610 contracts, with the maximum number of contracts with strike price $1,2800 (6261);

- Overall open interest on the PUT options with the expiration date December, 5 is 1115209 contracts, with the maximum number of contracts with strike price $1,2000 (7756);

- The ratio of PUT/CALL was 1.01 versus 1.01 from the previous trading day according to data from December, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.5900 (1145)

$1.5801 (1037)

$1.5703 (1509)

Price at time of writing this review: $1.5644

Support levels (open interest**, contracts):

$1.5596 (2771)

$1.5498 (904)

$1.5399 (991)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 42324 contracts, with the maximum number of contracts with strike price $1,6900 (1881);

- Overall open interest on the PUT options with the expiration date December, 5 is 41597 contracts, with the maximum number of contracts with strike price $1,5600 (2771);

- The ratio of PUT/CALL was 0.98 versus 1.00 from the previous trading day according to data from December, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:45

China: HSBC Services PMI, November 53.0

-

01:00

China: Non-Manufacturing PMI, November 53.9

-

00:30

Australia: Gross Domestic Product (YoY), Quarter III +2.7% (forecast +3.1%)

-

00:30

Australia: Gross Domestic Product (QoQ), Quarter III +0.3% (forecast +0.7%)

-