Notícias do Mercado

-

23:00

Schedule for today, Thursday, Dec 4’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Retail sales (MoM) October +1.2% +0.1%

00:30 Australia Retail Sales Y/Y October +5.7%

00:30 Australia Trade Balance October -2.26 -1.81

08:00 United Kingdom Halifax house price index November -0.4%

08:00 United Kingdom Halifax house price index 3m Y/Y November +8.8%

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Initial Jobless Claims November 313 297

13:30 U.S. FOMC Member Mester Speaks

15:00 Canada Ivey Purchasing Managers Index November 51.2 53.2

17:30 U.S. FOMC Member Brainard Speaks

22:30 Australia AiG Performance of Construction Index November 53.4

-

20:00

Dow +18.94 17,898.49 +0.11% Nasdaq +17.3 4,773.11 +0.36% S&P +5.46 2,072.01 +0.26%

-

17:00

European stocks close: FTSE 100 6,716.63 -25.47 -0.38% CAC 40 4,391.86 +3.56 +0.08% DAX 9,971.79 +37.71 +0.38%

-

17:00

European stocks close: most stocks closed higher on speculation the European Central Bank will add further stimulus measures

Most stock indices closed higher on speculation the European Central Bank (ECB) will add further stimulus measures. The ECB will release its interest decision tomorrow.

Eurozone' final services purchasing managers' index (PMI) fell to 51.1 in November from a preliminary reading of 51.3. Analysts had expected the final index to remain at 51.3.

Germany's final services PMI remained unchanged at 51.1 in November, in line with expectations.

France's final services PMI fell to 47.9 in November from a preliminary reading of 48.3. Analysts had expected the final index to remain at 48.3.

Retail sales in the Eurozone rose 0.4% in October, missing expectations for a 0.6% increase, after a 1.2% drop in September. September's figure was revised up from a 1.3% decline.

On a yearly basis, retail sales in the Eurozone surged 1.4% in October, exceeding expectations for a 0.9% gain, after a 0.5% increase in September. September's figure was revised down from a 0.6% rise.

The U.K. Chancellor George Osborne said in his Autumn Statement on Wednesday that the gross domestic product (GDP) forecast was raised to 3% in 2014 from 2.7% in March. The U.K. economy is expected to grow at 2.4% in 2015, so Osborne.

Unemployment in the U.K. is expected to fall to 5.4% in 2015, according Autumn Statement.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,716.63 -25.47 -0.38%

DAX 9,971.79 +37.71 +0.38%

CAC 40 4,391.86 +3.56 +0.08%

-

16:40

Oil: A review of the market situation

Prices for crude oil West Texas Intermediate rose moderately, while closer to $ 68 per barrel, as a government report pointed to a decline in US oil inventories. Meanwhile, the price of Brent crude oil fell slightly.

US Department of Energy announced that commercial oil reserves in the week 22-28 November fell by 3.7 million barrels to 379.3 million barrels, while the average forecast of anticipated growth of 600,000 barrels. Gasoline inventories rose by 2.1 million barrels to 208.6 million barrels. Analysts had expected gasoline inventories increase compared to the previous week at 800,000 barrels. Distillate stocks rose by 3 million barrels to 116.2 million barrels, while analysts had expected a decrease of 300,000 barrels.

Utilization rate of refining capacity increased by 1.9 percentage points to 93.4%. Analysts expected an increase of 0.4%. We also learned that the oil terminal in Cushing decreased by 0,694,000. Barrels - up to 23.885 million. Barrels

Recall yesterday's data from the Institute API reported a drop of oil reserves by 6.5 million. Barrels (per week to 28 November). Also, it was reported that gasoline inventories in the US have remained unchanged, while distillate inventories rose by 2.5 million. Barrels.

The course of trading and continues to influence the recent decision by OPEC. "The market is still trying to get back on their feet after the OPEC meeting last week. It seems there is some short-term support in the mark of 70-72 dollars per barrel mark Brent. But, in general, the market is still suffering from the uncertainty, "- said analyst Danske Bank A / S Jens Pedersen.

Worth to emphasize that in recent days, the market is characterized by sharp ups and downs in prices. "The instability of the market due to the fact that investors are trying to predict future events," - said the chief investment officer of Ayers Alliance Securities Jonathan Barrett. According to him, prices are close to the lower limit, because Russia can take some measures to stabilize them. Technical analysts believe that the fall in prices continue and the price of WTI crude oil could fall to $ 50 per barrel.

Cost of January futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 67.74 dollars per barrel on the New York Mercantile Exchange.

January futures price for North Sea Brent crude oil mix fell $ 0.41, to $ 70.64 a barrel on the London Stock Exchange ICE Futures Europe.

-

16:37

Foreign exchange market. American session: the Canadian dollar increased against the U.S. dollar after the Bank of Canada's interest rate decision

The U.S. dollar traded mixed against the most major currencies after the mixed economic data from the U.S. Private sector in the U.S. added 208,000 jobs in November, according the ADP report on Wednesday. October's figure was revised up to 233,000 jobs from a previous reading of 230,000 jobs. Analysts expected the private sector to add 223,000 jobs.

The Institute for Supply Management's non-manufacturing purchasing managers' index for the U.S. rose to 59.3 in November from 57.5 in October, beating expectations for a decline to 57.1.

The euro declined against the U.S. dollar. Eurozone' final services purchasing managers' index (PMI) fell to 51.1 in November from a preliminary reading of 51.3. Analysts had expected the final index to remain at 51.3.

Germany's final services PMI remained unchanged at 51.1 in November, in line with expectations.

France's final services PMI fell to 47.9 in November from a preliminary reading of 48.3. Analysts had expected the final index to remain at 48.3.

Retail sales in the Eurozone rose 0.4% in October, missing expectations for a 0.6% increase, after a 1.2% drop in September. September's figure was revised up from a 1.3% decline.

On a yearly basis, retail sales in the Eurozone surged 1.4% in October, exceeding expectations for a 0.9% gain, after a 0.5% increase in September. September's figure was revised down from a 0.6% rise.

The British pound rose against the U.S. dollar. The U.K. services PMI increased to 58.6 in November from 56.2 in October, exceeding expectations for a rise to 56.6.

The UK's Autumn Statement was released on Wednesday. The UK's gross domestic product forecast was raised to 3% in 2014 from 2.7% in March.

The Canadian dollar increased against the U.S. dollar after the Bank of Canada's interest rate decision. The Bank of Canada kept its interest rate unchanged at 1.00%. This decision was expected by analysts.

Canada's central bank said that the nation's economy "is showing signs of a broadening recovery".

The BoC Governor Stephen Poloz is expected to comment on the decision at 22:30 (GMT0).

The Swiss franc traded lower against the U.S. dollar after the Swiss gross domestic product (GDP). Switzerland's GDP rose 0.6% in the third quarter, beating expectations for a 0.3% increase, after a 0.3% gain in the second quarter. The second quarter's figure was revised up from a 0.2% gain.

On a yearly basis, Switzerland's economy grew at 1.9% in the third quarter, missing expectations for a 1.4% rise, after a 1.6% increase in the second quarter. The second quarter's figure was revised up from a 1.4% rise.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded slightly lower against the greenback due to stronger U.S. currency.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie dropped against the greenback after the release of Australia's GDP. Australia's GDP climbed 0.3% in the third quarter, missing expectations for a 0.7% gain, after a 0.5% rise in the second quarter.

On a yearly basis, Australia's GDP rose 2.7% in the third quarter, missing forecasts of 3.1% increase, after a 2.7% gain in the second quarter. The second quarter's figure was revised down from a 3.1% rise.

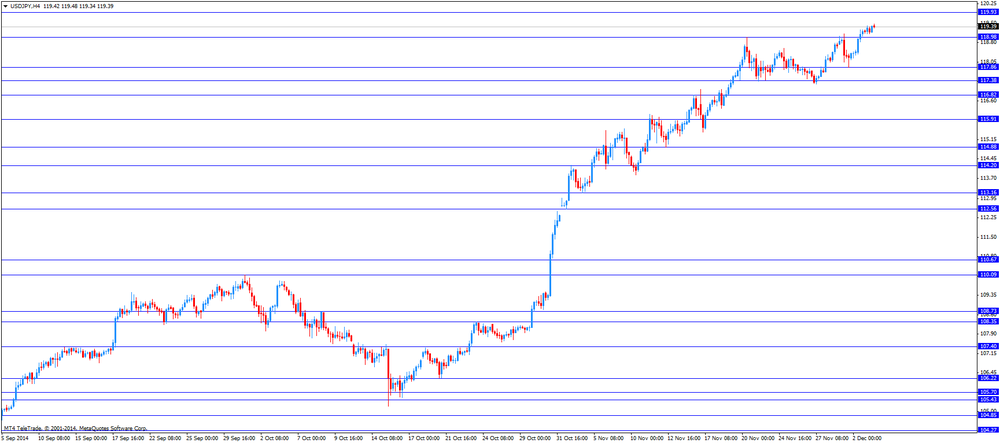

The Japanese yen declined against the U.S. dollar in the absence of any major economic reports from Japan.

-

16:20

Gold: A review of the market situation

Gold prices rose today, while a foothold above $ 1,200 an ounce, as the firmer oil prices led investors to seek more volatile products. Meanwhile, a further rise in prices is constrained by the strengthening of the US currency (US dollar index, which tracks the greenback against a basket of six major currencies, traded at 88.90, the highest since March 2009). A stronger dollar usually puts pressure on gold, as it reduces the metal's appeal as an alternative asset and raises the price dollar products for holders of other currencies.

Positive impact on the stock of the American labor market data, which were worse than expected. As it became known, private sector employment increased by 208,000 jobs in October and November. Expected to increase to 223 thousand. We also add that the figure for October was revised up to 233 thousand. To 230 thousand. Among producers employment increased by 32,000 jobs in November, compared with 46,000 jobs in October. The construction industry added 17,000 jobs during the month, well below the growth in the past month by 27 000. Meanwhile, the productive sector added 11,000 jobs in November, which is slightly less than the October 13 000. Employment in the services sector grew by 176,000 jobs in November compared with 187,000 in October.

Also today it was announced that the world's largest reserves of the gold-Fund ETF SPDR Gold Trust on Tuesday rose by 2.4 tons, but still close to six-year low.

"We expect that the pressure on the price of gold to continue in the first half of next year amid increasing rumors of the impending increase in US interest rates," - the report says Commerzbank. The bank forecasts that gold will fall in price up to $ 1,125 in the second quarter of 2015, but by the end of the year the price will rise to $ 1,250.

"The main factors for gold in the medium and long term, will the US economic recovery and the expected rise in interest rates next year, which should reduce investor demand for precious metals," - said an analyst at Julius Baer Carsten Menke.

Cost of January futures for gold on the COMEX today rose $ 5.14 to 1213.70 dollars per ounce.

-

15:58

ISM non-manufacturing purchasing managers’ index rose to 59.3 in November

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index rose to 59.3 in November from 57.5 in October, beating expectations for a decline to 57.1.

The ISM's new orders index climbed to 61.4 in November from 59.1 in October.

The ISM's business activity/production index increased to 64.4 in November from 60.0 October.

The ISM's employment index fell to 56.7 in November from 59.6 in October.

-

15:37

Bank of Canada kept its interest rate unchanged at 1.00%, the economy “is showing signs of a broadening recovery”

The Bank of Canada (BoC) announced its interest rate decision today. The BoC kept its interest rate unchanged at 1.00%. This decision was expected by analysts.

Canada's central bank said that the nation's economy "is showing signs of a broadening recovery". "Stronger exports are beginning to be reflected in increased business investment and employment", the BoC said.

Lower oil and certain other commodity prices will weigh on the economy in Canada, the BoC pointed out.

The BoC noted that inflation "has risen by more than expected" but remains below 2%. The central bank added that falling oil prices are a downside risk to inflation.

Canada's central bank pointed out that the current monetary policy "is appropriate".

The BoC Governor Stephen Poloz is expected to comment on the decision at 22:30 (GMT0).

-

15:30

U.S.: Crude Oil Inventories, November -3.7

-

15:04

Switzerland's GDP rose 0.6% in the third quarter

Switzerland's State Secretariat for Economics (SECO) released gross domestic product (GDP) figures on Wednesday. Switzerland's GDP rose 0.6% in the third quarter, beating expectations for a 0.3% increase, after a 0.3% gain in the second quarter. The second quarter's figure was revised up from a 0.2% gain.

The increase was driven by private consumption and exports of chemical and pharmaceutical products. Private consumption rose 0.6% in the third quarter, while exports climbed 4.7%.

On a yearly basis, Switzerland's economy grew at 1.9% in the third quarter, missing expectations for a 1.4% rise, after a 1.6% increase in the second quarter. The second quarter's figure was revised up from a 1.4% rise.

-

15:00

U.S.: ISM Non-Manufacturing, November 59.3 (forecast 57.1)

-

15:00

Canada: Bank of Canada Rate, 1.00% (forecast 1.00%)

-

14:53

Autumn Statement: UK’s economy is expected to grow 3% in 2014

The U.K. Chancellor George Osborne said in his Autumn Statement on Wednesday that the gross domestic product (GDP) forecast was raised to 3% in 2014 from 2.7% in March. The U.K. economy is expected to grow at 2.4% in 2015, so Osborne.

Unemployment in the U.K. is expected to fall to 5.4% in 2015, according Autumn Statement.

Inflation is expected to 1.5% in 2014 and 1.2% in 2015.

The Autumn Statement is a report containing future tax and spending plans, and the state of the UK's finances.

-

14:45

U.S.: Services PMI, November 56.2 (forecast 56.3)

-

14:34

U.S. Stocks open: Dow 17,869.34 -10.21 -0.06%, Nasdaq 4,760.25 +4.44 +0.09%, S&P 2,067.95 +1.40 +0.07%

-

14:27

Before the bell: S&P futures -0.05%, Nasdaq futures -0.02%

U.S. stock-index futures were little changed as investors weighed data on private payrolls before the government's labor report on Friday.

Global markets:

Nikkei 17,720.43 +57.21 +0.32%

Hang Seng 23,428.62 -225.68 -0.95%

Shanghai Composite 2,779.74 +16.19 +0.59%

FTSE 6,723.06 -19.04 -0.28%

CAC 4,388.63 +0.33 +0.01%

DAX 9,960.51 +26.43 +0.27%

Crude oil $67.44 (+0.84%)

Gold $1203.20 (+0.32%)

-

14:15

DOW components before the bell

(company / ticker / price / change, % / volume)

Wal-Mart Stores Inc

WMT

85.93

+0.01%

4.2K

Visa

V

260.05

+0.02%

0.4K

Boeing Co

BA

132.38

+0.08%

0.8K

Intel Corp

INTC

37.64

+0.11%

8.1K

Goldman Sachs

GS

190.44

+0.13%

0.7K

Merck & Co Inc

MRK

60.89

+0.18%

0.7K

Chevron Corp

CVX

114.25

+0.20%

1K

International Business Machines Co...

IBM

163.07

+0.25%

1.4K

Exxon Mobil Corp

XOM

94.48

+0.31%

6.7K

UnitedHealth Group Inc

UNH

100.01

+0.56%

7.1K

AT&T Inc

T

34.29

0.00%

24.7K

Nike

NKE

98.04

0.00%

0.4K

Pfizer Inc

PFE

31.56

-0.03%

0.7K

American Express Co

AXP

92.96

-0.04%

0.6K

Walt Disney Co

DIS

93.43

-0.04%

6.6K

McDonald's Corp

MCD

95.06

-0.05%

0.1K

3M Co

MMM

160.50

-0.06%

0.6K

Cisco Systems Inc

CSCO

27.80

-0.07%

2.5K

General Electric Co

GE

26.03

-0.08%

15.8K

Microsoft Corp

MSFT

48.42

-0.08%

6.5K

JPMorgan Chase and Co

JPM

61.02

-0.10%

1.4K

United Technologies Corp

UTX

109.57

-0.10%

1.6K

The Coca-Cola Co

KO

44.49

-0.11%

0.6K

Johnson & Johnson

JNJ

108.36

-0.14%

0.6K

Verizon Communications Inc

VZ

49.01

-0.20%

3.0K

E. I. du Pont de Nemours and Co

DD

71.49

-0.28%

0.6K

-

14:12

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

UnitedHealth (UNH) target raised to $108 from $94 at Oppenheimer and to $110 from $95 at Stifel

Apple (AAPL) target raised to $150 from $135 at JMP Securities

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2375(E501mn), $1.2400(E393mn), $1.2430(E567mn), $1.2450(E325mn), $1.2500(E924mn)

USD/JPY: Y118.00($900mn), Y118.30($1.4bn), Y119.00($340mn), Y119.50/60($500mn)

USD/CAD: Cad1.1290($610mn), Cad1.1375($1.53bn)

USD/CHF: Chf0.9600($1.0bn)

EUR/GBP: stg0.7820, stg0.7850

EUR/CHF: Chf1.2025(E450mn)

NZD/USD: $0.7700(NZ$700mn), $0.7800(NZ$711mn), $0.8000(NZ$1.5bn)

-

13:37

ADP report: private sector added 208,000 jobs in November

Private sector in the U.S. added 208,000 jobs in November, according the ADP report on Wednesday.

October's figure was revised up to 233,000 jobs from a previous reading of 230,000 jobs.

Analysts expected the private sector to add 223,000 jobs.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate will remain unchanged at 5.8% in November. The U.S. economy is expected to add 225,000 jobs in November.

-

13:15

U.S.: ADP Employment Report, November 208 (forecast 223)

-

13:00

Foreign exchange market. European session: the euro fell against the U.S. dollar the mostly weaker-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Gross Domestic Product (YoY) Quarter III +3.1% +3.1% +2.7%

00:30 Australia Gross Domestic Product (QoQ) Quarter III +0.5% +0.7% +0.3%

01:00 China Non-Manufacturing PMI November 53.8 53.9

01:45 China HSBC Services PMI November 52.9 53.0

06:45 Switzerland Gross Domestic Product (YoY) Quarter III +1.6% Revised From +1.4% +1.4% +0.6%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III +0.3% Revised From 0.2% +0.3% +1.9%

08:48 France Services PMI (Finally) November 48.3 48.3 47.9

08:53 Germany Services PMI (Finally) November 52.1 52.1 52.1

08:58 Eurozone Services PMI (Finally) November 51.3 51.3 51.1

09:30 United Kingdom Purchasing Manager Index Services November 56.2 56.6 58.6

10:00 Eurozone Retail Sales (YoY) October +0.5% Revised From +0.6% +0.9% +1.4%

10:00 Eurozone Retail Sales (MoM) October -1.2% Revised From -1.3% +0.6% +0.4%

12:30 United Kingdom Autumn Forecast Statement

The U.S. dollar traded mixed against the most major currencies ahead of the economic data from the U.S. The U.S. economy is expected to add 223,000 jobs in November, according to the ADP employment report.

The ISM non-manufacturing purchasing managers' index is expected to decline to 57.1 in November from 57.5 in October.

The euro fell against the U.S. dollar the mostly weaker-than-expected economic data from the Eurozone. Eurozone' final services purchasing managers' index (PMI) fell to 51.1 in November from a preliminary reading of 51.3. Analysts had expected the final index to remain at 51.3.

Germany's final services PMI remained unchanged at 51.1 in November, in line with expectations.

France's final services PMI fell to 47.9 in November from a preliminary reading of 48.3. Analysts had expected the final index to remain at 48.3.

Retail sales in the Eurozone rose 0.4% in October, missing expectations for a 0.6% increase, after a 1.2% drop in September. September's figure was revised up from a 1.3% decline.

On a yearly basis, retail sales in the Eurozone surged 1.4% in October, exceeding expectations for a 0.9% gain, after a 0.5% increase in September. September's figure was revised down from a 0.6% rise.

The British pound traded higher against the U.S. dollar after the better-than-expected services purchasing managers' index (PMI) from the U.K. The U.K. services PMI increased to 58.6 in November from 56.2 in October, exceeding expectations for a rise to 56.6.

The UK's Autumn Statement was released on Wednesday. The UK's gross domestic product forecast was raised to 3% in 2014 from 2.7% in March.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Bank of Canada's interest rate decision. Analysts expect that the Bank of Canada will keep unchanged its interest rate at 1.00%.

The Swiss franc traded lower against the U.S. dollar after the Swiss gross domestic product (GDP). Switzerland's GDP rose 0.6% in the third quarter, beating expectations for a 0.3% increase, after a 0.3% gain in the second quarter. The second quarter's figure was revised up from a 0.2% gain.

On a yearly basis, Switzerland's economy grew at 1.9% in the third quarter, missing expectations for a 1.4% rise, after a 1.6% increase in the second quarter. The second quarter's figure was revised up from a 1.4% rise.

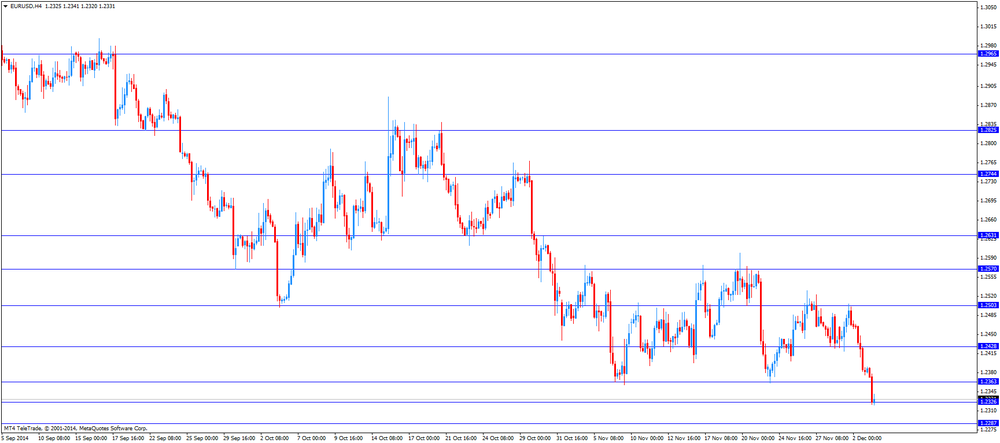

EUR/USD: the currency pair fell to $1.2320

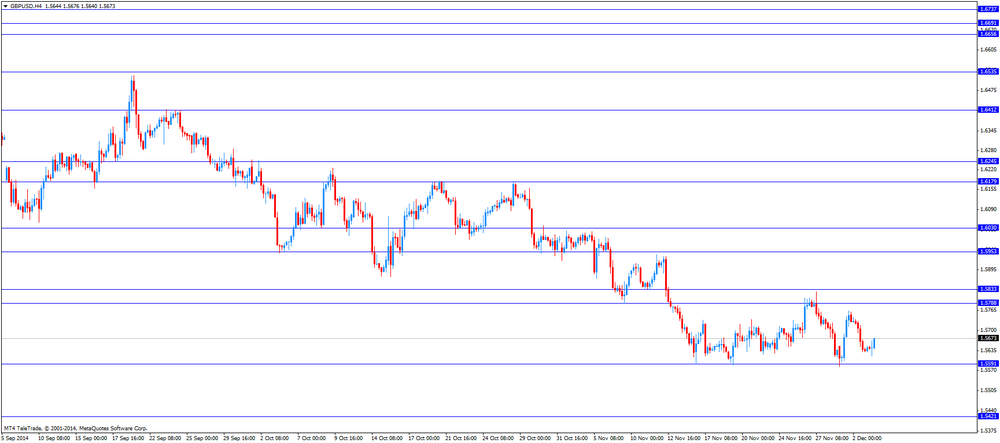

GBP/USD: the currency pair increased to $1.5676

USD/JPY: the currency pair rose to Y119.48

The most important news that are expected (GMT0):

13:15 U.S. ADP Employment Report November 230 223

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter III +2.0% +2.2%

15:00 Canada Bank of Canada Rate 1.00% 1.00%

15:00 Canada BOC Rate Statement

15:00 U.S. ISM Non-Manufacturing November 57.5 57.1

17:30 U.S. FOMC Member Charles Plosser Speaks

19:00 U.S. Fed's Beige Book

19:00 U.S. FOMC Member Brainard Speaks

22:30 Canada BOC Gov Stephen Poloz Speaks

-

12:48

Orders

EUR/USD

Offers $1.2450, $1.2410, $1.2400, $1.2355/60

Bids $1.2320, $1.2300, $1.2250, $1.2225, $1.2200

GBP/USD

Offers $1.5780/00, $1.5750, $1.5700

Bids $1.5610/00, $1.5550, $1.5520, $1.5500

AUD/USD

Offers $0.8580/00, $0.8540/50, $0.8500, $0.8450

Bids $0.8380, $0.8350, $0.8300, $0.8250

EUR/JPY

Offers Y148.50, Y148.00, Y147.60/65

Bids Y147.00, Y146.50, Y146.20/00

USD/JPY

Offers Y120.50, Y120.00, Y119.50

Bids Y119.00, Y118.70/60, Y118.50, Y118.25/20, Y118.00

EUR/GBP

Offers stg0.8000, stg0.7980, stg0.7950, stg0.7900

Bids stg0.7860/50, stg0.7820, stg0.7750

-

12:00

European stock markets mid-session: European indices trading mixed

European indices are trading mixed today. The FTSE 100 index lost -0.11% quoted at 6,734.67 points after upbeat data on the Purchasing Manager Index on Services. The index rose from 56.2 last month to 58.6 in November beating forecasts of 56.6. Markets await the Autumn Forecast Statement due at 12:30 GMT and tomorrow's ECB policy meeting. France's CAC 40 is slightly negative at -0.08% trading at 4,384.62 and Germany's DAX 30 gained +0.16% trading at 9,950.22 points.

France's Services PMI published today declined to 47.9, 0.4 below forecasts whereas Eurozone's Services PMI declined to 51.1, 0.2 weaker than predicted by analysts. Eurozone's Retail Sales for October increased by 0.4%, 0.2% below forecasts whereas Retail Sales on a yearly basis increased 1.4%. Analysts forecasts predicted a growth of 0.9%.

-

11:20

Oil: prices recoup losses

Oil prices recouped losses. Earlier in the week on Monday futures fell to their lowest level since 2009, as investors opened short positions in anticipation of lower prices in response to OPEC's decision last week to maintain current levels of production of 30 million barrels a day. In today's trading session Brent Crude gained +0.33% trading at USD70.77 a barrel, and WTI Crude added +0.60% currently quoted at USD67.28.

Yesterday the head of the International Energy Agency, Maria van der Hoeven said the fall in prices a serious challenge especially for companies that extract oil from unconventional sources. For example, the rapid growth of shale oil in the US, probably began to slow: according to Reuters, last month, the number of issued permits in the United States to drill new wells in shale deposits decreased by 15% compared with the previous month, according to the reduction in the number of permits issued on drilling in October.

-

11:00

Gold trading slightly above USD1,200

Gold is currently trading at USD1,208.50 a troy ounce just above the important level of USD1,200 despite a broadly stronger greenback. A stronger U.S. dollar usually weighs on gold. Investors await important U.S. data later in the session to obtain further clues on when the FED is going to raise interest rates. Gold was trading highly volatile in the last sessions along with oil prices as they are affecting inflation and the precious metal is often used as inflation-hedge.

Experts note that the prices of precious metals are likely to remain reduced and tend to decline further in the near term amid signs of strengthening US economy, which could cause the Fed to raise interest rates sooner and faster than previously predicted.

GOLD currently trading at USD1,203.80

-

10:19

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2375(E501mn), $1.2400(E393mn), $1.2430(E567mn), $1.2450(E325mn), $1.2500(E924mn)

USD/JPY: Y118.00($900mn), Y118.30($1.4bn), Y119.00($340mn), Y119.50/60($500mn)

USD/CAD: Cad1.1290($610mn), Cad1.1375($1.53bn)

USD/CHF: Chf0.9600($1.0bn)

EUR/GBP: stg0.7820, stg0.7850

EUR/CHF: Chf1.2025(E450mn)

NZD/USD: $0.7700(NZ$700mn), $0.7800(NZ$711mn), $0.8000(NZ$1.5bn)

-

10:00

Eurozone: Retail Sales (MoM), October +0.4% (forecast +0.6%)

-

10:00

Eurozone: Retail Sales (YoY), October +1.4% (forecast +0.9%)

-

10:00

EUR/USD: Euro trading at 27 month-low against the greenback, British pound steady

Today the euro traded at its weakest since late August 2012 one day before the ECB's policy makers meeting in Frankfurt, where new stimulus measures could be announced by the ECB. France's Services PMI published today declined to 47.9, 0.4 below forecasts whereas Eurozone's Services PMI declined to 51.1, 0.2 weaker than predicted by analysts. Eurozone's Retail Sales for October increased by 0.4%, 0.2% below forecasts whereas Retail Sales on a yearly basis increased 1.4%. Analysts' forecasts predicted a growth of 0.9%.

The British pound is trading slightly stronger after upbeat data on the Purchasing Manager Index on Services. The index rose from 56.2 last month to 58.6 in November beating forecasts of 56.6.

EUR/USD

GBP/USD

-

09:31

United Kingdom: Purchasing Manager Index Services, November 58.6 (forecast 56.6)

-

09:20

Press Review: Ruble Slides as Russia Slowdown Signs Fuel Worst Rout Since 1998

BLOOMBERG

Ruble Slides as Russia Slowdown Signs Fuel Worst Rout Since 1998

The ruble extended its worst rout in 16 years as a slump in Russian business activity showed the economic slowdown is worsening, undermining central bank attempts to shore up the currency.

The ruble sank 1.7 percent to 54.78 versus the dollar by 11:01 a.m. in Moscow, after touching a record-low for a fifth straight day. The currency has fallen 18 percent in the past seven days, the most since October 1998. The Bank of Russia said today it sold $700 million on Dec. 1, its first intervention since moving to a free float almost a month ago.

REUTERS

Euro hits 27-month low vs. strong dollar on ECB easing bets

(Reuters) - The euro slid to a 27-month trough against a buoyant dollar on Wednesday, a day ahead of a crucial European Central Bank meeting that could pave the way for more easing measures in the euro zone.

The greenback also hit a seven-year peak against the yen, boosted by comments from U.S. Federal Reserve officials who painted an upbeat picture of the U.S. economy despite falling oil prices, prompting a ramping up of expectations of a mid-2015 interest rate rise.

Source: http://www.reuters.com/article/2014/12/03/us-markets-forex-idUSKCN0JG15720141203

REUTERS

Exclusive: New U.S. oil and gas well November permits tumble nearly 40 percent

(Reuters) - Plunging oil prices sparked a drop of almost 40 percent in new well permits issued across the United States in November, in a sudden pause in the growth of the U.S. shale oil and gas boom that started around 2007.

Data provided exclusively to Reuters on Tuesday by industry data firm Drilling Info Inc showed 4,520 new well permits were approved last month, down from 7,227 in October.

Source: http://www.reuters.com/article/2014/12/03/us-usa-oil-permits-idUSKCN0JG2C120141203

-

09:00

Eurozone: Services PMI, November 51.1 (forecast 51.3)

-

09:00

European Stocks. First hour: European indices trading near openings

European stocks are trading higher early in today's session amid bets that the next ECB policy meeting, scheduled for the 4th of December in Frankfurt, might bring up new stimulus measures and move closer to a full-scale quantitative easing. European stocks remained supported after Friday's data on inflation which declined to a five year low at 0.3% in November. France's Services PMI declined to 47.9, 0.4 below forecasts whereas Eurozone's Services PMI declined to 51.1, 0.2 weaker than predicted by analysts.

Markets await data on the U.K Purchasing Manager Index, Eurozone Retail Sales, U.K. Autumn Forecast Statement and later in the session U.S. data on the ADP Employment Report, Nonfarm Productivity, the ISM Non-Manufacturing Index and speeches of FOMC members

The FTSE 100 index is currently trading negative losing -0.10% quoted at 6,735.63 points, Germany's DAX 30 is trading +0.11% at 9,944.61. France's CAC 40 lost -0.01%, currently trading at 4,387.45 points.

-

08:55

Germany: Services PMI, November 52.1 (forecast 52.1)

-

08:50

France: Services PMI, November 47.9 (forecast 48.3)

-

08:00

Global Stocks: U.S. and Asian indices trading higher on Tuesday

U.S. markets closed higher posting solid gains. The DOW JONES added +0.58% closing at 17,879.55 points and the S&P 500 rose +0.64 with a final quote of 2,066.55 points supported by strong gains in the energy sector an upbeat U.S. construction gauge and better-than expected car sales.

Hong Kong's Hang Seng is trading -0.83% at 23,457.32 erasing earlier gains of +1%. China's Shanghai Composite closed at 2,779.74 points, a gain of +0.59%. China's Non-Manufacturing PMI for November rose to 53.9 from a previous reading of 53.8 and the HSBC Services PMI added 0.1 to 53.0.

Japan's Nikkei rose for a fourth consecutive day, gaining +0.32% closing at 17,720.43 - a seven-year high, as the yen continued to weaken supporting automotive and electronics stocks.

-

07:30

Foreign exchange market. Asian session: the greenback traded broadly stronger against its major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Gross Domestic Product (YoY) Quarter III +3.1% +3.1% +2.7%

00:30 Australia Gross Domestic Product (QoQ) Quarter III +0.5% +0.7% +0.3%

01:00 China Non-Manufacturing PMI November 53.8 53.9

01:45 China HSBC Services PMI November 52.9 53

06:45 Switzerland Gross Domestic Product (YoY) Quarter III +0.6% +1.4% +0.6%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III 0.0% +0.3% +1.9%

The U.S. dollar traded stronger against its major peers after construction data beat forecasts. Yesterday The Federal Reserve Vice Chairman Stanley Fischer said at a forum in Washington on Tuesday that the Fed could delay its interest rate hike if inflation declines. He added that interest rate hike would be driven by the economic data and that low oil prices are a boon to the U.S. economy. The Federal Reserve Chair Janet Yellen said nothing about current economic situation and monetary policy on Tuesday. Markets are awaiting the ADP Employment Report, Nonfarm Productivity, the ISM Non-Manufacturing Index and speeches of FOMC members later in the day.

The Australian dollar drooped against the greenback and declined to a four-year low after the country's GDP data showed an increase of +0.3% quarter on quarter well below the expected +0.7% and oil price increased. China's Non-Manufacturing PMI for November rose to 53.9 from a previous reading of 53.8 and the HSBC Services PMI added 0.1 to 53.0. China is Australia's number one trade partner. Yesterday the Royal Bank of Australia announced to keep interest rates at a record low of 2.5% to boost the economy facing a high currency and declining export prices.

The New Zealand dollar weakened against the U.S. dollar after a decline in milk prices. At the Fonterra Cooperative Group Ltd. auction prices fell to USD2,229 per metric ton, less than half the early February price of USD5,005.

The Japanese yen lost against the U.S. dollar trading at seven-year lows at USD119.43, the weakest since August 2007 two days after Moody's downgraded Japan's sovereign debt rating. The yen has been under pressure since BoJ's unexpected stimulus program from late October.

EUR/USD: the euro declined against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded unchanged against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:48 France Services PMI (Finally) November 48.3 48.3

08:53 Germany Services PMI (Finally) November 52.1 52.1

08:58 Eurozone Services PMI (Finally) November 51.3 51.3

09:30 United Kingdom Purchasing Manager Index Services November 56.2 56.6

10:00 Eurozone Retail Sales (YoY) October +0.6% +0.9%

10:00 Eurozone Retail Sales (MoM) October -1.3% +0.6%

12:30 United Kingdom Autumn Forecast Statement

13:15 U.S. ADP Employment Report November 230 223

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter III +2.0% +2.2%

14:45 U.S. Services PMI (Finally) November 56.3 56.3

15:00 Canada Bank of Canada Rate 1.00% 1.00%

15:00 Canada BOC Rate Statement

15:00 U.S. ISM Non-Manufacturing November 57.5 57.1

15:30 U.S. Crude Oil Inventories November +1.9

17:30 U.S. FOMC Member Charles Plosser Speaks

19:00 U.S. Fed's Beige Book

19:00 U.S. FOMC Member Brainard Speaks

22:30 Canada BOC Gov Stephen Poloz Speaks

-

06:45

Switzerland: Gross Domestic Product (YoY), Quarter III +0.6% (forecast +1.4%)

-

06:45

Switzerland: Gross Domestic Product (QoQ) , Quarter III +1.9% (forecast +0.3%)

-

06:27

Options levels on wednesday, December 3, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2462 (1736)

$1.2421 (252)

$1.2398 (129)

Price at time of writing this review: $ 1.2373

Support levels (open interest**, contracts):

$1.2356 (6514)

$1.2319 (7209)

$1.2292 (5405)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 113610 contracts, with the maximum number of contracts with strike price $1,2800 (6261);

- Overall open interest on the PUT options with the expiration date December, 5 is 1115209 contracts, with the maximum number of contracts with strike price $1,2000 (7756);

- The ratio of PUT/CALL was 1.01 versus 1.01 from the previous trading day according to data from December, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.5900 (1145)

$1.5801 (1037)

$1.5703 (1509)

Price at time of writing this review: $1.5644

Support levels (open interest**, contracts):

$1.5596 (2771)

$1.5498 (904)

$1.5399 (991)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 42324 contracts, with the maximum number of contracts with strike price $1,6900 (1881);

- Overall open interest on the PUT options with the expiration date December, 5 is 41597 contracts, with the maximum number of contracts with strike price $1,5600 (2771);

- The ratio of PUT/CALL was 0.98 versus 1.00 from the previous trading day according to data from December, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:31

Nikkei 225 17,831.73 +168.51 +0.95%, Hang Seng 23,861.85 +207.55 +0.88%, Shanghai Composite 2,773.48 +9.93 +0.36%

-

01:45

China: HSBC Services PMI, November 53.0

-

01:00

China: Non-Manufacturing PMI, November 53.9

-

00:30

Australia: Gross Domestic Product (YoY), Quarter III +2.7% (forecast +3.1%)

-

00:30

Australia: Gross Domestic Product (QoQ), Quarter III +0.3% (forecast +0.7%)

-