Notícias do Mercado

-

23:35

Commodities. Daily history for Dec 2’2014:

(raw materials / closing price /% change)

Light Crude 67.65 +1.15%

Gold 1,197.50 -0.16%

-

23:34

Stocks. Daily history for Dec 2’2014:

(index / closing price / change items /% change)

Nikkei 225 17,663.22 +73.12 +0.42%

Hang Seng 23,654.3 +286.85 +1.23%

Shanghai Composite 2,763.32 +83.16 +3.10%

FTSE 100 6,742.1 +85.73 +1.29%

CAC 40 4,388.3 +10.97 +0.25%

Xetra DAX 9,934.08 -29.43 -0.30%

S&P 500 2,066.55 +13.11 +0.64%

NASDAQ Composite 4,755.81 +28.46 +0.60%

Dow Jones 17,879.55 +102.75 +0.58%

-

23:33

Currencies. Daily history for Dec 2’2014:

(pare/closed(GMT +2)/change, %)

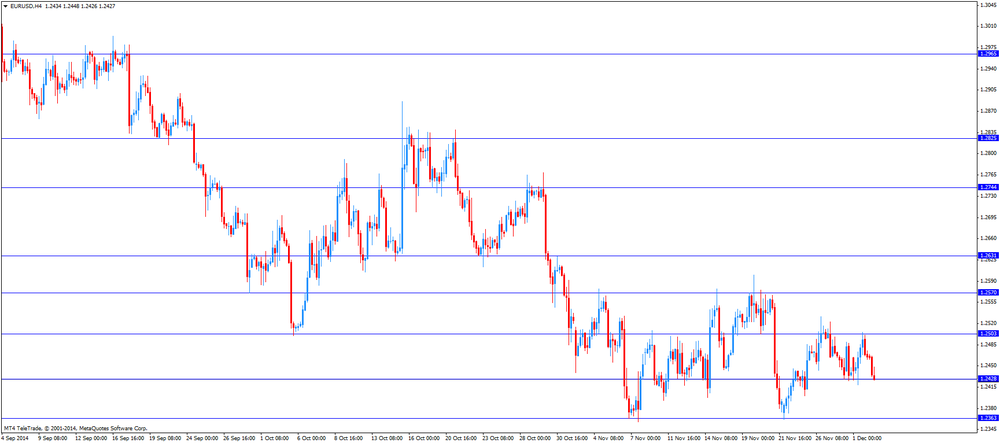

EUR/USD $1,2382 -0,70%

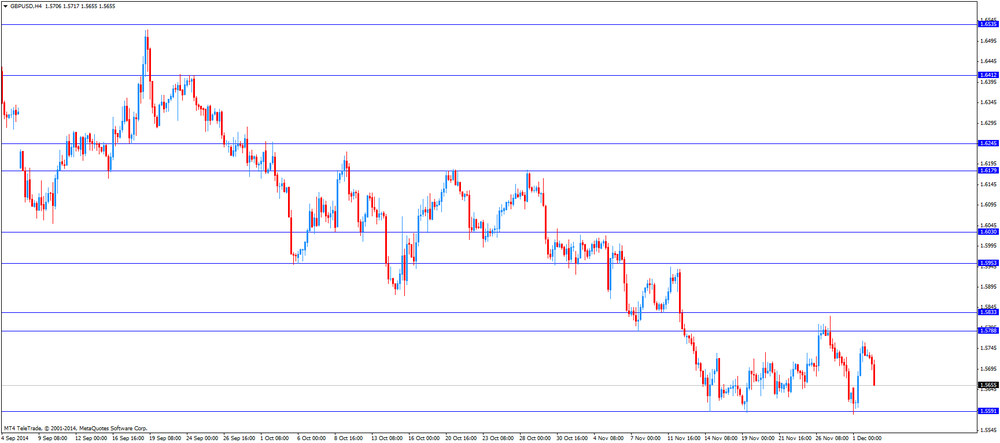

GBP/USD $1,5635 -0,59%

USD/CHF Chf0,9719 +0,77%

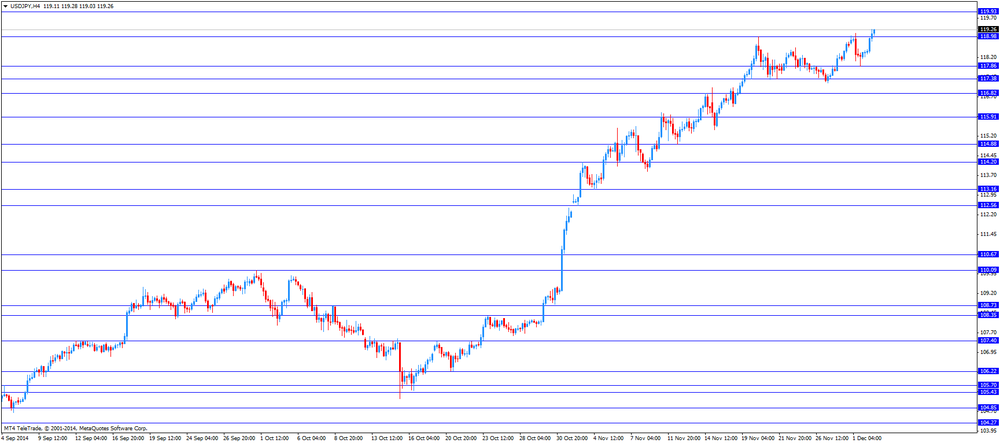

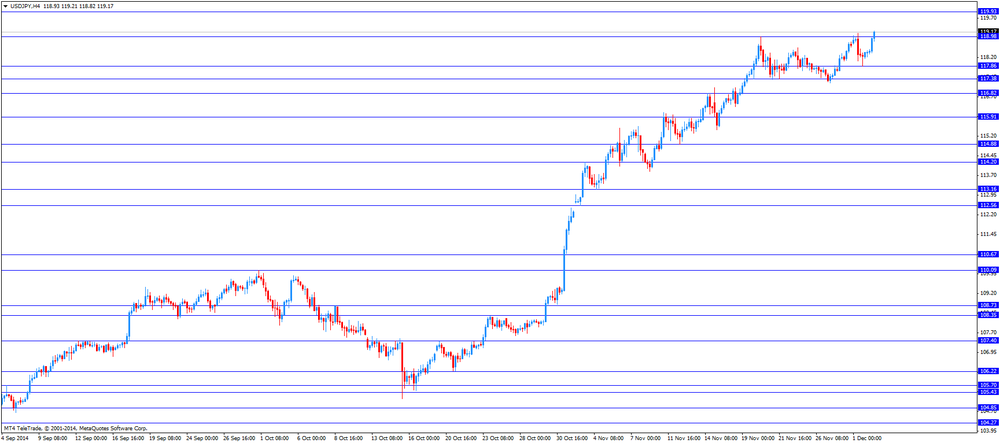

USD/JPY Y119,20 +0,68%

EUR/JPY Y147,61 -0,01%

GBP/JPY Y186,37 +0,09%

AUD/USD $0,8443 -0,53%

NZD/USD $0,7803 -0,77%

USD/CAD C$1,1405 +0,68%

-

23:01

Schedule for today, Wednesday, Dec 3’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Gross Domestic Product (YoY) Quarter III +3.1% +3.1%

00:30 Australia Gross Domestic Product (QoQ) Quarter III +0.5% +0.7%

01:00 China Non-Manufacturing PMI November 53.8

01:45 China HSBC Services PMI November 52.9

06:45 Switzerland Gross Domestic Product (YoY) Quarter III +0.6% +1.4%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III 0.0% +0.3%

08:48 France Services PMI (Finally) November 48.3 48.3

08:53 Germany Services PMI (Finally) November 52.1 52.1

08:58 Eurozone Services PMI (Finally) November 51.3 51.3

09:30 United Kingdom Purchasing Manager Index Services November 56.2 56.6

10:00 Eurozone Retail Sales (YoY) October +0.6% +0.9%

10:00 Eurozone Retail Sales (MoM) October -1.3% +0.6%

12:30 United Kingdom Autumn Forecast Statement

13:15 U.S. ADP Employment Report November 230 223

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter III +2.0% +2.2%

14:45 U.S. Services PMI (Finally) November 56.3 56.3

15:00 Canada Bank of Canada Rate 1.00% 1.00%

15:00 Canada BOC Rate Statement

15:00 U.S. ISM Non-Manufacturing November 57.5 57.1

15:30 U.S. Crude Oil Inventories November +1.9

17:30 U.S. FOMC Member Charles Plosser Speaks

19:00 U.S. Fed's Beige Book

19:00 U.S. FOMC Member Brainard Speaks

22:30 Canada BOC Gov Stephen Poloz Speaks

-

22:30

Australia: AIG Services Index, November 43.8

-

20:00

Dow +118.58 17,895.38 +0.67% Nasdaq +33.27 4,760.62 +0.70% S&P +15.21 2,068.65 +0.74%

-

19:45

U.S.: Total Vehicle Sales, mln, November 17.2 (forecast 16.5)

-

17:22

Reserve Bank of Australia kept its interest rate unchanged at 2.50%

The Reserve Bank of Australia (RBA) released its interest rate decision on Tuesday. The RBA kept its interest rate unchanged at 2.50%.

The RBA Governor Glenn Stevens said that "the most prudent course is likely to be a period of stability in interest rates". He reiterated that the Aussie "remains above most estimates of its fundamental value, particularly given the significant declines in key commodity prices in recent months".

Stevens noted that the central bank "still expects growth to be a little below trend for the next several quarters".

-

17:03

European stocks close: most stocks closed higher on a rebound of energy stocks

Most stock indices closed higher on a rebound of energy stocks.

Eurozone's producer price index fell 0.4% in October, missing expectations for a 0.3% increase, after a 0.2% rise in September.

The U.K. construction PMI decreased to 59.4 in November from 61.4 in October, missing expectations for a decline to 61.2.

BP Plc shares jumped 4.7%.

Royal Dutch Shell Plc shares rose 3.9%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,742.1 +85.73 +1.29%

DAX 9,934.08 -29.43 -0.30%

CAC 40 4,388.3 +10.97 +0.25

-

17:00

European stocks close: FTSE 100 6,742.1 +85.73 +1.29% CAC 40 4,388.3 +10.97 +0.25% DAX 9,934.08 -29.43 -0.30%

-

16:45

Oil: A review of the market situation

The cost of oil futures fell today as investors continue to win back OPEC's decision to maintain production at current levels.

Recall on November 27 in Vienna held a summit of the Organization of Petroleum Exporting Countries. The cartel decided to maintain the current oil production of 30 million barrels per day until June 2015, prompting markets to continue to reduce prices.

The course of today's trading was also influenced words of the head of the International Monetary Fund Christine Lagarde. She stated that the fall in world oil prices in general have a positive impact on the world economy. According to her, falling oil prices could add 0.8% GDP growth developed economies of the world "as they are all importers of oil, regardless of whether one is talking about the United States, Japan, Europe or China."

Meanwhile, the head of the International Energy Agency, Maria van der Hoeven said the fall in prices a serious challenge especially for companies that extract oil from unconventional sources. For example, the rapid growth of shale oil in the US, probably began to slow: according to Reuters, last month, the number of issued permits in the United States to drill new wells in shale deposits decreased by 15% compared with the previous month, according to the reduction in the number of permits issued on drilling in October.

Prices also affect expectations of fresh release weekly data on oil and petroleum products in the United States to gauge the strength of demand from the world's biggest consumer. It is expected that oil stocks rose 0.9 million barrels for the week ended November 28

Cost of January futures for US light crude oil WTI (Light Sweet Crude Oil) dropped to 68.19 dollars per barrel on the New York Mercantile Exchange.

January futures price for North Sea Brent crude oil mix fell $ 0.81, to $ 71.44 a barrel on the London Stock Exchange ICE Futures Europe.

-

16:41

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. construction spending

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. construction spending. The U.S. construction spending rose 1.1% in October, exceeding expectations for a 0.6% gain, after a 0.1% decline in September. September's figure was revised up from a 0.4% drop.

The Federal Reserve Vice Chairman Stanley Fischer said at a forum in Washington on Tuesday that the Fed could delay its interest rate hike if inflation declines. He added that interest rate hike would be driven by the economic data.

The Federal Reserve Chair Janet Yellen said nothing about current economic situation and monetary policy on Tuesday.

The euro traded lower against the U.S. dollar. Eurozone's producer price index fell 0.4% in October, missing expectations for a 0.3% increase, after a 0.2% rise in September.

The British pound traded lower against the U.S. dollar. The U.K. construction PMI decreased to 59.4 in November from 61.4 in October, missing expectations for a decline to 61.2.

The New Zealand dollar decreased against the U.S. dollar. In the overnight trading session, the kiwi traded slightly higher against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie rose against the greenback after the Reserve Bank of Australia's interest rate decision. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.50%.

The RBA Governor Glenn Stevens said that "the most prudent course is likely to be a period of stability in interest rates".

Australia's current account deficit fell to A$12.5 billion in the third quarter from A$13.9 billion in the second quarter, beating forecasts for a decline to A$13.5 billion. The second quarter's figure was revised down from a deficit of A$13.7 billion.

Building approvals in Australia climbed 11.4% in October, exceeding expectations for a 5.2% gain, after a11.2% decrease in September. September's figure was revised down from a 11.0% drop.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback due to stronger U.S. currency. Yesterday's cut of Japan's rating still weighed on the yen. Moody's cuts Japan's rating to A1 from AA3.

Labour cash earnings in Japan climbed 0.5% in October, missing expectations for a 0.8% increase, after a 0.7% gain in September. September's figure was revised down from a 0.8% rise.

Japan's monetary base increased 36.7% in November, missing expectation for a 37.2% gain, after a 36.9% rise in October.

-

16:20

Gold: A review of the market situation

Gold prices declined moderately today, dropping at the same time below $ 1,200 per ounce, which was due to the appreciation of the US currency.

The dollar rose 0.7 percent against a basket of major currencies, supported by comments from Fed Chairman Vice Stanley Fischer and the Federal Reserve Bank of New York, William Dudley. Both said that lower oil prices are generally very favorable for US economic growth. Dudley also said that the US central bank is likely to carry out first rate hike next summer. In his speech, he explained that the pace of interest rate hikes will be equally determined by the situation in the economy and how the financial conditions will respond to changes in the Fed's policy

Experts note that the prices of precious metals are likely to remain reduced and tend to decline further in the near term amid signs of strengthening US economy, which could cause the Fed to raise interest rates sooner and faster than previously predicted. Expectations of growth rates on loans put pressure on gold as a precious metal with difficulty competing with the yield of interest-earning assets at higher rates.

"The market has been too much short positions, but the growth seems excessive. I think the gold market will remain volatile until the end of the year "- said a trader for precious metals in Hong Kong. - In the near future direction of the market of gold depends on the dollar and oil. To support the growth of prices is also necessary demand in the physical market. "

Margins in China on Tuesday declined to less than $ 1 per ounce, and earlier in the week in China gold traded below the indicative price.

Little impact on the course of trading also has the fact that India last week unexpectedly eased restrictions on gold imports. But traders do not expect an immediate increase in purchases, since the country has sufficient reserves of precious metals.

Market participants also drew attention to the news from China. The Chinese government is likely to set the bar in GDP growth next year at 7%. In this regard, the Chinese authorities can go on a series of stimulus measures, including the introduction of tax incentives, and 1-2 times lower reserve requirements to trigger economic growth in the country.

Cost of January futures for gold on the COMEX today fell to 1199.00 dollars per ounce.

-

15:54

U.S. construction spending rose 1.1% in October

The U.S. Commerce Department released construction spending data on Tuesday. The U.S. construction spending rose 1.1% in October, exceeding expectations for a 0.6% gain, after a 0.1% decline in September. September's figure was revised up from a 0.4% drop.

The increase was driven by newly built homes and schools. Spending on single-family houses climbed 1.8% in October, while spending on public construction rose 2.3%.

-

15:00

-

15:00

U.S.: Construction Spending, m/m, November +1.1% (forecast +0.6%)

-

14:52

The Federal Reserve Chair Janet Yellen said nothing about current economic situation and monetary policy on Tuesday.

-

14:44

Federal Reserve Vice Chairman Stanley Fischer: if inflation declines in the U.S. declines, the Fed could delay its interest rate hike

The Federal Reserve Vice Chairman Stanley Fischer said at a forum in Washington on Tuesday that the Fed could delay its interest rate hike if inflation declines. He added that interest rate hike would be driven by the economic data.

The Fed' interest rate is at record low at 0.00% - 0.25% since the end of 2008. Analysts expects the first interest rate in the second half of next year.

-

14:35

U.S. Stocks open: Dow 17,797.93 +21.13 +0.12%, Nasdaq 4,736.19 +8.84 +0.19%, S&P 2,054.98 +1.54 +0.07%

-

14:27

Before the bell: S&P futures +0.18%, Nasdaq futures +0.23%

U.S. stock-index futures rose amid speculation overseas central banks will increase stimulus to help boost slowing economies.

Global markets:

Nikkei 17,663.22 +73.12 +0.42%

Hang Seng 23,654.3 +286.85 +1.23%

Shanghai Composite 2,763.32 +83.16 +3.10%

FTSE 6,741 +84.63 +1.27%

CAC 4,400.51 +23.18 +0.53%

DAX 9,969.95 +6.44 +0.06%

Crude oil $68.20 (-1.12%)

Gold $1201.00 (-1.34%)

-

14:15

DOW components before the bell

(company / ticker / price / change, % / volume)

Procter & Gamble Co

PG

90.10

+0.02%

1.1K

Visa

V

258.50

+0.14%

1.3K

Verizon Communications Inc

VZ

50.11

+0.16%

1.4K

Intel Corp

INTC

37.25

+0.22%

7.5K

Johnson & Johnson

JNJ

108.27

+0.22%

0.6K

Boeing Co

BA

132.75

+0.27%

0.1K

International Business Machines Co...

IBM

161.99

+0.28%

15.9K

Merck & Co Inc

MRK

60.71

+0.31%

1.4K

Nike

NKE

98.06

+0.38%

0.4K

United Technologies Corp

UTX

110.12

+0.39%

1.6K

Walt Disney Co

DIS

93.11

+0.44%

3.4K

Home Depot Inc

HD

98.97

+0.57%

1.4K

Microsoft Corp

MSFT

48.90

+0.58%

30.1K

3M Co

MMM

158.16

0.00%

0.6K

Goldman Sachs

GS

188.20

0.00%

0.9K

Caterpillar Inc

CAT

99.00

0.00%

3.1K

Cisco Systems Inc

CSCO

27.59

0.00%

7.8K

JPMorgan Chase and Co

JPM

60.00

0.00%

43.1K

UnitedHealth Group Inc

UNH

99.06

0.00%

2.0K

Pfizer Inc

PFE

31.26

0.00%

0.4K

Wal-Mart Stores Inc

WMT

86.22

0.00%

1.1K

Exxon Mobil Corp

XOM

92.32

-0.03%

26.8K

The Coca-Cola Co

KO

44.53

-0.04%

0.5K

American Express Co

AXP

92.03

-0.12%

0.5K

General Electric Co

GE

25.98

-0.15%

23.9K

Chevron Corp

CVX

111.50

-0.21%

1.9K

AT&T Inc

T

34.98

-0.23%

12.2K

McDonald's Corp

MCD

95.26

-0.54%

2.3K

Travelers Companies Inc

TRV

103.65

-0.76%

1.8K

-

14:03

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Travelers (TRV) downgraded to Neutral from Buy at BofA/Merrill

Other:

FedEx (FDX) target raised to $210 from $190 at Citigroup, maintain Buy

Microsoft (MSFT)initiated with a Overweight at JP Morgan

AT&T (T) initiated with a Underweight at HSBC Securities

Verizon (VZ) initiated with a Neutral at HSBC Securities

Apple (AAPL) target raised to $135 from $120, maintain Buy at Canaccord Genuity

-

13:51

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400(E716mn), $1.2450(E201mn), $1.2485(E279mn), $1.2500(E2.02bn), $1.2515(E222mn), $1.2525(E537mn), $1.2530(E623mn), $1.2545/50(E700mn)

USD/JPY: Y117.50($200mn), Y117.90($300mn), Y118.00($445mn), Y118.75($205mn), Y119.50

GBP/USD: $1.5750(stg262mn), $1.5800(stg600mn)

AUD/USD: $0.8500(A$2.5bn)

USD/CAD: Cad1.1270($250mn), Cad1.1280($540mn), Cad1.1310($201mn), Cad1.1350($455mn), Cad1.1410($320mn)

USD/CHF: Chf0.9575($200mn), Chf0.9650($320mn), Chf0.9685($1.15bn)

EUR/CHF: Chf1.2075(E298mn)

-

13:00

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead of a long row of speeches

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Building Permits, m/m October -11.2% Revised From -11.0% +5.2% +11.4%

00:30 Australia Building Permits, y/y October -11.4% Revised From -13.4% +2.5%

00:30 Australia Current Account, bln Quarter III -13.9% Revised From -13.7 -13.5 -12.5%

01:30 Japan Labor Cash Earnings, YoY October +0.7% Revised From +0.8% +0.8% +0.5%

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction November 61.4 61.2 59.4

10:00 Eurozone Producer Price Index, MoM October +0.2% +0.3% -0.4%

10:00 Eurozone Producer Price Index (YoY) October -1.4% -1.3%

The U.S. dollar traded higher against the most major currencies ahead of a long row of speeches. The Fed Vice Chairman Stanley Fischer is expected to speak at 13:10 (GMT0). The Fed Chairman Janet Yellen is expected to speak at 13:30 (GMT0). The FOMC Member Brainard Speaks is expected to speak at 17:00 (GMT0).

The euro traded lower against the U.S. dollar. Eurozone's producer price index fell 0.4% in October, missing expectations for a 0.3% increase, after a 0.2% rise in September.

The British pound declined against the U.S. dollar after the weaker-than-expected construction PMI from the U.K. The U.K. construction PMI decreased to 59.4 in November from 61.4 in October, missing expectations for a decline to 61.2.

EUR/USD: the currency pair fell to $1.2426

GBP/USD: the currency pair decreased to $1.5655

USD/JPY: the currency pair rose to Y119.21

The most important news that are expected (GMT0):

13:10 U.S. FED Vice Chairman Stanley Fischer Speaks

13:30 U.S. Fed Chairman Janet Yellen Speaks

17:00 U.S. FOMC Member Brainard Speaks

-

12:50

Orders

EUR/USD

Offers $1.2550, $1.2510, $1.2500

Bids $1.2400, $1.2350, $1.2320

GBP/USD

Offers $1.5850, $1.5780/00

Bids $1.5680, $1.5650, $1.5610/00

AUD/USD

Offers $0.8580/00, $0.8540/50, $0.8500

Bids $0.8450, $0.8400, $0.8380, $0.8350, $0.8300

EUR/JPY

Offers Y149.00, Y148.50, Y148.00

Bids Y147.55/50, Y147.00, Y146.50

USD/JPY

Offers Y120.50, Y120.00, Y119.50, Y119.20, Y119.00

Bids Y118.65/60, Y118.25/20, Y118.00, Y117.80

EUR/GBP

Offers stg0.8050, stg0.8000, stg0.7980, stg0.7950

Bids stg0.7900, stg0.7885/75, stg0.7860/50

-

12:00

European stock markets mid-session: European indices trading mixed

European indices are trading mixed today. The FTSE 100 index jumped +1.08% quoted at 6,728.30 points supported by strong gains in energy stocks, France's CAC 40 is slightly positive at +0.08% trading at 4,379.88 and Germany's DAX 30 lost -0.24% at 9,939.40 points after trading above the level of 10,000 points earlier in the session reaching highs at 10039.50 points close to its all-time high. Eurozone's Producer Price Index fell in October reading -0.4% on a monthly basis. Analysts forecasts predicted +0.3%, last month's reading was +0.2%. Pressure on the ECB to fight disinflation is growing ahead of its monthly policy meeting scheduled on Thursday but markets don't expect the ECB to announce new measures this week.

-

11:20

Oil: prices under pressure after yesterday’s gains

Oil prices were further under pressure after recouping losses yesterday with a rally from five-year lows helped by the depreciation of the US dollar. Earlier on Monday futures fell to their lowest level since 2009, as investors opened short positions in anticipation of lower prices in response to OPEC's decision last week to maintain current levels of production of raw materials. In today's trading session Brent Crude lost and is trading -1.05% at USD71.78 a barrel, and WTI Crude lost -1.28% currently quoted at USD68.12. Today a report that that oil exports from northern Iraq will be boosted weighed on oil prices. 250,000 barrels a day of crude will be exported from Kurdish oil fields, and 300,000 barrels from the Kirkuk field, according to Bloomberg.

-

11:00

Gold trading again under USD1,200 after yesterday’s biggest one-day gain in a year

Gold, currently trading at USD1,198.20 a troy ounce is trading lower today, just below the important level of USD1,200. Yesterday the precious metal touched a daily low of USD1,142.40 after Swiss voters said no to the "Save Our Swiss Gold" referendum and then started the biggest daily climb in a year reaching a one-month high at USD1,221.00.

Today gold continues to be under pressure as the U.S. dollar strengthens and falling oil prices make an inflation-hedge via gold less attractive.

GOLD currently trading at USD1,198.20

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400(E716mn), $1.2450(E201mn), $1.2485(E279mn), $1.2500(E2.02bn), $1.2515(E222mn), $1.2525(E537mn), $1.2530(E623mn), $1.2545/50(E700mn)

USD/JPY: Y117.50($200mn), Y117.90($300mn), Y118.00($445mn), Y118.75($205mn), Y119.50

GBP/USD: $1.5750(stg262mn), $1.5800(stg600mn)

AUD/USD: $0.8500(A$2.5bn)

USD/CAD: Cad1.1270($250mn), Cad1.1280($540mn), Cad1.1310($201mn), Cad1.1350($455mn), Cad1.1410($320mn)

USD/CHF: Chf0.9575($200mn), Chf0.9650($320mn), Chf0.9685($1.15bn)

EUR/CHF: Chf1.2075(E298mn)

-

10:00

Eurozone: Producer Price Index, MoM , October -0.4% (forecast +0.3%)

-

10:00

Eurozone: Producer Price Index (YoY), October -1.3%

-

09:55

United Kingdom: PMI construction contracted more than predicted

Momentum in one of U.K.'s important growth sectors declined more than analysts had predicted growing at the slowest pace in more than a year. U.K. activity in the construction sector shrank seasonally adjusted to 59.4 for November according to the index from a reading of 61.4 in October and below forecasts of 61.2 fuelling doubts on economic growth and a positive economic outlook.

-

09:30

United Kingdom: PMI Construction, November 59.4 (forecast 61.2)

-

09:20

Press Review: Draghi Treads Path of ECB Powerlessness Toward QE Without Reform

BLOOMBERG

Oil Investors May Be Running Off a Cliff They Can't See

Climate: Now or Never

A major threat to fossil fuel companies has suddenly moved from the fringe to center stage with a dramatic announcement by Germany's biggest power company and an intriguing letter from the Bank of England.

A growing minority of investors and regulators are probing the possibility that untapped deposits of oil, gas and coal -- valued at trillions of dollars globally -- could become stranded assets as governments adopt stricter climate change policies.

BLOOMBERG

Draghi Treads Path of ECB Powerlessness Toward QE Without Reform

Looking out from the top of the European Central Bank's new tower in Frankfurt, it's easy to find dark clouds on the horizon.

The view for policy makers is of a euro-zone populace so weary of years of economic turmoil that it's increasingly electing politicians who say no to pan-European cooperation, and spurn reforms that the ECB says are vital to revive the economy. Trapped by their mandate to prevent deflation, officials fret they might soon be forced to roll out quantitative easing that can never succeed by itself.

REUTERS

Fed welcomes energy drop, shrugs off disinflation threat

(Reuters) - The Federal Reserve is welcoming the sharp drop in global energy prices, with two influential policymakers on Monday cheering the boost it should provide American pocketbooks and shrugging off any pressure on already low inflation.

Soft oil prices in particular, which hit a five-year low on Friday, will only temporarily dampen overall U.S. prices, Fed Vice Chairman Stanley Fischer and New York Fed President William Dudley said at separate events. The pair painted a mostly rosy outlook for the world's largest economy, suggesting the central bank is not letting energy markets distract it from lifting rates some time next year.

Source: http://www.reuters.com/article/2014/12/01/us-usa-fed-idUSKCN0JF39U20141201

-

09:00

European Stocks. First hour: European indices adding gains – DAX near all-time-high

European stocks are trading higher early in today's session after yesterday's losses as investors speculate on additional stimulus by the ECB amid disappointing Chinese and European data. The next ECB policy meeting is scheduled for the 4th of December. Mario Draghi said the ECB might include sovereign debt in its asset buying program.

Markets were lifted by a rise in energy stocks after oils brief rebound. Markets look ahead to data on the Eurozone's Producer Price Index published at 10:00 GMT and later in the session Fed Chairman Janet Yellen's speech at 13:30 GMT.

The FTSE 100 index is currently trading positive adding +1.25% quoted at 6,739.50 points, Germany's DAX 30 continued to climb and is trading above the omportant level of 10.000 points +0.60% at 10,022.91 close to an all-time-high above 10,050 points. France's CAC 40 gained +0.93%, currently trading at 4,417.86 points.

-

09:00

European Stocks. First hour: European indices trading near openings

European stocks are trading higher early in today's session amid bets that the next ECB policy meeting, scheduled for the 4th of December in Frankfurt, might bring up new stimulus measures and move closer to a full-scale quantitative easing. European stocks remained supported after Friday's data on inflation which declined to a five year low at 0.3% in November. France's Services PMI declined to 47.9, 0.4 below forecasts whereas Eurozone's Services PMI declined to 51.1, 0.2 weaker than predicted by analysts.

Markets await data on the U.K Purchasing Manager Index, Eurozone Retail Sales, U.K. Autumn Forecast Statement and later in the session U.S. data on the ADP Employment Report, Nonfarm Productivity, the ISM Non-Manufacturing Index and speeches of FOMC members

The FTSE 100 index is currently trading negative losing -0.10% quoted at 6,735.63 points, Germany's DAX 30 is trading +0.11% at 9,944.61. France's CAC 40 lost -0.01%, currently trading at 4,387.45 points.

-

08:05

Global Stocks: U.S. indices trading lower on Monday - Asian stocks rally

U.S. markets closed lower on Monday for a second day. The DOW JONES lost -0.28% closing at 17,776.80 points and the S&P 500 declined -0.68%, suffering the biggest one-day loss in more than a month, with a final quote of 2,053.44 points after weaker data on Black Friday sales and disappointing China manufacturing. The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. The index declined to 58.7 in November from 59.0 in October, beating expectations for a decline to 57.9.Apple Inc lost almost 3.2% in its biggest daily decline in more than a month.

Chinese stocks posted solid gains, the most in 14 months, in yesterday's trading session fuelled by speculations after Monday's soft manufacturing data that China may bring more stimulus measures on the way. A rebound in commodities further supported the markets. Hong Kong's Hang Seng is trading +1.38% at 23,689.33. China's Shanghai Composite closed at 2,763.32 points, a gain of +3.10%.

Japan's Nikkei gained +0.42% closing at 17,663.22 with exporter shares leading the way, a seven-year high, as the yen continued to weaken .

-

07:30

Foreign exchange market. Asian session: U.S. dollar trading stronger against euro, yen and pound

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:50 Japan Monetary Base, y/y November +36.9% +37.2% +36.7%

01:30 Australia Building Permits, m/m October -11.2% [Revised From -11.0%] +5.2% +11.4%

01:30 Australia Building Permits, y/y October -11.4% [Revised From -13.4%] +2.5%

01:30 Australia Current Account, bln Quarter III -13.9% [Revised From -13.7] -13.5 -12.5%

02:30 Japan Labor Cash Earnings, YoY October +0.7% [Revised From +0.8%] +0.8% +0.5%

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

The U.S. dollar traded stronger against the euro, yen and British pound but lost against the aussie and the kiwi after the better-than-expected ISM manufacturing purchasing managers' index. Markets await Fed Chairman Janet Yellen's speech today scheduled for 13:30 GMT and her Vice Chairmen's speech 20 minutes earlier and tomorrows Employment Report.

The Australian dollar traded stronger after the Royal Bank of Australia announced to keep interest rates at a record low of 2.5% to boost the economy facing a high currency and declining export prices. RBA Governor Glenn Stevens said in a statement that inflation is expected to stay on target at 2-3% over the next two years and that there will be no changes in the interest rates for the next two years. Building permits on a monthly basis beat forecasts of +5.2% reading +11.4% in October. Yearly Building permits rose +2.5%. Australia's current account balance for the third quarter showed a deficit of 12.5 bln beating forecast predicting a deficit of 13.5 bln.

The New Zealand dollar traded stronger against the U.S. dollar further recovering from weak Chinese data.

The Japanese yen lost against the U.S. dollar almosterasing yesterday's gains trading at seven-year highs driven by Moody's cut in Japan's credit rating to A1 from Aa3 fuelling doubts about Japan's Abenomics - the main reason for the Japanese yen's weakness. Moody's justified the cut with increasing uncertainty over Japan's ability to reduce its deficit.

EUR/USD: the euro declined against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom PMI Construction November 61.4 61.2

10:00 Eurozone Producer Price Index, MoM October +0.2% +0.3%

10:00 Eurozone Producer Price Index (YoY) October -1.4%

13:10 U.S. FED Vice Chairman Stanley Fischer Speaks

13:30 U.S. Fed Chairman Janet Yellen Speaks

15:00 U.S. Construction Spending, m/m November -0.4% +0.6%

17:00 U.S. FOMC Member Brainard Speaks

19:30 U.S. Total Vehicle Sales, mln November 16.5 16.5

21:30 U.S. API Crude Oil Inventories November +2.8

22:30 Australia AIG Services Index November 43.6

-

06:21

Options levels on tuesday, December 2, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2544 (4747)

$1.2516 (1794)

$1.2493 (1639)

Price at time of writing this review: $ 1.2462

Support levels (open interest**, contracts):

$1.2419 (3504)

$1.2392 (6553)

$1.2370 (4202)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 112662 contracts, with the maximum number of contracts with strike price $1,2800 (6183);

- Overall open interest on the PUT options with the expiration date December, 5 is 113905 contracts, with the maximum number of contracts with strike price $1,2000 (7754);

- The ratio of PUT/CALL was 1.01 versus 1.12 from the previous trading day according to data from November, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.6000 (1537)

$1.5900 (1085)

$1.5801 (1004)

Price at time of writing this review: $1.5720

Support levels (open interest**, contracts):

$1.5689 (1707)

$1.5595 (2406)

$1.5498 (1298)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 41665 contracts, with the maximum number of contracts with strike price $1,6900 (1881);

- Overall open interest on the PUT options with the expiration date December, 5 is 41547 contracts, with the maximum number of contracts with strike price $1,6000 (2020);

- The ratio of PUT/CALL was 1.00 versus 0.98 from the previous trading day according to data from November, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:30

Australia: Announcement of the RBA decision on the discount rate, 2.50% (forecast 2.50%)

-

02:30

Nikkei 225 17,575.78 -14.32 -0.08%, Hang Seng 23,395.52 +28.07 +0.12%, Shanghai Composite 2,669.81 -10.34 -0.39%

-

01:31

Japan: Labor Cash Earnings, YoY, October +0.5% (forecast +0.8%)

-

00:31

Australia: Building Permits, y/y, October +2.5%

-

00:30

Australia: Building Permits, m/m, October +11.4% (forecast +5.2%)

-

00:30

Australia: Current Account, bln, Quarter III -12.5% (forecast -13.5)

-