Notícias do Mercado

-

23:50

Japan: Monetary Base, y/y, November +36.7% (forecast +37.2%)

-

23:34

Commodities. Daily history for Dec 1’2014:

(raw materials / closing price /% change)

Light Crude 69.24 +0.35%

Gold 1,211.90 -0.50%

-

23:32

Stocks. Daily history for Dec 1’2014:

(index / closing price / change items /% change)

Nikkei 225 17,590.1 +130.25 +0.75%

Hang Seng 23,367.45 -620.00 -2.58%

Shanghai Composite 2,680.16 -2.68 -0.10%

FTSE 100 6,656.37 -66.25 -0.99%

CAC 40 4,377.33 -12.85 -0.29%

Xetra DAX 9,963.51 -17.34 -0.17%

S&P 500 2,053.44 -14.12 -0.68%

NASDAQ Composite 4,727.35 -64.28 -1.34%

Dow Jones 17,776.8 -51.44 -0.29%

-

23:28

Currencies. Daily history for Dec 1’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2469 +0,24%

GBP/USD $1,5728 +0,58%

USD/CHF Chf0,9644 -0,16%

USD/JPY Y118,39 -0,23%

EUR/JPY Y147,62 0,00%

GBP/JPY Y186,2 +0,36%

AUD/USD $0,8488 -0,26%

NZD/USD $0,7863 +0,33%

USD/CAD C$1,1328 -0,95%

-

23:00

Schedule for today, Monday, Dec 2’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Building Permits, m/m October -11.0% +5.2%

00:30 Australia Building Permits, y/y October -13.4%

00:30 Australia Current Account, bln Quarter III -13.7 -13.5

01:30 Japan Labor Cash Earnings, YoY October +0.7% Revised From +0.8% +0.8%

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction November 61.4 61.2

10:00 Eurozone Producer Price Index, MoM October +0.2% +0.3%

10:00 Eurozone Producer Price Index (YoY) October -1.4%

13:10 U.S. FED Vice Chairman Stanley Fischer Speaks

13:30 U.S. Fed Chairman Janet Yellen Speaks

15:00 U.S. Construction Spending, m/m November -0.4% +0.6%

17:00 U.S. FOMC Member Brainard Speaks

19:30 U.S. Total Vehicle Sales, mln November 16.5 16.5

21:30 U.S. API Crude Oil Inventories November +2.8

22:30 Australia AIG Services Index November 43.6

-

20:00

Dow -39.62 17,788.62 -0.22% Nasdaq -61.76 4,729.87 -1.29% S&P -13.53 2,054.03 -0.65%

-

17:05

European stocks close: stocks closed lower, driven by lower miner and oil stocks

Stock indices closed lower, driven by lower miner and oil stocks.

Mostly weaker-than-expected PMIs from the Eurozone also weighed on markets. Eurozone' final manufacturing purchasing managers' index (PMI) fell to 50.1 in November from a preliminary reading of 50.4. Analysts had expected the final index to remain at 50.4.

Germany's final manufacturing PMI declined to 49.5 in November from a preliminary reading of 50.0. Analysts had expected the final index to remain at 50.0.

France's final manufacturing PMI climbed to 48.4 in November from a preliminary reading of 47.6. Analysts had expected the final index to remain at 47.6.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,656.37 -66.25 -0.99%

DAX 9,963.51 -17.34 -0.17%

CAC 40 4,377.33 -12.85 -0.29%

-

17:00

European stocks close: FTSE 100 6,656.37 -66.25 -0.99% CAC 40 4,377.33 -12.85 -0.29% DAX 9,963.51 -17.34 -0.17%

-

16:42

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the better-than-expected ISM manufacturing purchasing managers' index

The U.S. dollar traded mixed to lower against the most major currencies after the better-than-expected ISM manufacturing purchasing managers' index. The Institute for Supply Management manufacturing purchasing managers' index for the U.S. declined to 58.7 in November from 59.0 in October, beating expectations for a decline to 57.9.

The Markit final manufacturing purchasing managers' index rose to 54.8 in November from a previous reading of 54.7, missing expectations for a rise to 55.0.

The euro traded higher against the U.S. dollar after the mostly weaker-than-expected economic data from the Eurozone. Eurozone' final manufacturing purchasing managers' index (PMI) fell to 50.1 in November from a preliminary reading of 50.4. Analysts had expected the final index to remain at 50.4.

Germany's final manufacturing PMI declined to 49.5 in November from a preliminary reading of 50.0. Analysts had expected the final index to remain at 50.0.

France's final manufacturing PMI climbed to 48.4 in November from a preliminary reading of 47.6. Analysts had expected the final index to remain at 47.6.

The British pound traded higher against the U.S. dollar. The U.K. manufacturing PMI increased to 53.5 in November from 53.3 in October, beating expectations for a decline to 53.1. October's figure was revised up from 53.2.

Net lending to individuals in the U.K. increased by £2.6 billion in October, missing expectations for a £2.8 billion rise, after a £2.7 billion gain in September.

The number of mortgages approvals in the U.K. fell to 59,426 in October from 61,234 in September. That was the lowest level since June 2013. Analysts had expected the number of mortgages approvals to decline to 59,000.

The Swiss franc traded higher against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland decreased to 52.1 in November from 55.3 in October, missing expectations for a decline to 52.9.

The New Zealand dollar increased against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback after the weak Chinese economic data. China's manufacturing purchasing managers' index fell to 50.3 in November from 50.8 in October, missing expectations for a fall to 50.5.

The HSBC final manufacturing PMI for China remained unchanged at 50.0 in November, in line with expectations.

New Zealand's overseas trade index decreased 4.4% in the third quarter, after a 0.1% increase in the second quarter. The second quarter's figure was revised down from a 0.3 gain.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie decreased against the greenback after the weak Chinese economic data.

Company operating profits in Australia increased 0.5% in the third quarter, beating expectations for a 1.2% fall, after 7.5% drop in the second quarter. The second quarter's figure was revised down from a 6.9% decline.

The Japanese yen dropped against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback due to stronger U.S. currency.

In the morning trading session, the yen traded rose against the greenback. Moody's cuts Japan's rating to A1 from AA3.

Capital spending in Japan climbed 5.5% in the third quarter, after a 3.0% in the second quarter.

-

16:40

Oil: A review of the market situation

The cost of oil futures rose today by more than 2%, departing from the five-year low, helped by the depreciation of the US dollar.

Earlier today futures fell to their lowest level since 2009, as investors opened short positions in anticipation of lower prices in response to OPEC's decision last week to maintain current levels of production of raw materials. Concerns over weakening global demand and reported that OPEC producers do not intend to reduce output, had a significant pressure on prices in recent months.

"The market is still a lot of panic," - said principal analyst for oil in the Energy Aspects Amrita Sen. "As soon as the panic subsides, the price of Brent, the likely stabilize at around $ 65-80 per barrel in the short term."

Little influenced by today's data on China. In November, the index of purchasing managers in the manufacturing of China from HSBC, the national index of manufacturing activity fell to a six-month low of 50.0 compared to 50.4 in October, said HSBC Holdings PLC. The index value below 50 indicates a contraction of manufacturing activity compared with the previous month, while the value of the above indicates expansion. "The growth of domestic demand was slow, while new export orders fell to five-month low," - said the chief economist at HSBC Qu Hongbin China. Final figures were unchanged from the preliminary PMI (50.0). "Deflationary pressure remains strong and the labor market continue to weaken," - says Koo. We also add the official manufacturing PMI fell to 50.3 in November from 50.8 in October.

Meanwhile, Bloomberg, referring to the statements of analysts said that may reduce the cost of the hydrocarbons to around $ 40 per barrel. World oil prices may continue to fall and fall as long as the cost of oil producers to compensate for existing fields. Representative of the British Chatham House Paul Stevens said that the US shale oil can pay off even if the quotes around $ 40 per barrel. The International Energy Agency (IEA) believe that oil production in North America will be unprofitable at a cost of $ 42 a barrel.

Cost of January futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 68.09 dollars per barrel on the New York Mercantile Exchange.

January futures price for North Sea petroleum mix of Brent rose $ 3.34, to $ 72.06 a barrel on the London Stock Exchange ICE Futures Europe.

-

16:21

Gold: A review of the market situation

Gold prices rose significantly today, restored with all previously lost ground, which was also associated weakening of the US dollar and the results of the referendum on the gold in Switzerland.

As previously reported, the people of Switzerland voted in a referendum yesterday against the proposal to oblige the SNB to keep gold at least 20% of its reserves. If the relevant law was passed, the SNB would have to increase their gold reserves nearly tripled (now they make up 7.5% of the bank's reserves and equal to 1040 tons), ie the purchase of 1.5 thousand. Tons of gold - half of the annual production of this precious metals in the world - worth about $ 70 billion. Swiss francs. The authors of the bill is withdrawn at this 5 years. Referendum participants also voted against the proposal on the repatriation of all Swiss gold stored abroad, and a ban on the sale of precious metals in the future.

Increase in the price of gold has also helped the dollar's decline against other major currencies as a result of profit-taking by traders after the recent jump. Gold prices are likely to remain reduced and tend to decline further in the near term amid signs of strengthening US economy, which could cause the Fed to raise interest rates sooner and faster than previously predicted. Expectations of growth rates on loans put pressure on gold as a precious metal with difficulty competing with the yield of interest-earning assets at higher rates.

Had little effect as of today's US data. A report published by the Institute for Supply Management (ISM), showed that in November the activity in the US manufacturing sector has deteriorated slightly, but exceeded the forecasts of economists who had expected a slightly larger decrease in the index. PMI index for the US manufacturing fell to 58.7 in November against 59.0 in October. A reading above 50 indicates expansion of industrial activity. Note that the last value was higher than the estimates of experts - is expected to decrease to 57.9.

Meanwhile, it became known that the gold reserves in the SPDR Gold Trust fell to 717.63 tons, the lowest level since September 2008, indicating the departure of investors in the US.

Cost of January futures for gold on the COMEX today rose to 1196.40 dollars per ounce.

-

16:17

Microsoft buys email start-up Acompli for more than $200 million

Microsoft buys email start-up Acompli for more than $200 million, according to Re/Code. Acompli is an iOS and Android e-mail app.

-

15:58

The European Central Bank purchased 368 million euros of asset-backed securities and 5.1 billion euros of covered-bond purchases last week.

-

15:00

U.S.: ISM Manufacturing, November 58.7 (forecast 57.9)

-

14:45

U.S.: Manufacturing PMI, November 54.8 (forecast 55.0)

-

14:37

ISM manufacturing purchasing managers’ index declined to 58.7 in November

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 58.7 in November from 59.0 in October, beating expectations for a decline to 57.9.

The index was driven by strong demand and new orders. The new orders index rose to 66.0 in November.

The gauge of prices paid declined to 44.5 November from 53.5 in October. That was the lowest level since July 2012.

-

14:34

U.S. Stocks open: Dow 17,828.24 +0.49 +0.00%, Nasdaq 4,791.63 +4.31 +0.09%, S&P 2,067.56 -5.27 -0.25%

-

14:29

Before the bell: S&P futures -0.44%, Nasdaq futures -0.29%

U.S. stock-index futures declined, indicating equities will fall for a second day, as oil prices extended losses, and data showed Chinese manufacturing slowed last month.

Global markets:

Nikkei 17,590.1 +130.25 +0.75%

Hang Seng 23,367.45 -620.00 -2.58%

Shanghai Composite 2,680.74 -2.09 -0.08%

FTSE 6,659.21 -63.41 -0.94%

CAC 4,374.14 -16.04 -0.37%

DAX 9,946.67 -34.18 -0.34%

Crude oil $66.40 (+0.38%)

Gold $1179.30 (+0.39%)

-

14:14

DOW components before the bell

(company / ticker / price / change, % / volume)

3M Co

MMM

159.27

-0.51%

0.5K

Goldman Sachs

GS

188.41

0.00%

3.7K

American Express Co

AXP

91.60

-0.89%

1.0K

AT&T Inc

T

35.25

-0.37%

21.7K

Boeing Co

BA

133.50

-0.64%

0.3K

Caterpillar Inc

CAT

100.07

-0.53%

22.0K

Chevron Corp

CVX

108.64

-0.21%

17.1K

Cisco Systems Inc

CSCO

27.47

-0.62%

0.2K

E. I. du Pont de Nemours and Co

DD

71.40

0.00%

0.5K

Exxon Mobil Corp

XOM

90.10

-0.49%

37.2K

General Electric Co

GE

26.33

-0.60%

7.9K

Nike

NKE

99.29

0.00%

0.2K

Home Depot Inc

HD

99.00

-0.40%

0.1K

Intel Corp

INTC

37.20

-0.13%

12.7K

International Business Machines Co...

IBM

162.17

0.00%

2.2K

Johnson & Johnson

JNJ

107.90

-0.32%

1.1K

JPMorgan Chase and Co

JPM

60.09

-0.12%

0.8K

UnitedHealth Group Inc

UNH

98.43

-0.20%

1.5K

McDonald's Corp

MCD

96.60

-0.22%

2.6K

Merck & Co Inc

MRK

60.38

-0.03%

0.7K

Microsoft Corp

MSFT

47.70

-0.23%

5.4K

Pfizer Inc

PFE

31.03

-0.39%

3.5K

Procter & Gamble Co

PG

90.43

0.00%

1.3K

The Coca-Cola Co

KO

44.83

0.00%

0.1K

United Technologies Corp

UTX

110.08

0.00%

9.1K

Verizon Communications Inc

VZ

50.30

-0.57%

26.3K

Wal-Mart Stores Inc

WMT

86.94

-0.69%

16.6K

Walt Disney Co

DIS

92.20

-0.34%

11.3K

-

14:09

Upgrades and downgrades before the market open

Upgrades:

Deere (DE) upgraded to Outperform from Neutral at Robert W. Baird, target raised to $105 from $85

Deere (DE) upgraded to Market Perform from Underperform at Wells Fargo

Deere (DE) upgraded to Neutral from Underweight at JP Morgan

Downgrades:

Other:

Cisco Systems (CSCO) target raised to $30.50 from $28 at UBS

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400(E2.0bn), $1.2450(E1.0bn), $1.2475(E1.0bn), $1.2550(E642mn)

USD/JPY: Y117.75($300mn), Y118.75

GBP/USD: $1.5800(stg791mn)

AUD/USD: $0.8500(A$390mn), $0.8550(A$1.0bn)

USD/CHF Chf0.9500($604mn), Chf0.9525, Chf0.9650($445mn)

EUR/GBP: stg0.7750, stg0.7900

EUR/JPY: Y148.00

NZD/USD: $0.8000(NZ$1.4bn)

-

13:00

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the mostly weaker-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Company Operating Profits Quarter III -7.5% Revised From -6.9% -1.2% +0.5%

01:00 China Manufacturing PMI November 50.8 50.5 50.3

01:35 Japan Manufacturing PMI (Finally) November 52.1 52.1 52.0

01:45 China HSBC Manufacturing PMI (Finally) November 50.0 50.0 50.0

05:30 Australia RBA Commodity prices, y/y November -16.9% -18.6%

08:30 Switzerland Manufacturing PMI November 55.3 52.9 52.1

08:48 France Manufacturing PMI (Finally) November 47.6 47.6 48.4

08:53 Germany Manufacturing PMI (Finally) November 50.0 50.0 49.5

08:58 Eurozone Manufacturing PMI (Finally) November 50.4 50.4 50.1

09:30 United Kingdom Purchasing Manager Index Manufacturing November 53.3 Revised From 53.2 53.1 53.5

09:30 United Kingdom Net Lending to Individuals, bln October 2.7 2.8 2.6

09:30 United Kingdom Mortgage Approvals October 61 59 59

The U.S. dollar traded lower against the most major currencies ahead of the ISM manufacturing purchasing managers' index. The index is expected to decline to 57.9 in November from 59.0 in October.

The greenback remained supported by falling oil prices.

The euro traded higher against the U.S. dollar after the mostly weaker-than-expected economic data from the Eurozone. Eurozone' final manufacturing purchasing managers' index (PMI) fell to 50.1 in November from a preliminary reading of 50.4. Analysts had expected the final index to remain at 50.4.

Germany's final manufacturing PMI declined to 49.5 in November from a preliminary reading of 50.0. Analysts had expected the final index to remain at 50.0.

France's final manufacturing PMI climbed to 48.4 in November from a preliminary reading of 47.6. Analysts had expected the final index to remain at 47.6.

The British pound rose against the U.S. dollar after the better-than-expected manufacturing PMI from the U.K. The U.K. manufacturing PMI increased to 53.5 in November from 53.3 in October, beating expectations for a decline to 53.1. October's figure was revised up from 53.2.

Net lending to individuals in the U.K. increased by £2.6 billion in October, missing expectations for a £2.8 billion rise, after a £2.7 billion gain in September.

The number of mortgages approvals in the U.K. fell to 59,426 in October from 61,234 in September. That was the lowest level since June 2013. Analysts had expected the number of mortgages approvals to decline to 59,000.

The Swiss franc traded higher against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland decreased to 52.1 in November from 55.3 in October, missing expectations for a decline to 52.9.

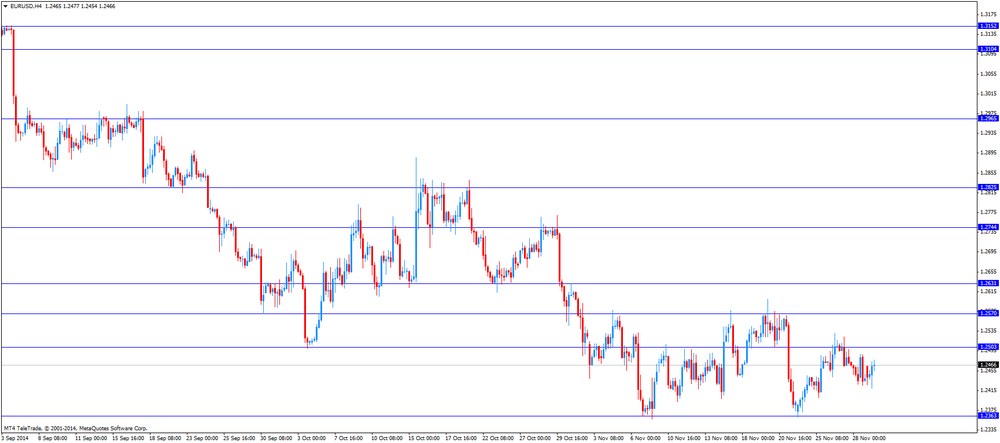

EUR/USD: the currency pair rose to $1.2477

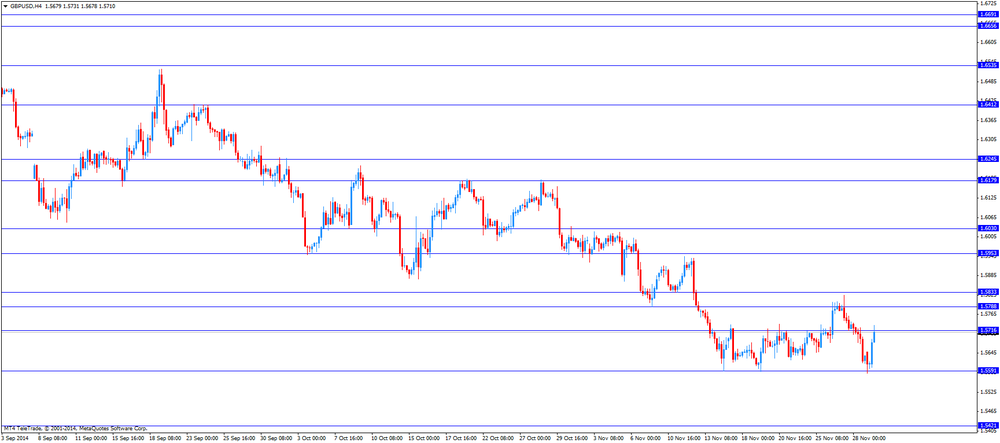

GBP/USD: the currency pair increased to $1.5731

USD/JPY: the currency pair fell to Y118.07

The most important news that are expected (GMT0):

15:00 U.S. ISM Manufacturing November 59.0 57.9

17:15 U.S. FOMC Member Dudley Speak

18:00 U.S. FED Vice Chairman Stanley Fischer Speaks

-

12:50

Orders

EUR/USD

Offers $1.2550, $1.2500

Bids $1.2400, $1.2350

GBP/USD

Offers $1.5850, $1.5780/00, $1.5750

Bids $1.5680/60, $1.5610/00, $1.5580, $1.5550

AUD/USD

Offers $0.8580/00, $0.8550, $0.8500

Bids $0.8445/40, $0.8400, $0.8380, $0.8350

EUR/JPY

Offers Y149.50, Y149.00, Y148.50

Bids Y147.00, Y146.50, Y146.20

USD/JPY

Offers Y120.00, Y119.50, Y119.20

Bids Y118.00, Y117.80, Y117.50

EUR/GBP

Offers stg0.8050, stg0.8000, stg0.7980

Bids stg0.7900, stg0.7885/75, stg0.7860/50

-

12:00

European stock markets mid-session: miners and oil stocks weigh European indices down

European indices declined in today's session weighed by miners and oil stocks after disappointing Chinese and U.S. data. France's final Manufacturing PMI increased to 48.4 beating forecast of 47.6. Germany's Manufacturing PMI decreased to 49.5, analyst expected it to remain at 50. Data on Eurozone's final Manufacturing PMI for November fell to 50.1. Forecast predicted 50.4, in line with the last month. An upbeat data was published for the U.K. with the Purchasing Manager Index for Manufacturing reading 53.5 at a four-month high beating forecast by 0.4 and increasing 0.3 from last month's data. Markets are awaiting the Manufacturing PMI, ISM Manufacturing and speeches of FOMC Member Dudley and FED Vice Chairman Stanley Fischer later in the day.

The FTSE 100 index is currently lower -0.93% at 6,659.88 points, France's CAC 40 lost -0.49% trading at 4,368.79 and Germany's DAX 30 is quoted at -0.37% at 9,943.52 points.

-

11:20

Oil: prices after OPEC meeting under further pressure

Oil prices were under further pressure after the decision of the OPEC to leave output on the current official production target at 30 million barrels a day challenging U.S. shale drillers and other higher-cost producers. Oil prices continued to tumble to their lowest since 2009. In today's trading session Brent Crude lost and is trading -1.21% at USD69.30 a barrel, losing 41% from its peak in June and WTI Crude lost -1.33% currently quoted at USD65.27. China, the world's biggest consumer of energy, profits from low oil prices and is boosting its stockpiles. Crude collapsed into an accelerating bear market last month amid the highest U.S. output in three decades and signs of slowing global demand and economic growth.

-

11:02

-

11:00

Gold tumbled to a two-week low but recovered

Gold, currently trading at USD1,174.50 a troy ounce recouped early trading losses touching a daily low of USD1,142.40 after Swiss voters said no to the "Save Our Swiss Gold" referendum that would have forced the Swiss central bank to hold at least 20 percent of its assets in gold and store them locally. The outcome was no surprise as polls already had forecast the initiative outcome. On Friday India's Reserve Bank eased rules on import, scrapping their 20:80 rule, forcing traders to export 20% of all gold being imported to India, in order to fight smuggling.

The precious metal continues to be under pressure as the U.S. dollar strengthens and falling oil prices make an inflation-hedge via gold less attractive. Investors cut holdings in exchange-traded products.

GOLD currently trading at USD1,174.50

-

10:27

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400(E2.0bn), $1.2450(E1.0bn), $1.2475(E1.0bn), $1.2550(E642mn

USD/JPY: Y117.75($300mn), Y118.75

GBP/USD: $1.5800(stg791mn)

AUD/USD: $0.8500(A$390mn), $0.8550(A$1.0bn)

USD/CHF Chf0.9500($604mn), Chf0.9525, Chf0.9650($445mn)

EUR/GBP: stg0.7750, stg0.7900

EUR/JPY: Y148.00

NZD/USD: $0.8000(NZ$1.4bn)

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , November 53.5 (forecast 53.1)

-

09:30

United Kingdom: Mortgage Approvals, October 59 (forecast 59)

-

09:20

Press Review: SNB Pledges Steps to Supplement Cap ‘Immediately’ If Needed

BLOOMBERG

OPEC Inaction Spurs Survival of Fittest as Oil Below $65

West Texas Intermediate tumbled below $65 a barrel to the lowest level since July 2009 amid speculation prices have further to drop before OPEC's decision to maintain output slows U.S. shale supply.

Benchmark futures in New York and London slumped more than 3 percent after capping their biggest monthly loss in about six years as the Organization of Petroleum Exporting Countries signaled the group will leave it to the market to reduce a global glut. Current prices are no guarantee of a significant decline in U.S. shale output, Iran's Oil Minister Bijan Namdar Zanganeh said in an interview on Nov. 28.

Source: http://www.bloomberg.com/news/2014-11-30/oil-slumps-below-65-amid-opec-inaction-to-stem-glut.html

BLOOMBERG

SNB Pledges Steps to Supplement Cap 'Immediately' If Needed

The Swiss National Bank will defend its cap on the franc via currency interventions and is prepared to take additional steps if needed.

"The SNB will continue to enforce the minimum exchange rate with the utmost determination and is prepared to buy foreign currency in unlimited quantities," the central bank, based in Bern and Zurich, said in a statement yesterday. "The SNB will take further measures immediately if required."

The comment came in response to voters rejecting an initiative that would have required the SNB to hold at least 20 percent of its assets in gold. The central bank said it was "pleased to hear" of yesterday's referendum outcome.

REUTERS

Fed rattled by elusive inflation, but loath to sound alarm yet

(Reuters) - With the U.S. economy humming along at its fastest clip in more than a decade, the Federal Reserve should be confident about its ability to weather a global slowdown and start lifting interest rates around the middle of next year.

But then there is inflation.

Interviews with Fed officials and those familiar with its thinking show the mood inside is more somber than the central bank's reassuring statements and evidence of robust economic health would suggest. The reason is the central bank's failure to nudge price growth up to its 2 percent target and, more importantly, signs that investors and consumers are losing faith it can get there any time soon.

Source: http://www.reuters.com/article/2014/12/01/us-usa-fed-inflation-insight-idUSKCN0JF1BV20141201

-

09:05

European Stocks. First hour: European indices trading negative

European stocks are trading lower in today's session after disappointing data from China an U.S. holiday spending slowed. Growing expectations for additional easing measures by the ECB were no support. France's final Manufacturing PMI increased to 48.4 beating forecast of 47.6. Germany's Manufacturing PMI decreased to 49.5, analyst expected it to remain at 50. Data on Eurozone's final Manufacturing PMI for November fell to 50.1. Forecast predicted 50.4, in line with the last month. Market participants await U.K. data on the Purchase Manager Index Manufacturing, Net Lending to Individuals and Mortgage Approvals due at 09:30 GMT.

The FTSE 100 index is currently trading with a loss of -1.02% at 6,654.16 points, Germany's DAX 30, a lost -0.36% or 36.33 points being quoted at 9,944.52. France's CAC 40 lost -0.88%, currently trading at 4,360.02 points.

-

09:00

Eurozone: Manufacturing PMI, November 50.1 (forecast 50.4)

-

08:55

Germany: Manufacturing PMI, November 49.5 (forecast 50.0)

-

08:50

France: Manufacturing PMI, November 48.4 (forecast 47.6)

-

08:45

Moody's Cuts Japan Rating to A1 from AA3

-

08:30

Switzerland: Manufacturing PMI, November 52.1 (forecast 52.9)

-

08:04

Global Stocks: U.S. mixed in a holiday-shortened session

U.S. markets closed mixed in a holiday-shortened session on Friday. The DOW JONES closed unchanged at 17,828.24 points whereas the S&P 500 declined -0.25% with a final quote of 2,067.56 points. Both indices ended a sixth week of consecutive gains. The energy sector of the S&P 500 fell 6.3 percent on Friday, shale-stock weighed on the sector as oil prices slumped. In November, the Dow and the S&P added 2.5%. Markets are awaiting the Manufacturing PMI, ISM Manufacturing and speeches of FOMC Member Dudley and FED Vice Chairman Stanley Fischer later in the day.

Hong Kong's Hang Seng is trading -2.60% at 23,364.90. China's Shanghai Composite closed at 2,680.74 points, a loss of -0.08.

Japan's Nikkei gained +0.75% after the latest economic data closing at a two-week high at 17,590.10 points.

-

07:30

Foreign exchange market. Asian session: the greenback outpaced major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Company Operating Profits Quarter III -6.9% -1.2% +0.5%

01:00 China Manufacturing PMI November 50.8 50.5 50.3

01:35 Japan Manufacturing PMI (Finally) November 52.1 52.1 52.0

01:45 China HSBC Manufacturing PMI (Finally) November 50.0 50.0 50.0

05:30 Australia RBA Commodity prices, y/y November -16.9% -18.6%

The U.S. dollar traded stronger against its major peers. The greenback was supported by declining oil prices that have a positive effect on the U.S. economy. Markets are awaiting the Manufacturing PMI, ISM Manufacturing and speeches of FOMC Member Dudley and FED Vice Chairman Stanley Fischer later in the day.

The Australian dollar fell sharply against the greenback in Asian trading making new four-year lows although Company Operating Profits rose unexpectedly by +0.5% beating forecast of a decline of -1.2%. But RBA Commodity prices declined -18.6% in November, compared to -16.9% in October. The negative outcome of the Swiss referendum that would have forced the SNB to hold more physical gold put further pressure on the aussie fuelling fears that demand for gold will further slowdown. Australia is the second largest producer of gold. Chinas Manufacturing PMI for November was positive reading 50.3 but lower than the 50.6 expected. The HSBC manufacturing index was in line with expectations at 50. China is the most important trade partner of Australia.

The New Zealand dollar traded weaker against the U.S. dollar for a third consecutive day. New Zealand's Overseas Trade Index for the third quarter declined -4.4% yesterday, after an increase of +0.1% in the last quarter.

The Japanese yen dropped against the U.S. dollar making new lows at USD119.03 in Asian trade. The lowest since August 2007. Yesterday data on Capital Spending showed an increase from +3.0% in the previous quarter to +5.5% in the third quarter. Data on the Manufacturing PMI was published early today reading 52.0, analysts expected 52.1. The OPEC's decision to not cut quotas made oil prices decline heavily fuelling fears that Japan will not reach its inflation targets.

EUR/USD: the euro declined against the greenback

USD/JPY: the U.S. dollar traded at new highs against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 Switzerland Manufacturing PMI November 55.3 52.9

08:48 France Manufacturing PMI (Finally) November 47.6 47.6

08:53 Germany Manufacturing PMI (Finally) November 50.0 50.0

08:58 Eurozone Manufacturing PMI (Finally) November 50.4 50.4

09:30 United Kingdom Purchasing Manager Index Manufacturing November 53.2 53.1

09:30 United Kingdom Net Lending to Individuals, bln October 2.7 2.8

09:30 United Kingdom Mortgage Approvals October 61 59

14:45 U.S. Manufacturing PMI (Finally) November 54.7 55.0

15:00 U.S. ISM Manufacturing November 59.0 57.9

17:15 U.S. FOMC Member Dudley Speak

18:00 U.S. FED Vice Chairman Stanley Fischer Speaks

23:50 Japan Monetary Base, y/y November +36.9% +37.2%

-

06:15

Options levels on monday, December 1, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2544 (4747)

$1.2516 (1794)

$1.2575 (358)

Price at time of writing this review: $ 1.2448

Support levels (open interest**, contracts):

$1.2408 (2543)

$1.2392 (6553)

$1.2370 (4202)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 112662 contracts, with the maximum number of contracts with strike price $1,2800 (6183);

- Overall open interest on the PUT options with the expiration date December, 5 is 113905 contracts, with the maximum number of contracts with strike price $1,2000 (7754);

- The ratio of PUT/CALL was 1.01 versus 1.12 from the previous trading day according to data from November, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.5900 (1085)

$1.5801 (1004)

$1.5703 (1560)

Price at time of writing this review: $1.5612

Support levels (open interest**, contracts):

$1.5595 (2406)

$1.5498 (1298)

$1.5399 (1004)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 41665 contracts, with the maximum number of contracts with strike price $1,6900 (1881);

- Overall open interest on the PUT options with the expiration date December, 5 is 41547 contracts, with the maximum number of contracts with strike price $1,6000 (2020);

- The ratio of PUT/CALL was 1.00 versus 0.98 from the previous trading day according to data from November, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:32

Australia: RBA Commodity prices, y/y, November -18.6%

-

03:00

Nikkei 225 17,610.12 +150.27 +0.86%, Hang Seng 23,641.59 -345.86 -1.44%, Shanghai Composite 2,699 +16.17 +0.60%

-

01:45

China: HSBC Manufacturing PMI, November 50.0 (forecast 50.0)

-

01:35

Japan: Manufacturing PMI, November 52.0 (forecast 52.1)

-

00:59

China: Manufacturing PMI , November 50.3 (forecast 50.5)

-

00:30

Australia: Company Operating Profits, Quarter III +0.5% (forecast -1.2%)

-

00:05

Commodities. Daily history for Nov 28’2014:

(raw materials / closing price /% change)

Light Crude 65.99 -0.24%

Gold 1,167.00 -0.70%

-

00:04

Stocks. Daily history for Nov 28’2014:

(index / closing price / change items /% change)

Nikkei 225 17,459.85 +211.35 +1.23 %

Hang Seng 23,987.45 -16.83 -0.07 %

Shanghai Composite 2,682.92 +52.43 +1.99 %

FTSE 100 6,722.62 -0.80 -0.01 %

CAC 40 4,390.18 +7.84 +0.18 %

Xetra DAX 9,980.85 +5.98 +0.06 %

S&P 500 2,067.56 -5.27 -0.25 %

NASDAQ Composite 4,791.63 +4.31 +0.09 %

Dow Jones 17,828.24 +0.49 0.00%

-

00:00

Currencies. Daily history for Nov 28’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,2439 -0,22%

GBP/USD $1,5636 -0,63%

USD/CHF Chf0,9659 +0,20%

USD/JPY Y118,66 +0,81%

EUR/JPY Y147,62 +0,60%

GBP/JPY Y185,53 +0,18%

AUD/USD $0,8510 -0,39%

NZD/USD $0,7837 -0,36%

USD/CAD C$1,1436 +0,94%

-