Notícias do Mercado

-

23:33

Currencies. Daily history for Dec 2’2014:

(pare/closed(GMT +2)/change, %)

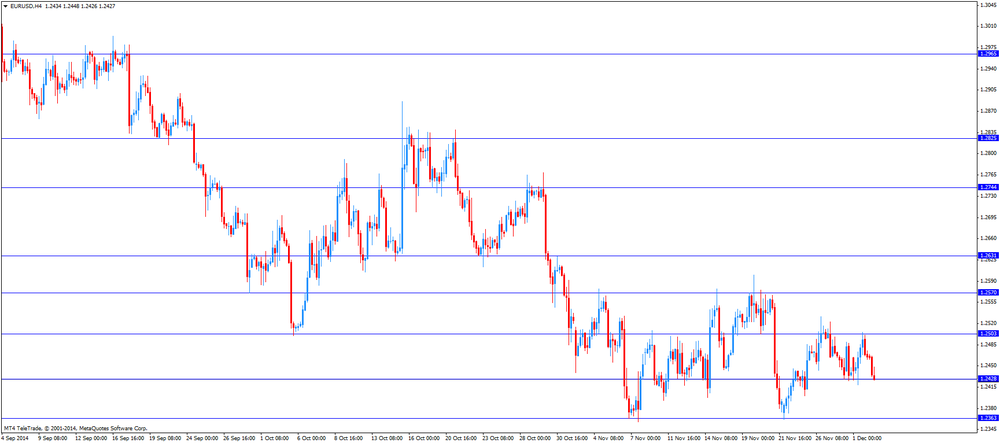

EUR/USD $1,2382 -0,70%

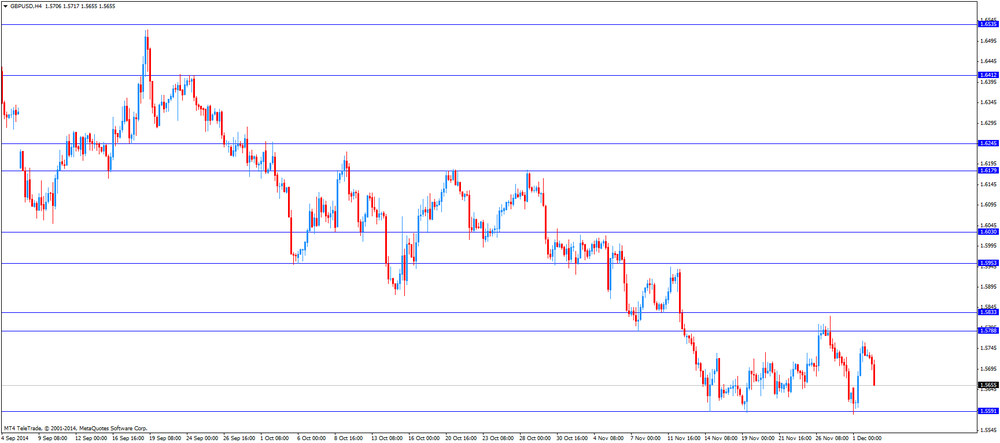

GBP/USD $1,5635 -0,59%

USD/CHF Chf0,9719 +0,77%

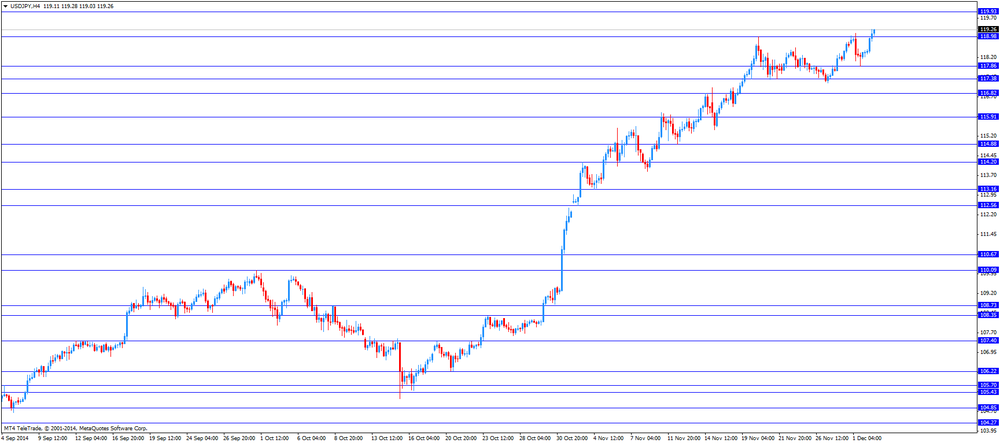

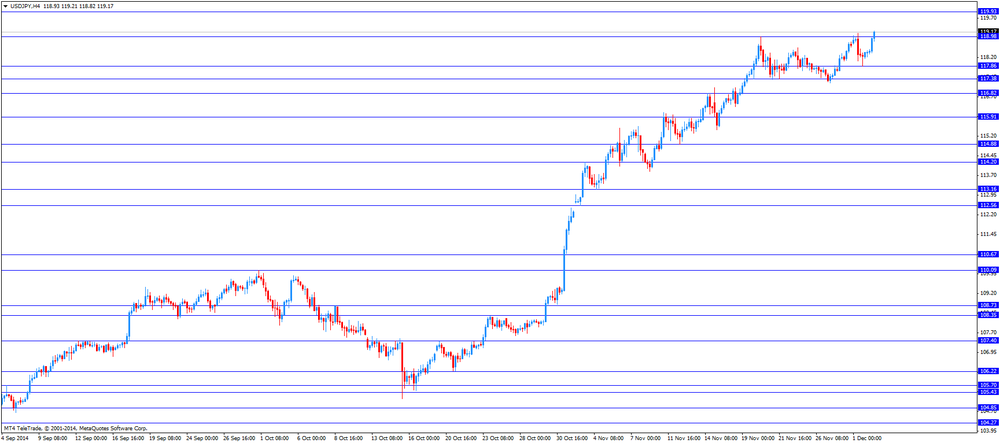

USD/JPY Y119,20 +0,68%

EUR/JPY Y147,61 -0,01%

GBP/JPY Y186,37 +0,09%

AUD/USD $0,8443 -0,53%

NZD/USD $0,7803 -0,77%

USD/CAD C$1,1405 +0,68%

-

23:01

Schedule for today, Wednesday, Dec 3’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Gross Domestic Product (YoY) Quarter III +3.1% +3.1%

00:30 Australia Gross Domestic Product (QoQ) Quarter III +0.5% +0.7%

01:00 China Non-Manufacturing PMI November 53.8

01:45 China HSBC Services PMI November 52.9

06:45 Switzerland Gross Domestic Product (YoY) Quarter III +0.6% +1.4%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III 0.0% +0.3%

08:48 France Services PMI (Finally) November 48.3 48.3

08:53 Germany Services PMI (Finally) November 52.1 52.1

08:58 Eurozone Services PMI (Finally) November 51.3 51.3

09:30 United Kingdom Purchasing Manager Index Services November 56.2 56.6

10:00 Eurozone Retail Sales (YoY) October +0.6% +0.9%

10:00 Eurozone Retail Sales (MoM) October -1.3% +0.6%

12:30 United Kingdom Autumn Forecast Statement

13:15 U.S. ADP Employment Report November 230 223

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter III +2.0% +2.2%

14:45 U.S. Services PMI (Finally) November 56.3 56.3

15:00 Canada Bank of Canada Rate 1.00% 1.00%

15:00 Canada BOC Rate Statement

15:00 U.S. ISM Non-Manufacturing November 57.5 57.1

15:30 U.S. Crude Oil Inventories November +1.9

17:30 U.S. FOMC Member Charles Plosser Speaks

19:00 U.S. Fed's Beige Book

19:00 U.S. FOMC Member Brainard Speaks

22:30 Canada BOC Gov Stephen Poloz Speaks

-

22:30

Australia: AIG Services Index, November 43.8

-

19:45

U.S.: Total Vehicle Sales, mln, November 17.2 (forecast 16.5)

-

17:22

Reserve Bank of Australia kept its interest rate unchanged at 2.50%

The Reserve Bank of Australia (RBA) released its interest rate decision on Tuesday. The RBA kept its interest rate unchanged at 2.50%.

The RBA Governor Glenn Stevens said that "the most prudent course is likely to be a period of stability in interest rates". He reiterated that the Aussie "remains above most estimates of its fundamental value, particularly given the significant declines in key commodity prices in recent months".

Stevens noted that the central bank "still expects growth to be a little below trend for the next several quarters".

-

16:41

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. construction spending

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. construction spending. The U.S. construction spending rose 1.1% in October, exceeding expectations for a 0.6% gain, after a 0.1% decline in September. September's figure was revised up from a 0.4% drop.

The Federal Reserve Vice Chairman Stanley Fischer said at a forum in Washington on Tuesday that the Fed could delay its interest rate hike if inflation declines. He added that interest rate hike would be driven by the economic data.

The Federal Reserve Chair Janet Yellen said nothing about current economic situation and monetary policy on Tuesday.

The euro traded lower against the U.S. dollar. Eurozone's producer price index fell 0.4% in October, missing expectations for a 0.3% increase, after a 0.2% rise in September.

The British pound traded lower against the U.S. dollar. The U.K. construction PMI decreased to 59.4 in November from 61.4 in October, missing expectations for a decline to 61.2.

The New Zealand dollar decreased against the U.S. dollar. In the overnight trading session, the kiwi traded slightly higher against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie rose against the greenback after the Reserve Bank of Australia's interest rate decision. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.50%.

The RBA Governor Glenn Stevens said that "the most prudent course is likely to be a period of stability in interest rates".

Australia's current account deficit fell to A$12.5 billion in the third quarter from A$13.9 billion in the second quarter, beating forecasts for a decline to A$13.5 billion. The second quarter's figure was revised down from a deficit of A$13.7 billion.

Building approvals in Australia climbed 11.4% in October, exceeding expectations for a 5.2% gain, after a11.2% decrease in September. September's figure was revised down from a 11.0% drop.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback due to stronger U.S. currency. Yesterday's cut of Japan's rating still weighed on the yen. Moody's cuts Japan's rating to A1 from AA3.

Labour cash earnings in Japan climbed 0.5% in October, missing expectations for a 0.8% increase, after a 0.7% gain in September. September's figure was revised down from a 0.8% rise.

Japan's monetary base increased 36.7% in November, missing expectation for a 37.2% gain, after a 36.9% rise in October.

-

15:54

U.S. construction spending rose 1.1% in October

The U.S. Commerce Department released construction spending data on Tuesday. The U.S. construction spending rose 1.1% in October, exceeding expectations for a 0.6% gain, after a 0.1% decline in September. September's figure was revised up from a 0.4% drop.

The increase was driven by newly built homes and schools. Spending on single-family houses climbed 1.8% in October, while spending on public construction rose 2.3%.

-

15:00

-

15:00

U.S.: Construction Spending, m/m, November +1.1% (forecast +0.6%)

-

14:52

The Federal Reserve Chair Janet Yellen said nothing about current economic situation and monetary policy on Tuesday.

-

14:44

Federal Reserve Vice Chairman Stanley Fischer: if inflation declines in the U.S. declines, the Fed could delay its interest rate hike

The Federal Reserve Vice Chairman Stanley Fischer said at a forum in Washington on Tuesday that the Fed could delay its interest rate hike if inflation declines. He added that interest rate hike would be driven by the economic data.

The Fed' interest rate is at record low at 0.00% - 0.25% since the end of 2008. Analysts expects the first interest rate in the second half of next year.

-

13:51

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400(E716mn), $1.2450(E201mn), $1.2485(E279mn), $1.2500(E2.02bn), $1.2515(E222mn), $1.2525(E537mn), $1.2530(E623mn), $1.2545/50(E700mn)

USD/JPY: Y117.50($200mn), Y117.90($300mn), Y118.00($445mn), Y118.75($205mn), Y119.50

GBP/USD: $1.5750(stg262mn), $1.5800(stg600mn)

AUD/USD: $0.8500(A$2.5bn)

USD/CAD: Cad1.1270($250mn), Cad1.1280($540mn), Cad1.1310($201mn), Cad1.1350($455mn), Cad1.1410($320mn)

USD/CHF: Chf0.9575($200mn), Chf0.9650($320mn), Chf0.9685($1.15bn)

EUR/CHF: Chf1.2075(E298mn)

-

13:00

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead of a long row of speeches

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Building Permits, m/m October -11.2% Revised From -11.0% +5.2% +11.4%

00:30 Australia Building Permits, y/y October -11.4% Revised From -13.4% +2.5%

00:30 Australia Current Account, bln Quarter III -13.9% Revised From -13.7 -13.5 -12.5%

01:30 Japan Labor Cash Earnings, YoY October +0.7% Revised From +0.8% +0.8% +0.5%

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction November 61.4 61.2 59.4

10:00 Eurozone Producer Price Index, MoM October +0.2% +0.3% -0.4%

10:00 Eurozone Producer Price Index (YoY) October -1.4% -1.3%

The U.S. dollar traded higher against the most major currencies ahead of a long row of speeches. The Fed Vice Chairman Stanley Fischer is expected to speak at 13:10 (GMT0). The Fed Chairman Janet Yellen is expected to speak at 13:30 (GMT0). The FOMC Member Brainard Speaks is expected to speak at 17:00 (GMT0).

The euro traded lower against the U.S. dollar. Eurozone's producer price index fell 0.4% in October, missing expectations for a 0.3% increase, after a 0.2% rise in September.

The British pound declined against the U.S. dollar after the weaker-than-expected construction PMI from the U.K. The U.K. construction PMI decreased to 59.4 in November from 61.4 in October, missing expectations for a decline to 61.2.

EUR/USD: the currency pair fell to $1.2426

GBP/USD: the currency pair decreased to $1.5655

USD/JPY: the currency pair rose to Y119.21

The most important news that are expected (GMT0):

13:10 U.S. FED Vice Chairman Stanley Fischer Speaks

13:30 U.S. Fed Chairman Janet Yellen Speaks

17:00 U.S. FOMC Member Brainard Speaks

-

12:50

Orders

EUR/USD

Offers $1.2550, $1.2510, $1.2500

Bids $1.2400, $1.2350, $1.2320

GBP/USD

Offers $1.5850, $1.5780/00

Bids $1.5680, $1.5650, $1.5610/00

AUD/USD

Offers $0.8580/00, $0.8540/50, $0.8500

Bids $0.8450, $0.8400, $0.8380, $0.8350, $0.8300

EUR/JPY

Offers Y149.00, Y148.50, Y148.00

Bids Y147.55/50, Y147.00, Y146.50

USD/JPY

Offers Y120.50, Y120.00, Y119.50, Y119.20, Y119.00

Bids Y118.65/60, Y118.25/20, Y118.00, Y117.80

EUR/GBP

Offers stg0.8050, stg0.8000, stg0.7980, stg0.7950

Bids stg0.7900, stg0.7885/75, stg0.7860/50

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400(E716mn), $1.2450(E201mn), $1.2485(E279mn), $1.2500(E2.02bn), $1.2515(E222mn), $1.2525(E537mn), $1.2530(E623mn), $1.2545/50(E700mn)

USD/JPY: Y117.50($200mn), Y117.90($300mn), Y118.00($445mn), Y118.75($205mn), Y119.50

GBP/USD: $1.5750(stg262mn), $1.5800(stg600mn)

AUD/USD: $0.8500(A$2.5bn)

USD/CAD: Cad1.1270($250mn), Cad1.1280($540mn), Cad1.1310($201mn), Cad1.1350($455mn), Cad1.1410($320mn)

USD/CHF: Chf0.9575($200mn), Chf0.9650($320mn), Chf0.9685($1.15bn)

EUR/CHF: Chf1.2075(E298mn)

-

10:00

Eurozone: Producer Price Index, MoM , October -0.4% (forecast +0.3%)

-

10:00

Eurozone: Producer Price Index (YoY), October -1.3%

-

09:55

United Kingdom: PMI construction contracted more than predicted

Momentum in one of U.K.'s important growth sectors declined more than analysts had predicted growing at the slowest pace in more than a year. U.K. activity in the construction sector shrank seasonally adjusted to 59.4 for November according to the index from a reading of 61.4 in October and below forecasts of 61.2 fuelling doubts on economic growth and a positive economic outlook.

-

09:30

United Kingdom: PMI Construction, November 59.4 (forecast 61.2)

-

09:20

Press Review: Draghi Treads Path of ECB Powerlessness Toward QE Without Reform

BLOOMBERG

Oil Investors May Be Running Off a Cliff They Can't See

Climate: Now or Never

A major threat to fossil fuel companies has suddenly moved from the fringe to center stage with a dramatic announcement by Germany's biggest power company and an intriguing letter from the Bank of England.

A growing minority of investors and regulators are probing the possibility that untapped deposits of oil, gas and coal -- valued at trillions of dollars globally -- could become stranded assets as governments adopt stricter climate change policies.

BLOOMBERG

Draghi Treads Path of ECB Powerlessness Toward QE Without Reform

Looking out from the top of the European Central Bank's new tower in Frankfurt, it's easy to find dark clouds on the horizon.

The view for policy makers is of a euro-zone populace so weary of years of economic turmoil that it's increasingly electing politicians who say no to pan-European cooperation, and spurn reforms that the ECB says are vital to revive the economy. Trapped by their mandate to prevent deflation, officials fret they might soon be forced to roll out quantitative easing that can never succeed by itself.

REUTERS

Fed welcomes energy drop, shrugs off disinflation threat

(Reuters) - The Federal Reserve is welcoming the sharp drop in global energy prices, with two influential policymakers on Monday cheering the boost it should provide American pocketbooks and shrugging off any pressure on already low inflation.

Soft oil prices in particular, which hit a five-year low on Friday, will only temporarily dampen overall U.S. prices, Fed Vice Chairman Stanley Fischer and New York Fed President William Dudley said at separate events. The pair painted a mostly rosy outlook for the world's largest economy, suggesting the central bank is not letting energy markets distract it from lifting rates some time next year.

Source: http://www.reuters.com/article/2014/12/01/us-usa-fed-idUSKCN0JF39U20141201

-

07:30

Foreign exchange market. Asian session: U.S. dollar trading stronger against euro, yen and pound

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:50 Japan Monetary Base, y/y November +36.9% +37.2% +36.7%

01:30 Australia Building Permits, m/m October -11.2% [Revised From -11.0%] +5.2% +11.4%

01:30 Australia Building Permits, y/y October -11.4% [Revised From -13.4%] +2.5%

01:30 Australia Current Account, bln Quarter III -13.9% [Revised From -13.7] -13.5 -12.5%

02:30 Japan Labor Cash Earnings, YoY October +0.7% [Revised From +0.8%] +0.8% +0.5%

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

The U.S. dollar traded stronger against the euro, yen and British pound but lost against the aussie and the kiwi after the better-than-expected ISM manufacturing purchasing managers' index. Markets await Fed Chairman Janet Yellen's speech today scheduled for 13:30 GMT and her Vice Chairmen's speech 20 minutes earlier and tomorrows Employment Report.

The Australian dollar traded stronger after the Royal Bank of Australia announced to keep interest rates at a record low of 2.5% to boost the economy facing a high currency and declining export prices. RBA Governor Glenn Stevens said in a statement that inflation is expected to stay on target at 2-3% over the next two years and that there will be no changes in the interest rates for the next two years. Building permits on a monthly basis beat forecasts of +5.2% reading +11.4% in October. Yearly Building permits rose +2.5%. Australia's current account balance for the third quarter showed a deficit of 12.5 bln beating forecast predicting a deficit of 13.5 bln.

The New Zealand dollar traded stronger against the U.S. dollar further recovering from weak Chinese data.

The Japanese yen lost against the U.S. dollar almosterasing yesterday's gains trading at seven-year highs driven by Moody's cut in Japan's credit rating to A1 from Aa3 fuelling doubts about Japan's Abenomics - the main reason for the Japanese yen's weakness. Moody's justified the cut with increasing uncertainty over Japan's ability to reduce its deficit.

EUR/USD: the euro declined against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom PMI Construction November 61.4 61.2

10:00 Eurozone Producer Price Index, MoM October +0.2% +0.3%

10:00 Eurozone Producer Price Index (YoY) October -1.4%

13:10 U.S. FED Vice Chairman Stanley Fischer Speaks

13:30 U.S. Fed Chairman Janet Yellen Speaks

15:00 U.S. Construction Spending, m/m November -0.4% +0.6%

17:00 U.S. FOMC Member Brainard Speaks

19:30 U.S. Total Vehicle Sales, mln November 16.5 16.5

21:30 U.S. API Crude Oil Inventories November +2.8

22:30 Australia AIG Services Index November 43.6

-

06:21

Options levels on tuesday, December 2, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2544 (4747)

$1.2516 (1794)

$1.2493 (1639)

Price at time of writing this review: $ 1.2462

Support levels (open interest**, contracts):

$1.2419 (3504)

$1.2392 (6553)

$1.2370 (4202)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 112662 contracts, with the maximum number of contracts with strike price $1,2800 (6183);

- Overall open interest on the PUT options with the expiration date December, 5 is 113905 contracts, with the maximum number of contracts with strike price $1,2000 (7754);

- The ratio of PUT/CALL was 1.01 versus 1.12 from the previous trading day according to data from November, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.6000 (1537)

$1.5900 (1085)

$1.5801 (1004)

Price at time of writing this review: $1.5720

Support levels (open interest**, contracts):

$1.5689 (1707)

$1.5595 (2406)

$1.5498 (1298)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 41665 contracts, with the maximum number of contracts with strike price $1,6900 (1881);

- Overall open interest on the PUT options with the expiration date December, 5 is 41547 contracts, with the maximum number of contracts with strike price $1,6000 (2020);

- The ratio of PUT/CALL was 1.00 versus 0.98 from the previous trading day according to data from November, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:30

Australia: Announcement of the RBA decision on the discount rate, 2.50% (forecast 2.50%)

-

01:31

Japan: Labor Cash Earnings, YoY, October +0.5% (forecast +0.8%)

-

00:31

Australia: Building Permits, y/y, October +2.5%

-

00:30

Australia: Building Permits, m/m, October +11.4% (forecast +5.2%)

-

00:30

Australia: Current Account, bln, Quarter III -12.5% (forecast -13.5)

-