Notícias do Mercado

-

23:27

Currencies. Daily history for Feb 06’2018:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2376 +0,08%

GBP/USD $1,3950 -0,05%

USD/CHF Chf0,93605 +0,47%

USD/JPY Y109,55 +0,38%

EUR/JPY Y135,59 +0,46%

GBP/JPY Y152,831 +0,32%

AUD/USD $0,7905 +0,36%

NZD/USD $0,7340 +1,04%

USD/CAD C$1,24933 -0,37%

-

23:03

Schedule for today, Wednesday, Feb 07’2018 (GMT0)

00:00 Japan Labor Cash Earnings, YoY December 0.9% 0.7%

05:00 Japan Leading Economic Index (Preliminary) December 108.3 108.1

05:00 Japan Coincident Index (Preliminary) December 117.9 118.2

07:00 Germany Industrial Production s.a. (MoM) December 3.4% -0.5%

07:45 France Trade Balance, bln December -5.7 -4.9

08:00 Switzerland Foreign Currency Reserves January 744

08:30 United Kingdom Halifax house price index 3m Y/Y January 2.7% 2.4%

08:30 United Kingdom Halifax house price index January -0.6% 0.2%

09:00 Eurozone ECB's Lautenschläger Speech

13:30 Canada Building Permits (MoM) December -7.7% 2%

13:30 U.S. FOMC Member Dudley Speak

15:30 U.S. Crude Oil Inventories February 6.776 2.86

16:15 U.S. FOMC Member Charles Evans Speaks

20:00 New Zealand RBNZ Interest Rate Decision 1.75% 1.75%

20:00 New Zealand RBNZ Rate Statement

20:00 U.S. Consumer Credit December 27.95 20

21:00 New Zealand RBNZ Press Conference

22:20 U.S. FOMC Member Williams Speaks

23:50 Japan Current Account, bln December 1.347 1017.5

-

22:46

Australia: AiG Performance of Construction Index, January 54.3

-

21:45

New Zealand: Employment Change, q/q, Quarter IV 0.5% (forecast 0.2%)

-

21:45

New Zealand: Unemployment Rate, Quarter IV 4.5% (forecast 4.6%)

-

15:29

Bitcoin recovers from three-month lows, now up more than 7 pct

-

15:08

The number of U.S job openings was little changed at 5.8 million on the last business day of December

The number of job openings was little changed at 5.8 million on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.5 million and 5.2 million, respectively. Within separations, the quits rate and the layoffs

and discharges rate were little changed at 2.2 percent and 1.1 percent, respectively. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions. -

15:00

U.S.: JOLTs Job Openings, December 5.811 (forecast 5.9)

-

15:00

Canada: Ivey Purchasing Managers Index, January 55.2 (forecast 61.0)

-

14:58

Fed's Bullard says recent labor market data may not be a signal inflation will accelerate

-

14:20

Canada's merchandise trade deficit totalled $3.2 billion in December, widening from a $2.7 billion deficit in November

Imports rose 1.5% and exports were up 0.6%, both led by energy products.

Total imports were up 1.5% to a record $49.7 billion in December, with increases in 9 of 11 sections. Volumes rose 1.0% and prices increased 0.5%. Higher imports of energy products and industrial machinery, equipment and parts were partially offset by lower imports of aircraft and other transportation equipment and parts.

Total exports rose for the third consecutive month, up 0.6% to $46.5 billion in December despite decreases in 6 of 11 sections. Prices were up 0.5% while volumes were essentially unchanged. Higher exports of energy products, and metal and non-metallic mineral products were partially offset by lower exports of consumer goods. Exports excluding energy products decreased 0.6%.

-

14:17

U.S trade balance deficit rose more than expected in December

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $53.1 billion in December, up $2.7 billion from $50.4 billion in November, revised. December exports were $203.4 billion, $3.5 billion more

than November exports. December imports were $256.5 billion, $6.2 billion more than November imports.

The December increase in the goods and services deficit reflected an increase in the goods deficit of $2.6 billion to $73.3 billion and a decrease in the services surplus of $0.1 billion to $20.2 billion.

For 2017, the goods and services deficit increased $61.2 billion, or 12.1 percent, from 2016. Exports increased $121.2 billion or 5.5 percent. Imports increased $182.5 billion or 6.7 percent.

-

13:30

U.S.: International Trade, bln, December -53.1 (forecast -52)

-

13:30

Canada: Trade balance, billions, December -3.19 (forecast -2.2)

-

11:55

Bank of England FPC's Stheeman says Brexit without financial services agreement would raise transaction costs for European, British and worldwide companies

-

Says hard to say if EU, rather than Britain, would be worse off with no post-brexit financial services agreement

-

FPC is "very much" alive to potential risks from UK consumer credit growth

-

Commercial real estate in prime central London is very fully valued

-

-

11:27

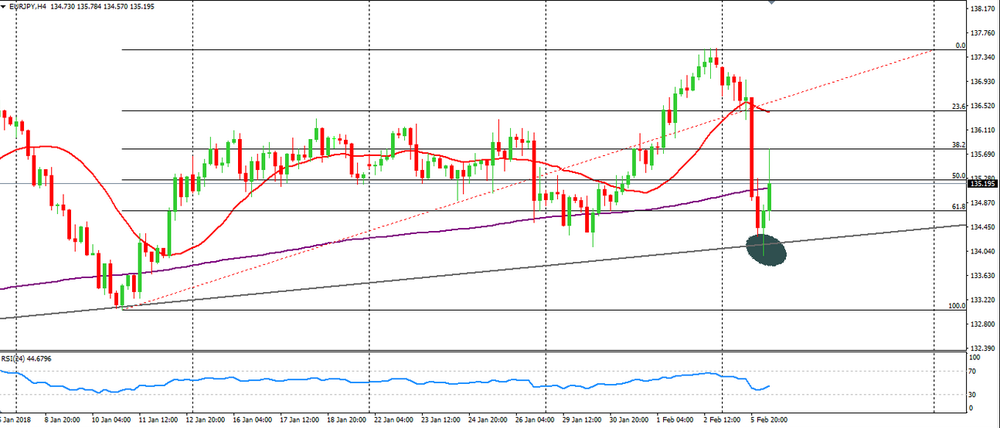

EUR/JPY Analysis

EUR/JPY has suffered a huge depreciation earlier in this week, largely due to recent stock-market corrections.

However, if we look at the 4-hour time frame chart, we can see that the price gave clear signs of a rejection of Fibonacci levels and the upside trend line that has been forming below the price.

Therefore, if the price continues to reject further down movements then we can expect a new appreciation on EUR/JPY.

-

10:17

Anti-Brexit lawmakers will appeal against Scottish court decision not to refer to European court of justice case on whether Britain could unilaterally stop Brexit

-

09:17

Euro zone retail PMI fell to 50.8 in January, from 53.0 in December

The headline IHS Markit Eurozone Retail PMI - which tracks the month-on-month changes in retail sales in the bloc‟s biggest three economies combined - fell to 50.8 in January, from 53.0 in December. Sales were down on an annual basis after having been broadly unchanged in December.

Alex Gill, economist at IHS Markit which compiles the Eurozone Retail PMI, said: "The latest data paint a mixed picture as to the overall health of the eurozone retail sector. On the one hand, like-for-like sales and employment continued to rise, albeit at weaker rates than seen in December. On the other, sales remained down on an annual basis, gross margins were squeezed further while weaker than expected sales contributed to a build-up of inventories.

-

08:59

German SPD's Schulz: I have good reasons to believe we will finish talks today @livesquawk

-

07:51

Options levels on tuesday, February 6, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2551 (2563)

$1.2526 (1505)

$1.2486 (4025)

Price at time of writing this review: $1.2395

Support levels (open interest**, contracts):

$1.2338 (3383)

$1.2294 (4413)

$1.2247 (4926)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 143659 contracts (according to data from February, 5) with the maximum number of contracts with strike price $1,1850 (7036);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4211 (982)

$1.4181 (1698)

$1.4154 (3462)

Price at time of writing this review: $1.3944

Support levels (open interest**, contracts):

$1.3887 (757)

$1.3841 (1202)

$1.3794 (1013)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 40952 contracts, with the maximum number of contracts with strike price $1,3600 (3462);

- Overall open interest on the PUT options with the expiration date February, 9 is 37589 contracts, with the maximum number of contracts with strike price $1,3400 (3038);

- The ratio of PUT/CALL was 0.92 versus 0.92 from the previous trading day according to data from February, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

Bitcoin falls more than 10 percent on Bitstamp, hits lowest level since mid-november - $5848

-

07:21

BoJ Kuroda: stock prices move on various factors, but Japan, Europe, U.S. economies are in very good shape

-

Inappropriate to shift monetary policy prematurely just to create future policy tools

-

-

07:20

Senior BoJ official: recent incident in Japan's crytocurrency market underscores importance of ensuring safety, stability of settlement, financial services

-

BoJ will take appropriate steps to boost cyber-resilience, support private-sector efforts to protect market infrastructure

-

Cyber attacks against market infrastructure could pose huge shock to financial system that could spread to global markets

-

Providers of cryptocurrency-related services must proactively take steps to boost security, explain risks involved to investors

-

Cryptocurrencies currently used mostly for investment, speculative trading with usage for settlement rare

-

-

07:17

Australian trade balance deficit higher than expected

Balance on goods and services:

-

In trend terms, the balance on goods and services was a deficit of $476m in december 2017, an increase of $313m on the deficit in november 2017.

-

In seasonally adjusted terms, the balance on goods and services was a deficit of $1,358m in december 2017, a turnaround of $1,394m on the surplus in november 2017.

Credits (exports of goods and services):

In seasonally adjusted terms, goods and services credits rose $510m (2%) to $32,465m. Non-rural goods rose $719m (4%). Rural goods fell $144m (4%), non-monetary gold fell $9m (1%) and net exports of goods under merchanting fell $1m (2%). Services credits fell $54m (1%).

-

-

07:12

Australian retail turnover fell 0.5 per cent in December

Australian retail turnover fell 0.5 per cent in December 2017, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

This follows a 1.3 per cent rise in November 2017.

"There were falls for household goods retailing (-2.6 per cent) and other retailing (-1.8 per cent) following strong rises in the November month," said Ben James, Director of Quarterly Economy Wide Surveys. "Department stores (-0.6 per cent), cafes, restaurants and takeaways (-0.1 per cent), and clothing, footwear and personal accessory retailing (-0.1 per cent) also fell. Food retailing rose (0.7 per cent) in December 2017."

In seasonally adjusted terms, there were falls in Victoria (-0.8 per cent), New South Wales (-0.4 per cent), Western Australia (-0.8 per cent), Tasmania (-1.6 per cent), the Australian Capital Territory (-1.5 per cent), South Australia (-0.3 per cent), and the Northern Territory (-0.7 per cent). Queensland was relatively unchanged (0.0 per cent) in seasonally adjusted terms.

-

07:11

Australia Central Bank: at its meeting today, the board decided to leave the cash rate unchanged at 1.50%

-

RBA says outlook for non-mining investment has improved

-

Low level of interest rates continuing to support the australian economy

-

Australian economy expected to grow around 3 pct in medium term

-

Labour market continues to strengthen

-

Household consumption is a source of uncertainty

-

Public infrastructure investment supporting economy

-

Unemployment rate expected to decline gradually

-

Rising A$ would result in slower economy, inflation

-

Says A$ remains within the range it has been over the past two years on trade-weighted basis

-

-

07:05

Huge rise for german factory orders in December

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had increased in December 2017 a seasonally and working-day adjusted 3.8% on the previous month. For November 2017, revision of the preliminary outcome resulted in a decrease of 0.1% compared with October 2017 (primary -0.4%). Price-adjusted new orders without major orders in manufacturing had increased in December 2017 a seasonally and working-day adjusted +0.8% on the previous month.

In December 2017, domestic orders increased by 0.7% and foreign orders increased by 5.9% on the previous month. New orders from the euro area were up 11.2%, new orders from other countries increased 2.7% compared to November 2017.

-

07:01

Germany: Factory Orders s.a. (MoM), December 3.8% (forecast 0.7%)

-

03:30

Australia: Announcement of the RBA decision on the discount rate, 1.5% (forecast 1.5%)

-

00:30

Australia: Trade Balance , December -1.358 (forecast 0.25)

-

00:30

Australia: Retail Sales, M/M, December -0.5% (forecast -0.2%)

-