Notícias do Mercado

-

23:28

Currencies. Daily history for Feb 06’2018:

(index / closing price / change items /% change)

Nikkei -1071.84 21610.24 -4.73%

TOPIX -80.33 1743.41 -4.40%

Hang Seng -1649.80 30595.42 -5.12%

CSI 300 -125.26 4148.89 -2.93%

Euro Stoxx 50 -83.85 3394.92 -2.41%

FTSE 100 -193.58 7141.40 -2.64%

DAX -294.83 12392.66 -2.32%

CAC 40 -124.02 5161.81 -2.35%

DJIA +567.02 24912.77 +2.33%

S&P 500 +46.20 2695.14 +1.74%

NASDAQ +148.36 7115.88 +2.13%

S&P/TSX +29.12 15363.93 +0.19%

-

21:19

The main US stock indexes finished trading on the positive territory

Major US stock indices rose strongly on Tuesday, partially recovering from the biggest one-day drop in S & P and Dow in more than 6 years. Support for the indices was exacerbated by increased risk aversion, as well as the fading of fears over inflation and higher yields on government bonds

Negligible impact on the course of trading also provided data on the United States. As shown today, the survey of vacancies and labor turnover (JOLTS), published by the Bureau of Labor Statistics in the US, in December the number of vacancies fell to 5.811 million. Meanwhile, the indicator for November was revised upwards to 5.978 million from 5.879 million. Analysts had expected, that the number of vacancies will decrease to 5.9 million. The vacancy rate was 3.8%, decreasing by 0.1% compared to November. The number of vacancies has changed little in both the private sector and the government segment.

Quotes of oil fell by about 1% on Tuesday, covered by the latest wave of sales, which dealt a blow to the stock markets, bonds, crypto-currencies, and commodities. Even though Wall Street stocks recorded their biggest one-day drop since late 2011 on Monday and volatility indicators jumped to multi-year highs, reflecting increased nervousness among investors, oil did not suffer to the same extent.

Most components of the DOW index finished in positive territory (26 out of 30). The leader of growth was the shares of DowDuPont Inc. (DWDP, + 5.97%). Outsider were shares of Exxon Mobil Corporation (XOM, -1.76%).

Almost all sectors of the S & P index recorded an increase. The consumer goods sector grew most (+ 2.0%). The decrease was shown only by the utilities sector (-0.8%).

At closing:

DJIA + 2.33% 24,912.77 +567.02

Nasdaq + 2.13% 7,115.88 +148.36

S & P + 1.74% 2,695.14 +46.20

-

20:01

DJIA +1.24% 24,646.62 +300.87 Nasdaq +0.01% 7,059.09 +0.79 S&P +0.93% 2,673.63 +24.69

-

17:00

European stocks closed: FTSE 100 -193.58 7141.40 -2.64% DAX -294.83 12392.66 -2.32% CAC 40 -124.02 5161.81 -2.35%

-

14:35

U.S. Stocks open: Dow -1.43% Nasdaq -1.05%, S&P -1.34%

-

14:27

Before the bell: S&P futures -0.12%, NASDAQ futures +0.17%

U.S. stock-index futures were mixed on Tuesday after big losses in the previous two trading sessions.

Global Stocks:

Nikkei 21,610.24 -1,071.84 -4.73%

Hang Seng 30,595.42 -1,649.80 -5.12%

Shanghai 3,369.71 -117.79 -3.38%

S&P/ASX 5,833.30 -192.90 -3.20%

FTSE 7,183.20 -151.78 -2.07%

CAC 5,137.49 -148.34 -2.81%

DAX 12,379.25 -308.24 -2.43%

Crude $63.47 (-1.06%)

Gold $1,336.80 (+0.02%)

-

13:41

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

225.05

-6.39(-2.76%)

16802

ALCOA INC.

AA

47.89

-0.57(-1.18%)

1512

ALTRIA GROUP INC.

MO

65.05

-0.99(-1.50%)

9377

Amazon.com Inc., NASDAQ

AMZN

1,361.50

-28.50(-2.05%)

158802

American Express Co

AXP

87.54

-4.47(-4.86%)

11259

AMERICAN INTERNATIONAL GROUP

AIG

59.21

-1.42(-2.34%)

13134

Apple Inc.

AAPL

154.93

-1.56(-1.00%)

555093

AT&T Inc

T

36.06

-0.57(-1.56%)

120697

Barrick Gold Corporation, NYSE

ABX

13.52

-0.11(-0.81%)

8040

Boeing Co

BA

318.49

-10.39(-3.16%)

91669

Caterpillar Inc

CAT

145.1

-5.98(-3.96%)

51837

Chevron Corp

CVX

110.8

-1.82(-1.62%)

22354

Cisco Systems Inc

CSCO

38.23

-0.55(-1.42%)

106380

Citigroup Inc., NYSE

C

70.97

-2.30(-3.14%)

96719

Exxon Mobil Corp

XOM

78.53

-1.19(-1.49%)

126179

Facebook, Inc.

FB

178.5

-2.76(-1.52%)

607679

FedEx Corporation, NYSE

FDX

242.6

-5.90(-2.37%)

1417

Ford Motor Co.

F

10.12

-0.12(-1.17%)

213411

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

17.3

-0.35(-1.98%)

32292

General Electric Co

GE

14.77

-0.14(-0.94%)

520638

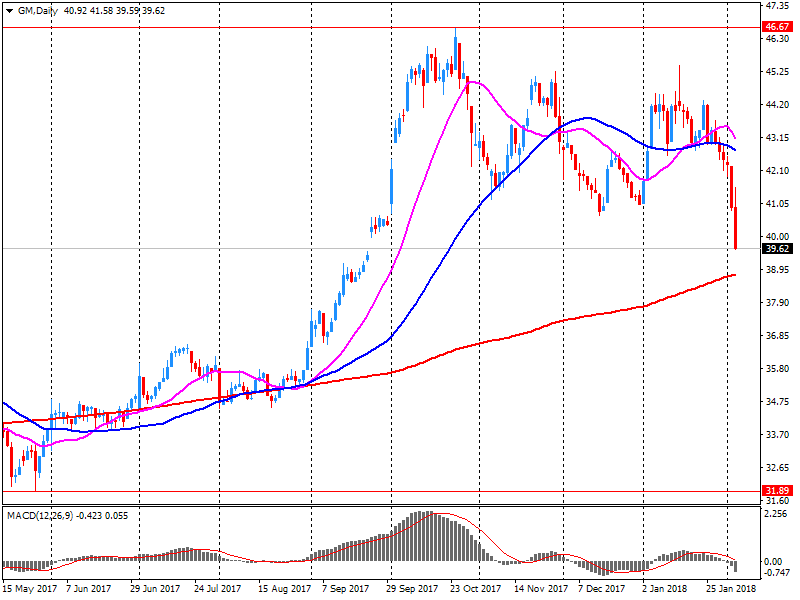

General Motors Company, NYSE

GM

39.39

-0.15(-0.38%)

297145

Goldman Sachs

GS

243.1

-6.01(-2.41%)

44199

Google Inc.

GOOG

1,030.95

-24.85(-2.35%)

28177

Hewlett-Packard Co.

HPQ

20.71

-0.58(-2.72%)

10898

Home Depot Inc

HD

177.27

-5.84(-3.19%)

27070

HONEYWELL INTERNATIONAL INC.

HON

146.67

-3.50(-2.33%)

1557

Intel Corp

INTC

43.8

-0.42(-0.95%)

89037

International Business Machines Co...

IBM

150.8

-1.73(-1.13%)

28888

Johnson & Johnson

JNJ

128.52

-1.87(-1.43%)

30124

JPMorgan Chase and Co

JPM

105.87

-2.93(-2.69%)

59688

McDonald's Corp

MCD

157.3

-6.55(-4.00%)

26969

Merck & Co Inc

MRK

55.06

-1.34(-2.38%)

19467

Microsoft Corp

MSFT

87.23

-0.77(-0.88%)

306903

Nike

NKE

62.55

-1.84(-2.86%)

53698

Pfizer Inc

PFE

34.16

-0.51(-1.47%)

46202

Procter & Gamble Co

PG

80

-1.06(-1.31%)

39319

Starbucks Corporation, NASDAQ

SBUX

53.56

-1.13(-2.07%)

23897

Tesla Motors, Inc., NASDAQ

TSLA

325.55

-7.58(-2.28%)

77262

The Coca-Cola Co

KO

44.07

-0.82(-1.83%)

26523

Travelers Companies Inc

TRV

134.91

-6.61(-4.67%)

9119

Twitter, Inc., NYSE

TWTR

24.5

-0.63(-2.51%)

168996

United Technologies Corp

UTX

124.15

-3.09(-2.43%)

20034

UnitedHealth Group Inc

UNH

212

-8.02(-3.65%)

16166

Verizon Communications Inc

VZ

49.6

-0.90(-1.78%)

19987

Visa

V

114.46

-1.81(-1.56%)

277412

Wal-Mart Stores Inc

WMT

98.35

-1.74(-1.74%)

34439

Walt Disney Co

DIS

102.24

-2.46(-2.35%)

85276

-

13:34

Target price changes before the market open

Freeport-McMoRan (FCX) target raised to $18 at Stifel

-

13:33

Downgrades before the market open

Exxon Mobil (XOM) downgraded to Underweight from Equal Weight at Barclays

-

13:32

Upgrades before the market open

Chevron (CVX) upgraded to Overweight from Equal Weight at Barclays

-

13:07

Company News: General Motors (GM) quarterly results beat analysts’ estimate

General Motors (GM) reported Q4 FY 2017 earnings of $1.65 per share (versus $1.28 in Q4 FY 2016), beating analysts' consensus estimate of $1.43.

The company's quarterly revenues amounted to $34.481 bln (-7.7% y/y), generally in-line with analysts' consensus estimate of $34.280 bln.

GM rose to $40.20 (+1.44%) in pre-market trading.

-

08:57

Major European stock markets started trading in the red zone: FTSE 7153.07 -181.91 -2.48%, DAX 12316.85 -370.64 -2.92%, CAC 5140.74 -145.09 -2.75%

-

07:18

Eurostoxx 50 futures down 4 pct, DAX futures down 4.5 pct, CAC 40 futures down 3.5 pct, FTSE futures down 3.3 pct

-

06:25

Global Stocks

European stocks finished sharply lower on Monday, tracking a global selloff in equities that picked up speed on Friday, after a better-than-expected U.S. jobs report stoked fears about rising inflation and higher interest rates.

U.S. stocks tumbled Monday, with the Dow recording its worst one-day point drop in history, in a selloff that at times took on the characteristics of a panic. The Dow was down more than 1,500 points at its session low, while the S&P 500 logged its first 5% pullback from its all-time high in over a year.

Japan's Nikkei index nosedived more than 6.5% on Tuesday, while Hong Kong's Hang Seng plummeted nearly 5%. Those sharp falls came after a brutal trading session in U.S. markets on Monday. The Dow closed down 1,175 points, or 4.6%. It was by far the index's biggest ever point decline for a single trading day.

-