Notícias do Mercado

-

23:26

Currencies. Daily history for Feb 07’2018:

(index / closing price / change items /% change)

Nikkei +35.13 21645.37 +0.16%

TOPIX +6.50 1749.91 +0.37%

Hang Seng -272.22 30323.20 -0.89%

CSI 300 -98.39 4050.50 -2.37%

KOSPI -56.75 2396.56 -2.31%

Euro Stoxx 50 +59.60 3454.52 +1.76%

FTSE 100 +138.02 7279.42 +1.93%

DAX +197.77 12590.43 +1.60%

CAC 40 +94.09 5255.90 +1.82%

DJIA -19.42 24893.35 -0.08%

S&P 500 -13.48 2681.66 -0.50%

NASDAQ -63.90 7051.98 -0.90%

S&P/TSX -33.35 15330.58 -0.22%

-

21:11

The main US stock indexes finished trading in negative territory

The main US stock indexes bargained for most of the session with an increase, but finished trading in negative territory amid a new wave of risk aversion.

Important statistical data that could have an impact on the mood of market participants, was not published.

A certain influence was made by the statements of the President of the Federal Reserve Bank of New York William Dudley and the president of the Federal Reserve Bank of Chicago, Charles Evans. Dudley said that the sharp fluctuations of the stock market, observed in recent days, did not change his assessment of the economy and the outlook for monetary policy. However, Dudley said that the Fed leaders should monitor the situation. "If quotes in the stock market fall significantly and remain low, it will really affect the prospects for the economy, as well as my opinion on the further course of monetary policy," added Dudley.

Meanwhile, Evans said that he would prefer not to change rates until mid-2018, to be sure of a steady increase in inflation. "If in the middle of the year the Fed leaders have more confidence in the growth of inflation, further increases in rates will be justified," Evans said.To remind, this year Evans does not have the right to vote in the FOMC when making decisions on the rate.

Oil prices fell more than 2% to a monthly low, after data from the United States unexpectedly indicated an increase in petroleum products stocks, and increased concerns over excess supply during the weaker demand season. The US Energy Ministry reported that in the week of January 27 - February 2, oil reserves increased by 1.895 million barrels to 20.254 million barrels. Analysts had expected an increase in inventories of 3.189 million barrels. Oil reserves in the Cushing terminal were reduced by 711,000 barrels, to 36.3 million barrels.

Most components of the DOW index finished trading in positive territory (18 out of 30). The leader of growth was the shares of The Boeing Company (BA, + 2.51%). Outsider were the shares of Apple Inc. (AAPL -1.85%).

Most sectors of the S & P index recorded an increase. The conglomerate sector grew most (+ 0.8%). The largest decline was in the commodity sector (-1.9%).

At closing:

DJIA -0.08% 24,893.35 -19.42

Nasdaq -0.90% 7,051.98 -63.90

S & P -0.50% 2,681.66 -13.48

-

20:01

DJIA +0.22% 24,967.93 +55.16 Nasdaq -0.58% 7,074.61 -41.27 S&P -0.15% 2,691.10 -4.04

-

17:00

European stocks closed: FTSE 100 +138.02 7279.42 +1.93% DAX +197.77 12590.43 +1.60% CAC 40 +94.09 5255.90 +1.82%

-

14:32

U.S. Stocks open: Dow -0.44% Nasdaq -0.40%, S&P -0.36%

-

14:21

Before the bell: S&P futures -0.45%, NASDAQ futures -0.39%

U.S. stock-index futures were lower on Tuesday, as an almost 2 percent gain in the previous session was not enough to calm the nerves following the worst one day fall in six years on Monday.

Global Stocks:

Nikkei 21,645.37 +35.13 +0.16%

Hang Seng 30,323.20 -272.22 -0.89%

Shanghai 3,309.58 -61.07 -1.81%

S&P/ASX 5,876.80 +43.50 +0.75%

FTSE 7,216.13 +74.73 +1.05%

CAC 5,197.83 +36.02 +0.70%

DAX 12,506.42 +113.76 +0.92%

Crude $63.17 (-0.35%)

Gold $1,325.90 (-0.27%)

-

13:42

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

232.75

-0.88(-0.38%)

12047

ALCOA INC.

AA

49.03

-0.40(-0.81%)

166

ALTRIA GROUP INC.

MO

66.51

-0.02(-0.03%)

5257

Amazon.com Inc., NASDAQ

AMZN

1,441.00

-1.84(-0.13%)

73922

American Express Co

AXP

93.51

-0.67(-0.71%)

5711

Apple Inc.

AAPL

162.54

-0.49(-0.30%)

249069

AT&T Inc

T

36.81

-0.02(-0.05%)

16528

Barrick Gold Corporation, NYSE

ABX

13.51

0.02(0.15%)

18327

Boeing Co

BA

338.5

-2.41(-0.71%)

17578

Caterpillar Inc

CAT

155.85

-0.56(-0.36%)

17138

Chevron Corp

CVX

116.82

-0.36(-0.31%)

5554

Cisco Systems Inc

CSCO

40.04

-0.13(-0.32%)

28607

Citigroup Inc., NYSE

C

74.53

-0.29(-0.39%)

10223

Exxon Mobil Corp

XOM

78.25

-0.10(-0.13%)

29078

Facebook, Inc.

FB

184.4

-0.91(-0.49%)

80880

Ford Motor Co.

F

10.7

-0.06(-0.56%)

78286

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.7

-0.04(-0.21%)

25689

General Electric Co

GE

15.3

0.03(0.20%)

73152

General Motors Company, NYSE

GM

41.7

-0.16(-0.38%)

2420

Goldman Sachs

GS

258.2

-0.50(-0.19%)

12598

Google Inc.

GOOG

1,078.00

-2.60(-0.24%)

8166

Hewlett-Packard Co.

HPQ

21.4

-0.03(-0.14%)

1517

Home Depot Inc

HD

190.93

-0.11(-0.06%)

7761

HONEYWELL INTERNATIONAL INC.

HON

152

0.60(0.40%)

1713

Intel Corp

INTC

44.62

-0.29(-0.65%)

31259

International Business Machines Co...

IBM

154.91

-0.43(-0.28%)

12053

International Paper Company

IP

59.63

0.06(0.10%)

300

Johnson & Johnson

JNJ

131.15

-0.68(-0.52%)

7063

JPMorgan Chase and Co

JPM

111.63

-0.48(-0.43%)

14659

McDonald's Corp

MCD

164.01

-1.17(-0.71%)

6618

Merck & Co Inc

MRK

55.12

-0.34(-0.61%)

5822

Microsoft Corp

MSFT

90.5

-0.83(-0.91%)

56181

Nike

NKE

64.7

-0.52(-0.80%)

5449

Pfizer Inc

PFE

35.06

-0.22(-0.62%)

10624

Procter & Gamble Co

PG

82.26

-0.12(-0.15%)

7518

Starbucks Corporation, NASDAQ

SBUX

55.25

-0.06(-0.11%)

4122

Tesla Motors, Inc., NASDAQ

TSLA

337.1

3.13(0.94%)

46378

The Coca-Cola Co

KO

44.6

-0.07(-0.16%)

15262

Travelers Companies Inc

TRV

138.72

-2.13(-1.51%)

5245

Twitter, Inc., NYSE

TWTR

26

0.76(3.01%)

150005

United Technologies Corp

UTX

128.62

-1.19(-0.92%)

6297

UnitedHealth Group Inc

UNH

222.5

-2.68(-1.19%)

3944

Verizon Communications Inc

VZ

50.51

-0.32(-0.63%)

5342

Visa

V

119.58

-0.39(-0.33%)

15468

Wal-Mart Stores Inc

WMT

100.61

-0.29(-0.29%)

5610

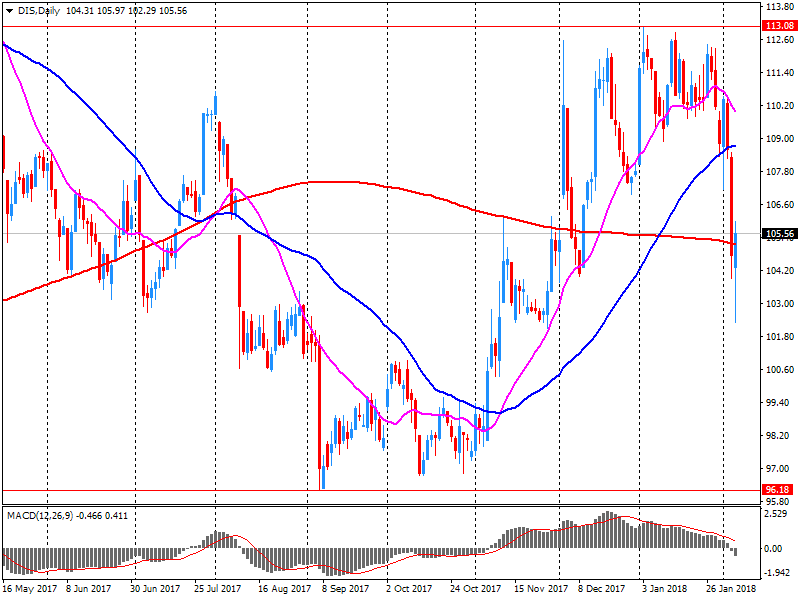

Walt Disney Co

DIS

108.08

1.91(1.80%)

129989

Yandex N.V., NASDAQ

YNDX

37.15

-0.15(-0.40%)

1774

-

13:39

Analyst coverage initiations before the market open

Apple (AAPL) initiated with a Neutral at Goldman; target $161

HP (HPQ) initiated with a Neutral at Goldman; target $25

Cisco Systems (CSCO) initiated with a Buy at Goldman; target $48

-

13:38

Target price changes before the market open

Walt Disney (DIS) target raised to $125 from $122 at B. Riley FBR

-

13:37

Upgrades before the market open

Chevron (CVX) upgraded to Outperform from Market Perform at Wells Fargo

-

12:19

Company News: Walt Disney (DIS) quarterly earnings beat analysts’ estimate

Walt Disney (DIS) reported Q1 FY 2018 earnings of $1.89 per share (versus $1.55 in Q1 FY 2017), beating analysts' consensus estimate of $1.61.

The company's quarterly revenues amounted to $15.351 bln (+3.8% y/y), generally in-line with analysts' consensus estimate of $15.474 bln.

DIS rose to $108.00 (+1.72%) in pre-market trading.

-

07:08

Eurostoxx 50 futures up 1.00 pct, DAX futures up 1.05 pct, CAC 40 futures up 0.95 pct, FTSE futures up 0.40 pct

-

06:28

Global Stocks

European stock markets closed sharply lower and suffered a seventh straight decline on Tuesday, after a historic selloff in the U.S. the prior day sparked a global market rout.

The U.S. stock market halted its death spiral to close higher Tuesday after a wild day of trading that saw the Dow ricocheting more than 1,000 points, underscoring a new regime of volatility on Wall Street.

Asian stocks rebounded Wednesday after equities in the U.S. roared back in a late-day rally, as investors returned to buying into weakness. "The only surprise about the current market volatility is that it hasn't happened sooner," said Richard Titherington, chief investment officer for emerging-market stocks in Asia at J.P. Morgan Asset & Wealth Management.

-