Notícias do Mercado

-

23:26

Currencies. Daily history for Feb 05’2018:

(index / closing price / change items /% change)

Nikkei -592.45 22682.08 -2.55%

TOPIX -40.46 1823.74 -2.17%

Hang Seng -356.56 32245.22 -1.09%

CSI 300 +2.92 4274.15 +0.07%

Euro Stoxx 50 -44.51 3478.77 -1.26%

FTSE 100 -108.45 7334.98 -1.46%

DAX -97.67 12687.49 -0.76%

CAC 40 -79.15 5285.83 -1.48%

DJIA -1175.21 24345.75 -4.60%

S&P 500 -113.19 2648.94 -4.10%

NASDAQ -273.42 6967.53 -3.78%

S&P/TSX -271.22 15334.81 -1.74%

-

21:17

The main US stock indexes finished trading in negative territory

Major US stock indices fell significantly, which was due to increased fears about inflation and higher bond yields.

Negligible impact on the course of trading also provided data on the United States. The research data in January indicate a continuation of business activity growth in the US services sector, although growth slowed for the third month and reached a nine-month low. Nevertheless, new orders continued to expand sharply, and the growth rate accelerated to the fastest since September last year. Seasonally adjusted final index of business activity in the US services sector from IHS Markit was 53.3 in January against 53.7 in December. The last value of the index showed that business activity among service providers has reached its weakest level since April 2017. The survey data linked the current recovery with more favorable economic conditions.

Meanwhile, the index of business activity in the US services sector, calculated by the Institute for Supply Management (ISM), rose in January to a level of 59.9 points compared to 55.9 points in December. Analysts predicted that the figure will rise to 56.5 points. Recall, the indicator is the result of a survey of about 400 firms from 60 sectors across the US. A value greater than 50 is usually considered an indicator of the growth of production activity.

All components of the DOW index finished trading in the red (30 of 30). Outsider were shares of Exxon Mobil Corporation (XOM, -5.41%).

All sectors of the S & P index showed a fall. The largest decrease was registered in the sector of industrial goods (-4.1%).

At closing:

DJIA -4.60% 24,345.75 -1175.21

Nasdaq -3.78% 6,967.53 -273.42

S & P -4.10% 2,648.94 -113.19

-

20:03

DJIA -3.11% 24,728.24 -792.72 Nasdaq -2.16% 7,084.80 -156.14 S&P -2.71% 2,687.29 -74.84

-

17:00

European stocks closed: FTSE 100 -108.45 7334.98 -1.46% DAX -97.67 12687.49 -0.76% CAC 40 -79.15 5285.83 -1.48%

-

14:37

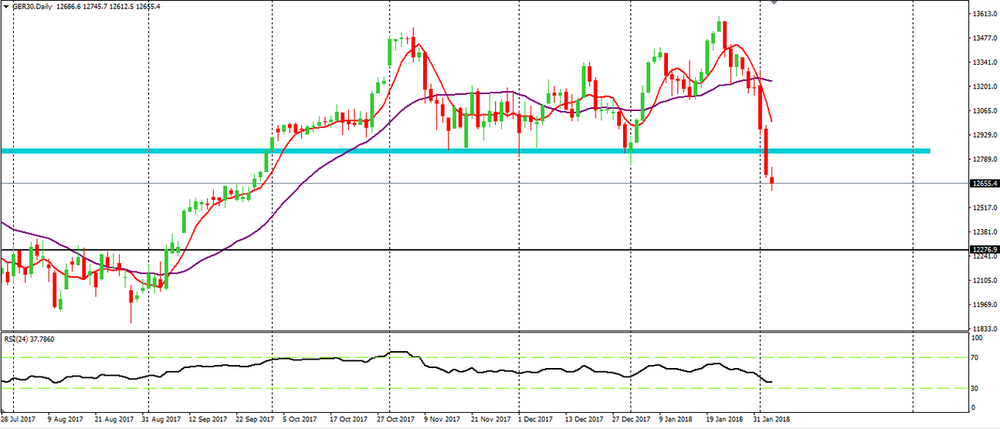

DAX Analysis

DAX on daily time frame chart, we can see that the price has broken a support zone which have been quite important.

Also, we have moving averages crossed above the price which can give us signs of a possible new bearish movement.

Therefore, we can expect a further bearish movement by DAX near to 12276

-

14:34

U.S. Stocks open: Dow -0.90% Nasdaq -0.84%, S&P -0.74%

-

14:28

Before the bell: S&P futures -0.27%, NASDAQ futures -0.34%

U.S. stock-index futures fell on Monday as bond yields continued to rise.

Global Stocks:

Nikkei 22,682.08 -592.45 -2.55%

Hang Seng 32,245.22 -356.56 -1.09%

Shanghai 3,487.38 +25.30 +0.73%

S&P/ASX 6,026.20 -95.20 -1.56%

FTSE 7,359.44 -83.99 -1.13%

CAC 5,295.26 -69.72 -1.30%

DAX 12,678.68 -106.48 -0.83%

Crude $65.11 (-0.52%)

Gold $1,340.20 (+0.22%)

-

13:47

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

244.39

-0.78(-0.32%)

15231

ALCOA INC.

AA

48.75

-0.34(-0.69%)

9647

ALTRIA GROUP INC.

MO

68.9

-0.50(-0.72%)

9915

Amazon.com Inc., NASDAQ

AMZN

1,410.06

-19.89(-1.39%)

176597

American Express Co

AXP

96

-0.68(-0.70%)

3482

Apple Inc.

AAPL

159.75

-0.75(-0.47%)

828849

AT&T Inc

T

37.79

-0.28(-0.74%)

88342

Barrick Gold Corporation, NYSE

ABX

13.85

0.11(0.80%)

13976

Boeing Co

BA

345

-3.91(-1.12%)

50211

Caterpillar Inc

CAT

155.2

-2.29(-1.45%)

30586

Chevron Corp

CVX

117.25

-1.33(-1.12%)

41916

Cisco Systems Inc

CSCO

40.99

0.06(0.15%)

54550

Citigroup Inc., NYSE

C

75.64

-1.38(-1.79%)

55298

Deere & Company, NYSE

DE

163.1

-1.86(-1.13%)

1073

Exxon Mobil Corp

XOM

83.17

-1.36(-1.61%)

32321

Facebook, Inc.

FB

188.17

-2.11(-1.11%)

256337

Ford Motor Co.

F

10.65

-0.06(-0.56%)

97601

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

17.84

-0.13(-0.72%)

23759

General Electric Co

GE

15.53

-0.11(-0.70%)

362576

General Motors Company, NYSE

GM

40.94

-0.06(-0.15%)

56979

Goldman Sachs

GS

257.6

-2.44(-0.94%)

23531

Google Inc.

GOOG

1,096.00

-15.90(-1.43%)

32346

Hewlett-Packard Co.

HPQ

22.3

-0.18(-0.80%)

4357

Home Depot Inc

HD

190.5

-3.47(-1.79%)

16336

HONEYWELL INTERNATIONAL INC.

HON

154.57

-2.08(-1.33%)

3546

Intel Corp

INTC

46.32

0.17(0.37%)

129779

International Business Machines Co...

IBM

158.1

-0.93(-0.58%)

25756

Johnson & Johnson

JNJ

136.11

-1.57(-1.14%)

10069

JPMorgan Chase and Co

JPM

112.98

-1.30(-1.14%)

49345

McDonald's Corp

MCD

168.2

-1.18(-0.70%)

12569

Merck & Co Inc

MRK

58.37

-0.19(-0.32%)

21472

Microsoft Corp

MSFT

90.68

-1.10(-1.20%)

251662

Nike

NKE

66.33

-0.89(-1.32%)

8975

Pfizer Inc

PFE

36.42

-0.19(-0.52%)

11300

Procter & Gamble Co

PG

83.81

-0.44(-0.52%)

10181

Starbucks Corporation, NASDAQ

SBUX

55.7

-0.07(-0.13%)

20994

Tesla Motors, Inc., NASDAQ

TSLA

339.1

-4.65(-1.35%)

72923

The Coca-Cola Co

KO

46.47

-0.26(-0.56%)

7099

Twitter, Inc., NYSE

TWTR

25.34

-0.58(-2.24%)

175355

United Technologies Corp

UTX

133.1

-1.51(-1.12%)

2634

UnitedHealth Group Inc

UNH

229.1

-2.78(-1.20%)

3510

Verizon Communications Inc

VZ

52.5

-0.48(-0.91%)

22225

Visa

V

118.5

-2.41(-1.99%)

76685

Wal-Mart Stores Inc

WMT

103

-1.48(-1.42%)

19618

Walt Disney Co

DIS

107.91

-0.79(-0.73%)

8777

Yandex N.V., NASDAQ

YNDX

38

0.13(0.34%)

226

-

13:42

Target price changes before the market open

Alcoa (AA) target raised to $71 from $68 at JP Morgan

Boeing (BA) target raised to $415 from $395 at Berenberg

Amazon (AMZN) target raised to $1700 from $1360 at Nomura

Exxon Mobil (XOM) target lowered to $80 from $84 at Credit Suisse

-

13:41

Downgrades before the market open

Chevron (CVX) removed from Conviction Buy List at Goldman

-

13:20

Company News: Arconic (ARNC) quarterly results beat analysts’ expectations

Arconic (ARNC) reported Q4 FY 2017 earnings of $0.31 per share (versus $0.12 in Q4 FY 2016), beating analysts' consensus estimate of $0.24.

The company's quarterly revenues amounted to $3.271 bln (+10.2% y/y), beating analysts' consensus estimate of $3.085 bln.

The company issued mixed guidance for FY 2018, projecting EPS of $1.45-1.55 (versus analysts' consensus estimate of $1.58) at revenues of $13.4-13.7 bln (versus analysts' consensus estimate of $13.05 bln).

ARNC fell to $28.80 (-1.06%) in pre-market trading.

-

11:57

Earnings Season in U.S.: Major Reports of the Week

February 5

Before the Open:

Arconic (ARNC). Consensus EPS $0.24, Consensus Revenues $3084.91 mln.

After the Close:

February 6

Before the Open:

General Motors (GM). Consensus EPS $1.43, Consensus Revenues $34279.69 mln.

After the Close:

Walt Disney (DIS). Consensus EPS $1.61, Consensus Revenues $15474.08 mln.

February 7

After the Close:

Tesla (TSLA). Consensus EPS -$3.15, Consensus Revenues $3260.65 mln.

February 8

Before the Open:

Twitter (TWTR). Consensus EPS $0.14, Consensus Revenues $686.13 mln.

After the Close:

American Intl (AIG). Consensus EPS $0.79, Consensus Revenues $12345.49 mln.

-

08:41

Major stock exchanges in Europe trading in the red zone: FTSE 7365.54 -77.89 -1.05%, DAX 12636.01 -149.15 -1.17%, CAC 5304.74 -60.24 -1.12%

-

07:23

Eurostoxx futures down 0.7 pct, DAX futures down 0.7 pct, CAC 40 futures down 0.6 pct, FTSE futures down 1.1 pct, IBEX futures down 1.4 pct

-

06:35

Global Stocks

European stocks dropped for a fifth straight session on Friday, with the German market leading the charge south after Deutsche Bank posted a bigger-than-expected loss in the fourth quarter. A continued rise in bond yields also weighed on European equities, sparking a pullout of money from stocks after solid U.S. labor market data stoked fears of rapidly rising inflation.

Dow futures fell more than 200 points Sunday, following steep losses on Wall Street last week. Dow Jones industrial average futures YMH8, -0.45% were last down 194 points, or 0.7%, after being down as much as 250 points earlier in Sunday trading. S&P 500 futures ESH8, -0.24% were last down 12.70 points, or 0.4%, and Nasdaq futures NQH8, -0.17% fell 23.75 points, or 0.4%, recovering somewhat from deeper losses earlier.

The global stock-market rout continued Monday in Asia, with indexes in Japan and Taiwan down more than 2% following heavy selling in the U.S. and Europe on Friday. "Everyone is getting cautious," said Hisao Matsuura, chief strategist at Nomura Japan. He said the continuing rise in global bond yields caught investors unaware, weighing on stocks.

-