Notícias do Mercado

-

19:20

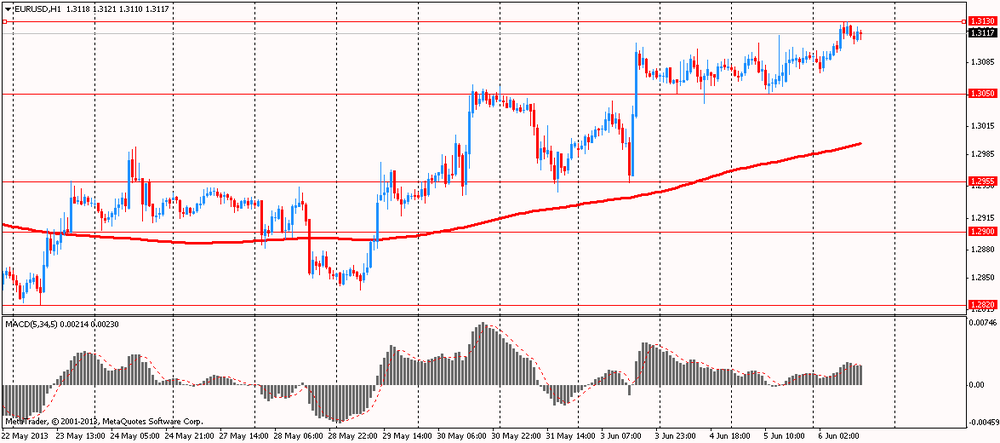

American focus: the euro has grown substantially in the background Draghi comments

The euro exchange rate rose significantly against the dollar, after the Governing Council of the ECB decided to leave the refinancing rate unchanged at 0.5% in June, after it had previously been a decrease of 0.25%. In a subsequent press conference, ECB President Draghi commented on the decision. The head of the Central Bank said that the inflation rate in the euro zone has been volatile in 2013. He assured that the inflation outlook remains "balanced," noting that the CPI growth risks were associated with higher indirect taxes and the prices of raw materials and downstream risks - with the weakness of economic activity. Despite the fact that the Central Bank is expected gradual recovery in economic activity in the second half of 2013, as evidenced by the growth of economic indicators, there are different factors that will contribute to easing - for example, the slow implementation of reforms by national governments, as well as weak domestic demand. Central Bank is ready to support demand through monetary policy, which will remain accommodative until it is needed. Draghi said that the EU should carry out structural reforms to boost competitiveness, employment, and reduce the deficit.

During the question and answer session the head of the European Central Bank said that the Governing Council discussed various non-standard measures such as the LTRO and ABS. He also noted that the Central Bank is technically ready to introduce negative rates, but as long as it is not needed.

Meanwhile, it was reported that the ECB cut its growth forecast for this year, it is expected that the economy will shrink by 0.6%. Leaders ECB expects the economy will grow in 2014 by 1.1%.

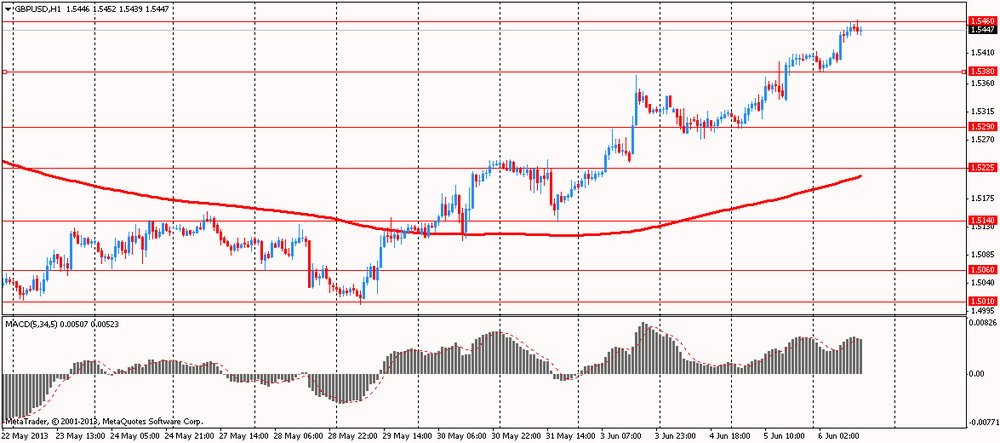

The British pound also strengthened significantly against the U.S. dollar, in response, so comments on Draghi. We add that a partial influence on the bidding was that MPC of the Bank of England today left interest rates at a record low 0.5%, where it has been since March 2009. He also upheld the asset purchase program at £ 375 billion previously it was increased by £ 50 billion to £ 375 billion in July 2012. Both solutions in line with the main forecast.

Support the pound also had data on house prices in the UK, which in May rose at the fastest pace in nearly two and a half years. Activity in the housing market has increased due to a variety of government programs. This is stated in a report released Thursday by the mortgage lender Halifax. The sales volume remained at the levels observed before the crisis, mainly due to lack of homes for sale. However, according to the government's own program for the housing market from the start of the program has already booked 4,000 houses under construction for two months. House prices rose in May by 0.4% compared to the previous month and by 2.6% compared to the same period last year. Annual growth was most rapid in September 2010. In April, prices rose by 1.1% compared with the previous month and up 2% compared to the same period last year.

The cost of the Canadian dollar sharply higher against the U.S. dollar, after data showed that the index of business activity managers from Ivey, who represented the Association of Purchasing Managers Canada and the Richard Ivey School of Business (Purchasing Management Association of Canada, Ivey) in May to a seasonally fluctuations rose to 63.1, indicating a high rate of growth in zakupok.Znachenie indicator above 50 indicates an increase in purchases and the value below 50 indicates a decrease. The median forecast of economists was at 55.3.

Also on the dynamics of trade impact statement skids Governor of the Bank of Canada, who said that the slowdown in domestic demand limits the incentive policy. He also added that "at some point" rates would be raised "to more normal levels," and the momentum of the foreign demand should help to increase the confidence of exporters. At the same time, skid agreed that household debt limits the effectiveness of policies, and the high value of the Canadian dollar has not yet encourages companies to invest in machinery.

-

15:01

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.2850, $1.2950, $1.3000, $1.3050, $1.3100, $1.3110, $1.3120, $1.3125

USD/JPY Y97.30, Y97.50, Y98.50, Y98.70, Y99.00/05, Y99.25, Y99.50, Y100.00, Y100.50, Y101.00, Y101.50

EUR/JPY Y130.00

GBP/USD $1.5130, $1.5250, $1.5300

EUR/CHF Chf1.2300, Chf1.2350

EUR/GBP stg0.8550

AUD/USD $0.9550

NZD/USD $0.8000

-

13:30

-

13:18

European session: the euro is stable in anticipation Draghi comments

07:00 United Kingdom Halifax house price index May +1.1% +0.2% +0.4%

07:00 United Kingdom Halifax house price index 3m Y/Y May +2.0% +2.5% +2.6%

07:15 Switzerland Consumer Price Index (MoM) May 0.0% +0.1% +0.1%

07:15 Switzerland Consumer Price Index (YoY) May -0.6% -0.6% -0.5%

10:00 Germany Factory Orders s.a. (MoM) April +2.3% -1.0% -2.3%

10:00 Germany Factory Orders n.s.a. (YoY) April -0.4% -0.2% -0.4%

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.50% 0.50% 0.50%

The euro exchange rate is kept in the range after the ECB left policy unchanged. At today's meeting the Governing Council of the ECB decided to leave rates unchanged, in line with the forecast. The bank said that the main refinancing rate, the lending rate and deposit rate will remain unchanged at 0.5%, 1.00% and 0.00%, respectively. Now all the attention is focused on the speech of the Central Bank, Mario Draghi, who will comment on the reasons for the decision at a press conference.

Inhibit the growth of the euro weak data on promzakazy in Germany, which fell more than expected. Orders in the industrial sector in Germany in April ypali by 2.3% compared to the previous month. Economists had expected a decline of 1.0%. In March, the volume of orders increased by 2.3%. In a statement, the ministry said that the volume of orders in April was below average. The demand for industrial goods in Germany in April was disappointing everywhere, especially in the country. The volume of domestic orders fell by 3.2% compared with March. The volume of foreign orders fell by 1.5%, while the volume of orders from the countries of the euro zone fell by 3.6%.

The pound shows a moderate increase against the dollar after the Bank of England's MPC today left interest rates at a record low 0.5%, where it has been since March 2009. He also upheld the asset purchase program at £ 375 billion previously it was increased by £ 50 billion to £ 375 billion in July 2012. Both solutions in line with the main forecast.

Support the pound had data on house prices in the UK, which in May rose at the fastest pace in nearly two and a half years. Activity in the housing market has increased due to a variety of government programs. This is stated in a report released Thursday by the mortgage lender Halifax.

The sales volume remained at the levels observed before the crisis, mainly due to lack of homes for sale. However, according to the government's own program for the housing market from the start of the program has already booked 4,000 houses under construction for two months. House prices rose in May by 0.4% compared to the previous month and by 2.6% compared to the same period last year. Annual growth was most rapid in September 2010. In April, prices rose by 1.1% compared with the previous month and up 2% compared to the same period last year.

EUR / USD: during the European session, the pair rose to $ 1.3130

GBP / USD: during the European session, the pair rose to $ 1.5463

USD / JPY: during the European session, the pair fell to Y98.84

At 12:30 GMT will be the monthly press conference of the ECB. At the same time, in the U.S. there are initial applications for unemployment benefits. At 14:00 GMT Canada is to publish an index of the PMI Ivey (including seasonally adjusted) in May.

-

13:02

Orders

EUR/USD

Offers $1.3240/50, $1.3220, $1.3190/200, $1.3140/50

Bids $1.3060/50, $1.3030, $1.3000/995, $1.2980/70

GBP/USD

Offers $1.5550/60, $1.5530/35, $1.55515/20, $1.5490/500, $1.5465/70

Bids $1.5380, $1.5350, $1.5335/30, $1.5270, $1.5260/50

AUD/USD

Offers $0.9600/10, $0.9580, $0.9545/50, $0.9520

Bids $0.9435/30, $0.9420, $0.9400/370, $0.9350, $0.9330/20

EUR/JPY

Offers Y131.20, Y130.90/1.00, Y130.60/70

Bids Y129.20, Y129.00, Y128.60/50

USD/JPY

Offers Y100.70, Y100.40/50, Y100.00, Y99.50

Bids Y98.60/50, Y98.00, Y97.50-30, Y97.00

EUR/GBP

Offers stg0.8595/600, stg0.8575/80, stg0.8560/65, stg0.8540/45, stg0.8526

Bids stg0.8475/70, stg0.8445/40, stg0.8420, stg0.8400

-

12:45

-

12:00

-

12:00

-

11:15

Swiss consumer prices continue to fall

Switzerland's consumer prices declined 0.5 percent year-on-year in May, after easing 0.6 percent each in April and March, the Federal Statistical Office reported Thursday.

Economists were forecasting the consumer price index to fall by 0.6 percent again in May.

On a monthly basis, consumer prices edged up 0.1 percent, in line with forecast, following a flat reading last month.

Footwear and clothing logged the biggest annual fall of 4.5 percent in May. Meanwhile, cost of food and non-alcoholic beverages gained 0.8 percent, it said.

-

11:01

-

11:00

-

10:45

FRANCE AUCTION RESULTS:

AFT sold E7.988bln vs target E7.0bln-E8.0bln

- E1.825bln of 3.50% Apr 2020 OAT; avg yield 1.30% (1.62%), cover 2.22 (2.86)

- E3.84bln of 1.75% May 2023 OAT; avg yield 2.04% (1.81%), cover 1.61 (2.0)

- E2.323bln of 2.75% Oct 2027 OAT; avg yield 2.58%, cover 2.56.

-

10:32

SPAIN AUCTION RESULTS:

Tesoro sold E4.024bln vs target E3.0bln-E4.0bln

- E1.528bln of 2.75% Mar 2015 Bono, cover 2.96 vs 4.01 previous

- E1.009bln of 3.30% July 2016 Bono; cover 2.39 vs 2.24 previous

- E1.487bln of 4.40% Oct 2023 Obligaciones; cover 2.52

Tesoro releases further auction results:

- Sold 2.75% Mar 2015 Bono at avg yield 1.903% vs 2.28% prev

- Sold 3.30% July 2016 Bono at avg yield 2.706% vs 2.44% prev

- Sold 4.40% Oct 2023 Obligacion; avg yield 4.517% vs 4.452% Prev.

Tail calculations:

- 2.75% Mar 2015 Bono; 2.5bps vs 3.1bps prev

- 3.30% Jul 2016 Bono; 2.6bps vs 3.0bps prev

- 4.40% Oct 2023 Obligacion; 1.9bps

-

10:18

Option expiries for today's 1400GMT cut

EUR/USD $1.2850, $1.2950, $1.3000, $1.3050, $1.3100, $1.3110, $1.3120, $1.3125

USD/JPY Y97.30, Y97.50, Y98.50, Y98.70, Y99.00/05, Y99.25, Y99.50, Y100.00, Y100.50, Y101.00, Y101.50

EUR/JPY Y130.00

GBP/USD $1.5130, $1.5250, $1.5300

EUR/CHF Chf1.2300, Chf1.2350

EUR/GBP stg0.8550

AUD/USD $0.9550

NZD/USD $0.8000

-

08:15

-

08:15

-

08:01

-

08:00

-

07:01

Asian session: The greenback rallied from the lowest level in almost a month

01:30 Australia Trade Balance April 0.31 0.21 0.03

The greenback rallied from the lowest level in almost a month versus the Japanese currency before U.S. data this week forecast to show the number of applications for unemployment benefits fell and payrolls increased. The Labor Department reported last month that U.S. nonfarm payrolls swelled by 165,000 jobs in April, more than forecast, and the unemployment rate unexpectedly fell to 7.5 percent. It will probably say tomorrow that employers added 165,000 workers in May, another survey showed.

Economists in a separate poll estimate that a Labor Department report today will show applications for jobless benefits slid by 9,000 to 345,000 in the week ended June 1.

A private report yesterday showed U.S. companies hired fewer workers than economists projected, and Japan's Prime Minister Shinzo Abe failed to provide additional detail on stimulus measures. Figures from the Roseland, New Jersey-based ADP Research Institute showed yesterday that U.S. companies boosted employment by 135,000 workers in May. The median forecast of economists surveyed by Bloomberg News was 165,000.

The European Central Bank will probably leave its benchmark interest-rate unchanged when it meets today, according to 57 of 59 economists in a Bloomberg survey. The central bank cut borrowing costs by 25 basis points to an all-time low of 0.5 percent on May 2, and President Mario Draghi signaled he's prepared to cut again if economic data worsen.

Australia's dollar slid to a more than one-year low after the nation's trade surplus narrowed. Exports outpaced imports by A$28 million ($27 million) in April, the Bureau of Statistics said in a report in Sydney today. That was less than the median economist estimate for a A$180 million trade surplus in a Bloomberg News survey.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3075/95

GBP / USD: during the Asian session the pair traded in the range of $ 1.5380-15

USD / JPY: during the Asian session the pair traded in the range of Y98.85-50

There is a full calendar on both sides of the Atlantic Thursday,including policy decisions from both the Bank of England and the ECB. The data calendar gets underway early, with the release of the French first quarter unemployment numbers. At 0730GMT, German Economics Minister Philipp Roesler will deliver a speech at the Asian-German business conference, in Berlin. German data will be released at 1000GMT, when the April manufacturing numbers will cross the wires. At 1145GMT, the ECB June rate decision is expected, to be followed at 1230GMT by President Mario Draghi's press conference. German Chancellor Angela Merkel will give a speech at a construction industry conference, in Berlin at 1320GMT.

At 0700GMT, the UK Halifax house Price index will be released and is expected to underline the continuing recovery in the housing market. UK data will also see the release of the May SMMT Car Registrations numbers, due at 0800GMT. The outcome of the BOE's June policy meeting will be released at 1100GMT. Aside from Governor Sir Mervyn King's reign coming to an end, the meeting itself looks almost inevitably to be a non-event. Analysts are united in the belief policy will be left on hold, with the six-three split repeated yet again. The economic news has largely taken a turn for the better, and only the signs of diminishing inflationary pressures provides any extra ammunition for King's camp, but the majority on the MPC will be in no rush to see how this plays out.

-

06:21

Currencies. Daily history for Jun 5'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3091 +0,08%

GBP/USD $1,5406 +0,60%

USD/CHF Chf0,9419 -0,53%

USD/JPY Y99,15 -0,90%

EUR/JPY Y129,82 -0,81%

GBP/JPY Y152,72 -0,31%

AUD/USD $0,9533 -1,21%

NZD/USD $0,7971 -0,58%

USD/CAD C$1,0341 +0,02%

-

06:06

Schedule for today, Thursday, June 6’2013:

01:30 Australia Trade Balance April 0.31 0.21

07:00 United Kingdom Halifax house price index May +1.1% +0.2%

07:00 United Kingdom Halifax house price index 3m Y/Y May +2.0% +2.5%

07:15 Switzerland Consumer Price Index (MoM) May 0.0% +0.1%

07:15 Switzerland Consumer Price Index (YoY) May -0.6% -0.6%

10:00 Germany Factory Orders s.a. (MoM) April +2.2% -1.0%

10:00 Germany Factory Orders n.s.a. (YoY) April -0.4% -0.2%

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.50% 0.50%

12:30 Eurozone ECB Press Conference

12:30 U.S. Initial Jobless Claims May 354 345

14:00 Canada Ivey Purchasing Managers Index May 52.2 55.3

-