Notícias do Mercado

-

20:01

-

19:20

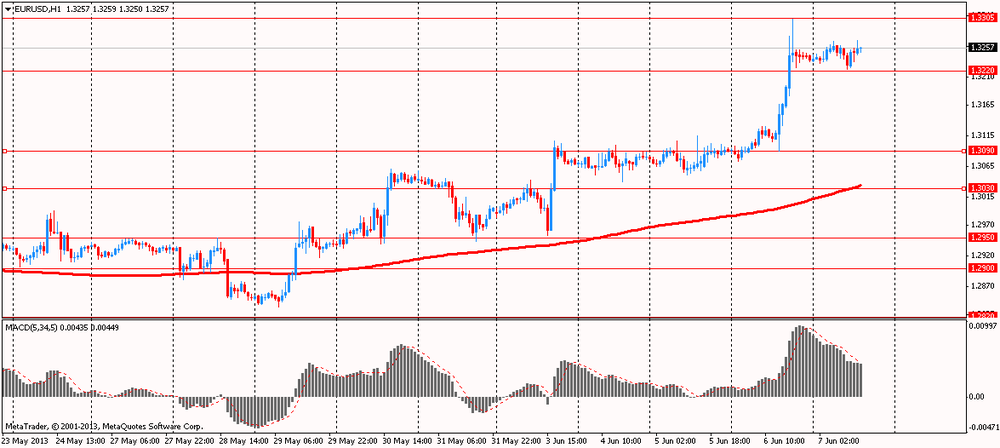

American focus: the dollar rose after the jobs data

The dollar rose against the euro, which helped to published U.S. data. According to a report released by the Department of Labor on Friday, May employment in the U.S. rose slightly more than economists expected. The report said that in May, the number of jobs outside the agricultural sector in the U.S. in May rose by 175 thousand after downwardly revised increase of 149 thousand jobs in April. Economists had expected employment to increase by about 163 thousand jobs compared to the addition of 165 thousand jobs, which originally reported for the previous month.

Despite the continued growth in the number of jobs, the unemployment rate rose to 7.6% in May from 7.5% in April, reflecting an increase in the labor force.

Also, a report showed the number of jobs in the private sector in the U.S. in May increased by 179 thousand, while the number of jobs in the U.S. manufacturing in May declined by 8 thousand, and in the service sector increased by 176 thousand number of jobs in the budget U.S. in May decreased by 3 thousand, and the federal decreased by 14 thousand total duration of the working week in the U.S. in May was unchanged at 34.5 hours Average hourly earnings in the U.S. in May rose 0.01 dollars to 23.89 dollars

The yen fell sharply against the dollar after data on U.S. employment by stimulating growth of USD / JPY to new intraday highs around 97.80. Data on the number of jobs that were higher than expected, caused a rapid increase in the U.S. dollar, with traders immediately responded by linking data with the results of the recent Fed projections on the reduction of purchase of shares. Experts still predict that the yen is likely to decline again due to weak economic data. The policy of aggressive monetary stimulus the Bank of Japan to influence the yen weakened capital outflows from Japan in the coming years, especially against the background of the global economic recovery.

The Canadian dollar rose against the U.S. dollar, which has been associated with the publication of the Canadian data. As it became known, labor productivity in Canada in the 1st quarter grew by 0.2% q / q, this is the best figure since the fourth quarter of 2011. The growth occurred after 0.1% growth in the previous three months. In this case, the unit cost of labor for the first time in six quarters fell by 0.1% q / q Canada's unemployment rate in May was 7.1% against 7.2% in April. The number of jobs in Canada in May increased by 95 thousand compared with April. Economists had expected an increase of 17.3 million The number of jobs to full-time employment in Canada in May grew by 76.7 thousand, underemployment 18.2 million Average hourly earnings in Canada in May rose by 2.3% y / y g The labor force in Canada in May increased by 80.9 thousand people, compared with April. The share of economically active population in Canada in May was 66.7% versus 66.5% in April.

-

15:29

British inflation expectations unchanged in May, BoE/GfK NOP Survey shows

Britons' inflation expectations for the year ahead stayed at 3.6 percent in May, unchanged from February, results of a quarterly survey by the Bank of England and GfK NOP revealed Friday.

According to the Inflation Attitudes Survey, inflation will then fall to 3.3 percent in the 12 months after that. Inflation expectations for a longer-term, say in five years time, came in at 3.6 percent, the same rate as seen in the previous survey period.

When asked about the future path of interest rates, 34 percent of respondents said they expect rates to rise over the next 12 months, compared with 36 percent in February. Only 5 percent forecasts rates to fall.

By a margin of 68 percent to 6 percent, survey respondents believed that the economy would end up weaker rather than stronger if prices started to rise faster, compared with 71 percent to 5 percent in February.

-

14:51

Option expiries for today's 1400GMT cut

EUR/USD $1.3250, $1.3300

USD/JPY Y96.50, Y97.00, Y97.50, Y98.00

GBP/USD $1.5500

USD/CHF Chf0.9300, Chf0.9400

AUD/USD $0.9450, $0.9500, $0.9550

USD/CAD C$1.0170

-

13:32

-

13:32

-

13:31

-

13:31

-

13:31

-

13:30

-

13:30

-

13:19

European session: the euro and the pound are in the range

06:00 Germany Current Account April 20.2 13.0 17.6

06:00 Germany Trade Balance April 17.6 16.5 17.7

06:45 France Trade Balance, bln April -4.7 -4.4 -4.5

07:00 Switzerland Foreign Currency Reserves May 436.1 440.0 441.4

08:30 United Kingdom Consumer Inflation Expectations Quarter II +3.6% +3.6%

08:30 United Kingdom Trade in goods April -9.2 -8.8 -8.2

10:00 Germany Industrial Production s.a. (MoM) April +1.2% 0.0% +1.8%

10:00 Germany Industrial Production (YoY) April -2.5% -0.8% +1.0%

The euro exchange rate is kept in the range, disregarding block statistics on the trade balance and industrial production in Germany.

Data from the Federal Statistical Office of Germany has shown that the growth of German exports gained momentum in April, which is further evidence of recovery in Europe's largest economy. Reported exports of Germany in April rose by 1.9% compared with March, while imports increased by 2.3%. Both figures are adjusted for seasonal variations and the number of working days. These data suggest that the increase in global demand benefit the companies in the country, in addition, domestic demand is also increasing.

Data from the Ministry of Economy of Germany showed that industrial production in Germany exceeded expectations in April, thanks to the activity in the construction sector. This is another proof of the accelerating pace of recovery of economic growth in Europe's largest economy. According to the data, industrial production in Germany in April increased for the third consecutive month, up 1.8% compared with March. Economists had expected the index to remain unchanged from the previous month. Manufacturing output increased by 1.5% compared with March, adjusted for seasonal variations and the number of working days. Production in the construction sector jumped 6.7% after a decline in the winter.

The pound also traded without a trend. According to the data, the UK trade deficit was 8.2 billion pounds (12.8 billion dollars), compared to 9.2 billion pounds in the previous month. Economists had forecast a deficit reduction to 8.8 billion pounds. Improving the balance of foreign trade in the UK in April was due to the reduction in imports by 1.3 billion pounds, rather than export growth. In April, exports of the UK fell by 400 million feet.

The yen continues to strengthen after Finance Minister Taro Aso that while interventions in the domestic currency market are planned. The Minister said that in the near future, he does not intend to intervene in the foreign exchange market to counter the recent restoration of the Japanese currency. It's a rare occasion when a representative of the Japanese authorities to publicly rule out intervention after the sharp appreciation of the currency. "I've been following it, but does not intend to intervene or take action in the near future just because of this" - Aso said at a press conference after a regular cabinet meeting, when asked about the sharp rise in the Japanese currency before the start of today's session.

EUR / USD: during the European session, the pair is trading in the range of $ 1.3223 - $ 1.3270

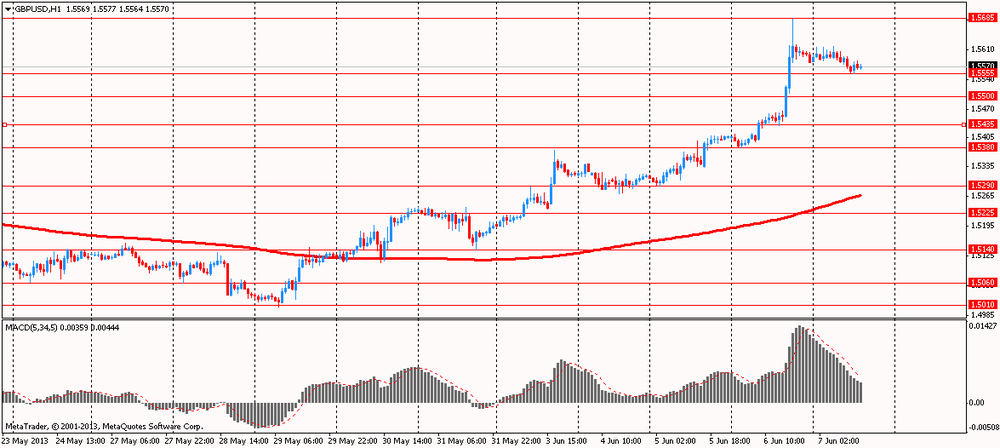

GBP / USD: during the European session, the pair is trading in the range of $ 1.5555 - $ 1.5620

USD / JPY: during the European session, the pair fell to Y95.28

At 12:30 GMT in Canada will the unemployment rate, change in the number of employees, change in the number of full-time and part-time jobs in May, the change in labor productivity for the 1st quarter. At 12:30 GMT the U.S. will release the unemployment rate, change in the number of employed in non-agricultural sector, changes in the number of employees in the private sector of the economy, changes in the number of employees in the manufacturing sector of the economy, change in average hourly wages, the total revision of employment for 2 months in May.

-

11:03

-

11:00

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3000, $1.3050, $1.3100, $1.3125, $1.3250, $1.3300

USD/JPY Y97.50, Y98.00, Y99.00, Y99.25, Y99.50

GBP/USD $1.5350, $1.5400, $1.5500

USD/CHF Chf0.9300, Chf0.9400, Chf0.9500

AUD/USD $0.9450, $0.9550

USD/CAD C$1.0170, C$1.0300, C$1.0310, C$1.0400

-

09:32

-

09:31

-

08:01

-

07:47

-

07:24

Asian session: The yen extended its biggest gain in three years

The yen extended its biggest gain in three years after Japanese Finance Minister Taro Aso said he wouldn't intervene to weaken the currency.

The dollar held near its lowest in more than three months versus the euro before payrolls data in the U.S. that will offer guidance on whether the Federal Reserve can pursue an early exit to monetary stimulus that tends to debase the currency. In the U.S., the Labor Department will probably say today the economy added 163,000 jobs in May, while the jobless rate held unchanged at 7.5 percent, according to median forecasts in a Bloomberg News survey of economists. That will follow June 5 figures from ADP that U.S. companies boosted employment by 135,000 workers last month, trailing analyst estimates.

The Aussie dollar fell against its 16 most-traded peers before Chinese data tomorrow forecast to show growth in imports slowed to the least in three months, dimming the demand outlook for commodities. Imports (CNFRIMPY) grew 6.6 percent in May compared with a year earlier, according to a poll of economists. Imports gained 16.8 percent in April.

EUR / USD: during the Asian session the pair was trading around $ 1.3075/95

GBP / USD: during the Asian session the pair traded in the range of $ 1.5575-15

USD / JPY: during the Asian session the pair fell to Y95.60

The median forecast of all respondents in the MNI US Employment Report Survey was for a payroll number of 160,000 - very close to the MNI economist survey median forecast of 165,000 The median forecast for private payrolls was also just under the MNI economist survey median forecast at 170,000 compared to 177,000 There was a strong agreement across respondents that the jobless rate would remain at 7.5%. Within roles, brokers and economists were generally more optimistic for a higher payroll figure than traders. Within asset class, respondents whose main asset class was FX were also more optimistic than those in Fixed Income. Regarding the "question of the day" which we asked amid a background of current taper-on/taper-off and risk-on/risk-off sentiment, where strong data has in the past been bullish for stocks, but now seen as increased chances the Fed may to start to taper its asset purchases under its QE programme: "What do you think would be the main market impact from a strong payrolls report?" 74% of all respondents and 70% of all Fixed Income respondents said the main market impact would be for higher bond yields. -

07:00

-

06:18

Currencies. Daily history for Jun 6'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3238 +1,11%

GBP/USD $1,5581 +1,12%

USD/CHF Chf0,9304 -1,24%

USD/JPY Y97,45 -1,74%

EUR/JPY Y128,98 -0,65%

GBP/JPY Y151,79 -0,61%

AUD/USD $0,9557 +0,25%

NZD/USD $0,7982 +0,14%

USD/CAD C$1,0272 -0,67%

-

06:08

Schedule for today, Friday, June 7’2013:

05:00 Japan Leading Economic Index April 97.9 98.8

05:00 Japan Coincident Index April 93.8 94.9

06:00 Germany Current Account April 20.2 13.0

06:00 Germany Trade Balance April 17.6 16.5

06:45 France Trade Balance, bln April -4.7 -4.4

07:00 Switzerland Foreign Currency Reserves May 433.6 440.0

08:30 United Kingdom Consumer Inflation Expectations Quarter II +3.6%

08:30 United Kingdom Trade in goods April -9.1 -8.8

10:00 Germany Industrial Production s.a. (MoM) April +1.2% 0.0%

10:00 Germany Industrial Production (YoY) April -2.5% -0.8%

12:30 Canada Labor Productivity Quarter I +0.1% +0.3%

12:30 Canada Unemployment rate May 7.2% 7.1%

12:30 Canada Employment May 12.5 17.3

12:30 U.S. Average workweek May 34.4 34.5

12:30 U.S. Average hourly earnings May +0.2% +0.2%

12:30 U.S. Unemployment Rate May 7.5% 7.5%

12:30 U.S. Nonfarm Payrolls May 165 163

19:00 U.S. Consumer Credit April 8.0 13.4

-