Notícias do Mercado

-

21:32

Japan CFTC JPY NC Net Positions fell from previous ¥-54K to ¥-57K

-

21:32

Australia CFTC AUD NC Net Positions up to $-27.2K from previous $-35.4K

-

21:31

United States CFTC Oil NC Net Positions rose from previous 181.1K to 226.1K

-

21:31

United States CFTC Gold NC Net Positions up to $195.2K from previous $181.6K

-

21:31

United States CFTC S&P 500 NC Net Positions dipped from previous $-224.7K to $-321.5K

-

21:31

United Kingdom CFTC GBP NC Net Positions increased to £-14.8K from previous £-24.1K

-

21:30

European Monetary Union CFTC EUR NC Net Positions fell from previous €145K to €143.4K

-

20:01

United States Consumer Credit Change came in at $15.29B below forecasts ($19B) in February

-

17:43

EUR/USD tumbled in late trading, yet printed 0.61% gains for the week

- EUR/USD hovers around 1.0900 after hitting a low of 1.0876.

- US Nonfarm Payrolls rose below forecast but cemented the case for a 25 bps Fed rate hike.

- ECB’s Knot: Further rate hikes need, and no rate cuts in 2023.

The EUR/USD falls during the North American session and retraces towards the 1.0900 figure after a solid US Nonfarm Payrolls report. However, the Euro (EUR) is set to finish the week with decent gains of 0.61%, though it ended short of reclaiming 1.1000. At the time of writing, the EUR/USD is trading at 1.0910, below its opening price by 0.07%.

EUR/USD clings to 1.0900 on mixed US jobs data

The US economic docket featured March’s jobs report, revealed by the US Department of Labor. Payrolls rose below estimates of 240k and hit 236K, but the data insights triggered a jump in odds for a US Federal Reserve’s (Fed) 25 bps rate hike. The Participation Rate jumped to 62.6%, from 62.4% foresaw, and the Unemployment Rate remained unchanged at 3.6% YoY. Average Hourly Earnings fell to 4.2% annually basis, beneath the consensus.

Therefore, US Treasury bond yields extended their gains, with the 2-year US T-bond yield, the most sensitive to interest rates, climbing 16 basis points. The Fed swaps are repricing the May monetary policy meeting, with odds for a 25 bps rate hike by the US Federal Reserve itching up, to 67.0%, compared to Thursday’s 49.2%, as shown by the CME FedWatch Tool.

Even though the European (EU) economic docket was absent, Klas Knot, an European Central Bank (ECB) Governing Council Member, had crossed the wires. Knot commented the ECB is not done with interest rate hikes, as core inflation remains at 6%, three times the ECB’s 2% target.

“The only question is whether you still need to take a further step up by half a percentage point, like the last few times we raised rates, or can you already scale back to smaller increments of a quarter of a percentage point,” he said.

When asked about cutting rates towards the year’s end, Knot described such a scenario as “almost impossible.”

Meanwhile, Worldwide Interest Rate Probabilities (WIRP) show odds for a 25 bps rate hike by the European Central Bank at 90%. Following that, another 25 bps rate increase is expected, and no movement for Q4.

What to watch?

The EU’s docket will feature Retail Sales, Industrial Production, Germany’s inflation, and a round of ECB speakers throughout the week. On the US front, the calendar will feature the Consumer and the Producer Price Index (CPI/PPI) for March, the FOMC’s last meeting minutes, Jobless Claims, and Retail Sales on the data side. The Fed parade will continue during the week.

EUR/USD Technical Levels

-

16:56

Forex Today: After NFP, attention turns to US inflation and global growth concerns

Here is what you need to know for next week:

Markets continue to move fast. A month ago, Silicon Valley Bank (SVB) was still relatively unknown. Later, came the banking crisis, and now it looks like it's the beginning of worries about global growth after softer economic data. The Federal Reserve (Fed) went from a potential "higher for longer interest rates" to a "hike despite the turmoil", and now there is no clear forward guidance. The bond market shifted expectations from "higher for longer" to rate cuts by the third quarter, amid global growth concerns. After recent data, including the March US Jobs report, the Federal Reserve (Fed) and many central banks look set for the last round of interest rate hikes, before taking a pause.

Next week's inflation numbers could provide some clarity regarding the potential trajectory of monetary policy. On Wednesday, the March Consumer Price Index is due (also the FOMC minutes) and on Thursday, the Producer Price Index. Retail Sales and Consumer Confidence on Friday will offer a perspective on the state of the consumer.

Analysts will continue to track the Fed facility usage and banking deposit outflows. Concerns regarding the banking industry continue to fade, but it is too soon to declare victory. A new earnings season begins next week. On Tuesday, China will report March inflation and, on Thursday, trade data.

The beginning of the week looks set to be quiet, considering that it will be a holiday in many countries. Market activity will return to normal on Tuesday. Traders will digest the US March jobs report. The numbers came in line with expectations. Nonfarm payrolls rose by 236,000, the smallest gain in two years, but at the same time shows a healthy labor market.

Despite rising on Friday after the NFP, the US Dollar Index posted the fourth weekly decline in a row, around 102.00. It hit fresh monthly lows but then recovered some ground as US yields stabilize. EUR/USD continued to move higher and posted the highest weekly close in a year, supported by hawkish expectations from the European Central Bank (ECB). The Euro is looking at the 1.1000 mark.

The Pound was among the top performers of the week. GBP/USD rose for the fourth week in a row, posting the highest close since June 22; however, it failed to hold above 1.2500. The Japanese Yen also outperformed as the bond market points to a recession. USD/JPY closed around 132.00, holding in a familiar range. A new era begins at the Bank of Japan as Kazuo Ueda replaces Hurohiko as governor.

The Loonie was the best in the commodity currencies space, supported by the rally in crude oil prices and by stronger-than-expected data from Canada. USD/CAD bottomed near 1.3400 and then rebounded to 1.3500, trimming gains. On Wednesday, the Bank of Canada will announce its monetary policy decision. It is expected to hold the key interest rate at 4.50%.

AUD/USD posted another weekly close around 0.6650 as it continues to face difficulties above 0.6700. The Reserve Bank of Australia (RBA) left the interest rate unchanged at 3.60% and Governor Lowe said it does not imply it's the end of the tightening cycle. Next week, Australia will release the March employment report. An increase in 41,600 jobs is expected and the Unemployment rate to stay at 3.5%.

Despite the hawkish surprise from the Reserve Bank of New Zealand (RBNZ) by raising rates by 50 basis points, NZD/USD ended the week marginally lower, at 0.6240, after a reversal from 0.6380.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

16:22

EUR/GBP records modest gains amidst low liquidity conditions on Good Friday

- EUR/GBP barely moved the needle amidst thin liquidity conditions on a worldwide holiday.

- A solid US jobs report pushed recession fears away, as US equity futures showed.

The EUR/GBP advances for two straight days and hits a four-day high of around 0.8790 on a subdued trading session in observance of the Good Friday holiday. The EUR/GBP is trading at 0.8782, registering minuscule gains of 0.04%.

The cash market is closed due to a holiday. However, the US futures market is open, and equities have responded optimistically to the latest round of US economic data and edged higher. The US Nonfarm Payrolls March report was solid, though a whisker below estimates of 240K, at 236K. Some of the highlights of the report came above estimates. The Participation Rate climbed to 62.6%, above forecasts of 62.4%, while the Unemployment Rate remained unchanged at 3.6% YoY. Average Hourly Earnings dipped to 4.2% YoY, below the 4.3% foresaw.

Aside from this, a light Eurozone (EU) and United Kingdom (UK) economic dockets left traders adrift to data from the United States (US).

On Thursday, the European Central Bank (ECB) economist Philip Lange flagged the risk of further rate hikes. He said, “If the baseline we developed before the banking stress holds up, it will be appropriate to have a further increase in May.” Lane added that they would be data-dependant “about assessing whether that baseline still holds true at the time of our May meeting.”

Meanwhile, Worldwide Interest Rate Probabilities (WIRP) show odds for a 25 bps rate hike by the European Central Bank at 90%. Following that, another 25 bps rate increase is expected, and no movement for Q4.

EUR/GBP Technical Analysis

The EUR/GBP daily chart suggests the pair would end the week trading sideways, capped to the upside, by the confluence of the 20 and 50-day Exponential Moving Averages (EMAs) at 0.8791 and 0.8803, respectively. For a bullish resumption, the EUR/GBP must reclaim 0.8805, so the pair could test the March 30 high at 0.8828, followed by March 23 cycle high at 0.8865.

On the downside, the EUR/GBP price action is capped by the 100-day EMA at 0.8779. Once broken, the EUR/GBP could dip towards April 6 low at 0.8739, followed by the 200-day EMA at 0.8714, before dropping to 0.8700.

EUR/GBP Technical Levels

-

15:40

US: Hiring is slowing, but not collapsing – Wells Fargo

Data released on Friday showed the US economy added 236,000 jobs in March, the smallest gain in over two years. Analysts at Wells Fargo point out this is the type of employment report they believe the Federal Reserve wants to see: job growth slowing in an orderly fashion, labor supply expanding and wage growth that is edging closer to rates that are consistent with the central bank's 2% inflation target. They expected another rate hike by 25 bps in May, probably the last one.

Job growth slows from hot to warm

“The employment report can be added to the growing list of indicators that suggest the labor market is softening directionally. While the level of many labor market gauges remain impressive, the weaker direction suggests the FOMC has the end of the tightening cycle within sight.”

“We continue to expect the FOMC will raise the fed funds rate by an additional 25 bps points on May 3 as the trend in inflation has not yet turned convincingly lower.”

“With the effects of policy tightening to date beginning to more clearly seep through to the jobs market, it may prove to be the final hike this cycle as the FOMC becomes more convinced the economy is softening sufficiently to keep inflation firmly on a downward path.”

-

15:31

Turkey Treasury Cash Balance increased to -32.05B in March from previous -171.48B

-

15:26

US Dollar Index extends recovery after NFP but still down for the week

- US Dollar Index spikes to 102.29 and retreats to 102.00.

- March US jobs report mostly in line with expectations.

- Holiday likely to keep price action limited, normal activity to return on Tuesday.

The US Dollar Index (DXY) rose to 102.29 after the release of the US March jobs report and then pulled back toward 102.00, amid risk appetite. The numbers boosted US yields and equity futures on a tight volume session.

After NFP, attention turns to CPI

The US Labor Department's announced that Nonfarm Payrolls increased by 236K in March, against the market consensus of 240K. The Unemployment Rate fell from 3.6% to 3.5%, even as the Labor Participation Force rose. Average hourly earnings rose by 0.3% MoM, matching consensus.

The negative surprise that could be expected following the latest economic reports did not happen and could explain why the Dollar reacted to the upside. Now attention turns to next week's US Consumer Price Index data.

The DXY is rising on Friday, as it trades slightly above 102.00. Despite posting the third consecutive gain, it is still down for the week. It will be the fourth weekly slide in a row.

DXY levels

-

15:12

USD/MXN falls toward the 18.1000 area, following a solid US NFP report

- USD/MXN dropped from around 18.2600 to 18.1000 but stabilized around 18.1500.

- A solid US Nonfarm Payrolls report weighed on the US Dollar against the Mexican currency.

- Average Hourly Earnings edged lower, while the jobless rate remained unchanged.

The USD/MXN slumps to a two-day low after a US jobs report was below estimates but showed that the labor market is still resilient. Contrarily to most G7 FX currencies, the Mexican Peso (MXN) stood tall against the US Dollar (USD). At the time of typing, the USD/MXN trades volatile within the 18.1500-18.1000 range, below its opening price.

USD/MXN drops after the US jobs report

On a thin liquidity trading session in observance of the Good Friday holiday, the US Department of Labor revealed that the United States (US) economy added fewer jobs than estimated. Figures came at 236K, below the consensus of 240K, and trailed the revised 326K February’s data. Digging deeper into the data, Average Hourly Earnings decreased to 4.2% YoY, beneath forecasts of 4.3%, and the Unemployment Rate was 3.4% YoY, 0.2% lower than the anticipated 3.6%.

The data pushed recessionary fears away, with US equity futures rising, after the release of the US Nonfarm Payrolls report.

US Treasury bond yields are climbing as traders began to price in a May rate hike, with the US 2-year T-bond yield, the most sensitive to interest rates, rising 18 basis points, at 3.966%, a whisker below 4%. The swaps market shows odds for a 25 bps increase at 70.7%, compared to Thursday’s 49.2%, as demonstrated by the CME FedWatch Tool.

USD/MXN 1-Hour Chart Reaction

The USD/MXN initial reaction was upwards to 18.2669 before shifting gears and collapsing below the S1 daily pivot point, which lies at 18.1630, extending its losses toward 18.1002, shy of cracking the S2 pivot at 18.0919. Since then, the USD/MXN settled at around 18.1229, in between the S1 and S2 pivot point levels.

-

14:28

USD/CAD braces to 1.3500 after hitting a 4-day peak after US NFP data

- USD/CAD jumped in response to the US jobs data.

- Despite the lower-than-expected job growth in March, the US Dollar gained ground.

- Average Hourly Earnings edged lower, while the jobless rate remained unchanged.

The USD/CAD touched four-day news highs after the US Nonfarm Payrolls, though it retreated somewhat, as the US jobs data showed that the labor market continued to slow down. At the time of writing, the USD/CAD trades volatile within the 1.3497-1.3510 range, holding to its earlier gains.

US Dollar strengthens, despite a soft US NFP report

On Friday, the US Bureau of Labor Statistics (BLS) showed that US job growth in March slowed to 236K, lower than the expected 240K and the 311K jobs added in February. The Average Hourly Earnings increased by 4.2% YoY, falling short of the forecasted 4.3%, and the Unemployment Rate was 3.4% YoY, 0.2% lower than the anticipated 3.6%.

In the fixed-income market, US Treasury bond yields extended their gains, with the 2-year US T-bond yield, the most sensitive to interest rates, rising 12 basis points. The CME FedWatch Tool made a U-turn, with odds for a 25 bps rate hike by the US Federal Reserve itching up, to 59.8%, compared to Thursday’s 49.2%.

USD/CAD 1-Hour Chart Reaction

On the headline, the USD/CAD bounced from around 1.3500 and hit a daily high of 1.3530, breaking the R1 daily pivot at 1.3518 on its way north. Of late, the USD/CAD pair reversed its course, stabilizing around the current exchange rates but holding the spot price at around 1.3500. For a bullish resumption, the USD/CAD needs to reclaim 1.3518, so it can re-test the day’s high before testing the R2 pivot at 1.3540. Conversely, a fall below 1.3500 will exacerbate a dip toward the daily pivot at 1.3481.

-

14:05

AUD/USD rebounds from weekly lows back to 0.6670 after US jobs report

- US Nonfarm Payrolls rise by 236K in March, near consensus.

- US Unemployment Rate drops to 3.5%; Labor Participation Force rises to 62.6%.

- US Dollar rises after the report, but fails to hold to most gains.

After the release of the March US employment report the US Dollar rose across the board, sending AUD/USD to 0.6639, the lowest level since March 27. The move was short-lived, and the pair is moving back toward where it was before the report near 0.6675. Overall, the reaction has been limited amid tight volume.

A not negative jobs report

The US Labor Department's jobs report showed Nonfarm Payrolls increased by 236K in March, near the 240K of markets consensus. The Unemployment Rate fell from 3.6% to 3.5%. Average hourly earnings rose by 0.3% MoM, matching consensus.

Numbers did not show a negative surprise which was somewhat likely considering the latest economic reports that pointed to a softer labor market. March's NFP showed a slowdown in the pace of hiring, but still solid numbers.

It is a quiet session, with many markets closed due to Good Friday. The reaction has been limited. US yields spike higher but then pulled back a bit. The US 10-year climbed to 3.38% and then pulled back to 3.34%, while the 2-year stands at 3.92%. Higher Treasury yields boosted the US Dollar. The DXY is above 102.00, while Wall Street futures are in positive ground.

The AUD/USD is hovering around 0.6670, about to end the week, and also unchanged for Friday after recovering from NFP losses.

Technical levels

-

13:59

USD/JPY surges to a 3-day high on sluggish US Nonfarm Payrolls report

- USD/JPY climbed on an initial reaction to the US Nonfarm Payrolls headline.

- The US economy added fewer jobs than forecasts in March, but the US Dollar advanced.

- The Unemployment Rate remained steady while Average Hourly Earnings dipped.

The USD/JPY is rising sharply after the US Nonfarm Payrolls report showed that the labor market continued to slow down but was a whisker below expectations. At the time of writing, the USD/JPY trades in a wide range of 131.53-132.40, above its opening price.

US Nonfarm Payrolls missed estimates, but the US Dollar strengthens

The US Bureau of Labor Statistics (BLS) data showed that employment in March decelerated to 236K, below the 240K expected by the street, and trailed 311K jobs added in February. Average Hourly Earnings came at 4.2% YoY, below expectations of 4.3%, while the Unemployment Rate was 3.4% YoY, 0.2% below the 3.6% foreseen.

USD/JPY 1-Hour Chart Reaction

The USD/JPY jumped from around 131.50, a tick above the central daily pivot point at 131.48, and broke above the previous three-day high of 131.93, and did not look back on the reaction to the headline. On its way north, the USD/JPY cleared the R1 daily pivot point at 132.18 but fell short of testing the R2 pivot at 132.60. A clear breach of the latter, and the USD/JPY could test April 4 133.16 daily high before challenging the R3 pivot at 133.31. On the flip side, a fall below 132.00 will expose the daily pivot at 131.48, followed by the S1 pivot at 131.06.

-

13:45

GBP/USD falls to new four-day lows on a soft US jobs report as the US Dollar climbs

- GBP/USD tumbled on an initial reaction to the headline.

- US Nonfarm Payrolls for March came below estimates, but the US Dollar rallied.

- Average Hourly Earnings came a tick lower, while the Unemployment Rate was unchanged.

GBP/USD tumbles on a worse-than-expected US Nonfarm Payrolls report, with the US economy adding fewer jobs than analysts’ consensus. However, the initial reaction favored the US Dollar (USD). At the time of writing, the GBP/USD trades volatile around the 1.2450-1.2370 range, below its opening price.

US Nonfarm Payrolls below estimates, but the greenback rises

Delving into March’s Nonfarm Payrolls data, the US Bureau of Labor Statistics (BLS) revealed the creation of fewer than 240K employments estimated, increased by 236, and trailed February’s 311K. Average Hourly Earnings, estimated at 4.3%, came at 4.2%, and the Unemployment Rate was at 3.5%YoY, below the expected 3.6%.

GBP/USD 1-Hour Chart Reaction

The GBP/USD printed a new four-day low, at 1.2389, in a perception that the report was soft, but not as probably estimated to be a scenario that could weaken the USD. The GBP/USD tumbled below the S1 daily pivot, at 1.2405, with traders eyeing the S2 daily pivot at 1.2370.

-

13:40

EUR/USD drops to four-day lows after NFP as USD strengthens

- US Nonfarm Payrolls rise by 236K in March against 240K expected; Unemployment rate drops to 3.5%.

- US Dollar rises after NFP, US yields soar.

- EUR/USD drops to test levels under 1.0880.

The EUR/USD fell from 1.0915 to the 1.0880 zone, reaching the lowest level since Monday, after the release of the US employment report. Numbers came in mostly in line with expectations, boosting the Greenback across the board.

Markets react to NFP

The US Labor Department's closely watched jobs report showed Nonfarm Payrolls increased by 236,000 in March, near the 240,000 of markets consensus. The Unemployment rate fell by one-tenth of a percentage point to 3.5%. Average hourly earnings rose by 0.3% MoM, matching consensus.

The data was mostly in line with expectations, however, market participants might have been looking at weaker-than-expected data considering the latest economic indicators that point to a softer labor market.

The US yields jumped after the report, boosting the US Dollar. At the same time, Wall Street futures are up. The DXY is above 102.00, while the US 10-year yields rose from 3.32% to 3.37%.

The EUR/USD is testing levels under 1.0880 amid a stronger Greenback. Further weakens in the pair could expose the next support at 1.0850 and then 1.0820. A recovery above 1.0925 would change the intraday outlook from negative to positive.

Technical levels

-

13:32

United States Average Hourly Earnings (YoY) below expectations (4.3%) in March: Actual (4.2%)

-

13:31

United States Nonfarm Payrolls below expectations (240K) in March: Actual (236K)

-

13:31

Breaking: US Nonfarm Payrolls rise by 236,000 in March vs. 240,000 expected

The data published by the US Bureau of Labor Statistics (BLS) revealed on Friday that Nonfarm Payrolls rose by 236,000 in March. This reading came in slightly lower than the market expectation of 240,000 and followed February's print of 326,000 (revised from 311,000).

Follow our live coverage of market reaction to the US jobs report.

Additional details of the report revealed that the Unemployment Rate ticked down to 3.5% from 3.6% in March and the Labor Force Participation Rate improved to 62.6% from 62.5%. Finally, annual wage inflation, as measure by the Average Hourly Earnings, declined to 4.2% from 4.6%, compared to the analysts' estimate of 4.3%.

Market reaction

The US Dollar Index edged slightly higher with the initial reaction and was last seen rising 0.15% on the day at 102.08. Trading conditions, however, remain thin due to the Easter holiday.

-

13:31

United States Average Hourly Earnings (MoM) meets expectations (0.3%) in March

-

13:30

United States Unemployment Rate came in at 3.5%, below expectations (3.6%) in March

-

13:30

United States Labor Force Participation Rate came in at 62.6%, above forecasts (62.4%) in March

-

13:30

United States Average Weekly Hours below forecasts (34.5) in March: Actual (34.4)

-

13:30

United States U6 Underemployment Rate in line with expectations (6.7%) in March

-

10:29

Reserve Bank of India: A surprise pause, but not a pivot – ANZ

Economists at Australia and New Zealand bnaking group (ANZ) provide their afterthoughts on the Reserve Bank of India’s (RBI) surprise policy move on Thursday.

Key quotes

“The monetary policy committee (MPC) delivered a surprise pause against expectations of a 25bp hike, citing a need to assess the impact of previous hikes amid an uncertain economic environment.”

“For FY24, the growth forecast was nudged up by 10bps to 6.5% and the inflation projection trimmed by 10bps to 5.2%. Lower oil price assumption was cited as the reason for the improved growth-inflation outlook.”

“We believe that India’s rate hike cycle is over for now. However, by maintaining its “withdrawal of accommodation” stance, the MPC has preserved the scope for further hikes, if needed. Upside inflation risks from a surge in oil prices and poor monsoon will be on our radar.”

-

10:25

Week ahead: The Big three – TDS

Analysts at TD Securities (TDS) offer a sneak peek of the top three market-moving events due on the cards next week.

Key quotes

“US CPI: Core prices likely cooled off modestly in March, with the index still rising a strong 0.4% m/m, as we look for recent relief from goods deflation to turn into inflation this month. Shelter prices likely remained the key wildcard, while slowing gas prices and softer food-price gains will likely dent non-core inflation. Our m/m forecasts imply 5.1%/5.6% y/y for total/core prices.”

“BoC rate decision: We look for the BoC to hold at 4.50% in what should be an easy decision, with recent banking stress removing some pressure after the rebound in Q1 GDP. The more interesting element will be how the Bank incorporates banking stress in the April MPR. Balancing stronger growth and a more ominous outlook should result in a mixed tone, but one that supports the conditional pause.”

“FOMC Minutes: The rate hike at the March FOMC meeting was widely viewed as dovish. The distribution of the March dot plot for 2023, however, suggested a more hawkish sentiment across the FOMC. With banking stress now appearing to be somewhat contained, the minutes for this meeting might emphasize this hawkish sentiment given continued elevated inflationary pressures.”

-

10:21

US Dollar steadies despite weak data – BBH

Economists at BBH said in their latest note, “the dollar is getting some traction as risk-off impulses offset the impact of weak US data.”

Additional quotes

“DXY is up for the second straight day and trading near 102 after two straight down days. Clean break below 102 sets up a test of the February low near 100.82.“

“ADP reported its private sector jobs estimate. It came in at 145k vs. 210k expected and 242k in February. While ADP has understated NFP for much of this past year, market expectations for March jobs data Friday have softened.”

“NFP consensus now stands at 235k vs. 311k in February, while the unemployment rate is seen steady at 3.6%. Average hourly earnings are expected to slow to 4.3% y/y vs. 4.6% in February. It's worth noting that the data will come on Good Friday. With markets likely to be very thin, we could get some outsize movements from the numbers, whether good or bad.“

-

10:07

USD/JPY: All about the curve – TDS

Analysts at TD Securities (TDS) offer their outlook on the USD/JPY pair heading into the United States Nonfarm Payrolls (NFP) report and the Consumer Price Index (CPI) data

Key quotes

“The downside surprise in ISM services nearly pushed USDJPY to challenge key technical support around 130. But the dip was short-lived, suggesting that position squaring ahead of the NFP report into a liquidity challenged long weekend.”

“Getting below 130 in USDJPY is a formidable but surmountable challenge given the technical formations there.”

“Should NFP or CPI underwhelm, the level will face an onslaught of pressure. USDJPY is one of the purest expressions of Fed policy risks in FX. Since SVB's collapse, the pair and the broad USD have displayed more persistence in trading in sympathy with the red/green SOFR strip (i.e. cut pricing) though yield variation in the UST curve is less impactful. Notably, USDJPY and calendar spreads beyond M4 are highly inversely correlated, so any curve steepening in this area will push USDJPY somewhat higher.”

“The question is whether the market will remain fixated on cuts in this part of the curve. “

-

10:00

Singapore Foreign Reserves (MoM) rose from previous 294.1B to 312.2B in March

-

08:13

EUR/USD edges lower on Good Friday, United States Nonfarm Payrolls eyed

- EUR/USD pares weekly gains during three-week uptrend on Good Friday holiday.

- United States statistics weigh on Federal Reserve bets and favor the Euro buyers.

- Recession fears, geopolitical headlines prod EUR/USD buyers ahead of the key US Nonfarm Payrolls.

EUR/USD bulls take a breather around 1.0920 as it awaits the key United States employment numbers during early Friday. In doing so, the Euro pair also bears the burden of the Good Friday holidays in the major Western markets, including Europe.

It’s worth noting, however, that the comparatively more hawkish bias for the European Central Bank (ECB) than the Federal Reserve (Fed) keeps the EUR/USD on the way to posting the third consecutive weekly gain, despite recent recession woes.

EUR/USD cheers upbeat data

EUR/USD remains firmer overall as the latest data from Germany and the Eurozone appear to keep the European Central Bank (ECB) hawks on the table, unlike their US counterparts.

That said, Germany’s Industrial Production (IP) rose 0.6% YoY in February versus -2.7% market forecasts and -1.6% previous readings. The monthly figures also came in firmer than 0.1% expected, to 2.0% versus 3.7% prior. On Wednesday, Germany Factory Orders improved to -5.7% YoY for February from -12.0 revised down prior and -10.5% market forecasts while the MoM growth came in at 4.8% compared to 0.3% expected and 0.5% previous readings.

On a broader front, Eurozone S&P Global Composite PMI eased to 53.7 in March versus 54.1 first readings whereas Services PMI also declined to 55.0 during the stated month from 55.6 preliminary forecasts.

Elsewhere, the US Initial Jobless Claims improved to 228K for the week ended on March 31 versus 200K expected and upwardly revised 246K prior. It’s worth noting that the Challenger Job Cuts for the said month rose to 89.703K from 77.77K prior. Previously, US JOLTS Job Openings dropped to the 19-month low in February while the ADP Employment Change for March also disappointed markets with 145K figures. Further, the US ISM Services PMI for March also amplified pessimism as it dropped to 51.2 versus 54.5 expected and 55.1 prior.

European Central Bank policymakers appear more hawkish than Federal Reserve talks

Considering the upbeat data, European Central Bank (ECB) Chief Economist Philip Lane signaled in a university lecture in Cyprus that the May decision depends on three factors, namely inflation outlook, underlying dynamic and how quickly these interest rate increases are restricting the economy and bringing down inflation.” The policymaker also said that due to these reasons they haven’t indicated or pre-announced what the expectation is for the next meeting or the upcoming meetings.

On the other hand, St. Louis Federal Reserve President James Bullard said on Thursday he thinks inflation is going to be sticky going forward.

With the comparatively more hawkish ECB policymaker's tone, the EUR/USD remains firmer ahead of the key data.

Recession woes challenge EUR/USD buyers

It should be noted that the Federal Reserve’s (Fed) preferred gauge of economic health cited the recession woes and put a floor under the EUR/USD prices. “Research from the Fed has argued that the ‘near-term forward spread’ comparing the forward rate on Treasury bills 18 months from now with the current yield on a three-month Treasury bill was the most reliable bond market signal of an imminent economic contraction,” per Reuters.

On the same line are comments from International Monetary Fund (IMF) Managing Director Kristalina Georgieva who said in her prepared remarks on Thursday that she expects the global economy to grow by less than 3% in 2023, down from 3.4% in 2022, per Reuters.

All eyes on United States employment numbers

Given the recently downbeat US employment clues, as well as the hopes of no rate hikes from the Federal Reserve (Fed), today’s US jobs report for March becomes crucial even as the Good Friday holiday is expected to limit the EUR/USD pair’s reaction to data.

Market forecasts suggest a softer print of the headline Nonfarm Payrolls (NFP), to 240K from 311K prior, as well as no change in the Unemployment Rate of 3.6%. However, the mixed expectations for the Average Hourly Earnings make the outcome even more interesting.

Also read: Nonfarm Payrolls Preview: Markets fear depressing data, three scenarios for the US Dollar

EUR/USD technical analysis

EUR/USD stays within a three-day-old descending triangle chart pattern, suggesting further upside on the bullish breakout.

Adding strength to the hopes of witnessing further Euro gains is the steady Relative Strength Index (RSI) line, placed at 14, not to forget the quote’s successful trading above the 200-Hour Moving Average (HMA).

That said, the EUR/USD bulls need validation from 1.0930 to retake control.

Following that, the latest peak of 1.0973 and the yearly high of around 1.1035 can test the Euro buyers ahead of directing them to the March 2022 high of near 1.1185.

Meanwhile, a downside break of the 1.0885 level comprising the triangle’s lower line will defy the bullish chart pattern and can lure the EUR/USD bears. Even so, the 200-HMA level of 1.0880 can act as an extra filter towards the south before delivering the quote to the bear’s door.

EUR/USD: Hourly chart

Trend: Further upside expected

-

08:03

Austria Industrial Production (YoY) climbed from previous -0.7% to 8.5% in February

-

07:57

Forex Today: Eyes on Nonfarm Payrolls on Good Friday

Here is what you need to know on Friday, April 7:

Major currency pair move in extremely tight ranges on Friday as global stock and bond markets remain closed on Easter Friday. In the early American session, the US Bureau of Labor Statistics will release the Nonfarm Payrolls (NFP) report for March.

On Thursday, the US Dollar Index, which tracks the US Dollar's (USD) performance against a basket of six major currencies, closed flat. Although Wall Street's main indexes managed to register modest gains on the day, the benchmark 10-year US Treasury bond yield recovered to 3.3%, helping the USD hold its ground.

Nonfarm Payrolls in the US are forecast to rise by 240,000 in March following February's better-than-expected increase of 311,000. The Unemployment Rate is expected to hold steady at 3.6% and the annual wage inflation, as measured by the Average Hourly Earnings, is seen edging lower to 4.3% from 4.6%.

Nonfarm Payrolls Preview: Markets fear depressing data, three scenarios for the US Dollar.

During the Asian trading hours on Friday, the data from Japan showed that the Leading Economic Index in February improved modestly to 97.7 from 96.6 in January. Meanwhile, outgoing Bank of Japan (BoJ) Governor Haruhiko Kuroda said that Japan is seeing a broadening trend where rising inflation is being reflected in wages. USD/JPY showed no immediate reaction to this comment and was last seen moving sideways slightly below 132.00.

Gold price registered losses for the second straight day on Thursday but managed to hold above $2,000 heading into the long weekend.

US March Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises.

EUR/USD closed marginally higher on Thursday after having met support near 1.0900. The pair moves sideways slightly above that level early Friday.

Following a two-day slide, GBP/USD has steadied near 1.2450 on Good Friday.

Bitcoin declined slightly on Thursday but doesn't have a difficult time holding near $28,000. Ethereum lost nearly 2% on Thursday and seems to have gone into a consolidation phase at around $1,850 on Friday.

-

07:46

France Trade Balance EUR came in at €-9.9B, above expectations (€-14.202B) in February

-

07:46

France Imports, EUR fell from previous €62.363B to €60.9B in February

-

07:45

France Exports, EUR rose from previous €49.425B to €50.992B in February

-

07:45

France Exports, EUR up to €50.922B in February from previous €49.425B

-

07:45

France Current Account registered at €-3B above expectations (€-6B) in February

-

07:42

BoJ’s Kuroda: Japan seeing broadening trend where rising inflation is being reflected in wages

Speaking at his retirement news conference on Friday, outgoing Bank of Japan (BoJ) Governor Haruhiko Kuroda said that “Japan is seeing a broadening trend where rising inflation is being reflected in wages.”

Additional quotes

Japan has made steady progress toward sustainably, steadily achieving BoJ’s price target.

Japan's tightening job market is laying groundwork for wages to rise more.

Hope the ‘norm’ that wages, prices won’t rise will change and inflation target in tandem with wage hikes is achieved.

If wages keep rising next year, we can foresee inflation stably, sustainably hitting BoJ’s price goal accompanied by wage growth.

It is possible to exit from ultra-easy policy while ensuring financial system remains stable.

Timing for achieving inflation target stably, sustainably is nearing as public perception that inflation, wages won't rise is starting to change.

Govt-BoJ joint statement was appropriate in terms of achieving a non-deflationary situation, but won’t comment on future development.

Market reaction

USD/JPY is advancing toward 132.00, adding 0.09% on the day. Kuroda’s last words fail to lift the sentiment around the Japanese Yen.

-

07:39

GBP/USD clings to mild gains around mid-1.2400s amid BoE vs. Fed talks ahead of US NFP

- GBP/USD snaps two-day losing streak with minor gains.

- Comparatively more hawkish hopes from BoE than Fed contrast with Brexit doubts to prod Cable buyers.

- US employment numbers are likely to allow GBP/USD to remain firmer for the fourth consecutive week.

GBP/USD seesaws around 1.2155-60 while printing the first daily gains in three amid early Good Friday morning in London. In doing so, the Cable pair cheers hawkish hopes from the Bank of England (BoE) while also portraying the cautious mood ahead of the key US Nonfarm Payrolls (NFP).

Andrew Goodwin, Chief UK Economist at Oxford Economics suggests another 0.25% rate hike from the “Old Lady”, as the BoE is informally known, amid persistent inflation pressure.

That said, the UK’s house price index signaled intact price pressure even if the BoE’s Monthly Decision Maker Panel (DMP) survey hints at likely easing the Consumer Price Index (CPI), from 5.9% expected in February to 5.8% for one-year ahead measure.

On the other hand, fears that the new Brexit deal will deter the European Union (EU) imports, per BBC News, seem to challenge the GBP/USD prices. The news quotes a Cold Chain Federation while stating that new plans for post-Brexit border checks on goods coming into the UK will deter many EU suppliers and push up food prices.

Elsewhere, downbeat US data raise fears of no rate hikes from the Federal Reserve (Fed) in May and weigh on the US Dollar. However, the same US statistics trigger recession woes and put a floor under the greenback. With this, the US Dollar Index (DXY) clings to mild gains around 102.00.

Talking about the US data, Initial Jobless Claims improved to 228K for the week ended on March 31 versus 200K expected and upwardly revised 246K prior. It’s worth noting that the Challenger Job Cuts for the said month rose to 89.703K from 77.77K prior. Previously, US JOLTS Job Openings dropped to the 19-month low in February while the ADP Employment Change for March also disappointed markets with 145K figures. Further, the US ISM Services PMI for March also amplified pessimism as it dropped to 51.2 versus 54.5 expected and 55.1 prior.

Amid these plays, market sentiment remains sour and the yields seem to pause recent downside, which in turn challenges the GBP/USD buyers. However, it all depends upon the US employment report for fresh calls.

Also read: Nonfarm Payrolls Preview: Markets fear depressing data, three scenarios for the US Dollar

Technical analysis

A one-month-old ascending trend channel, currently between 1.2375 and 1.2550, defends GBP/USD bulls.

-

07:33

FX option expiries for Apr 7 NY cut

FX option expiries for Apr 7 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0950 558.9m

- 1.0825 500m

- GBP/USD: GBP amounts

- 1.1900 563m

- 1.2400 360m

- 1.2000 325m

- USD/JPY: USD amounts

- 132.00 591m

- 131.40 411m

- 130.70 380m

- AUD/USD: AUD amounts

- 0.6675 445m

-

07:18

IMF’s Georgieva: Appropriate to give more flexibility to BoJ’s monetary policy

International Monetary Fund’s (IMF) Managing Director Kristalina Georgieva expressed her view on the Bank of Japan’s (BoJ) monetary policy on Friday, per Jiji News.

Key quotes

“Appropriate to give more flexibility to BoJ’s monetary policy.”

“Will fully support further smoothing of yield curve control if necessary.”

Related reads

- USD/JPY: Well-set for weekly loss near 131.50, Kuroda’s retirement speech, US NFP in focus

- BoJ JGBs holdings hit record in March

-

07:08

USD/JPY: Well-set for weekly loss near 131.50, Kuroda’s retirement speech, US NFP in focus

- USD/JPY clings to mild losses amid inactive markets, mixed concerns at home.

- BoJ held record JGB’s in March to tame hawkish concerns as Kuroda bids adieu.

- Japan’s real wages remain downbeat despite recent improvements, household spending also drop.

- Fears of BoJ’s exit from ultra-easy monetary policy, downbeat US data and yields keep bears hopeful ahead of key catalysts.

USD/JPY struggles for clear directions as Good Friday’s off outside Japan joins mixed factors at home, as well as cautious mood ahead of the key US data, to challenge momentum traders. That said, the Yen pair seesaws around 131.60-70 while printing mild losses on its way to reverse the previous weekly gain, which was the first in five.

Earlier in the day, Japan’s inflation-adjusted prices of household spending for February, also known as real wages, improved from a one-year low. On the same line were figures for Overall Household Spending and Labor Cash Earnings as both these catalysts improved for the said month. However, the actual figures still suggest a contraction in spending, which in turn pushes the Bank of Japan (BoJ) to propel markets.

Together with the recently firmer data, the hopes of the BoJ’s exit from the easy-money policy also required the Japanese central bank to buy more bonds. As a result, the BoJ held record Japanese Government Bonds (BoJ) in March.

It’s worth noting that the early 2023 edit of the Yield Curve Control and the stark dove Haruhiko Kuroda’s retirement from the BoJ’s Governorship also advocate the central bank’s hawkish move in the future and allow the JPY to remain firmer. Even so, Japan’s Finance Minister (FinMin) Shunichi Suzuki and Japanese Chief Cabinet Secretary Hirokazu Matsuno both signaled the continuation of the current monetary policy earlier in Asia.

On the other hand, downbeat US data triggered recession woes and exert downside pressure on the US Dollar, as well as on the Treasury bond yields. Even so, the market’s risk-off mood and consolidation ahead of the key US jobs report for March put a floor under the US Dollar, which in turn prods USD/JPY bears.

Apart from the US employment figures, a retirement speech from BoJ Governor Kuroda will also be eyed closed for fresh impulse.

While the downbeat market forecasts for the US Nonfarm Payrolls (NFP) suggest more weakness of the USD/JPY pair, the recently easing hawkish Fed bias and hopes of witnessing softer jobs report gives room for a surprise factor and a strong reaction to the same. On the other hand, increasing odds of the BoJ hawkish move also favor the Yen pair sellers.

Technical analysis

USD/JPY remains indecisive until it stays between the 50-DMA level of around 133.15 and an upward-sloping support line from mid-January, close to 131.30 by the press time.

-

06:41

USD/MXN Price Analysis: Bears need acceptance from 18.15 support confluence

- USD/MXN remains sidelined after snapping three-day uptrend the previous day.

- Convergence of 200-HMA, three-week-old previous resistance line puts a floor under Mexican Peso pair’s price.

- Hesitance in extending trend line break, looming bull cross on MACD lures buyers; recovery remains elusive below 18.40.

USD/MXN pair treads water around 18.23 during a sluggish start of the Good Friday holidays in major bourses. In doing so, the Mexican Peso (MXN) pair struggles to extend the previous day’s downside break of an upward-sloping trend line stretched from Tuesday.

Not only the USD/MXN pair’s resistance in extending the trend line break but an impending bull cross on the MACD indicator also challenge the sellers.

Furthermore, the 200-HMA and resistance-turned-support line from mid-March, around 18.15 by the press time, acts as a tough nut to crack for the USD/MXN bears.

In a case where the pair drops below 18.15, the odds of witnessing a fresh Year-To-Date (YTD) low, currently around 17.96, can’t be ruled out.

Meanwhile, USD/MXN recovery should initially cross the three-day-old previous support line, around 18.35 at the latest, to restore intraday buyer’s confidence.

Even so, the weekly top surrounding 18.40 can act as an extra filter towards the north before giving control to the bulls.

Following that, multiple levels near the 38.2% Fibonacci retracement of the pair’s fall from March 20 to April 03, around 18.45, can entertain the USD/MXN bulls before directing them to 18.80 and then to the 19.00 psychological magnet.

Overall, USD/MXN is yet to break the 18.15 support to convince bears. Until then, the hopes of witnessing a recovery remain on the table.

USD/MXN: Hourly chart

Trend: Recovery expected

-

06:23

BoC to stand pat this year, rate cuts unlikely - Reuters poll

The latest poll of economists surveyed by Reuters unveiled that the Bank of Canada (BoC) is likely to maintain its key interest rate at 4.50% through the balance of this year.

Key takeaways

“All 33 economists polled March 31-April 6 said it will hold its overnight rate at 4.50% on April 12.”

“A majority of forecasters, 23 of 31, said the rate would remain unchanged for the rest of 2023. Only seven expected at least one 25-basis-point rate cut by end-year, down from 13 in a survey taken about a month ago.”

“The economy was predicted to grow 0.7% and 1.4% this year and next, compared with 0.5% and 1.5%, respectively.”

“The Canadian dollar is forecast to rise over the coming year.”

-

06:08

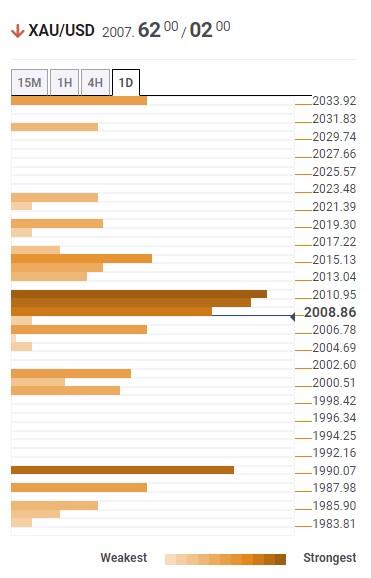

Gold Price Forecast: XAU/USD stays bullish beyond $1,990 – Confluence Detector

- Gold price edges lower in its battle with the wall of resistance around $2,010.

- Recession woes, geopolitical concerns challenge XAU/USD bulls near multi-month high.

- US NFP needs to part ways from downbeat US data to renew hawkish Fed bias.

- US inflation, FOMC Minutes also eyed to better predict May’s Fed rate hike.

Gold price (XAU/USD) slips off bull’s radar for a while as markets consolidate amid the Good Friday holiday, despite being set for the weekly gain to around $2,007. Adding filters to the XAU/USD trading is the cautious mood ahead of the US employment data for March, as well as the looming recession woes. It should be noted, however, that the recently downbeat US employment clues and easing hawkish concerns about the Fed’s next move keep the Gold price firmer, backed by a weaker US Dollar.

Moving on, Nonfarm Payrolls (NFP) need to match the downbeat expectations from the jobs report to keep Gold buyers in the driver’s seat. In absence of this, the Gold price may extend the latest pullback towards the $1,990 support confluence with eyes on the key US inflation and Fed Minutes.

Also read: Gold Price Forecast: XAU/USD could aim for $2,043 on weak US Nonfarm Payrolls report

Gold Price: Key levels to watch

Our Technical Confluence Indicator shows that the Gold price recently slipped beneath the $2,010 key support confluence while pausing the run-up to poke the previous yearly high marked in March 2022.

The stated support confluence, now resistance, includes Fibonacci 38.2% on one-day, previous monthly high and Pivot Point one-week R2.

In a case where the Gold price jumps back beyond the $2,010 level, the Fibonacci 161.8% on one-week and SMA10 on 4H can check the XAU/USD bulls around $2,015 before restoring the previous upside bias.

Following that, a run-up towards the Pivot Point one-week R3, around $2,035 becomes swift.

On the contrary, the metal’s sustained trading below $2,010 can drag it to another key support for the Gold price, surrounding $1,990, which encompasses Pivot Point one-day S2 and Pivot Point one-week R1.

Should the XAU/USD bears keep the reins past $1,990, the odds of witnessing a slump toward the February 2022 peak of around $1,960 and multiple lows close to $1,950 can’t be ruled out.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

-

06:01

Japan Leading Economic Index increased to 97.7 in February from previous 96.6

-

06:01

Japan Coincident Index increased to 99.2 in February from previous 96.4

-

05:31

Netherlands, The Consumer Spending Volume down to 2.6% in February from previous 6.2%

-

05:31

Netherlands, The Manufacturing Output (MoM) rose from previous -3.3% to 0.4% in March

-

05:23

BoJ JGBs holdings hit record in March

According to the latest data published by the Bank of Japan (BoJ), the central bank’s holdings of Japanese government bonds (JGBs) hit a record at the end of March.

Key takeaways

“The BoJ's holdings of JGBs stood at JPY582 trillion ($4.42 trillion) as of March 31, up 10.6% from a year earlier, and a record for the end of the fiscal year 2013.”

“The central bank purchased a record JPY136 trillion yen in the year through March, almost double the amount in the previous year, separate data showed earlier this week.”

Market reaction

At the time of writing, USD/JPY is trading on the back so far this Good Friday, ranging around 131.65 following rejection just shy of the 132.00 level.

-

04:41

USD/INR Price Analysis: Indian Rupee prods key hurdle for bulls around 81.80 with eyes on US NFP

- USD/INR stays well-set for three-week losing streak, down for the fourth consecutive day.

- Indian Rupee buyers take a breather at 11-week-old ascending trend line.

- Clear break of upward-sloping previous support line from September 2022, bearish MACD signal favor USD/INR sellers.

- Convergence of Five-month-old support line, 200-DMA appears a tough nut to crack for pair bears.

USD/INR bears poke a multi-day-old support line around 81.80 as it braces for the third consecutive weekly loss on early Friday. Apart from the stated support line, the Good Friday holiday and cautious mood ahead of the US Nonfarm Payrolls (NFP) release also challenge the Indian Rupee (INR) pair.

Also read: Nonfarm Payrolls Preview: Markets fear depressing data, three scenarios for the US Dollar

It’s worth noting, however, that a daily closing below the support-turned-resistance line from the last September, around 82.00 by the press time, joins the bearish MACD signals to keep USD/INR sellers hopeful of breaking the immediate 81.80 support.

Following that, the quote can quickly drop to the previous monthly low of around 81.50.

Though, a convergence of the 200-DMA and a five-month-old ascending trend line, close to 81.40 at the latest, appears a tough nut to crack for the USD/INR bears afterward.

Meanwhile, USD/INR recovery remains elusive unless the pair stays below the 82.00 previous support.

Even if the quote rises past 82.00, a downward-sloping resistance line from March 22, around 82.35 at the latest, can test the USD/INR bulls.

Above all, USD/INR buyers should remain cautious unless witnessing a daily close beyond the descending resistance line from October 2022, near 83.00 by the press time.

USD/INR: Daily chart

Trend: Further downside expected

-

04:19

China’s Commerce Ministry urges Australia to treat all firms, including TikTok fairly

When asked about Australia banning Tiktok on government devices, China’s Commerce Ministry said that they urge Australia to treat all companies fairly.

Additional quotes

Urge Australia to create a favorable atmosphere for the development of China-Australia economic and trade cooperation.

The ban undermines the international community's confidence in the business environment in Australia and also harms the interests of Australian businesses and the public.

Market reaction

Despite the renewed Sino-Australian tensions, AUD/USD is grinding 0.14% higher on the day at 0.6780, as of writing.

-

04:18

WTI crude oil grinds higher past $80.00 as NFP, recession concerns jostle with OPEC+ surprise

- WTI crude oil prints three-week uptrend, seesaws around 10-week high of late.

- OPEC+ surprise manages to keep Oil buyers on the table even if recession woes prod WTI of late.

- Downbeat US data weigh on US Dollar and allow the Oil price to remain firmer ahead of the key NFP.

- Odds of more Oil price upside can’t be ruled out amid downbeat forecasts for the US employment report for March.

WTI crude oil remains inactive around $80.50, well-set for a three-week uptrend, as energy markets cheer the Good Friday holiday. In doing so, the black gold defends the week-start gains offered by the Organization of the Petroleum Exporting Countries (OPEC) and its allies led by Russia, known as OPEC+, which announced surprise output cut. However, fears of recession and a cautious mood ahead of the US employment report for March challenge the energy benchmark of late.

The OPEC+ group surprised markets with nearly 1.66 million barrels per day of a voluntary output cut. Following the OPEC+ announcements, the International Energy Agency (IEA) said that the OPEC+ decision to cut oil output risks exacerbating a strained market by pushing up oil prices amid inflationary pressures.

On the other hand, the US Dollar’s weakness, backed by downbeat US data, also underpinned the black gold’s recovery moves.

That said, the US Dollar Index (DXY) pares weekly losses around 102.00 while printing a four-day losing streak.

Talking about the US data, Initial Jobless Claims improved to 228K for the week ended on March 31 versus 200K expected and upwardly revised 246K prior. It’s worth noting that the Challenger Job Cuts for the said month rose to 89.703K from 77.77K prior. Previously, US JOLTS Job Openings dropped to the 19-month low in February while the ADP Employment Change for March also disappointed markets with 145K figures. Further, the US ISM Services PMI for March also amplified pessimism as it dropped to 51.2 versus 54.5 expected and 55.1 prior.

Also supporting the Oil price could be China’s optimism for economic growth and upbeat activity data from the dragon nation. Pan Gongsheng, head of China’s State Administration of Foreign Exchange (SAFE), said on Friday that Beijing “will fend off external financial market shocks and risks.”

It should be observed, however, that the recent calls of recession challenge the WTI crude oil buyers and hence more clues of economic slowdown should be watched for clear directions, especially when the commodity prices trade near the short-term key resistance line.

Apart from the recession news, the US jobs report for March will also be crucial to watch for clear directions. Analysts anticipate a softer print of the headline Nonfarm Payrolls (NFP), to 240K from 311K prior, as well as no change in the Unemployment Rate of 3.6%. However, the mixed expectations for the Average Hourly Earnings make the outcome even more interesting.

Technical analysis

Unless providing a daily closing beyond a four-month-old descending resistance line, around $81.70 by the press time, WTI crude oil buyers should remain cautious.

-

04:00

EUR/USD Price Analysis: Advocates further upside ahead of US NFP, 1.0930 is the key

- EUR/USD remains sluggish on Good Friday holiday, stays on the way to three-week uptrend.

- Sustained trading above the key support lines, 100-SMA keeps Euro buyers hopeful.

- US Nonfarm Payrolls (NFP) should match downbeat forecasts to push back sellers.

EUR/USD treads water around 1.0930 key upside hurdle during the Good Friday holiday morning in Europe. In doing so, the Euro pair remains well-set to post a three-week winning streak while trading successfully above the 100-SMA and the key support lines stretched from March. However, the market’s cautious mood ahead of the US Nonfarm Payrolls (NFP) seems to challenge the pair traders of late.

Also read: EUR/USD eyes fourth weekly gains above 1.0900 despite US Dollar’s bounce ahead of US NFP

Apart from the sustained trading beyond the 100-SMA and two support lines stretched from the last month, a mostly steady condition of the RSI (14) also suggests the continuation of the EUR/USD pair’s advances.

However, a clear break of the two-week-long horizontal hurdle surrounding 1.0930 becomes necessary for the EUR/USD bulls before challenging the latest peak of 1.0973.

Following that, a run-up towards the yearly high of around 1.1035 and then to the March 2022 high of near 1.1185 can’t be ruled out.

Alternatively, pullback moves may aim for a three-week-long support line, close to 1.0870, amid bearish MACD signals.

Even so, the ascending trend line from March 24 and the 100-SMA, near 1.0835 and 1.0810 in that order, can challenge the EUR/USD bears before giving them control.

EUR/USD: Four-hour chart

Trend: Further upside expected

-

03:39

USD/CHF stays pressured towards 0.9000 as markets await NFP on Good Friday

- USD/CHF fades the previous day’s corrective bounce off 22-month low.

- Downbeat US data, mixed concerns about US recession and Fed weigh on the Swiss Franc pair.

- US NFP can propel markets amid Good Friday-induced inaction, firmer readings can renew US Dollar strength.

USD/CHF holds lower ground near 0.9040 as the US Dollar braces for the all-important US employment data on early Friday. It should be noted that the Good Friday holiday restricts the Swiss Franc (CHF) pair’s immediate moves but downbeat US data and recession woes keep the pair sellers hopeful.

That said, Thursday’s no change in the Swiss Unemployment Rate for March contrasts with a reduction in the nation’s Foreign Currency Reserves to confuse USD/CHF traders. However, downbeat US data propels recession woes and exert downside pressure on the prices.

That said, the US Initial Jobless Claims improved to 228K for the week ended on March 31 versus 200K expected and upwardly revised 246K prior. It’s worth noting that the Challenger Job Cuts for the said month rose to 89.703K from 77.77K prior. Previously, US JOLTS Job Openings dropped to the 19-month low in February while the ADP Employment Change for March also disappointed markets with 145K figures. Further, the US ISM Services PMI for March also amplified pessimism as it dropped to 51.2 versus 54.5 expected and 55.1 prior.

Not only the data, but the Federal Reserve’s (Fed) preferred gauge of economic health’s drumming of recession woes, despite the latest inaction, also favors USD/CHF bears. “Research from the Fed has argued that the ‘near-term forward spread’ comparing the forward rate on Treasury bills 18 months from now with the current yield on a three-month Treasury bill was the most reliable bond market signal of an imminent economic contraction,” per Reuters.

On a different page, geopolitical headlines and the Swiss National Bank’s (SNB) comparatively more hawkish move versus the Federal Reserve (Fed) keeps the USD/CHF bears hopeful.

Moving on, the Good Friday holiday may restrict immediate USD/CHF moves ahead of today’s US jobs report. Market forecasts suggest a softer print of the headline Nonfarm Payrolls (NFP), to 240K from 311K prior, as well as no change in the Unemployment Rate of 3.6%. However, the mixed expectations for the Average Hourly Earnings make the outcome even more interesting.

Also read: Nonfarm Payrolls Preview: Markets fear depressing data, three scenarios for the US Dollar

Technical analysis

Unless crossing a nine-week-old resistance line, around 0.9080 by the press time, the USD/CHF remains vulnerable to test June 2021 low of around 0.8950.

-

03:22

AUD/USD Price Analysis: Portrays pre-NFP consolidation above 0.6650

- AUD/USD picks up bids to refresh intraday high, snaps three-day losing streak.

- Clear break of one-month-old ascending trend channel, bearish moving average crossover keeps sellers hopeful.

- US NFP may bolster recession woes and weigh on prices on matching downbeat forecasts.

AUD/USD pares weekly losses around 0.6680 as traders prepare for the US Nonfarm Payrolls (NFP) during Good Friday’s holiday-driven sluggish session. In doing so, the Aussie pair prints the first daily gains in four amid upbeat headlines from Australia’s major customer China.

Also read: China’s SAFE: Will fend off external financial market shocks and risks

However, the Reserve Bank of Australia’s (RBA) dovish play joins the recession woes and exerts downside pressure on the AUD/USD prices.

Also read: AUD/USD justifies risk-barometer status around 0.6670 as recession woes loom, US NFP eyed

Technically, the Aussie pair’s rejection of a one-month-old bullish channel and a bearish moving average crossover, signaled by the 50-DMA’s piercing of the 100-DMA from above, keep the AUD/USD sellers hopeful. Adding strength to the downside bias is the steady RSI (14) line.

That said, the quote’s latest rebound remains elusive unless it stays below the aforementioned channel’s lower line, close to 0.6690 by the press time.

Apart from the 0.6690 immediate hurdle, the 0.6700 round figure can also test the pair buyers before giving them control.

Even so, the 50-DMA, the 100-DMA and the top line of the stated channel, around 0.6785, 0.6800 and 0.6820 in that order, can challenge the AUD/USD buyers afterward.

Alternatively, an upward-sloping support line from the last November, close to 0.6620 by the press time, puts a floor under the AUD/USD prices.

Following that, the previous monthly low of 0.6564, also the Year-To-Date (YTD) bottom, will gain the market’s attention.

AUD/USD: Daily chart

Trend: Further upside expected

-

03:05

China’s SAFE: Will fend off external financial market shocks and risks

Pan Gongsheng, head of China’s State Administration of Foreign Exchange (SAFE), said on Friday that Beijing “will fend off external financial market shocks and risks.”

Pan said that they “will maintain stable operations and healthy order of FX market.”

Market reaction

At the time of writing, AUD/USD is adding 0.12% on the day to trade at 0.6778, trapped in a tight range amid Good Friday-led thin market conditions.

-

03:02

USD/CAD prods three-day rebound below 1.3500 ahead of US NFP

- USD/CAD struggles for clear directions amid Good Friday holiday, pauses three-day uptrend.

- Strong Canada jobs report contrast with downbeat US data to challenge Loonie pair buyers.

- WTI crude oil price grinds higher and challenge the USD/CAD bulls.

- Recession woes, BoC’s dovish bias keeps Loonie buyers hopeful ahead of US Employment report for March.

USD/CAD pares weekly gains around 1.3490 as traders seek more clues amid a sluggish session on the early Good Friday holiday. Adding strength to the market’s inaction could be the cautious mood ahead of the US employment data for March.

The Loonie pair rose in the last three consecutive days despite firmer Canada statistics and upbeat prices of the WTI crude oil, Ontario’s main export earner. The reason could be linked to the Bank of Canada’s (BoC) dovish bias and the looming recession woes, backed by the downbeat US data.

On Thursday, Canada’s headline Net Change in Employment rose to 34.7K in March from 21.8K prior, versus 12K market consensus, whereas the Unemployment Rate reprinted 5.0% figure compared to analysts’ estimate of 5.1%. It’s worth noting, however, that the Participation Rate eased to 65.6% during the stated month from 65.7% expected and prior. Further, the Average Hourly Wages eased to 5.2% YoY in March versus 5.4% previous reading. On a different page, Canadian Ivey Purchasing Managers Index improved to 58.2 seasonally adjusted for March versus 56.1 expected and 51.6 prior.

On the other hand, US Initial Jobless Claims improved to 228K for the week ended on March 31 versus 200K expected and upwardly revised 246K prior. It’s worth noting that the Challenger Job Cuts for the said month rose to 89.703K from 77.77K prior. Previously, US JOLTS Job Openings dropped to the 19-month low in February while the ADP Employment Change for March also disappointed markets with 145K figures. Further, the US ISM Services PMI for March also amplified pessimism as it dropped to 51.2 versus 54.5 expected and 55.1 prior.

It should be noted that the downbeat US data pushed the Federal Reserve’s (Fed) preferred gauge of economic health towards drumming recession woes, which in turn lures the USD/CAD buyers, despite the latest inaction. “Research from the Fed has argued that the ‘near-term forward spread’ comparing the forward rate on Treasury bills 18 months from now with the current yield on a three-month Treasury bill was the most reliable bond market signal of an imminent economic contraction,” per Reuters.

Elsewhere, WTI crude oil eyes the third consecutive weekly gain, around $80.50 at the latest, amid fears of supply cuts and hopes of more demand from China.

To sum up, USD/CAD bears the burden of upbeat Canada data and firmer Oil prices but the recession woes and pre-NFP consolidation tests traders of late.

Also read: Nonfarm Payrolls Preview: Markets fear depressing data, three scenarios for the US Dollar

Technical analysis

Although an eight-month-old ascending support line restricts the immediate downside of the USD/CAD pair to around 1.3425, the bulls need validation from the 100-DMA hurdle of near 1.3530 to keep the reins.

-

02:38

US Dollar Index: DXY grinds near 102.00 as recession fears underpin haven demand ahead of US NFP

- US Dollar Index remains inactive amid Good Friday holiday, pares weekly losses of late.

- Downbeat US data, dovish Fed bets keep DXY sellers hopeful ahead of the key employment report.

- Recession woes put a floor under the prices as Fed’s preferred economic indicator signals slowdown.

US Dollar Index licks its wounds around 102.00 as global markets turn inactive amid the Good Friday holiday at major bourses. Also restricting the moves of the US Dollar’s gauge versus the six major currencies is the cautious mood ahead of the all-important US employment data for March.

The DXY has been in jeopardy of late as downbeat US statistics, especially concerning employment, contrast with the haven demand amid recession fears and geopolitical woes. However, dovish Fed bets keep a tab on the US Dollar Index as the key data loom.

On Thursday, US Initial Jobless Claims improved to 228K for the week ended on March 31 versus 200K expected and upwardly revised 246K prior. It’s worth noting that the Challenger Job Cuts for the said month rose to 89.703K from 77.77K prior. Previously, US JOLTS Job Openings dropped to the 19-month low in February while the ADP Employment Change for March also disappointed markets with 145K figures. Further, the US ISM Services PMI for March also amplified pessimism as it dropped to 51.2 versus 54.5 expected and 55.1 prior.

With the disappointing US data, the Federal Reserve’s (Fed) preferred gauge of economic health cited the recession woes and put a floor under the DXY prices. “Research from the Fed has argued that the ‘near-term forward spread’ comparing the forward rate on Treasury bills 18 months from now with the current yield on a three-month Treasury bill was the most reliable bond market signal of an imminent economic contraction,” per Reuters.

It’s worth mentioning that the CME’s FedWatch Tool suggests a 45% chance of no Fed action in May.

Apart from the aforementioned catalysts, the geopolitical concerns surrounding China and North Korea also contribute to the US Dollar’s safe-haven demand.

Against this backdrop, Wall Street closed with minor gains and so did the yields as traders brace for the all-important US employment data. With this, the market’s sentiment remains dicey and allows the US Dollar to grind higher.

Moving on, DXY may witness lackluster moves ahead of today’s jobs report for March. Market forecasts suggest a softer print of the headline Nonfarm Payrolls (NFP), to 240K from 311K prior, as well as no change in the Unemployment Rate of 3.6%. However, the mixed expectations for the Average Hourly Earnings make the outcome even more interesting.

Technical analysis

Thursday’s Doji candlestick joins sustained trading below the one-month-old resistance line, around 102.40 by the press time, to keep US Dollar Index bears hopeful.

-

02:23

PBOC sets USD/CNY reference rate at 6.8838 vs. 6.8747 previous

People’s Bank of China (PBOC) set the USD/CNY central rate at 6.8838 on Friday, versus Thursday's fix of 6.8747 and market expectations of 6.8820. It's worth noting that the USD/CNY closed near 6.8745 the previous day.

In addition to the USD/CNY fix, the PBOC also released data for the Open Market Pperations (OMO) that suggest the Chinese central bank drained a net 1.132 trillion Yuan on the day, per Reuters calculations.

Further details of the PBOC update suggests that the Chinese central bank held 7-day Repo Rate unchanged at 2.0% at Friday’s fix.

About the fix

China maintains strict control of the yuan’s rate on the mainland.

The onshore yuan (CNY) differs from the offshore one (CNH) in trading restrictions, this last one is not as tightly controlled.

Each morning, the People’s Bank of China (PBOC) sets a so-called daily midpoint fix, based on the yuan’s previous day's closing level and quotations taken from the inter-bank dealer.

-

02:11

Silver Price Analysis: XAG/USD traces fourth weekly gain in options market catalyst near $25.00

Silver price (XAG/USD) seesaws around $25.00 in the last few days after retreating from the one-year high on Wednesday, making rounds to $24.95 during Good Friday’s inactive Asian session. Even so, the bright metal stays well-set for a consecutive fourth weekly gain while tracing the upbeat options market signals.

That said, a one-month risk reversal (RR) of the Silver price, a gauge of the spread between the call and put options, prints a mild daily loss of -0.1000 by the end of Thursday’s North American session.

It’s worth noting, however, that the weekly RR is up for the fourth consecutive time, to 0.2000 at the latest. Further, the monthly options market signals are also firmer so far in April after posting the biggest gains in a year in March.

While the options market flashes upbeat signals, the Good Friday holiday may restrict XAG/USD moves ahead of the all-important Nonfarm Payrolls (NFP).

Also read: US March Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises

-

02:00

Japan’s Matsuno: Hope BoJ Governor Ueda, two Deputy Governors will work as one team

Japanese Chief Cabinet Secretary Hirokazu Matsuno crossed wires during early Friday while conveying hopes from incoming officials for the Bank of Japan (BoJ), including Governor Kazuo Ueda and two Deputy Governors.

The policymaker also announced extension of sanctions against North Korea, including export ban, for two years.

Key comments

Hope BoJ Governor Ueda, two Deputy Governors will work as one team.

Expect BoJ to work closely with Government, guide appropriate monetary policy with eye on economic, price, financial trends.

USD/JPY bounces off intraday low

Following the news, USD/JPY picks up bids from intraday low to pare the weekly losses, down 0.05% on a day near 131.75 by the press time.

Also read: USD/JPY ignores yields to slip beneath 132.00 as Japan’s real wages drop at a slower pace, US NFP eyed

-

01:38

USD/JPY ignores yields to slip beneath 132.00 as Japan’s real wages drop at a slower pace, US NFP eyed

- USD/JPY takes offers to refresh intraday low, reverses the previous day’s corrective bounce.

- Japan’s Inflation-adjusted real wages drops for 11th month in February but at a slower pace.

- Benchmark Treasury bond yields consolidates weekly losses amid Good Friday holiday in major markets.

- Recession woes, downbeat US data favor Yen bears ahead of top-tier US employment statistics.

USD/JPY renews its intraday low near 131.60 as it justifies the upbeat Japan data amid sluggish markets due to the Good Friday holiday at major bourses. That said, the Yen pair remains on the way to posting weekly losses with the latest fall, especially amid increasing hawkish bias for the Bank of Japan (BoJ).

The hawkish bias for the BoJ intensifies amid upbeat Japanese data, as well as comments from the Japanese Finance Minister (FinMin) Sunichi Suzuki.

“Inflation-adjusted real wages, a gauge of households' purchasing power, dropped by 2.6% in February from a year earlier, following a 4.1% fall in January that marked the fastest decline in nearly nine years,” per Reuters. It’s worth observing that Japan’s Overall Household Spending and Labor Cash Earnings also improved in February and favor the odds of the BoJ’s exit from the ultra-easy monetary policy.

It should be noted that Japan’s FinMin Suzuki showed hopes of witnessing suitable policy and hence raise fears of hawkish stunts from the BoJ officials, especially amid Haruhiko Kuroda’s departure.

Elsewhere, US Treasury bond yields pare weekly losses amid mixed concerns about the US recession and downbeat US data. With this, the US 10-year and two-year Treasury bond yields also stay pressured, despite the latest consolidation around 3.30% and 3.83% in that order.

Further, “Research from the Fed has argued that the ‘near-term forward spread’ comparing the forward rate on Treasury bills 18 months from now with the current yield on a three-month Treasury bill was the most reliable bond market signal of an imminent economic contraction,” said Reuters.

Above all, the divergence between the upbeat Japan data and disappointing US statistics keeps the USD/JPY pair on the bear’s table. However, the Yen pair’s further downside hinges on how well the US employment numbers can push back the recession woes. Forecasts suggest the headline Nonfarm Payrolls (NFP) be 240K, down from 311K prior, as well as estimating no change in the Unemployment Rate of 3.6%.

Technical analysis

Although the 50-DMA restricts immediate USD/JPY upside to around 133.15, USD/JPY bears need validation from an upward-sloping support line from mid-January, close to 131.30 by the press time.

-

01:19

Japan FinMin Suzuki: I hope the BoJ maintains suitable policy

Japan’s Finance Minister (FinMin) Shunichi Suzuki praised the efforts of Bank of Japan’s (BoJ) outgoing Governor Haruhiko Kuroda early Friday.

“Bank of Japan outgoing governor Haruhiko Kuroda's monetary stimulus has achieved major results over the past decade,” said Japan FinMin Suzuki per Reuters.

“Kuroda has helped create a situation where Japan is no longer described as being in deflation,” adds Suzuki per Reuters.

The policymaker also hopes, per Reuters, that the BoJ maintains suitable policy.

USD/JPY retreats

Following the news, USD/JPY pares the previous day’s rebound, down 0.10% around the intraday low of 131.61.

It’s worth noting that Good Friday holidays in major markets, except for Japan, allow the USD/JPY pair to remain active and consolidate recent gains while being on the way to posting a weekly loss.

-

01:15

Currencies. Daily history for Thursday, April 6, 2023

Pare Closed Change, % AUDUSD 0.66705 -0.76 EURJPY 143.775 0.47 EURUSD 1.09185 0.11 GBPJPY 163.79 0.18 GBPUSD 1.24389 -0.18 NZDUSD 0.62444 -1.18 USDCAD 1.34867 0.24 USDCHF 0.90464 -0.19 USDJPY 131.705 0.36 -

01:11

NZD/USD stays pressured around 0.6250 amid Good Friday holiday, focus on US NFP

- NZD/USD appears well-set for weekly loss after falling the most in a month the previous day.

- Sour sentiment allowed Kiwi traders to reverse RBNZ-led rally.

- US data flags recession fears and weigh on commodities, Antipodeans.

- NFP will be crucial, more volatility eyed amid thin market presence.