Notícias do Mercado

-

23:46

GBP/USD Price Analysis: Retreats towards 1.2400 within bullish channel as US NFP looms

- GBP/USD remains pressured after reversing from 10-month high in the last two consecutive days.

- One-month-old bullish channel, ascending support line from early March prod Cable bears.

- MACD, RSI suggests further consolidation of weekly gains ahead of top-tier US employment data.

- Bulls need validation from 1.2550 to retake control.

GBP/USD drops to 1.2430 as it extends the two-day downtrend to a sluggish Asian session on Good Friday. In doing so, the Cable pair pares the weekly losses, the fourth consecutive one, while easing from the top line of a one-month-old ascending trend channel.

That said, the GBP/USD pair’s pullback from the short-term key hurdle also gains support from bearish MACD signals and the RSI (14) line’s retreat from the overbought territory, which suggests further declines of the quote.

However, a one-week-old horizontal support area around 1.2430 currently restricts the Cable pair’s immediate downside ahead of an upward-sloping support line from March 08, close to 1.2375.

It’s worth noting, though, that the GBP/USD pair’s weakness past 1.2375 will be tough as the stated channel’s lower line and the 100-SMA, respectively near 1.2350 and 1.2300, could challenge the bears before giving them control.

On the contrary, recovery moves need to cross a downward-sloping resistance line from Tuesday, around 1.2475 by the press time.

Even so, the latest multi-month peak of 1.2525, the highest since June 2022, will precede the aforementioned channel’s top line, around 1.2550, to challenge the GBP/USD buyers.

Should the Cable pair remains firmer past 1.2550, backed by price-positive US Nonfarm Payrolls (NFP), the odds of witnessing a run-up to a May 2022 high of around 1.2665 can’t be ruled out.

Also read: Nonfarm Payrolls Preview: Markets fear depressing data, three scenarios for the US Dollar

GBP/USD: Four-hour chart

Trend: Limited downside expected

-

23:24

Fed Chair 'Powell's curve' plunges to new lows, flashing US recession warning – Reuters

Reuters came out with downbeat signals from the Federal Reserve’s (Fed) research amid the ongoing recession chatters as Asian markets cheer the Good Friday holiday.

“The Federal Reserve’s preferred bond market signal of an upcoming recession has plunged to fresh lows, bolstering the case for those who believe the central bank will soon need to cut rates to revive economic activity,” said the news.

Reuters also adds that research from the Fed has argued that the “near-term forward spread” comparing the forward rate on Treasury bills 18 months from now with the current yield on a three-month Treasury bill was the most reliable bond market signal of an imminent economic contraction.

Additional quotes

That spread, which has been in negative territory since November, plunged to new lows this week, standing at nearly minus 170 basis points on Thursday.

Money market investors, however, on Thursday were largely betting the Fed would have cut rates by about 70 basis points by December, from the current 4.75%-5% range.

‘Powell’s curve ... continues to plunge to fresh century lows,’ Citi rates strategists William O’Donnell and Edward Acton said in a note on Thursday. Refinitiv data showed the curve was the most inverted since at least 2007.

Market reaction

The news allows the US Dollar to benefit from its haven appeal and exert downside pressure on the EUR/USD. However, the holiday mood restricts the pair’s immediate moves despite retreating to 1.0920 during early Friday.

Also read: EUR/USD eyes fourth weekly gains above 1.0900 despite US Dollar’s bounce ahead of US NFP

-

23:15

EUR/USD eyes fourth weekly gains above 1.0900 despite US Dollar’s bounce ahead of US NFP

- EUR/USD grinds higher as traders await the key US employment numbers after a mixed daily performance, retreating of late.

- Upbeat German data contrasts with downbeat US statistics to underpin bullish bias for Euro.

- Recession woes, pre-data anxiety join holiday-driven inaction to prod traders.

- US job numbers are the only game in the town to watch for fresh impulse, volatility expected.

EUR/USD bulls keep the reins around 1.0920, retreating of late, as it portrays the typical Good Friday inaction, as well as anxiety ahead of the US Nonfarm Payrolls (NFP), during the early hours of the day. The major currency pair witnessed a volatile Thursday amid the initial US Dollar rebound on recession woes before ending the day unchanged with downbeat US data contrasting with firmer statistics from the Eurozone.

Consecutive weakness in the US Dollar and downbeat US Treasury bond yields triggered fears of a recession in the world’s largest economy, which in turn allowed the USD bears to take a breather during early Thursday. However, another set of downbeat US jobs report reversed the greenback’s gains afterward as traders brace for the all-important NFP.

That said, US Initial Jobless Claims improved to 228K for the week ended on March 31 versus 200K expected and upwardly revised 246K prior. It’s worth noting that the Challenger Job Cuts for the said month rose to 89.703K from 77.77K prior.

It should be noted that Reuters raised fears of recession by citing the Federal Reserve (Fed) Chairman Jerome Powell’s preferred bond market indicator’s latest slump. “Research from the Fed has argued that the “near-term forward spread” comparing the forward rate on Treasury bills 18 months from now with the current yield on a three-month Treasury bill was the most reliable bond market signal of an imminent economic contraction,” said the news.

On the same line, International Monetary Fund (IMF) Managing Director Kristalina Georgieva said in her prepared remarks on Thursday that they expect the global economy to grow by less than 3% in 2023, down from 3.4% in 2022, per Reuters.

Elsewhere, Germany’s Industrial Production (IP) rose 0.6% YoY in February versus -2.7% market forecasts and -1.6% previous readings. The monthly figures also came in firmer than 0.1% expected, to 2.0% versus 3.7% prior. On Wednesday, Germany Factory Orders improved to -5.7% YoY for February from -12.0 revised down prior and -10.5% market forecasts while the MoM growth came in at 4.8% compared to 0.3% expected and 0.5% previous readings.

Amid these plays, Wall Street and US Treasury bond yields both pare weekly losses but fail to gain major acceptance from bulls.

Moving on, off in the major markets can keep the EUR/USD inactive and vulnerable to sharp moves amid less liquidity on the scheduled US employment numbers for March. It’s worth mentioning that the recently dovish Fed bets and downbeat US data give rise to hopes of a positive surprise and huge volatility in prices afterward.

Also read: Nonfarm Payrolls Preview: Markets fear depressing data, three scenarios for the US Dollar

Technical analysis

EUR/USD’s sustained trading beyond the 10-DMA, around 1.0880 by the press time, joins the gradually rising RSI (14) to favor bulls in aiming for the Year-To-Date high of 1.1033.

-

22:47

USD/MXN falls as a late boost in risk sentiment supports the Mexican Peso

- The Mexican Peso trimmed some of its weekly losses after depreciating to 18.40 weekly.

- US job data sparks recession fears as Initial Jobless Claims rise to 228K.

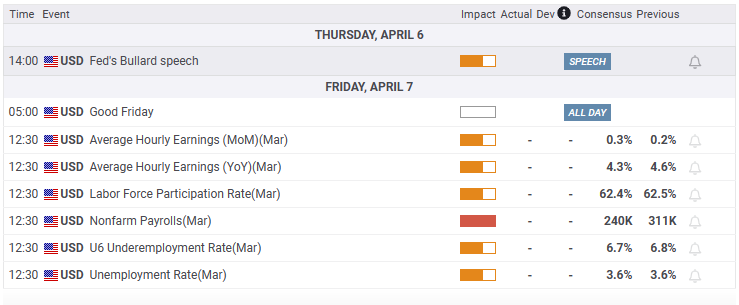

- US Nonfarm Payrolls are expected to decelerate from February’s 311K to 240K.

The Mexican Peso (MXN) snapped three days of consecutive losses and advances against the US Dollar (USD) due to a late improvement in risk sentiment. Therefore, the USD/MXN dropped from around the 20-day Exponential Moving Average (EMA) and trades at around 18.2285, down 0.04%.

Wall Street finished the week with gains. The latest round of jobs data revealed in the United States (US) economic calendar increased the likelihood of a recession. The Initial Jobless Claims for the last week rose by 228K, crushed estimates of 200K, but trailed the previous week’s data, which was revised to 246K. Continuing claims, which smooths week-to-week changes, were little changed at 1.82 in the week ending March 25.

From the start of the week, the US PMI’s employment index has indicated that job creation is slowing down. This was confirmed by the US JOLTs Opening report, which demonstrated a decrease in job openings. As a result, there is now increased speculation that the Federal Reserve may halt its tightening cycle.

The St. Louis Fed President James Bullard said the first quarter was stronger than expected. Additionally, Bullard said inflation would be “sticky going forward” and that the Fed “needs to stay at it” to get inflation back to its 2% target.

Meanwhile, the US Dollar Index, a measure of the buck’s value vs. a basket of six currencies, edged higher towards the end of the New York session, up 0.31%, at 101.905, but failed to bolster the USD/MXN.

On the Mexican front, speculations that the Bank of Mexico (Banxico) might end its tightening cycle depreciated the MXN by 1.2% in the week. BofA Global Research strategists wrote, “Banxico dropped the hiking bias at its most recent policy decision and said that future movements would depend on the inflation outlook, which is now improving.”

“Banxico dropped the hiking bias at its most recent policy decision and said that future movements would depend on the inflation outlook, which is now improving,” BofA Global Research strategists wrote in a note.

“Banxico will likely cut when the US Fed cuts, but not before, and not more than the Fed,” BofA strategists said.

What to watch?

On Friday, the US economic docket would release the US Nonfarm Payrolls report for March, is expected to decelerate to 240K after February’s astonishing 311K. The Unemployment Rate is estimated to stay steady at 3.6%, while Average Hourly Earnings are declining to 4.3% YoY, vs. 4.6% in February.

USD/MXN Technical Levels

-

22:16

USD/INR to hover around 82.25 through the end of the second quarter – Wells Fargo

On Thursday, the Reserve Bank of India (RBI) kept its key interest rate on hold, against expectations of a 25 basis points rate hike. Analysts at Wells Fargo see the RBI on hold for the next months. They expect the Indian Rupee to underperform among emerging market currencies.

Key Quotes:

“The Reserve Bank of India (RBI) opted for a hawkish hold at its April meeting; however, mixed signals complicate the outlook for Indian monetary policy. We now believe the RBI will be on hold through Q3-2023, but is still on track to initiate an easing cycle in Q4 of this year.”

“With the RBI on hold and the Fed likely to deliver another 25 bps hike in May, expect the rupee to continue moving sideways in the short-term.”

“Over the longer-term, an aggressive Fed easing cycle and broad-based U.S. dollar depreciation should lead to rupee strength; however, we expect INR to underperform across the emerging market currency complex. On the other hand, we believe India's economy will be one of the important drivers of global activity and be responsible for an outsized contribution to global economic growth this year.”

“We forecast the USD/INR exchange rate to hover near INR82.25 through the end of the second quarter.”

-

22:09

Bank of Canada: Staying on the sidelines looks like an easy decision – RBC

Next week, the Bank of Canada will have its monetary policy meeting. Market participants see the central bank keeping rates unchanged. Analysts at RBC point out the central bank will likely stay on hold despite the fact that economic growth have been more resilient than expected.

Bank of Canada to stay on the sidelines

“The central bank is widely expected to make a second consecutive decision to hold. This is despite economic growth that’s been more resilient than expected so far this year.”

“So why hold interest rates again when the economy is still running hot? The BoC’s pause on rate hiking was driven by an expectation that growth would stall through mid-2023, and Governor Macklem said it would take an “accumulation of evidence” to the contrary for it to resume tightening.”

“Cooler inflation readings have been encouraging—particularly since the softening has come even before the full effect of higher interest rates hits household purchasing power. And the recent round of financial instability is a reminder that aggressive interest rate increases over the last year could yet have unexpected consequences.”

“Inflation (and the broader economy) are still running too hot for the BoC to actively consider cutting interest rates but staying on the sidelines for now looks like an easy decision to make.”

-

21:40

Forex Today: NFP is the only game in town

The US official employment report will be released on Friday, with markets closed around the world for Easter. Nonfarm Payrolls are seen rising by 240,000 in March. Trading volume will likely be light, with volatility spikes around the release of the NFP. Before and afterwards, not much action is expected.

Here is what you need to know on Friday, April 7:

Holidays and an empty economic calendar in Asia warrant limited price action ahead. Later, a crucial economic report amid thin trading conditions will set the environment for erratic moves in the FX board, including wide spreads.

The Euro was the best G10 performer on Thursday. Germany offered another strong report, with February’s Industrial Production rising by 2%. EUR/USD climbed above 1.0900, and its outlook is neutral to positive.

Data from the US showed a decline in Initial Jobless Claims to 228,000 after sharp negative revisions that point to a looser labor market.

The labor market is starting to look not so tight according to data released this week, but the NFP will have the final word. Payrolls are expected to rise 240,000 and the Unemployment rate to stay at 3.6%. Earnings will also be watched closely. A negative report could increase the bets of no more rate hikes from the Federal Reserve.

USD/JPY ended a three-day negative streak, moving away from a dangerous area toward 132.00, helped by the slight rebound in Treasury yields. Bank of Japan’s Haruhiko Kuroda governorship ends on Saturday.

USD/CAD rose modestly on Thursday, but the Loonie outperformed AUD and NZD following Canadian employment data. The economy added 35,000 jobs in March, surpassing expectations. Next week, the Bank of Canada is seen staying on hold. USD/CAD held below 1.3500.

AUD/USD fell for a third consecutive day, posting the lowest daily close in a week around 0.6670. The Kiwi fell across the board as NZD/USD suffered the biggest slide in weeks to end below 0.6250.

The Mexican Peso outperformed among emerging market currencies, with USD/MXN falling 0.25% to 18.25. The Reserve Bank of India unexpectedly kept interest rates unchanged at 6.5%. USD/INR closed at 81.80, the weakest level in a month.

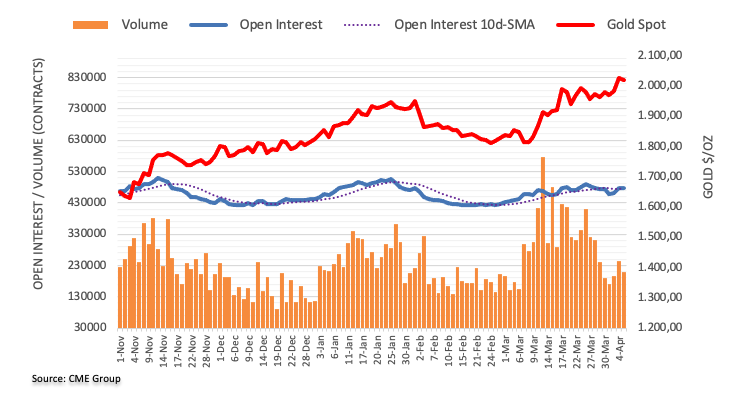

Gold retreated further but remained above $2,000, while Silver moved sideways below $25.00. Crude Oil prices continued to consolidate, holding on to an 8% weekly gain.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:29

AUD/USD drops for three straight days as Wall Street gains offset by risk aversion

- The US labor market eases, as Initial Jobless Claims for April 1 rise to 228K, exceeding estimates of 200K

- St. Louis Fed President Bullard notes stronger than expected Q1 data while warning of “sticky” inflation.

- US Nonfarm Payrolls are expected at 240K, while the Unemployment Rate is foreseen at 3.6%.

The AUD/USD extends its losses to three consecutive days, as Wall Street is set to finish the week with gains, except for the Dow Jones, losing 0.02%. In the FX space, risk aversion was the main driver of the session, weakening high beta currencies, like the Australian Dollar (AUD), which tumbled 0.74% vs. the buck. At the time of writing, the AUD/USD is trading at 0.6671.

AUD/USD falls below 0.6700, weighed by the risk-off sentiment in the FX market

On Thursday, the North American session was characterized by fluctuating sentiment, though US equity bulls lifted the S&P 500 and the Nasdaq. The US economic docket features Initial Jobless Claims for April 1, which jumped to 228K, above estimates of 200K, but trailed the prior’s week, which was upward revised to 246K.

Since the beginning of the week, the employment index of the US PMIs has shown signs that hiring is decelerating. That was confirmed by the US JOLTs Opening report, which showed that vacancies shifted downwards. Therefore, growing speculations for a Federal Reserve’s (Fed) pause on its tightening cycle increased.

On Wednesday, the ADP Employment Change report for March showed that companies hired fewer employees than expected. Given the backdrop, the latest US labor market data has sparked worries that an upcoming US recession is around the corner.

Hence, the AUD/USD began Thursday’s session at around 0.6730s, the day’s high. Nevertheless, it resumed its downtrend, as the release of the US Nonfarm Payrolls report and the Good Friday holiday motivated traders to book profits.

OF late, the St. Louis Federal Reserve President James Bullard commented that Q1’s incoming data is more robust than expected, adding that financial conditions are less tighter than the 2007-2009 crisis. Bullard said inflation would be “sticky going forward” and that the Fed “needs to stay at it” to get inflation back to its 2% target.

An absent Australian economic docket will leave traders focused on the release of the US Nonfarm Payrolls. The US Bureau of Labor Statistics (BLS) will release the report on April 7 at 12:30 GMT. Most banks expect the US economy to add 240K jobs after a February increase of 311K. The Unemployment Rate is estimated to stay steady at 3.6%, while Average Hourly Earnings are declining to 4.3% YoY, vs. 4.6% in February.

AUD/USD Technical Levels

-

20:23

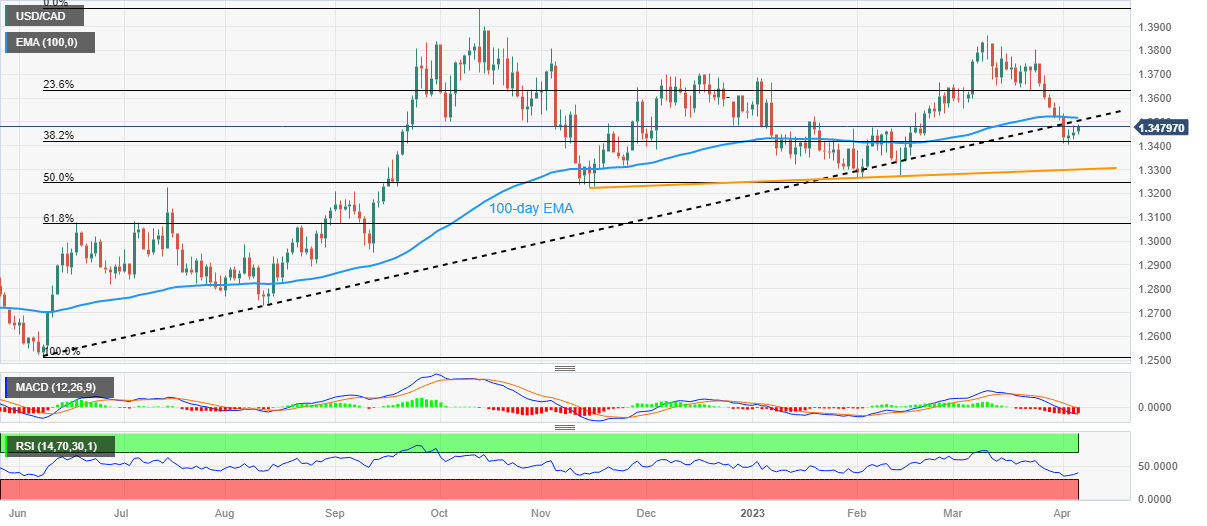

USD/CAD Price Analysis: Supported by a 5-month-old trendline, climbs steadily

- Short term, the USD/CAD is downward biased, and the ongoing upward correction might be capped around 1.3568/75.

- USD/CAD Price Analysis: Further upside potential for USD/CAD lies at 1.3705, December 16 cycle high.

After diving towards 1.3400, the USD/CAD is staging a three-day comeback, though it remains trading above a five-month-old support trendline. At the time of writing, the USD/CAD is trading at 1.3474 after hitting a daily low of 1.3446.

USD/CAD Price Action

From a daily chart perspective, the USD/CAD is still neutral to upward biased, despite dipping 2.85% since March 24. Nevertheless, buyers kept sellers from testing the 200-day Exponential Moving Average (EMA) at 1.3374 and are hopeful of reclaiming the 100-day EMA at 1.3515. Even though the USD/CAD is printing a leg-up, the USD/CAD advancement could be capped by the 20 and 50-day EMA confluence at around 1.3568/75. If that scenario plays out, the USD/CAD might resume its current downtrend and test the 200-day EMA soon.

On the flip side, for a bullish continuation, the USD/CAD must surpass the 1.3575 area on its way to 1.3600. Once cleared, the USD/CAD upside risks lie at 1.3705, the December 16 cycle high, followed by the March 24 daily high at 1.3804.

Oscillator-wise, the Relative Strength Index (RSI) shifted gears and is aiming north but at bearish territory. This means sellers remain in charge, and the upward correction could be at risk of turning direction. Meanwhile, the Rate of Change (RoC) shows that buyers stepped in but are more likely to be outweighed by sellers.

USD/CAD Daily Chart

USD/CAD Technical Levels

-

19:14

Silver Price Analysis: XAG/USD, clouded by investors’ indecision, fluctuates around $24.90s

- Silver prices show hesitation near YTD highs amidst market uncertainty.

- Oscillators flashed mixed signals, keeping XAG/USD traders at bay.

- XAG/USD Price Analysis: Upside risks at around $25.12; otherwise, it could fall towards $24.00.

Silver price registers back-to-back doji’s at around the YTD highs hit at 25.13 but stays shy of the $25.00 a troy ounce figure. At the time of writing, the XAG/USD is trading at 24.95 after hitting a daily high of $25.00.

XAG/USD Price Action

Buyers and sellers of the white metal, also known as Silver, are undecided according to the XAG/USD’s price action during the last couple of days. The Relative Strength Index (RSI) shifted overbought since the beginning of the week, flashing that buying pressure would fade soon. The Rate of Change (RoC) signals buyers remain in charge, but they must reclaim the YTD high at $25.13 before posing a threat to test the last year’s high at $26.95.

For a bullish resumption, XAG/USD needs a daily close above $25.00. That would open the door to testing the YTD high at $25.12, followed by $25.87, April’s 14 high. The following resistance would be $26.00, followed by the April 18 cycle high of $26.21.

If XAG/USD prints a daily close below $25.00, it could exacerbate a test of February’s 25 cycle high at $24.62. Once cleared, the white metal could drop to test a previous resistance trendline turned support at around $24.25-40 before diving towards $24.00.

XAG/USD Daily Chart

XAG/USD Technical Levels

-

19:08

EUR/USD bulls retreat into NFP

- EUR/USD treads water ahead of key US data inputs.

- The focus at this point is the pivotal Nonfarm Payrolls.

EUR/USD is topping the extreme of the day in late New York in holiday calmness. The pair is currently trading at 1.0930 at hourly resistance. The pair has traveled between a low of 1.0884 and a high of 1.0937. The focus at this point is the pivotal Nonfarm Payrolls and the impact of the Federal Reserve´s policy.

The greenback has been pressured of late following a week of troublesome data. As a prelude, the ADP National Employment report showed US private employers hired fewer workers than expected in March, suggesting a cooling labor market. Private employment increased by 145,000 jobs last month, while economists polled by Reuters had forecast private employment increasing by 200,000, Reuters reported. Additionally, the ISM's Non-Manufacturing index dropped to 51.2 in March from 55.1 in February. The services sector's employment indicator slid as well to 45.8 from 47.6 in February.

Looking ahead the focus will be on US inflation and analysts at TD Securities said ´´core prices likely cooled off modestly in March, with the index still rising a strong 0.4% MoM as we look for recent relief from goods deflation to turn into inflation this month.´´

-

18:40

Canada: Solid hiring continued in March – CIBC

Data released on Thursday showed the Canadian economy added 35,000 jobs in March, surpassing expectations. Despite the strong numbers, the Bank of Canada (BoC) is expected to keep rates unchanged next week. Analysts at CIBC see the BoC on hold for the rest of the year before allowing rate cuts starting early in 2024.

Key Quotes:

“The solid hiring to start 2023 continued in March, with a 35K increase in employment easily outstripping consensus forecasts for a modest 7.5K gain. However, job gains were narrower by sector than they had been in prior months, with the overall increase driven by strong hiring in only three areas (transportation, business services and finance).”

“Other sectors of the economy either saw little change in employment or outright declines, and as such today's data are not quite as strong as they first appear. Still, the continued hiring, combined with low unemployment rate and strong wage inflation, will likely see the Bank of Canada maintain a hiking bias as it holds rates steady next week, and not hint at the cuts that have been priced into markets.”

-

18:26

NZD/USD tumbles on risk aversion on increased recessionary fears in the US

- Surging jobless claims sparked concern among traders and boosted the US Dollar to the detriment of the New Zealand Dollar.

- Bullard warns of sticky inflation, says Fed needs to stay vigilant to reach 2% target

- After the RBNZ 50 bps rate hike, the New Zealand Dollar rally faded as the NZD/USD dropped below the 200-DMA.

NZD/USD stumbles below the 200-day Exponential Moving Average (EMA) due to a risk aversion as the United States (US) labor market data crumble, sparking recessionary fears. Therefore, investors seeking safety in the FX space bought the US Dollar (USD). At the time of writing, the NZD/USD is exchanging hands at 0.6255., down almost 1%.

NZD/USD creeps below the 200-DMA, following bad US jobs data

Wall Street’s shift from being in the red turning positive. US economic data revealed that the labor market begins to loosen up as the Federal Reserve (Fed) maintains its hiking campaign. However, unemployment claims rising above estimates of 200K to 228K for the week ending on April 1 spurred speculations that a Fed pivot might be around the corner.

Earlier in the week, the JOLTs report flashed that job openings have begun to downtrend, while the latest ADP report showed that private hiring was below forecasts. Therefore, money market futures trimmed the chances for a 25 bps rate hike by the Federal Reserve, with traders estimating rates to be kept unchanged at the upcoming Fed meeting, according to CME FedWatch Tool.

The odds of keeping rates at 4.75%-5.00% are 56.1%. In addition, some investors speculate that the Fed could cut rates as soon as July.

The US Dollar Index (DXY), which tracks the performance of six currencies against the American Dollar (USD), registers minuscule losses of 0.08%, down at 101.802, after reaching a two-day high at 102.138. US Treasury bond yields resumed their downward trajectory, a headwind for the greenback.

Lately, the St. Louis Federal Reserve President James Bullard said that Q1’s incoming data is more robust than expected, adding that financial conditions are less tighter than the 2007-2009 crisis. Bullard said inflation would be “sticky going forward” and that the Fed “needs to stay at it” to get inflation back to its 2% target.

On the New Zealand (NZ) front, the rally sparked by the Reserve Bank of New Zealand’s (RBNZ) 50 bps rate hike at the April 5 meeting was short-lived, as the NZD/USD turned bearish, below the 200-day EMA, which lies at 0.6268. ANZ analysts are expecting an additional 25 bps rate hike. They added, “We’ve updated our OCR call, banking the 25bp surprise in April and maintaining our expectation for a 25bp follow-up in May (which will take the OCR to a peak of 5.5%). We’ve also penciled in three cuts for late 2024.”

NZD/USD Technical Analysis

-

18:03

United States Baker Hughes US Oil Rig Count dipped from previous 592 to 590

-

16:38

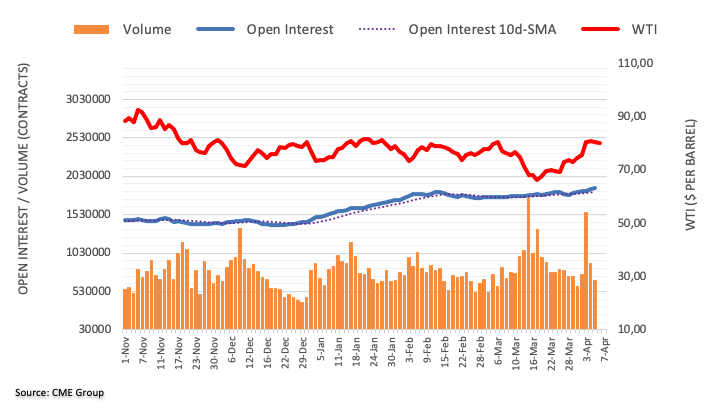

Gold Price Forecast: XAU/USD dips for the second day as US labor market data sparks recession fears

- Gold price takes a hit on disappointing US unemployment claims as the labor market eases.

- US Treasury US bond yields drop, but XAU/USD traders booking profits ahead of US NFP spurred the ongoing dip.

- St. Louis Fed President Bullard warns of sticky inflation, says Fed needs to stay vigilant to reach 2% target

Gold price slides for the second consecutive day, though it’s bracing for the March 20 high at around $2,009.75. Worse than expected, US labor market data accumulated during the week triggered investors worried about a possible recession in the United States (US). Therefore, traders scaled back their bullish bets in the yellow metal. At the time of writing, the XAU/USD is trading at $2,011.28.

XAU/USD retreats from YTD highs, ahead of US Nonfarm Payrolls report

Global equities are trading mixed, with most European (EU) bourses trading with gains. Wall Street is extending its losses to four straight days. Gold price headed down spurred by a jump in US Initial Jobless Claims for the week ending on April 1, which increased by 228K above forecasts of 200K. Additionally, data from the week before April 1 was upward revised from 198K to 246K, painting a dismal scenario for the US labor market.

Latest data like the ADP report missing estimates and job vacancies heading south exacerbated an investor’s flight to safety, initially sending XAU/USD rallying towards its YTD high of $2,032.13. Nevertheless, bad US jobs data underpin the greenback despite US Treasury bond yields continuing to drop.

US Treasury bond yields, particularly the most sensitive to interest rates, the 2-year, dropped to 3.674% before reversing their course and is up at 3.783%.

Even though the US 2-year Treasury bond yield has gained traction, money market futures estimate that the Federal Reserve (Fed) would hold rates unchanged, as shown by the CME Fed WatchTool. The odds of keeping rates at 4.75%-5.00% are 56.1%. In addition, some investors speculate that the Fed could cut rates as soon as July.

Lately, the St. Louis Federal Reserve President James Bullard said that Q1’s incoming data is stronger than expected, adding that financial conditions are less tighter than the 2007-2009 crisis. Bullard said inflation would be “sticky going forward” and that the Fed “needs to stay at it” to get inflation back to its 2% target.

ING estimates XAU/USD can hit the all-time-high

ING Analysts commented that flows toward XAU were due to the banking crisis. Analysts noted, “US data showed the job market is loosening, fuelling expectations that the Fed is nearing the end of its monetary tightening cycle.”

“Markets will be keeping a close eye on the US jobs report later this week and whether this takes the gold market to striking distance of its all-time high of US$2,075.47/oz made in August 2020,” according to ING.

XAU/USD Technical Analysis

The uptrend in XAU/USD remains intact, though the current dip could be due to Gold traders’ banking profits ahead of the US Nonfarm Payrolls report. Nevertheless, buyers must keep XAU/USD price above $2,000 if they want to challenge the ATH at $2,075.47. On the flip side, a fall below the former, and sellers could drag XAU/USD to test the 20-day EMA at $1,960.42. Once cleared, the March 17 low at $1,918.38 would be exposed, ahead of the 50-day EMA at $1,912.95.

What to watch?

-

16:35

United States 4-Week Bill Auction dipped from previous 4.6% to 4.44%

-

16:06

Fed’s Bullard: Inflation is going to be “sticky” going forward

St. Louis Federal Reserve President James Bullard said on Thursday he thinks inflation is going to be sticky going forward. Regarding monetary policy, he considers that interest rates are currently at the low end of a sufficiently restrictive range. He mentioned the need to “stay at it” to get inflation back into the target.

Bullard warned that one of the biggest risks for the US economy is that the current inflation becomes entrenched.

Amid ongoing developments in the bond market, Bullard explained that some yield curve inversion reflects the inflation outlook. According to him, it is a great time to reassess how the deposit insurance is designed.

Market reaction

The US Dollar Index is trading flat on Thursday around 101.85, on a light volume session ahead of the Easter holidays. The Greenback erased modest gains after Wall Street’s opening bell.

-

15:58

Gold Price Forecast: XAU/USD to see another leg higher toward $2,230 on a move above $2,055/75 – SocGen

Gold has crossed above recent brief consolidation and April 2022 levels ($2,000) denoting persistence in uptrend. A break above the $2,055/2075 resistance zone would clear the way toward $2,150 and $2,230, analysts at Société Générale report.

$1,945 should be an important support near term

“XAU/USD is expected to head gradually towards the upper part of its range since 2020 at $2,055/2,075. This is a key resistance zone. If Gold establishes itself above this hurdle, it could mean onset of a larger uptrend toward next projections of $2,150 and $2,230.

“Lower end of recent consolidation at $1,945 should be an important support near term.”

-

15:40

US NFP Preview: Softer-than-expected or roughly in-line data to keep soft USD trend in place – Credit Suisse

Economists at Credit Suisse preview the Nonfarm Payrolls release and consider key possible ensuing market scenarios.

Stronger-than-expected NFP readings could trigger renewed USD strength

“Stronger-than-expected NFP readings could drive pushback against the dovish drift in Fed policy expectations, triggering renewed USD strength in the process. The likely mixed liquidity conditions could amplify market moves. However, barring shocking data outcomes, we’d look to stick to our strategy of fading USD strength against EUR and would wait for next week’s US CPI data before making a more comprehensive assessment.”

“Softer-than-expected or roughly in-line numbers validating the dovish Fed narrative can keep the current soft USD trend in place.”

“In the unlikely event that the data were to show shockingly weak numbers, featuring a sharply higher unemployment rate and/or an NFP print well below the low end of the Bloomberg analyst forecast range (currently 150K), broader risk-off price action might complicate the FX picture and keep USD weakness more focused in ‘safe haven’ pairs such as USD/JPY and more mixed elsewhere, with USD-EM likely sharply higher. We view this as a tail risk, it is not our baseline scenario.”

See – US Nonfarm Payrolls: Banks Preview, labor market still going strong

-

15:30

United States EIA Natural Gas Storage Change came in at -23B below forecasts (-21B) in March 31

-

15:27

GBP/USD sees pullback from 9-month high as US jobs data deteriorated

- US BLS data reveals an unexpected rise in Initial Jobless Claims to 228K as the labor market eases.

- Labor market data from multiple sources signal a slowdown in the jobs market.

- Money market futures estimates that the Fed will hold rates unchanged at May’s meeting.

The Pound Sterling (GBP) pullback from a 9-month high against the US Dollar (USD) on Tuesday dropped below the 1.2500 figure due to the buck’s renewed strength. The labor market in the United States (US) continues to deteriorate, painting a gloomy scenario for the US economy. The GBP/USD is trading at 1.2422 after hitting a high of 1.2486

GBP/USD drops as bad US jobs data underpin the greenback

Wall Street is trading with losses. The US Bureau of Labor Statistics (BLS) showed that Initial Jobless Claims for the week ending on April 1 exceeded forecasts of 200K, with data hitting 228K. Data linked to the labor market, namely the JOLTs job opening, ADP Employment Change, and the ISM Manufacturing PMI employment subcomponent, portrayed the labor market easing. That spurred an investor reaction, meaning that recessionary fears are the main reasons for the risk-off impulse seen in the last three days.

GBP/USD traders bought the US Dollar, with the pair diving from around daily highs of 1.2480, toward the lows at 1.2412. US Treasury bond yields, particularly the most sensitive to interest rates, the 2-year, dropped to 3.674% before reversing its course and is up at 3.789%.

Although the US 2-year Treasury bond yield has recovered, money market futures estimate that the Federal Reserve (Fed) would pause its tightening cycle at the May meeting. The odds of keeping rates unchanged are at 56.1%. In addition, some investors speculate that the Fed could cut rates as soon as July.

On Wednesday, the Cleveland Fed President Loretta Mester commented that rates need to rise “a little bit higher” and then hold them there for some time. She estimates that inflation will get to the Fed’s target by 2025.

The US Dollar Index (DXY), a gauge for the greenback value against a basket of six currencies, posts back-to-back bullish candles and rises 0.22%, up at 102.104.

On the UK front, the economy in the United Kingdom (UK) has fared well, contrasting the catastrophic economic projections by the Bank of England (BoE) and the UK’s Office for Budget Responsibility (OBR). Projections foresaw an 18-month recession, though the economy has avoided a recession and even posted more robust growth numbers in January. In the meantime, expectations for a 25 bps rate hike by the BoE stay at 63% at the May meeting.

GBP/USD Technical Analysis

After two straight sessions of registering losses, the GBP/USD stayed short of breaking to fresh three-day lows, below 1.2394, Tuesday’s low. If GBP/USD holds the spot price above the latter, it will keep buyers hopeful of breaking to new YTD highs above 1.2525. Upside risks lie at June 7 high at 1.2599, followed by May 27 pivot high at 1.2667. Contrarily, if GBP/USD drops past 1.2394, that would pave the way for a test of the 20-day EMA at 1.2290, below the 1.2300 psychological level.

-

15:19

Room for a moderate cyclical decline in the Dollar over the next six to 12 months – Charles Schwab

Economists at Charles Schwab expect the US Dollar to weaken moderately over the coming months, Nonetheless, the greenback is set to retain its dominance in the long run.

Fed nears the end of its rate hiking cycle while other central banks continue to tighten policy

“Over the next six to 12 months, we see room for a moderate cyclical decline in the Dollar. The main driver is likely to be a greater convergence of interest rates in the major economies as the US Federal Reserve nears the end of its rate hiking cycle while other central banks continue to tighten policy.”

“The ECB and BoE appear on track to keep hiking rates due to persistently high inflation. The BoJ may loosen its yield curve control policy, allowing bond yields to move up, which would likely mean less demand for US Dollar-denominated assets by Japanese investors. We view these developments as the most significant risk to the Dollar's strength in 2023 and 2024.”

“Longer-term, movement to a multi-currency global economy is possible and could have benefits, particularly for emerging-market countries where moves in the Dollar can have big effects on economic growth. However, it would require some major structural changes in many regions. These changes take time and political will.”

-

15:01

USD/JPY to reach 124 by Q4 as the likelihood of a BoJ policy shift should accelerate Yen gains – Wells Fargo

Economists at Wells Fargo believe the Bank of Japan will elect to deliver a policy shift later this year in Q4-2023. Such a policy move should see longer-term Japanese yields spike higher and add to their constructive medium-term outlook for the Yen.

BoJ policy change on the horizon

“We now believe the BoJ will take advantage of a tactical opportunity to further tweak its policy settings in Q4-2023, and we lean towards the October meeting in terms of timing.”

“We expect the Bank of Japan's policy adjustment to be a further step towards normalizing Japan's government bond market. Specifically, we expect the BoJ to lift the target for the 10-year Japanese government bond yield to 0.25% from 0% and widen the tolerance band around that target to +/- 75 bps.”

“While we are already positive on Yen's longer-term prospects, the likelihood of a BoJ policy shift should accelerate yen gains. Thus, against a backdrop of an earlier Bank of Japan adjustment than we previously expected, we also forecast a stronger Yen.”

“We now forecast the USD/JPY exchange rate to reach 124.00 by Q4-2023 and 120.00 by mid-2024, which would equate to a EUR/JPY exchange rate of 140.00 by Q4-2023 and 140.50 by mid-2024.”

-

15:00

Canada Ivey Purchasing Managers Index s.a registered at 58.2 above expectations (56.1) in March

-

15:00

Canada Ivey Purchasing Managers Index climbed from previous 50.8 to 65.2 in March

-

14:54

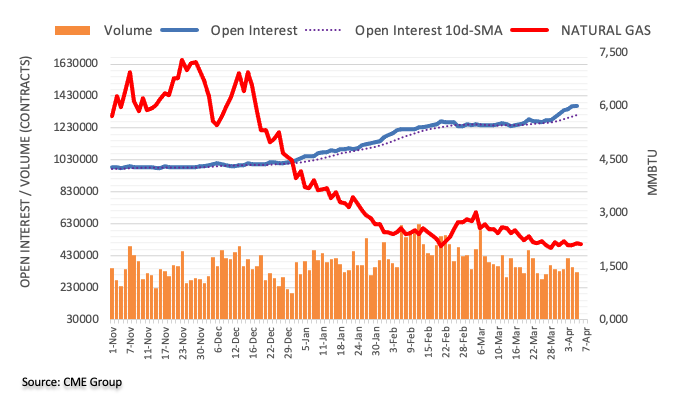

WTI comes under pressure and pokes with $80.00

- Prices of the WTI add to Wednesday’s decline near $80.00.

- The WTI advances for the third week in a row so far.

- Weekly US oil rig count comes next in the docket.

Prices of the WTI trades on the back foot for the second day in a row and puts the key $80.00 mark per barrel to the test on Thursday.

WTI remains propped up by OPEC+ cut

So far, the barrel of the American benchmark for the sweet light crude oil remains on the defensive amidst some profit taking sentiment as well as renewed recession concerns.

However, the commodity remains well en route to close the third week with gains, this time bolstered by the decision by the OPEC+ to reduce the oil output and another larger-than-expected weekly drop in US crude oil supplies (as per the EIA’s report on Wednesday).

The firm performance of the commodity so far this week continues to echo on prices of RBOB gasoline futures, which trade in levels last seen back in late October 2022 past the $2.80 mark.

Later in the session, driller Baker Hughes will report on US oil rig count in the week to April 7 (592 prev.).

WTI significant levels

At the moment the barrel of WTI is down 0.02% at $80.20 and a breach of $79.05 (monthly low April 3) would open the door to $66.86 (low March 24) and then $64.41 (2023 low March 20). On the upside, the next hurdle is located at $81.75 (monthly high April 4) followed by $82.60 (2023 high January 23) and finally $83.67 (200-day SMA).

-

14:53

USD/JPY refreshes daily top amid notable USD demand, upside potential seems limited

- USD/JPY gains some positive traction on Thursday and snaps a three-day losing streak.

- Some follow-through USD buying is seen as a key factor lending support to the major.

- Bets for an imminent Fed rate-hike pause and a softer risk tone could cap further gains.

The USD/JPY pair reverses an early North American session dip to sub-131.00 levels and climbs to a fresh daily top in the last hour, snapping a three-day losing streak. The pair moves further away from a one-week low touched on Wednesday and now trades around the 131.65-131.70 region, up nearly 0.30% for the day.

The US Dollar (USD) is seen building on the previous day's bounce from over a two-month low and gaining some follow-through traction for the second successive day, which, in turn, acts as a tailwind for the USD/JPY pair. That said, any meaningful upside still seems elusive amid growing acceptance that the Federal Reserve (Fed) is nearly done with its inflation-fighting rate hikes. In fact, the markets are pricing in an even chance of a 25bps lift-off at the next FOMC meeting in May and the possibility of rate cuts by year-end.

A larger-than-expected rise in the US Weekly Initial Jobless Claims comes on the back of the disappointing release of the US ADP report on Wednesday and suggests that the Fed's efforts to cool the labor market could be having some impact. The data lifts bets for an imminent pause in the rate-hiking cycle by the US central bank, which keeps the US Treasury bond yields depressed near a multi-month low. This, in turn, should hold back the USD bulls from placing aggressive bets and cap gains for the USD/JPY pair, at least for now.

Traders might also prefer to move to the sidelines and wait for the release of the closely-watched US monthly employment data on Friday. The popularly known NFP report will play a key role in influencing market expectations about the next policy move by the Fed and drive the USD demand. This, in turn, should help investors to determine the next leg of a directional move for the USD/JPY pair. Nevertheless, the fundamental backdrop warrants some caution before positioning for any further appreciating move for the major.

Technical levels to watch

-

14:48

USD unlikely to strengthen significantly at the moment – Scotiabank

USD quiets down ahead of a long weekend for many. Shaun Osborne, Chief FX Strategist at Scotiabank, believes that narrowing short-term spreads will weigh on the greenback.

Yields and yield spreads remain a key influence over the USD’s performance

“Slower growth fears weighed on stocks and have extended the USD some haven demand. I doubt the USD can strengthen significantly at the moment, however.”

“Slowing growth momentum plus concerns about the impact of credit tightening on the economic outlook have prompted a significant rally in red pack Eurodollar futures — implying markets anticipate significant (more than 200 bps) Fed rate cuts two years hence. Markets anticipate (currently, at least) much smaller rate reductions in the UK and Eurozone over that timeframe. Narrowing short-term spreads will limit the potential for the EUR to weaken and, ultimately, weigh on the USD.”

-

14:29

IMF’s Georgieva: Global economy to grow by less than 3% in 2023, down from 3.4% in 2022

International Monetary Fund (IMF) Managing Director Kristalina Georgieva said in her prepared remarks on Thursday that they expect the global economy to grow by less than 3% in 2023, down from 3.4% in 2024, per Reuters.

Additional takeaways

"90% of advanced economies will see decline in growth in 2023; India and China to account for half of global growth."

"IMF projects global growth to remain at around 3% over the next five years, lowest medium-term growth forecast since 1990."

"Recent banking sector pressures exposed risk management failures at specific banks and supervisory lapses."

"Robust recovery remains elusive with rising geopolitical tensions and still-high inflation."

"Central banks should continue tight stance to fight inflation, address financial stability risks when they occur."

"Calling for major boost in spending on renewable energy, continued global trade and moves to diversify supply chains."

"Countries should further reduce budget deficits while supporting the most vulnerable to safeguard social cohesion."

"Banks generally stronger and more resilient than in 2008 financial crisis, but there are concerns about hidden vulnerabilities."

"Message to policymakers on monetary policy is to be vigilant and be more agile than ever."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen rising 0.2% on a daily basis at 102.10.

-

14:26

USD/CAD: Solid NFP print to set up the risk of a push higher – TDS

The Canadian labour market continues to defy gravity with employment rising by another 35K in March. Limited reaction in CAD though. A solid US payrolls number in the upcoming report could support USD/CAD in the very near-term, economists at TD Securities report.

Canadian labour market still red hot in March

“The Canadian labour market added 35K jobs in March, greatly surpassing the market estimate of 7.5K. The unemployment rate was unchanged at 5.0%, and wage growth decelerated from +5.4% YoY to +5.2% YoY.”

“The CAD was little changed following the number though this may be a function of the simultaneous release of US claims data, long weekend liquidity issues and US payrolls tomorrow.”

“The moderation in the wage numbers may be slightly encouraging for the BOC, though the robustness of job growth offers some offset.”

“The aggressive dovish repricing in the fed funds curve and our expectation for a solid NFP print sets up the risk of a push higher in USD/CAD. Should NFP surprise below consensus, however, 1.3380/00 will be important support.”

See – US Nonfarm Payrolls: Banks Preview, labor market still going strong

-

14:20

USD/MXN to trade to 17.50 and even 17.00 later this year – ING

The Peso is selling off. However, AMLO's 'new nationalisation' should not be a MXN negative, economists at ING report.

Very good demand for the Peso should USD/MXN correct to the 18.50-19.00 region

“Driving the correction looks to be a corporate finance deal announced this week that the Mexican government is buying 75% of the Mexican gas and wind facilities from Spain's Iberdola in a deal worth nearly$6bn. Mexican President AMLO describes this as a 'new nationalisation' – although that term may not be as scary for investors as it sounds. We do not read the deal as negative for Mexico's potential to attract nearshoring FDI inflows and suspect that there will be very good demand for the Peso should USD/MXN correct to the 18.50-19.00 region.”

“We see the potential for USD/MXN to trade to 17.50 and even 17.00 later this year.”

-

14:17

USD/CHF recovers early lost ground amid modest USD strength, flat-lines around 0.9065 area

- USD/CHF attracts some dip-buying on Thursday amid a modest USD strength.

- The upside seems limited amid bets for an imminent pause in Fed rate hikes.

- Looming recession fears benefits the safe-haven CHF and contributes to cap.

The USD/CHF pair struggles to capitalize on the previous day's recovery from the 0.9000 psychological mark, or its lowest level since June 2021 and attracts some intraday sellers on Thursday. Spot prices, however, manage to reverse an intraday dip and trade just above mid-0.9000s during the early North American session, nearly unchanged for the day.

The US Dollar (USD) gains some positive traction for the second straight day and moves away from over a two-month low set on Wednesday, which, in turn, lends some support to the USD/CHF pair. The USD uptick, meanwhile, lacks bullish conviction and runs the risk of fizzling out rather quickly amid growing acceptance that slowing economic growth will force the Federal Reserve (Fed) to pause its rate-hiking cycle.

In fact, the markets are currently pricing in an even chance of a 25 bps lift-off at the upcoming FOMC monetary policy meeting in May and the possibility of rate cuts by year-end. A larger-than-expected rise in the US Weekly Initial Jobless Claims comes on the back of the disappointing release of the US ADP report on Wednesday and suggests that the Fed's efforts to cool the labor market could be having some impact.

This, in turn, reaffirms expectations the Fed is nearly done with its inflation-fighting rate-hikes and keeps the US Treasury bond yields depressed near a multi-month low, which, in turn, should act as a headwind for the buck. Furthermore, looming recession risks continues to weigh on investors' sentiment and benefit the safe-haven Swiss Franc. This might further contribute to capping the upside for the USD/CHF pair.

Traders might also refrain from placing aggressive directional bets and prefer to wait on the sidelines ahead of the release of the closely-watched US monthly jobs data on Friday. The popularly known as the NFP report will play a key role in influencing market expectations about the Fed's next policy move, which, in turn, will drive the USD demand and help investors to determine the next leg of a directional move for the USD/CHF pair.

Technical levels to watch

-

14:03

EUR/USD: Market tilting firmly toward another 25 bps hike in June would still be EUR-supportive – Scotiabank

EUR/USD drifts but underlying support from narrower spreads remains intact, Shaun Osborne, Chief FX Strategist at Scotiabank, reports.

EUR should find firm support on dips

“Given elevated core inflation data, it seems likely to me that policy hawks will continue to push for rate hikes outside of more severe market turmoil. A 25 bps hike is more or less fully priced in for May 4th at this point. A half point move remains a long shot but a hawkish policy outlook – tilting market pricing more firmly towards another 25 bps hike in June would still be EUR-supportive.”

“A break under 1.0880 support would imply the risk of a short-term dip at least in the EUR back to the 1.08 area. Broader trends (and trend momentum) remain EUR-bullish, however, implying the EUR should find firm support on dips.”

-

14:00

Russia Central Bank Reserves $ declined to $593.9B from previous $594.6B

-

13:53

Nasdaq 100: A meaningful move higher can emerge toward resistance at 13603/721 – Credit Suisse

Nasdaq 100 ended Q1 strongly. Analysts at Credit Suisse look for further strength to the 50% retracement at 13606/721.

Rally to extend

“A more meaningful move higher can emerge for resistance next at the 50% retracement and summer 2022 high at 13603/721. Our bias would be to then look for a fresh cap here and for a correction lower and fresh consolidation phase. Should strength directly extend though, we would see resistance next at the 61.8% retracement and price resistance at 14277/349.”

“Below support at 12518 is needed to suggest we have seen a ‘false’ break higher for a slide back to support next at the 63-Day Moving Average, currently at 12128.”

-

13:51

EUR/USD Price Analysis: Sustained gains seen above 1.0970

- EUR/USD trades within a tight range around the 1.0900 region.

- The immediate barrier comes at the April top near 1.0970.

EUR/USD trades without a clear direction around the 1.0900 region on Thursday.

The likelihood of extra advances appears favoured for the time being. Against that, the pair needs to clear the April high at 1.0973 (April 4) to put the key 1.1000 mark back on the radar and then challenge the YTD peak at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0348.

EUR/USD daily chart

-

13:48

USD/CAD remains under 1.3500 after upbeat Canadian jobs report

- US Initial Jobless Claims rise to 228,000, above the 200,000 of market consensus.

- Canadian economy adds 34,700 jobs in March, more than 12,000 expected.

- USD/CAD remains in the previous range, below 1.3500.

The USD/CAD is hovering around 1.3470/80 after the release of employment numbers from the US and Canada. The pair dropped to 1.3457 and then bounced to 1.3480 after the economic figures, staying sideways, in a familiar range.

Employment numbers from US and Canada

In Canada, the economy added 34,700 jobs in March, surpassing expectations. The Unemployment rate stayed unchanged at 5%. The Loonie strengthened against it main rivals, hitting fresh daily highs, expected versus the US Dollar.

The weekly US Jobless Claims report came in below expectations. Initial Jobless Claims rose to 228,000, above the 200,000 of market consensus. The Labor Department made a sharp revision to the upside in the previous weeks, reflecting a change in the methodology. Friday is Nonfarm Payrolls Day.

The US Dollar rose despite signs of labor conditions softening. US stocks react negatively, probably reflecting fears about the global economic outlook. US yield dropped but quickly rebound.

Technical outlook

The USD/CAD is moving between two key moving averages in the daily chart: the 200-day offers support at 1.3380 while the 55 and 100-day are near 1.3525.

The bias is skewed to the downside, however technical indicators favor some consolidation after the recent rally of the Loonie that send USD/CAD from 1.3740 to the 1.3400 area.

USD/CAD Daily Chart

-

13:48

US Nonfarm Payrolls: Banks Preview, labor market still going strong

The US Bureau of Labor Statistics (BLS) will release the March jobs report on Friday, April 7 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 11 major banks regarding the upcoming employment data.

Nonfarm Payrolls in the US are forecast to rise by 240K following the 311K increase recorded in February, with the unemployment rate seen steady at 3.6% and average hourly earnings declining to 4.3% year-on-year vs. 4.6% in February.

Commerzbank

“At 240K, we expect a smaller increase in payrolls in March than in January (+504K) and February (+311K). However, the figures for the first two months were probably somewhat inflated by the unusually mild weather, and mid-March was rather too cold. If our forecast materialized, the number of new jobs created would continue to exceed the monthly average increase in new workers of an estimated maximum of 100K, which is fed by population growth. The labor market would thus remain tight, and the unemployment rate would probably remain at a very low 3.6%.”

ING

“While we remain nervous about the outlook for jobs given the rise in job lay-off announcements and the inevitable tightening of lending conditions resulting from banking stresses that will be a major headwind for struggling businesses, this will take time to be reflected in payroll numbers. Anything over 200K in terms of March payroll growth will likely boost expectations for a 25 bps rate hike.”

Danske Bank

“We think employment growth remained upbeat in March, and look for 250K NFP gain.”

NBF

“We expect payroll growth to have decelerated to 190K, which would remain very solid given the increasingly limited number of people remaining on the sidelines. The household survey is expected to show a similar gain, something which would leave the unemployment rate unchanged at 3.6%, assuming the participation rate stayed put at 62.5%.”

SocGen

“Our NFP projections are for a moderation. Our forecast absolute gain of 215K in March is still strong, but if realised, would be the softest since December 2021. We view monthly gains in excess of 150-175K as strong since over time, such a pace would further reduce the unemployment rate. With the unemployment rate at 3.6%, labour markets are tight. Wages are likely to grow by 0.3% mom in March, similar to the previous reading. This would mark a deceleration in wage growth. Average hourly earnings are not the best measure for compensation pressures, but the data is monthly and earlier than other data, so it is closely watched. A softening in wages may reflect management strategies to resist demands. If employers see labour requirements as being met and fear a potential layoff round in coming quarters, their willingness to boost wages to retain and attract workers diminishes.”

Deutsche Bank

“We expect nonfarm payrolls to gain +250K and both the unemployment rate and hourly earnings growth to remain unchanged (3.6% and +0.2%, respectively).”

CIBC

“Jobless claims remained low in the March payroll survey reference period, signaling a healthy 220K pace of hiring. Although our forecast of 0.3% growth in average hourly earnings doesn’t preclude reaching ontarget inflation, a 220K pace of hiring is roughly double what Powell has suggested is consistent with sustainable on-target inflation, and we, therefore, continue to expect a final 25 bps rate hike ahead, assuming no proliferation of banking sector issues. With private measures of job openings easing, and previously announced layoffs still coming to fruition, we expect to see a further cooling in the pace of hiring ahead, in combination with a deterioration in cyclical sectors, which will likely leave the Fed on pause after the May FOMC. We’re a little below the consensus on payrolls, but likely not by enough to put downwards pressure on bond yields, as the fading of banking sector concerns is an overriding factor.”

BMO

“US payrolls will be released on Good Friday this year (thus producing the rare case of Canadian jobs arriving earlier). We expect it will be worth the wait, with a solid gain of around 240K likely on tap, lifting the tally for all of Q1 to above 1 million net new jobs – making a mockery of recession talk, at least at the start of the year.”

Citi

“We expect monthly payroll growth to continue to slow in March, but to a still strong pace of 250K jobs added, although with slight downside risks due to some more signs of job losses in rate-sensitive sectors. We also expect a 0.3% MoM increase in average hourly earnings in March with roughly balanced risks of a larger or smaller increase. On the one hand, tightness in the US labor market should continue to put upward pressure on wages and expect that underlying wage growth is running at least 4-6% annualized. On the other, changes in the sector composition of payroll employment in recent months have likely put downward pressure on average hourly earnings and could continue to do so in March. And after rising somewhat unexpectedly to 3.6% in February, we expect the unemployment rate to decline to 3.5% in March. This is based on a similar expectation for employment growth in the household survey that determines the unemployment rate and the labor force participation rate remaining unchanged after a few months of recent increases.”

Wells Fargo

“We look for job growth to slow to 240K in March. The still-tight state of the labor market is likely to be reflected by the unemployment rate ticking back down to 3.5% and March's rise in average hourly earnings edging up to 0.3%.”

TDS

“We expect the March jobs report to show that payrolls grew with 270K and while this is a slight slowdown from stronger prints in Jan-Feb, it still suggests an above-trend pace of job growth in March. The unemployment rate is projected to stay unchanged at 3.6%. Finally, wage growth will probably print a firm 0.3% MoM.”

-

13:39

US: Weekly Initial Jobless Claims decline to 228K vs. 200K expected

- Initial Jobless Claims in the US decreased by 18,000 in the week ending April 1.

- US Dollar Index continues to fluctuate in daily range at around 102.00.

There were 228,000 initial jobless claims in the week ending April 1, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 246,000 (revised from 191,000) and came in worse than the market expectation of 200,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.3% and the 4-week moving average was 237,750, a decrease of 4,250 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending March 25 was 1,823,000, an increase of 6,000 from the previous week's revised level," the DOL further added.

It's worth noting that the DOL announced a revision to seasonal adjustment factors starting with this data.

"Beginning with the Unemployment Insurance (UI) Weekly Claims News Release issued Thursday, April 6, 2023, the methodology used to seasonally adjust the national initial claims and continued claims reflects a change in the estimation of the models," the DOL said in its press release.

Market reaction

The US Dollar Index clings to its daily recovery gains at around 102.00 after this report.

-

13:34

Canada: Unemployment Rate stays unchanged at 5% in March vs. 5.1% expected

- Unemployment Rate in Canada held steady at 5% in March.

- USD/CAD continues to trade in its daily range below 1.3500.

The data published by Statistics Canada revealed on Thursday that the Unemployment Rate stayed unchanged at 5% in March. This reading came in slightly better than the market expectation of 5.1%.

Further details of the publication revealed that the Net Change in Employment came in at +34.7K in March, surpassing analysts' estimate of 12,000. Finally, the Participation Rate edged lower to 65.5% from 65.7%.

Market reaction

USD/CAD edged slightly higher with the initial reaction to this data and was last seen rising 0.15% on a daily basis at 1.3478.

-

13:33

GBP/USD: A pause in the underlying bull trend before another push higher – Scotiabank

GBP/USD consolidates around key support in the mid-1.24s. Economists at Scotiabank expect the pair to extend its up move toward 1.2750.

Firm support on modest GBP dips

“Look for more range trading in the short run but expect firm support on modest GBP dips.”

“The basic message from short-term price action (developing ‘bull flag’) remains essentially the same – a pause in the underlying bull trend before another push higher.”

“Cable dips have been well supported at or just below 1.2440/45 (former highs and now major support).”

“Trend momentum remains bullish, implying limited downside and ongoing upside risk (potential to 1.2750/00).”

-

13:31

Canada Unemployment Rate below expectations (5.1%) in March: Actual (5%)

-

13:30

Canada Net Change in Employment came in at 34.7K, above expectations (12K) in March

-

13:30

United States Initial Jobless Claims above forecasts (200K) in March 31: Actual (228K)

-

13:30

Canada Participation Rate below forecasts (65.7%) in March: Actual (65.6%)

-

13:30

United States Continuing Jobless Claims came in at 1.823M, above forecasts (1.699M) in March 24

-

13:30

United States Initial Jobless Claims 4-week average up to 237.75K in March 31 from previous 198.25K

-

13:23

AUD/USD remains depressed below 0.6700 mark, seems vulnerable to slide further

- AUD/USD remains depressed for the third straight day and is pressured by a combination of factors.

- The RBA’s dovish tilt undermines the Aussie and weighs on the pair amid a modest USD strength.

- Bets for an imminent Fed rate-hike pause act as a headwind for the USD and might help limit losses.

The AUD/USD pair remains under some selling pressure for the third straight day on Thursday and trades just below the 0.6700 round-figure mark heading into the North American session.

The Australian Dollar continues to be weighed down by the Reserve Bank of Australia's (RBA) dovish outlook, which, along with a modest US Dollar (USD) strength, exerts some downward pressure on the AUD/USD pair. It is worth recalling that the Australian central bank on Tuesday paused its rate-hiking cycle following 10 consecutive raises and signalled that inflation had likely peaked. In the accompanying policy statement, the RBA noted that it wanted additional time to assess the full effects of past increases as the economy slows.

The USD, on the other hand, edges higher for the second straight day and looks to build on the overnight modest bounce from over a two-month low, which is seen as another factor dragging the AUD/USD pair lower. The incoming macro data from the US pointed to slowing economic growth and revived recession fears. This, in turn, continues to weigh on investors' sentiment and benefits the Greenback's relative safe-haven status. That said, rising bets for an imminent pause in the Federal Reserve's (Fed) rate-hike cycle cap gains for the buck.

In fact, the markets are currently pricing in an even chance of a 25 bps lift-off at the next FOMC monetary policy meeting in May and see the possibility of rate cuts by year-end. The bets were lifted by the disappointing US economic releases, which suggested that the Fed's efforts to cool the labor market could be having some impact. This keeps the US Treasury bond yields depressed near their lowest level in seven months, which is holding back the USD bulls from placing aggressive bets and might limit losses for the AUD/USD pair, at least for now.

The aforementioned mixed fundamental backdrop warrants some caution before positioning for any further depreciating move, though the price action suggests that the path of least resistance for the AUD/USD pair is to the downside. Traders, however, might prefer to move to the sidelines ahead of Friday's release of the closely-watched US monthly employment details - popularly known as the NFP report. In the meantime, the USD price dynamics will be looked upon to grab some short-term trading opportunities around the major.

Technical levels to watch

-

13:02

Chile Core Consumer Price Index (Inflation) (MoM) climbed from previous 0.2% to 1.4% in March

-

13:00

Chile Consumer Price Index (Inflation) (MoM) up to 1.1% in March from previous -0.1%

-

12:59

USD Index Price Analysis: Still scope for a drop to 100.80

- DXY erodes the initial bull run to the area just above 102.00.

- Next on the downside emerges the YTD low around 100.80.

DXY comes under pressure and returns to the negative territory after briefly trespassing the 102.00 barrier on Thursday.

The bearish sentiment around the dollar remains well and sound and this could force the index to retest the so far April low at 101.43 (April 5) in the near term. The loss of this level could pave the way for a deeper decline to the 2023 low around 100.80 (February 2).

Looking at the broader picture, while below the 200-day SMA, today at 106.50, the outlook for the index is expected to remain negative.

DXY daily chart

-

12:56

Gold Price Forecast: XAU/USD may flirt with all-time high of $2,075 – ING

Catching some attention has been the move in Gold above $2,000. What does Gold above $2,000 mean? Gold is seen as the flip side of the Dollar trend and of course, a key hedge against inflation, economists at ING report.

Is Gold telling us something about the Dollar?

“There does not yet seem to be much weight to the narrative that a US banking crisis is going to undermine the Fed's battle against high and ingrained inflation. And certainly Gold – as a non-interest bearing asset – is doing well compared to the near 5% rates available in overnight Dollar deposits.”

“What also may be at work in favour of Gold are FX reserve management trends. The increasingly bipolar geopolitical world – exacerbated by the war in Ukraine – means that BRICS+ central banks will be keeping a greater share of their international reserves in Gold. This is a structural positive for Gold and a structural negative for the Dollar, one to add to the cyclical negative of what should be a Fed easing cycle later this year.”

“Markets will be keeping a close eye on the US jobs report later this week and whether this takes the gold market to striking distance of its all-time high of $2,075.47 made in August 2020.”

-

12:41

USD/CAD: Firm jobs data may provide a lift to the Loonie – Scotiabank

USD/CAD continues to edge higher after the mid-week test and rejection of the low 1.34 zone. Economists at Scotiabank expect the Loonie to benefit from firm Canadian Employment report.

Resistance at 1.3505/25 looks firm

“The labour market here remains tight and elevated wage data, in particular, is likely to bother policymakers who have noted previously that high wage growth is inconsistent with regaining control of inflation (absent an unheard-of increase in domestic productivity).”

“US/Canada 2Y spreads have narrowed this week – providing some backstop for the CAD – and may narrow a little more if the jobs data are firm.”

“Intraday, resistance at 1.3505/25 looks firm. Support (bearish break-out) is 1.3450.”

See – Canadian Jobs Preview: Forecasts from four major banks, employment may suffer a bit of retreat

-

12:31

United States Challenger Job Cuts climbed from previous 77.77K to 89.703K in March

-

12:29

USD/SGD to fall in Q2 within a 1.2800-1.3400 range – Credit Suisse

Economists at Credit Suisse think USD weakness will push USD/SGD lower in a 1.28-1.34 range.

Prospect of a dovish Fed pivot means that the NEER basket will strengthen against the USD

“For USD/SGD, the movements of the broad US Dollar, rather than SGD NEER volatility, has been the bigger driver of USD/SGD over the last 12 months. We expect this trend to continue in Q2 2023.”

“The prospect of a dovish Fed pivot means that the NEER basket will strengthen against the US Dollar. Therefore, because of our view for a weaker USD against basket currencies (including JPY and EUR), we expect USD/SGD to fall in Q2 within a 1.2800-1.3400 range.”

-

12:25

EUR/JPY Price Analysis: Price action remains erratic

- EUR/JPY reverses two sessions with losses and regains 143.00.

- The 200-day SMA continues to hold the downside so far.

EUR/JPY picks up some pace and reclaims the area above 143.00 the figure on Thursday.

The cross keeps navigating choppy waters for the time being. In the meantime, a daily close above the 2023 peak at 145.67 (March 31) should encourage the cross to challenge the December 2022 high around 146.70 (December 15), while the breach of the 200-day SMA at 141.83 exposes a deeper drop to recent lows near 139.00.

So far, further upside looks favoured while the cross trades above the 200-day SMA.

EUR/JPY daily chart

-

12:01

EUR/USD to eventually move above its YTD high at 1.1035 for a test of 1.1185/1.1275 – Credit Suisse

Economists at Credit Suisse look for EUR/USD to eventually see a clear and sustained break above its downtrend from May 2021 and 50% retracement of the 2021/2022 bear trend for strength back to the 1.1035 YTD high, then resistance at 1.1185/1.1275.

Initial support aligns at 1.0788

“EUR/USD remains well supported and is seeing a fresh and concerted retest of key resistance from the 50% retracement of the 2021/2022 fall and downtrend from May 2021 at 1.0921/44. We continue to look for an eventual sustained break higher for a retest of the 1.1035 YTD high. Whilst this should continue to be respected, we stay bullish for an eventual test of 1.1185/1.1275 – the 61.8% retracement and March 2022 high.”

“Support is seen at 1.0788 initially, with 1.0714 ideally still holding. A break would warn of a fall back to the uptrend from last September, currently at 1.0630.”

-

11:59

When is the Canadian monthly jobs report and how could it affect USD/CAD?

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly employment report for March later this Thursday at 12:30 GMT. The Canadian economy is anticipated to have added 12K jobs during the reported month, down from February's reading of 21.8K. Moreover, the unemployment rate is anticipated to edge higher to 5.1% from 5.0% in the previous month.

Analysts at Citi Bank offer a brief preview of the key macro data and explain: “After a few months of very strong employment gains, we expect a modest 10K drop in employment in the labor force survey in March, although with risks tilted to the upside due to strong population growth from immigration. An eventual contraction in activity later this year alongside slowing in the US which should result in job losses, but even in this scenario, the rise in unemployment could be relatively muted. Expectation for modest job loss in March would imply an increase in the unemployment rate to a still-low 5.2%.”

How could the data affect USD/CAD?

Ahead of the crucial employment details, the USD/CAD pair is seen trading with a positive bias for the third successive day and draws support from a combination of factors. A softer tone around Crude Oil prices undermines the commodity-linked Loonie, which, along with a modest US Dollar (USD), uptick acts as a tailwind for the major.

Any disappointment from the Canadian employment details could further weigh on the domestic currency and provide an additional boost to the USD/CAD pair. Conversely, stronger data might lend support to the Canadian Dollar and cap the upside for the major. The immediate market reaction, however, is more likely to be limited as the focus remains glued to the closely-watched US monthly jobs data - popularly known as NFP.

Valeria Bednarik, Chief Analyst at FXStreet, offers a brief technical outlook for the USD/CAD pair and writes: “Technical readings in the daily chart suggest the upward potential remains limited, as indicators have barely recovered from near oversold readings, lacking strength enough to confirm another leg north. Furthermore, USD/CAD develops below a directionless 100 Simple Moving Average (SMA) at 1.3520, while the 20 SMA gains bearish traction far above the longer one.”

Valeria further outlines important technical levels to trade the USD/CAD pair: “A steeper decline could be expected on a break below the 1.3400 threshold, with market players targeting then the 1.3250/70 region, where the pair bottomed multiple times between November and February. Gains beyond 1.3520, on the other hand, could see the pair testing the 1.3600 mark.”

Key Notes

• Canada Employment Preview: Modest gain anticipated, but a surprise not off the table

• Canadian Jobs Preview: Forecasts from four major banks, employment may suffer a bit of retreat

• USD/CAD Forecast: 100 DMA holds the key ahead of Canadian jobs data

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

-

11:34

USD Index to eye new lows for the year – Credit Suisse

The recent rebound in the US Dollar Index is over. Economists at Credit Suisse stay tactically negative, looking for a move back to the 100.82 YTD low and eventually what they expect to be stronger support at 98.98/97.89.

Resistance at 103.36 ideally caps to keep the immediate risk lower

“We maintain our 1-3 month negative outlook for a retest of the 100.82 YTD low. Whilst this should be respected, we look for new lows for the year for support next at 100.00 and then what we look to be better support, starting at the 61.8% retracement of the 2021/2022 uptrend at 98.98 and stretching down to 97.44, which also includes the long-term 200-week average, currently at 97.89.”

“Resistance at 103.36 now ideally caps to keep the immediate risk lower. Above can see strength back to 105.12.”

-

11:20

Gold Price Forecast: XAU/USD bounces off daily low, holds steady around $2,020 level

- Gold price reverses an intraday dip on Thursday, albeit lacks any follow-through buying.