Notícias do Mercado

-

23:21

Currencies. Daily history for Aug 7'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3360 -0,17%

GBP/USD $1,6830 -0,12%

USD/CHF Chf0,9087 +0,14%

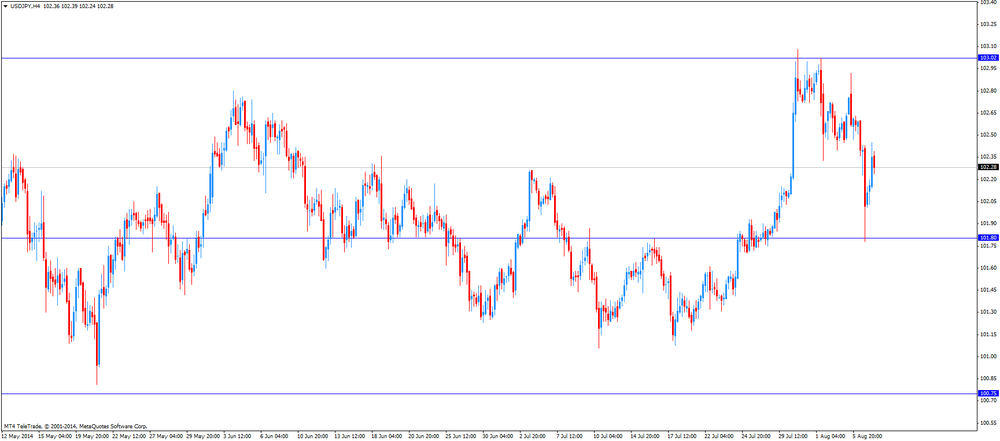

USD/JPY Y102,10 -0,01%

EUR/JPY Y136,41 -0,18%

GBP/JPY Y171,82 -0,13%

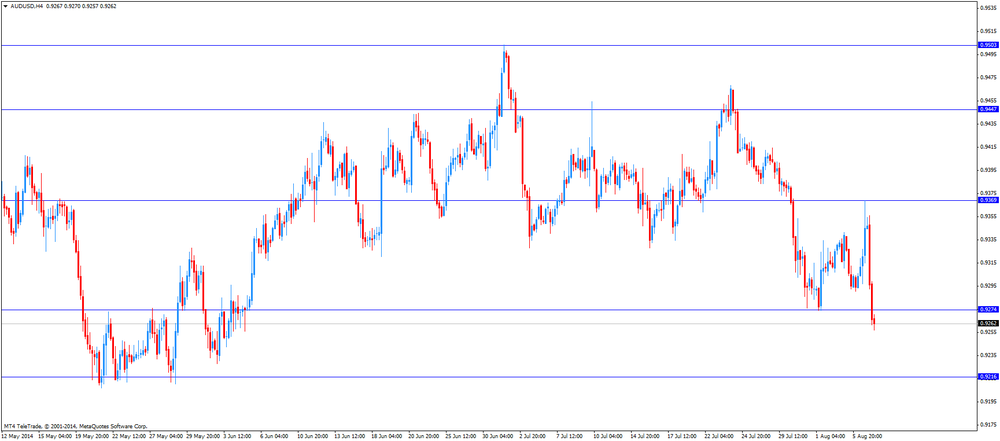

AUD/USD $0,9266 -0,87%

NZD/USD $0,8466 -0,07%

USD/CAD C$1,0926 +0,10%

-

23:00

Schedule for today, Friday, Aug 8’2014:

(time / country / index / period / previous value / forecast)

01:30 Australia Home Loans June 0.0% +0.7%

01:30 Australia RBA Monetary Policy Statement Quarter III

02:00 China Trade Balance, bln July 31.6 26.0

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Eco Watchers Survey: Current July 47.7 48.7

05:00 Japan Eco Watchers Survey: Outlook July 53.3

05:45 Switzerland Unemployment Rate July 3.2% 3.2%

06:00 Germany Current Account June 13.2

06:00 Germany Trade Balance June 18.8 19.8

06:45 France Industrial Production, m/m June -1.7% +1.1%

06:45 France Industrial Production, y/y June -3.7%

07:30 Japan BOJ Press Conference

08:30 United Kingdom Trade in goods June -9.2 -8.9

12:30 Canada Employment July -9.4 +25.4

12:30 Canada Unemployment rate July 7.1% 7.0%

12:30 U.S. Nonfarm Productivity, q/q Quarter II -3.2% +1.4%

12:30 U.S. Unit Labor Costs, q/q Quarter II +5.7% +1.3%

14:00 U.S. Wholesale Inventories June +0.5% +0.6%

-

20:00

U.S.: Consumer Credit , June 17.2 (forecast 18.3)

-

16:45

Foreign exchange market. American session: the euro fell against the U.S. dollar after the European Central Bank's decision and ECB’s press conference

The U.S. dollar higher to mixed against the most major currencies after the better-than-expected number of initial jobless claims in the U.S. The number of initial jobless in the week ending August 2 dropped by 14,000 to 289,000 from the previous week's figure of 303,000. Analysts had expected the number of initial jobless claims to climb by 2,000 to 305,000. The previous week's figure was revised down from 302,000.

The euro fell against the U.S. dollar after the European Central Bank's decision and ECB's press conference. The ECB kept its interest rate unchanged at 0.15%. This decision was expected by market participants.

The ECB President Mario Draghi said that the central bank "intensified" preparation for an Asset Backed Securities (ABS) program. This program should be launched if necessary.

The ECB President reiterated that interest rates will remain at low levels "for an extended period of time" and the ECB could launch unconventional measures to tackle low inflation.

Mr. Draghi warned that tensions between Russia and the EU over Ukraine may affect the economic recovery in the EU.

Germany's industrial production climbed 0.3% in June, after a 1.7% decline in May, but missing expectations for a 1.4% rise. May's figure was revised up from a 1.8% fall.

France's trade deficit widened to 5.4 billion euro in June from a deficit of 5.1 billion euro in May, missing forecasts of a decline to 5.0 billion euro deficit. May's figure was revised down from a deficit of 4.9 billion euro.

The British pound traded mixed against the U.S. dollar after the Bank of England's interest decision. The BoE kept its interest rate at 0.50%. This decision was expected by analysts.

The BoE's asset purchase facility program remained at £375 billion. This decision was also expected by analysts.

The Swiss franc traded lower against the U.S. dollar. Switzerland's foreign currency reserves increased to 453.4 billion Swiss francs in July from 449.6 billion in June.

SECO consumer climate index declined to -1 in the second quarter from 1 in the previous quarter, missing expectations for a rise to 4.

The Canadian dollar traded mixed against the U.S. dollar after the better-than-expected economic data from Canada. The Ivey purchasing managers' index for Canada jumped to 54.1 in July from 46.9 in June, in line with expectations.

Canada's building permits increased 13.5% in June, beating expectations for a 1.8% fall, after a 15.4 rise in May. May's figure was revised up from a 13.8% gain.

The New Zealand dollar traded slightly higher against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded lower against the U.S. dollar after the weak labour market data from Australia. The number of employed people in Australia declined by 300 in July, missing expectations for a rise of 13,500, after an increase of 14,900 in June. June's figure was revised down from a 15,900 rise.

Australia's unemployment rate climbed to 6.4% in July from 6.0% in June. Analysts had expected the unemployment rate to remain unchanged.

The Australian Industry Group/Housing Industry Association Australian performance of construction index rose to 52.6 in July from 51.8 in June.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the Japanese yen declined against the U.S. dollar after Reuters reported today that Japan's Government Pension Investment Fund (GPIF) plans to buy more domestic stocks. GPIF's target is over 20% of funds in domestic stocks (current target: 12%).

No major economic reports were released in Japan.

-

15:55

European Central Bank kept its interest rate unchanged at 0.15%

The European Central Bank (ECB) released its interest rate decision today. Interest rate remained unchanged at 0.15%. This decision was expected by market participants. The ECB President Mario Draghi said that the central bank "intensified" preparation for an Asset Backed Securities (ABS) program. This program should be launched if necessary.

Inflation increased 0.4% in July, missing expectations for a 0.5% rise.

Mario Draghi said inflation should remain low in the coming months, but it is expected to climb in 2015 and 2016. The ECB's inflation target is 2%.

The ECB President reiterated that interest rates will remain at low levels "for an extended period of time" and the ECB could launch unconventional measures to tackle low inflation.

Mr. Draghi warned that tensions between Russia and the EU over Ukraine may affect the economic recovery in the EU.

The French and Italian governments needed to implement economic reforms, so Draghi.

-

15:00

Canada: Ivey Purchasing Managers Index, July 54.1 (forecast 54.1)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3350, $1.3375, $1.3400, $1.3500

USD/JPY Y101.80, Y102.00, Y102.50, Y103.00, Y103.40

EUR/GBP stg0.7975

AUD/USD $0.9300, $0.9350, $0.9380

USD/CAD C$1.0975

-

13:30

U.S.: Initial Jobless Claims, July 289 (forecast 305)

-

13:30

Canada: Building Permits (MoM) , June +13.5% (forecast -1.8%)

-

13:08

Foreign exchange market. European session: the British pound fell against the U.S. dollar after the Bank of England’s interest decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Unemployment rate July 6.0% 6.0% 6.4%

01:30 Australia Changing the number of employed July 15.9 13.5 -0.3

05:45 Switzerland SECO Consumer Climate Quarter II 1 4 -1

06:00 Germany Industrial Production s.a. (MoM) June -1.7% Revised From -1.8% +1.4% +0.3%

06:00 Germany Industrial Production (YoY) June +1.1% Revised From +1.3% -0.5%

06:45 France Trade Balance, bln June -5.1 Revised From -4.9 -5.0 -5.4

07:00 Switzerland Foreign Currency Reserves July 449.6 453.4

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15% 0.15%

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims in the U.S. The number of initial jobless claims in the U.S. is expected to climb by 3,000 to 305,000.

The euro traded little changed against the U.S. dollar after the European Central Bank's decision. The ECB kept its interest rate unchanged at 0.15%.

Germany's industrial production climbed 0.3% in June, after a 1.7% decline in May, but missing expectations for a 1.4% rise. May's figure was revised up from a 1.8% fall.

France's trade deficit widened to 5.4 billion euro in June from a deficit of 5.1 billion euro in May, missing forecasts of a decline to 5.0 billion euro deficit. May's figure was revised down from a deficit of 4.9 billion euro.

The British pound fell against the U.S. dollar after the Bank of England's interest decision. The BoE kept its interest rate at 0.50%. This decision was expected by analysts.

The BoE's asset purchase facility program remained at £375 billion. This decision was also expected by analysts.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's foreign currency reserves increased to 453.4 billion Swiss francs in July from 449.6 billion in June.

SECO consumer climate index declined to -1 in the second quarter from 1 in the previous quarter, missing expectations for a rise to 4.

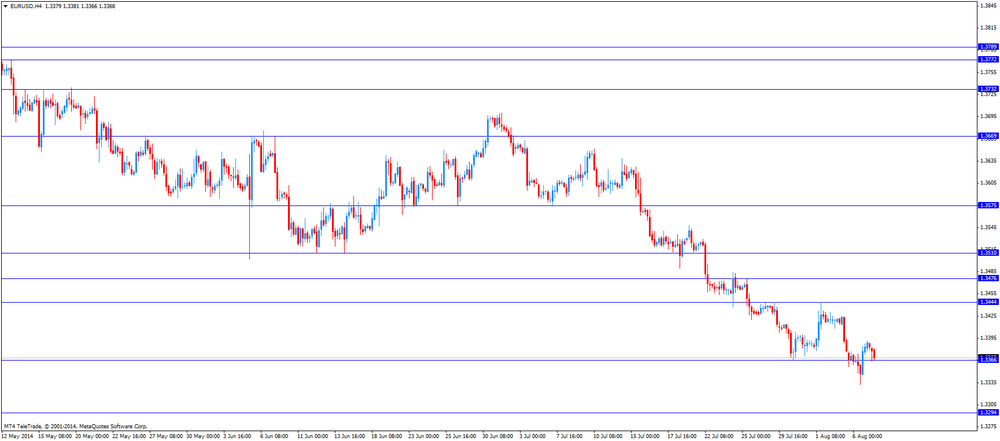

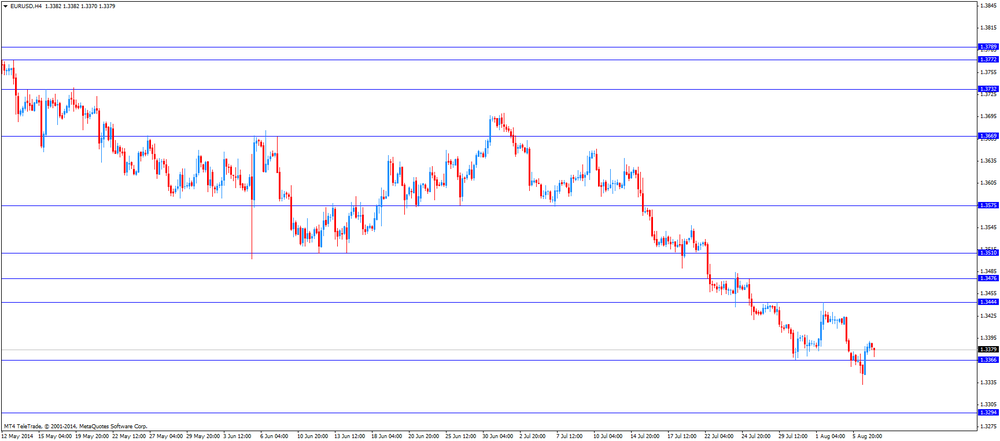

EUR/USD: the currency pair declined to $1.3364

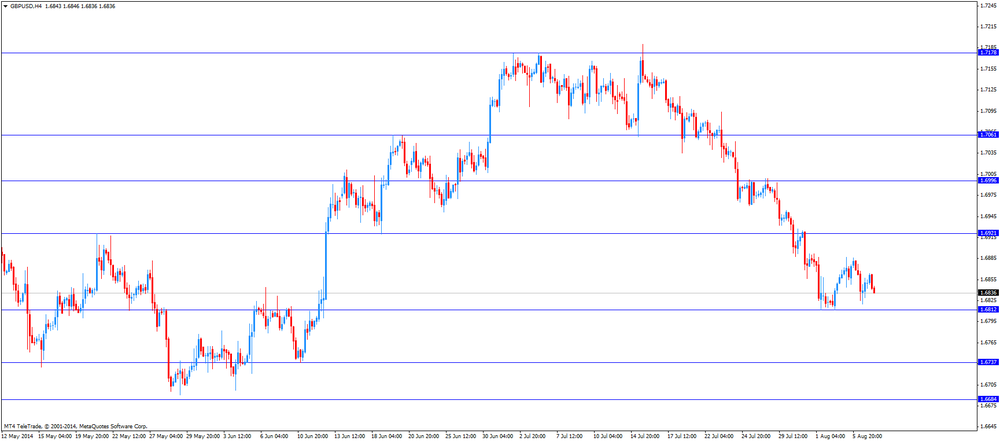

GBP/USD: the currency pair fell to $1.6833

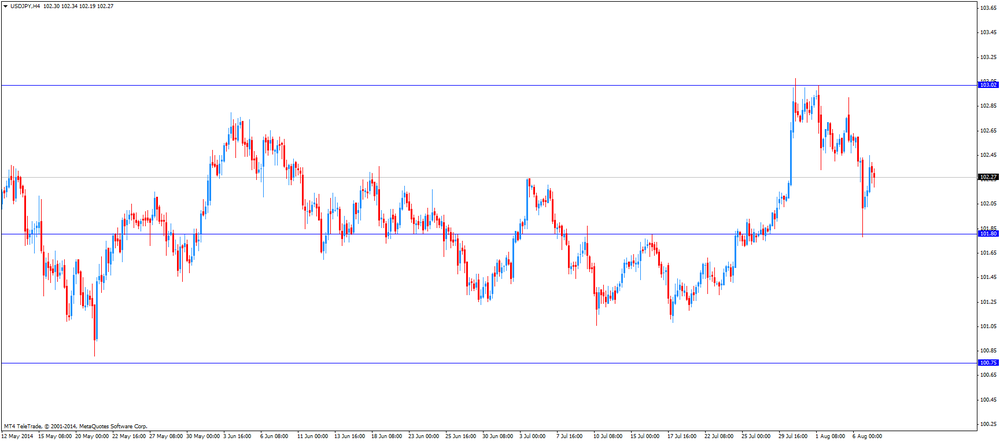

USD/JPY: the currency pair decreased to Y102.19

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 Canada Building Permits (MoM) June +13.8% -1.8%

12:30 U.S. Initial Jobless Claims July 302 305

14:00 Canada Ivey Purchasing Managers Index July 46.9 54.1

23:50 Japan Current Account (adjusted), bln June 384.6 110.0

-

13:00

Orders

EUR/USD

Offers $1.3530, $1.3500-10, $1.3485, $1.3445-50, $1.3400

Bids $1.3320, $1.3300, $1.3295

GBP/USD

Offers $1.6700, $1.6926, $1.6900

Bids $1.6800, $1.6785/80, $1.6750, $1.6700-693

AUD/USD

Offers $0.9505, $0.9465, $0.9400, $0.9370

Bids $0.9230, $0.9200, $0.9135

EUR/JPY

Offers Y138.80, Y138.50, Y138.00, Y137.30

Bids Y136.15, Y136.00, Y135.00

USD/JPY

Offers Y104.00, Y103.50, Y103.15, Y102.90

Bids Y101.80/70, Y101.30, Y101.05

EUR/GBP

Offers stg0.8100, stg0.8000, stg0.7985, stg0.7960

Bids stg0.7915, stg0.7900, stg0.7885, stg0.7870

-

12:45

Eurozone: ECB Interest Rate Decision, 0.15% (forecast 0.15%)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3350, $1.3375, $1.3400, $1.3500

USD/JPY Y101.80, Y102.00, Y102.50, Y103.00, Y103.40

EUR/GBP stg0.7975

AUD/USD $0.9300, $0.9350, $0.9380

USD/CAD C$1.0975

-

09:57

Foreign exchange market. Asian session: the Australian dollar dropped against the U.S. dollar after the weak labour market data from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Unemployment rate July 6.0% 6.0% 6.4%

01:30 Australia Changing the number of employed July 14.9 13.5 -0.3

05:45 Switzerland SECO Consumer Climate Quarter II 1 4 -1

06:00 Germany Industrial Production s.a. (MoM) June -1.7% Revised From -1.8% +1.4% +0.3%

06:00 Germany Industrial Production (YoY) June +1.1% Revised From +1.3% -0.5%

06:45 France Trade Balance, bln June -5.1 Revised From -4.9 -5.0 -5.4

07:00 Switzerland Foreign Currency Reserves July 449.6 453.4

The U.S. dollar traded higher against the most major currencies. The U.S. currency was supported by yesterday's U.S. trade data. The U.S. trade deficit declined to $41.5 billion in June from a deficit of $44.7 billion in May, beating expectations for a decrease to $44.2 billion. May's figure was revised down from a deficit of $44.4 billion.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar dropped against the U.S. dollar after the weak labour market data from Australia. The number of employed people in Australia declined by 300 in July, missing expectations for a rise of 13,500, after an increase of 14,900 in June. June's figure was revised down from a 15,900 rise.

Australia's unemployment rate climbed to 6.4% in July from 6.0% in June. Analysts had expected the unemployment rate to remain unchanged.

The Australian Industry Group/Housing Industry Association Australian performance of construction index rose to 52.6 in July from 51.8 in June.

The Japanese yen declined against the U.S. dollar after Reuters reported today that Japan's Government Pension Investment Fund (GPIF) plans to buy more domestic stocks. GPIF's target is over 20% of funds in domestic stocks (current target: 12%).

No major economic reports were released in Japan.

EUR/USD: the currency pair declined to $1.3379

GBP/USD: the currency pair decreased to $1.6841

USD/JPY: the currency pair climbed to Y102.45

AUD/USD: the currency pair was down to $0.9261

The most important news that are expected (GMT0):

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15%

12:30 Eurozone ECB Press Conference

12:30 Canada Building Permits (MoM) June +13.8% -1.8%

12:30 U.S. Initial Jobless Claims July 302 305

14:00 Canada Ivey Purchasing Managers Index July 46.9 54.1

23:50 Japan Current Account (adjusted), bln June 384.6 110.0

-

08:01

Switzerland: Foreign Currency Reserves, July 453.4

-

07:45

France: Trade Balance, bln, June -5.4 (forecast -5.0)

-

07:00

Germany: Industrial Production s.a. (MoM), June +0.3% (forecast +1.4%)

-

06:45

Switzerland: SECO Consumer Climate, Quarter II -1 (forecast 4)

-

06:25

Options levels on thursday, August 7, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3502 (2805)

$1.3454 (2823)

$1.3414 (1550)

Price at time of writing this review: $ 1.3381

Support levels (open interest**, contracts):

$1.3338 (3199)

$1.3296 (2582)

$1.3249 (1423)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 34739 contracts, with the maximum number of contracts with strike price $1,3600 (4262);

- Overall open interest on the PUT options with the expiration date August, 8 is 32824 contracts, with the maximum number of contracts with strike price $1,3500 (5491);

- The ratio of PUT/CALL was 0.95 versus 0.98 from the previous trading day according to data from August, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (2737)

$1.7000 (1625)

$1.6901 (1332)

Price at time of writing this review: $1.6847

Support levels (open interest**, contracts):

$1.6799 (3334)

$1.6700 (1096)

$1.6600 (431)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 20885 contracts, with the maximum number of contracts with strike price $1,7100 (2737);

- Overall open interest on the PUT options with the expiration date August, 8 is 26808 contracts, with the maximum number of contracts with strike price $1,6800 (3334);

- The ratio of PUT/CALL was 1.28 versus 1.34 from the previous trading day according to data from August, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:31

Australia: Changing the number of employed, July -300(forecast 13.5)

-

02:30

Australia: Unemployment rate, July 6,4% (forecast 6.0%)

-

00:31

Australia: AiG Performance of Construction Index, July 52.6

-