Notícias do Mercado

-

23:57

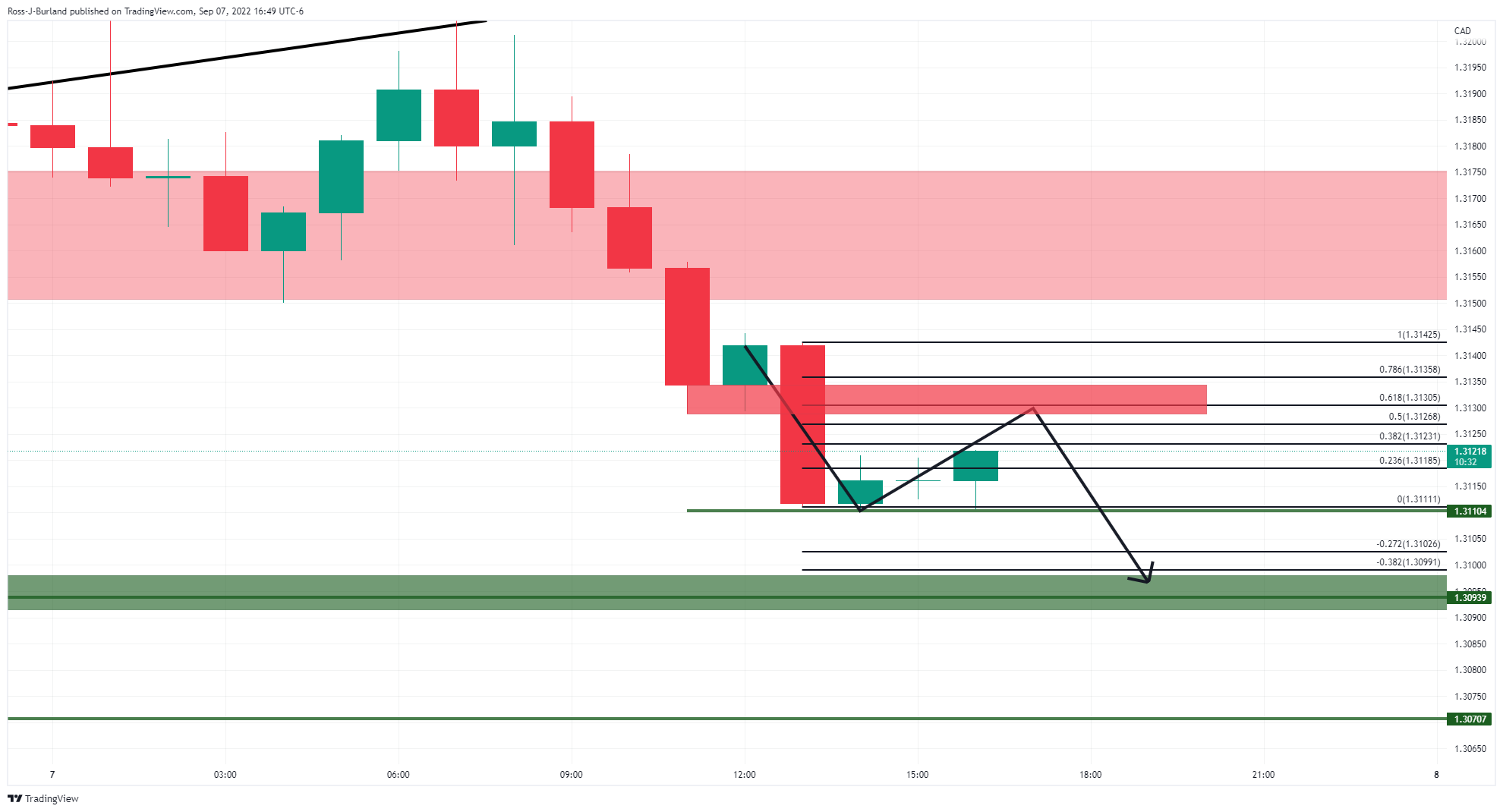

USD/CAD Price Analysis: Bullish correction playing out with focus on 1.3130 key resistance

- USD/CAD may face resistance near 1.3130 which puts an emphasis o the downside.

- Beyond 1.3130, there are prospects of a move into 1.3150/75.

USD/CAD lost its footing on Wednesday as risk sentiment improved, knocking the US dollar off its bull cycle highs while the Bank of Canada hiked rates by 75 basis points. This has seen the technical outlook a touch less bullish than it was the prior day as the following illustrates.

USD/CAD H4 chart

The M-formation is a reversion pattern that would be expected to see the price revert into the neckline between a 38.2% Fibonacci and a 50% mean reversion area of around 1.3150.

USD/CAD H1 chart

With that being said, the lower time frame price action is less bullish given the potential resistance up ahead near 1.3130 where prior support falls in near a 61.8% Fibonacci retracement of the prior bearish impulse on the hourly chart. A break below 1.31 opens risk of a test and break below 1.3070.

-

23:50

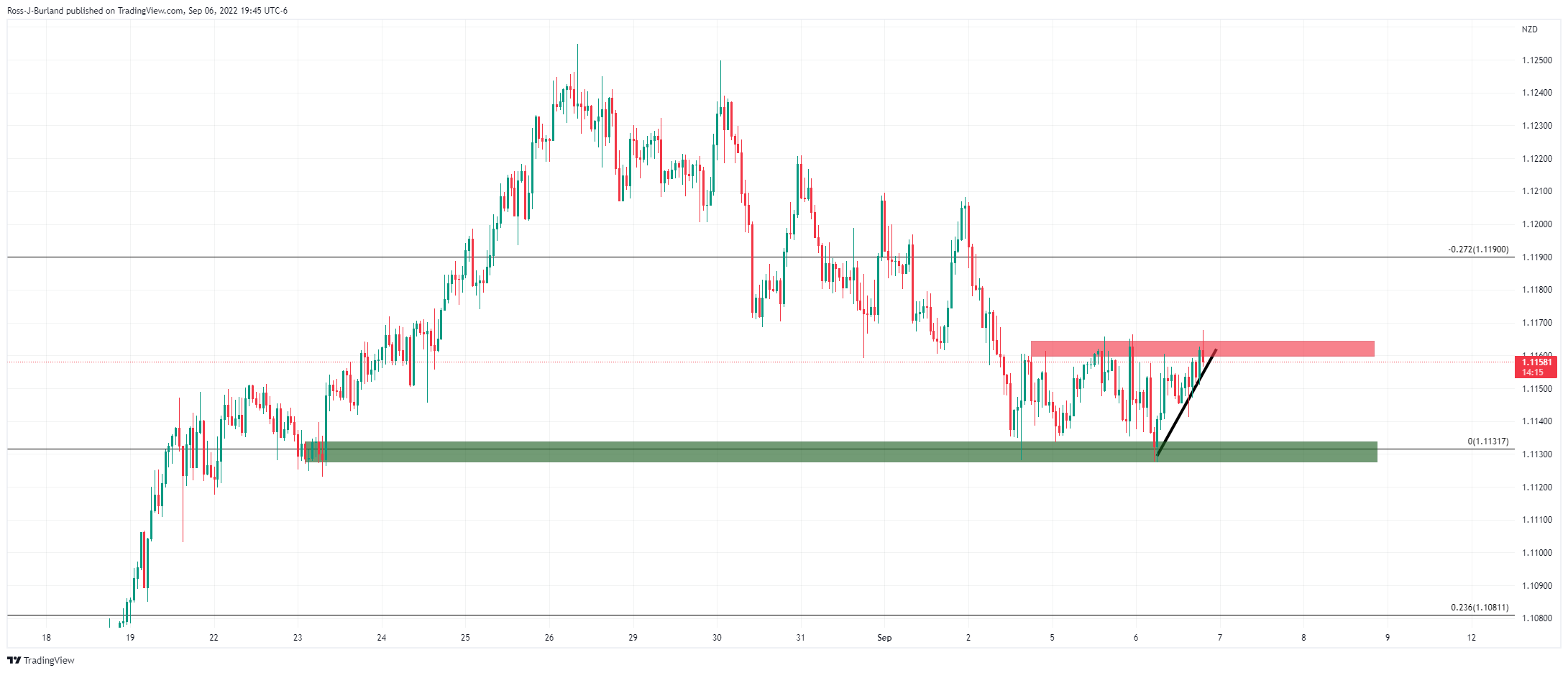

NZD/USD Price Analysis: Fades recovery below 10-DMA hurdle near 0.6100

- NZD/USD bulls take a breather after bouncing off two-year low.

- Fortnight-old trend line breakout favors buyers to poke 10-DMA hurdle, MACD, RSI signal further rebound.

- Downward sloping support line from May could lure bears on marking fresh multi-day low.

NZD/USD struggles to extend the biggest daily rebound in two weeks, fading the bounce off a two-year low while retreating to 0.6075 during the initial Asian session on Thursday. Even so, the Kiwi pair defends the previous day’s break out of a fortnight-old resistance line while retreating from the 10-DMA.

Given the receding bearish bias of the MACD and the gradually improving RSI, the latest NZD/USD rebound from the multi-day low is likely to overcome the immediate hurdle, namely the 10-DMA level surrounding the 0.6100.

However, the late August low near 0.6155-60 could challenge the pair buyers afterward, a break of which will direct the bulls towards the August 25 swing high near 0.6255.

It’s worth noting that the NZD/USD run-up beyond 0.6255 will enable the Kiwi pair buyers to aim for the previous monthly high around 0.6470.

Alternatively, a downside break of the previous resistance line, around 0.6060 by the press time, won’t hesitate to drag the quote back to the 0.6000 threshold. Also acting as a downside filter is the latest low of 0.5996.

In a case where the NZD/USD prices drop below 0.5996, May 2020 low and a four-month-old descending support line near 0.5920-15 appears the strong support to watch.

NZD/USD: Daily chart

Trend: Further recovery expected

-

23:45

New Zealand Manufacturing Sales: -4.9% (2Q) vs previous -3.5%

-

23:32

EUR/USD Price Analysis: Extra gains inevitable on establishment above 1.0000

- The short-term trend has turned bullish on establishment above 1.0000.

- An upside break of the Descending Triangle strengthened the Eurozone bulls.

- After a tad longer period, the RSI (14) has shifted into the bullish range of 60.00-80.00.

The EUR/USD pair is on the verge of extending its gains as the asset is crossing Wednesday’s high at 1.0011. Precisely an establishment above the magical figure of 1.0000 is sufficient to strengthen the shared currency bulls. Earlier, the pair displayed a juggernaut rally after sensing a significant buying interest near the crucial support of 0.9880.

On an hourly scale, EUR/USD is scaling vigorously higher after a breakout of the Descending Triangle chart pattern. The downward-sloping trendline of the chart pattern is plotted from the August 31 high at 1.0079. While the horizontal support is marked from Monday’s low at 0.9878.

The major has crossed the 20-and 200-period Exponential Moving Averages (EMAs) at 0.9955 and 0.9965 respectively. It is worth noting that the asset is auctioning above the aforementioned EMAs while the 20-EMA is still below the giant one. This indicates that the shared currency bulls are extremely strong.

Also, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00 after an extended period, which favors an upside momentum.

A break above Thursday’s high at 1.0013 will drive the asset towards August 31 high at 1.0079, followed by August 16 low at 1.0123.

Alternatively, the shared currency bulls would lose their grip if the asset drops below August 26 low at 0.9947. If it happens then the major could decline further towards Monday’s low at 0.9878 and round-level support at 0.9800.

EUR/USD hourly chart

-637981866935628632.png)

-

23:24

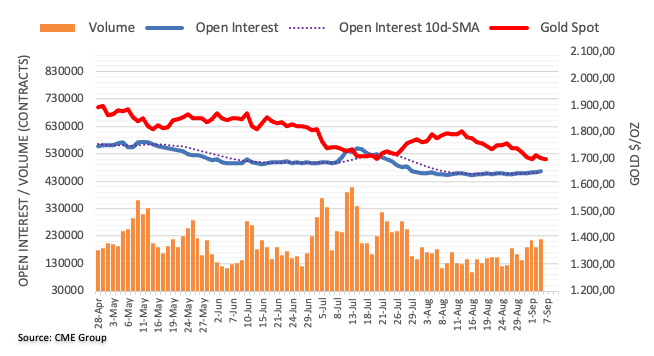

Gold Price Forecast: XAU/USD pokes monthly resistance above $1,700, Fed’s Powell eyed

- Gold price defends recovery from seven-week-old support line, grinds higher of late.

- Pre-event pullback of US dollar helped XAU/USD buyers despite mixed US data, fears of recession.

- Fed’s Powell could renew US dollar strength amid hawkish expectations.

Gold price (XAU/USD) grinds higher as bulls attack a short-term key hurdle surrounding $1,718 during the initial hour of Thursday’s Asian session. The yellow metal marked the biggest daily gains in over a week the previous day after the US dollar witnessed a pullback from the 20-year high during the US session, after initially refreshing the peak.

That said, the US Dollar Index (DXY) jumped to the highest levels in two decades before retreating to 109.60 by the end of Wednesday’s North American session. While the greenback earlier cheered the risk-off mood and the hawkish Fed expectations, the cautious mood ahead of Fed Chairman Jerome Powell’s speech and mixed data seemed to have trigged the DXY pullback.

Hawkish hopes from the European Central Bank (ECB) and a narrowing trade deficit appeared to have weighed on the US dollar before a few hours.

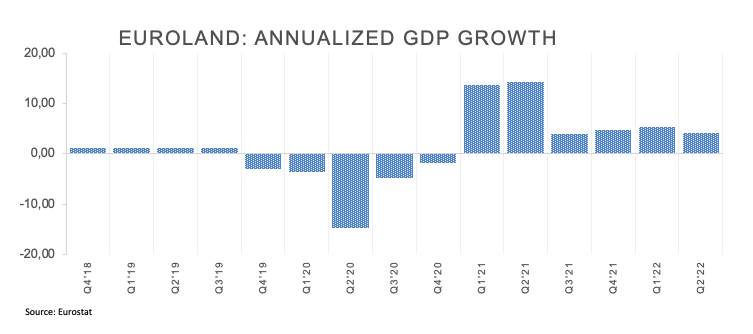

The ECB is likely to lift the benchmark rates by 75 basis points (bps) in today’s monetary policy meeting as the energy crisis propels inflation to a record top. The challenge is in the form of the recession but the latest improvement in the data seemed to have favored the bloc’s currency, which in turn weighed on the US dollar and favored the XAU/USD.

The Eurozone’s final reading of the Gross Domestic Product (GDP) rose by 0.8% QoQ in the three months to June of 2022 (Q2 2022) vs. 0.6% initial forecasts. That said, the YoY figures also improved to 4.1% in Q2 vs. 3.9% marked in the initial forecasts. On the other hand, US Goods and Services Trade Balance improved to $-70.7B in July from $-80.9B prior, versus $-70.3B forecasts. Further, the Good Trade Balance deteriorated to $-91.1B from $-89.1B marked in July.

Amid these plays, Wall Street closed positive and the yields retreated, which in turn weighed on the gold price.

Moving on, risk catalysts will be crucial for the XAU/USD prices ahead of the key ECB decision and a speech from Fed’s Powell. It’s worth noting that hawkish hopes from the ECB and the Fed may test XAU/USD bulls ahead of the event but the ultimate result is likely to weigh on the metal prices as the Fed is comparatively better placed than the ECB.

Technical analysis

Gold price rebounds from the nearly two-month-old support line amid bullish MACD signals and firmer RSI (14) to poke a downward sloping resistance line from August 12, around $1,718.

Given the firmer oscillators backing the XAU/USD recovery, the prices are likely to extend the latest run-up towards crossing the immediate hurdle. However, the convergence of the 200-EMA and the 50% Fibonacci retracement level of late July to early August upside, near $1,745, could challenge the metal’s further upside.

It’s worth noting, however, that the late August swing low near $1,728 appears to lure short-term gold buyers.

Meanwhile, pullback moves may witness the 78.6% Fibonacci retracement level of $1,707 as immediate support before testing the aforementioned support line from late July, around $1,690 by the press time.

Following that, the yearly low surrounding $1,680 could become the last defense of the gold buyers.

Gold: Four-hour chart

Trend: Limited recovery expected

-

23:23

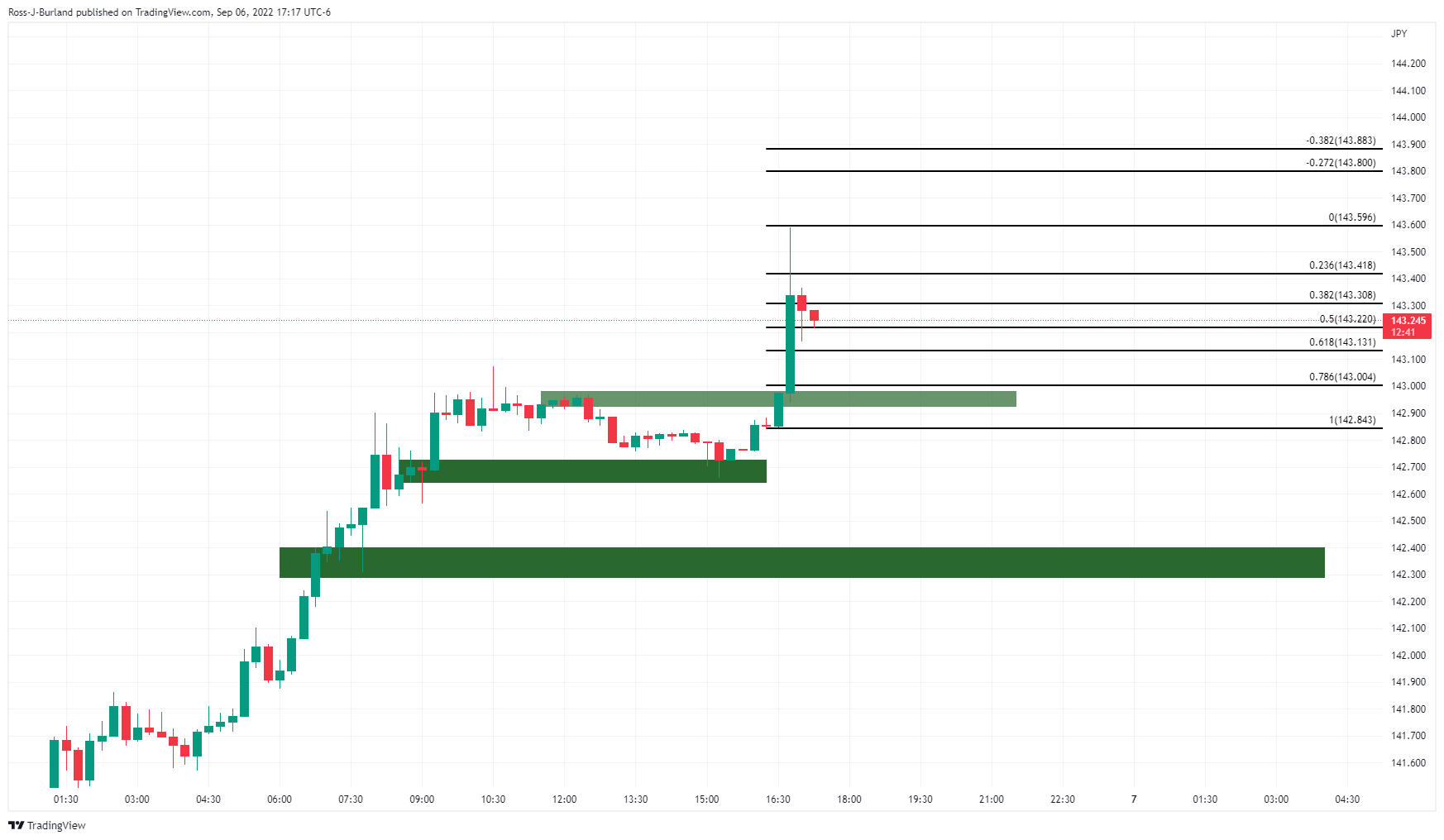

EUR/JPY Price Analysis: Approaches the YTD high at around 144.00, on risk-off mood

- On Wednesday, the EUR/JPY gained more than 1.70% during the day.

- EUR/JPY price action shows the pair is overextended, opening the door for a mean reversion move.

The Japanese yen continues to weaken against most G8 currencies, and the common currency is no exception, with the EUR/JPY registering huge gains of more than 240 pips, closing to the YTD high at around 144.27. The EUR/JPY retreated and is trading at 143.99, some 40 pips shy of the 2022 highs, as the Asian session begins.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart suggests the pair is overextended after rallying close to 500 pips in two days, ahead of the European Central Bank (ECB) monetary policy. Oscillators, particularly the Relative Strength Index (RSI) at overbought conditions, suggest that the pair could retreat from current exchange rates before extending its gains if that’s the case.

Shifting to the 4-hour scale, the EUR/JPY is trading below June’s 29 daily high, and the Relative Strength Index (RSI) is in overbought territory, above its last peak, meaning that a reversal looms.

Therefore, If that scenario plays out, the EUR/JPY first support would be the daily pivot point at 143.05. The break below will expose the S1 daily pivot at 142.10, followed by the 20-EMA at 141.11.

On the flip side, a break above the YTD low at 144.27, the next resistance would be the psychological 145.00 figure.

EUR/JPY Key Technical Levels

-

22:53

AUD/USD advances towards 0.6800 ahead of RBA’s Lowe and Fed Powell’s speech

- AUD/USD is scaling higher and may find a hurdle around 0.6800.

- The minutes from Fed’s Beige Book have halted the DXY’s rally.

- RBA’s hawkish stance on OCR and Australian mixed GDP numbers supported antipodean.

The AUD/USD pair has turned sideways after a sheer upside move and will continue marching towards the immediate hurdle of 0.6800. The asset is oscillating in a 0.6766-0.6770 range and an upside break of the same will resume the upside journey. On Wednesday, the major rebounded firmly after defending the critical support of 0.6700 as the release of the Federal Reserve (Fed) Beige Book that dictates a qualitative review of economic conditions in the US weakened the US dollar index (DXY).

Fed’s Beige Book trims DXY’s appeal

The catalyst which dragged the DXY below the psychological support of $110.00 was a shift in the consumption pattern of the households. As price pressures have remained a hardship for households, households dropped shopping for durable goods and stocked necessity goods seldom. A drop in retail demand for durable goods displays a decline in consumer confidence as demand for essentials cannot be postponed. Apart from that, inflation pressures are displaying exhaustion signals.

More hawkish commentary came from Fed Vice Chair Lael Brainard citing that the central bank will continue its restrictive approach till it records a decline in the inflation rate for several months. The Fed needs to be confident that the desired rate of 2% will be accomplished before trimming the hawkish tone.

Mixed GDP and hawkish RBA supported Aussie

On the Aussie front, mixed Gross Domestic Product (GDP) data and a rate hike announcement by the Reserve Bank of Australia (RBA) have strengthened the antipodean. The Australian GDP data landed at 0.9%, lower than the expectations of 1% but above the prior release of 0.8% on a quarterly basis. However, the annual data has improved to 3.6% against the estimates and the prior print of 3.5% and 3.3% respectively. Also, RBA Governor Philip Lowe announced a fourth consecutive 50 basis points (bps) interest rate hike.

Going forward, investors will focus on the speech from Fed chair Jerome Powell and RBA Governor Philip Lowe. Fed Powell is expected to dictate the likely monetary policy action this month while RBA Lowe will discuss the rationale behind steeping up the Official Cash Rate (OCR) by 50 bps consecutively for the fourth time.

-

22:13

GBP/USD Price Analysis: Rebounds at 37-year lows, reclaims the 1.1500 figure

- GBP/USD is recording decent gains after nosediving to a 1985 daily low.

- The British pound found some base around 1.1400, rallying more than 130-pips on the day.

- The major might record a leg-up before extending its fall for a re-test of the YTD low at a1.1406.

The GBP/USD refreshed a 37-year low but bounced off and reclaimed the 1.1500 figure after meandering around the 1.1400 round figure during the day. The GBP/USD recovered some ground and settled at current exchange rates, trading at 1.1531, above its opening price by 0.18%, at the time of writing.

GBP/USD Price Analysis: Technical outlook

The GBP/USD trades were volatile during Wednesday’s trading session. The major is still downward biased, despite recovering more than 100-pips losses. It is worth noting that the Sterling dropped below the descending channel, where the major has been trading since late May, when the British pound began its downfall throughout 2022.

GBP traders should know that the Relative Strength Index (RSI) is within the oversold territory, so the pair might print a leg-up before resuming its downward path. Therefore, the GBP/USD’s first resistance would be the September 6 daily high at 1.1608. Once cleared, the next supply zone would be the 50% Fibonacci retracement at 1.1652, followed by the 61.8% Fibonacci level at 1.1710.

On the downside, the GBP/USD first floor would be the 1.1500 figure. The break below will expose the YTD low at 1.1400, followed by the psychological 1.1300 figure.

GBP/USD Key Technical Levels

-

21:39

United States API Weekly Crude Oil Stock increased to 3.645M in September 2 from previous 0.593M

-

21:33

NZD/USD heads into the close near daily highs ahead of US Fed gov. Powell

- NZD/USD holds in positive territory into the early Asian session.

- The kiwi has been driven higher by a fall in the greenback from the lofty bull cycle highs.

NZD/USD is ending the day close to the highs of 0.6075 after rallying around 0.6% from a low of 0.5996, rebounding on the back of a move lower in US bond yields and firmer equities.

Despite data that has been signalling strength in the US economy, the greenback flipped over on Wednesday even though traders continue to bet on a 75-basis-point interest rate hike by the Federal Reserve later this month. Fed fund futures are implying that investors are pricing in a more than 76% chance of such a move.

''Once again there was nothing NZ-specific about the move, and that’s the way it feels like it’s going to be for a while as global FX markets digest significant themes (restated Fed hawkishness, the far-reaching consequences of surging energy costs, debates over how sticky inflation is, and climate change – to name a few),'' analysts at ANZ Bank said in early Asia open on Thursday.

''Technically though, the textbook bounce in the NZD off 0.60 (it fell below it briefly, but it wasn’t sustained) is a positive sign for those of that ilk, and if the global market backdrop doesn’t deteriorate, it may have formed a base. But that can’t be assured, and it makes sense to brace for volatility.''

Looking ahead, the main focus will be on Fed chair Powell's speech ahead of the US Consumer Price data next week as traders for clues on the path of monetary policy. At midnight this Friday, the Fed media blackout goes into effect and there will be no speakers until Chair Powell’s post-decision press conference on September 21.

-

20:49

Gold Price Forecast: XAU/USD runs up to test critical resistance with eyes on a significant bullish breakout

- The gold price firms to take on ket resistance as the US dollar tails off from fresh bull cycle highs.

- Gold bulls eye a 50% mean reversion with the prospects of a break to $1,735 beyond there.

The gold price has added to gains on the day, although is starting to tail off from the New York session highs of $1,719.29 currently. The precious metal is around 0.8% higher on the day, having risen from a low of $1,691.46 to a high of $1,719.29 as the greenback and US yields retrace.

The US dollar has fallen off the strongest levels in two decades as per the DXY index, which measures the greenback vs. a basket of currencies. The index was last seen down 0.44% to 109.76, after earlier touching 110.786 the highest since 2002. US Treasury yields also slid from early highs, bullish for gold since it offers no interest. The yield on the US 10-year note was last seen down 2.45% to 3.271%.

Meanwhile, however, hawkish comments from Fed Chair Jerome Powell were compounded by signs of an economic slowdown in Europe and China and aggressive steps by major central banks to tame inflation, all of which has been underpinning the greenback of late. Additionally, data signalling strength in the US economy has prompted traders to bet on a 75-basis-point interest rate hike by the Fed later this month. Despite last week's mixed jobs data in the Nonfarm Payrolls, the Fed fund futures are still implying that investors are pricing in a more than 78% chance of such a move. Nevertheless, the Atlanta Fed GDP nowcast estimates for the third revised 1.4% from the 2.6% pace in the previous estimate on Sept. 1. The next update is scheduled for Friday, ahead of next week's critical US Consumer Price Index.

More immediately, the European Central Bank is meeting on Thursday which could be a further weight to gold prices with the board leaning towards a 75bp rate hike given that the ECB is behind the curve. ''The possibility that failure to deliver a 75bp rate hike could send the euro spiralling lower. Markets look set to remain volatile and it is important to remain open to the potential for swift changes in sentiment given current positioning,'' analysts at ANZ Bank said.

Meanwhile, ''traders are questioning whether the move lower in precious metals is fundamentally running out of steam, after a repricing in rates markets has left market expectations more closely in line with the Fed's outlook for rates,'' analysts at TD Securities said who argue that while rates pricing now appears closer to fair value.

''Gold markets have failed to price the implications of a sustained period of restrictive interest rates,' they said, expecting odds of a major capitulation event growing with every tick lower in gold prices. The analysts say that this ''could coincide with a break below a multi-decade uptrend in the yellow metal near $1675/oz.''

''Gold markets still feature an extremely concentrated and bloated position held by a small number of family offices and proprietary trading shops, which are increasingly at risk as prices approach their pandemic-era entry levels. At the same time, the margin of safety against a short squeeze continues to grow, increasing odds that we can break through this critical support. And, our tracking of Shanghai gold trader positioning suggests that China's appetite for gold is finally starting to ebb, potentially adding into a liquidation vacuum.''

Gold technical analysis

The price is headed towards a price imbalance near $1,721. Beyond there, a 50% mean reversion comes in near $1,727 prior structure. On the downside, however, a retest of the 2021 lows around $1,676 is feasible, but the upside is playing out which leaves the prospects of a break to $1,735 on the table in the meantime as per the projected W-formation.

-

20:38

Forex Today: Dollar eases as eyes shifts to ECB’s decision

What you need to take care of on Thursday, September 8:

The American dollar maintained its strong footing throughout the first half of the day but gave up during the American session.

The EUR/USD pair flirted with the December 2002 low at 0.9859 before recovering, now battling to regain parity. Nevertheless, the European energy crisis will likely limit shared currency demand. Skyrocketing prices in the EU are taking their toll on households and businesses and pushing high inflation up. European non-ferrous metal producers have called for emergency EU action to prevent permanent deindustrialization in a letter to the European Commission President, Ursula Von der Leyen. Producers noted that "50% of the EU's aluminium and zinc capacity has already been forced offline due to the power crisis."

Russian President Vladimir Putin rushed to answer by announcing Moscow is working on the construction of new pipelines to transport gas, some of which pass through Mongolia to China. He also noted that the G7 oil price cap "would be an absolutely stupid decision," adding they would not supply "anything" if it's contrary to Russian economic interest. "No gas, no oil, no coal, no fuel oil, nothing."

The European Central Bank will announce its monetary policy decision on Thursday. The ECB is widely anticipated to hike rates by 50 bps when it meets on Thursday, but the focus will be on whether European policymakers are willing to put growth behind taming inflation or not.

The US published the Beige Book, a survey of economic conditions based on data from 12 district banks. The document showed that price growth has slowed in 9 of the 12 districts, although most surveyed believe price pressures will last at least until the end of the year.

The Bank of Canada hiked its main rate by 75 basis points to 3.25%, in line with market expectations. The accompanying statement showed that policymakers would likely continue to raise the benchmark given the inflation outlook. On a positive note, the document also revealed that they believe the economy continues to operate in excess demand and labor markets remain tight. USD/CAD trades around 1.3140.

Bank of England Monetary Policy Report Hearings put pressure on the pound at the beginning of the day, with GBP/USD plummeting to 1.1404. Policymakers are still on the tightening path, and Governor Andrew Bailey noted that the central bank would continue to respond to price shock. Broad dollar's weakness helped the pair to recover to the current 1.1510 price zone.

The USD/JPY pair kept marching higher and reached 144.98, to end the day around the 144.00 figure.

The AUD/USD pair trades around 0.6750 by the end of the day, trimming early losses. Encouraging Australian data did little for the pair, rising amid the better tone of Wall Street and easing government bond yields weighing on the American currency.

Spot gold fell to an intraday low of $1,691.32 a troy ounce but managed to recover towards the current $1,716 level.

Crude oil prices, on the other hand, edged sharply lower amid speculation about easing Chinese demand following tepid local data. China's trade surplus was $79.39 billion in August, well below the $101.26 billion from July.

What the rejection at $19,000 now means for the Bitcoin price

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:02

EUR/USD advances sharply, reaching a weekly high at around parity

- EUR/USD advances sharply, above the 0.9980 mark, ahead of the ECB’s decision.

- The US trade deficit narrowed, though it failed to boost the greenback.

- Fed policymakers reiterated the Fed’s commitment to tame inflation while saying that rates will remain in the restrictive territory.

The EUR/USD advanced sharply on Wednesday, spurred by a slightly risk-on impulse in the North American session, with US equities rising while US Treasury bond yields slip from YTD highs as market players focus on the US Federal Reserve rate path.

The EUR/USD opened near the lows of the day, shy of the 0.9900 mark, and tumbled towards the daily low at 0.9880, before rallying, towards parity at 1.0000. nevertheless, the major retreated to current exchange rates. At the time of writing, the EUR/USD is trading at 0.9982, well above its opening price.

US data revealed earlier, particularly the Trade Balance, showed that the US deficit narrowed in July, as the US Department of Commerce reported. The figures revealed that the deficit descended 12.6% to $70.6 Billion, while Exports of goods and services climbed 0.2%.

Meanwhile, a tranche of Fed speakers are grabbing headlines ahead of the blackout period, which will start on September 10. The first one to hit the stand was the Cleveland Fed Loretta Mester, saying that the market needs to focus on the path of interest rates, rather than “one particular meeting,” while adding that the size of the rate hike that she wants, would be decided in the meeting.

Later, Fed Vice Chair Lael Brainard said that the Fed will keep tighter monetary policy conditions “for as long as it takes to get inflation down.” Brainard added that although July’s inflation figures were positive, the Fed needs to see “several months of low monthly inflation” to be confident that inflation is indeed cooling down.

Meanwhile, the Fed Beige Book reported that some firms see some easing in labor shortages and price pressures.

According to the Fed’s report, “Overall labor market conditions remained tight, although nearly all Districts highlighted some improvement in labor availability.” Regarding price pressures, nine districts reported some degree of moderation.

What to watch

On Thursday, the European Central Bank would reveal its monetary policy decision, with most analysts expecting a 75 bps rate hike. Nevertheless, researchers of 12 major banks, eight of them expect a 75 bps, while the other four, are not clearly decided between a 50 or a 75 bps increase.

Also read: ECB Preview: Forecasts from 12 major banks, even 75 bps is too little to lift the euro

EUR/USD Price Analysis: Technical outlook

The EUR/USD bounced off the week’s lows, below the 0.9900 figure, while the Relative Strength Index (RSI) is aiming towards the 50-midline. EUR/USD traders should be aware that a divergence between price action and the RSI formed. So EUR/USD Wednesday’s price action is a reaction of the previously mentioned.

Therefore, the EUR/USD first resistance would be parity. A break above will expose the 20.day EMA at 1.0039 and 1.0100. On the flip side, the EUR/USD first support would be 0.9900. Once cleared, the next support would be the YTD low at 0.9863m and the 0.9800 mark.

-

20:00

Argentina Industrial Output n.s.a (YoY) down to 5.1% in July from previous 6.9%

-

19:21

Fed's Beige Book: US firms see progress on labor supply, price pressures

The Federal Reserve's Beige Book notes that economic activity, stating that "the outlook for future economic growth remained generally weak.

The US central bank released its latest summary of feedback from business contacts nationwide as it mulls whether to proceed with a third straight 75-basis-point interest rate hike at its Sept. 20-21 policy meeting or go with a still larger-than-usual 50-basis-point rise in its battle to curb high inflation.

Key notes

- Economic activity was unchanged, on balance, since early july, with five districts reporting slight to modest growth in activity and five others reporting slight to modest softening.

- The outlook for future economic growth remained generally weak, with contacts noting expectations for further softening of demand over the next six to twelve months.

- Price levels remained highly elevated, but nine districts reported some degree of moderation in their rate of increase.

- The outlook for future economic growth remained generally weak, with contacts noting expectations for further softening of demand over the next six to twelve months.

- Employers noted improved worker retention, on balance.

- Wages grew across all districts, although reports of a slower pace of increase and moderating salary expectations were widespread.

-

18:58

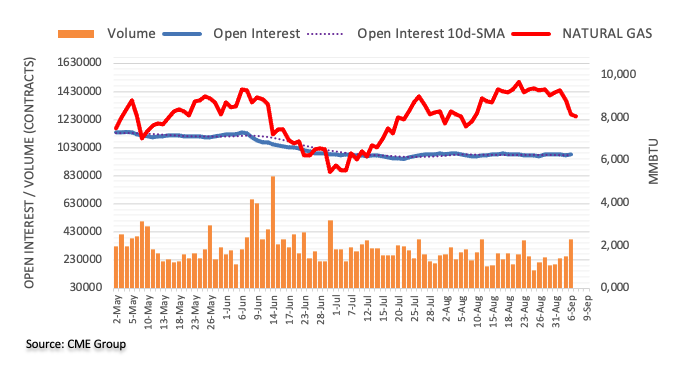

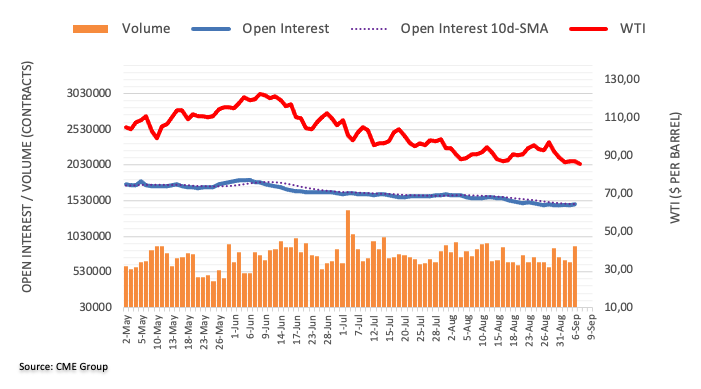

WTI bears stay in control, slicing through key support

- Oil loses ground as the market prices in weak demand from China.

- Russian threats to halt oil exports lends some support.

West Texas Intermediate crude is under pressure midweek, losing some 5% in Midday New York trade and taking out key support territory as the greenback rises to a 20-year high at the same time the market prices in weak demand from China.

The headlines are dominated by the Covid-19 lockdowns in China, the world's No.1 net importer. and the worries as restrictions on movements that are now impacting 46 cities. As many as 65 million people across the country are now subject to restrictions on their mobility and the dent to demand is expected to quickly ripple through international markets already grappling with fears that the global economy is barreling toward a recession.

''More infectious strains of the virus are raising concerns that authorities will be forced to more frequently lockdown areas as China persists with a zero-COVID strategy,'' analysts at ANZ Bank explained.

However, Russian threats to halt oil exports should the G-7 and European Union plan to cap prices for Russian oil go forward offered some support for oil. Nevertheless, a decision this week by OPEC+ to lower production quotas by 100,000 barrels per day has also been taken into consideration.

Analysts at TD Securities said that this signals that this group of swing producers will be increasingly active in its decision-making as we stare down the barrel of the recession. ''In turn, energy supply risks should also be bolstered by the revival of the OPEC+ put. The right tail in energy markets is fattening,'' the analysts argued.

Meanwhile, the Energy Information Administration (EIA) on Wednesday slightly raised its forecast for 2022 global oil demand while trimming its estimate for production this year.

-

18:15

USD/CHF Price Analysis: Pullbacks from weekly highs, as a triple-top emerges in the H4

- USD/CHF retraces from weekly highs and dives below the 0.9800 figure due to a risk-on impulse.

- A triple-top chart pattern in the 4-hour chart keeps the USD/CHF under some selling pressure, targeting a fall to 0.9660.

USD/CHF slides from weekly highs reached at around 0.9869 on Wednesday, despite risk appetite improving, which usually benefits riskier assets during the day. The USD/CHF is trading at 0.9783, below its opening price, by 0.51%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF is pulling back after reaching a solid weekly high at around 0.9869, set during the overlap of the Asian/European session, courtesy of market sentiment shifting sour. Nevertheless, as the North American session progressed, investors’ mood improved, as seen by US equities trading in the green.

In the USD/CHF case, the Swiss Franc strength dragged prices lower, so far clearing on its way south the 0.9800 figure.

Short term, the USD/CHF four-hour chart, illustrates a formation of a triple-top chart pattern, and so far, the major is retreating from weekly high levels, approaching the “neckline” around the 0.9766 area. A decisive breach of the latter could send the major tumbling towards the triple-top measured target at 0.9660, but first, it will need to overcome some hurdles on its way south.

The USD/CHF first support would be the bottom-trend line of an ascending channel drawn since August 11, around 0.9720, followed by the 0.9700 figure, followed by the 100-EMA at 0.9680.

USD/CHF Key Technical Levels

-

17:49

Fed's Brainard: Monetary policy will need to be restrictive for some time

Fed Vice Chair Lael Brainard reiterated on Wednesday that the Fed's policy rate will need to rise further and that they will need to keep the policy restrictive 'for some time,' as reported by Reuters.

Additional takeaways

"Our resolve is firm, goals clear, tools up to the task."

"We need several months of low monthly inflation readings to be confident inflation is moving down to 2%."

"Higher policy rate, balance sheet reduction should help bring demand into alignment with supply."

"Especially important to guard against rise in inflation expectations."

"Labor demand continues to exhibit considerable strength, hard to reconcile with more downbeat tone of activity."

"May take some time for full effect of tighter financial conditions to work through economy."

"At some point in tightening cycle, risks will become more two-sided."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen losing 0.25% on the day at 109.97.

-

17:38

Bank of Canada appears ready to sacrifice more growth – CIBC

As expected, the Bank of Canada (BoC) on Wednesday announced a 75 basis points rate hike to 3.25%, the highest level since 2008. Analysts at CIBC, point out the central bank appears ready to sacrifice more growth than what they expected to get inflation falling on a faster trajectory.

Key Quotes:

“The 75 bp hike to an overnight rate of 3.25% was widely expected, but we took note that the final paragraph opted to retain the view that “interest rates will need to rise further.” We’ll therefore be lifting our target for the end of this tightening cycle, with another 25-50 bps on tap for October.”

“The BoC appears ready to sacrifice more growth than we expected to get inflation falling on a faster trajectory, and we'll be bumping down our GDP projections for Canada in an updated forecast to be released next week. While the Bank could opt for as little as an extra quarter point, had they been convinced that 3.5% was the ceiling, they could have done that move today, so we'll have to give some thought to whether they're thinking of a 3.75% rate. That would be a half point above what we had built into our prior GDP call, and therefore somewhat material to the outlook.”

“The fact that the Fed is also talking fairly tough these days, and might also be leaning to hike a bit more than we had projected, dulls the benefits to the loonie of a more hawkish Bank of Canada. We still judge it as unlikely that the peak overnight rate in Canada will end up exceeding that of the US.”

-

17:32

EUR/GBP hits two-month highs near 0.8700 ahead of ECB

- EUR/GBP resumes upside after two-day correction.

- Price peaks at 0.8688, the strongest level since June 15.

- Thursday: ECB decision and Truss’s energy plan.

The EUR/GBP resumed the upside after a two-day correction. Recently it climbed to 0.8688, reaching the highest level since June 15. It is hovering around 0.8665, about to post the second highest daily close in 16 months.

Thursday could be a busy volatile day for EUR/GBP with the European Central Bank meeting and the energy plan in the UK. The ECB is expected to raise rates by 75 basis points and will release macro forecasts. “Higher than expected August CPI readings certainly make the case for more aggressive tightening and it seems that more and more officials on the Governing Council are leaning towards this outcome. While the energy crisis adds another wrinkle to the process, we think it is too early yet for it to impact ECB policy right now”, mentioned analysts at Brown Brother Harriman.

UK PM Liz Truss is expected to unveil her energy plans tomorrow as the pound remains under pressure. The GBP/USD dropped toward the lowest levels in decades near 1.1400.

With EUR/GBP trading around critical levels and considering the mentioned developments, volatility is set to remain elevated. The cross is near 0.8700 and also close to the 200-week Simple Moving Average at currently at 0.8702. A firm break above 0.8720 should clear the way to more gains over the medium-term. On the contrary, if the pound manages to keep that level, a recovery seems likely, particularly if the cross falls below 0.8560.

Technical levels

-

17:21

AUD/USD creeps lower despite a risk-on impulse spurred by US equities

- AUD/USD reclaimed the 0.6700 figure but remains unable to register gains.

- The US trade deficit narrowed in July, as exports registered a record high.

- Australia’s GDP exceeded estimates, while money market futures foresee a 50 bps RBA rate hike in October.

AUD/USD operates below its opening price on Wednesday, spurred by a sour market sentiment during the Asian session. However, as the European and North American sessions have taken over, sentiment shifted slightly positive, so the AUD/USD is recovering some ground.

During the day, the AUD/USD tumbled towards the 0.6698 daily low but bounced off, trimming some of its losses. At the time of writing, the AUD/USD is trading at 0.6726, down 0.09%.

AUD/USD on the defensive despite positive Aussie data

The US Department of Commerce revealed that July’s US trade deficit narrowed, as exports registered a record high, which could impact and contribute to GDP growth in Q3. Later, the Cleveland Fed President Loretta Mester crossed newswires, saying that the last labor market report flashed signs of moderation. She added that markets need to focus on the path of interest rates rather than “one particular meeting.” Further, she expressed that she will decide the size of rate hikes in the September meeting, and she’s not convinced that inflation has peaked yet.

On the Australian front, the Gross Domestic Product for Q2 expanded aligned with estimations of 0.9% QoQ, while Australia grew at a 3.6% pace on an annual basis. Meanwhile, money market futures expect an additional 50 bps interest rate increase from the Reserve Bank of Australia (RBA) in October, and the yield curve forecast rates to peak at around 3.85%.

AUD/USD Price Analysis: Technical outlook

From a daily chart perspective, the AUD/USD appears to form a double-bottom. Wednesday’s daily low tested a downslope-resistance-trendline, drawn from April 2022 highs, which turned support, quickly rejecting lower prices, reclaiming the 0.6700 mark. Nevertheless, to validate the chart pattern abovementioned, the AUD/USD needs to reclaim the 0.7136 resistance. Otherwise, a drop below 0.6698 could pave the way for a re-test of the YTD low.

-

16:31

USD/JPY retreats from the 145.00 area as dollar loses momentum

- US dollar retreats across the board amid an improvement in risk sentiment.

- Yen trims losses versus the dollar, drops further versus other currencies.

- USD/JPY overbought but still pointing to the upside.

The USD/JPY peaked at 144.98 on Wednesday, the highest level since 1998. After being unable to break above 145.00 the rally lost momentum and it pulled back to 144.20, on the back of a broad-base correction of the US dollar.

The greenback moved off highs during the American session as Wall Street turned positive. As of writing, the Dow Jones was up by 0.80% and the Nasdaq by 0.87%. The improvement in risk sentiment avoided a general recovery of the yen.

The Japanese yen trimmed losses against the dollar but it printed fresh lows versus most of the currencies. The DXY was in red for the day at 110.15 after hitting a multi-year high at 110.78.

The USD/JPY is still up more than 400 pips from Tuesday’s opening level. The divergence between the Fed and the Bank of Japan continues to be the key driver of the rally. The 145.00 zone has become the new resistance. On the downside, 144.20 is the immediate support followed by 143.40.

Later on Wednesday, the Federal Reserve will release the Beige Book. On Thursday, Q2 growth data from Japan is due.

Technical levels

-

16:17

US: Atlanta Fed GDPNow for Q3 declines to 1.4%

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 1.4% in the third quarter, down from 2.6% in the previous estimate.

"After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, the US Bureau of Economic Analysis, and the Institute for Supply Management, the nowcasts of third-quarter real personal consumption expenditures growth, third-quarter real gross private domestic investment growth, and third-quarter real government spending growth decreased from 3.1%, -3.5%, and 1.7%, respectively, to 1.7%, -5.8, and 1.3, respectively, while the nowcast of the contribution of the change in real net exports to third-quarter real GDP growth increased from 0.82 percentage points to 1.09 percentage points," Atlanta Fed explained in its publication.

Market reaction

This report doesn't seem to be having a significant impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was posting small daily losses at 110.17.

-

16:10

USD/CAD holds to gains around 1.3170s, post-BoC 75 bps hike

- USD/CAD reaction was muted, with the pair seesawing in the 1.3160-1.3201 range, on the BoC decision.

- The Bank of Canada opened the door for further hikes as core inflation continued broadening.

- Fed’s Mester: To decide the size of the hike in the September meeting.

The USD/CAD is soaring despite the recent decision of the Bank of Canada to hike rates by 75 bps, from 2.50% to 3.25%, amidst a mixed market sentiment, with most global equities tumbling, except for US stocks. At the time of writing, the USD/CAD edges up 0.18%, trading at 1.3173, above its opening price.

USD/CAD extends its gain, despite BoC’s rate hike

The Loonie failed to gain traction after the BoC decided to hike rates. The central bank noted that they would need to rise further, given the inflation outlook. According to the BoC, core inflation continues broadening, particularly in services, reiterating its commitment to price stability and adding that it would take action as required to achieve the 2% goal.

The USD/CAD seesawed on the headlines, edging towards 1.3163 and then surging to 1.3201 before stabilizing at current exchange rates.

In the meantime, the Canadian economic docket also revealed the Ivey Purchasing Managers Index for August, which came at 60.9, seasonally adjusted, whine unadjusted rose by 57.1.

At the same time, the Cleveland Fed President Loretta Mester was crossing newswires. Mester said that the last labor market report flashed signs of moderation. She added that markets need to focus on the path of interest rates rather than “one particular meeting.” Furthermore expressed that she will decide the size of rate hikes in the September meeting, and she’s not convinced that inflation has peaked yet.

Earlier, the US trade deficit narrowed in July, as exports recorded a high, which could see trade continuing to contribute to the Gross Domestic Product (GDP) in the third quarter.

On Thursday, an absent Canadian economic docket would leave traders lying on the dynamics of the greenback. The US calendar will release Initial Jobless Claims for the week ending on September 3, alongside Fed speakers led by Chairman Jerome Powell. Chicago Fed President Charles Evans and Minnesota’s Neil Kashkari.

USD/CAD Key Technical Levels

-

15:42

Fed's Mester: Not convinced inflation has peaked yet

Cleveland Federal Reserve Bank President Loretta Mester said on Wednesday that she is not convinced yet that inflation in the US has peaked, as reported by Reuters.

Additional takeaways

"Better for markets to focus on path of interest rates than any one particular meeting."

"Policy should be guided by incoming data as it informs the outlook."

"I will decide my preferred size of rate hike at the September meeting itself."

"Medium and longer-term inflation expectations still in the range consistent with 2% inflation goal but I am very attentive to that."

"Growth rate of wages still higher than what is consistent with 2% inflation."

"Lags in policy are a consideration for the future, not right now with inflation so high."

"Our challenge is to engineer a slow down in activity without causing a recession."

Market reaction

The US Dollar Index edged lower after these comments and was last seen posting small daily losses at 110.20.

-

15:00

Canada Ivey Purchasing Managers Index s.a climbed from previous 49.6 to 60.9 in August

-

15:00

Canada Ivey Purchasing Managers Index: 57.1 (August) vs 53.2

-

15:00

Canada BoC Interest Rate Decision in line with expectations (3.25%)

-

15:00

Breaking: Bank of Canada hikes policy rate by 75 bps to 3.25%

The Bank of Canada (BoC) hiked its policy rate by 75 basis points (bps) to 3.25% in September. This decision came in line with the market expectation.

In its policy statement, the BoC said rates will need to rise further given the inflation outlook.

Market reaction

With the initial reaction, USD/CAD edged lower from session highs but quickly recovered its losses. As of writing, the pair was up 0.3% on the day at 1.3190.

Key takeaways from policy statement

"Will be assessing how much higher rates need to go as the effects of tighter monetary policy work through the economy."

"Canadian inflation excluding gasoline increased in July and data indicate a further broadening of price pressures, particularly in services."

"Surveys suggest short-term inflation expectations remain high; the longer this continues, the greater the risk elevated inflation becomes entrenched."

"Canadian economy continues to operate in excess demand and labor markets remain tight."

"While Q2 growth was somewhat weaker than bank had projected, indicators of domestic demand were very strong."

"Global and Canadian economies evolving broadly in line with July projections."

"BoC continues to expect Canadian economy to moderate in H2 2022."

"Canadian housing market is pulling back as anticipated amid higher mortgage rates."

"BoC remains resolute in commitment to price stability and will take action as required to achieve 2% inflation target."

-

14:58

Gold Price Forecast: XAU/USD steadies around $1,700 mark, not out of the woods yet

- Gold remains depressed for the third successive day, though the downside seems cushioned.

- Aggressive Fed rate hike bets lift the USD to a fresh two-decade high and act as a headwind.

- Retreating US bond yields seem to cap gains for the USD and lend support to the XAU/USD.

Gold struggles to capitalize on its modest intraday bounce and attracts fresh selling near the $1,707 region on Wednesday. The XAU/USD remains on the defensive through the early North American session and is currently trading around the $1,700 round-figure mark.

The relentless US dollar buying remains unabated for the third successive day, which turns out to be a key factor exerting downward pressure on the dollar-denominated gold. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, hits a fresh two-decade high and remains well supported by hawkish Fed expectations.

Tuesday's upbeat US ISM Services PMI reaffirmed market bets that the US central bank will continue to hike interest rates more aggressively to tame inflation. The Fed is widely expected to deliver a supersized 75 bps rate hike at the end of a two-day policy meeting on September 21, which, in turn, continues to act as a tailwind for the greenback.

Apart from this, a recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - further undermines the safe-haven gold. That said, a modest pullback in the US Treasury bond yields is holding back the USD bulls from placing fresh bets and lending some support to the non-yielding metal, for the time being.

There isn't any major market-moving economic data due for release from the US on Wednesday, leaving the USD bulls at the mercy of the US bond yields. That said, speeches by Fed officials might influence the USD price dynamics and provide some impetus to gold. Traders will further take cues from the broader risk sentiment to grab short-term opportunities.

Nevertheless, the fundamental backdrop remains tilted in favour of bearish traders. This, in turn, suggests that any attempted recovery move could be seen as a selling opportunity and runs the risk of fizzling out rather quickly. Gold still seems vulnerable to retesting the $1,689-$1,688 intermediate support before eventually dropping to the YTD low, around the $1,680 area.

Technical levels to watch

-

14:38

EUR/USD Price Analysis: Extra downside remains on the cards

- EUR/USD remains under pressure in the lower end of the range.

- Further decline could see the 2022 low at 0.9863 revisited.

EUR/USD alternates gains with losses around the 0.9900 region on Wednesday.

Against that, the inability of the pair to regain serious upside traction should keep the door to further retracement open in the near term. Extra losses face the immediate target at the 2022 low at 0.9863 (September 6) seconded by 0.9859 (December 2002 low) and then 0.9685 (October 2002 low).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0773.

EUR/USD daily chart

-

14:17

Australia: RBA tightens further its policy – UOB

Economist at UOB Group Lee Sue Ann comments on the latest interest rate decision by the RBA.

Key Takeaways

“The Reserve Bank of Australia (RBA) decided to increase the offical cash rate (OCR) by 50bps to 2.35%. It also increased the interest rate on Exchange Settlement balances by 50bps to 2.25%. This is the fourth consecutive month that the RBA has raised rates by 50bps.”

“Once again, the RBA signalled that it will continue to hike in the coming months, but is not on a preset path. We now pencil in 25bps hikes for the remaining three meetings in 2022. That will take the OCR to 3.10% by year-end. We then look for a pause thereafter.”

“The next RBA meeting is on 4 Oct. Immediate focus will now shift to 2Q22 GDP data due on Wed (7 Sep) at 9.30am SGT, where expectations are for the Australian economy to expand by 0.9% q/q or 3.4% y/y.”

-

14:11

US Dollar Index Price Analysis: The 111.00 level is just around the corner

- DXY keeps pushing higher and prints tops near 110.80.

- The continuation of the upside could see 111.00 revisited.

DXY advances for the third session in a row and approaches the 111.00 mark on Wednesday.

The short-term bullish view in the dollar remains well in place for the time being and propped up by the 7-month support line just below 106.00.

Still on the upside, the surpass of the recent top at 110.78 (September 7) could face the next barrier at the weekly highs at 111.90 (June 6 2002) and 113.35 (May 24 2002).

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 101.20.

DXY daily chart

-

14:05

When is the BoC monetary policy decision and how could it affect USD/CAD?

BoC Monetary Policy Decision – Overview

The Bank of Canada (BoC) is scheduled to announce its monetary policy decision this Wednesday at 14:00 GMT. The Canadian central bank is widely expected to lift its policy rate by 75 bps to 3.25% at the end of the September meeting in an effort to keep inflation expectations anchored. Apart from the decision, investors will further take cues from the accompanying monetary policy statement in the absence of the post-meeting press conference.

Analysts at Wells Fargo offer a brief overview and explain: “We expect the BoC to deliver a 75 bps hike to 3.25%. We think the BoC will slow down the pace of its hikes beyond September, only taking the policy rate to 3.75% by the end of Q4-2022, although we see the risks as remaining tilted to a higher peak. We will be particularly interested in guidance on future policy from the BoC, especially against a backdrop of slowing growth and still-elevated inflation.”

How Could it Affect USD/CAD?

Ahead of the key event risk, weaker crude oil prices continue to undermine the commodity-linked loonie. This, along with relentless US dollar buying, lifts the USD/CAD pair back closer to the monthly peak touched last week. Given that the markets have fully priced in a 75 bps rate hike, the expected move is unlikely to provide any respite to the Canadian dollar.

Furthermore, a tilt toward a more conservative policy stance amid concerns about the worsening economic outlook and easing price pressures could weigh heavily on the domestic currency. This, in turn, will set the stage for an extension of the recent appreciating move for the USD/CAD pair witnessed over the past month or so.

That said, an unlikely event of a more aggressive 100 bps rate hike could trigger a significant market reaction and provide a strong boost to the Canadian dollar. The USD/CAD pair might then turn vulnerable and dive back towards the 1.3100 round-figure mark. Some follow-through selling below the 1.3075-1.3070 region could pave the way for a fall towards the 1.3035-1.3030 intermediate support en route to the 1.3000 psychological mark.

Key Notes

• BoC Preview: Will BoC take its foot off the pedal?

• BoC Preview: Forecasts from eight major banks, hiking rates again

• USD/CAD: Any support for the loonie from the BoC may fade rapidly – ING

About the BoC Interest Rate Decision

BoC Interest Rate Decision is announced by the Bank of Canada. If the BoC is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the CAD. Likewise, if the BoC has a dovish view on the Canadian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

-

13:55

United States Redbook Index (YoY): 10.9% (September 2) vs previous 14.2%

-

13:44

Canada: International Merchandise Trade surplus narrows to C$4.05 billion in July

- Canada's international trade surplus narrowed at a softer pace than expected in July.

- USD/CAD continues to trade in positive territory below 1.3200.

Canada's merchandise trade surplus with the world narrowed to C$4.05 billion in July from C$4.88 billion in June, Statistics Canada reported on Wednesday. This reading came in slightly better than the market expectation for a surplus of C$3.8 billion.

"Following six consecutive monthly increases, total exports decreased 2.8% to $68.3 billion in July," the publication further read. "Total imports fell 1.8% in July to $64.2 billion, the first decrease since January."

Market reaction

Ahead of the Bank of Canada's (BoC) policy announcements, USD/CAD showed no immediate reaction to this report and was last seen rising 0.27% on a daily basis at 1.3188.

-

13:36

GBP/USD struggles near March 2020 low, seems vulnerable amid blowout USD rally

- GBP/USD meets with a fresh supply on Wednesday and drops to its lowest level since March 2020.

- The BoE policymakers failed to lift bets for a 75 bps September rate hike and weighed on the GBP.

- The relentless USD buying contributes to the decline and supports prospects for additional losses.

The GBP/USD pair comes under renewed selling pressure on Wednesday and sinks to the lowest level since March 2020 during the mid-European session. The pair is currently trading around the 1.1425-1.1420 region and seems vulnerable to prolonging a nearly one-month-old descending trend.

The Bank of England policymakers, including Governor Andrew Bailey, testified before the Parliament's Treasury Committee this Wednesday and failed to reinforce bets for a more aggressive rate hike. This, in turn, is seen as a key factor weighing on the British pound and exerting downward pressure on the GBP/USD pair amid relentless US dollar buying.

The BoE MPC member Silvana Tenreyro noted that we are still to see the majority of the impact of the significant policy tightening already in place. Tenreyro added that a more gradual pace of tightening reduces the risk of overshooting. Adding to this, Governor Bailey said that more forceful bank rate moves to open the door for policy hold or reversal later.

Against the backdrop of a bleak outlook for the UK economy, the not-so-hawkish remarks might continue to undermine sterling. The USD, on the other hand, hits a fresh two-decade high and continues to draw support from firming expectations that the Fed will continue to tighten its monetary policy at a faster pace to curb stubbornly high inflationary pressures.

In fact, the markets are pricing in a greater chance of a supersized 75 bps rate hike at the upcoming FOMC policy meeting on September 20-21. This, along with the prevalent risk-off mood and worries about a deeper global economic downturn, should act as a tailwind for the safe-haven greenback and supports prospects for a further depreciating move for the GBP/USD pair.

Some follow-through selling below the March 2020 low, around the 1.1410 region, will reaffirm the negative bias and pave the way for deeper losses. In the absence of any major market-moving economic releases from the US, speeches by Fed officials will play a key role in influencing the USD price dynamics. Apart from this, the broader risk sentiment might also drive the USD demand and provide some meaningful impetus to the GBP/USD pair.

Technical levels to watch

-

13:35

US: Goods and services deficit narrow to $70.6 billion in July vs. $70.3 billion expected

- International goods and services deficit of the US narrowed sharply in July.

- US Dollar Index clings to strong daily gains above 110.50.

The data published by the US Census Bureau showed on Wednesday that the goods and services deficit narrowed by $10.2 billion to $70.6 billion in July. This reading came in slightly higher than the market expectation for a deficit of $70.3 billion.

"July exports were $259.3 billion, $0.5 billion more than June exports," the publication further read. "July imports were $329.9 billion, $9.7 billion less than June imports."

Market reaction

These figures failed to trigger a significant market reaction and the US Dollar Index was last seen gaining 0.4% on the day at 110.68.

-

13:33

EUR/USD: Little downside pressure for now – Scotiabank

EUR/USD trades narrowly around 0.99. For the moment, there is little real pressure on the downside, economists at Scotiabank note.

Safe technical ground remains distant at 1.0135

“Tuesday’s range was bearish for the EUR and the failure to pick up any, lasting support after reaching a new cycle low is a negative. But the market is just about holding within the Tuesday range so far today, suggesting little real pressure on the downside at the moment.”

“Safe technical ground (major resistance) remains distant for the EUR at 1.0135. Support is 0.9850 and 0.9750.”

-

13:32

Chile Trade Balance dipped from previous $76M to $-990M in August

-

13:31

United States Goods and Services Trade Balance registered at $-70.7B, below expectations ($-70.3B) in July

-

13:30

United States Goods Trade Balance: $-91.1B (July) vs previous $-89.1B

-

13:30

United States Goods and Services Trade Balance registered at $-70.65B, below expectations ($-70.3B) in July

-

13:30

Canada Imports fell from previous $64.86B to $64.2B in July

-

13:30

Canada Exports down to $68.25B in July from previous $69.9B

-

13:30

Canada International Merchandise Trade came in at $4.05B, above forecasts ($3.8B) in July

-

13:28

EUR/USD: Further worsening of energy crisis can trigger a drop to the 0.96-0.97 area – ING

Post the European Central Bank (ECB) meeting, the energy crisis should remain the key driver for the euro. Therefore, economists at ING expect the EUR/USD pair to remain skewed to the downside.

The 0.98-0.99 area could prove to be a near-term anchor

“We expect the energy story to return firmly to the driving seat for EUR/USD after the post-ECB reaction. Barring a very hawkish surprise, this should keep EUR/USD below parity and prevent it to reconnect with the more supportive rate differential.”

“The 0.98-0.99 area could prove to be a near-term anchor for EUR/USD, but a further worsening of the energy crisis and/or further dollar strengthening can trigger a drop to the 0.96-0.97 area.”

See – ECB Preview: Forecasts from 12 major banks, even 75 bps is too little to lift the euro

-

13:27

ECB Preview: Forecasts from 12 major banks, even 75 bps is too little to lift the euro

The European Central Bank (ECB) is set to announce its decision on monetary policy on Thursday, September 8 at 12:15 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of 12 major banks.

The ECB is expected to hike rates by 50 bps but markets are wagering a 75 bps rate hike amid surging energy costs. Furthermore, the bank’s staff projections are in focus, with no respite seen for the EUR.

Danske Bank

“We now expect ECB to hike 75 bps, which will be followed by 50 bps in October and 25 bps in December, but acknowledge the increased uncertainty on the two latter hike size expectations. This is +25 bps for our previous rate hike expectations at both the September and October meetings, respectively, and we now see the end-point of the ECB deposit rate at 1.5%. As regards the reinvestment schedule, we currently do not foresee that ECB will change it, but increased market and ECB focus. We believe the euro area will face a recession and ECB will hike into that, however, we also acknowledge that even without the ECB tightening, the European economy was in a severe situation to begin with a worsening energy crisis.”

Rabobank

“The ECB is hard-pressed to demonstrate determination to achieve its price stability objective. The macroeconomic projections will show a weaker growth outlook, but the ECB is clearly willing to risk a slowdown as inflation could -again- turn out to stay higher for longer. Inflation expectations are at risk of de-anchoring, and a weak EUR adds to price pressures. Markets price roughly 67 bp of hikes currently, and the ECB cannot underdeliver if it wants to show commitment to bring inflation back to 2%. We now expect a 75 bps rate hike, but risk of 50 bps remains significant. Lagarde will stress that this is not a precursor to more 75 bps moves.”

Commerzbank

“We expect 75 bps. Admittedly, 50 bps can by no means be ruled out either; after all, many supporters of a fundamentally loose monetary policy (‘doves’) have not spoken out recently. But 75 bps is also supported by the fact that the inflation rate for August rose again and was well above expectations. However, the ECB is unlikely to raise rates by another 75 basis points after next week's meeting since they are nearing the neutral rate. Rather, we expect 50 basis points for the October meeting and 25 basis points each for December and February 2023. At the beginning of 2023, the deposit rate would be 1.75%.”

Nordea

“We now see the ECB delivering a 75 bps hike and the bank is most likely to hike at a similar speed in October.”

TDS

“This decision is balanced on a knife's edge between 50 bps and 75 bps. We opt for the more cautious 50 bps hike on the back of recent Lane comments, but neither outcome would surprise us. A 50 or 75bp hike probably won't do many favours for the EUR, given the importance of the terms of trade shock, growth, and global risk sentiment. A more forceful ECB could limit the downside, especially if the energy shocks ease a bit. Yet, we still like selling EUR/USD rallies ahead of 1.02, aiming for a test of 0.98 in the near future.”

SocGen

“Until recently, we would not have believed in an outsized 75 bps ECB hike given the risks to the growth outlook, even though we think the ECB has reacted too slowly so far. However, with high inflation now lingering for longer, risking a more problematic wage-price spiral, and, importantly, with markets pricing in close to a 75 bps hike, the focus is rather on the risks of not raising by 75 bps, with the currency impact an important aspect. We thus think there is an urgency to reach a more neutral policy stance. Given the threat to the ECB’s credibility, we also wonder why quantitative tightening (QT) is not discussed. As we argued in the past, not using QT should imply higher rate hikes. The greatest risk of raising rates by 75 bps now is that the ECB may need to trigger the TPI soon. This, along with an uncertain growth outlook and a low neutral rate (1%), will be stressed by the doves who might put up more of a fight than in July (also as there is no TPI to compromise on). We expect rate hikes of 75 bps, 50 bps and 25 bps in the forthcoming meetings this year, taking the deposit rate into neutral territory as the economy slows, and another three 25 bps hikes next year. With high uncertainty over how effective rate hikes will be in a landscape of high excess liquidity, QT will need to be considered soon, unless a deeper slowdown in activity intervenes.”

ING

“We expect the ECB to ‘only’ hike by 50 bps. This would be a compromise, keeping the door open for further rate hikes. A 75 bps rise looks like one bridge too far for the doves but cannot be excluded. Further down the road, we can see the ECB hiking again at the October meeting but have difficulties seeing the ECB continue hiking when the eurozone economy is hit by a winter recession. Hiking into a recession is one thing, hiking throughout a recession is another.”

Nomura

“We now expect a 75 bps increase in policy rates. Continued upside surprises to price data since the last meeting, markedly elevated core and supercore inflation, as well as continued concerns over a de-anchoring of inflation expectations, will force the hand of the ECB Governing Council to tighten more aggressively in the near term. We have made other adjustments to our forecast profile and now see 50 bps hikes in both October and December, 2% peak rates by February, and cuts from September 2023.”

ANZ

“We think inflation trends and disparities merit a 75 bps hike. EUR weakness is a problem. The ECB’s task is greatly complicated by uncertainty over Russian gas supplies. Moscow’s decision not to re-start gas flows via the Nord Stream pipeline raises downside growth risks while increasing the inflation outlook. The ECB must prioritise its price stability mandate amid unprecedented uncertainty. Decisive monetary normalisation is a sensible strategy as containing inflation is central to euro area (EA) economic stability. We have raised our terminal deposit facility forecast 50 bps to 2.0%.”

Citibank

“Besides the size of the 2nd hike (we expect 50 bps), the focus will be on the prospects for the terminal rate, APP reinvestments as well as the remuneration of deposits. ECB staff projections could matter if they show above-target inflation in 2024 or deep recession.”

BMO

“We now expect the ECB to raise rates by 75 bps. How the euro reacts will be watched carefully. The ECB may not target the exchange rate, but having a weak euro also contributes to higher inflation. The sustainability of the euro’s strength will depend more heavily on 1) the general USD tone, 2) credit market conditions, and 3) energy price developments.”

ABN Amro

“We expect the ECB to raise its policy rates by 75 bps. The larger expected hike reflects: 1. The hawkish comments from the majority of Governing Council officials over the last few days 2. Headline inflation has continued to accelerate, while the drivers of price pressures have generally been more elevated than the ECB expected in June. For instance, the euro has weakened further 3. GDP in the first half of this year has come in higher than the central bank expected 4. The shift in market pricing and analyst forecasts means that a larger move would not be a shock (even though such a move is not fully priced).”

-

13:15

USD/CAD to extend its rise in September – BofA

Economists at the Bank of America Global Research expect the Bank of Canada (BoC) to hike 75 basis points (bps). However, the USD/CAD pair is set to extend its race higher.

CAD yields to decline heading into year-end

“We expect the BoC to hike the policy rate by 75 bps to 3.25% to put it above the neutral range. Risks are balanced. Once the policy rate is in tightening territory the BoC will likely resume a gradual pace en route to 4.0% to tame inflation.”

“We expect CAD yields to decline heading into year-end. Our base view is for the USD/CAD uptrend to continue in September.”

See – BoC Preview: Forecasts from eight major banks, hiking rates again

-

13:12

The USD and CHF are investors' safe haven choice – Crédit Agricole

In the view of economists at Crédit Agricole CIB Research, the US dollar is the first choice for safe haven followed by the Swiss franc. Meanwhile, the only significant support for the Japanese yen is its appeal as a safe-haven currency.

JPY’s only safe-haven appeal is that it is cheap

“The USD is investors’ first choice and the CHF is likely the second choice given its geographical proximity to Europe, which currently needs safe havens, and the currency offers short-term positive yields.”

“The JPY offers no short-term positive yields and is more exposed to high energy prices than the USD and the CHF. The JPY’s only safe-haven appeal at the moment is that it is cheap.”

-

13:05

GBP/USD: Below 1.1410 would open up the December 1985 all-time low near 1.0520 – BBH

GBP/USD has declined below 1.15. A break under 1.1410 would set up a test of the December 1985 all-time low around 1.0520, economists at BBH report.

UK is stepping back from a Brexit confrontation with the EU

“GBP/USD remains on track to test the March 2020 low near 1.1410. After that is the December 1985 all-time low near 1.0520.”

“The UK will reportedly request an extension to the grace periods. This is welcome news as the last thing the UK needs right now is a trade war with its largest trading partner. That said, Brexit is now on the back burner but the matter is in no way resolved.”

“Energy price caps will help limit inflation, which at the margin lessens the need for some amount of tightening. However, the cap is an artificial construct that doesn’t do anything to address the underlying supply-demand imbalance and comes at a fiscal cost.”

-

12:55

Philippines: Inflation pressures eased a tad in August – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest inflation figures in Philippines.

Key Takeaways

“Headline inflation eased for the first time in six months to 6.3% y/y in Aug after hitting a 45-month high of 6.4% in Jul. The Aug inflation outturn defied our expectation for a rise to 6.5% and Bloomberg consensus for holding steady at 6.4%. It was mainly pulled down by a smaller gain in prices of food, fuels and electricity during the month.”

“However, nearly 70% of 12 CPI components saw a further jump in their prices, indicating that inflation could remain sticky in the near term. Global commodity prices are still subject to upside risks while the country’s currency (PHP) is still prone to a weakening bias, which are wildcards for the inflation outlook going into 4Q22 and 2023. Hence, we believe the blip in Aug inflation is temporary. Inflation will likely rebound to surpass 7.0% by year-end before decelerating and returning to the BSP’s 2.0%4.0% medium-term target range in 2H23. We raise our full-year inflation projections to 5.5% for 2022 (from 5.0% previously, BSP est: 5.0%) and 4.5% for 2023 (from 4.0% previously, BSP est: 4.2%).”

“As the latest inflation outturn is likely to be a temporary blip, it will not deter BSP from hiking rates further this month (22 Sep), in our view. We stick to our call that BSP will hike its policy rates by another 25bps on 22 Sep and thereafter keep the overnight reverse repurchase (RRP) rate at 4.00% through 4Q22 and 2023, unless both global and domestic environments move in unexpected directions.”

-

12:45

EUR/JPY Price Analysis: Next on tap emerges the 2022 high past 144.00

- EUR/JPY widens the rally beyond the 143.00 mark.

- Next target now comes at the 2022 high above 144.00.

EUR/JPY picks up pace and trades with gains for the fourth consecutive session on Wednesday.

Extra gains in the cross remain well favoured for the time being, with the next target now emerging at the YTD high at 144.27 (June 28).

While above the 200-day SMA at 134.68, the prospects for the pair should remain constructive.

EUR/JPY daily chart

-

12:00

United States MBA Mortgage Applications: -0.8% (September 2) vs -3.7%

-

11:56

USD/JPY hits fresh high since August 1998, climbs further beyond mid-144.00s

- USD/JPY gains strong follow-through traction on Wednesday and spikes to a fresh 24-year peak.

- The Fed-BoJ policy divergences continue to weigh heavily on the JPY and remain supportive.

- Retreating US bond yields hold back the USD bulls from placing fresh bets and might cap gains.

The USD/JPY pair builds on the previous day's blowout rally and gains strong follow-through traction on Wednesday. The pair hits a fresh 24-year peak during the first half of the European session and is currently placed just above mid-144.00s.

The dramatic freefall in the Japanese yen remains a key theme in the markets amid a big divergence in the monetary policy stance adopted by the Bank of Japan and other major central banks. It is worth mentioning that the BoJ has been lagging in the process of policy normalisation and remains committed to continuing with its monetary easing. This, along with a modest bounce in the equity markets, weighs heavily on the safe-haven JPY and continues to push the USD/JPY pair higher.

Bullish traders further took cues from the fact that the BoJ said it would buy ¥550 billion of bonds at its regular operations, up from ¥500 billion scheduled, to keep the benchmark 10-year yield below the 0.25% upper limit. The intraday buying, meanwhile, remains unabated despite the latest verbal warning by officials against a sharp fall of the yen. In fact, Chief Cabinet Secretary Hirokazu Matsuno told reporters that he is concerned about rapid, one-sided moves in the currency market recently and added that the government would like to take necessary steps if such movements continue.

Apart from this, the underlying strong bullish sentiment surrounding the US dollar lifts the USD/JPY pair to its highest level since August 1998. Firming expectations that the Fed will stick to its aggressive policy tightening path allow the greenback to stand tall near a two-decade high. In fact, the markets are pricing in a supersized 75 bps rate hike at the September FOMC meeting and the bets were reaffirmed by Tuesday's upbeat US ISM Services PMI. That said, a modest pullback in the US Treasury bond yields might keep a lid on any further gains for the greenback and the USD/JPY pair.

There isn't any major market-moving economic data due for release from the US on Wednesday. Hence, the focus will be on speeches by Fed officials, due later during the early North American session. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the USD/JPY pair. Apart from this, traders might take cues from the broader risk sentiment to grab short-term opportunities. Nevertheless, the fundamental backdrop supports prospects for further gains.

Technical levels to watch

-

11:47

EU's von der Leyen: Will propose a cap on Russian gas

The European Commission will propose a cap on the price of Russian gas imports and will propose a mandatory target for reducing electricity usage at peak hours, European Commission President Ursula von der Leyen told reporters on Wednesday.

"We must cut Russia's revenues which Putin uses to finance this atrocious war in Ukraine," von der Leyen added and said that they will also propose a cap on revenues of companies producing electricity with low costs.

Market reaction

EUR/USD showed no immediate reaction to these comments and it was last seen trading flat on the day at 0.9900.

-

11:37

China: PBoC reduces Foreign Currency Deposit RRR – UOB

UOB Group’s Economist Ho Woei Chen, CFA, and Senior FX Strategist Peter Chia, review the latest decision by the PBoC.

Key Takeaways

“In a statement on Mon (5 Sep), the People’s Bank of China (PBoC) said the reserve requirement ratio for foreign currency deposits (FC RRR) will be reduced to 6% from the current 8% with effect from 15 Sep. This is the second FC RRR cut this year, following a 100bps reduction that took effect on 15 May.”

“Given the outstanding foreign currency deposits of about USD0.95 tn, the 2 percent point cut in the FC RRR is estimated to increase liquidity by around USD19 bn.”

“With the increasing headwinds in China, the PBoC will need to maintain an accommodative monetary policy and a proactive fiscal policy to support the recovery. Chinese officials said on Mon (5 Sep) that the government will accelerate its stimulus rollout in 3Q22. Policy priority will remain on stabilising the economy as well as preventing sharp depreciation to the CNY ahead of the 20th Party Congress that starts on 16 Oct. To further stem the depreciation, the PBoC may also increase offshore bill issuance to absorb the CNH liquidity.”

“The latest move is unlikely to be a game changer for the current bout of CNY weakness. We reiterate our current set of USD/CNY forecasts which are at 7.00 in 3Q22, 7.05 in 4Q22, 7.08 in 1Q23 and 7.10 in 2Q23.”

-

11:37

BoE's Pill: Too much tightening on QT could be offset with less rate hikes

"If we think quantitative tightening (QT) is causing too much tightening, we can offset that with less interest rate increases," Bank of England (BOE) Chief Economist Huw Pill told the UK's Treasury Select Committee on Wednesday.