Notícias do Mercado

-

23:59

USD/CHF Price Analysis: Triple-top in the hourly chart emerges, targets 0.9660

- USD/CHF remains subdued for five consecutive trading days, eyeing a break of the 0.9861 weekly high.

- A triple-top chart pattern in the USD/CHF hourly chart could pave the way towards 0.9660.

The USD/CHF barely advances as the Asian session begins, up by 0.09%, consolidating in the 0.9765-0.9860 range for the fifth straight trading session. At the time of writing, the USD/CHF is trading at 0.9848, above its opening price, after hitting the respective weekly low and high, at 0.9765-0-9861, on Tuesday.

USD/CHF Price Analysis: Technical outlook

The USD/CHF is subdued, though exchanges hands below the weekly high. The Relative Strength Index (RSI), albeit near overbought conditions, suggests that buyers remain in control of the price action. A break above 0.9861 would exacerbate a move towards the July 14 daily high at 0.9886 before testing the 0.9900 psychological level. Once broken, the next stop would be parity.

Short term, the USD/CHF four-hour chart depicts a triple-top formation, meaning that further downside pressure is expected. To validate the pattern, the USD/CHF needs to break below the “neckline” at 0.9765, exacerbating a move towards the triple-top 100-pip target at 0.9660.

USD/CHF Key Technical Levels

-

23:44

EUR/USD sellers flirt with 0.9900 at 19-year low, focus on ECB, Fed’s Powell

- EUR/USD steadies at the lowest levels in two decades as bears keep riens.

- Recession fears, firmer US data favor sellers ahead of the key events.

- ECB is likely to announce 0.50% rate hike, Fed’s Powell may defend aggressive policies.

- Updates on stimulus packages from Europe and the US, second-tier data may entertain traders ahead of the key Thursday.

EUR/USD treads water around 0.9900 after refreshing the 19-year low the previous day as traders await the European Central Bank (ECB) monetary policy meeting and a speech from Fed Chairman Jerome Powell. Also restricting the major currency pair’s latest moves are mixed concerns during Wednesday’s Asian session.

Russia’s pause to all oil/gas exports to the European Union (EU) and firmer US ISM Services PMI enabled the EUR/USD bears to cheer a fresh multi-year low. In doing so, the quote ignored the policymakers’ signals for more stimulus measures to defend the energy companies and the public from the energy crisis.

That said, US ISM Services PMI rose to 56.9 versus 55.1 market forecast and 56.7 prior. However, the S&P Global Composite PMI and Services PMI eased to 44.6 and 43.7 respectively versus 45.0 and 44.1 initial forecasts in that order. Even so, the US Dollar Index (DXY) rose after the release and refreshed a 20-year high.

It should be noted that the mixed comments from the ECB policymakers and downbeat German Factory Orders for August, -13.6% YoY versus -6.1% expected and -9.0% prior, also weighed on the EUR/USD prices.

“Eurozone inflation is close to its peak,” ECB Governing Council member Yannis Stournaras said on Tuesday. Further, ECB policymaker Martins Kazaks said in an interview with Eurofi magazine on Tuesday that the “ECB will hike above a neutral rate if needed.” However, he added that a broad and protracted recession could slow rate hikes. Meanwhile, Governing Council member Mario Centeno said that “the ECB may achieve inflation goal with slow normalization.”

Against this backdrop, Wall Street closed in the red while the 10-year US Treasury yields jumped the most in a month to poke the highest levels since mid-June.

Looking forward, final readings of the Eurozone’s second quarter (Q2) Gross Domestic Product, expected to confirm 0.6% QoQ and 3.9% YoY prints, will precede Fedspeak to entertain EUR/USD traders. However, major attention will be given to the ECB’s action and Fed’s Powell as recession fears challenge the policy hawks.

Technical analysis

A sustained downside trading below July’s low near 0.9950 directs EUR/USD towards the 61.8% Fibonacci Expansion (FE) of May-August moves, near 0.9845. Also acting as an immediate support is the December 2002 low of around 0.9860.

-

23:31

Australia AiG Performance of Services Index rose from previous 51.7 to 53.3 in August

-

23:30

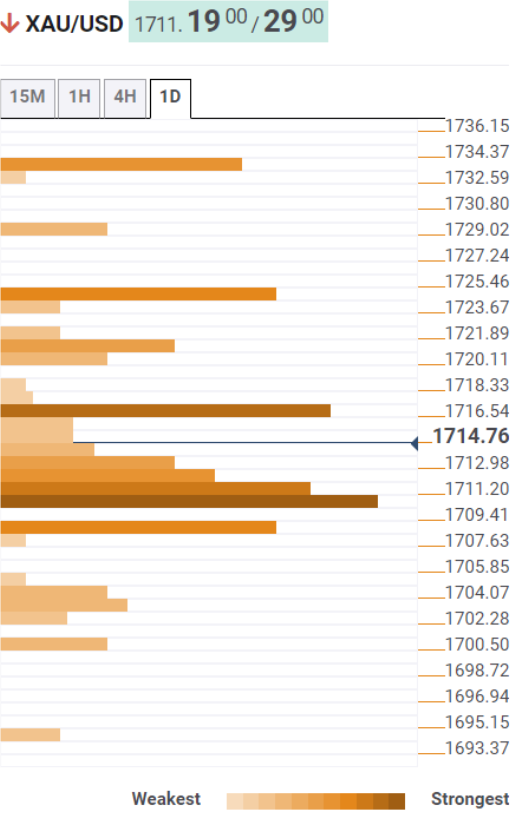

Gold Price Forecast: XAU/USD attempts a rebound from $1,700, Fed Powell’s speech buzz

- Gold price has sensed a buying interest around $1,700.00, downside remains favored on firmer DXY.

- A surprise rise in the US ISM Services PMI data has weakened the precious metal.

- An establishment below 61.8% Fibo retracement at $1,703.51 is indicating more downside ahead.

Gold price (XAU/USD) has picked bids around the psychological support of $1,700.00 in the early Asian session. The precious metal has fetched a buying interest after displaying a sheer downside. Earlier, the yellow metal witnessed selling pressure after attempting to cross $1,725.00 and accelerated downside momentum after dropping below $1,710.00.

The gold prices fell like a house of cards after the release of surprisingly higher US ISM Services PMI data. As the Federal Reserve (Fed) is hiking interest rates vigorously for the past few months to scale down inflationary pressures, a decline in Services PMI was expected by the market participants. However, the Non-Manufacturing data landed at 56.9 vs. 55.1 the expectations, and 56.7 the prior release.

Later this week, the speech from Federal Reserve (Fed) chair Jerome Powell will be of utmost importance. No doubt, price pressures have already displayed signs of exhaustion and have trimmed to 8.5% in July against 9.1% recorded for June. But, the price rise index is still higher than the desired rate of 2% for the longer term. Therefore, investors should brace for a ‘hawkish’ stance by Fed Powell while addressing the world economy about the interest rates.

Gold technical analysis

On an hourly scale, gold prices have surrendered the 61.8% Fibonacci retracement (placed from Thursday’s low at $1,688.92 to Tuesday’s high at $1,726.84) at $1,703.51. A bear cross, represented by the 20-and 50-period Exponential Moving Averages (EMAs) at $1,711.97, is indicating more weakness ahead.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which signals a continuation of downside momentum.

Gold hourly chart

-

23:17

AUD/USD steadies below 0.6750 as bears approach yearly low, Aussie GDP, Fed’s Powell eyed

- AUD/USD remains pressured at seven-week low with eyes on yearly bottom.

- Risk-aversion joined RBA-inspired fears to weigh on prices, US ISM Services PMI favored greenback bulls.

- Stimulus hopes from major economies initially propelled prices before the buyers failed.

- Australia’s Q2 GDP will be important for fresh impulse.

AUD/USD stays bearish at an almost two-month low, after falling the most in eight days the previous day, as the traders await Australia’s second quarter (Q2) Gross Domestic Product (GDP) and a speech from Fed Chair Jerome Powell. That said, the Aussie pair holds lower ground near 0.6730 during the initial Asian session on Wednesday.

The Reserve Bank of Australia’s (RBA) fourth rate hike worth 50 basis points (bps) couldn’t impress the AUD/USD bulls as the Aussie central bank signaled to slow the pace of the rate increase. The RBA also mentioned household spending is “an important source of uncertainty,” weighing on the Aussie prices.

The risk barometer pair also dropped due to the broad risk-aversion amid fears of recession and the central bank aggression after the US data printed higher figures. US ISM Services PMI rose to 56.9 versus 55.1 market forecast and 56.7 prior. However, the S&P Global Composite PMI and Services PMI eased to 44.6 and 43.7 respectively versus 45.0 and 44.1 initial forecasts in that order. Even so, the US Dollar Index (DXY) rose after the release and refreshed a 20-year high.

On the contrary, stimulus hopes from the US, China, the UK and Europe, to battle the energy/covid crisis and defend against slowdown fears, seem to have favored the AUD/USD bulls earlier on Tuesday before the bears took control.

Amid these plays, Wall Street closed in the red while the 10-year US Treasury yields jumped the most in a month to poke the highest levels since mid-June.

Moving on, Australia’s Q2 GDP will be crucial amid the latest challenges to the growth, mainly emanating from China. The forecasts suggest 1.0% QoQ and 3.5% YoY figures versus 0.8% and 3.3% respective priors, matching which could help the AUD/USD prices to consolidate recent losses.

Following that, China's trade numbers for August and Thursday's speech from Fed Chair Jerome Powell will be important as traders seek more clues on the Fed’s next moves amid escalating recession fears.

Technical analysis

A clear downside break of the two-month-old horizontal support area surrounding 0.6770-60 directs the AUD/USD prices towards the yearly low near 0.6680. However, any further downside won’t hesitate to test the downward sloping support line from May near 0.6550.

-

23:17

GBP/JPY Price Analysis: Rallies more than 200 pips on Tuesday, above 164.50 despite a risk-off mood

- GBP/JPY bounced from daily lows below 162.00, advancing sharply and reaching the 165.00 figure.

- The daily chart portrays the GBP/JPY as upward biased.

- Short term, the GB/JPY might retest the YTD highs; otherwise, a fall towards 163.00 is on the cards.

The GBP/JPY breaks above the 162.83 top of a 20-day trading range, rallying sharply more than 250 pips on Tuesday, courtesy of broad Japanese yen weakness across the board, despite a risk-off impulse in the financial markets.

On Tuesday, the GBP/JPY opened near the 20-day EMA, below it at around 161.88, and never looked back, soaring sharply, registering a six-weekly high at around 165.09, in the middle of the New York session. As the Asian Pacific session begins, the GBP/JPY is trading at 164.56, slightly below the opening price.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart illustrates the pair breaking above 162.83, top of the 160.80-162.83 range, opening the door for further gains. Worth noting that the Relative Strength Index (RSI) crossed above the 50-midline to the bullish territory. Therefore, the GBP/JPY could test the 166.00 figure in the near term.

Meanwhile, the GBP/JPY one-hour chart depicts the cross-currency pair retracing from daily highs nearby 165.00, eyeing a fall towards the 20-EMA at 164.15. If the GBP/JPY drops below the latter, it will exacerbate a move towards the daily pivot point at 163.80, followed by the 163.00 figure. Otherwise, if the GBP/JPY holds the fort above 164.00, its first resistance would be the 165.00 mark. Once cleared, the next resistance would be the R1 daily pivot at 165.77, followed by the psychological 166.00 price level.

GBP/JPY Key Technical Levels -

23:00

Chile BCCH Interest Rate registered at 10.75% above expectations (10.5%) in August

-

22:57

GBP/USD struggles around 1.1520 ahead of BOE Bailey and Fed Powell’s speech

- GBP/USD is sensing resistance around 1.1520 as the focus shifts to speeches from central banks.

- An upbeat US ISM Services PMI data has infused fresh blood into the DXY.

- Liz Truss seems on a spree of announcing relief packages to safeguard households against higher inflation.

The GBP/USD pair is facing barriers in crossing the immediate hurdle of 1.1520 in the early Tokyo session. The asset is displaying a volatility contraction phase after correcting from the round-level resistance of 1.1600 on Tuesday. The cable witnessed a steep fall after the market participants underpinned the greenback on robust US ISM Services PMI data.

Upbeat US ISM Services PMI strengthened he DXY

The Non-Manufacturing ISM data landed at 56.9, higher than the estimates and the prior release of 55.1 and 56.7 respectively. A surprising improvement in the Services PMI strengthened the mighty US dollar index (DXY) and printed a fresh two0decade high at 110.55. The DXY is establishing itself above the psychological resistance of 110.00 and is gearing up for a fresh rally ahead.

Going forward, the DXY will dance to the tunes of the speech from Federal Reserve (Fed) Jerome Powell scheduled on Thursday. Fed Powell will provide cues about the likely monetary policy action in September monetary policy meeting.

Truss’s relief packages to scale down the impact of higher inflation

On the UK front, after securing the position of next UK Prime Minister, Liz Truss is continuously announcing relief packages for the households against soaring inflation. To safeguard households from soaring energy bills, Liz Truss announced a fund of 130 billion pounds for freezing bills. Under this, the new cabinet will set a fixed unit price for energy suppliers to sell gas & electricity to households.

And, now Truss will cut taxes for households, which will remain supportive to combat higher payouts. Apart from that, the Cabinet will focus on making more investments and scaling up the employment generation process. In addition to that, the speech from Bank of England (BOE) Governor Andrew Bailey will remain in focus. BOE’s Bailey will dictate the likely monetary policy action at the next policy meeting, scheduled for September 15.

-

21:52

NZD/USD reaches a fresh YTD low at around 0.6035 on risk aversion

- NZD/USD creeps lower to fresh 2022 lows at around the 0.6030s region.

- The US ISM Non-Manufacturing PMI for August exceeded forecasts, surprising market players.

- ANZ Analysts on the NZD/USD: Hard to stand in front of the US dollar train.

The NZD/USD dives from weekly highs at 0.6128 due to worries that the US Federal Reserve would likely continue to tighten monetary policy aggressively after August ISM Manufacturing and Non-Manufacturing readings remained in expansionary territory, with better-than-expected figures.

The New Zealand dollar opened at around 0.6100 before advancing sharply toward the day’s highs. Nevertheless, as market sentiment turned sour, the greenback strengthened, as shown by the NZD/USD tumbling towards the daily lows at around 0.6035. At the time of writing, the NZD/USD is trading at 0.6040, below its opening price.

NZD/USD drops after US ISM Services PMI expanded more than estimates

Earlier in the North American session, the US Institute for Supply Management revealed that the Non-Manufacturing PMI for August expanded by 56.9, exceeding forecasts of 54.9 while peaking at July’s 56.9 reading. Furthermore, New Orders increased to 61.8, more than 59.9 in July, while Prices Paid slowed to 71.5 from 72.3, signaling that higher interest rates are beginning to affect the economy.

So far, US economic data released throughout September further cements the case for a 75 bps rate hike. As reported by the ISM, US factory and services activity continued expanding, and the Nonfarm Payrolls, exceeding estimates, paint a solid economic outlook for the US. The last piece of the puzzle would be the Consumer Price Index (CPI), to be released next week.

Meanwhile, the US Dollar Index, a gauge of the buck’s value, is up by 0.60%, at 110.263, hitting a fresh 20-year high during the session, underpinned by the rise in US T-bond yields. The US 10´-year benchmark note rate sits at 3.351%, up by 13 bps.

An absent New Zealand economic docket would leave NZD/USD traders adrift to US dollar dynamics, alongside Cleveland’s Fed Loretta Mester speech on Wednesday.

ANZ Analysts on the NZD/USD: Hard to stand in front of the US dollar train

Analysts of ANZ bank, in a note to clients, wrote: “Markets remain highly focussed on offshore factors, and while NZ interest rates here will rise in broad unison with their US counterparts, the USD’s dominance will just keep piling pressure in inflation here, which in turn speaks to a firmer policy response and more pain. Bottom line – it’s hard to stand in front of the US dollar train at the moment.”

NZD/USD Key Technical Levels

-

21:33

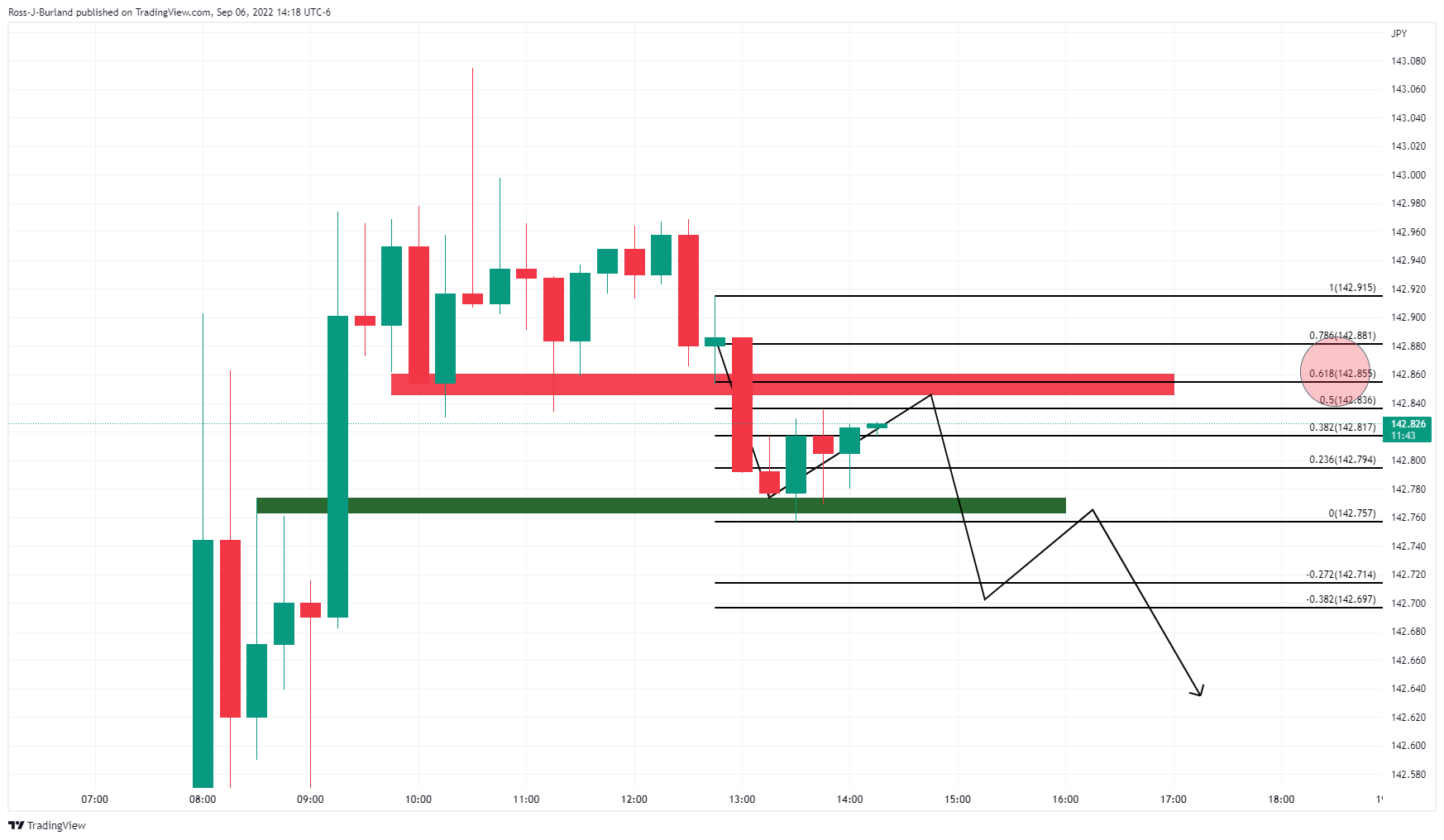

USD/JPY Price Analysis: Bears step in, but there is some work to do yet

- USD/JPY bears are moving in but there could be some more working of the highs to come yet.

- The price has rallied parabolically and a pullback could be on the cards.

USD/JPY rallied on Tuesday and took out the symbolic level of 142, scoring a fresh 24-year low as the US dollar sprung into life again and while the gap between Japanese monetary policy and its counterparts widens. USD/July hit the highest levels since August 1998.

The Japanese Finance Minister Shunichi Suzuki jaw-boned the currency but that did nothing to prevent it from falling to a 24-year low on Tuesday. He reiterated that sharp yen moves were "undesirable" and that he was watching rising volatility in the exchange market with a "great sense of urgency".

"It's important for currencies to move stably, reflecting economic fundamentals," Suzuki told reporters at the finance ministry. When pressed to comment on the impact of a weak yen on the economy, Suzuki said "a weak yen has both merit and demerit, but sharp moves are undesirable."

The yen has slumped nearly 20% since the start of the year, on diverging monetary policies between Japan and the United States. However, the Reserve Bank of Australia also hiked rates this week and the focus will turn to the European Central Bank which is also expected to pull the trigger again, potentially hiking as high as 75bps.

Meanwhile, the US dollar has been a major culprit in the extreme moves in forex this week. On Tuesday, data was the catalyst again with the August ISM services index beating expectations, rising to 56.9 (56.7 previously, 55.3 expected). ''The data complement the labour market’s strength and suggest that the economy remains some distance from recession,'' analysts at ANZ Bank said.

USD/JPY technical analysis

The price could be in for some corrective activity for the day ahead and the 50% mean reversion level signs with the first three hours of Wall Street's high.

From a 15-min time frame basis, the peak formation is more convincing, but a correction to the 61.8% could still be on the cards to restest the support of the topping formaiton. A downside extension of the bearish breakout impulse could be on the cards thereafter.

-

20:59

Forex Today: Pain for the EUR means gains for the USD

What you need to take care of on Wednesday, September 7:

The greenback extended its winning streak, ending Tuesday higher against most of its major rivals. The EUR and the JPY were the worst performers, falling to multi-year lows against their American rival. EUR/USD traded as low as 0.9863, now hovering around 0.9900, while USD/JPY trades a handful of pips below 143.07, a level that was last seen in 1998.

The weakness of the shared currency is directly linked to the conflict with Russia, as the latter cut all gas provision to the Old Continent. Western nations are still looking to cap Russian oil.

The GBP/USD pair is also under pressure, but ending the day, little changed at around 1.1510. The UK Prime Minister Liz Truss has announced energy bail-outs to cope with the crisis that affects all of Europe. Truss proposed to freeze roughly £130 billion in household energy bills while mulling another £40 billion for small businesses.

The Aussie was the weakest commodity-linked currency, with AUD/USD down to 0.6730 after the RBA hinted it would slow the hiking pace. The country will release Q2 Gross Domestic Product early on Wednesday.

The USD/CAD hovers around 1.3150, helped by weakening crude oil prices. WTI currently trades at $86.80 a barrel.

Spot gold trades at around $1,700 a troy ounce.

US data unexpectedly beat expectations as the US Services PMI advanced to 56.9 in August, also beating the market’s expectations. Government bond yields soared, with the 10-year Treasury note currently yielding 3.34%.

Wall Street seesawed between gains and losses along the session but gave up ahead of the close. Major indexes closed in the red, despite their European counterparts being able to post modest gains.

Binance to begin auto converting users’ USDC into BUSD

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:19

EUR/USD Price Analysis: Bears taking on critical H4 support

- EUR/USD bulls have moved in and there is a meanwhile focus on a correction.

- The bears, on the other hand, are seeking a break of the critical longer-term support structure.

As per the prior analysis from the start of the week, EUR/USD Price Analysis: Bulls eye a 50% mean reversion near 0.9950, the price moved into the key resistance but has subsequently fallen down to test a critical support structure again.

The following illustrates the bearish bias while below 0.9980:

EUR/USD prior analysis

As illustrated above, the price was creeping in on the gap and it had made a 38.2% Fibonacci retracement, but a fuller correction was to be expected prior to the next bearish impulse to the downside.

The bullish inverse head and shoulders were also a compelling feature on the hourly time frame:

EUR/USD live update

As shown, the price followed the projections accordingly and now the focus is on the M-formation and critical support that could now act as resistance:

On the other hand, there are bullish structures that have formed on the lower timeframes. The following 15-min W-formations could result in some meanwhile demand in the coming sessions:

-

19:41

EUR/JPY Price Analysis: Rallies to fresh seven-week highs due to JPY weakness

- EUR/JPY bounces nearby the 20-day EMA and jumps more than 200 pips on Tuesday.

- The EUR/JPY daily bias shifted from neutral to upwards.

- In the near term, a re-test of the YTD high at 144.27 is likely if EUR/JPY buyers reclaim 142.32; otherwise, it might fall towards 138.00.

The EUR/JPY rallies sharply as the Japanese yen continues weakening across the FX board, up by almost 1.50%, nearly 200 pips. At the time of writing, the EUR/JPY is trading at 141.53, some pips below the seven-week high.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY extended its gains for the second consecutive day during the week. The cross-currency pair bounced off the week's lows at 136.91, so far advancing close to 300 pips, and on its way north, it cleared the September 2 daily high at 140.75. Therefore, the EUR/JPY bias shifted from neutral to upward biased, opening the door for further gains.

The EUR/JPY four-hour chart depicts the pair as upward biased, clearing crucial supply areas on its rally above 141.50. If EUR/JPY buyers reclaim the July 21 daily high at 142.32, a test of the YTD at 144.27 is on the cards.

Therefore, the EUR/JPY's first resistance would be the 142.00 mark. Break above will expose the July 21 high at 142.32, followed by the 143.00 figure and the YTD high target. On the flip side, the EUR/JPY first support would be the September 2 daily high at 140.75, followed by the 20-EMA at 139.95 and the 50-EMA at 138.70.

EUR/JPY Key Technical Levels

-

19:26

Gold Price Forecast: XAU/USD bleeds out from key resistance, but how far can the US dollar climb?

- Gold bears move back in following a significant bullish correction.

- The US dollar is moving on on a weekly target in the DXY near 110.80.

- The US CPI data next week will be a critical feature on the calendar ahead of the Fed.

The gold price on Tuesday has fallen back under pressure as the New York session blasts the US dollar to the moon on the back of mixed data at the start of the session. The yellow metal fell from a one-week high amid the ongoing speculation that global banks will continue along the path of their aggressive monetary policy tightening. Gold, at the time of writing, is lower by some 0.5% at $1,700 after falling from a high of $1,726.79 to the current lows.

The US dollar jumped on the back of the US services industry PMIs for August that have underpinned the market's opinion that the economy was not in recession last month. The DXY index, which measures the greenback vs. a basket of currencies rallied to fresh bull cycle highs of 110.553 while the Institute for Supply Management said its Non-manufacturing PMI edged up to a reading of 56.9 last month from 56.7 in July, the second consecutive monthly increase after three months of declines. The growth in services followed the ISM's manufacturing survey last week that showed US factory activity grew steadily in August, outpacing the nation's counterpart economies, such as Europe and China.

This data, however, will come in second place to next week's US Consumer Price Index for August where the core rate will be scrutinised for signs that the Fed will hike by 75bps rather the 50bps. Fed fund futures are now pricing in a 73% chance of a 75-basis-point rate hike by the Fed at its Sept. 20-21 policy meeting.

Meanwhile, the US benchmark Treasury yields rallied to their highest levels since June on expectations that the Federal Reserve will keep hiking interest rates which have weighed on the gold price considering its strips away the opportunity cost of holding the non-yielding precious metal.

However, analysts at TD Securities argued that ''while rates pricing now appears closer to fair, gold markets have failed to price the implications of a sustained period of restrictive interest rates.''

''Historical analogs suggest that periods in which market expectations for the real fed funds rate were above estimates of the natural rate of interest were accompanied by a persistent underperformance in gold prices. In turn, while gold prices may now have accurately captured the expected level of interest rates, they are not reflecting the implications of a sustained period of the restrictive policy,'' the analysts explained.

''Further,'' the analysts said, 'we see odds of a major capitulation event growing with every tick lower in gold prices, which could coincide with a break below a multi-decade uptrend in the yellow metal near $1675/oz. Gold markets still feature an extremely concentrated and bloated position held by a small number of family offices and proprietary trading shops, which are increasingly at risk as prices approach their pandemic-era entry levels.''

Gold technical analysis

As per the pre-open analysis, Gold, Chart of the Week: Bears eye a break of multi-decade uptrend near $1,676, it was explained that the price had since corrected from a strong sell-off on the daily timeframe and the bulls were moving which left prospects for a deeper correction over the start of the week as illustrated on the chart below:

Gold, live market update

The price was headed towards a price imbalance near $1,721 and beyond there, a 50% mean reversion comes in near $1,727 prior structure. The bears have committed to the market here and we have seen a subsequent move to the downside again. This leaves the extension of the downside probable for a retest of the 2021 lows around $1,676:

With that being said, the US dollar may struggle at this juncture, at least for the immediate future as it homes in on a 110.80 weekly level:

-

18:51

United States 52-Week Bill Auction increased to 3.46% from previous 3.2%

-

18:27

AUD/USD falls sharply below 0.6800 despite RBA’s rate hike, Aussie GDP data eyed

- AUD/USD falls from weekly highs at around 0.6830s due to increased odds of an aggressive Fed hike.

- US ISM Non-Manufacturing activity for August surprisingly exceeded estimations, easing US recession worries.

- Australia’s GDP for the Q2, quarterly and yearly, is eyed on Wednesday’s Asian session.

The AUD/USD dives below its opening price, snapping two days of gains after the Reserve Bank of Australia hiked rates as expected. However, upbeat US economic data fueled estimations that, indeed, the US Federal Reserve would hike by 75 bps the Federal Funds Rate (FFR) in the September 21-22 meeting.

The AUD/USD reached Tuesday’s high after the RBA’s decision around 0.6832. but extended its losses, despite Philippe Lowe and Co. reiterating that the central bank is not done with tightening monetary conditions. So the AUD/USD extended its losses earlier in the North American session and is trading at 0.6732 at the time of writing.

AUD/USD dives on positive US economic data, despite RBA’s rate hike

During the New York session, August’s US ISM Non-Manufacturing PMI rose to 56.9, higher than forecasts at 54.9, and topped July’s 56.9 reading. Furthermore, New Orders increased to 61.8, more than 59.9 in July, while Prices Paid slowed to 71.5 from 72.3, signaling that higher interest rates are beginning to affect the economy.

Earlier in the Asian session, the Reserve Bank of Australia decided to raise rates by 50 bps, as widely estimated by analysts. Furthermore, the central bank kept the door open for further increases, but they are not on a pre-set path and would be guided by incoming economic data and the outlook for inflation and the labor market.

Later in the day, the Australian economic docket will feature GDP for Q2, with estimates at around 1% QoQ and 3.5% YoY. Analysts at TD Securities estimate GDP at 1.3% QoQ and 3.9% YoY.

“This should pip the market’s and the RBA’s 1% q/q, 3.5% y/y forecast. In terms of breakdown, we expect consumption +1% q/q, investment +0.6% q/q, net exports +0.8% ppt, and inventories +1.5% q/q. We don’t think a softer outcome (0.7 % q/q or below) will materially change the near-term RBA outlook, but a print of 1.5% q/q or above is likely to be viewed as hawkish by the market,” TDS analysts noted.

On the US front, Cleveland’s Fed President Loretta Mester is due to speak on Wednesday.

AUD/USD Key Technical Levels

-

17:40

Türkiye: CPI surprises to the downside in August, likely to be at 70% by year-end - BBVA

Inflation data in Türkiye came in below expectations in August with an increase of 1.46% in August. According to the Research Department at BBVA, stronger aggregate demand than supply, high cost push factors, recent utility price hikes and significantly deteriorated inflation expectations will lead to further acceleration in the Consumer Price Index despite recent easing in global commodity prices. Theys expect year-end consumer inflation at 70%, being supported by favorable base effects and assuming no further shocks to the exchange rate.

Key Quotes:

“Consumer prices rose by 1.46% in August, once again below both market consensus and our expectation (2%), which led to an annual inflation of 80.2%. The downside surprise stemmed from a larger decline in energy prices and weaker food inflation.”

“The surprise in energy prices also led to a smaller increase (2.4% mom) in domestic producer prices compared to previous months and resulted in an annual inflation of 143.7%.”

“We envisage that without any clear coordination on both fiscal and monetary policies to fight against inflation, the time inconsistency problem would eventually lead to higher inflation figures than the official targets as we had repeatedly witnessed in the recent years. High inertia, particularly on backward indexation (such as wages and rents), worsened inflation expectations, loose economic policies, and swelling intervention and regulatory barriers will continue to keep upside risks on the inflation outlook.”

“Ongoing high external financing needs and strong dollarization fuel depreciation pressures, which result in higher production costs. Therefore, we forecast consumer inflation to be 70% at the end of this year and 33% at the end of 2023, with risks skewed to the upside.”

-

17:24

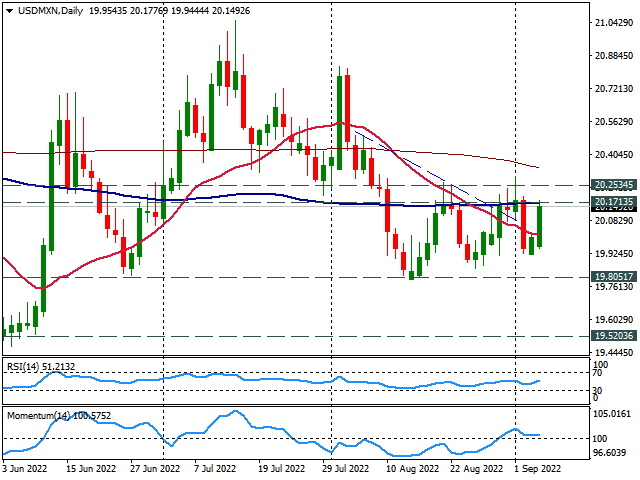

USD/MXN Price Analysis: Testing 20.17 while looking at the critical 20.25

- USD/MXN jumps back above 20.00 as dollar strengthens versus emerging market currencies.

- Pair hits the 100-day SMA and retreats.

- Daily close above 20.25 to point to more gains.

The USD/MXN is rising for the second day in a row on Tuesday, boosted by a stronger US dollar and extending a rebound after approaching to 19.90. The pair peaked at 20.17, after the release of US economic data, matching the 100-day Simple Moving Average (SMA).

The immediate resistance stands at 20.17; above the USD/MXN could rise to test 20.25. A break higher should change the short-term bias to neutral/bullish. A daily close above 20.25 would be a positive development of the US dollar, targeting the 20.45 zone.

Since mid-August USD/MXN is moving sideways in a range between 19.80 and 20.25. An interim support area is seen at 19.90. A firm break under 19.80 would weaken the dollar further, exposing 19.72.

USD/MXN daily chart

-

17:15

UK PM Truss: Will cut taxes to reward hard work

In a speech delivered on Tuesday, incoming British Prime Minister Liz Truss said that she will cut taxes to reward hard work, as reported by Reuters.

Additional takeaways

"We now face severe global headwinds."

Now is the time to tackle the issue holding Britain back."

"We need more investment and jobs in towns."

"We have what it takes to tackle national challenges."

"We can't have security at home without security abroad."

"I will get Britain working again."

"I will deal hands-on with the energy crisis."

"I will take action this week."

"I will secure our future energy supply."

"I will make sure people get the health services they need."

"We shouldn't be daunted by challenges we face."

Market reaction

GBP/USD pair showed no immediate reaction to these remarks and was last seen rising 0.25% on the day at 1.1540.

-

17:11

USD/CAD drops from weekly highs ahead of the BoC’s decision

- USD/CAD retraces from daily highs on the Bank of Canada’s monetary policy decision looming.

- In the last couple of weeks, upbeat US economic data reinforces the economy is stronger than the GDP contraction in the second quarter.

- On Wednesday, the Bank of Canada (BoC) is expected to hike rates by 75 bps.

The USD/CAD trims some of its Monday’s gains, edged slightly lower by some 0.08% after upbeat US economic data reinforced the scenario of the Fed’s tightening 75 bps in the September meeting. Nevertheless, the market’s reaction was limited due to expectations of the Bank of Canada hiking rates ahead of the Fed’s September meeting.

The USD/CAD extended its losses after hitting a daily high at 1.3170, though it erased those gains post-US economic data release, with the spot price stabilizing at current price levels. At the time of writing, the USD/CAD is trading at 1.3124.

USD/CAD trims some of its Monday’s gains on the BoC monetary decision looming

On Tuesday, the US economic calendar featured the US ISM Non-Manufacturing PMI for August, which exceeded estimations of 54.9, coming at 56.9 vs. 56.7 in the previous month’s reading. The same report showed the Prices Paid Index slowing to 71.5 from 72.3, while New Orders ticked up to 61.8, higher than 59.9 in July.

In the meantime, the US Dollar Index, a gauge of the buck’s value against a basket of six currencies, march firmly above the 110.000 mark, at 110.195, up by 0.54%, underpinned by higher US Treasury bond yields. The US 10-year benchmark note rate sits at 3.322%, up by ten bps, the highest level since June 2022.

Elsewhere, the Bank of Canada is expected to hike rates by 75 bps in September 7 meeting. The Bank of Canada Governor Tiff Macklem clarified that the central bank is focused on getting rates “slightly above” the neutral rate, where monetary policy neither stimulates nor weighs on the economy. Analysts estimate that the BoC would likely pause, after its anticipated hike, after last week’s GDP release suggested that the economy is cooling faster than expected.

What to watch

The Canadian economic docket will feature the Bank of Canada monetary policy decision on Wednesday. On the US front, Cleveland’s Fed President Loretta Mester will cross newswires.

USD/CAD Key Technical Levels

-

16:54

US ISM Services: Most components moving in the right direction – Wells Fargo

The ISM service sector activity index showed the highest reading in four months, after an unexpected increase in August. The underlying details point to services resilience with business activity and new orders notching their highest reading this year, explained analysts at Wells Fargo. They point out that supply challenges are easing, but hiring remains a challenge for employers.

Key Quotes:

“The ISM services index rose 0.2 points in August to 56.9, marking the fastest pace of expansion in the sector in four months. Most of the underlying components of the survey moved in the right direction and the headline index was buoyed by a pickup in business activity and new orders.”

“While hiring remains a challenge, the employment component climbed back into expansion territory in August. Hiring has wobbled between expansion and contraction for most of the year, despite sturdy job gains in the actual payroll report. Some of the gap is likely explained by employers being unable to find workers.”

“Among many crosscurrents in the economy at present, the outlook for services spending is an important one and the latest data suggest continued expansion in the sector. Consumer demand looks to be resilient despite high inflation and rising interest rates. It's not a lack of demand, but still strained supply that remains the biggest issue.”

-

15:58

GBP/USD wobbles around 1.1520 after upbeat US ISM Services PMI

- GBP/USD trimmed earlier gains nearby the 1.1600 figure on positive US economic data.

- The US services sector improved while price pressures continued to ease.

- Kwasi Kwarteng, the so-called new Chancellor in the UK: “Truss government would not blow a hole in public finances.”

The GBP/USD tumbled toward its opening price after the US ISM Non-Manufacturing PMI, a gauge of the services sector in August, improved, while supply bottlenecks and price pressures eased.

The GBP/USD is trading at 1.1528, slightly above its opening price, after hitting a fresh weekly high around 1.1609, but better-than-estimated US data sent cable nosediving, reaching a daily low at around 1.1493.

The Institute for Supply Management reported that the US ISM Non-Manufacturing PMI was up 56.9 vs. 56.7 in July, above estimates of 54.9, according to Reuters. Some of the report’s highlights were New Orders ticking up to 61.8, higher than 59.9 in July, while the Prices Paid Index decelerated to 71.5 from 72.3.

The GBP/USD edged lower, registering a daily low at the data release, at 1.1493. However, it bounced off the lows toward the current exchange rate. At the same time, the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, edged towards 110.390, up 0.73%.

Earlier during the day, Queen Elizabeth appointed Liz Truss as the new UK Primer Minister. In the meantime, Kwasi Kwarteng, set to be the UK’s next Chancellor of the Exchequer, said that the new government would not blow a hole in the public finances, as widely expected via the FT.

Kwarteng added that the new administration would act in “a fiscally responsible way,” adding that the Truss government would be “bold” in promoting growth. He noted, “Liz is committed to a lean state and, as the immediate shock subsides, we will work to reduce the debt-to-GDP ratio over time.”

Datawise, the UK economic docket featured the S&P Global CIPS Construction PMI for August, which came at 49.2, higher than July’s 48.9, but remained in contractionary territory. The all-sector PMI, which includes data from the services segment and manufacturing, dropped to 49.6 from 51.8 in July, reinforcing the challenges that the new UK Prime Minister Liz Truss would face.

What to watch

The UK economic docket will feature the Halifax House Prices for August, while on the US front, the Trade Balance, alongside Fed speakers, will shed some light on the economic conditions in the US.

GBP/USD Key Technical Levels

-

15:57

New Zealand GDT Price Index above expectations (-1.4%): Actual (4.9%)

-

15:55

NZD/USD his two-year lows near 0.6000 after US data

- US dollar hits fresh highs across the board after US data.

- ISM service for August comes above expectation.

- NZD/USD drops sharply, remains above 0.6000.

The NZD/USD dropped further after the release of the US ISM service sector report and bottomed at 0.6034, the lowest level since May 2020. It then rebounded to 0.6050 trimming losses.

Upbeat US data, bad news

The August ISM service sector index rose unexpectedly to 56.9 against expectations of 55.1. The recovery boosted further the US dollar that printed fresh highs. Equity prices in Wall Street hit new lows and US yields jumped.

The NZD/USD reached levels below last week's lows. It is hovering around 0.6050, still on its way to the lowest daily close in years. A consolidation clearly below 0.6050 should open the doors for a test of 0.6000.

The stronger dollar and the deterioration in risk sentiment could keep the NZD/USD under pressure. Also, commodity prices are falling. The Chinese yuan hit new multi-year lows versus the dollar with USDCNH approaching 7.00.

On Wednesday, China will report trade data for August, and Australia, Q2 growth numbers. The relevant report of the week in New Zealand will be on Thursday with Q2 manufacturing activity. “This reading is key for the economic outlook after Q2 real retail sales unexpectedly fell -2.3% q/q vs. -0.9% in Q1, raising the risk that Q2 GDP also contracts again after -0.2% q/q in Q1”, said analysts at Brown Brothers Harriman.

Technical levels

-

15:25

Gold Price Forecast: XAU/USD not reflect the implications of a sustained period of restrictive policy – TDS

Gold markets have failed to price the implications of a sustained period of restrictive interest rates. Therefore, economists at TD Securities expect the yellow metal to remain vulnerable.

Odds of a major capitulation event grow with every tick lower

“Historical analogs suggest that periods in which market expectations for the real fed funds rate were above estimates of the natural rate of interest were accompanied by a persistent underperformance in gold prices. In turn, while gold prices may now have accurately captured the expected level of interest rates, they are not reflecting the implications of a sustained period of restrictive policy.”

“We see odds of a major capitulation event growing with every tick lower in gold prices, which could coincide with a break below a multi-decade uptrend in the yellow metal near $1,675.”

-

15:04

EUR/USD makes a U-turn and drops to new lows near 0.9870

- EUR/USD reversed the initial uptick to the vicinity of 0.9990.

- The dollar pushes higher and records new cycle highs.

- US ISM Non-Manufacturing next of relevance in the docket.

After briefly testing the 0.9990 region, EUR/USD sparked a corrective downside and returned to the sub-0.9900 region on Tuesday.

EUR/USD could now revisit the 2022 low

EUR/USD now adds to Monday’s negative start of the week and revisits the area below the 0.9900 yardstick on the back of the abrupt change of direction in the greenback, which lifts the US Dollar Index (DXY) to new highs near 110.30, an area last traded back in December 2002.

The daily downtick in the pair comes hand in hand with the march higher in US and German yields, as US investors return to their desks following Monday’s inactivity due to the Labor Day holiday.

Earlier in the euro docket, Germany’s Construction PMI eased to 42.6 in August (from 43.7). In the US calendar, the ISM Non-Manufacturing surprised to the upside at 56.9 in August.

What to look for around EUR

EUR/USD failed to ignite a lasting bullish attempt and succumbed once again to the unabated rally in the dollar.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence. The latter, in the meantime, keeps closely following the prevailing debate around the size of the next interest rate hikes by both the ECB and the Federal Reserve.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany Construction PMI (Tuesday) – Flash EMU Q2 GDP Growth Rate (Wednesday) – ECB Interest Rate Decision, Fed Powell (Thursday) – Eurogroup Meeting, Emergency Energy Meeting (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is losing 0.52% at 0.9876 and a breach of 0.9874 (2022 low September 5) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2002 low). On the other hand, the next up barrier emerges at 1.0090 (weekly high August 26) ahead of 1.0182 (55-day SMA) and then 1.0202 (August 17 high).

-

15:02

US: ISM Services PMI improves to 56.9 in August vs. 55.5 expected

- US ISM Services PMI improved modestly in August.

- US Dollar Index touched a two-decade high above 110.50 after the data.

The business activity in the US service sector expanded at a slightly stronger pace in August than it id in July with the ISM Services PMI rising to 56.9 from 56.7. This reading came in better than the market expectation of 55.5.

Further detail of the publication revealed that the Prices Pair Index declined modestly to 71.5 from 72.3 and the Employment Index recovered to 50.2 from 49.1.

Commenting on the survey, "the services sector had a slight uptick in growth for the month of August due to increases in business activity, new orders and employment," noted Anthony Nieves, Chair of the Institute for Supply Management Services Business Survey Committee.

"Based on comments from Business Survey Committee respondents, there are some supply chain, logistics and cost improvements; however, material shortages remain a challenge," Nieves added. "Employment improved slightly despite a restricted labor market."

Market reaction

The US Dollar Index extended its dally and touched a fresh two-decade high of 110.55 with the initial reaction to the ISM report.

-

15:00

United States ISM Services PMI above expectations (55.1) in August: Actual (56.9)

-

15:00

United States ISM Services Prices Paid below expectations (76.5) in August: Actual (71.5)

-

15:00

United States ISM Services Employment Index above expectations (48.2) in August: Actual (50.2)

-

15:00

United States ISM Services New Orders Index registered at 61.8 above expectations (57) in August

-

14:52

Gold Price Forecast: XAU/USD refreshes daily low, eyes $1,700 amid Fed rate-hike jitters

- Gold struggles to preserve early gains to a one-week low and turns lower for the second straight day.

- Hawkish Fed expectations, rising US bond yields, resurgent USD demand exert downward pressure.

- The risk-on impulse overshadows recession fears and fails to lend support to the safe-haven XAU/USD.

Gold witnessed an intraday turnaround from a one-week high, around the $1,727 region touched earlier this Tuesday and turns lower for the second successive day. Spot prices refresh daily low during the early North American session, albeit have managed to hold above the $1,700 round-figure mark.

The risk-on impulse - as depicted by a generally positive tone around the equity markets - turns out to be a key factor that failed to assist the safe-haven gold to capitalize on its early positive move. Apart from this, the emergence of fresh US dollar buying attracts fresh selling around the dollar-denominated commodity and contributes to the intraday decline.

In fact, the USD Index has shot back closer to a two-decade high touched earlier this week and remains well supported by hawkish Fed expectations. Investors seem convinced that the Fed will continue to tighten its monetary policy more aggressively to tame inflation. Moreover, the current market pricing indicates a greater chance of a 75 bps rate hike in September.

This, in turn, triggers a fresh leg up in the US Treasury bond yields, which provides an additional lift to the buck and contributes to driving flows away from the non-yielding gold. That said, growing recession fears, along with economic headwinds stemming from fresh COVID-19 curbs in China, might keep a lid on the optimistic move and lend support to the precious metal.

Nevertheless, the bias still seems tilted in favour of bearish traders and supports prospects for a further depreciating move. Some follow-through selling below the $1,700 mark will reaffirm the negative outlook and make gold vulnerable to retesting last week's swing low, around the $1,689 region, before eventually dropping to the $1,680 area, or the YTD low touched in July.

Technical levels to watch

-

14:50

US: S&P Global Composite PMI falls to 44.6 (final) in August from 47.7

- US S&P Global Composite PMI declined to 44.6 in August.

- US Dollar Index posts strong gains above 110.00 in the American session.

Economic activity in the US private sector contracted at a stronger pace in August than it did in July with the S&P Global Composite PMI dropping to 44.6 from 47.7. This print came in weaker than the flash estimate and the market expectation of 45.

Further details of the publication revealed that the S&P Global Services PMI slumped to 43.7 from 47.3 in July, compared to the flash estimate of 44.1.

Commenting on the PMI report, "August saw the US economy slide into a steepening downturn, underscoring the rising risk of a deepening recession as households and business grapple with the rising cost of living and tightening financial conditions," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen rising 0.6% on the day at 110.25.

-

14:46

United States S&P Global Composite PMI below expectations (45) in August: Actual (44.6)

-

14:46

United States S&P Global Services PMI came in at 43.7, below expectations (44.1) in August

-

14:28

BoC Preview: Forecasts from eight major banks, hiking rates again

The Bank of Canada (BoC) is set to announce its interest rate decision on Wednesday, September 7 at 14:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of nine major banks, regarding the upcoming announcement.

The BoC is widely expected to hike its policy rate by 75 basis points (bps) to 3.25% from 2.50% following its September policy meeting.

BMO

“We now look for a 75 bps hike, with an outside chance of a larger move (a la their July 100 bps surprise).”

ING

“We do see a hawkish 75 bps hike supporting CAD on the day of the announcement, but most of the benefits of the BoC tightening for the loonie may take time to emerge, and would likely rely on stabilisation in global risk sentiment and some easing in USD strength. This could start to happen towards the end of the year, and still, high energy prices do suggest that a move to 1.25 in early 2023 is a tangible possibility.”

RBC Economics

“Another hefty 75 bps increase in the overnight rate is what we expect from the BoC. This would take the rate to a restrictive 3.25%, just above the 2% to 3% range the central bank deems ‘neutral’ (the rate at which interest rates are neither adding to nor subtracting from longer-run economic growth trends). And the bank’s commitment to front-loading rate hikes in the face of red-hot inflation means an even bigger 100 bps increase (matching July’s hike) can’t be ruled out. We expect policymakers to maintain a tightening bias beyond September, and follow up with an additional 25 basis point hike in October, bringing the overnight rate to 3.5%.”

TDS

“The economic situation clearly calls for restrictive policy rates, and we see a clear path for the BoC to hike by 75 bps in September. We expect the pace of tightening to slow in October however, which may imply some moderation in the Bank's forward-looking language in the September communique.”

NBF

“The BoC is set to deliver its fifth rate increase in as many meetings. We believe that 75 bps is the most likely outcome. In addition to the headline decision, there will be as much attention on updated policy guidance. We’ve argued that the BoC should pause its hiking cycle after bringing the policy rate into restrictive territory, allowing the economy time to catch up to the rapid tightening introduced to date. We might not see this explicitly written in the statement, but we’ll be looking for clues that the Bank is considering taking its foot off the brake – perhaps by emphasizing the need to be ‘data dependent’ going forward. The decision itself will be a statement-only affair, but we will hear from Senior Deputy Governor Carolyn Rogers on Thursday in an Economic Progress Report.”

Citibank

“We expect a 75 bps hike by the BoC, taking the policy rate to 3.25% with modestly hawkish risks around communications. Ultimately, the September meeting may still be too soon to sway much from a still-very aggressive stance to raising rates in order to cool inflation. Updates to the September policy statement could echo the op-ed released by Governor Macklem in August following the softer July CPI report. This suggests the statement could express some optimism around a potential peak in inflation as energy prices have declined. However, this is unlikely to reflect a new shift in the BoC’s assessment of the current inflation backdrop. So far, rate hikes have been explicitly characterized as front-loading, but this guidance may be rewritten as further rate hikes reflect a move to a restrictive level of rates. Our base case is that the BoC is unlikely to guide towards reaching a point of pausing the hiking cycle at least until the October meeting.”

CIBC

“We’re looking for a 75 bps hike, with the statement changing to say that interest rates might (rather than will) have to rise further.”

Wells Fargo

“We expect the BoC to deliver a 75 bps hike to 3.25%. We think the BoC will slow down the pace of its hikes beyond September, only taking the policy rate to 3.75% by the end of Q4-2022, although we see the risks as remaining tilted to a higher peak. We will be particularly interested in guidance on future policy from the BoC, especially against a backdrop of slowing growth and still-elevated inflation.”

-

14:08

When is the US ISM Services PMI and how could it affect EUR/USD?

US ISM Services PMI Overview

The Institute of Supply Management (ISM) will release the Non-Manufacturing Purchasing Managers' Index (PMI) - also known as the ISM Services PMI – at 14:00 GMT this Tuesday. The gauge is expected to fall to 55.1 in August from 56.7 in the previous month. Given that the Fed looks more at inflation than growth, investors will keep a close eye on the Prices Paid sub-component, which is anticipated to rise from 72.3 in July to 76.5 during the reported month.

According to Yohay Elam, Senior Analyst at FXStreet: “The services sector, America's largest, has been humming along at a rapid clip since the worst of the pandemic. Despite easing in early 2022, the indicator remained well above 50. That is the level separating expansion from contraction.”

How Could it Affect EUR/USD?

Ahead of the key release, the US dollar climbs back closer to a two-decade high set earlier this week amid a fresh leg up in the US Treasury bond yields, bolstered by hawkish Fed expectations. A stronger-than-expected US macro data will reinforce bets for a supersized 75 bps Fed rate hike move in September and lift the US bond yields even higher, along with the greenback.

Conversely, a weaker print will add to worries about a global economic downturn and act as a tailwind for the safe-haven greenback. This, along with worries about the worsening energy crisis in Europe, which could drag the region's economy faster and deeper into the recession, suggests that the path of least resistance for the EUR/USD pair is to the downside.

Eren Sengezer, European Session Lead Analyst at FXStreet, offers a brief technical overview of the EUR/USD pair: “The Relative Strength Index (RSI) indicator on the four-hour chart edged lower after having climbed above 50 during the Asian trading hours, reflecting the buyers' unwillingness to commit to additional euro gains.”

Eren also outlines important levels to trade the EUR/USD pair: “Currently, the pair is trading at 0.9950, where the 20-period SMA is located. In case this level turns into resistance, additional losses toward 0.9900 (psychological level) and 0.9880 (September 5 low) could be witnessed.”

“On the other hand, EUR/USD faces immediate resistance at 0.9980 (50-period SMA) ahead of 1.0000 (psychological level, Fibonacci 23.6% retracement of the latest downtrend) and 1.0025 (100-period SMA),” Eren adds further.

Key Notes

• ISM Services PMI Preview: High bar to help dollar bears pass through and take over

• EUR/USD Forecast: Euro could find it hard to benefit from risk flows

• EUR/USD: A drop to the 0.9600-0.9650 supports cannot be excluded – ING

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

-

13:49

USD/TRY remains bid above 18.00, keeps targeting 2022 highs

- USD/TRY adds to Monday’s gains and revisits 18.22.

- The stronger dollar puts the pair under upside pressure.

- The CBRT will decide on interest rates on September 22.

The persistent bid bias around the greenback pushes USD/TRY back to the 18.22 region on Tuesday.

USD/TRY up on USD-buying, looks to CBRT

USD/TRY extends the auspicious start of the week and once again trades at shouting distance from the all-time highs around 18.25 on Tuesday. The upbeat tone in the greenback continues to put the risk complex and the EM FX space under persistent pressure, always sustained by firm prospects of Fed’s tightening.

The lira, on the other hand, depreciated further after inflation figures in Türkiye ran at the hottest pace since September 1998 in August, at just above 80.0% YoY.

However, positive news for the lira came after the Türkiye’s Medium Term Program (MTP) now expects consumer prices to decline in the next years until levels below the 10.0% mark by 2025.

The MTP also expects the economy to expand 5% next year and 5.5% in 2024 and 2025. It is worth noting that Türkiye’s economy expanded the most in the G-20 in Q2, only after Saudi Arabia.

Türkiye’s finmin N.Nebati commented on the program and highlighted that policies aim at ensuring high-value added production, a continuing improvement in the current account, productivity and higher exports.

Now that inflation figures are out, investors' attention is expected to gyrate to the next monetary policy meeting by the Turkish central bank (CBRT).

What to look for around TRY

USD/TRY flirted with all-time highs around 18.25 last Friday, keeping the uptrend well in place and entering the ninth consecutive month in the positive territory.

In the meantime, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, there seems to be no other immediate option to attract foreign currency other than via tourism revenue, in a context where official figures for the country’s FX reserves remain surrounded by increasing skepticism.

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.09% at 18.2235 and faces the immediate target at 18.2574 (2022 high September 2) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.7586 (monthly low August 9) would pave the way for 17.6435 (55-day SMA) and finally 17.1903 (weekly low July 15).

-

13:38

USD/JPY rallies to levels beyond 142.00 mark, highest since August 1998

- USD/JPY prolongs its recent strong bullish momentum and surges to a fresh 24-year peak.

- The Fed-BoJ policy divergence, widening US-Japan rate differential weigh heavily on the JPY.

- The emergence of fresh USD buying provides an additional boost and contributes to the rally.

The USD/JPY pair catches aggressive bids on Tuesday and rallies to levels just above the 142.00 mark, hitting a fresh 24-year high during the mid-European session.

The Japanese yen continues with its relative underperformance amid bets that the Bank of Japan’s ultra-loose monetary policy would continue. In contrast, the Federal Reserve is expected to stick to its aggressive policy-tightening path to tame inflation. This marks a big divergence in the monetary policy stance adopted by two major central banks and assists the USD/JPY pair to prolong a nearly one-month-old upward trajectory.

The recent hawkish remarks by several Fed officials reinforced market expectations for a supersized 75 bps rate hike at the September FOMC policy meeting. This remains supportive of elevated US Treasury bond yields, widening the US-Japan rate differential. Apart from this, the risk-on impulse - as depicted by a positive tone around the equity markets - undermines the safe-haven JPY and contributes to the USD/JPY pair's strong positive move.

The momentum is also supported by the emergence of fresh buying around the US dollar, which climbs back closer to a two-decade high amid hawkish Fed expectations. Furthermore, a sustained move above the previous YTD peak and a subsequent strength beyond the 141.00 mark seem to have prompted some technical buying around the USD/JPY pair. That said, the slightly overbought RSI (14) on the daily chart warrants some caution for aggressive bullish traders.

Nevertheless, the fundamental backdrop suggests that the path of least resistance for the USD/JPY pair is to the upside and any meaningful pullback might still be seen as a buying opportunity. Market participants now look forward to the US economic docket, featuring the ISM Services PMI for a fresh impetus during the early North American session. Traders will further take cues from the US bond yields, the USD price dynamics and the broader risk sentiment.

Technical levels to watch

-

13:18

EUR/PLN: Stable for now, decline expected in 2023 – ING

Economists at ING expect the EUR/PLN to trade sideways throughout the rest of the year. In 2023, however, the pair should start to move downward.

Zloty should be supported by high rates in Poland in 2023

“In the remainder of 2022, we expect EUR/PLN to remain in a broad horizontal trend. During the holiday period, investors betting against the zloty took notable stop-losses on low liquidity. Hence, now they should be less inclined to take long EUR/PLN or USD/PLN positions.”

“Next year, we expect a gradual EUR/PLN decline. The zloty should be supported by high rates in Poland, while some key central banks gear towards easing.”

-

13:15

EUR/JPY: Negative growth outlook favours downside – ING

Economists at ING note that EUR/JPY is positively correlated with growth cycle. Therefore, they expect the pair to move downward over the coming months.

The cycle is not looking good

“EUR/JPY typically tends to be positively correlated with the global growth cycle – and clearly the cycle is not looking good.”

“Fiscal efforts by governments to offset the energy crisis at both the consumer and business level will struggle to prevent economies entering recession. The recent hawkish turn from the ECB has yet to provide any lasting support to the euro.”

“Our EZ macro team looks for just a 75 bps ECB tightening cycle this year – compared to 166 bps of tightening expected by the market. If correct, that should leave the euro vulnerable this autumn.”

-

13:06

GBP/USD could extend its rebound if it manages to clear 1.1600

GBP/USD clings to daily recovery gains above 1.1550. The pair needs to clear 1.1600 to attract buyers, FXStreet’s Eren Sengezer reports.

The near-term technical outlook points to a bullish shift

“Near-term technical outlook points to a bullish tilt following the latest rebound.”

“1.1600 (psychological level, static level) aligns as immediate resistance. In case the pair manages to hold above that level, the 1.1640/50 area (50-period SMA, static level) could be seen as the next hurdle ahead of 1.1700 (static level, psychological level).”

“On the downside, 1.1550 (20-period SMA) forms first support before 1.1500 (psychological level, upper limit of the descending channel) and 1.1440 (September 5 low).”

-

12:49

Reuters Poll: ECB expected to hike by 75 bps on September 8

34 of 67 economists polled by Reuters said that they expect the European Central Bank (ECB) to hike the rate on the main refinancing operations by 75 basis points (bps) to 1.25% on September 8.

29 economists forecasted the bank to raise its key rate by 50 bps while four economists said they saw the ECB raising the rate by only 25 bps.

Market reaction

The shared currency stays under modest bearish pressure heading into the American session on Tuesday. As of writing, the EUR/USD pair was posting small daily losses at 0.9920.

-

12:00

EUR/USD Price Analysis: Upside remains capped by 1.0100

- EUR/USD fades the initial bull run to 0.9985/90.

- The resumption of the selling pressure could retest the YTD low.

EUR/USD climbed to the proximity of 0.9990 earlier in the session, just to deflate afterwards and return to the 0.9930 region.

Against that, the inability of the pair to regain serious upside traction should keep the door to further retracement open in the near term. Extra losses face the immediate target at the 2022 low at 0.9877 (September 5) seconded by 0.9859 (December 2002 low) and then 0.9685 (October 2002 low).

The continuation of the downtrend remains in the pipeline, as the daily RSI around 36 still allows for some weakness prior to reach the oversold territory.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0780.

EUR/USD daily chart

-

11:54

UK's Truss planning to freeze energy prices for 18 months – BBC

British Prime Minister Liz Truss plans to freeze energy prices for households for 18 months and allow energy companies to take out government-guaranteed loans to make up for the difference between the wholesale and retail prices, BBC reported on Tuesday.

Truss is expected to unveil her plan on Thursday.

Market reaction

This headline doesn't seem to be having a significant impact on risk sentiment with the UK's FTSE 100 Index clinging to small daily gains at 7,299 points. Meanwhile, GBP/USD was last seen rising 0.5% on the day at 1.1572.

-

11:53

USD/CAD keeps the red on softer USD, downside remains cushioned amid sliding oil prices

- USD/CAD comes under fresh selling pressure on Tuesday amid the ongoing USD profit-taking slide.

- A sharp fall in crude oil prices undermines the loonie and helps limit deeper losses for the major.

- Investors now eye US ISM Services PMI for some impetus ahead of the BoC meeting on Wednesday.

The USD/CAD pair meets with a fresh supply on Tuesday and maintains its offered tone through the first half of the European session. The pair, however, recovers a few pips from the daily low and is currently trading comfortably above the 1.3100 round-figure mark.

A recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - drags the safe-haven US dollar away from a two-decade high touched on Monday. This turns out to be a key factor exerting some downward pressure on the USD/CAD pair. That said, a sharp fall in crude oil prices undermines the commodity-linked loonie and offers some support to spot prices.

Oil prices come under renewed selling pressure and drop back closer to a multi-month low touched last week. An OPEC+ deal to cut output by 100,000 barrels per day in October was seen as a symbolic move. This, along with worries that a global economic downturn and COVID-19 curbs in China will dent fuel demand, overshadows concerns over tight global supply and weighs heavily on the black liquid.

Furthermore, rising US Treasury bond yields, bolstered by hawkish Fed expectations, support prospects for the emergence of some USD dip-buying and should limit losses for the USD/CAD pair. Investors seem convinced that the Fed will stick to its aggressive policy tightening path to tame inflation and have been pricing in a greater chance of a supersized 75 bps at the September FOMC policy meeting.

The fundamental backdrop suggests that the path of least resistance for the USD/CAD pair is to the upside and any meaningful slide might still be seen as a buying opportunity. Traders, however, might prefer to move to the sidelines ahead of the Bank of Canada meeting on Wednesday. In the meantime, the US ISM Services PMI might provide some impetus later during the early North American session.

Technical levels to watch

-

11:30

US Dollar Index Price Analysis: Another test of the 2022 high appears in store… soon

- DXY keeps navigating in the upper end of the range just below 110.00.

- Further upside could well see the YTD peak past 110.00 revisited.

DXY trades with modest gains in the 109.70/80 band on Tuesday.

The short-term bullish view in the dollar remains well in place for the time being and propped up by the 7-month support line, today around 105.80.

Still on the upside, the surpass of the recent top at 110.27 (September 5) could face the next barrier at the weekly highs at 111.90 (June 6 2002) and 113.35 (May 24 2002).

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 101.13.

However, the current overbought conditions of the index could trigger some corrective downside, which should be seen as a buying opportunity.

DXY daily chart

-

11:14

European energy bills to surge $2 trillion by 2023 – Goldman Sachs

Analysts at Goldman Sachs said in their latest note that energy bills for European households will surge by EUR2 trillion ($2 trillion) at their peak in early 2023.

Key quotes (via Bloomberg)

"At their height, energy bills will represent about 15% of Europe’s gross domestic product."

“In our view, the market continues to underestimate the depth, the breadth and the structural repercussions of the crisis.”

“We believe these will be even deeper than the 1970s oil crisis.”

“Stock investors are too pessimistic about the effect of regulatory efforts.”

“The introduction of price caps in power generation could save the bloc around 650 billion euros in power bills and offer consumers and markets some relief while allowing governments to forgo a windfall-profits tax.”

-

11:05

EUR/JPY Price Analysis: Increasing bets for a move to 142.00 and above

- EUR/JPY extends the rebound past the 141.00 mark on Tuesday.

- Immediately to the upside comes the 142.30 zone.

EUR/JPY accelerates gains and trespasses the 141.00 barrier, or multi-week highs, on Tuesday.

Extra gains in the cross remains favoured for the time being, with the next target now emerging at the weekly top at 142.32 (July 21) ahead of the 2022 peak at 144.27 (June 28).

While above the 200-day SMA at 134.60, the prospects for the pair should remain constructive.

EUR/JPY daily chart

-

11:02

AUD/USD slides to its lowest level since mid-July, seems vulnerable to weaken further

- AUD/USD struggles to capitalize on its intraday gains despite another 50 bps rate hike by the RBA.

- The risk-on mood undermines the safe-haven USD, though fails to benefit the risk-sensitive aussie.

- Hawkish Fed expectations favour the USD bulls and support prospects for further losses for the pair.

The AUD/USD pair witnessed an intraday turnaround from the 0.6830-0.6835 area on Tuesday and drops to its lowest level since mid-July during the first half of the European session. The pair is currently placed around the 0.6760 region and seems vulnerable to prolonging a nearly one-month-old descending trend.

Despite the Reserve Bank of Australia's decision to hike interest rates by 50 bps rate, the Australian dollar struggles to capitalize on its modest intraday gains. Expectations that the RBA is nearing the end of its rate hike cycle turn out to be a key factor acting as a headwind and attracting fresh selling around the AUD/USD pair.

Even the risk-on impulse, which is seen dragging the safe-haven US dollar away from a two-decade high touched the previous day, fails to impress bulls. The global risk sentiment stabilizes after China pledged to make renewed efforts to boost its economy. This, however, did little to lend any support to the risk-sensitive aussie.

Growing recession fears, along with the economic headwinds stemming from fresh COVID-19 curbs in China and the ongoing war in Ukraine, should keep a lid on any optimistic move. Apart from this, hawkish Fed expectations should limit the USD losses, suggesting that the path of least resistance for the AUD/USD pair is to the downside.

In fact, the markets seem convinced that the Fed will tick to its aggressive policy tightening path and have been pricing in a greater chance of a supersized 75 bps rate hike at the September meeting. This is reinforced by a fresh leg up in the US Treasury bond yields, which supports prospects for the emergence of some USD dip-buying.

Market participants now look forward to the US economic docket, featuring the release of the ISM Services PMI later this Tuesday. The data might influence the USD price dynamics and provide some impetus to the AUD/USD pair. The focus will then shift to the quarterly Australian GDP report, scheduled during the Asian session on Wednesday.

Technical levels to watch

-

10:56

Gold Price Forecast: XAU/USD eyes $1,700 as path of least resistance appears down – Confluence Detector

- Gold price reverses sharply amid an upturn in the yields and the US dollar.

- Global tightening bets, recession fears continue to bode ill for the bullion.

- XAU/USD eyes the $1,700 mark amid a bear cross and a wall of resistance levels.

Gold price is looking to resume the recent downtrend, as sellers fight back control ahead of key US events and the ECB rate hike decision. The European energy crisis-led recession fears keep investors on the edge while driving yields higher globally. The benchmark US 10-year Treasury yields are roughly 2% higher on the day at around 3.25%, emerging as the main catalyst behind the dollar recovery and the renewed downside in the non-yielding bullion. The bright metal also remains weighed down by hopes for continued tightening by major global central banks, as they remain committed in their fight to tame inflation. Further, a looming bear cross on the metal’s daily chart also keeps the downside favored for sellers. All eyes now remain on the US ISM Services PMI, ECB policy announcement and Fed Chair Jerome Powell’s speech for fresh trading impetus.

Also read: Gold Price Forecast: Will XAU/USD find acceptance above 23.6% Fibo resistance?

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is challenging powerful support at around $1,711, which is the convergence of the previous month’s low and Fibonacci 23.6% one-day.

A sustained break below the latter will put the previous day’s low of $1,709 under threat. The next support zone is seen around $1,703, where the Fibonacci 23.6% one-week and pivot point one-day S2 merge.

Sellers will then test the $1,700 mark, the round figure and the pivot point one-day S3.

On the flip side, a dense cluster of healthy resistance levels is stacked up around $1,713, the intersection of the SMA10 four-hour, Fibonacci 61.8% one-day and the SMA5 one-day.

The previous day’s high of $1,716 will offer further resistance to bulls on their road to recovery. The next relevant upside target is aligned at the Fibonacci 161.8% one-day at $1,720.

The confluence of the Fibonacci 61.8% one-week and pivot point one-day R3 at $1,724 will be the level to beat for buyers.

Here is how it looks on the tool

About Technical Confluences Detector