Notícias do Mercado

-

21:00

U.S.: Federal budget , March -106.5

-

19:00

American focus: the dollar has grown significantly

The yen fell against the dollar while still achieving the lowest level in almost four years, as the Bank of Japan has confirmed its commitment to promote the program, and some officials from the Fed pushed for the speedy completion of the program to buy bonds. Note that the Japanese currency briefly recovered early losses after the Bank of Japan Haruhiko Kuroda said that the bank has done enough at this point, suggesting a pause in the easing cycle. Kuroda also said that monetary policy can not be determined by the currency exchange rate, and its purpose is not the depreciation of the yen.

The cost of the Australian dollar rose again, helped by data from China. According to a report on the results of March trade deficit totaled 884 million, while according to the average forecast of economists was to be recorded a surplus of $ 15.15 billion Recall that in February, the trade surplus was $ 15.23 billion In addition, the data showed that exports rose in March by 10 per cent per annum, which was much less than forecast at 11.7 per cent increase. We also recall that in February, exports increased by 21.8 percent. On the other hand, imports rose last month to 14.1 percent per annum, ahead of forecast by 6 percent growth and offsetting much of the decline in the previous month, which was 15.2 percent.

The dollar rose against the euro, after the minutes of the Fed on March 19 and 20, suddenly released a few hours earlier than planned, showed that members of the FOMC continues to discuss the 85-billion program of QE, and then when it should turn . According to the report, almost all Fed officials want to maintain a bond purchasing program, at least until mid-2013. However, a consensus on what to do next, no, this, many members noted that if the outlook for the labor market improves, as expected, it may be necessary to cut the program later this year, and by year-end and stop. Representatives of the FOMC do not see significant changes in the economic outlook, although it should be noted that the meeting took place before the weak employment report for March.

-

15:30

U.S.: Crude Oil Inventories, April +0.3

-

14:46

Option expiries for today's 1400GMT cut

EUR/USD $1.2995, $1.3010, $1.3020, $1.3050, $1.3075, $1.3100

USD/JPY Y99.00, Y99.20, Y99.35, Y99.500

GBP/USD $1.5300, $1.533

EUR/GBP stg0.8500

AUD/USD $1.0500, $1.0510, $1.0600

-

13:35

European session: the yen pared losses

06:45 France Industrial Production, m/m February -0.8% +0.4% +0.7%

06:45 France Industrial Production, y/y February -3.5% -3.7% -3.4%

The yen pared losses after Bank of Japan Governor Haruhiko Kuroda indicated policy adjustments are unlikely every month while reiterating that the central bank will take all steps necessary to meet its inflation target.

The euro rose against the dollar and the yen despite the unfavorable data on industrial production in Spain and Italy. The European single currency rose to its highest level against the yen in more than three years and up to one month high against the U.S. dollar, while last week's announcement aggressive measures easing of monetary policy by the Bank of Japan continued to provide indirect support for the euro. The euro constrain ambiguous data on industrial production. The data in Spain and Italy were disappointing, and the report of France was better than expected.

The commodity currencies of Australia, New Zealand and Canada against the U.S. dollar after China reported a trade deficit of $ 880 million dollars in March, against a surplus of 15.25 billion U.S. dollars in February. Special support for commodity currencies received by the data showing that China's imports rose in March by 14.1% after a decline of 15.2% in February. Expected increase in imports by 6.1%.

Investors are waiting for the publication of minutes of the March meeting of the Open Market of the Federal Reserve System. Market participants will closely examine them for guidance as to when the Fed will complete or reduce the amount of its current program of quantitative easing.

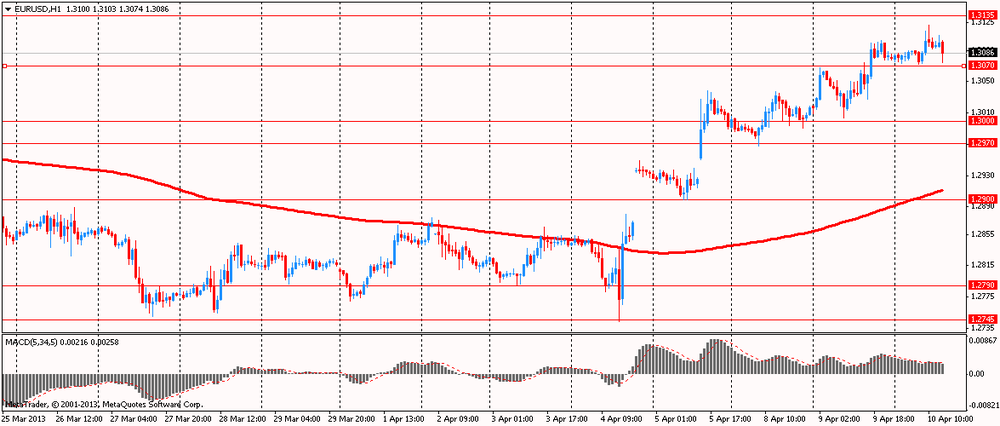

EUR / USD: during the European session, the pair rose to $ 1.3122, then dropped to $ 1.3074

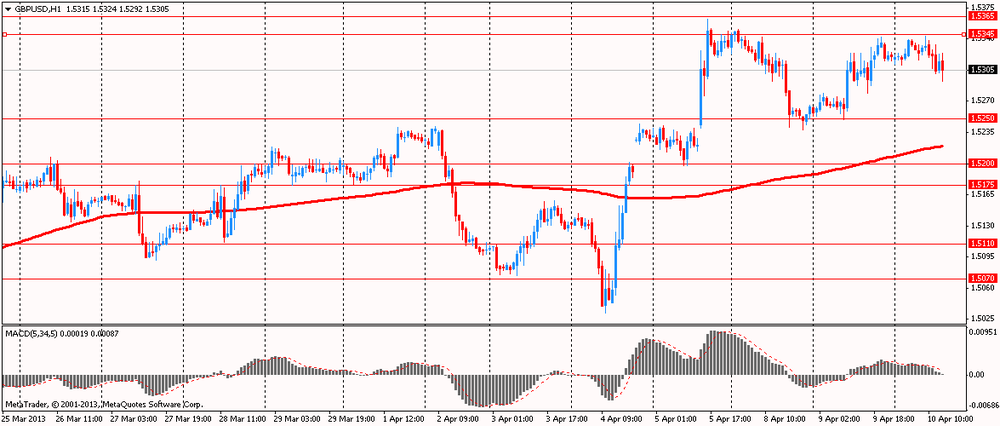

GBP / USD: during the European session, the pair fell to $ 1.5292

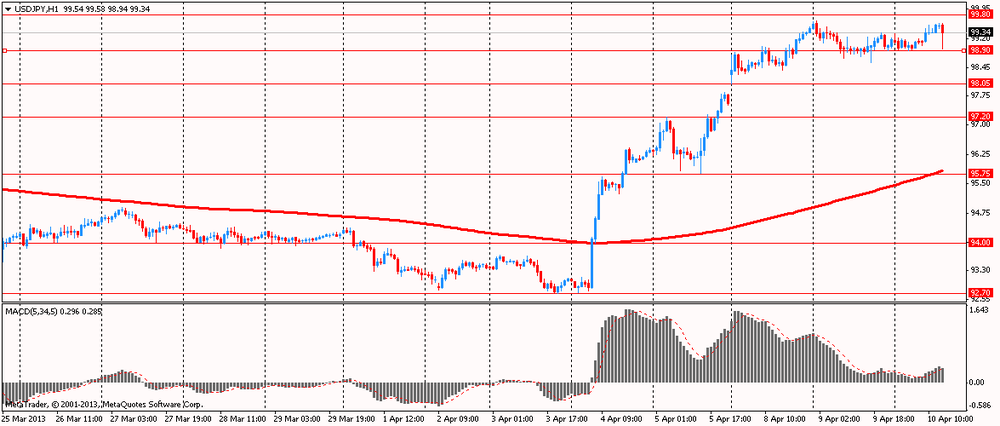

USD / JPY: during the European session, the pair rose to Y99.59, then fell to Y98.94

At 14:30 GMT the United States will publish data on crude oil from the Ministry of Energy. At 17:00 GMT the United States places the 10-year bonds. At 18:00 GMT will be publication of the minutes of the Fed meeting. At 18:00 GMT the United States will be released monthly performance report for March. At 22:30 GMT New Zealand is to publish an index of business activity in the manufacturing sector of Business NZ in March. End the day at 23:50 GMT Japan data on the change in orders for machinery and equipment in February.

-

13:27

Orders

EUR/USD

Offers $1.3150, $1.3130/40

Bids $1.3075/70, $1.3050, $1.3020, $1.3005/990, $1.2980

GBP/USD

Offers $1.5450/60, $1.5410/20, $1.5390/400, $1.5360/50, $1.5340/50

Bids $1.510/00, $1.5285/80, $1.5255/40, $1.5215/10, $1.5200-1.5195, $1.5160/50

AUD/USD

Offers $1.0650, $1.0600, $1.0575/80, $1.0550

Bids $1.0480, $1.0460/50, $1.0425/20, $1.0405/00

EUR/GBP

Offers stg0.8630/40, stg0.8610/15, stg0.8600/05, stg0.8580/85, stg0.8560/65

Bids stg0.8500, stg0.8485/80, stg0.8460/50, stg0.8410/00

EUR/JPY

Offers Y131.50, Y131.00, Y130.75

Bids Y130.00/90, Y129.55/60, Y129.20, Y129.00, Y128.80/75

USD/JPY

Offers Y100.25, Y100.00, Y99.75

Bids Y98.95/90, Y98.70, Y98.50

-

11:06

France industrial output growth tops expectations

Strong growth in the transport and refining sectors boosted the French manufacturing output in February, helping overall production to recover at a faster-than-expected pace.

Industrial output grew 0.7 percent in February from a month ago, when it fell 0.8 percent, the statistical office Insee said Wednesday. Production was forecast to grow 0.2 percent, following a 1.2 percent drop originally estimated for January.

Likewise, manufacturing output grew 0.8 percent, offsetting the 1.3 percent drop seen in January and also exceeded the 0.2 percent rise forecast by economists. The January figure was revised from the 1.4 percent drop reported on March 11.

The month-on-month expansion in manufacturing was underpinned by a 17 percent surge in production of coke and refined petroleum products and a 3.6 percent rise in manufacture of transport equipment. Meanwhile, declines in manufacture of food products as well as electronic products weighed on overall production.

Construction output advanced 1 percent, while mining and quarrying output gained only 0.5 percent.

During the three months ended February, output decreased slightly by 0.3 percent in the manufacturing sector and by 0.1 percent in the industry as a whole.

-

10:58

GERMAN AUCTION RESULTS:

Germany alloted E4.22bln of 2-year benchmark 0.25% Mar 2015 Schatz issue Wednesday at an average yield 0.02% (0.06%) and bid-to-cover ratio 2.2 times (1.7).

-

10:37

ITALY T-BILL AUCTION RESULTS:

Italy sold E11.0bln in 3-/12-mth BOTs

- E3.0bln 3-month BOT, avg yield 0.243%, cover 1.9 times

- E8.0bln 12-month BOT, avg yield 0.922% (1.28%), cover 1.64 (1.5)

-

10:19

Option expiries for today's 1400GMT cut

EUR/USD $1.2900, $1.2950, $1.2975, $1.2985, $1.2995, $1.3010, $1.3020, $1.3050

USD/JPY Y98.00, Y99.00, Y99.20, Y99.50

EUR/JPY Y129.00

EUR/GBP stg0.8500

USD/CHF Chf0.9515

AUD/USD $1.0450, $1.0500, $1.0600

-

08:53

Forex: Tuesday’s review

The yen rose against the dollar, departing from its lowest level in nearly four years on speculation that the decline of 6.4 percent in the last three days was too fast. The Japanese currency rose against all but one of its 16 major counterparts after the earlier fell to 99.66 per dollar, its lowest level since May 2009. Recall that the leaders of the Bank of Japan, headed by Governor Haruhiko Kuroda said after a meeting last week announced that they will raise the monthly purchase of bonds by 7.5 trillion yen, as they have set a period of two years to achieve its goal of 2 % inflation.

The euro rose to a three-week high against the U.S. dollar as the fact that the European Financial Stability Fund said that the sale of bonds was recorded in high demand. As it became known, the fund sold five-year bonds in the amount of EUR 8 billion, while the volume of supply of 14 billion euros.

The British pound rose after data showed that UK industrial production rose in February more than expected, which means that the decreased risk of returning the economy back into recession in the 1st quarter of 2013. National Bureau of Statistics said Tuesday that the growth of industrial production in February by 1% compared to the previous month. Growth contributed to the restoration of oil and gas, the growth in the mining industry and the growth in the energy sector caused by the cold weather. Manufacturing production increased over the same period by 0.8%.

The Australian currency is growing a second day, as the monetary stimulus in the U.S. and Japan have increased the demand for higher-yielding assets. Also contributed to the increase in the inflation data in China that showed a slowdown in the growth of the consumer price index, which weakened the excitement about a possible tightening of monetary policy by the government. Thus, the index of consumer prices in March fell by 0.9% m / m while the forecast decrease by only 0.6% m / m and a rise of 1.1% m / m, while compared to the previous year index increased by 2 1%, while analysts expected a more significant increase of 2.4% y / y growth of 3.2% y / ya month earlier.

-

07:46

France: Industrial Production, m/m, February +0.7% (forecast +0.4%)

-

07:09

Asian session: The yen fell

00:30 Australia Westpac Consumer Confidence April +2.0% -5.1%

02:00 China Trade Balance, bln March 15.3 15.2 -0.9

The yen fell versus most of its 16 major counterparts as the Bank of Japan’s unprecedented stimulus measures aimed at ending almost two decades of deflation spurred bets the currency will weaken further.

The yen was 1 percent from 100 per dollar before BOJ Governor Haruhiko Kuroda speaks at a Yomiuri newspaper event on April 12, following his decision last week to double monthly bond purchases to achieve 2 percent annual inflation in two years. BOJ policy makers said at the conclusion of their meeting on April 4 that they will boost monthly debt purchases to 7.5 trillion yen ($76 billion). They also suspended a cap on some bond holdings and dropped a limit on debt maturities. Officials will next meet on April 26.

The greenback traded near a three-week low versus the euro before the Federal Reserve releases minutes of its March meeting. Chairman Ben S. Bernanke left the pace of government and mortgage debt purchases at $85 billion a month and said further improvement in the U.S. labor market is needed for the central bank to consider reducing its record monetary easing. The Commerce Department may say on April 12 that U.S. retail sales stagnated last month after a 1.1 percent gain in the previous period, according to the median estimate of economists surveyed by Bloomberg News.

Australia’s currency climbed for a third day after a report today showed imports by China, the South Pacific nation’s biggest trading partner, climbed 14.1 percent in March from a year earlier. That’s more than twice the 6 percent gain predicted by economists in a Bloomberg poll and a reversal from the 15.2 percent decline recorded in February.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3070-90.

GBP / USD: during the Asian session, the pair rose to $ 1.5340.

USD / JPY: during the Asian session, the pair traded in the range of Y98.90-35.

Although there is a full calendar scheduled for Wednesday, the main data releases are largely second tier, with the FOMC minutes the stand-out release. The calendar gets underway at 0645GMT, with the release of the February industrial output data. Analysts are looking for a 0.2% increase on month and an annual fall of 3.9% At 0700GMT, Spanish February industrial output numbers are expected and will likely top continue to make ugly reading, although analysts are looking for a very modest uptick to -4.9% y/y. Italian February industrial output numbers are expected at 0800GMT, with expectations for a 0.5% on month fall and an annualised fall fo 4.0%. The OECD February leading indicator numbers are due at 1000GMT.

-

06:24

Currencies. Daily history for Apr 9'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3080 +0,48%

GBP/USD $1,5320 +0,37%

USD/CHF Chf0,9325 -0,23%

USD/JPY Y99,17 -0,30%

EUR/JPY Y129,72 +0,18%

GBP/JPY Y151,91 +0,05%

AUD/USD $1,0487 +0,70%

NZD/USD $0,8522 +0,69%

USD/CAD C$1,0161 -0,03%

-

06:10

Schedule for today, Wednesday, Apr 10’2013:

00:30 Australia Westpac Consumer Confidence April +2.0% -5.1%

02:00 China Trade Balance, bln March 15.3 15.2 -0.9

04:00 China New Loans March 620 890

06:45 France Industrial Production, m/m February -1.2% +0.4%

06:45 France Industrial Production, y/y February -3.5% -3.7%

14:30 U.S. Crude Oil Inventories April +2.7

18:00 U.S. FOMC meeting minutes March

18:00 U.S. Federal budget March -203.5

22:30 New Zealand Business NZ PMI March 56.3

23:50 Japan Core Machinery Orders February -13.1% +6.9%

-