Notícias do Mercado

-

21:00

U.S.: Federal budget , March -106.5

-

20:00

Dow +141.61 14,815.07 +0.97% Nasdaq +57.31 3,295.17 +1.77%S&P +18.61 1,587.22 +1.19%

-

19:00

American focus: the dollar has grown significantly

The yen fell against the dollar while still achieving the lowest level in almost four years, as the Bank of Japan has confirmed its commitment to promote the program, and some officials from the Fed pushed for the speedy completion of the program to buy bonds. Note that the Japanese currency briefly recovered early losses after the Bank of Japan Haruhiko Kuroda said that the bank has done enough at this point, suggesting a pause in the easing cycle. Kuroda also said that monetary policy can not be determined by the currency exchange rate, and its purpose is not the depreciation of the yen.

The cost of the Australian dollar rose again, helped by data from China. According to a report on the results of March trade deficit totaled 884 million, while according to the average forecast of economists was to be recorded a surplus of $ 15.15 billion Recall that in February, the trade surplus was $ 15.23 billion In addition, the data showed that exports rose in March by 10 per cent per annum, which was much less than forecast at 11.7 per cent increase. We also recall that in February, exports increased by 21.8 percent. On the other hand, imports rose last month to 14.1 percent per annum, ahead of forecast by 6 percent growth and offsetting much of the decline in the previous month, which was 15.2 percent.

The dollar rose against the euro, after the minutes of the Fed on March 19 and 20, suddenly released a few hours earlier than planned, showed that members of the FOMC continues to discuss the 85-billion program of QE, and then when it should turn . According to the report, almost all Fed officials want to maintain a bond purchasing program, at least until mid-2013. However, a consensus on what to do next, no, this, many members noted that if the outlook for the labor market improves, as expected, it may be necessary to cut the program later this year, and by year-end and stop. Representatives of the FOMC do not see significant changes in the economic outlook, although it should be noted that the meeting took place before the weak employment report for March.

-

18:20

Wednesday: Results of the day on the main stock exchanges in Europe

European stocks gained the most in a month, with the Stoxx Europe 600 Index posting its longest winning streak since January, as banks advanced and a report showed Chinese imports beat forecasts in March.

The Stoxx 600 increased 1.8 percent to 293.19 at the close of trading, its biggest advance since March 5.

China’s imports rose by a better-than-forecast 14.1 percent in March, while export growth slowed to 10 percent from a year earlier, the customs administration said today in Beijing.

In the U.S., several members of the Federal Open Market Committee said the central bank should begin tapering its bond buying program later this year and stop it by year end. The members “thought that if the outlook for labor market conditions improved as anticipated, it would probably be appropriate to slow purchases later in the year and to stop them by year-end,” according to the record of the Federal Open Market Committee’s March 19-20 meeting released today in Washington ahead of the regularly scheduled 2 p.m. time.

National benchmark indexes climbed in all of the 18 western European (SXXP) markets except Iceland.

FTSE 100 6,390.82 +77.61 +1.23% CAC 40 3,743.79 +73.07 +1.99% DAX 7,811.07 +173.56 +2.27%

National Bank of Greece SA and Eurobank Ergasias SA surged 27 percent to 59.9 euro cents, and 26 percent to 29.4 cents, respectively. The planned merger of the two lenders has been postponed and not canceled, Bank of Greece Governor George Provopoulos told lawmakers in Athens today.

SMA Solar rose 8.8 percent to 19.88 euros. Wacker Chemie, which makes the main raw material in solar panels, gained 5.8 percent to 59.16 euros. Meyer Burger Technology AG climbed 7.9 percent to 7.94 Swiss francs.

First Solar Inc., the world’s largest thin-film solar manufacturer by output, surged the most on record yesterday after forecasting sales of $3.8 billion to $4 billion this year. Earnings will be $4 to $4.50 a share, exceeding the $3.57 average of 23 analysts’ estimates.

Gerresheimer, which develops and produces specialty glass and plastics products, gained 2.5 percent to 44.74 euros. First- quarter revenue jumped 10 percent to 296.7 million euros ($388 million), compared with the average analyst estimate of 286.7 million euros.

EasyJet Plc (EZJ) increased 6.7 percent to 1,090 pence after Citigroup Inc. raised Europe’s second-largest discount airline to buy from neutral, saying it expects the company’s 2013 earnings per share to grow about 30 percent, then 6 percent to 7 percent annually thereafter. Citigroup also said its sees dividend growth and possibly more special dividends.

-

17:00

European stock close: FTSE 100 6,390.82 +77.61 +1.23% CAC 40 3,743.79 +73.07 +1.99% DAX 7,811.07 +173.56 +2.27%

-

16:40

Oil: an overview of the market situation

Oil prices fell, dropping below $ 106 per barrel, helped by a report published by the Ministry of Energy. It became known that crude oil inventories rose last week, thus, reaching its highest level in more than two decades.

The data showed that crude oil inventories in the U.S. rose by 0, 25 million barrels, amounting in this case 388.874 million barrels, while gasoline stocks rose by 1.699 million barrels to 222.363 million. Meanwhile, the Department of Energy said that distillate stocks in the U.S. fell by 0.169 million barrels to 112.817 million. We also learned that the oil terminal in Cushing last week rose by 0.889 million barrels to 50.07 million barrels and refinery utilization in the United States amounted to 86.8% against 86.3% a week earlier.

Meanwhile, today it was reported that OPEC cut its outlook for growth in oil demand in 2013 to 40,000 barrels a day, remarking that the revision of the forecast for demand associated with fears over Cyprus. In addition, the data showed that in March, oil cartel decreased by 0.1 million barrels per day to 30.19 million barrels a day because of Nigeria.

In addition, we note that the impact on the dynamics of trade data, which were presented today General Administration of Customs of China. According to the report, in March trade deficit of 884 million, while according to the average forecast of economists was to be recorded a surplus of $ 15.15 billion Recall that in February, the trade surplus was $ 15.23 billion in addition, the data showed that exports in March rose by 10 per cent per annum, which was significantly less than forecast at 11.7 percent increase. We also recall that in February, exports increased by 21.8 percent. On the other hand, the volume of imports rose last month to 14.1 percent per annum, ahead of forecast growth of 6 percent and offsetting most of the decline from the previous month, which was 15.2 percent.

May futures on U.S. light crude oil WTI (Light Sweet Crude Oil) dropped to 93.86 dollars per barrel.

May futures price for North Sea Brent crude oil mixture fell to $ 105.62 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices fell sharply, dropping at the same time below $ 1570, which was associated with the expectations of the publication of minutes of the last meeting of the FOMC. Note that due to human error, the Fed minutes were presented for 5 hours earlier than planned. As it became known, records showed that all but a handful of leaders Fed at its last meeting agreed that they wanted to continue the program, at least until the middle of the year. "But they expressed a range of views on how to buy bonds may develop after mid-year. Some leaders at the March meeting, it seemed that the Fed will be able to start reducing purchases of bonds around the middle of the year. Others expect that the Fed will continue to purchase until September, after which they will roll. Several executives wanted to continue the program at its current rate until the end of 2013 year and in 2014. Some also did not rule out the possibility of increasing the program if economic prospects worsen.

We also add that the drop in the value of gold has contributed information that Goldman Sachs lowered its forecast for the price of gold for 2013 and 2014. According to estimates Goldman Sachs, by the end of 2013 enes at reaching $ 1,450 per ounce, while by the end of 2014 they will be equal to 1270 dollars per ounce. Meanwhile, it was reported that Goldman Sachs started to open short positions in the gold futures on the COMEX.

May futures on COMEX gold fell today, and now stands at 1569.50 dollars per ounce.

-

15:30

U.S.: Crude Oil Inventories, April +0.3

-

14:46

Option expiries for today's 1400GMT cut

EUR/USD $1.2995, $1.3010, $1.3020, $1.3050, $1.3075, $1.3100

USD/JPY Y99.00, Y99.20, Y99.35, Y99.500

GBP/USD $1.5300, $1.533

EUR/GBP stg0.8500

AUD/USD $1.0500, $1.0510, $1.0600

-

14:33

U.S. Stocks open: Dow 14,698.14 +24.68 +0.17%, Nasdaq 3,251.44 +13.58 +0.42%, S&P 1,572.18 +3.57 +0.23%

-

14:29

Before the bell: S&P futures +0.16%, Nasdaq futures +0.19%

U.S. stock futures rose even after minutes from the Federal Reserve’s last meeting showed some policy makers saw quantitative easing efforts tapering around mid-year even as participants “remain concerned” about market stability.

Global Stocks:

Nikkei 13,288.13 +95.78 +0.73%

Hang Seng 22,034.56 +164.22 +0.75%

Shanghai Composite 2,226.13 +0.35 +0.02%

FTSE 6,357.72 +44.51 +0.71%

CAC 3,710.28 +39.56 +1.08%

DAX 7,715.55 +78.04 +1.02%

Crude oil $93.79 -0.44%

Gold $1578.70 -0.50%

-

14:05

Upgrades and downgrades before the market open:

Other:

Walt Disney (DIS) reiterated at Buy at B. Riley & Co., target raised from $63 to $65

-

13:35

European session: the yen pared losses

06:45 France Industrial Production, m/m February -0.8% +0.4% +0.7%

06:45 France Industrial Production, y/y February -3.5% -3.7% -3.4%

The yen pared losses after Bank of Japan Governor Haruhiko Kuroda indicated policy adjustments are unlikely every month while reiterating that the central bank will take all steps necessary to meet its inflation target.

The euro rose against the dollar and the yen despite the unfavorable data on industrial production in Spain and Italy. The European single currency rose to its highest level against the yen in more than three years and up to one month high against the U.S. dollar, while last week's announcement aggressive measures easing of monetary policy by the Bank of Japan continued to provide indirect support for the euro. The euro constrain ambiguous data on industrial production. The data in Spain and Italy were disappointing, and the report of France was better than expected.

The commodity currencies of Australia, New Zealand and Canada against the U.S. dollar after China reported a trade deficit of $ 880 million dollars in March, against a surplus of 15.25 billion U.S. dollars in February. Special support for commodity currencies received by the data showing that China's imports rose in March by 14.1% after a decline of 15.2% in February. Expected increase in imports by 6.1%.

Investors are waiting for the publication of minutes of the March meeting of the Open Market of the Federal Reserve System. Market participants will closely examine them for guidance as to when the Fed will complete or reduce the amount of its current program of quantitative easing.

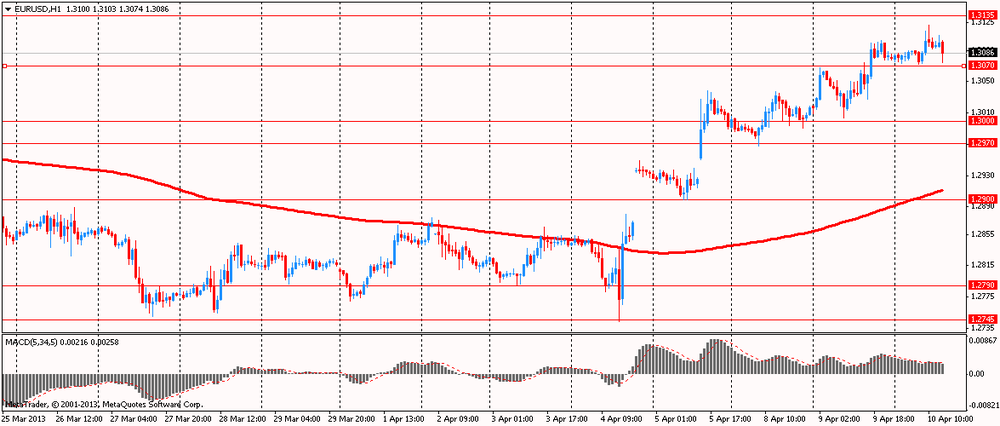

EUR / USD: during the European session, the pair rose to $ 1.3122, then dropped to $ 1.3074

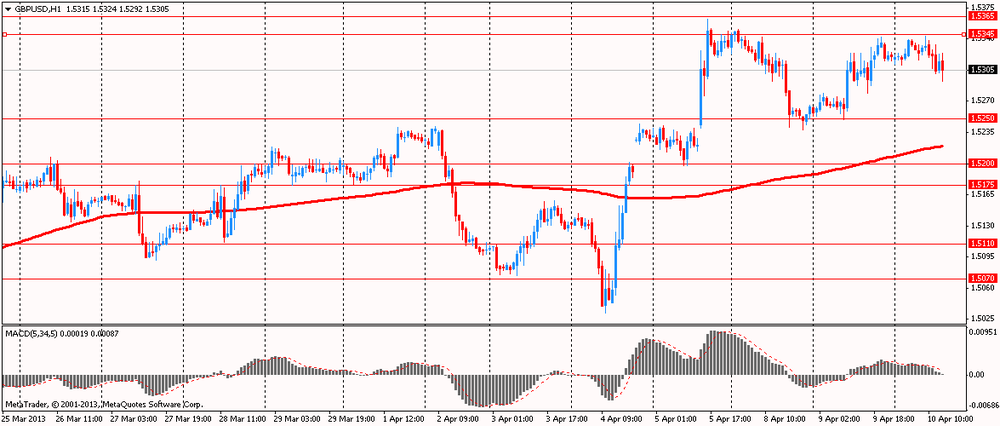

GBP / USD: during the European session, the pair fell to $ 1.5292

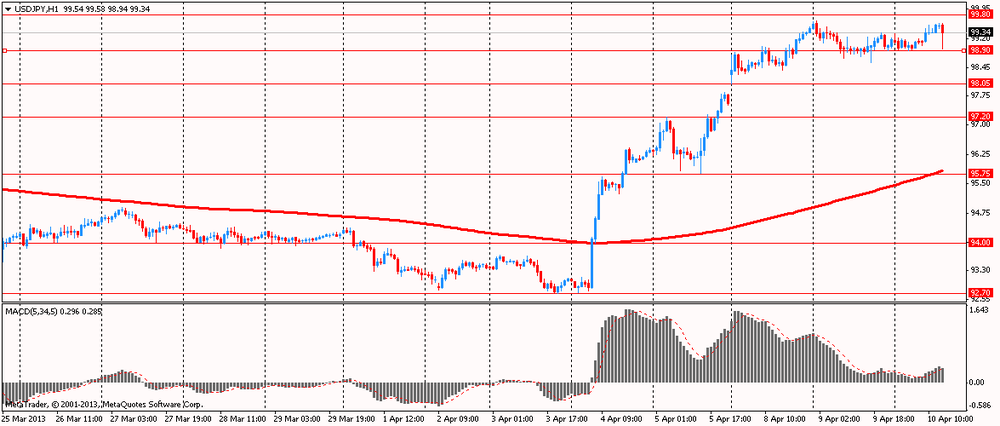

USD / JPY: during the European session, the pair rose to Y99.59, then fell to Y98.94

At 14:30 GMT the United States will publish data on crude oil from the Ministry of Energy. At 17:00 GMT the United States places the 10-year bonds. At 18:00 GMT will be publication of the minutes of the Fed meeting. At 18:00 GMT the United States will be released monthly performance report for March. At 22:30 GMT New Zealand is to publish an index of business activity in the manufacturing sector of Business NZ in March. End the day at 23:50 GMT Japan data on the change in orders for machinery and equipment in February.

-

13:27

Orders

EUR/USD

Offers $1.3150, $1.3130/40

Bids $1.3075/70, $1.3050, $1.3020, $1.3005/990, $1.2980

GBP/USD

Offers $1.5450/60, $1.5410/20, $1.5390/400, $1.5360/50, $1.5340/50

Bids $1.510/00, $1.5285/80, $1.5255/40, $1.5215/10, $1.5200-1.5195, $1.5160/50

AUD/USD

Offers $1.0650, $1.0600, $1.0575/80, $1.0550

Bids $1.0480, $1.0460/50, $1.0425/20, $1.0405/00

EUR/GBP

Offers stg0.8630/40, stg0.8610/15, stg0.8600/05, stg0.8580/85, stg0.8560/65

Bids stg0.8500, stg0.8485/80, stg0.8460/50, stg0.8410/00

EUR/JPY

Offers Y131.50, Y131.00, Y130.75

Bids Y130.00/90, Y129.55/60, Y129.20, Y129.00, Y128.80/75

USD/JPY

Offers Y100.25, Y100.00, Y99.75

Bids Y98.95/90, Y98.70, Y98.50

-

11:42

European stocks gained for a third day

European stocks gained for a third day, the longest winning streak since January, as Chinese imports beat forecasts and investors awaited the minutes of last month’s Federal Reserve meeting.

China’s imports rose by a better-than-forecast 14.1 percent in March, while export growth slowed to 10 percent from a year earlier, the customs administration said today in Beijing.

In the U.S., the Federal Open Market Committee releases minutes of its March 19-20 meeting, after which Chairman Ben S. Bernanke said further gains in the U.S. labor market were needed for the Fed to consider reducing its monetary easing. Policy makers reiterated the Fed’s key interest rate will stay near zero as long as unemployment stays above 6.5 percent and the inflation outlook is less than 2.5 percent.

Wacker Chemie and SMA Solar gained 6.1 percent to 59.30 euros and 6.6 percent to 19.48 euros, respectively. Meyer Burger Technology AG climbed 6.7 percent to 7.85 Swiss francs.

First Solar Inc., the world’s largest thin-film solar manufacturer by output, surged the most on record yesterday, after forecasting sales of $3.8 billion to $4 billion this year. Earnings will be $4 to $4.50 a share, exceeding the $3.57 average of 23 analysts’ estimates.

Stada Arzneimittel AG, Germany’s biggest publicly traded generic-drug maker, retreated 2 percent to 29.67 euros after Bank of America Corp. cut the stock to underperform from neutral, meaning investors should sell the shares.

FTSE 100 6,358.76 +45.55 +0.72%

CAC 40 3,718.35 +47.63 +1.30%

DAX 7,731.8 +94.29 +1.23%

-

11:06

France industrial output growth tops expectations

Strong growth in the transport and refining sectors boosted the French manufacturing output in February, helping overall production to recover at a faster-than-expected pace.

Industrial output grew 0.7 percent in February from a month ago, when it fell 0.8 percent, the statistical office Insee said Wednesday. Production was forecast to grow 0.2 percent, following a 1.2 percent drop originally estimated for January.

Likewise, manufacturing output grew 0.8 percent, offsetting the 1.3 percent drop seen in January and also exceeded the 0.2 percent rise forecast by economists. The January figure was revised from the 1.4 percent drop reported on March 11.

The month-on-month expansion in manufacturing was underpinned by a 17 percent surge in production of coke and refined petroleum products and a 3.6 percent rise in manufacture of transport equipment. Meanwhile, declines in manufacture of food products as well as electronic products weighed on overall production.

Construction output advanced 1 percent, while mining and quarrying output gained only 0.5 percent.

During the three months ended February, output decreased slightly by 0.3 percent in the manufacturing sector and by 0.1 percent in the industry as a whole.

-

10:58

GERMAN AUCTION RESULTS:

Germany alloted E4.22bln of 2-year benchmark 0.25% Mar 2015 Schatz issue Wednesday at an average yield 0.02% (0.06%) and bid-to-cover ratio 2.2 times (1.7).

-

10:37

ITALY T-BILL AUCTION RESULTS:

Italy sold E11.0bln in 3-/12-mth BOTs

- E3.0bln 3-month BOT, avg yield 0.243%, cover 1.9 times

- E8.0bln 12-month BOT, avg yield 0.922% (1.28%), cover 1.64 (1.5)

-

10:19

Option expiries for today's 1400GMT cut

EUR/USD $1.2900, $1.2950, $1.2975, $1.2985, $1.2995, $1.3010, $1.3020, $1.3050

USD/JPY Y98.00, Y99.00, Y99.20, Y99.50

EUR/JPY Y129.00

EUR/GBP stg0.8500

USD/CHF Chf0.9515

AUD/USD $1.0450, $1.0500, $1.0600

-

10:00

FTSE 100 6,326.5 +13.29 +0.21%, CAC 40 3,685.28 +14.56 +0.40%, DAX 7,666.3 +28.79 +0.38%

-

09:00

Wednesday: Asia Pacific stocks close

Asian stocks rose, with the benchmark regional equities gauge heading for its longest winning streak in seven weeks, as investors speculated stimulus measures will boost economic growth and increase profits.

Nikkei 225 13,288.13 +95.78 +0.73%

Hang Seng 21,896.4 +26.06 +0.12%

S&P/ASX 200 4,968 -8.84 -0.18%

Shanghai Composite 2,223.3 -2.47 -0.11%

BHP Billiton Ltd., the world’s largest miner, climbed 1.7 percent to advance for a fourth day in Sydney, its longest winning streak in more than two months.

Mitsubishi UFJ Financial Group Inc., Japan’s biggest bank, rose to the highest since June 2009 as speculation grew that Bank of Japan stimulus measures will boost earnings at financial-services firms.

Billabong International Ltd. slumped 27 percent after the Australian surfwear maker said it will hold talks on a A$287 million ($300 million) takeover deal.

-

08:53

Forex: Tuesday’s review

The yen rose against the dollar, departing from its lowest level in nearly four years on speculation that the decline of 6.4 percent in the last three days was too fast. The Japanese currency rose against all but one of its 16 major counterparts after the earlier fell to 99.66 per dollar, its lowest level since May 2009. Recall that the leaders of the Bank of Japan, headed by Governor Haruhiko Kuroda said after a meeting last week announced that they will raise the monthly purchase of bonds by 7.5 trillion yen, as they have set a period of two years to achieve its goal of 2 % inflation.

The euro rose to a three-week high against the U.S. dollar as the fact that the European Financial Stability Fund said that the sale of bonds was recorded in high demand. As it became known, the fund sold five-year bonds in the amount of EUR 8 billion, while the volume of supply of 14 billion euros.

The British pound rose after data showed that UK industrial production rose in February more than expected, which means that the decreased risk of returning the economy back into recession in the 1st quarter of 2013. National Bureau of Statistics said Tuesday that the growth of industrial production in February by 1% compared to the previous month. Growth contributed to the restoration of oil and gas, the growth in the mining industry and the growth in the energy sector caused by the cold weather. Manufacturing production increased over the same period by 0.8%.

The Australian currency is growing a second day, as the monetary stimulus in the U.S. and Japan have increased the demand for higher-yielding assets. Also contributed to the increase in the inflation data in China that showed a slowdown in the growth of the consumer price index, which weakened the excitement about a possible tightening of monetary policy by the government. Thus, the index of consumer prices in March fell by 0.9% m / m while the forecast decrease by only 0.6% m / m and a rise of 1.1% m / m, while compared to the previous year index increased by 2 1%, while analysts expected a more significant increase of 2.4% y / y growth of 3.2% y / ya month earlier.

-

07:46

France: Industrial Production, m/m, February +0.7% (forecast +0.4%)

-

07:21

European bourses are initially seen trading modestly higher Weds: the FTSE up 2, the DAX up 21 and the CAC up 12.

-

07:09

Asian session: The yen fell

00:30 Australia Westpac Consumer Confidence April +2.0% -5.1%

02:00 China Trade Balance, bln March 15.3 15.2 -0.9

The yen fell versus most of its 16 major counterparts as the Bank of Japan’s unprecedented stimulus measures aimed at ending almost two decades of deflation spurred bets the currency will weaken further.

The yen was 1 percent from 100 per dollar before BOJ Governor Haruhiko Kuroda speaks at a Yomiuri newspaper event on April 12, following his decision last week to double monthly bond purchases to achieve 2 percent annual inflation in two years. BOJ policy makers said at the conclusion of their meeting on April 4 that they will boost monthly debt purchases to 7.5 trillion yen ($76 billion). They also suspended a cap on some bond holdings and dropped a limit on debt maturities. Officials will next meet on April 26.

The greenback traded near a three-week low versus the euro before the Federal Reserve releases minutes of its March meeting. Chairman Ben S. Bernanke left the pace of government and mortgage debt purchases at $85 billion a month and said further improvement in the U.S. labor market is needed for the central bank to consider reducing its record monetary easing. The Commerce Department may say on April 12 that U.S. retail sales stagnated last month after a 1.1 percent gain in the previous period, according to the median estimate of economists surveyed by Bloomberg News.

Australia’s currency climbed for a third day after a report today showed imports by China, the South Pacific nation’s biggest trading partner, climbed 14.1 percent in March from a year earlier. That’s more than twice the 6 percent gain predicted by economists in a Bloomberg poll and a reversal from the 15.2 percent decline recorded in February.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3070-90.

GBP / USD: during the Asian session, the pair rose to $ 1.5340.

USD / JPY: during the Asian session, the pair traded in the range of Y98.90-35.

Although there is a full calendar scheduled for Wednesday, the main data releases are largely second tier, with the FOMC minutes the stand-out release. The calendar gets underway at 0645GMT, with the release of the February industrial output data. Analysts are looking for a 0.2% increase on month and an annual fall of 3.9% At 0700GMT, Spanish February industrial output numbers are expected and will likely top continue to make ugly reading, although analysts are looking for a very modest uptick to -4.9% y/y. Italian February industrial output numbers are expected at 0800GMT, with expectations for a 0.5% on month fall and an annualised fall fo 4.0%. The OECD February leading indicator numbers are due at 1000GMT.

-

06:25

Commodities. Daily history for Apr 9’2013:

Change % Change Last

GOLD 1,584.30 +11.80 +0.75%

OIL 94.03 +0.67 +0.72%

-

06:24

Stocks. Daily history for Apr 9'2013:

Change % Change Last

Nikkei 225 13,192.35 -0.24 0.00%

Hang Seng 21,891.65 +173.60 +0.80%

S&P/ASX 200 4,976.84 +71.35 +1.45%

Shanghai Composite 2,225.77 +14.18 +0.64%

FTSE 100 6,313.21 +36.27 +0.58%

CAC 40 3,670.72 +3.94 +0.11%

DAX 7,637.51 -25.13 -0.33%

Dow +59.67 14,673.15 +0.41%

Nasdaq +15.61 3,237.86 +0.48%

S&P +5.52 1,568.59 +0.35%

-

06:24

Currencies. Daily history for Apr 9'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3080 +0,48%

GBP/USD $1,5320 +0,37%

USD/CHF Chf0,9325 -0,23%

USD/JPY Y99,17 -0,30%

EUR/JPY Y129,72 +0,18%

GBP/JPY Y151,91 +0,05%

AUD/USD $1,0487 +0,70%

NZD/USD $0,8522 +0,69%

USD/CAD C$1,0161 -0,03%

-

06:10

Schedule for today, Wednesday, Apr 10’2013:

00:30 Australia Westpac Consumer Confidence April +2.0% -5.1%

02:00 China Trade Balance, bln March 15.3 15.2 -0.9

04:00 China New Loans March 620 890

06:45 France Industrial Production, m/m February -1.2% +0.4%

06:45 France Industrial Production, y/y February -3.5% -3.7%

14:30 U.S. Crude Oil Inventories April +2.7

18:00 U.S. FOMC meeting minutes March

18:00 U.S. Federal budget March -203.5

22:30 New Zealand Business NZ PMI March 56.3

23:50 Japan Core Machinery Orders February -13.1% +6.9%

-