Notícias do Mercado

-

16:39

Foreign exchange market. American session: the Canadian dollar traded mixed against the U.S. dollar after the better-than-expected Canadian labour market data

The U.S. dollar traded mixed to higher against the most major currencies. The greenback remained supported by growing concerns about the global economy. The International Monetary Fund cut its forecast for global economic growth for 2014 and 2015 this week.

The U.S. import price index declined 0.5% in September, in line with expectations, after a 0.6% fall in August. August's figure was revised up from a 0.9% drop.

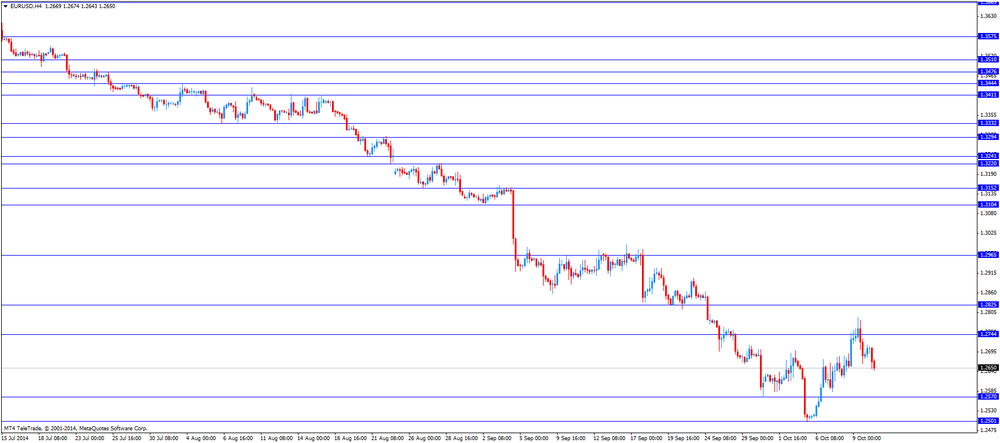

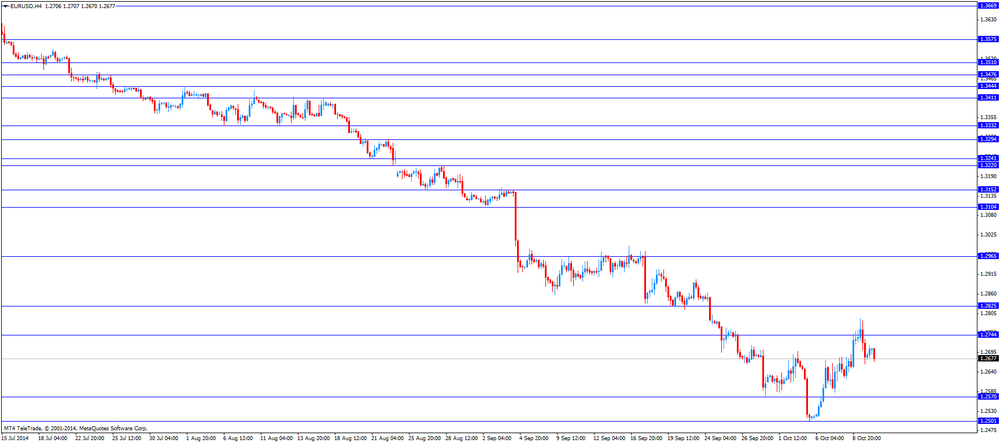

The euro traded lower against the U.S. dollar. France's industrial production was flat in August, beating forecasts of a 0.2% decline, after a 0.3% increase in July. July's figure was revised up from a 0.2% gain.

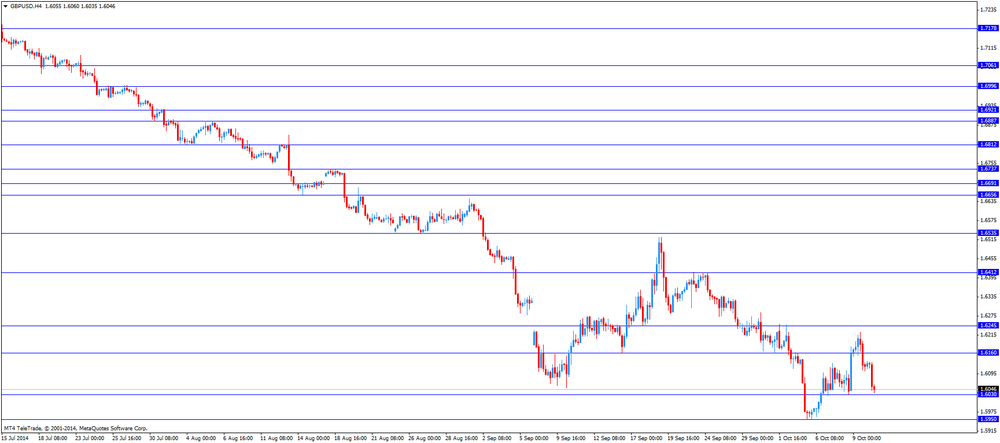

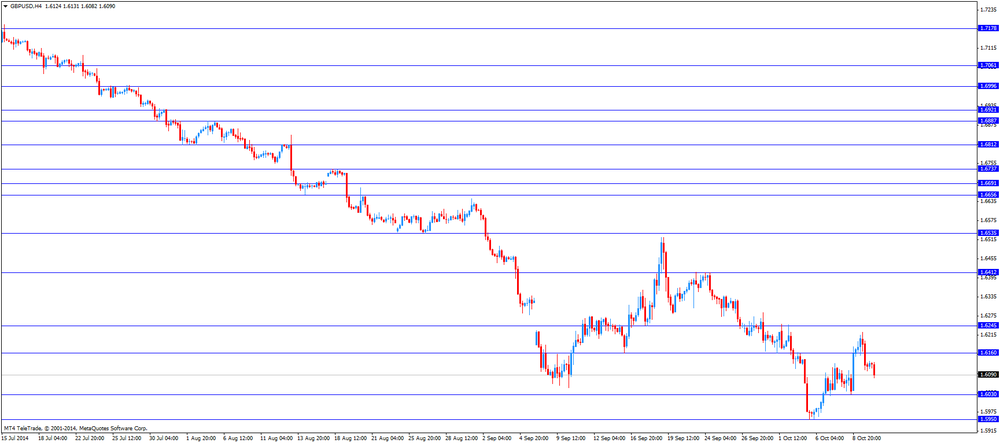

The British pound traded mixed against the U.S. dollar. Earlier, the pound fell against the greenback despite the better-than-expected trade balance data from the U.K. The trade deficit in the U.K. fell to £9.10 billion in August from £10.41 billion in July, beating expectations for a decrease to £9.60 billion. July's figure was revised from a deficit of £10.19 billion.

The Canadian dollar traded mixed against the U.S. dollar after the better-than-expected Canadian labour market data. Canada's unemployment rate dropped to 6.8% in September from 7.0% in August. That was the lowest level since December 2008.

Analysts had expected the unemployment rate to remain unchanged at 7.0%.

The number of employed people jumped by 74,100 in September, exceeding expectations for a rise of 20,000, after a 11,000 fall in August.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major economic reports from New Zealand. In the morning trading session, the kiwi decreased against the greenback.

The Australian dollar traded mixed against the U.S. dollar. In the morning trading session, the Aussi dropped against the greenback.

Home loans in Australia declined 0.9% in August, missing expectations for a 0.2% rise, after a 0.3% increase in July.

The Reserve Bank of Australia assistant governor Malcolm Edey told today that the long period of low interest rates led to a "concentration of risk- taking" in parts of Australian economy, particularly in the housing market.

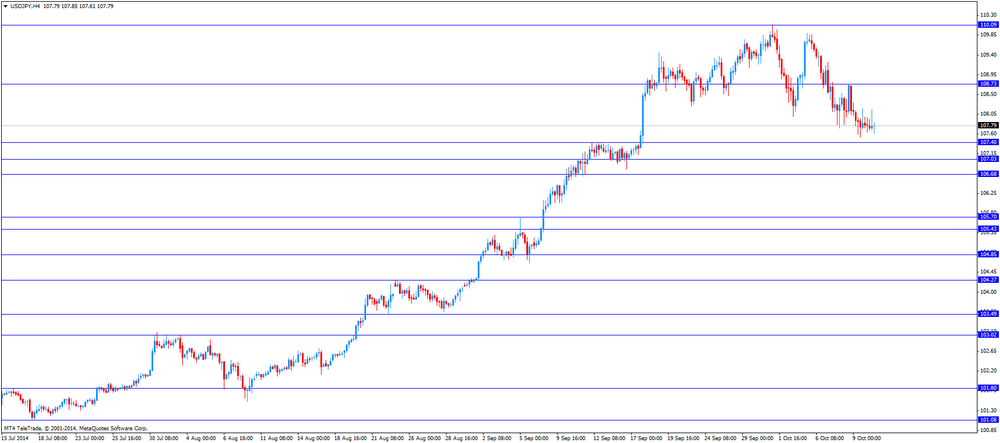

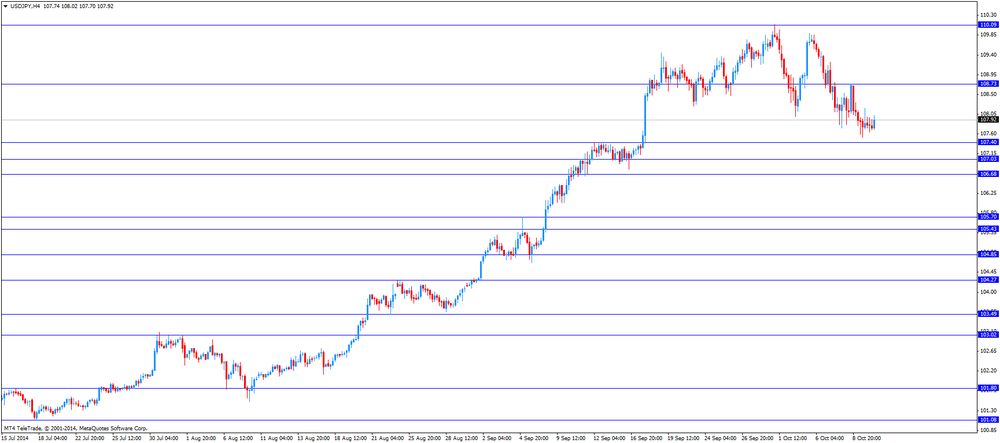

The Japanese yen traded mixed against the U.S. dollar. The BoJ released its minutes from the latest meeting. The central bank said that exports remained weak. One BoJ board member expressed concerns that inflation target of 2% would be achieved in about two years.

Japan's tertiary industry index fell 0.1% in August, missing expectations for a 0.2% rise, after a 0.3% drop in July. July's figure was revised down from a flat reading.

Japan's consumer confidence index fell to 39.9 in September from 41.2 in August, missing expectations for a rise to 42.2.

-

16:17

Bank of Canada’s Business Outlook Survey: companies expect a modest improvement in business activity

The Bank of Canada (BoC) released its autumn Business Outlook Survey today. The BoC's survey showed that companies expect a modest improvement in business activity, supported by the improving U.S. demand.

The survey also showed that inflation expectations increased.

Expectations of higher sales over the next 12 months rose and reached the highest level since the beginning of 2012, so BoC Business Outlook Survey.

The survey said that some companies expect to rise investment in machinery and equipment over the next 12 months.

More companies plan to add more jobs over the next year to meet additional demand, so the survey.

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600-05(E1.4bn), $1.2650(E1.5bn), $1.2700(E2.0bn), $1.2735-45(E600mn), $1.2750(E1.3bn), $1.2800(E1.0bn)

USD/JPY: Y107.50($2.9bn), Y107.75($500mn), Y108.00($630mn), Y108.30($900mn), Y109.50($3.6bn)

GBP/USD: $1.6100(stg1.0bn), $1.6150(stg170mn), $1.6250(stg255mn), $1.6300(stg554mn)

EUR/GBP: Stg0.7750(E338mn), stg0.7790-0.7800(E494mn), stg0.7885-90(E600mn)

USD/CHF: Chf0.9450($271mn)

AUD/USD: $0.8740-50(A$380mn), $0.8765-75(A$613mn), $0.8850(A$402mn), $0.8900(A$1.0bn)

NZD/USD: $0.7880(NZ$700mn), $0.7900(NZ$628mn), $0.8125(NZ$2.1bn)

USD/CAD: C$1.1000-10($1.5bn), C$1.1100-10($635mn), C$1.1150-60($1.0bn)

-

14:38

Canada’s unemployment rate declined to 6.8% in September

Statistics Canada released the labour market data today. Canada's unemployment rate dropped to 6.8% in September from 7.0% in August. That was the lowest level since December 2008.

Analysts had expected the unemployment rate to remain unchanged at 7.0%.

The number of employed people jumped by 74,100 in September, exceeding expectations for a rise of 20,000, after a 11,000 fall in August.

69,300 full-time jobs were added to the economy in Canada. That was the biggest surprise.

-

13:44

Bank of Japan minutes: exports remained weak

The Bank of Japan (BoJ) released its minutes from the latest meeting. The central bank said that exports remained weak. The BoJ expects exports to increase moderately as overseas economies recover.

The central bank thinks the negative effects of the sales tax hike "had gradually begun to wane".

The BoJ expect Japan's economy will recover moderately.

Board members agreed that private consumption declined due to the sales tax hike.

One BoJ board member expressed concerns that inflation target of 2% would be achieved in about two years.

Many BoJ board members said that "it was important to continue to carefully monitor developments in inflation expectations".

-

13:30

Canada: Employment , September +74.1 (forecast +20.0)

-

13:30

Canada: Unemployment rate, September 6.8% (forecast 7.0%)

-

13:30

U.S.: Import Price Index, September -0.5% (forecast -0.5%)

-

13:00

Orders

EUR/USD

Offers $1.2800/10

Bids $1.2650, $1.2635, $1.2600, $1.2585/80

GBP/USD

Offers

Bids $1.6020, $1.6010-00, $1.5980

AUD/USD

Offers $0.8845/50, $0.8820, $0.8800, $0.8750/60

Bids $0.8700, $0.8650, $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y138.20, Y138.00, Y137.85/90, Y137.50, Y137.15/20

Bids Y136.50, Y136.00, Y135.50, Y135.00

USD/JPY

Offers Y108.90/00, Y108.75/80, Y108.50, Y108.20/40

Bids Y107.50, Y107.00, Y106.85/80

EUR/GBP

Offers stg0.7980

Bids stg0.7840/30

-

13:00

Foreign exchange market. European session: the British pound declined against the U.S. dollar despite the better-than-expected trade balance data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans August +0.3% +0.2% -0.9%

00:45 Australia RBA Assist Gov Edey Speaks

05:00 Japan Consumer Confidence September 41.2 42.2 39.9

06:45 France Industrial Production, m/m August +0.3% Revised From +0.2% -0.2% 0.0%

06:45 France Industrial Production, y/y August +0.1% -0.3%

08:30 United Kingdom Trade in goods August -10.4 Revised From -10.2 -9.6 -9.1

The U.S. dollar traded mixed to higher against the most major currencies. The greenback remained supported by yesterday's better-than-expected number of initial jobless claim in the U.S. and by growing concerns about the global economy.

The number of initial jobless claims in the week ending October 4 declined by 1,000 to 287,000 from 288,000 in the previous week.

The International Monetary Fund cut its forecast for global economic growth for 2014 and 2015 this week.

The U.S. import price index is expected to decline 0.5% in September, after a 0.9% fall in August.

The euro fell against the U.S. dollar. France's industrial production was flat in August, beating forecasts of a 0.2% decline, after a 0.3% increase in July. July's figure was revised up from a 0.2% gain.

The British pound declined against the U.S. dollar despite the better-than-expected trade balance data from the U.K. The trade deficit in the U.K. fell to £9.10 billion in August from £10.41 billion in July, beating expectations for a decrease to £9.60 billion. July's figure was revised from a deficit of £10.19 billion.

The Canadian dollar traded mixed ahead of the Canadian labour market data. Canadian unemployment rate is expected to remain unchanged at 7.0% in August.

Canada's economy is expected to add 20,000 jobs in September.

EUR/USD: the currency pair fell to $1.2643

GBP/USD: the currency pair decreased to $1.6035

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Unemployment rate September 7.0% 7.0%

12:30 Canada Employment September -11.0 +20.0

12:30 U.S. Import Price Index September -0.9% -0.5%

13:00 U.S. FOMC Member Charles Plosser Speaks

14:30 Canada Bank of Canada Business Outlook Survey Quarter III

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600-05(E1.4bn), $1.2650(E1.5bn), $1.2700(E2.0bn), $1.2735-45(E600mn), $1.2750(E1.3bn), $1.2800(E1.0bn)

USD/JPY: Y107.50($2.9bn), Y107.75($500mn), Y108.00($630mn), Y108.30($900mn), Y109.50($3.6bn)

GBP/USD: $1.6100(stg1.0bn), $1.6150(stg170mn), $1.6250(stg255mn), $1.6300(stg554mn)

EUR/GBP: Stg0.7750(E338mn), stg0.7790-0.7800(E494mn), stg0.7885-90(E600mn)

USD/CHF: Chf0.9450($271mn)

AUD/USD: $0.8740-50(A$380mn), $0.8765-75(A$613mn), $0.8850(A$402mn), $0.8900(A$1.0bn)

NZD/USD: $0.7880(NZ$700mn), $0.7900(NZ$628mn), $0.8125(NZ$2.1bn)

USD/CAD: C$1.1000-10($1.5bn), C$1.1100-10($635mn), C$1.1150-60($1.0bn)

-

10:20

Foreign exchange market. Asian session: the Australian dollar traded mixed against the U.S. dollar after the weaker-than-expected home loans from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans August +0.3% +0.2% -0.9%

00:45 Australia RBA Assist Gov Edey Speaks

05:00 Japan Consumer Confidence September 41.2 42.2 39.9

06:45 France Industrial Production, m/m August +0.3% Revised From +0.2% -0.2% 0.0%

06:45 France Industrial Production, y/y August +0.1% -0.3%

08:30 United Kingdom Trade in goods August -10.4 Revised From -10.2 -9.6 -9.1

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by yesterday's better-than-expected number of initial jobless claim in the U.S. The number of initial jobless claims in the week ending October 4 declined by 1,000 to 287,000 from 288,000 in the previous week. Analysts had expected the number of initial jobless claims to increase by 3,000 to 291,000.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar after the weaker-than-expected home loans from Australia. Home loans in Australia declined 0.9% in August, missing expectations for a 0.2% rise, after a 0.3% increase in July.

The Reserve Bank of Australia assistant governor Malcolm Edey told today that the long period of low interest rates led to a "concentration of risk- taking" in parts of Australian economy, particularly in the housing market.

The Japanese yen traded mixed against the U.S. dollar after the Bank of Japan (BoJ) minutes and Japan's tertiary industry index. The BoJ released its minutes from the latest meeting. The central bank said that exports remained weak. One BoJ board member expressed concerns that inflation target of 2% would be achieved in about two years.

Japan's tertiary industry index fell 0.1% in August, missing expectations for a 0.2% rise, after a 0.3% drop in July. July's figure was revised down from a flat reading.

Japan's consumer confidence index fell to 39.9 in September from 41.2 in August, missing expectations for a rise to 42.2.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Unemployment rate September 7.0% 7.0%

12:30 Canada Employment September -11.0 +20.0

12:30 U.S. Import Price Index September -0.9% -0.5%

13:00 U.S. FOMC Member Charles Plosser Speaks

14:30 Canada Bank of Canada Business Outlook Survey Quarter III

-

09:30

United Kingdom: Trade in goods , August -9.1 (forecast -9.6)

-

07:45

France: Industrial Production, m/m, August 0.0% (forecast -0.2%)

-

06:32

Options levels on friday, October 10, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2852 (2819)

$1.2810 (1555)

$1.2771 (378)

Price at time of writing this review: $ 1.2700

Support levels (open interest**, contracts):

$1.2636 (1862)

$1.2578 (2373)

$1.2544 (3031)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 50625 contracts, with the maximum number of contracts with strike price $1,2900 (5966);

- Overall open interest on the PUT options with the expiration date November, 7 is 49720 contracts, with the maximum number of contracts with strike price $1,2400 (4871);

- The ratio of PUT/CALL was 0.98 versus 0.98 from the previous trading day according to data from October, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.6403 (1242)

$1.6306 (1183)

$1.6210 (1829)

Price at time of writing this review: $1.6123

Support levels (open interest**, contracts):

$1.6090 (844)

$1.5994 (2045)

$1.5896 (1019)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 22264 contracts, with the maximum number of contracts with strike price $1,6750 (1904);

- Overall open interest on the PUT options with the expiration date November, 7 is 29115 contracts, with the maximum number of contracts with strike price $1,5400 (2211);

- The ratio of PUT/CALL was 1.31 versus 1.29 from the previous trading day according to data from October, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:30

Australia: Home Loans , August -0.9% (forecast +0.2%)

-

00:51

Japan: Tertiary Industry Index , August -0.1% (forecast +0.2%)

-