Notícias do Mercado

-

20:00

Dow -11.75 16,647.50 -0.07% Nasdaq -57.37 4,320.97 -1.31% S&P -6.17 1,922.04 -0.32%

-

17:00

European stocks close: FTSE 100 6,339.97 -91.88 -1.43% CAC 40 4,073.71 -67.74 -1.64% DAX 8,788.8 -216.21 -2.40%

-

17:00

European stocks close: stocks closed lower on concerns over the global growth and on concerns Eurozone could fall into recession

Stock indices closed lower on concerns over the global growth and Eurozone could fall into recession.

The International Monetary Fund cut its forecast for global economic growth for 2014 and 2015 this week. The International Monetary Fund chief Christine Lagarde said yesterday that the likelihood of the Eurozone slipping into recession is 35-40% if nothing will be done.

Several disappointing economic data was released in Germany this week. Four German economic institutes lowered their forecast for Germany's economic growth yesterday.

There is also differences between the European Central Bank (ECB) and Germany. The ECB President Mario Draghi said at the Brookings Institution in Washington yesterday that the central bank is willing to add more stimulus measures if needed. But German Finance Minister Wolfgang Schaeuble yesterday warned against further stimulus measures.

France's industrial production was flat in August, beating forecasts of a 0.2% decline, after a 0.3% increase in July. July's figure was revised up from a 0.2% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,339.97 -91.88 -1.43%

DAX 8,788.81 -216.21 -2.40%

CAC 40 4,073.71 -67.74 -1.64%

-

16:40

Oil: an overview of the market situation

Oil prices rose slightly today, which is mainly due to technical factors. But despite the recovery, Brent crude oil continues to trade near four-year low.

Experts point out that the fundamental factors of weaker growth in the global economy, falling demand and excessive growth stocks remain the same. Oil prices close to the oversold technical indicators that reflect. Meanwhile, hourly charts indicate the likelihood of further correction before the weekend. However, the correction may be small, since oil prices are influenced by the stock markets of the USA, which are now falling.

Little impact on the bidding had presented today OPEC monthly report. It repeated the view expressed earlier by some members of the cartel view that global oil demand will increase with the onset of winter. Meanwhile, we add that OPEC has maintained its forecast for global oil demand this year at 91.19 million barrels per day. In comparison with 2013 year, the demand has increased by 1.05 million b / d. Forecast for 2015 maintained at 92.38 million b / d. OPEC expects to meet demand in 2014, her average will need to produce 29.5 million b / d in 2015 - 29.2 million b / d. Demand for oil produced outside of OPEC, is expected to reach 55.91 million b / d (an increase of 1.68 million b / d compared to the previous year). Recall Organization discuss quota for oil is 30 million barrels per day, at a meeting on November 27 and show no signs that its members are willing to work together to support the global market.

Pressure on prices has had a statement of IMF managing director Christine Lagarde that the eurozone faces a high probability of a new recession. Previously, the world's leading investors Mark Mobius and Jim Rogers noted that in the current situation to predict the price of oil there is no way. According to them, as the oil may fall to $ 60 a barrel, and again exceed the mark of $ 100.

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) rose to $ 84.92 a barrel on the New York Mercantile Exchange (NYMEX).

November futures price for North Sea Brent crude oil mixture rose $ 0.23 to $ 89.34 a barrel on the London exchange ICE Futures Europe.

-

16:39

Foreign exchange market. American session: the Canadian dollar traded mixed against the U.S. dollar after the better-than-expected Canadian labour market data

The U.S. dollar traded mixed to higher against the most major currencies. The greenback remained supported by growing concerns about the global economy. The International Monetary Fund cut its forecast for global economic growth for 2014 and 2015 this week.

The U.S. import price index declined 0.5% in September, in line with expectations, after a 0.6% fall in August. August's figure was revised up from a 0.9% drop.

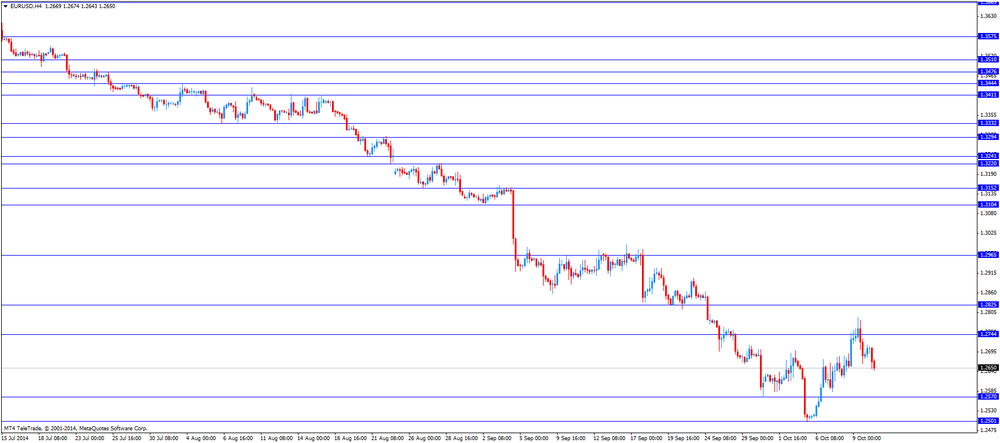

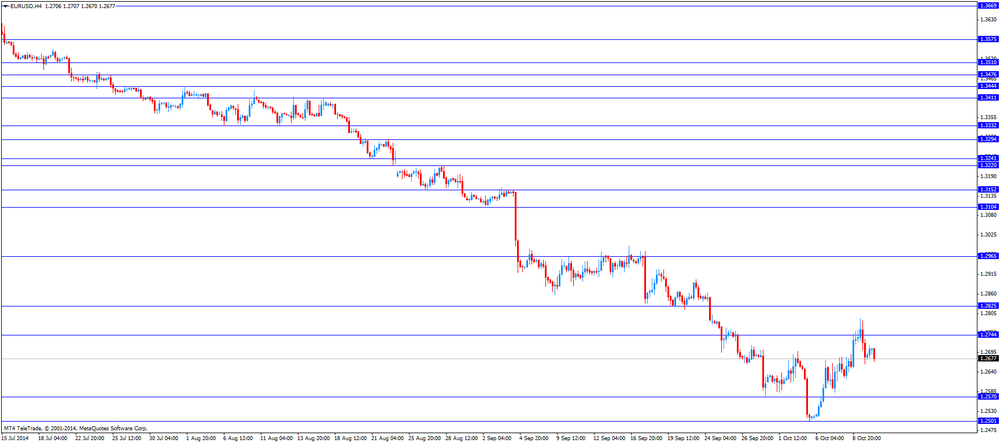

The euro traded lower against the U.S. dollar. France's industrial production was flat in August, beating forecasts of a 0.2% decline, after a 0.3% increase in July. July's figure was revised up from a 0.2% gain.

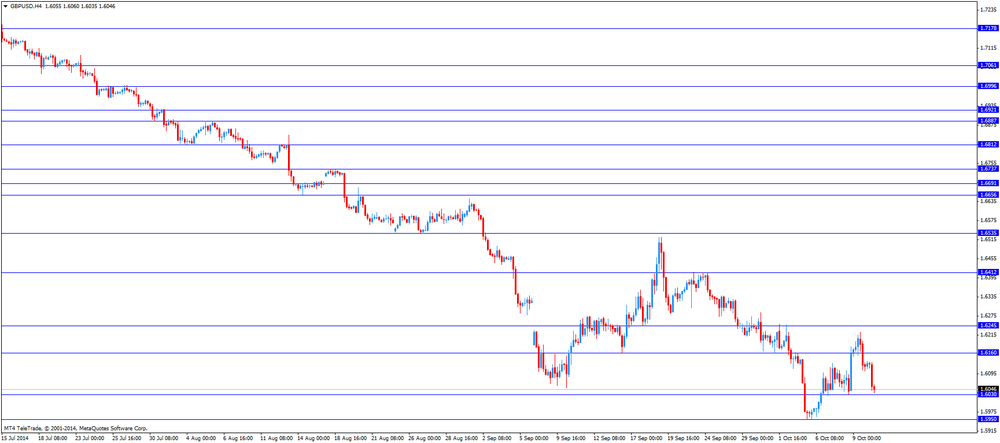

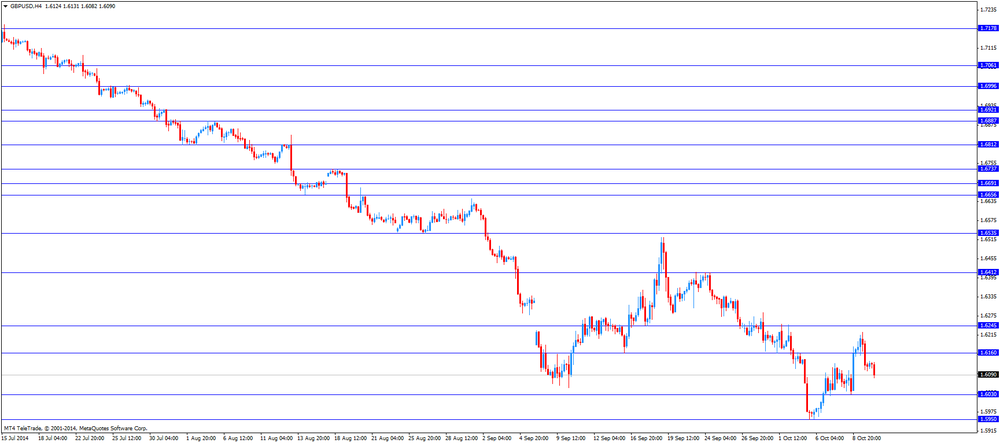

The British pound traded mixed against the U.S. dollar. Earlier, the pound fell against the greenback despite the better-than-expected trade balance data from the U.K. The trade deficit in the U.K. fell to £9.10 billion in August from £10.41 billion in July, beating expectations for a decrease to £9.60 billion. July's figure was revised from a deficit of £10.19 billion.

The Canadian dollar traded mixed against the U.S. dollar after the better-than-expected Canadian labour market data. Canada's unemployment rate dropped to 6.8% in September from 7.0% in August. That was the lowest level since December 2008.

Analysts had expected the unemployment rate to remain unchanged at 7.0%.

The number of employed people jumped by 74,100 in September, exceeding expectations for a rise of 20,000, after a 11,000 fall in August.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major economic reports from New Zealand. In the morning trading session, the kiwi decreased against the greenback.

The Australian dollar traded mixed against the U.S. dollar. In the morning trading session, the Aussi dropped against the greenback.

Home loans in Australia declined 0.9% in August, missing expectations for a 0.2% rise, after a 0.3% increase in July.

The Reserve Bank of Australia assistant governor Malcolm Edey told today that the long period of low interest rates led to a "concentration of risk- taking" in parts of Australian economy, particularly in the housing market.

The Japanese yen traded mixed against the U.S. dollar. The BoJ released its minutes from the latest meeting. The central bank said that exports remained weak. One BoJ board member expressed concerns that inflation target of 2% would be achieved in about two years.

Japan's tertiary industry index fell 0.1% in August, missing expectations for a 0.2% rise, after a 0.3% drop in July. July's figure was revised down from a flat reading.

Japan's consumer confidence index fell to 39.9 in September from 41.2 in August, missing expectations for a rise to 42.2.

-

16:20

Gold: an overview of the market situation

Gold prices declined moderately today, but continue to show growth in the week as positive economic data from the United States strengthened the dollar and reduced investor demand for safe-haven assets.

Nevertheless, we add, which will reduce expectations of a quick rate hike by the Federal Reserve continue to influence the market. Yesterday, the price of gold rose above two-week high on the day after the Fed meeting minutes of September 16-17, showed that some members of the committee believes that the existing wording misleading as to the timing of rate increases, and the growth of interest on loans should be linked to the success of the American economy. Protocols have also shown that the central bank has reduced the United States economic growth forecast because of the fledgling dollar and concerns about the weakness of the global economy.

"Minutes of the Fed really revived the gold market", - said Bob Haberkorn, senior broker RJO Futures in Chicago. - "The market appreciates the fact that interest rates will not rise in the short term, and most traders have adjusted their expectations for a rate hike."

Margins in China are held at the level of $ 5-6 to the spot price, indicating the interest of the buyers. Return to the market of Chinese players on Wednesday after a holiday week supported the gold price.

"In the near future, I think gold will be about $ 1210 with the support of sentiment that emerged after the publication of the minutes of the meeting of the Fed. Prices may reach $ 1,240 resistance level, and by the end of the year to fall below $ 1,200, "- said the analyst Jinrui Futures.

The cost of the December gold futures on the COMEX today dropped to 1221.00 dollars per ounce.

-

16:17

Bank of Canada’s Business Outlook Survey: companies expect a modest improvement in business activity

The Bank of Canada (BoC) released its autumn Business Outlook Survey today. The BoC's survey showed that companies expect a modest improvement in business activity, supported by the improving U.S. demand.

The survey also showed that inflation expectations increased.

Expectations of higher sales over the next 12 months rose and reached the highest level since the beginning of 2012, so BoC Business Outlook Survey.

The survey said that some companies expect to rise investment in machinery and equipment over the next 12 months.

More companies plan to add more jobs over the next year to meet additional demand, so the survey.

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600-05(E1.4bn), $1.2650(E1.5bn), $1.2700(E2.0bn), $1.2735-45(E600mn), $1.2750(E1.3bn), $1.2800(E1.0bn)

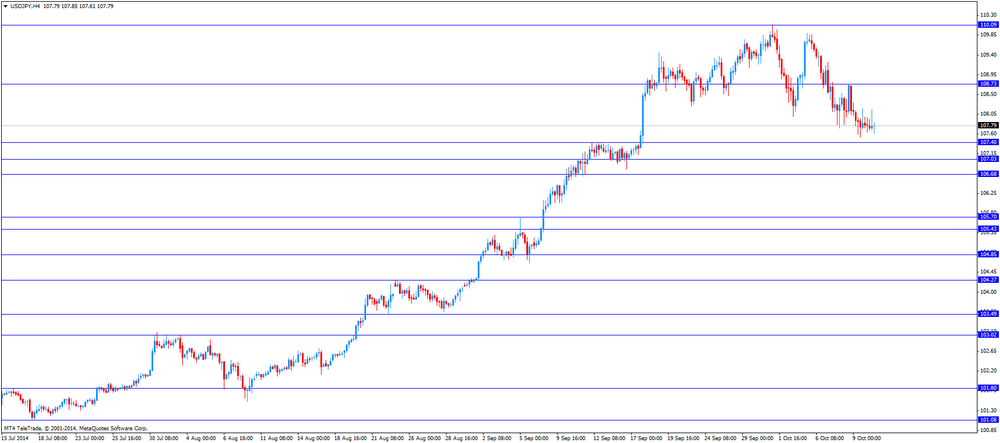

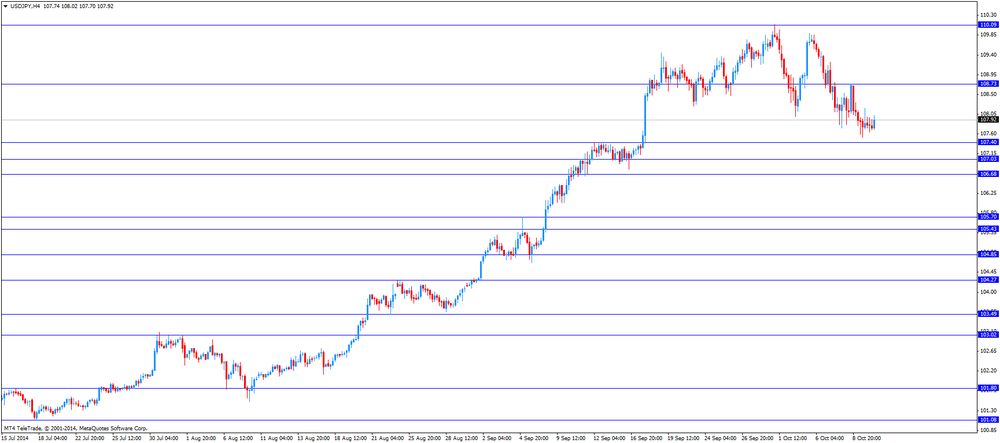

USD/JPY: Y107.50($2.9bn), Y107.75($500mn), Y108.00($630mn), Y108.30($900mn), Y109.50($3.6bn)

GBP/USD: $1.6100(stg1.0bn), $1.6150(stg170mn), $1.6250(stg255mn), $1.6300(stg554mn)

EUR/GBP: Stg0.7750(E338mn), stg0.7790-0.7800(E494mn), stg0.7885-90(E600mn)

USD/CHF: Chf0.9450($271mn)

AUD/USD: $0.8740-50(A$380mn), $0.8765-75(A$613mn), $0.8850(A$402mn), $0.8900(A$1.0bn)

NZD/USD: $0.7880(NZ$700mn), $0.7900(NZ$628mn), $0.8125(NZ$2.1bn)

USD/CAD: C$1.1000-10($1.5bn), C$1.1100-10($635mn), C$1.1150-60($1.0bn)

-

14:38

Canada’s unemployment rate declined to 6.8% in September

Statistics Canada released the labour market data today. Canada's unemployment rate dropped to 6.8% in September from 7.0% in August. That was the lowest level since December 2008.

Analysts had expected the unemployment rate to remain unchanged at 7.0%.

The number of employed people jumped by 74,100 in September, exceeding expectations for a rise of 20,000, after a 11,000 fall in August.

69,300 full-time jobs were added to the economy in Canada. That was the biggest surprise.

-

14:34

U.S. Stocks open: Dow 16,647.69 -11.56 -0.07%, Nasdaq 4,344.15 -34.19 -0.78%, S&P 1,925.82 -2.39 -0.12%

-

14:29

Before the bell: S&P futures -0.09%, Nasdaq futures -0.60%

U.S. stock futures fluctuated amid concern that slower global growth will hurt the economy.

Global markets:

Nikkei 15,300.55 -178.38 -1.15%

Hang Seng 23,088.54 -445.99 -1.90%

Shanghai Composite 2,374.54 -14.83 -0.62%

FTSE 6,374.16 -57.69 -0.90%

CAC 4,100.8 -40.65 -0.98%

DAX 8,851.57 -153.45 -1.70%

Crude oil $84.25 (-1.80%)

Gold $1222.10 (-0.27%)

-

14:16

DOW components before the bell

(company / ticker / price / change, % / volume)

Goldman Sachs

GS

181.29

+0.01%

3.4K

Pfizer Inc

PFE

29.02

+0.10%

5.0K

AT&T Inc

T

34.70

+0.12%

9.2K

Johnson & Johnson

JNJ

102.40

+0.31%

4.5K

Wal-Mart Stores Inc

WMT

78.13

+0.35%

0.9K

E. I. du Pont de Nemours and Co

DD

68.02

+1.05%

2.9K

Travelers Companies Inc

TRV

93.89

0.00%

1.6K

United Technologies Corp

UTX

99.94

0.00%

0.8K

Merck & Co Inc

MRK

59.19

-0.03%

3.4K

3M Co

MMM

138.59

-0.04%

2.0K

Visa

V

207.60

-0.05%

5.0K

The Coca-Cola Co

KO

43.85

-0.05%

32.7K

Nike

NKE

87.18

-0.06%

0.1K

Walt Disney Co

DIS

85.65

-0.07%

2.0K

Caterpillar Inc

CAT

93.40

-0.11%

5.4K

American Express Co

AXP

85.78

-0.13%

0.5K

McDonald's Corp

MCD

92.60

-0.13%

3.6K

Boeing Co

BA

122.59

-0.14%

1.8K

JPMorgan Chase and Co

JPM

59.00

-0.14%

23.9K

Procter & Gamble Co

PG

83.54

-0.14%

2.1K

General Electric Co

GE

24.74

-0.16%

28.2K

UnitedHealth Group Inc

UNH

84.80

-0.16%

1.6K

Microsoft Corp

MSFT

45.75

-0.22%

8.5K

Exxon Mobil Corp

XOM

91.60

-0.24%

6.1K

Verizon Communications Inc

VZ

48.81

-0.25%

1.2K

Chevron Corp

CVX

114.19

-0.28%

4.1K

Home Depot Inc

HD

92.80

-0.29%

0.1K

International Business Machines Co...

IBM

185.73

-0.37%

1.1K

Cisco Systems Inc

CSCO

23.94

-1.03%

21.9K

Intel Corp

INTC

32.90

-2.14%

32.9K

-

14:10

Upgrades and downgrades before the market open

Upgrades:

DuPont (DD) upgraded to Buy from Hold at Jefferies, target raised to $84 from $72

Halliburton (HAL) upgraded to Buy from Hold at Societe Generale, target lowered to $75 from $80

Downgrades:

Other:

Hewlett-Packard (HPQ) initiated with a Hold at Jefferies, target $38

-

13:44

Bank of Japan minutes: exports remained weak

The Bank of Japan (BoJ) released its minutes from the latest meeting. The central bank said that exports remained weak. The BoJ expects exports to increase moderately as overseas economies recover.

The central bank thinks the negative effects of the sales tax hike "had gradually begun to wane".

The BoJ expect Japan's economy will recover moderately.

Board members agreed that private consumption declined due to the sales tax hike.

One BoJ board member expressed concerns that inflation target of 2% would be achieved in about two years.

Many BoJ board members said that "it was important to continue to carefully monitor developments in inflation expectations".

-

13:30

Canada: Employment , September +74.1 (forecast +20.0)

-

13:30

Canada: Unemployment rate, September 6.8% (forecast 7.0%)

-

13:30

U.S.: Import Price Index, September -0.5% (forecast -0.5%)

-

13:00

Orders

EUR/USD

Offers $1.2800/10

Bids $1.2650, $1.2635, $1.2600, $1.2585/80

GBP/USD

Offers

Bids $1.6020, $1.6010-00, $1.5980

AUD/USD

Offers $0.8845/50, $0.8820, $0.8800, $0.8750/60

Bids $0.8700, $0.8650, $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y138.20, Y138.00, Y137.85/90, Y137.50, Y137.15/20

Bids Y136.50, Y136.00, Y135.50, Y135.00

USD/JPY

Offers Y108.90/00, Y108.75/80, Y108.50, Y108.20/40

Bids Y107.50, Y107.00, Y106.85/80

EUR/GBP

Offers stg0.7980

Bids stg0.7840/30

-

13:00

Foreign exchange market. European session: the British pound declined against the U.S. dollar despite the better-than-expected trade balance data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans August +0.3% +0.2% -0.9%

00:45 Australia RBA Assist Gov Edey Speaks

05:00 Japan Consumer Confidence September 41.2 42.2 39.9

06:45 France Industrial Production, m/m August +0.3% Revised From +0.2% -0.2% 0.0%

06:45 France Industrial Production, y/y August +0.1% -0.3%

08:30 United Kingdom Trade in goods August -10.4 Revised From -10.2 -9.6 -9.1

The U.S. dollar traded mixed to higher against the most major currencies. The greenback remained supported by yesterday's better-than-expected number of initial jobless claim in the U.S. and by growing concerns about the global economy.

The number of initial jobless claims in the week ending October 4 declined by 1,000 to 287,000 from 288,000 in the previous week.

The International Monetary Fund cut its forecast for global economic growth for 2014 and 2015 this week.

The U.S. import price index is expected to decline 0.5% in September, after a 0.9% fall in August.

The euro fell against the U.S. dollar. France's industrial production was flat in August, beating forecasts of a 0.2% decline, after a 0.3% increase in July. July's figure was revised up from a 0.2% gain.

The British pound declined against the U.S. dollar despite the better-than-expected trade balance data from the U.K. The trade deficit in the U.K. fell to £9.10 billion in August from £10.41 billion in July, beating expectations for a decrease to £9.60 billion. July's figure was revised from a deficit of £10.19 billion.

The Canadian dollar traded mixed ahead of the Canadian labour market data. Canadian unemployment rate is expected to remain unchanged at 7.0% in August.

Canada's economy is expected to add 20,000 jobs in September.

EUR/USD: the currency pair fell to $1.2643

GBP/USD: the currency pair decreased to $1.6035

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Unemployment rate September 7.0% 7.0%

12:30 Canada Employment September -11.0 +20.0

12:30 U.S. Import Price Index September -0.9% -0.5%

13:00 U.S. FOMC Member Charles Plosser Speaks

14:30 Canada Bank of Canada Business Outlook Survey Quarter III

-

12:17

European stock markets mid session: stocks traded lower on speculation Europe is headed for recession

Stock indices traded lower on speculation Europe is headed for recession. Several disappointing economic data was released in Germany this week. Four German economic institutes lowered their forecast for Germany's economic growth yesterday.

There is also differences between the European Central Bank (ECB) and Germany. The ECB President Mario Draghi said at the Brookings Institution in Washington yesterday that the central bank is willing to add more stimulus measures if needed. But German Finance Minister Wolfgang Schaeuble yesterday warned against further stimulus measures.

France's industrial production was flat in August, beating forecasts of a 0.2% decline, after a 0.3% increase in July. July's figure was revised up from a 0.2% gain.

Current figures:

Name Price Change Change %

FTSE 6,346.45 -85.40 -1.33%

DAX 8,819.18 -185.84 -2.06%

CAC 40 4,076.7 -64.75 -1.56%

-

10:59

Asian Stocks close: stocks closed lower on growing concerns about the global economy

Asian stock indices closed lower on growing concerns about the global economy. The International Monetary Fund cut its forecast for global economic growth for 2014 and 2015 this week.

Several disappointing economic data was released in Germany this week.

Investors have concerns that Europe's slowdown could hurt global growth.

Chinese stocks declined on profit taking.

Hong Kong's stock index Hang Seng dropped after the government scrapped negotiations with pro-democracy protestors on Friday.

The BoJ released its minutes from the latest meeting. The central bank said that exports remained weak. One BoJ board member expressed concerns that inflation target of 2% would be achieved in about two years.

Japan's tertiary industry index fell 0.1% in August, missing expectations for a 0.2% rise, after a 0.3% drop in July. July's figure was revised down from a flat reading.

Japan's consumer confidence index fell to 39.9 in September from 41.2 in August, missing expectations for a rise to 42.2.

Indexes on the close:

Nikkei 225 15,300.55 -178.38 -1.15%

Hang Seng 23,088.54 -445.99 -1.90%

Shanghai Composite 2,374.54 -14.83 -0.62%

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD: $1.2600-05(E1.4bn), $1.2650(E1.5bn), $1.2700(E2.0bn), $1.2735-45(E600mn), $1.2750(E1.3bn), $1.2800(E1.0bn)

USD/JPY: Y107.50($2.9bn), Y107.75($500mn), Y108.00($630mn), Y108.30($900mn), Y109.50($3.6bn)

GBP/USD: $1.6100(stg1.0bn), $1.6150(stg170mn), $1.6250(stg255mn), $1.6300(stg554mn)

EUR/GBP: Stg0.7750(E338mn), stg0.7790-0.7800(E494mn), stg0.7885-90(E600mn)

USD/CHF: Chf0.9450($271mn)

AUD/USD: $0.8740-50(A$380mn), $0.8765-75(A$613mn), $0.8850(A$402mn), $0.8900(A$1.0bn)

NZD/USD: $0.7880(NZ$700mn), $0.7900(NZ$628mn), $0.8125(NZ$2.1bn)

USD/CAD: C$1.1000-10($1.5bn), C$1.1100-10($635mn), C$1.1150-60($1.0bn)

-

10:20

Foreign exchange market. Asian session: the Australian dollar traded mixed against the U.S. dollar after the weaker-than-expected home loans from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans August +0.3% +0.2% -0.9%

00:45 Australia RBA Assist Gov Edey Speaks

05:00 Japan Consumer Confidence September 41.2 42.2 39.9

06:45 France Industrial Production, m/m August +0.3% Revised From +0.2% -0.2% 0.0%

06:45 France Industrial Production, y/y August +0.1% -0.3%

08:30 United Kingdom Trade in goods August -10.4 Revised From -10.2 -9.6 -9.1

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by yesterday's better-than-expected number of initial jobless claim in the U.S. The number of initial jobless claims in the week ending October 4 declined by 1,000 to 287,000 from 288,000 in the previous week. Analysts had expected the number of initial jobless claims to increase by 3,000 to 291,000.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar after the weaker-than-expected home loans from Australia. Home loans in Australia declined 0.9% in August, missing expectations for a 0.2% rise, after a 0.3% increase in July.

The Reserve Bank of Australia assistant governor Malcolm Edey told today that the long period of low interest rates led to a "concentration of risk- taking" in parts of Australian economy, particularly in the housing market.

The Japanese yen traded mixed against the U.S. dollar after the Bank of Japan (BoJ) minutes and Japan's tertiary industry index. The BoJ released its minutes from the latest meeting. The central bank said that exports remained weak. One BoJ board member expressed concerns that inflation target of 2% would be achieved in about two years.

Japan's tertiary industry index fell 0.1% in August, missing expectations for a 0.2% rise, after a 0.3% drop in July. July's figure was revised down from a flat reading.

Japan's consumer confidence index fell to 39.9 in September from 41.2 in August, missing expectations for a rise to 42.2.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Unemployment rate September 7.0% 7.0%

12:30 Canada Employment September -11.0 +20.0

12:30 U.S. Import Price Index September -0.9% -0.5%

13:00 U.S. FOMC Member Charles Plosser Speaks

14:30 Canada Bank of Canada Business Outlook Survey Quarter III

-

09:30

United Kingdom: Trade in goods , August -9.1 (forecast -9.6)

-

07:45

France: Industrial Production, m/m, August 0.0% (forecast -0.2%)

-

06:32

Options levels on friday, October 10, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2852 (2819)

$1.2810 (1555)

$1.2771 (378)

Price at time of writing this review: $ 1.2700

Support levels (open interest**, contracts):

$1.2636 (1862)

$1.2578 (2373)

$1.2544 (3031)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 50625 contracts, with the maximum number of contracts with strike price $1,2900 (5966);

- Overall open interest on the PUT options with the expiration date November, 7 is 49720 contracts, with the maximum number of contracts with strike price $1,2400 (4871);

- The ratio of PUT/CALL was 0.98 versus 0.98 from the previous trading day according to data from October, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.6403 (1242)

$1.6306 (1183)

$1.6210 (1829)

Price at time of writing this review: $1.6123

Support levels (open interest**, contracts):

$1.6090 (844)

$1.5994 (2045)

$1.5896 (1019)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 22264 contracts, with the maximum number of contracts with strike price $1,6750 (1904);

- Overall open interest on the PUT options with the expiration date November, 7 is 29115 contracts, with the maximum number of contracts with strike price $1,5400 (2211);

- The ratio of PUT/CALL was 1.31 versus 1.29 from the previous trading day according to data from October, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:01

Nikkei 225 15,303.99 -174.94 -1.13%, Hang Seng 23,184.12 -350.41 -1.49%, S&P/ASX 200 5,209.4 -87.28 -1.65%, Shanghai Composite 2,380.76 -8.62 -0.36%

-

01:30

Australia: Home Loans , August -0.9% (forecast +0.2%)

-

00:51

Japan: Tertiary Industry Index , August -0.1% (forecast +0.2%)

-