Notícias do Mercado

-

23:54

Japan: Current Account (adjusted), bln, September 414.4 (forecast 3.0)

-

23:31

Currencies. Daily history for Nov 10’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2420 -0,26%

GBP/USD $1,5841 -0,20%

USD/CHF Chf0,9679 +0,19%

USD/JPY Y114,85 +0,23%

EUR/JPY Y142,63 -0,06%

GBP/JPY Y181,92 +0,01%

AUD/USD $0,8621 -0,13%

NZD/USD $0,7747 0,00%

USD/CAD C$ 1,1379 + 0,42%

-

23:00

Schedule for today, Tuesday, Nov 11’2014:

(time / country / index / period / previous value / forecast)

00:01 United Kingdom BRC Retail Sales Monitor y/y October -2.1%

00:30 Australia National Australia Bank's Business Confidence October 5

00:30 Australia House Price Index (QoQ) Quarter III -1.8% -1.6%

00:30 Australia House Price Index (YoY) Quarter III +10.1%

02:00 China New Loans October 857 615

05:00 Japan Consumer Confidence October 39.9 40.6

06:00 Japan Eco Watchers Survey: Current October 47.4 49.2

06:00 Japan Eco Watchers Survey: Outlook October 48.7

06:00 Japan Prelim Machine Tool Orders, y/y October +34.7% Revised From +34.8%

20:00 New Zealand RBNZ Financial Stability Report

20:05 New Zealand RBNZ Governor Graeme Wheeler Speaks

23:30 Australia Westpac Consumer Confidence November +0.9%

23:50 Japan Tertiary Industry Index September -0.1% +0.9%

-

16:33

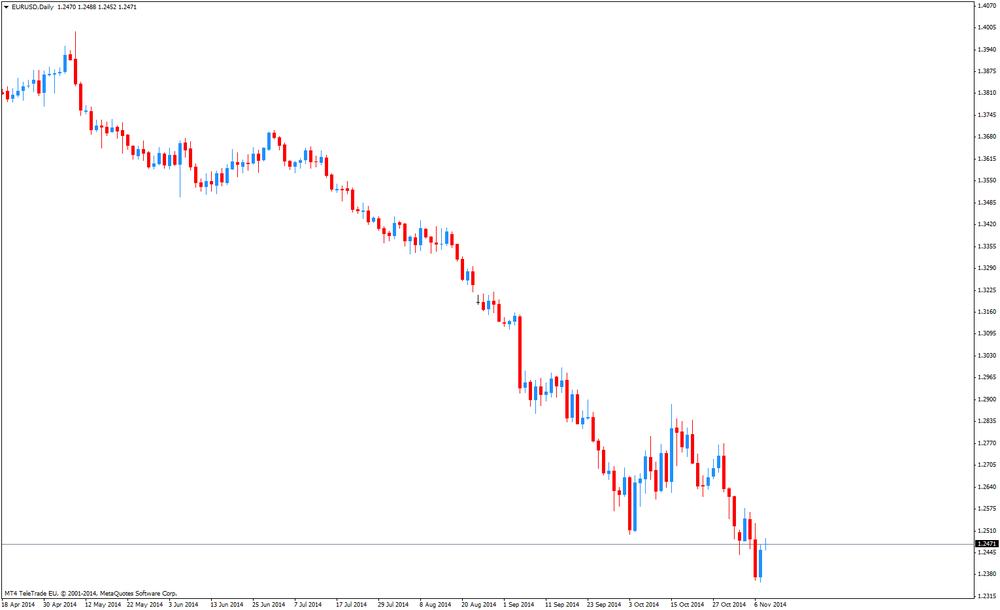

Foreign exchange market. American session: the euro declined against the U.S. dollar as the European Central Bank (ECB) slowed purchases of covered bonds

The U.S. dollar traded higher against the most major currencies in the absence of any major economic reports from the U.S.

The greenback came under pressure on Friday after the mixed labour market data from the U.S. The U.S. economy added 214,000 jobs in October, missing expectations for a rise of 229,000 jobs, after a gain of 256,000 jobs in September.

The U.S. unemployment rate declined to 5.8% in October from 5.9% in September. Analysts had expected the unemployment rate to remain unchanged.

The euro declined against the U.S. dollar as the European Central Bank (ECB) slowed purchases of covered bonds in the week ending November 7, 2014. The European Central Bank increased by 2.629 billion euros its amount of covered bonds in the week ending November 7, 2014. The ECB held covered bonds in the value of 7.408 billion euros on Monday. The central bank bought 3.075 billion euros in the second week and 1.704 billion euros in the first week as the central bank started its covered bond-buying programme.

Eurozone's Sentix investor confidence index increased to -11.9 in November from -13.7 in October, missing expectations for a rise to -6.9.

A reading above 0.0 indicates optimism, below 0.0 indicates pessimism.

The British pound traded lower against the U.S. dollar in the absence of any major reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian housing starts. Housing starts in Canada increased to a seasonally adjusted annualized rate of 183,604 units in October from 197,355 units in September. September's figure was revised up from 197,343 units. Analysts had expected an increase to 200,000 units.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded higher against due to profit-taking on the greenback.

The Australian dollar fell against the U.S. dollar. In the overnight trading session, the Aussie traded higher against due to profit-taking on the U.S. dollar.

Home loans in Australia decreased 0.7% in September, missing expectations for a 0.3% fall, after a 0.9% drop in August.

The Japanese yen was down against the U.S. dollar in the absence of any major economic reports from Japan.

-

16:05

ECB slowed purchases of covered bonds in the week ending November 7, 2014

The European Central Bank (ECB) increased by 2.629 billion euros its amount of covered bonds in the week ending November 7, 2014. The ECB held covered bonds in the value of 7.408 billion euros on Monday. The central bank bought 3.075 billion euros in the second week and 1.704 billion euros in the first week as the central bank started its covered bond-buying programme.

The ECB has not yet begun to purchase asset-backed securities (ABS).

The ECB's asset-buying programme is determined to provide more liquidity into the financial system and to expand its balance sheet. The central bank hopes to boost inflation in the Eurozone toward its 2% target.

-

15:34

Swiss franc hits 2-year-high against the euro

The Swiss franc hits 2-year-high against the euro on Monday. The currency pair EURCHF was testing 1.20 franc ceiling set by the Swiss National Bank (SNB). The SNB could intervene if the EURCHF would decline further.

The volatility of EURCHF is higher now ahead of Switzerland's referendum in on November 30. Population in Switzerland will vote whether the SNB should keep at least 20% of its assets in gold, up from 8% now. Switzerland's central bank would need to foreign reserves to reach this target.

-

13:57

Canadian housing starts declined to 183,604 units in October

The Canada Mortgage and Housing Corporation (CMHC) released its housing starts figures for Canada on Monday. Housing starts in Canada increased to a seasonally adjusted annualized rate of 183,604 units in October from 197,355 units in September. September's figure was revised up from 197,343 units. Analysts had expected an increase to 200,000 units.

The CMHC's Chief Economist Bob Dugan said that the decrease was driven by the decline of starts of multi-unit dwellings, including condominiums.

Multiple housing starts decreased to 98,673 units in October from 114,539 units in September.

Single-detached housing starts rose to 66,010 in October from 62,514 in September.

-

13:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2300(E1.7bn), $1.2350(E506mn), $1.2400(E1.2bn), $1.2500(E2.2bn), $1.2550(E3.1bn)

USD/JPY: Y113.00($867mn), Y113.70-80($500mn), Y115.00($1.5bn)

USD/CHF: Chf0.9650($1.0bn)

AUD/USD: $0.8500(A$500mn), $0.8600(A$1.2bn), $0.8650(A$1.3bn)

NZD/USD: $0.7600(NZ$334mn)

USD/CAD: C$1.1200($340mn), C$1.1305($720mn), C$1.1400($265mn)

-

13:16

Canada: Housing Starts, October 184 (forecast 200)

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580, $1.2550, $1.2500

Bids $1.2360/50, $1.2300, $1.2250

GBP/USD

Offers $1.6000, $1.5950/60, $1.5935

Bids $1.5800, $1.5785, $1.5700

AUD/USD

Offers $0.8800, $0.8760, $0.8750, $0.8700

Bids $0.8600, $0.8520, $0.8500, 0.8450

EUR/JPY

Offers Y144.50, Y144.00, Y143.60, Y143.10

Bids Y141.55/50, Y141.00, Y140.50

USD/JPY

Offers Y116.50, Y116.00, Y115.55

Bids Y113.00, Y112.60, Y112.00

EUR/GBP

Offers stg0.7900, stg0.7885, stg0.7860

Bids stg0.7795, stg0.7755/45, stg0.7700

-

10:25

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2300(E1.7bn), $1.2350(E506mn), $1.2400(E1.2bn), $1.2500(E2.2bn), $1.2550(E3.1bn)

USD/JPY: Y113.00($867mn), Y113.70-80($500mn), Y115.00($1.5bn)

USD/CHF: Chf0.9650($1.0bn)

AUD/USD: $0.8500(A$500mn), $0.8600(A$1.2bn), $0.8650(A$1.3bn)

NZD/USD: $0.7600(NZ$334mn)

USD/CAD: C$1.1200($340mn), C$1.1305($720mn), C$1.1400($265mn)

-

09:53

-

09:30

Eurozone: Sentix Investor Confidence, November -11.9 (forecast -6.9)

-

09:17

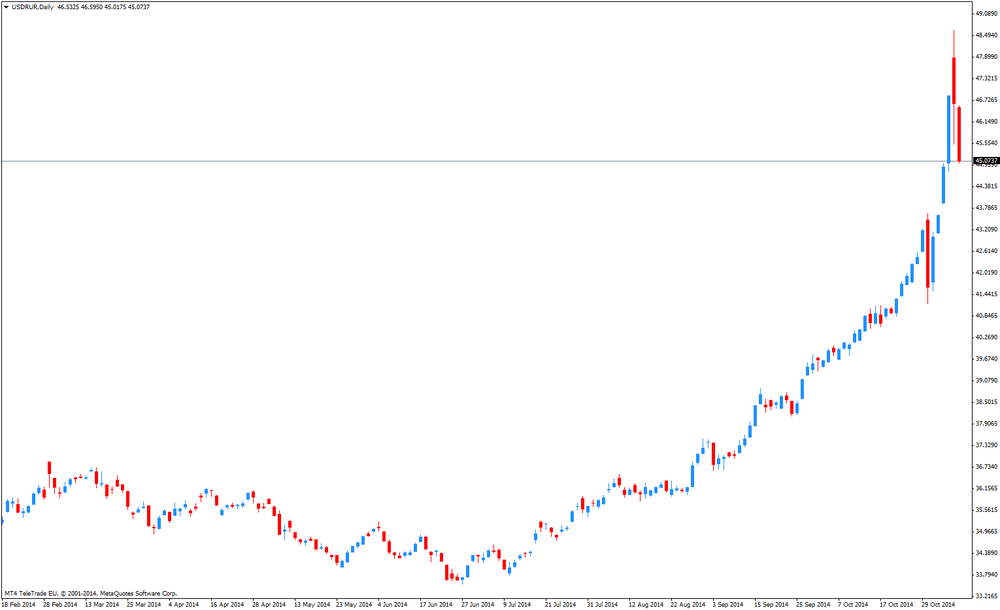

Press Review: Russian central bank abandons rouble trading band and cuts economic forecast for 2015

REUTERS

Bank of Russia Cuts 2015 Economic Forecast to Show No Growth

Russia's central bank cut its base-case economic forecast for next year to show no growth, assuming sanctions remain in place and oil averages $95 a barrel.

The regulator also pushed back its medium-term inflation target of 4 percent to 2017 from 2016, according to a revised monetary policy plan for 2015-17 released today. The base-case scenario sees sanctions lasting through the end of 2017.

REUTERS

Russian central bank abandons rouble trading band, floats rouble

The Russian central bank said on Monday it had abandoned the rouble's trading corridor, allowing the currency to float freely.

The bank also said in a statement it would intervene in the foreign currency market if it saw a threat to financial stability. (Reporting by Lidia Kelly and Elena Fabrichnaya; Writing by Lidia Kelly, editing by Elizabeth Piper)

Source: http://www.reuters.com/article/2014/11/10/russia-cenbank-rouble-idUSL6N0T01MK20141110

BLOOMBERG

Gold Bulls Accelerate Retreat to This Year's Fastest Pace

Hedge funds made their biggest cut of the year in bullish gold wagers as prices tumbled to the lowest since 2010.

The net-long position in New York futures and options contracted 36 percent as long holdings fell the most in almost two years, U.S. government data show. Investors sold 22.4 metric tons of bullion held through exchange-traded products last week, trimming assets to the least since August 2009.

REUTERS

Dollar lower, franc within sight of SNB ceiling vs euro

The dollar made a poor start to the week on Monday, with some investors still seeing Friday's weaker than expected U.S. jobs numbers as an excuse to pause after three strong weeks of gains.

The Swiss franc EURCHF= was back on the verge of the central bank's 1.20 franc ceiling versus the euro after another week that highlighted the euro zone's problems.

Source: http://www.reuters.com/article/2014/11/10/us-markets-forex-idUSKCN0IT0Y320141110

-

07:47

Foreign exchange market. Asian session: The greenback lost against its major peers after Fridays U.S. job data fell short of expectations

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Home Loans September -0.9% -0.3% -0.7%

01:30 China PPI y/y October -1.8% -1.9% -2.2%

01:30 China CPI y/y October +1.6% +1.6% +1.6%

The greenback traded weaker against its major peers for the second day in a row after U.S. job data (nonfarm payrolls 214,000; forecast 231,000) fell short of expectations although overall unemployment rate dropped from 5.9% to 5.8%, a new six-year low. Investors might be taking profits after the strong rally and reduce their bets on the FED rising interest rates earlier than expected.

The Australian dollar further recovered from his four-year low from last Friday when Australian central bank forecasts showed weak domestic growth. Gains were supported by data published that Chinas export growth did not slow down as much as predicted and China's annual consumer inflation staying near five-year lows.

Those figures also helped the kiwi recovering from its two-year low. Investors are awaiting Reserve Bank governor Wheeler releasing the bank's half-yearly financial stability report on Wednesday and his statements over the strength of the currency.

The Japanese yen currently trading at USD114.16 further recovered from its new record-low of USD115.51 after the BoJ's economic stimulus from last week and a four month rally of the U.S. dollar.

EUR/USD: the currency pair raised to USD1.2471

USD/JPY: the U.S. dollar lost against the Japanese yen and is currently trading at Y114.17

GPB/USD: the currency pair rose to GPB 1.5900

The most important news that are expected (GMT0):

09:30 Eurozone Sentix Investor Confidence November -13.7 -6.9

13:15 Canada Housing Starts October 197 200

23:50 Japan Current Account (adjusted), bln September 130.8 3.0

-

06:15

Options levels on manday, November 10, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2648 (3084)

$1.2584 (3244)

$1.2535 (659)

Price at time of writing this review: $ 1.2476

Support levels (open interest**, contracts):

$1.2396 (3888)

$1.2360 (6444)

$1.2308 (4977)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 95717 contracts, with the maximum number of contracts with strike pric $1,2800 (5232);

- Overall open interest on the PUT options with the expiration date December, 5 is 103638 contracts, with the maximum number of contracts with strike price $1,2200 (6884);

- The ratio of PUT/CALL was 1.08 versus 0.96 from the previous trading day according to data from November, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.6202 (1345)

$1.6103 (902)

$1.6006 (1900)

Price at time of writing this review: $1.5904

Support levels (open interest**, contracts):

$1.5791 (879)

$1.5694 (1104)

$1.5596 (811)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 33837 contracts, with the maximum number of contracts with strike price $1,6000 (1900);

- Overall open interest on the PUT options with the expiration date December, 5 is 35856 contracts, with the maximum number of contracts with strike price $1,6000 (2082);

- The ratio of PUT/CALL was 1.06 versus 1.22 from the previous trading day according to data from November, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:32

China: PPI y/y, October -2.2% (forecast -1.9%)

-

01:30

China: CPI y/y, October +1.6% (forecast +1.6%)

-

00:30

Australia: Home Loans , September -0.7% (forecast -0.3%)

-