Notícias do Mercado

-

19:00

U.S.: Federal budget , June 70.5 (forecast 79.0)

-

16:32

Foreign exchange market. American session: the Canadian dollar dropped against the U.S. dollar after the weaker-than-expected Canadian labour market data

The U.S. dollar traded higher against the most major currencies in quiet trade. No major economic reports will be released in the U.S. on Friday.

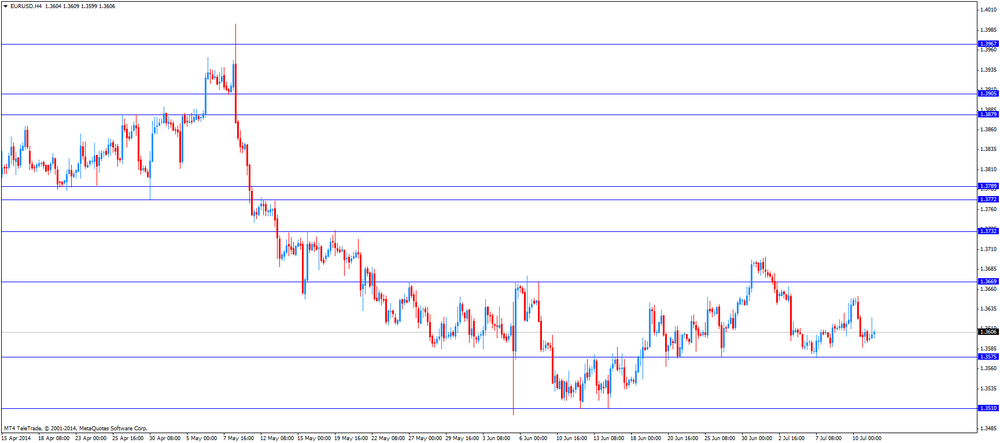

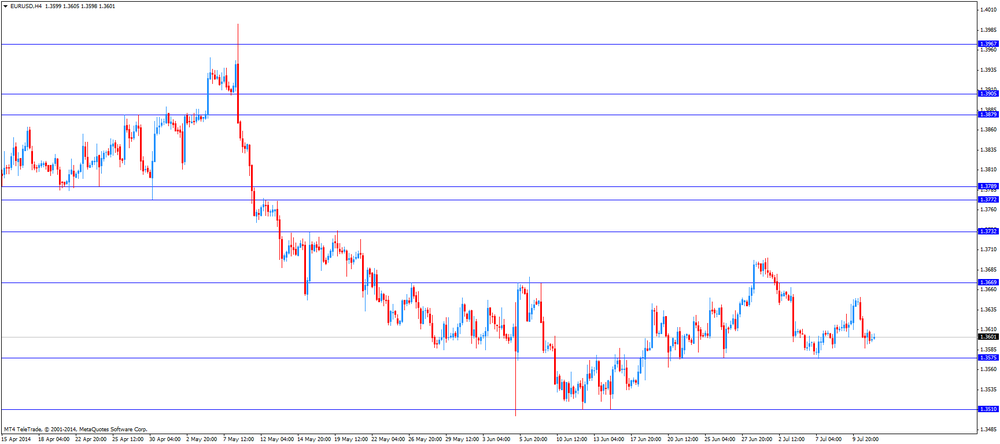

The euro traded mixed against the U.S. dollar. Concerns over the banking sectors in Southern European countries weighed on the euro.

The German consumer price index increased 0.3% in June, in line with expectations, after a 0.3% gain in May. On a yearly basis, the consumer price index in Germany rose 1.0% in June, in line with expectations, after a 0.9% increase in May.

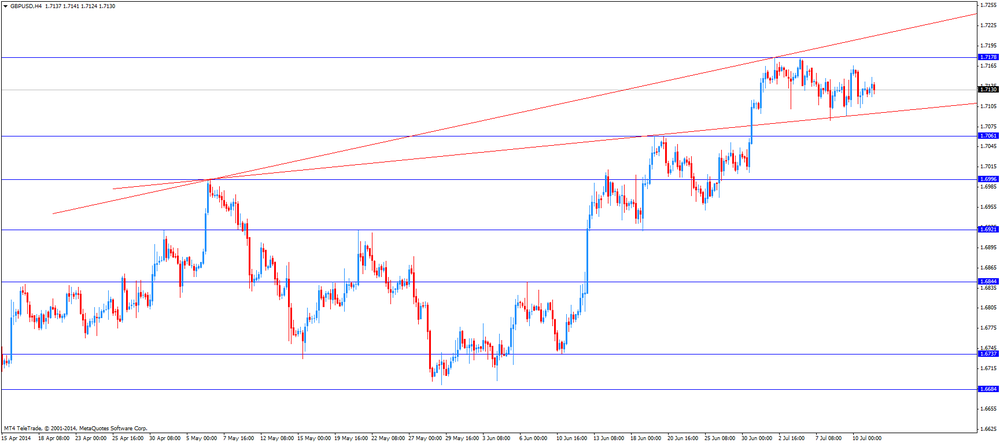

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

The Canadian dollar dropped against the U.S. dollar after the weaker-than-expected Canadian labour market data. Canadian unemployment rate climbed to a seasonally adjusted 7.1% in June from 7.0% in May. That was the highest level since last December.

Analysts had expected the unemployment rate to remain unchanged at 7.0%.

The Canadian economy unexpectedly lost 9,400 jobs last month, missing expectation for rise of 26,200 jobs, after adding 25,800 jobs in May.

The New Zealand dollar traded slightly lower highs against the U.S dollar. The food price index in New Zealand jumped 1.4% in June, after a 0.6% rise in May. On an annual basis, food prices in New Zealand increased 1.2% in June, after a 1.8% gain in May.

The monthly increase was driven by fresh vegetables and higher meat prices. The price of vegetables rose 8.9%. Poultry prices surged 9.9%.

The Australian dollar traded lower against the U.S. dollar after comments by the Reserve Bank of Australia Governor Glenn Stevens. He warned that the Australian dollar remained strong and there is a risk of a strong decline of the Aussie.

The number of home loans in Australia remained unchanged flat in May, beating expectations for a 0.4% decline.

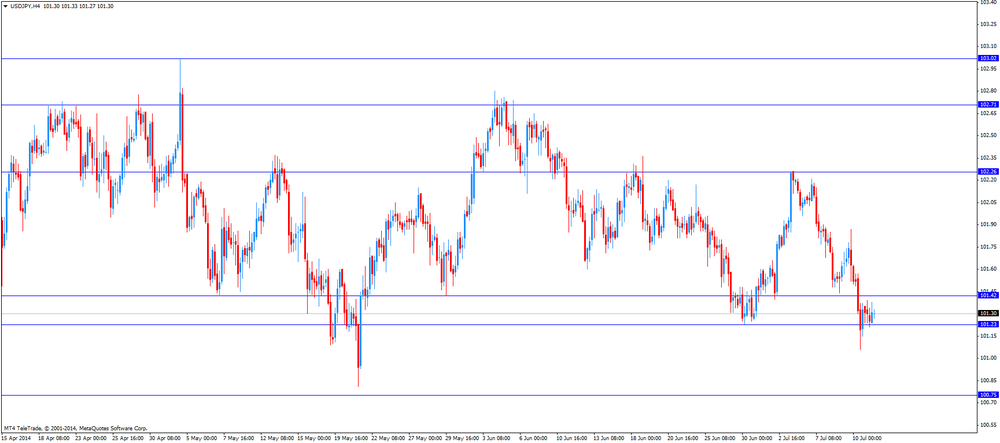

The Japanese yen traded mixed against the U.S. dollar. The yen was supported by concerns over the banking sectors in Southern European countries.

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3620-30, $1.3640

USD/JPY Y101.00, Y101.45-50, Y101.70, Y102.00

EUR/JPY Y138.50

EUR/GBP stg0.7900

AUD/USD $0.9300-05, $0.9320, $0.9350, $0.9390, $0.9500

USD/CAD C$1.0600, C$1.0625, C$1.0725

-

14:23

Canada’s unemployment rate increased to 7.1% in June

Statistics Canada released the labour market data today. Canadian unemployment rate climbed to a seasonally adjusted 7.1% in June from 7.0% in May. That was the highest level since last December.

Analysts had expected the unemployment rate to remain unchanged at 7.0%.

The Canadian economy unexpectedly lost 9,400 jobs last month, missing expectation for rise of 26,200 jobs, after adding 25,800 jobs in May.

The decline of jobs was driven by a larger drop of 43,000 part-time positions.

-

13:30

Canada: Unemployment rate, June 7.1% (forecast 7.0%)

-

13:30

Canada: Employment , June -9.4 (forecast +26.2)

-

13:00

Orders

EUR/USD

Offers $1.3700-20, $1.3680/85, $1.3660, $1.3625

Bids $1.3585, $1.3565, $1.3550/40, $1.3500

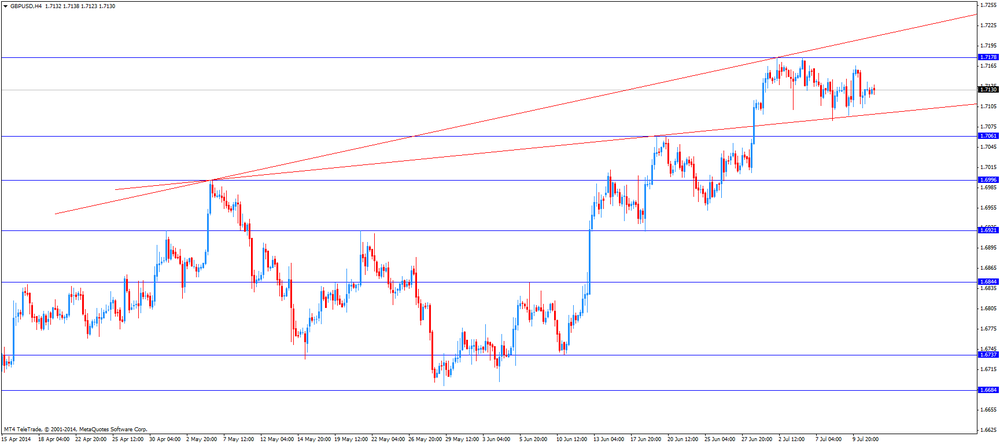

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7065, $1.7035/30, $1.7010

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9450

Bids $0.9360, $0.9330, $0.9320, $0.9300

EUR/JPY

Offers Y139.30, Y139.00, Y138.80, Y138.60, Y138.10/00

Bids Y137.45, Y137.00, Y136.15

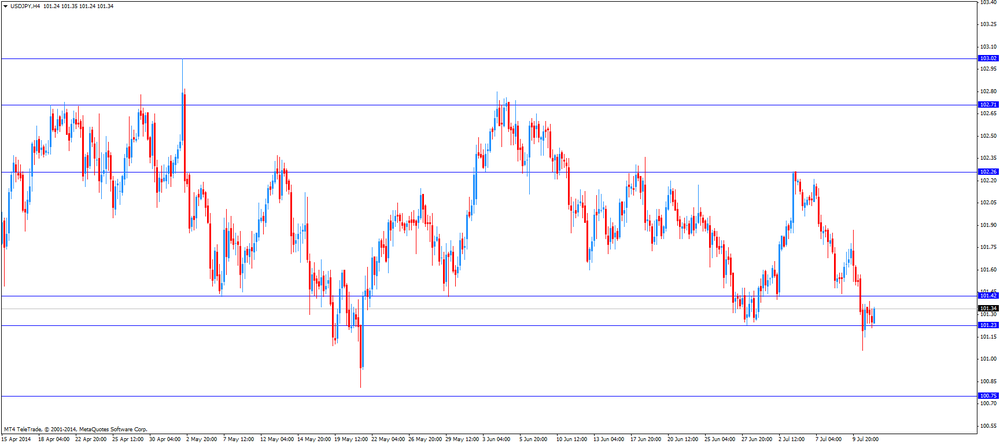

USD/JPY

Offers Y102.50, Y102.30, Y101.90/00, Y101.45

Ордера на покупку Y101.10/00, Y100.80, Y100.00

EUR/GBP

Offers stg0.8030, stg0.8000, stg0.7970

Bids stg0.7925, stg0.7905-890, stg0.7800

-

13:00

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies in quiet trade

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans May 0.0% -0.4% 0.0%

06:00 Germany CPI, m/m (Finally) June +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) June +0.9% +1.0% +1.0%

The U.S. dollar traded mixed against the most major currencies in quiet trade. No major economic reports will be released in the U.S. on Friday.

The euro traded mixed against the U.S. dollar. Concerns over the banking sectors in Southern European countries weighed on the euro.

The German consumer price index increased 0.3% in June, in line with expectations, after a 0.3% gain in May. On a yearly basis, the consumer price index in Germany rose 1.0% in June, in line with expectations, after a 0.9% increase in May.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian labour market report. The Canadian unemployment rate should remain unchanged at 0.7% in June.

The number of employed people in Canada should increase by 26,200 in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Employment June +25.8 +26.2

12:30 Canada Unemployment rate June 7.0% 7.0%

18:00 U.S. Federal budget June -130.0 79.0

-

10:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3620-30, $1.3640

USD/JPY Y101.00, Y101.45-50, Y101.70, Y102.00

EUR/JPY Y138.50

EUR/GBP stg0.7900

AUD/USD $0.9300-05, $0.9320, $0.9350, $0.9390, $0.9500

USD/CAD C$1.0600, C$1.0625, C$1.0725

-

09:53

Foreign exchange market. Asian session: the U.S. dollar traded slightly higher against the most major currencies due to concerns over the banking sectors in Southern European countries

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans May 0.0% -0.4% 0.0%

06:00 Germany CPI, m/m (Finally) June +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) June +0.9% +1.0% +1.0%

The U.S. dollar traded slightly higher against the most major currencies due to concerns over the banking sectors in Southern European countries. Especially, there are growing concerns over the financial health of Porugal's Espirito Santo Financial Group. Espirito Santo Financial Group is the largest lender in Portugal.

The New Zealand dollar traded mixed near 3-year highs against the U.S dollar. The food price index in New Zealand jumped 1.4% in June, after a 0.6% rise in May. On an annual basis, food prices in New Zealand increased 1.2% in June, after a 1.8% gain in May.

The monthly increase was driven by fresh vegetables and higher meat prices. The price of vegetables rose 8.9%. Poultry prices surged 9.9%.

The Australian dollar traded slightly lower against the U.S. dollar after home loans data from Australia. The number of home loans in Australia remained unchanged flat in May, beating expectations for a 0.4% decline.

The Japanese yen traded higher against the U.S. dollar due to increasing demand for safe-haven yen. The yen was supported by concerns over the banking sectors in Southern European countries.

EUR/USD: the currency pair declined to $1.3595

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair decreased to Y101.21

The most important news that are expected (GMT0):

12:30 Canada Employment June +25.8 +26.2

12:30 Canada Unemployment rate June 7.0% 7.0%

18:00 U.S. Federal budget June -130.0 79.0

-

07:00

Germany: CPI, m/m, June +0.3% (forecast +0.3%)

-

07:00

Germany: CPI, y/y , June +1.0% (forecast +1.0%)

-

06:25

Options levels on friday, July 11, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3675 (2674)

$1.3655 (639)

$1.3631 (77)

Price at time of writing this review: $ 1.3596

Support levels (open interest**, contracts):

$1.3574 (375)

$1.3556 (1942)

$1.3532 (3208)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 23449 contracts, with the maximum number of contracts with strike price $1,3800 (3694);

- Overall open interest on the PUT options with the expiration date August, 8 is 32020 contracts, with the maximum number of contracts with strike price $1,3500 (7544);

- The ratio of PUT/CALL was 1.36 versus 1.34 from the previous trading day according to data from July, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.7402 (1005)

$1.7303 (1456)

$1.7206 (1338)

Price at time of writing this review: $1.7126

Support levels (open interest**, contracts):

$1.7092 (1887)

$1.6996 (1817)

$1.6898 (1871)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15271 contracts, with the maximum number of contracts with strike price $1,7250 (2119);

- Overall open interest on the PUT options with the expiration date August, 8 is 19587 contracts, with the maximum number of contracts with strike price $1,7100 (1887);

- The ratio of PUT/CALL was 1.28 versus 1.25 from the previous trading day according to data from Jule, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:28

Currencies. Daily history for Jule 10'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3606 -0,25%

GBP/USD $1,7131 -0,14%

USD/CHF Chf0,8924 +0,17%

USD/JPY Y101,31 -0,32%

EUR/JPY Y137,85 -0,56%

GBP/JPY Y173,55 +0,12%

AUD/USD $0,9390 -0,17%

NZD/USD $0,8815 -0,03%

USD/CAD C$1,0651 -0,01%

-

05:03

Schedule for today, Friday, Jule 11’2014:

(time / country / index / period / previous value / forecast)

01:45 New Zealand Food Prices Index, m/m June +0.6%

01:45 New Zealand Food Prices Index, y/y June +1.8%

01:50 New Zealand REINZ Housing Price Index, m/m June -1.2%

04:30 Australia Home Loans May 0.0% -0.4%

09:00 Germany CPI, m/m (Finally) June +0.3% +0.3%

09:00 Germany CPI, y/y (Finally) June +0.9% +1.0%

15:30 Canada Employment June +25.8 +26.2

15:30 Canada Unemployment rate June 7.0% 7.0%

21:00 U.S. Federal budget June -130.0 79.0

-