Notícias do Mercado

-

23:21

Currencies. Daily history for Aug 11'2014:

(pare/closed(GMT +2)/change, %)

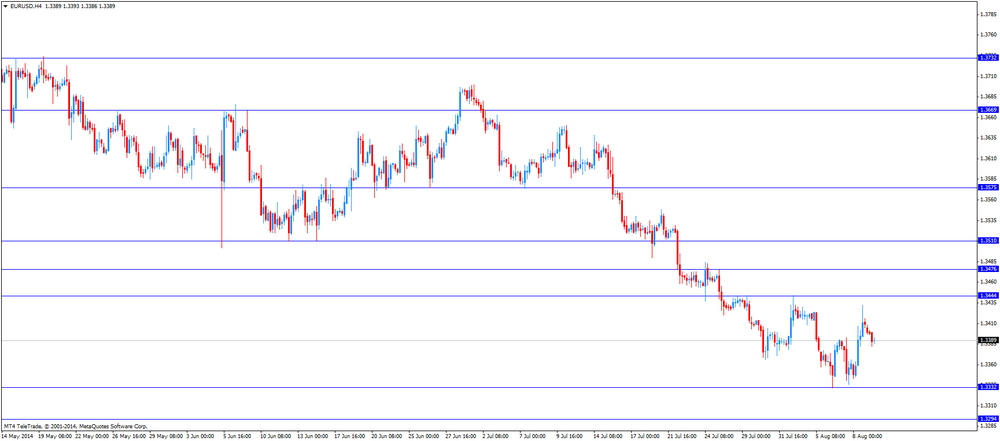

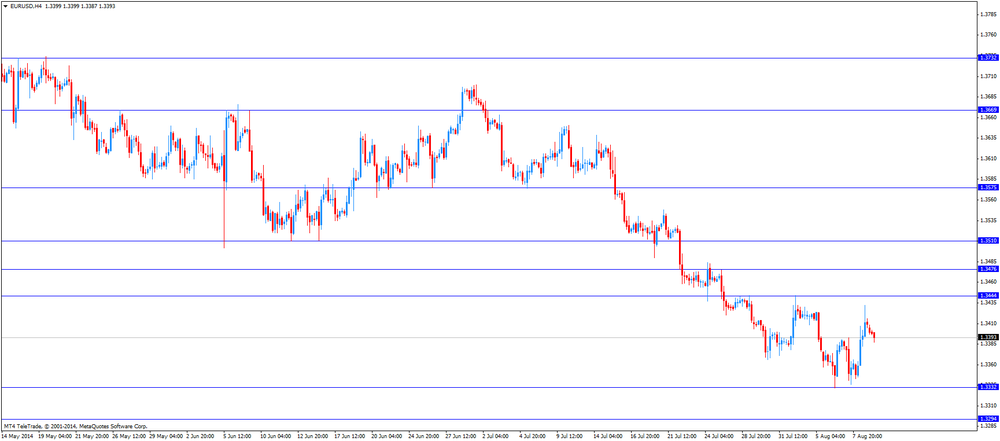

EUR/USD $1,3384 -0,19%

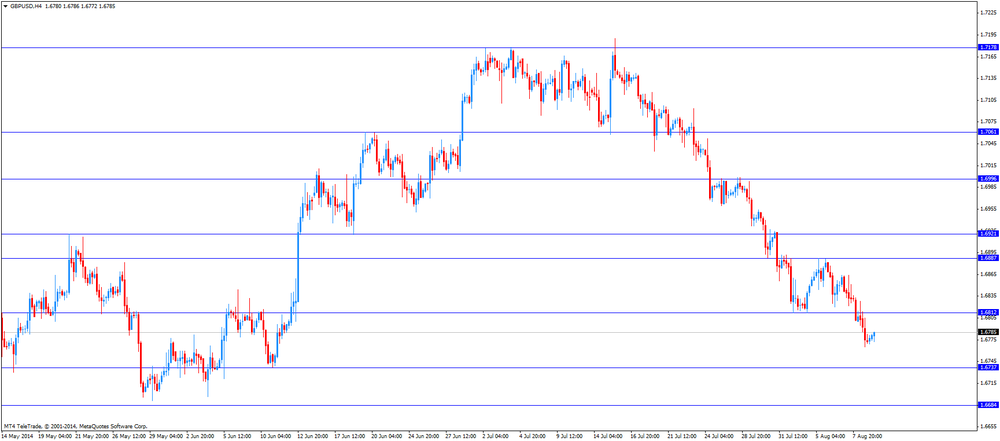

GBP/USD $1,6786 +0,08%

USD/CHF Chf0,9064 +0,14%

USD/JPY Y102,18 +0,16%

EUR/JPY Y 136,76 -0,04%

GBP/JPY Y171,52 +0,23%

AUD/USD $ 0,9264 -0,12%

NZD/USD $0,8456 -0,05%

USD/CAD C$1,0922 -0,45%

-

23:00

Schedule for today, Tuesday, Aug 12’2014:

(time / country / index / period / previous value / forecast)

01:30 Australia National Australia Bank's Business Confidence July 8

01:30 Australia House Price Index (QoQ) Quarter II +1.7% +1.1%

01:30 Australia House Price Index (YoY) Quarter II +10.9%

04:30 Japan Industrial Production (MoM) June -3.3% +0.5%

04:30 Japan Industrial Production (YoY) June +3.2%

09:00 Eurozone ZEW Economic Sentiment August 48.1 41.3

09:00 Germany ZEW Survey - Economic Sentiment August 27.1 18.2

14:00 U.S. JOLTs Job Openings June 4635 4740

18:00 U.S. Federal budget July 70.5 -98.2

20:30 U.S. API Crude Oil Inventories August -5.5

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan GDP, q/q Quarter II +1.6% -1.7%

23:50 Japan GDP, y/y Quarter II +3.0%

-

16:27

Foreign exchange market. American session: the Canadian dollar increased against the U.S. dollar due to the better-than-expected housing starts in Canada

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports in the U.S.

The euro traded mixed against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

The Swiss franc traded mixed against the U.S. dollar after Swiss retail sales. Retail sales in Switzerland climbed 3.4% in June, exceeding expectations for a 0.7% increase, after a 0.5% fall in May. May's figure was revised up from a 0.6% decrease.

The Canadian dollar increased against the U.S. dollar due to the better-than-expected housing starts in Canada. The number of housing starts in Canada jumped to 200,100 units in July, beating expectations for a fall to 194,000 units, after 198,700 units in June. June's figure was revised up from 198,000 units.

The New Zealand dollar traded mixed against the U.S dollar as market sentiment recovered from risk aversion of investors. Investors preferred safe-haven assets last week as geopolitical tensions in Iraq and Ukraine weighed on markets.

No major economic reports were released in New Zealand.

The Australian dollar traded lower against the U.S. dollar. No major economic reports were released in Australia.

The Japanese yen traded mixed against the U.S. dollar. Japan's tertiary industry index declined 0.1% in June, after a 0.9% rise in May.

Consumer confidence in Japan rose to 41.5 in July from 41.1 in June, missing expectations for a gain to 42.3.

Japan's prelim machine tool orders increased 37.7% in July, after a 34.1% rise in June.

-

15:30

Federal Reserve Vice Chairman Stanley Fischer: Economic recovery has been “disappointing”

Federal Reserve Vice Chairman Stanley Fischer said at Swedish Finance Ministry conference on Monday:

- Economic recovery in the US and in other countries has been "disappointing" and could have a permanent negative impact on economic growth;

- The decrease in the labour force largely reflects demographic factors;

- Quantitative easing program has been "largely successful".

- Economic recovery in the US and in other countries has been "disappointing" and could have a permanent negative impact on economic growth;

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD $1.3350, $1.3370, $1.3400, $1.3435, $1.3450, $1.3500, $1.3535

USD/JPY Y101.50-60, Y101.75-85, Y101.90-102.00, Y102.45, Y102.50

EUR/JPY Y136.25-30

EUR/GBP stg0.8000, stg0.8075

EUR/CHF Chf1.2165

EUR/SEK Sek9.2100

AUD/USD $0.9250, $0.9300-10, $0.9325, $0.9350

NZD/USD $0.8600

USD/CAD C$!.0915, C$1.0920, C$1.0970

-

13:15

Canada: Housing Starts, July 200 (forecast 194)

-

13:00

Foreign exchange market. European session: the Swiss franc traded mixed against the U.S. dollar after Swiss retail sales

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report August

05:00 Japan Consumer Confidence July 41.1 42.3 41.5

06:00 Japan Prelim Machine Tool Orders, y/y July +34.1% +37.7%

07:15 Switzerland Retail Sales Y/Y June -0.6% +0.7% +3.4%

07:15 U.S. FED Vice Chairman Stanley Fischer Speaks

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports in the U.S.

The euro traded lower against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

The Swiss franc traded mixed against the U.S. dollar after Swiss retail sales. Retail sales in Switzerland climbed 3.4% in June, exceeding expectations for a 0.7% increase, after a 0.5% fall in May. May's figure was revised up from a 0.6% decrease.

The Canadian dollar traded slightly higher against the U.S. dollar ahead of housing starts in Canada. The number of housing starts in Canada is expected to decline to 194,000 units in July, after 198,200 units in June.

EUR/USD: the currency pair declined to $1.3382

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:15 Canada Housing Starts July 198 194

-

12:45

Orders

EUR/USD

Offers $1.3500, $1.3475/85, $1.3445-50

Bids $1.3335

GBP/USD

Offers $1.6900, $1.6885-90, $1.6800

Bids $1.6750, $1.6700, $1.6693, $1.6665/60

AUD/USD

Offers $0.9350, $0.9315/20, $0.9300, $0.9285/90

Bids $0.9250, $0.9220/00, $0.9150, $0.9100

EUR/JPY

Offers Y138.00, Y137.50, Y137.20/25

Bids Y136.50, Y136.25/20, Y136.00, Y135.50

USD/JPY

Offers Y103.00, Y102.80/85, Y102.50

Bids Y102.00, Y101.80, Y101.50, Y101.20

EUR/GBP

Offers stg0.8010, stg0.8000

Bids stg0.7900

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3350, $1.3370, $1.3400, $1.3435, $1.3450, $1.3500, $1.3535

USD/JPY Y101.50-60, Y101.75-85, Y101.90-102.00, Y102.45, Y102.50

EUR/JPY Y136.25-30

EUR/GBP stg0.8000, stg0.8075

EUR/CHF Chf1.2165

EUR/SEK Sek9.2100

AUD/USD $0.9250, $0.9300-10, $0.9325, $0.9350

NZD/USD $0.8600

USD/CAD C$!.0915, C$1.0920, C$1.0970

-

09:40

Foreign exchange market. Asian session: the Japanese yen traded lower against the U.S. dollar due to decreasing demand for safe-haven currency as geopolitical concerns eased slightly

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report August

05:00 Japan Consumer Confidence July 41.1 42.3 41.5

06:00 Japan Prelim Machine Tool Orders, y/y July +34.1% +37.7%

07:15 Switzerland Retail Sales Y/Y June -0.6% +0.7% +3.4%

07:15 U.S. FED Vice Chairman Stanley Fischer Speaks

The U.S. dollar traded mixed to higher against the most major currencies.

The New Zealand dollar traded mixed against the U.S dollar as market sentiment recovered from risk aversion of investors. Investors preferred safe-haven assets last week as geopolitical tensions in Iraq and Ukraine weighed on markets.

No major economic reports were released in New Zealand.

The Australian dollar traded mixed against the U.S. dollar as market sentiment recovered from risk aversion of investors.

No major economic reports were released in Australia.

The Japanese yen traded lower against the U.S. dollar due to decreasing demand for safe-haven currency as geopolitical concerns eased slightly.

Japan's tertiary industry index declined 0.1% in June, after a 0.9% rise in May.

Consumer confidence in Japan rose to 41.5 in July from 41.1 in June, missing expectations for a gain to 42.3.

Japan's prelim machine tool orders increased 37.7% in July, after a 34.1 rise in June.

EUR/USD: the currency pair decreased to $1.3400

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y102.18

The most important news that are expected (GMT0):

12:15 Canada Housing Starts July 198 194

-

08:15

Switzerland: Retail Sales Y/Y, June +3.4% (forecast +0.7%)

-

07:06

Japan: Prelim Machine Tool Orders, y/y , July +37.7%

-

06:13

Options levels on monday, August 11, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3505 (3183)

$1.3480 (4367)

$1.3446 (618)

Price at time of writing this review: $ 1.3400

Support levels (open interest**, contracts):

$1.3377 (4478)

$1.3358 (1968)

$1.3333 (4422)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 50923 contracts, with the maximum number of contracts with strike price $1,3600 (4401);

- Overall open interest on the PUT options with the expiration date September, 5 is 55800 contracts, with the maximum number of contracts with strike price $1,3100 (6073);

- The ratio of PUT/CALL was 1.10 versus 0.94 from the previous trading day according to data from August, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.7002 (1363)

$1.6904 (886)

$1.6808 (521)

Price at time of writing this review: $1.6781

Support levels (open interest**, contracts):

$1.6694 (2781)

$1.6596 (1418)

$1.6498 (1644)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 20409 contracts, with the maximum number of contracts with strike price $1,7300 (1534);

- Overall open interest on the PUT options with the expiration date September, 5 is 27225 contracts, with the maximum number of contracts with strike price $1,6800 (3253);

- The ratio of PUT/CALL was 1.33 versus 1.27 from the previous trading day according to data from August, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:54

Japan: Tertiary Industry Index , June -0.1%

-