Notícias do Mercado

-

23:30

Currencies. Daily history for Aug 12'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3367 -0,13%

GBP/USD $1,6809 +0,14%

USD/CHF Chf0,9074 +0,11%

USD/JPY Y102,24 +0,06%

EUR/JPY Y136,67 -0,07%

GBP/JPY Y171,85 +0,19%

AUD/USD $0,9263 -0,01%

NZD/USD $0,8430 -0,31%

USD/CAD C$1,0923 +0,01%

-

23:00

Schedule for today, Wednesday, Aug 13’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence August +1.9%

01:30 Australia Wage Price Index, q/q Quarter II +0.7% +0.8%

01:30 Australia Wage Price Index, y/y Quarter II +2.6%

05:30 China Retail Sales y/y July +12.4% +12.5%

05:30 China Fixed Asset Investment July +17.3% +17.4%

05:30 China Industrial Production y/y July +9.2% +9.1%

06:00 Germany CPI, m/m July +0.3% +0.3%

06:00 Germany CPI, y/y July +0.8% +0.8%

06:45 France CPI, m/m July 0.0% -0.2%

06:45 France CPI, y/y July +0.5%

08:30United Kingdom Average earnings ex bonuses, 3 m/y June +0.7%

08:30 United Kingdom Average Earnings, 3m/y June +0.3% -0.1%

08:30 United Kingdom Claimant count July -36.3 -29.7

08:30 United Kingdom Claimant Count Rate July 3.1%

08:30 United Kingdom ILO Unemployment Rate June 6.5% 6.4%

09:00 Eurozone Industrial production, (MoM) June -1.1% +0.5%

09:00 Eurozone Industrial Production (YoY) June +0.5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 0.1

09:30 United Kingdom BOE Inflation Letter Quarter III

09:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Retail sales July +0.2% +0.2%

12:30 U.S. Retail sales excluding auto July +0.4% +0.4%

13:05 U.S. FOMC Member Dudley Speak

14:00 U.S. Business inventories June +0.5% +0.4%

14:30 U.S. Crude Oil Inventories August -1.8

22:30 New Zealand Business NZ PMI July 53.3

22:45 New Zealand Retail Sales, q/q Quarter II +0.7% +1.0%

22:45 New Zealand Retail Sales ex Autos, q/q Quarter II +0.8%

23:01 United Kingdom RICS House Price Balance July 53% 51%

23:50 Japan Core Machinery Orders June -19.5% +15.5%

23:50 Japan Core Machinery Orders, y/y June -14.3%

-

19:00

U.S.: Federal budget , July -94.6 (forecast -98.2)

-

16:40

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the JOLTS report

The U.S. dollar traded mixed to lower against the most major currencies after the JOLTS report in the U.S. The Bureau of Labor Statistics in the U.S. released the JOLTS report today. Job openings rose to 4.67 million in June from the 4.577 million job openings, missing expectations for an increase to 4.74 million job openings. That was the highest level since February 2001.

May's figure was revised down from 4.635 million job openings.

Investors continued to monitor closely the situation in Ukraine and Iraq. Russia sent 280 trucks carrying humanitarian aid to Southeast Ukraine.

Iraqi President nominated a new Prime Minister but Nuri al-Maliki, the current Prime Minister, has refused to go.

The euro declined against the U.S. dollar due to the weaker-than-expected economic sentiment from the Eurozone, but later recovered a part of its losses. The ZEW Centre for Economic Research released its economic sentiment index for Germany and the Eurozone. The economic sentiment index for Germany plunged to 8.6 in August from 27.1 in July. That was the lowest level since December 2012. Analysts had expected a decline to 18.2.

The drop was driven by geopolitical tensions.

Eurozone's ZEW economic sentiment index fell to 23.7 in August from 48.1 in July. Analysts had expected a decrease to 41.3.

The British pound increased against the U.S. dollar in the absence of any major economic reports in the UK.

The New Zealand dollar dropped to a 2-month low against the U.S dollar due to decreasing demand for risk-related assets as geopolitical tensions in Iraq and Ukraine weighed on markets. But the kiwi recovered a part of its losses in the European trading session.

Real Estate Institute of New Zealand released its housing price index on Tuesday. The index declined 0.7% in July, after a 0.3% fall in June.

The Australian dollar traded slightly higher against the U.S. dollar. The National Australia Bank's business confidence index climbed to 11 in July from 8 in June.

House price index in Australia increased 1.8% in the second quarter, exceeding expectations for a 1.1% rise, after a 1.5% gain in the first quarter. The first quarter's figure was revised down from a 1.7% increase.

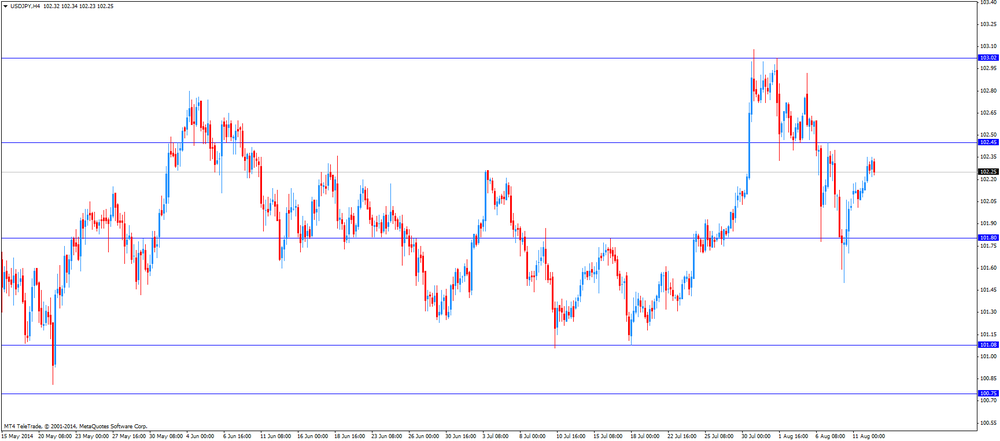

The Japanese yen traded higher against the U.S. dollar due to safe-haven demand. In the overnight trading session, some economic data was releases in Japan. Japan's industrial production decreased 3.4% in June, missing expectations for a 0.5% rise, after a 3.3% decline in May.

On a yearly basis, industrial production in Japan rose 3.1% in June, after a 3.2% increase in May.

Japan's corporate goods price index (CGPI) increased 4.3% in July from a year earlier. That was the 16th straight gain but the pace of rise slowed.

-

15:02

U.S.: JOLTs Job Openings, June 4670 (forecast 4740)

-

13:07

Foreign exchange market. European session: the euro dropped against the U.S. dollar due to the weaker-than-expected economic sentiment from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence July 8 11

01:30 Australia House Price Index (QoQ) Quarter II +1.7% +1.1% +1.8%

01:30 Australia House Price Index (YoY) Quarter II +10.9% +10.1%

02:30 New Zealand REINZ Housing Price Index, m/m July -0.3% -0.7%

04:30 Japan Industrial Production (MoM) (Finally) June -3.3% +0.5% -3.4%

04:30 Japan Industrial Production (YoY) (Finally) June +3.2% +3.1%

09:00 Eurozone ZEW Economic Sentiment August 48.1 41.3 23.7

09:00 Germany ZEW Survey - Economic Sentiment August 27.1 18.2 8.6

The U.S. dollar traded mixed to higher against the most major currencies. Investors monitor closely the situation in Ukraine and Iraq. Russia sent 280 trucks carrying humanitarian aid to Southeast Ukraine.

Iraqi President nominated a new Prime Minister but Nuri al-Maliki, the current Prime Minister, has refused to go.

The euro dropped against the U.S. dollar due to the weaker-than-expected economic sentiment from the Eurozone. The ZEW Centre for Economic Research released its economic sentiment index for Germany and the Eurozone. The economic sentiment index for Germany plunged to 8.6 in August from 27.1 in July. That was the lowest level since December 2012. Analysts had expected a decline to 18.2.

The drop was driven by geopolitical tensions.

Eurozone's ZEW economic sentiment index fell to 23.7 in August from 48.1 in July. Analysts had expected a decrease to 41.3.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

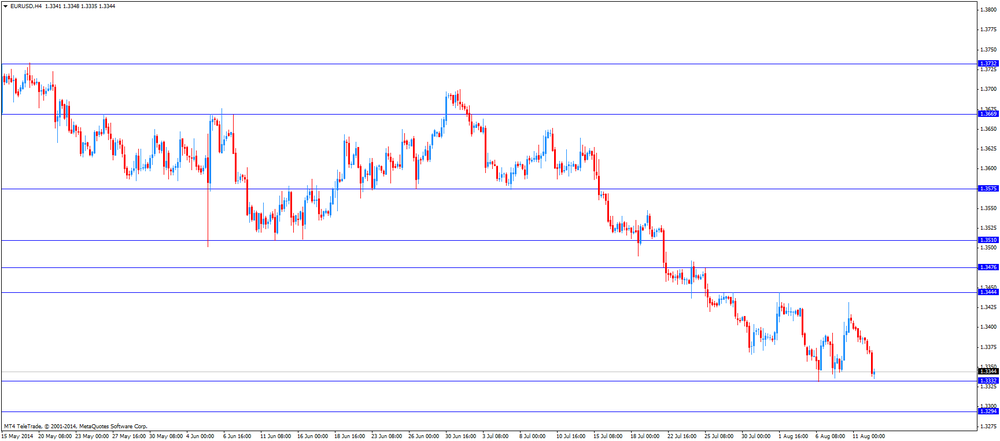

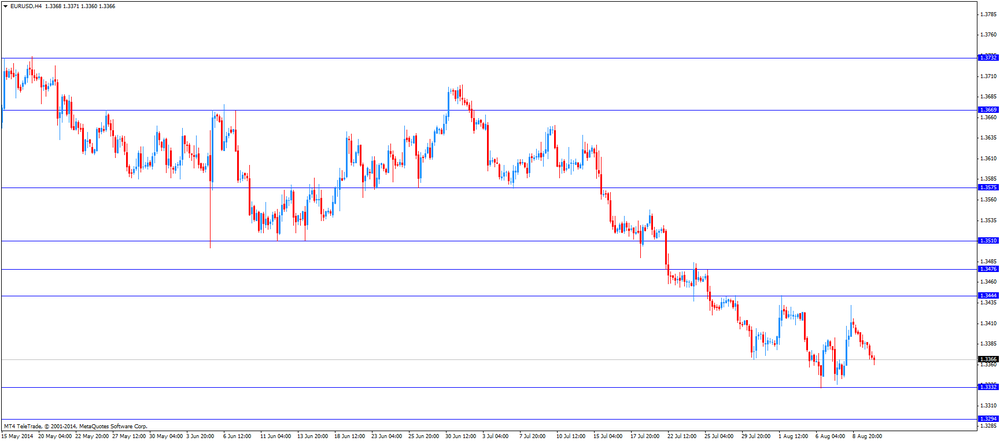

EUR/USD: the currency pair declined to $1.3335

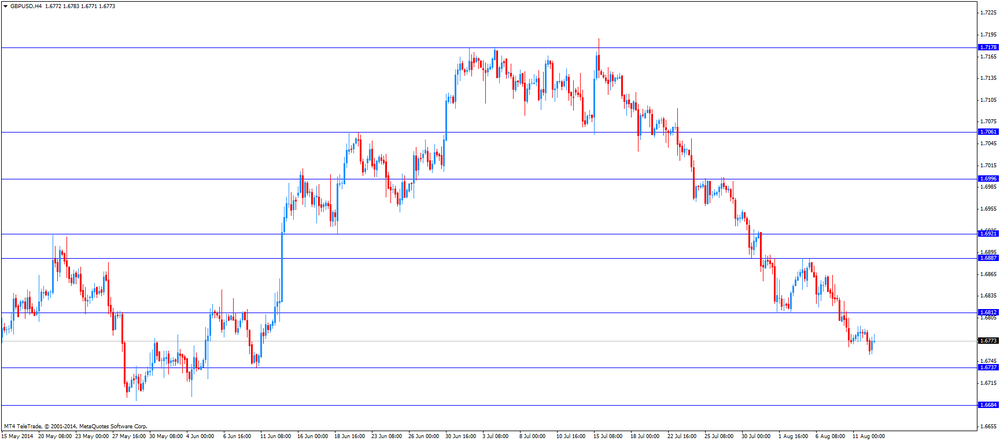

GBP/USD: the currency pair traded mixed

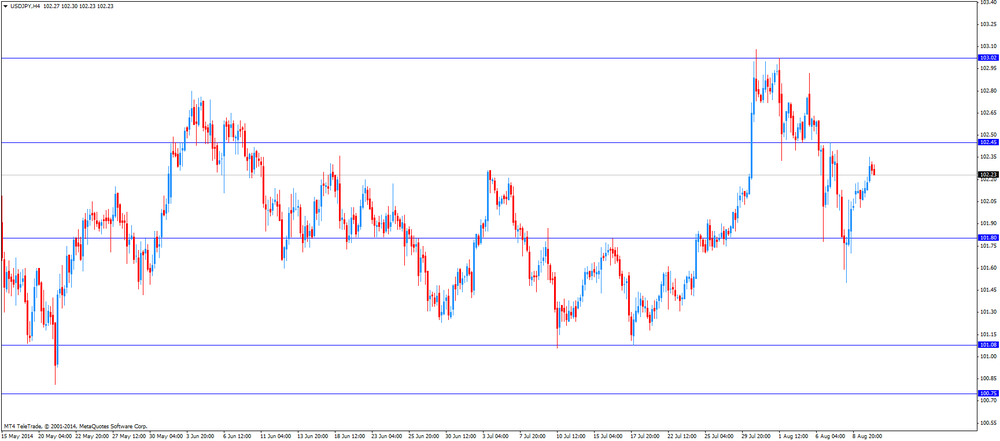

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. JOLTs Job Openings June 4635 4740

18:00 U.S. Federal budget July 70.5 -98.2

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan GDP, q/q (Preliminary) Quarter II +1.6% -1.7%

23:50 Japan GDP, y/y Quarter II +3.0%

-

12:54

Orders

EUR/USD

Offers $1.3500, $1.3475/85, $1.3445-50

Bids $1.3335-30, $1.3280/70

GBP/USD

Offers $1.6900, $1.6885-90, $1.6820-30, $1.6800

Bids $1.6750, $1.6700, $1.6693, $1.6665/60

AUD/USD

Offers $0.9350, $0.9315/20, $0.9300, $0.9285/90

Bids $0.9240, $0.9220/00, $0.9150

EUR/JPY

Offers Y137.50, Y137.20/25, Y137.00, Y136.75/80

Bids Y136.25/20, Y136.00, Y135.50, Y135.25

USD/JPY

Offers Y103.00, Y102.80/85, Y102.65/70, Y102.50

Bids Y102.00, Y101.80, Y101.50, Y101.20

EUR/GBP

Offers stg0.8010, stg0.8000

Bids stg0.7950

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3340-50, $1.3400, $1.3425

USD/JPY Y101.25, Y102.00-05, Y102.15, Y102.25

EUR/JPY Y136.20, Y136.50

GBP/USD $1.6900

EUR/GBP stg0.7940, stg0.7965, stg0.0.8050

AUD/USD $0.9240, $0.9300, $0.9370-75

USD/CAD C$1.0930-35, C$1.0950, C$1.0970-75, C$1.1000

-

10:02

Eurozone: ZEW Economic Sentiment, August 23.7 (forecast 41.3)

-

10:00

Germany: ZEW Survey - Economic Sentiment, August 8.6 (forecast 18.2)

-

09:54

Foreign exchange market. Asian session: the Australian dollar traded mixed against the U.S. dollar after the better-than-expected economic data from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence July 8 11

01:30 Australia House Price Index (QoQ) Quarter II +1.7% +1.1% +1.8%

01:30 Australia House Price Index (YoY) Quarter II +10.9% +10.1%

02:30 New Zealand REINZ Housing Price Index, m/m July -0.3% -0.7%

04:30 Japan Industrial Production (MoM) (Finally) June -3.3% +0.5% -3.4%

04:30 Japan Industrial Production (YoY) (Finally) June +3.2% +3.1%

The U.S. dollar traded higher against the most major currencies. Geopolitical tensions in Iraq and Ukraine weighed on markets.

The New Zealand dollar dropped to a 2-month low against the U.S dollar due to decreasing demand for risk-related assets as geopolitical tensions in Iraq and Ukraine weighed on markets.

Real Estate Institute of New Zealand released its housing price index on Tuesday. The index declined 0.7% in July, after a 0.3% fall in June.

The Australian dollar traded mixed against the U.S. dollar after the better-than-expected economic data from Australia. The National Australia Bank's business confidence index climbed to 11 in July from 8 in June.

House price index in Australia increased 1.8% in the second quarter, exceeding expectations for a 1.1% rise, after a 1.5% gain in the first quarter. The first quarter's figure was revised down from a 1.7% increase.

The Japanese yen traded slightly lower against the U.S. dollar after the economic data from Japan. Japan's industrial production decreased 3.4% in June, missing expectations for a 0.5% rise, after a 3.3% decline in May.

On a yearly basis, industrial production in Japan rose 3.1% in June, after a 3.2% increase in May.

Japan's corporate goods price index (CGPI) increased 4.3% in July from a year earlier. That was the 16th straight gain but the pace of rise slowed.

EUR/USD: the currency pair decreased to $1.3370

GBP/USD: the currency pair fell to $1.6770

USD/JPY: the currency pair rose to Y102.35

The most important news that are expected (GMT0):

09:00 Eurozone ZEW Economic Sentiment August 48.1 41.3

09:00 Germany ZEW Survey - Economic Sentiment August 27.1 18.2

14:00 U.S. JOLTs Job Openings June 4635 4740

18:00 U.S. Federal budget July 70.5 -98.2

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan GDP, q/q (Preliminary) Quarter II +1.6% -1.7%

23:50 Japan GDP, y/y Quarter II +3.0%

-

06:20

Options levels on tuesday, August 12, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3480 (4367)

$1.3446 (618)

$1.3428 (37)

Price at time of writing this review: $ 1.3372

Support levels (open interest**, contracts):

$1.3358 (1968)

$1.3333 (4422)

$1.3303 (3302)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 50923 contracts, with the maximum number of contracts with strike price $1,3600 (4401);

- Overall open interest on the PUT options with the expiration date September, 5 is 55800 contracts, with the maximum number of contracts with strike price $1,3100 (6073);

- The ratio of PUT/CALL was 1.10 versus 0.94 from the previous trading day according to data from August, 8

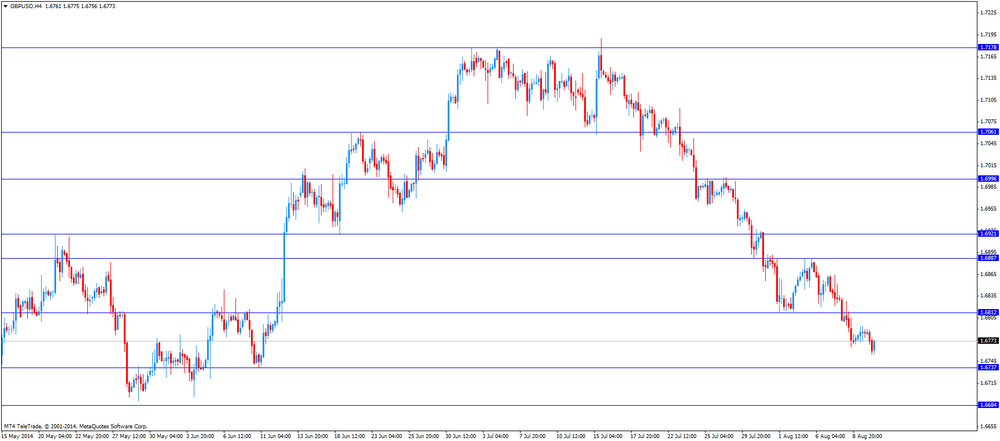

GBP/USD

Resistance levels (open interest**, contracts)

$1.7002 (1363)

$1.6904 (886)

$1.6808 (521)

Price at time of writing this review: $1.6761

Support levels (open interest**, contracts):

$1.6694 (2781)

$1.6596 (1418)

$1.6498 (1644)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 20409 contracts, with the maximum number of contracts with strike price $1,7300 (1534);

- Overall open interest on the PUT options with the expiration date September, 5 is 27225 contracts, with the maximum number of contracts with strike price $1,6800 (3253);

- The ratio of PUT/CALL was 1.33 versus 1.27 from the previous trading day according to data from August, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:33

Japan: Industrial Production (YoY), June +3.1%

-

05:32

Japan: Industrial Production (MoM) , June -3.4% (forecast +0.5%)

-

02:31

Australia: House Price Index (QoQ), Quarter II +1.8% (forecast +1.1%)

-

02:30

Australia: National Australia Bank's Business Confidence, July 8

-

02:30

Australia: House Price Index (YoY), Quarter II +10.1%

-

00:01

United Kingdom: BRC Retail Sales Monitor y/y, July -0.3%

-