Notícias do Mercado

-

23:46

New Zealand: Retail Sales ex Autos, q/q, Quarter II +1.2%

-

23:45

New Zealand: Retail Sales, q/q, Quarter II +1.0% (forecast +1.0%)

-

23:30

New Zealand: Business NZ PMI, July 53.0

-

23:00

Schedule for today, Thursday, Aug 14’2014:

(time / country / index / period / previous value / forecast)

01:00 Australia Consumer Inflation Expectation August +3.8%

05:30 France GDP, q/q Quarter II 0.0% +0.1%

05:30 France GDP, Y/Y Quarter II +0.7%

06:00 Germany GDP (QoQ) Quarter II +0.8% -0.1%

06:00 Germany GDP (YoY) Quarter II +2.5%

06:45 France Non-Farm Payrolls Quarter II -0.1% -0.1%

07:15 Switzerland Producer & Import Prices, m/m July 0.0% 0.0%

07:15 Switzerland Producer & Import Prices, y/y July -0.8%

08:00 Eurozone ECB Monthly Report August

09:00 Eurozone Harmonized CPI July +0.1% -0.6%

09:00 Eurozone Harmonized CPI, Y/Y July +0.4% +0.4%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y July +0.8% +0.8%

09:00 Eurozone GDP (QoQ) Quarter II +0.2% +0.1%

09:00 Eurozone GDP (YoY) Quarter II +0.9% +0.7%

12:30 Canada New Housing Price Index June +0.1% +0.2%

12:30 U.S. Initial Jobless Claims August 289 307

12:30 U.S. Import Price Index July +0.1% -0.2%

-

16:43

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the disappointing U.S. retail sales

The U.S. dollar traded mixed against the most major currencies after the disappointing U.S. retail sales. Retail sales were flat in July, missing expectations for a 0.2%rise, after a 0.2% increase in June.

Retail sales, excluding automobile sales, climbed 0.1% in July, missing expectations for a 0.4% rise, after a 0.4% gain in June.

Business inventories in the U.S. rose 0.4% in June, in line with expectations, after a 0.5% increase in May.

The euro traded mixed against the U.S. dollar after the weaker-than-expected economic data from the Eurozone. Eurozone's industrial production declined 0.3% in June, missing forecasts of a 0.5% rise, after a 1.1% fall in May.

German consumer price index increased 0.3% in July, in line with expectations, after a 0.3% rise in June.

French consumer price index dropped 0.3% in July.

The British pound fell against the U.S. dollar as the Bank of England lowered its forecast for wage growth in 2014. The BoE lowered its forecast to 1.25% from 2.5%.

The unemployment rate in the UK declined to 6.4% in in the three months to June, in line with expectations, down from 6.5% a month earlier. That was the lowest level since late 2008.

The claimant count declined by 33,600 people in July, exceeding expectations for a fall of 29,700, after a decrease of 39,500 people in June. June's figure was revised up from a decrease of 36,300.

But the average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. The last month's figure was revised up from a 0.3% gain. That was first negative average earnings index since March-May 2009.

The average earnings index, excluding bonuses, increased by 0.6% in the three months to June, after a 0.7% rise in the three months to May.

The weak average earnings index may mean that the Bank of England will delay interest rate hike.

The Swiss franc traded mixed against the U.S. dollar. Swiss ZEW Economic Sentiment Index rose to 2.5 in August from 0.1 in July.

The New Zealand dollar increased against the U.S dollar due to the weak U.S. retail sales. No major economic reports were released in New Zealand.

The Australian dollar traded higher against the U.S. dollar after the strong Westpac Melbourne Institute Index of Consumer Sentiment for Australia and due to the weak U.S. retail sales. The Westpac Melbourne Institute Index of Consumer Sentiment for Australia climbed 3.8% in August, after a 1.9% gain in July.

Australia's Wage Price Index increased 0.6% in the second quarter, missing expectations for a 0.8% rise, after a 0.7% gain in the first quarter.

On a yearly basis, the Wage Price Index in Australia rose 2.6% in the second quarter, after a 2.6% increase in the first quarter.

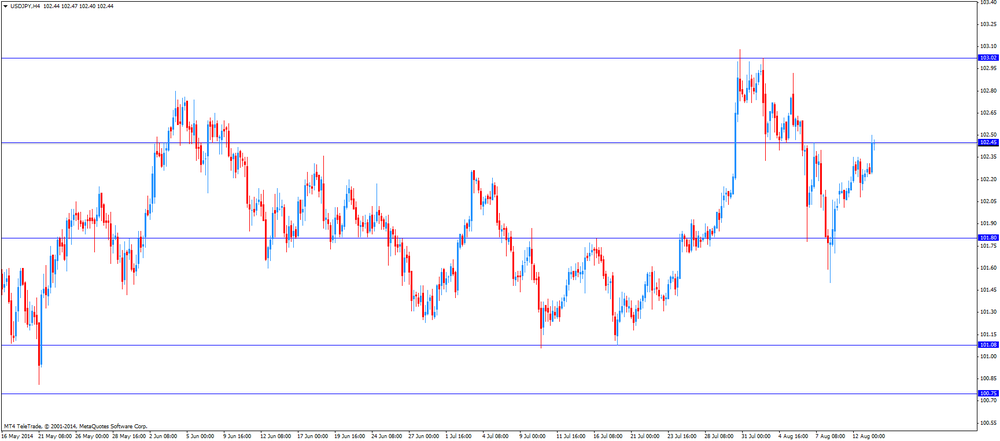

The Japanese yen traded mixed against the U.S. dollar after the disappointing data from Japan and disappointing U.S. retail sales. Japan's preliminary gross domestic product dropped 1.7% in the second quarter, in line with expectations, after a 1.5% gain in the first quarter. The first quarter figure was revised down from a 1.6% rise.

The decline of GDP was driven by the tax hike in April.

On a yearly basis, Japan's preliminary gross domestic product slid 6.8% in the second quarter, after a 6.1% rise in the first quarter. The first quarter figure was revised down from a 6.7% increase.

The Bank of Japan released minutes from the BoJ's meeting on July 14 and 15. The central bank said that the country's economic recovery remains on track. The BoJ added that it will continue with the quantitative and qualitative monetary easing, aiming to achieve the inflation target of 2%.

-

15:52

Bank of Japan monetary policy minutes: economic recovery remains on track

The Bank of Japan released minutes from the BoJ's meeting on July 14 and 15. The central bank said:

- The country's economic recovery remains on track;

- The central bank decided to leave its monetary policy unchanged;

- Inflation, excluding fresh food, is expected to be at 1.9% in the fiscal 2015;

- Some members said upward pressure on prices would increase further as the output gap improves and as inflation expectations climb;

- Some members expressed a recovery in exports had been delayed;

- The BoJ will continue with the quantitative and qualitative monetary easing, aiming to achieve the inflation target of 2%.

- The country's economic recovery remains on track;

-

15:30

U.S.: Crude Oil Inventories, August +1.4

-

15:11

U.S. retail sales flat in July

The U.S. Commerce Department released retail sales today. Retail sales were flat in July, missing expectations for a 0.2%rise, after a 0.2% increase in June.

Retail sales, excluding automobile sales, climbed 0.1% in July, missing expectations for a 0.4% rise, after a 0.4% gain in June.

Motor vehicles and parts sales dropped 0.2%. Sales at general merchandise stores decreased 0.5%, while department stores fell 0.7%.

The slowdown in purchases points to some loss of momentum in the economy. Retail sales account for a third of consumer spending in the U.S.

-

15:00

U.S.: Business inventories , June +0.4% (forecast +0.4%)

-

13:57

Bank of England upgraded its 2014 growth forecast

The Bank of England (BoE) released its quarterly inflation report on Wednesday. The BoE upgraded its growth forecast from 3.4% to 3.5% in 2014, and from 2.9% to 3.0% in 2015.

Unemployment rate is expected to drop to 6.0% this year, while inflation is expected to be just below 2 per cent over the next three years.

On another side, the central bank cut its forecast for wage growth in 2014. The BoE lowered its forecast to 1.25% from 2.5%. Wage growth is expected to remain below inflation.

The BoE revealed its revealed downward revisions of its wage growth forecasts after the release of the official labour market data earlier in the morning. The average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. The last month's figure was revised up from a 0.3% gain. That was first negative average earnings index since March-May 2009.

The weak average earnings index may mean that the Bank of England will delay interest rate hike.

The BoE said it will focus more on wages in its assessment of "spare capacity". The central bank revised down its forecast of spare capacity in the economy from 1-1.5% to 1%.

The Bank of England Governor Mark Carney said that when the BoE starts to hike its interest rate, it will do so in a "small, slow" manner.

Mark Carney added that "sustained economic momentum is looking more assured", and "the economy is returning to a semblance of normality".

-

13:31

U.S.: Retail sales, July 0,0% (forecast +0.2%)

-

13:31

U.S.: Retail sales excluding auto, July +0,1% (forecast +0.4%)

-

13:02

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the weaker-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence August +1.9% +3.8%

01:30 Australia Wage Price Index, q/q Quarter II +0.7% +0.8% +0.6%

01:30 Australia Wage Price Index, y/y Quarter II +2.6% +2.6%

05:30 China Retail Sales y/y July +12.4% +12.5% +12.2%

05:30 China Fixed Asset Investment July +17.3% +17.4% +17.0%

05:30 China Industrial Production y/y July +9.2% +9.1% +9.0%

06:00 Germany CPI, m/m (Finally) July +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) July +0.8% +0.8% +0.8%

06:45 France CPI, m/m July 0.0% -0.2% -0.3%

06:45 France CPI, y/y July +0.5% +0.6%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June +0.7% +0.6%

08:30 United Kingdom Average Earnings, 3m/y June +0.3% -0.1% -0.2%

08:30 United Kingdom Claimant count July -36.3 -29.7 -33.6

08:30 United Kingdom Claimant Count Rate July 3.1% 3.0%

08:30 United Kingdom ILO Unemployment Rate June 6.5% 6.4% 6.4%

09:00 Eurozone Industrial production, (MoM) June -1.1% +0.5% -0.3%

09:00 Eurozone Industrial Production (YoY) June +0.5% 0.0%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 0.1 2.5

09:30 United Kingdom BOE Inflation Letter Quarter III

09:30 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead of U.S. retail sales. Retail sales in the U.S. are expected to increase 0.2% in July, after a 0.2% gain in June.

Retail sales, excluding automobile sales, are expected to climbs 0.4% in July, after a 0.4% rise in June.

Business inventories in the U.S. are expected to rise 0.4% in June, after a 0.5% increase in May.

The euro traded mixed against the U.S. dollar after the weaker-than-expected economic data from the Eurozone. Eurozone's industrial production declined 0.3% in June, missing forecasts of a 0.5% rise, after a 1.1% fall in May.

German consumer price index increased 0.3% in July, in line with expectations, after a 0.3% rise in June.

French consumer price index dropped 0.3% in July.

The British pound slid against the U.S. dollar as the Bank of England lowered its forecast for wage growth in 2014. The BoE lowered its forecast to 1.25% from 2.5%.

The unemployment rate in the UK declined to 6.4% in in the three months to June, in line with expectations, down from 6.5% a month earlier. That was the lowest level since late 2008.

The claimant count declined by 33,600 people in July, exceeding expectations for a fall of 29,700, after a decrease of 39,500 people in June. June's figure was revised up from a decrease of 36,300.

But the average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. The last month's figure was revised up from a 0.3% gain. That was first negative average earnings index since March-May 2009.

The average earnings index, excluding bonuses, increased by 0.6% in the three months to June, after a 0.7% rise in the three months to May.

The weak average earnings index may mean that the Bank of England will delay interest rate hike.

The Swiss franc traded mixed against the U.S. dollar. Swiss ZEW Economic Sentiment Index rose to 2.5 in August from 0.1 in July.

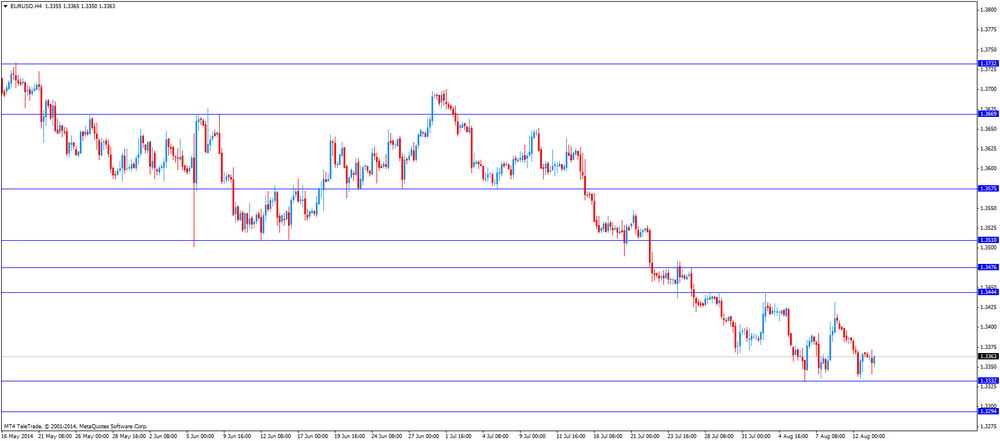

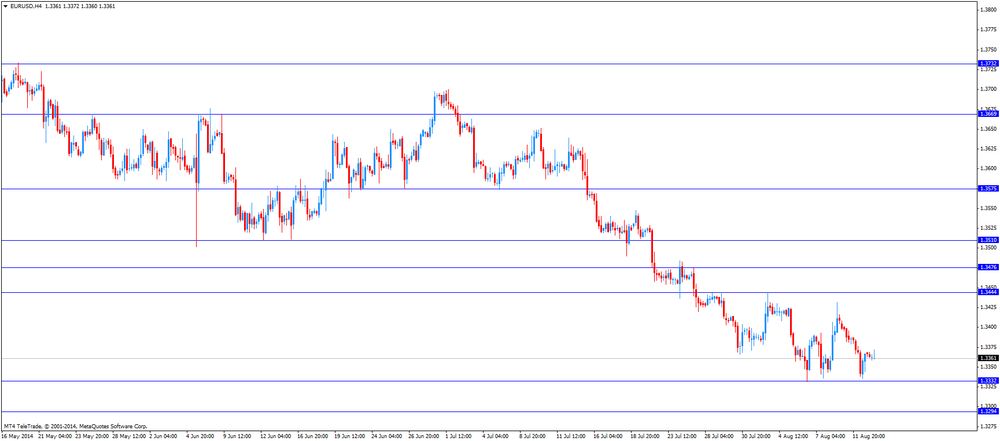

EUR/USD: the currency pair traded mixed

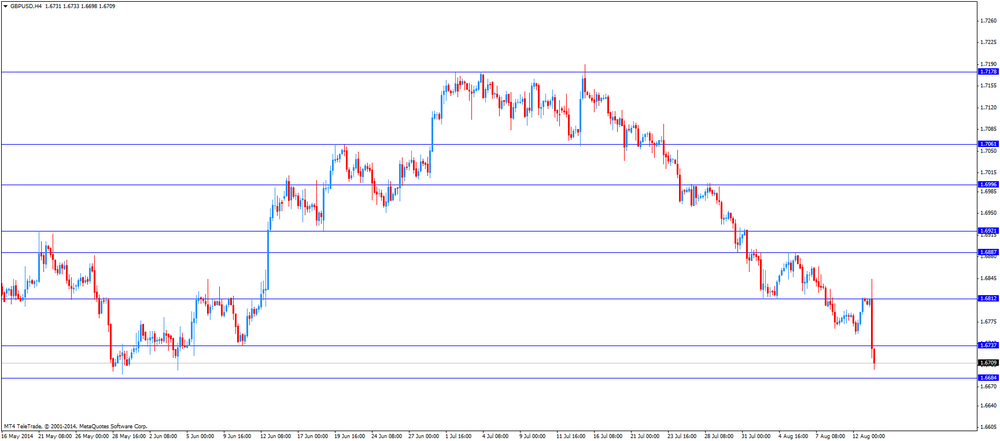

GBP/USD: the currency pair dropped to $1.6698

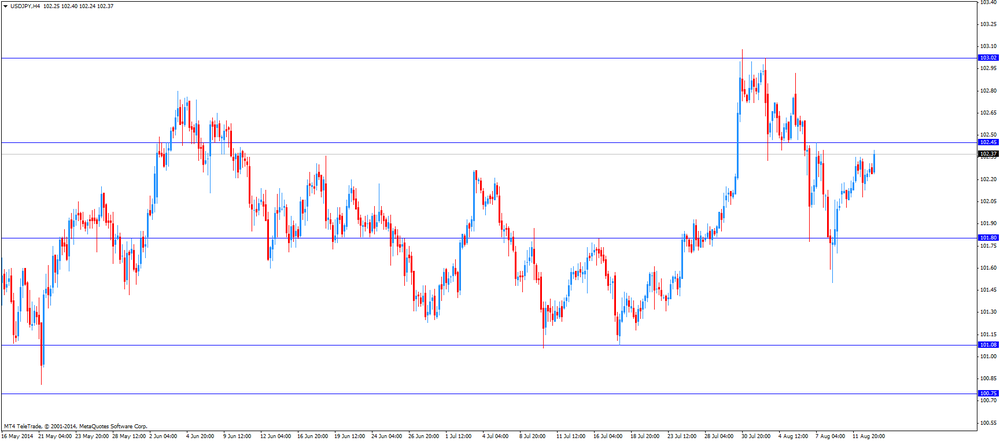

USD/JPY: the currency pair climbed to Y102.50

The most important news that are expected (GMT0):

12:30 U.S. Retail sales July +0.2% +0.2%

12:30 U.S. Retail sales excluding auto July +0.4% +0.4%

13:05 U.S. FOMC Member Dudley Speak

14:30 U.S. Crude Oil Inventories August -1.8

22:30 New Zealand Business NZ PMI July 53.3

22:45 New Zealand Retail Sales, q/q Quarter II +0.7% +1.0%

22:45 New Zealand Retail Sales ex Autos, q/q Quarter II +0.8%

23:50 Japan Core Machinery Orders June -19.5% +15.5%

23:50 Japan Core Machinery Orders, y/y June -14.3%

-

11:48

-

11:11

UK unemployment rate reached the lowest level since late 2008

The Office for National Statistics (ONS) in the UK released the labour market data on Wednesday. The unemployment rate declined to 6.4% in in the three months to June, in line with expectations, down from 6.5% a month earlier. That was the lowest level since late 2008.

The claimant count declined by 33,600 people in July, exceeding expectations for a fall of 29,700, after a decrease of 39,500 people in June. June's figure was revised up from a decrease of 36,300.

The ONS said that the number of unemployed fell by 132,000 to 2.08 million people.

But average weekly earnings remained weak. The average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. The last month's figure was revised up from a 0.3% gain. That was first negative average earnings index since March-May 2009.

The average earnings index, excluding bonuses, increased by 0.6% in the three months to June, after a 0.7% rise in the three months to May.

The weak average earnings index may mean that the Bank of England will delay interest rate hike.

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3325-35, $1.3340, $1.3350, $1.3400-10

USD/JPY Y102.05, Y102.10, Y102.15, Y102.25-30, Y102.50

GBP/USD $1.6850, $1.6915

EUR/GBP stg0.7950

AUD/USD $0.9175, $0.9225, $0.9300, $0.9350, $0.9375

NZD/USD $0.8450

USD/CAD C$1.0970-75

-

10:00

Eurozone: Industrial production, (MoM), June -0.3% (forecast +0.5%)

-

10:00

Eurozone: Industrial Production (YoY), June 0.0%

-

09:57

Foreign exchange market. Asian session: the Australian dollar rose against the U.S. dollar after the strong Westpac Melbourne Institute Index of Consumer Sentiment for Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence August +1.9% +3.8%

01:30 Australia Wage Price Index, q/q Quarter II +0.7% +0.8% +0.6%

01:30 Australia Wage Price Index, y/y Quarter II +2.6% +2.6%

05:30 China Retail Sales y/y July +12.4% +12.5% +12.2%

05:30 China Fixed Asset Investment July +17.3% +17.4% +17.0%

05:30 China Industrial Production y/y July +9.2% +9.1% +9.0%

06:00 Germany CPI, m/m (Finally) July +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) July +0.8% +0.8% +0.8%

06:45 France CPI, m/m July 0.0% -0.2% -0.3%

06:45 France CPI, y/y July +0.5% +0.6%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June +0.7% +0.6%

08:30 United Kingdom Average Earnings, 3m/y June +0.3% -0.1% -0.2%

08:30 United Kingdom Claimant count July -36.3 -29.7 -33.6

08:30 United Kingdom Claimant Count Rate July 3.1% 3.0%

08:30 United Kingdom ILO Unemployment Rate June 6.5% 6.4% 6.4%

The U.S. dollar traded mixed to higher against the most major currencies. Investors continue to monitor geopolitical tensions in Iraq and Ukraine.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar rose against the U.S. dollar after the strong Westpac Melbourne Institute Index of Consumer Sentiment for Australia. The index climbed 3.8% in August, after a 1.9% gain in July.

Australia's Wage Price Index increased 0.6% in the second quarter, missing expectations for a 0.8% rise, after a 0.7% gain in the first quarter.

On a yearly basis, the Wage Price Index in Australia rose 2.6% in the second quarter, after a 2.6% increase in the first quarter.

The Japanese yen traded mixed against the U.S. dollar after the disappointing data from Japan. Japan's preliminary gross domestic product dropped 1.7% in the second quarter, in line with expectations, after a 1.5% gain in the first quarter. The first quarter figure was revised down from a 1.6% rise.

The decline of GDP was driven by the tax hike in April.

On a yearly basis, Japan's preliminary gross domestic product slid 6.8% in the second quarter, after a 6.1% rise in the first quarter. The first quarter figure was revised down from a 6.7% increase.

The Bank of Japan released minutes from the BoJ's meeting on July 14 and 15. The central bank said that the country's economic recovery remains on track. The BoJ added that it will continue with the quantitative and qualitative monetary easing, aiming to achieve the inflation target of 2%.

EUR/USD: the currency pair decreased to $1.3360

GBP/USD: the currency pair fell to $1.6799

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

09:00 Eurozone Industrial production, (MoM) June -1.1% +0.5%

09:00 Eurozone Industrial Production (YoY) June +0.5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 0.1

09:30 United Kingdom BOE Inflation Letter Quarter III

09:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Retail sales July +0.2% +0.2%

12:30 U.S. Retail sales excluding auto July +0.4% +0.4%

13:05 U.S. FOMC Member Dudley Speak

14:30 U.S. Crude Oil Inventories August -1.8

22:30 New Zealand Business NZ PMI July 53.3

22:45 New Zealand Retail Sales, q/q Quarter II +0.7% +1.0%

22:45 New Zealand Retail Sales ex Autos, q/q Quarter II +0.8%

23:50 Japan Core Machinery Orders June -19.5% +15.5%

23:50 Japan Core Machinery Orders, y/y June -14.3%

-

09:31

United Kingdom: Average earnings ex bonuses, 3 m/y, June +0.6%

-

09:31

United Kingdom: Average Earnings, 3m/y , June -0.2% (forecast -0.1%)

-

09:30

United Kingdom: Claimant count , July -33.6 (forecast -29.7)

-

09:30

United Kingdom: ILO Unemployment Rate, June 6.4% (forecast 6.4%)

-

09:30

United Kingdom: Claimant Count Rate, July 3.0%

-

07:44

France: CPI, m/m, July -0.3% (forecast -0.2%)

-

07:44

France: CPI, y/y, July +0.6%

-

07:00

Germany: CPI, m/m, July +0.3% (forecast +0.3%)

-

07:00

Germany: CPI, y/y , July +0.8% (forecast +0.8%)

-

06:31

China: Fixed Asset Investment, July +17.0% (forecast +17.4%)

-

06:30

China: Retail Sales y/y, July +12.2% (forecast +12.5%)

-

06:30

China: Industrial Production y/y, July +9.0% (forecast +9.1%)

-

06:29

Options levels on wednesday, August 13, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3451 (4592)

$1.3408 (645)

$1.3385 (39)

Price at time of writing this review: $ 1.3363

Support levels (open interest**, contracts):

$1.3337 (1832)

$1.3293 (3263)

$1.3261 (4979)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 52591 contracts, with the maximum number of contracts with strike price $1,3400 (4592);

- Overall open interest on the PUT options with the expiration date September, 5 is 56311 contracts, with the maximum number of contracts with strike price $1,3100 (6096);

- The ratio of PUT/CALL was 1.07 versus 1.10 from the previous trading day according to data from August, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.7101 (1514)

$1.7002 (2458)

$1.6905 (1577)

Price at time of writing this review: $1.6801

Support levels (open interest**, contracts):

$1.6696 (2925)

$1.6598 (1767)

$1.6499 (1845)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 24572 contracts, with the maximum number of contracts with strike price $1,7000 (2458);

- Overall open interest on the PUT options with the expiration date September, 5 is 29346 contracts, with the maximum number of contracts with strike price $1,6800 (3993);

- The ratio of PUT/CALL was 1.19 versus 1.33 from the previous trading day according to data from August, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:30

Australia: Wage Price Index, q/q, Quarter II +0.6% (forecast +0.8%)

-

02:30

Australia: Wage Price Index, y/y, Quarter II +2.6%

-

01:30

Australia: Westpac Consumer Confidence, August +3.8%

-

00:50

Japan: GDP, y/y, Quarter II +2.0%

-

00:50

Japan: GDP, q/q, Quarter II -1.7% (forecast -1.7%)

-