Notícias do Mercado

-

23:46

New Zealand: Retail Sales ex Autos, q/q, Quarter II +1.2%

-

23:45

New Zealand: Retail Sales, q/q, Quarter II +1.0% (forecast +1.0%)

-

23:30

New Zealand: Business NZ PMI, July 53.0

-

23:00

Schedule for today, Thursday, Aug 14’2014:

(time / country / index / period / previous value / forecast)

01:00 Australia Consumer Inflation Expectation August +3.8%

05:30 France GDP, q/q Quarter II 0.0% +0.1%

05:30 France GDP, Y/Y Quarter II +0.7%

06:00 Germany GDP (QoQ) Quarter II +0.8% -0.1%

06:00 Germany GDP (YoY) Quarter II +2.5%

06:45 France Non-Farm Payrolls Quarter II -0.1% -0.1%

07:15 Switzerland Producer & Import Prices, m/m July 0.0% 0.0%

07:15 Switzerland Producer & Import Prices, y/y July -0.8%

08:00 Eurozone ECB Monthly Report August

09:00 Eurozone Harmonized CPI July +0.1% -0.6%

09:00 Eurozone Harmonized CPI, Y/Y July +0.4% +0.4%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y July +0.8% +0.8%

09:00 Eurozone GDP (QoQ) Quarter II +0.2% +0.1%

09:00 Eurozone GDP (YoY) Quarter II +0.9% +0.7%

12:30 Canada New Housing Price Index June +0.1% +0.2%

12:30 U.S. Initial Jobless Claims August 289 307

12:30 U.S. Import Price Index July +0.1% -0.2%

-

20:00

Dow+87.02 16,647.56 +0.53% Nasdaq +42.47 4,431.72 +0.97% S&P +11.81 1,945.56 +0.61%

-

17:05

European stocks close: stocks closed higher due to the better-than-forecasted corporate earnings

Stock indices closed higher as E.ON and Swiss Life posted the better-than-forecasted earnings.

Eurozone's industrial production declined 0.3% in June, missing forecasts of a 0.5% rise, after a 1.1% fall in May.

The unemployment rate in the UK decreased to 6.4% in in the three months to June, in line with expectations, down from 6.5% a month earlier. That was the lowest level since late 2008.

The claimant count declined by 33,600 people in July, exceeding expectations for a fall of 29,700, after a decrease of 39,500 people in June.

But the average earnings index, including bonuses, fell by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. That was first negative average earnings index since March-May 2009.

The cut of forecast for wage growth in 2014 by the Bank of England weighed on markets. The BoE lowered its forecast to 1.25% from 2.5%.

Investors continue to monitor tensions between Russia and Ukraine. Ukraine plans to block a Russian humanitarian aid convoy.

E.ON shares jumped 5.1% after reporting the first-half net income beat analysts' forecast.

Merck KGaA shares increased 3.2% after reporting the better-than-forecasted second-quarter earnings.

Swiss Life Holding AG shares 7.1% after reporting the better-than-forecasted first-half profit. The company also said that it will buy real estate asset manager Corpus Sireo.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,656.68 +24.26 +0.37%

DAX 9,198.88 +129.41 +1.43%

CAC 40 4,194.79 +32.63 +0.78%

-

17:00

European stocks closed in plus: FTSE 100 6,656.68 +24.26 +0.37% CAC 40 4,194.79 +32.63 +0.78% DAX 9,198.88 +129.41 +1.43%

-

16:43

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the disappointing U.S. retail sales

The U.S. dollar traded mixed against the most major currencies after the disappointing U.S. retail sales. Retail sales were flat in July, missing expectations for a 0.2%rise, after a 0.2% increase in June.

Retail sales, excluding automobile sales, climbed 0.1% in July, missing expectations for a 0.4% rise, after a 0.4% gain in June.

Business inventories in the U.S. rose 0.4% in June, in line with expectations, after a 0.5% increase in May.

The euro traded mixed against the U.S. dollar after the weaker-than-expected economic data from the Eurozone. Eurozone's industrial production declined 0.3% in June, missing forecasts of a 0.5% rise, after a 1.1% fall in May.

German consumer price index increased 0.3% in July, in line with expectations, after a 0.3% rise in June.

French consumer price index dropped 0.3% in July.

The British pound fell against the U.S. dollar as the Bank of England lowered its forecast for wage growth in 2014. The BoE lowered its forecast to 1.25% from 2.5%.

The unemployment rate in the UK declined to 6.4% in in the three months to June, in line with expectations, down from 6.5% a month earlier. That was the lowest level since late 2008.

The claimant count declined by 33,600 people in July, exceeding expectations for a fall of 29,700, after a decrease of 39,500 people in June. June's figure was revised up from a decrease of 36,300.

But the average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. The last month's figure was revised up from a 0.3% gain. That was first negative average earnings index since March-May 2009.

The average earnings index, excluding bonuses, increased by 0.6% in the three months to June, after a 0.7% rise in the three months to May.

The weak average earnings index may mean that the Bank of England will delay interest rate hike.

The Swiss franc traded mixed against the U.S. dollar. Swiss ZEW Economic Sentiment Index rose to 2.5 in August from 0.1 in July.

The New Zealand dollar increased against the U.S dollar due to the weak U.S. retail sales. No major economic reports were released in New Zealand.

The Australian dollar traded higher against the U.S. dollar after the strong Westpac Melbourne Institute Index of Consumer Sentiment for Australia and due to the weak U.S. retail sales. The Westpac Melbourne Institute Index of Consumer Sentiment for Australia climbed 3.8% in August, after a 1.9% gain in July.

Australia's Wage Price Index increased 0.6% in the second quarter, missing expectations for a 0.8% rise, after a 0.7% gain in the first quarter.

On a yearly basis, the Wage Price Index in Australia rose 2.6% in the second quarter, after a 2.6% increase in the first quarter.

The Japanese yen traded mixed against the U.S. dollar after the disappointing data from Japan and disappointing U.S. retail sales. Japan's preliminary gross domestic product dropped 1.7% in the second quarter, in line with expectations, after a 1.5% gain in the first quarter. The first quarter figure was revised down from a 1.6% rise.

The decline of GDP was driven by the tax hike in April.

On a yearly basis, Japan's preliminary gross domestic product slid 6.8% in the second quarter, after a 6.1% rise in the first quarter. The first quarter figure was revised down from a 6.7% increase.

The Bank of Japan released minutes from the BoJ's meeting on July 14 and 15. The central bank said that the country's economic recovery remains on track. The BoJ added that it will continue with the quantitative and qualitative monetary easing, aiming to achieve the inflation target of 2%.

-

16:40

Oil: an overview of the market situation

Brent prices rose moderately after earlier today hit a low for the last 13 months. As for oil WTI, its price is slightly decreased.

One of the reasons for the drop in oil prices was the resumption of supplies from Libya. August 12 of the Libyan port of Ras Lanuf came tanker with 680 thousand barrels of oil. He goes to Italy, according to the Ministry of Libya's oil. Oil supply is growing amid weakening demand. In the second quarter of 2014, according to the International Energy Agency, the pace of oil demand growth were minimal in two years. IEA lowered the outlook on the dynamics of growth in oil demand this year by 180,000 barrels per day to 1 million barrels. One of the reasons for reducing the rate of growth in demand was slowing Chinese economy. Industrial production in July increased by 9% compared to 9.2% in June. China has also slowed the buildup of oil reserves.

Also today, the Department of Energy announced that commercial oil stocks in the United States last week rose by 1,401 thousand. Barrels - up to 367,019 million barrels. Gasoline inventories fell by 1,160 thousand. Barrels and reached 212,689 million barrels. Commercial distillate stocks fell by 2,421 thousand. Barrels, reaching 122,502 million barrels.

Experts expect diminishing reserves of oil for 2050 thousand. Barrels, gasoline inventories decrease by 1,500 thousand. Barrels and distillate stocks decrease by 50 thousand. Barrels.

Recall that yesterday's report from the think tank the American Petroleum Institute (API) has shown that commercial crude oil inventories in the United States by the end of the reporting week, which ended on August 8, increased by 2.0 million barrels., While gasoline inventories rose by 2.7 million barrel. In this case, heavy distillate stocks in the United States for the past reporting period decreased by 2.6 million barrels., The report API.

Market participants also drew attention to the report from the Commerce Department. As it became known, in June, inventories of goods in the warehouses of the United States rose by 0.4% compared to May, which was in line with expectations of experts. Recall that in May, inventories increased by 0.5%. Sales from warehouses in the last month rose by 0.3%, as in May. Stocks of retailers in June increased by 0.5%, their sales increased by 0.2%. Stocks in the warehouses of companies processing industry increased by 0.3% and sales - by 0.5%. Wholesalers increased inventories by 0.3% and sales - by 0.2%. The number of cars in the retail stores in June rose by 0.9%, their sales were down 0.3%. Stocks in warehouses in June was enough to ensure sales, taking into account the current rate of demand for 1.29 months, as in May.

The cost of the September futures for the American light crude oil WTI (Light Sweet Crude Oil) fell to $ 96.82 a barrel and then dropped to $ 97.25 a barrel on the New York Mercantile Exchange (NYMEX).

September futures price for North Sea Brent crude oil mixture rose $ 0.40 to $ 103.22 a barrel on the London exchange ICE Futures Europe.

-

16:21

Gold: an overview of the market situation

Gold prices rose sharply today, which was associated with the release of weak retail sales data in the United States, which have reduced the speculation in an earlier interest rate hikes by the Federal Reserve.

The Commerce Department said retail sales and the sale of food in July, adjusted for seasonal fluctuations remained unchanged compared with the previous month. Americans spent more on food and clothes, but cut spending on cars and shopping in department stores. Excluding autos, retail sales rose 0.1% in July compared with the previous month. Economists had expected sales to rise 0.2% in July and will rise by 0.4% excluding autos.

Retail sales rose 0.2% in June compared with the previous month, unchanged compared with the earlier estimate of the Ministry of Trade. In May, sales rose by 0.4% compared with the previous month, the result was revised down from a previously reported growth of 0.5%.

Consumer spending has been uneven in July. Sales of motor vehicles and parts fell by a seasonally adjusted 0.2% in June, sales at furniture stores fell by 0.1% and sales at department stores fell by 0.7%. Expenses increased by 0.2% for building materials and garden stores offer, slowing the growth of 1% in the previous month. Costs at the gas station went up by 0.1% from June, but remained below 1.2% compared to July 2013 costs rose 0.4% last month from June to clothing stores, rose 0.2% in grocery stores and increased by 0.2% in the food services and drinking establishments.

The dynamics also affect the disappointing Chinese economic data, has renewed concerns about the health of the 2nd largest economy in the world.

Meanwhile, it became known that the assets the world's largest holder of gold investment institutions ETFs SPDR Gold Trust at the end of the day on August 12 did not change after August 8, 2014. they decreased by 1.79 m and amounted to 795.86 tons - the lowest since June 30, 2014.

From a technical point of view, today and in the coming days, the price of gold price dynamics will be limited to the level of support $ 1300.0 per ounce and resistance level $ 1320.0 per ounce.

The cost of the September futures contract for gold on COMEX today rose to $ 1313.30 per ounce.

-

15:52

Bank of Japan monetary policy minutes: economic recovery remains on track

The Bank of Japan released minutes from the BoJ's meeting on July 14 and 15. The central bank said:

- The country's economic recovery remains on track;

- The central bank decided to leave its monetary policy unchanged;

- Inflation, excluding fresh food, is expected to be at 1.9% in the fiscal 2015;

- Some members said upward pressure on prices would increase further as the output gap improves and as inflation expectations climb;

- Some members expressed a recovery in exports had been delayed;

- The BoJ will continue with the quantitative and qualitative monetary easing, aiming to achieve the inflation target of 2%.

- The country's economic recovery remains on track;

-

15:30

U.S.: Crude Oil Inventories, August +1.4

-

15:11

U.S. retail sales flat in July

The U.S. Commerce Department released retail sales today. Retail sales were flat in July, missing expectations for a 0.2%rise, after a 0.2% increase in June.

Retail sales, excluding automobile sales, climbed 0.1% in July, missing expectations for a 0.4% rise, after a 0.4% gain in June.

Motor vehicles and parts sales dropped 0.2%. Sales at general merchandise stores decreased 0.5%, while department stores fell 0.7%.

The slowdown in purchases points to some loss of momentum in the economy. Retail sales account for a third of consumer spending in the U.S.

-

15:00

U.S.: Business inventories , June +0.4% (forecast +0.4%)

-

14:30

Before the bell: S&P futures +0.68%, Nasdaq futures +1.14%

U.S. stock futures rose despite data showed retail sales were little changed last month and investors assessed corporate earnings reports.

Global markets:

Nikkei 15,213.63 +52.32 +0.35%

Hang Seng 24,890.34 +200.93 +0.81%

Shanghai Composite 2,222.88 +1.28 +0.06%

FTSE 6,640.75 +8.33 +0.13%

CAC 4,183.6 +21.44 +0.52%

DAX 9,148.81 +79.34 +0.87%

Crude oil $97.35 (-0.02%)

Gold $1314.00 (+0.27%)

-

14:15

DOW components before the bell

(company / ticker / price / change, % / volume)

Walt Disney Co

DIS

87.21

0.00%

2.6K

Merck & Co Inc

MRK

57.49

+0.81%

0.8K

JPMorgan Chase and Co

JPM

56.69

+0.60%

1.3K

United Technologies Corp

UTX

105.52

+0.58%

2.7K

General Electric Co

GE

25.75

+0.55%

6.1K

Cisco Systems Inc

CSCO

25.28

+0.52%

0.1K

Microsoft Corp

MSFT

43.74

+0.51%

3.7K

International Business Machines Co...

IBM

188.25

+0.49%

2.0K

Goldman Sachs

GS

173.00

+0.39%

0.1K

Home Depot Inc

HD

83.20

+0.34%

0.4K

Verizon Communications Inc

VZ

49.00

+0.33%

3.4K

Intel Corp

INTC

33.23

+0.30%

5.8K

American Express Co

AXP

87.31

+0.26%

0.1K

AT&T Inc

T

34.73

+0.26%

0.1K

Visa

V

210.72

+0.20%

3.0K

The Coca-Cola Co

KO

39.76

+0.20%

0.1K

Pfizer Inc

PFE

28.13

+0.18%

11.3K

Boeing Co

BA

120.60

+0.11%

0.5K

McDonald's Corp

MCD

93.65

+0.10%

0.1K

-

14:01

Upgrades and downgrades before the market open

Upgrades:

Ford Motor (F) upgraded to Buy from Hold at Stifel, target $22

Downgrades:

Other:

-

13:57

Bank of England upgraded its 2014 growth forecast

The Bank of England (BoE) released its quarterly inflation report on Wednesday. The BoE upgraded its growth forecast from 3.4% to 3.5% in 2014, and from 2.9% to 3.0% in 2015.

Unemployment rate is expected to drop to 6.0% this year, while inflation is expected to be just below 2 per cent over the next three years.

On another side, the central bank cut its forecast for wage growth in 2014. The BoE lowered its forecast to 1.25% from 2.5%. Wage growth is expected to remain below inflation.

The BoE revealed its revealed downward revisions of its wage growth forecasts after the release of the official labour market data earlier in the morning. The average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. The last month's figure was revised up from a 0.3% gain. That was first negative average earnings index since March-May 2009.

The weak average earnings index may mean that the Bank of England will delay interest rate hike.

The BoE said it will focus more on wages in its assessment of "spare capacity". The central bank revised down its forecast of spare capacity in the economy from 1-1.5% to 1%.

The Bank of England Governor Mark Carney said that when the BoE starts to hike its interest rate, it will do so in a "small, slow" manner.

Mark Carney added that "sustained economic momentum is looking more assured", and "the economy is returning to a semblance of normality".

-

13:31

U.S.: Retail sales, July 0,0% (forecast +0.2%)

-

13:31

U.S.: Retail sales excluding auto, July +0,1% (forecast +0.4%)

-

13:02

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the weaker-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence August +1.9% +3.8%

01:30 Australia Wage Price Index, q/q Quarter II +0.7% +0.8% +0.6%

01:30 Australia Wage Price Index, y/y Quarter II +2.6% +2.6%

05:30 China Retail Sales y/y July +12.4% +12.5% +12.2%

05:30 China Fixed Asset Investment July +17.3% +17.4% +17.0%

05:30 China Industrial Production y/y July +9.2% +9.1% +9.0%

06:00 Germany CPI, m/m (Finally) July +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) July +0.8% +0.8% +0.8%

06:45 France CPI, m/m July 0.0% -0.2% -0.3%

06:45 France CPI, y/y July +0.5% +0.6%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June +0.7% +0.6%

08:30 United Kingdom Average Earnings, 3m/y June +0.3% -0.1% -0.2%

08:30 United Kingdom Claimant count July -36.3 -29.7 -33.6

08:30 United Kingdom Claimant Count Rate July 3.1% 3.0%

08:30 United Kingdom ILO Unemployment Rate June 6.5% 6.4% 6.4%

09:00 Eurozone Industrial production, (MoM) June -1.1% +0.5% -0.3%

09:00 Eurozone Industrial Production (YoY) June +0.5% 0.0%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 0.1 2.5

09:30 United Kingdom BOE Inflation Letter Quarter III

09:30 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead of U.S. retail sales. Retail sales in the U.S. are expected to increase 0.2% in July, after a 0.2% gain in June.

Retail sales, excluding automobile sales, are expected to climbs 0.4% in July, after a 0.4% rise in June.

Business inventories in the U.S. are expected to rise 0.4% in June, after a 0.5% increase in May.

The euro traded mixed against the U.S. dollar after the weaker-than-expected economic data from the Eurozone. Eurozone's industrial production declined 0.3% in June, missing forecasts of a 0.5% rise, after a 1.1% fall in May.

German consumer price index increased 0.3% in July, in line with expectations, after a 0.3% rise in June.

French consumer price index dropped 0.3% in July.

The British pound slid against the U.S. dollar as the Bank of England lowered its forecast for wage growth in 2014. The BoE lowered its forecast to 1.25% from 2.5%.

The unemployment rate in the UK declined to 6.4% in in the three months to June, in line with expectations, down from 6.5% a month earlier. That was the lowest level since late 2008.

The claimant count declined by 33,600 people in July, exceeding expectations for a fall of 29,700, after a decrease of 39,500 people in June. June's figure was revised up from a decrease of 36,300.

But the average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. The last month's figure was revised up from a 0.3% gain. That was first negative average earnings index since March-May 2009.

The average earnings index, excluding bonuses, increased by 0.6% in the three months to June, after a 0.7% rise in the three months to May.

The weak average earnings index may mean that the Bank of England will delay interest rate hike.

The Swiss franc traded mixed against the U.S. dollar. Swiss ZEW Economic Sentiment Index rose to 2.5 in August from 0.1 in July.

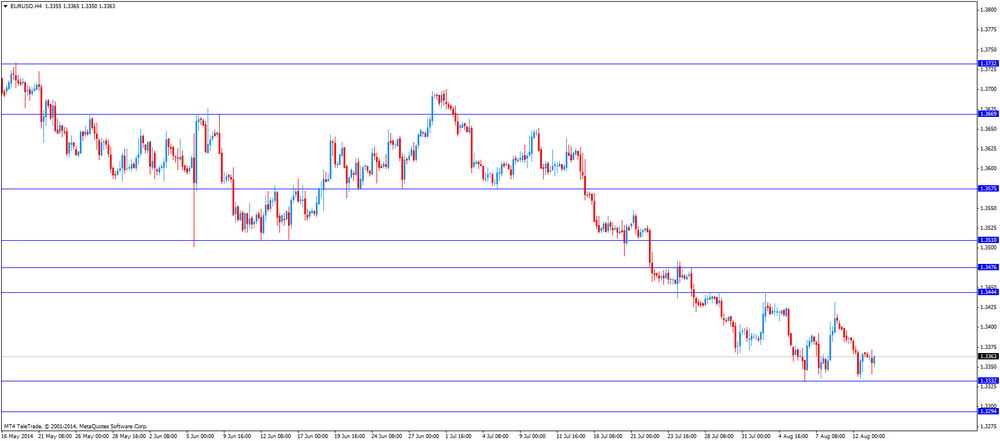

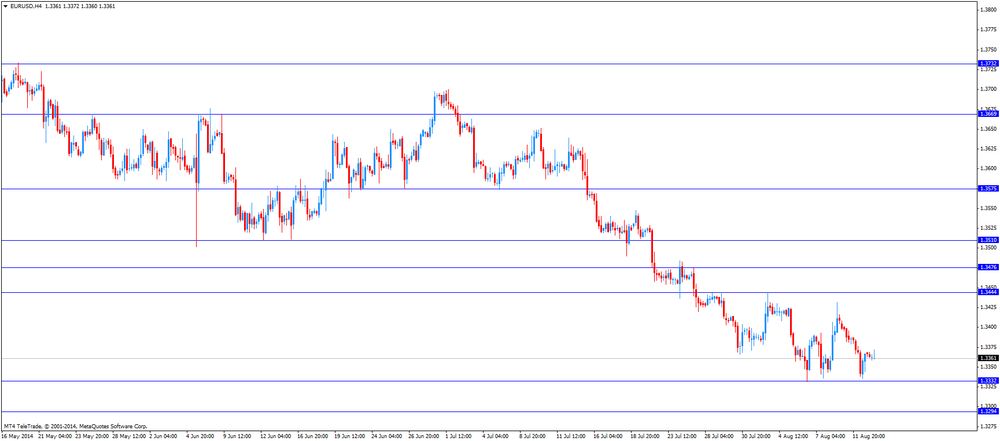

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair dropped to $1.6698

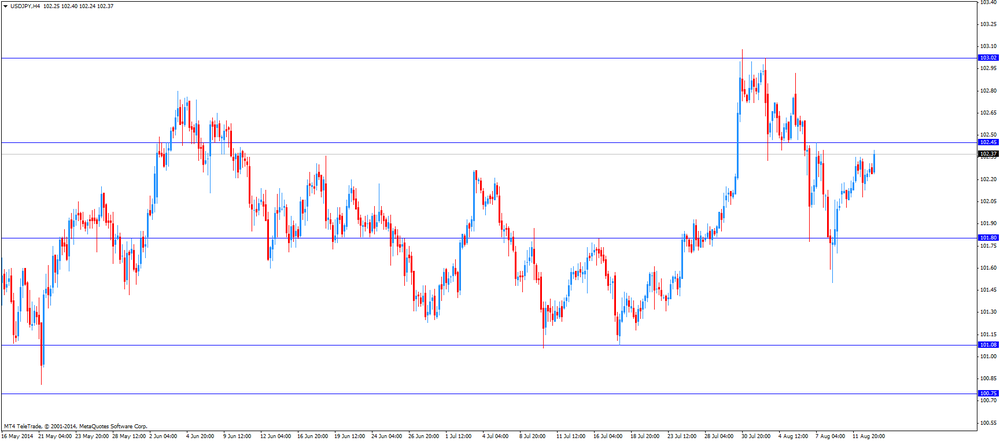

USD/JPY: the currency pair climbed to Y102.50

The most important news that are expected (GMT0):

12:30 U.S. Retail sales July +0.2% +0.2%

12:30 U.S. Retail sales excluding auto July +0.4% +0.4%

13:05 U.S. FOMC Member Dudley Speak

14:30 U.S. Crude Oil Inventories August -1.8

22:30 New Zealand Business NZ PMI July 53.3

22:45 New Zealand Retail Sales, q/q Quarter II +0.7% +1.0%

22:45 New Zealand Retail Sales ex Autos, q/q Quarter II +0.8%

23:50 Japan Core Machinery Orders June -19.5% +15.5%

23:50 Japan Core Machinery Orders, y/y June -14.3%

-

12:12

European stock markets mid session: stocks traded higher as E.ON and Swiss Life shares increased

Stock indices traded higher as E.ON and Swiss Life shares increased.

Eurozone's industrial production declined 0.3% in June, missing forecasts of a 0.5% rise, after a 1.1% fall in May.

The unemployment rate in the UK decreased to 6.4% in in the three months to June, in line with expectations, down from 6.5% a month earlier. That was the lowest level since late 2008.

The claimant count declined by 33,600 people in July, exceeding expectations for a fall of 29,700, after a decrease of 39,500 people in June.

But the average earnings index, including bonuses, fell by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. That was first negative average earnings index since March-May 2009.

The cut of forecast for wage growth in 2014 by the Bank of England weighed on markets. The BoE lowered its forecast to 1.25% from 2.5%.

Investors continue to monitor tensions between Russia and Ukraine. Ukraine plans to block a Russian humanitarian aid convoy.

E.ON shares jumped 4.6% after reporting the first-half net income beat analysts' forecast.

Swiss Life Holding AG shares rose after reporting the better-than-forecasted first-half profit. The company also said that it will buy real estate asset manager Corpus Sireo.

Current figures:

Name Price Change Change %

FTSE 100 6,663.48 +31.06 +0.47%

DAX 9,171.44 +101.97 +1.12%

CAC 40 4,195.79 +33.63 +0.81%

-

11:48

-

11:11

UK unemployment rate reached the lowest level since late 2008

The Office for National Statistics (ONS) in the UK released the labour market data on Wednesday. The unemployment rate declined to 6.4% in in the three months to June, in line with expectations, down from 6.5% a month earlier. That was the lowest level since late 2008.

The claimant count declined by 33,600 people in July, exceeding expectations for a fall of 29,700, after a decrease of 39,500 people in June. June's figure was revised up from a decrease of 36,300.

The ONS said that the number of unemployed fell by 132,000 to 2.08 million people.

But average weekly earnings remained weak. The average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. The last month's figure was revised up from a 0.3% gain. That was first negative average earnings index since March-May 2009.

The average earnings index, excluding bonuses, increased by 0.6% in the three months to June, after a 0.7% rise in the three months to May.

The weak average earnings index may mean that the Bank of England will delay interest rate hike.

-

10:45

Asian Stocks close: most stocks closed higher despite the weaker-than-expected data from China and Japan

Most Asian stock closed higher and extend gains for third day. Market participants were focused on corporate earnings.

China's industrial production increased 9.0% in July, missing forecasts of a 9.1% rise, after a 9.2% gain in June.

Fixed asset investment in China rose 17% in July, missing expectations for a 17.4% gain, after a 17.3% increase in June.

New loans in local currency in China were 385.2 billion yuan in July, down from June's 1,080 billion yuan and well below expectations of 780 billion yuan. That was the lowest level since December 2009.

Retail sales in China climbed 12.2% in July, missing expectations for a 12.5% increase, after 12.4% rise in June.

Investors speculate that the government in China will add stimulus measures to support the economy.

Japan's preliminary gross domestic product dropped 1.7% in the second quarter, in line with expectations, after a 1.5% gain in the first quarter. The first quarter figure was revised down from a 1.6% rise.

The decline of GDP was driven by the tax hike in April.

On a yearly basis, Japan's preliminary gross domestic product slid 6.8% in the second quarter, after a 6.1% rise in the first quarter. The first quarter figure was revised down from a 6.7% increase.

The Bank of Japan released minutes from the BoJ's meeting on July 14 and 15. The central bank said that the country's economic recovery remains on track. The BoJ added that it will continue with the quantitative and qualitative monetary easing, aiming to achieve the inflation target of 2%.

Investors continue to monitor tensions between Russia and Ukraine. Ukraine plans to block a Russian humanitarian aid convoy.

Indexes on the close:

Nikkei 225 15,213.63 +52.32 +0.35%

Hang Seng 24,890.34 +200.93 +0.81%

Shanghai Composite 2,222.88 +1.28 +0.06%

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3325-35, $1.3340, $1.3350, $1.3400-10

USD/JPY Y102.05, Y102.10, Y102.15, Y102.25-30, Y102.50

GBP/USD $1.6850, $1.6915

EUR/GBP stg0.7950

AUD/USD $0.9175, $0.9225, $0.9300, $0.9350, $0.9375

NZD/USD $0.8450

USD/CAD C$1.0970-75

-

10:00

Eurozone: Industrial production, (MoM), June -0.3% (forecast +0.5%)

-

10:00

Eurozone: Industrial Production (YoY), June 0.0%

-

09:57

Foreign exchange market. Asian session: the Australian dollar rose against the U.S. dollar after the strong Westpac Melbourne Institute Index of Consumer Sentiment for Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence August +1.9% +3.8%

01:30 Australia Wage Price Index, q/q Quarter II +0.7% +0.8% +0.6%

01:30 Australia Wage Price Index, y/y Quarter II +2.6% +2.6%

05:30 China Retail Sales y/y July +12.4% +12.5% +12.2%

05:30 China Fixed Asset Investment July +17.3% +17.4% +17.0%

05:30 China Industrial Production y/y July +9.2% +9.1% +9.0%

06:00 Germany CPI, m/m (Finally) July +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) July +0.8% +0.8% +0.8%

06:45 France CPI, m/m July 0.0% -0.2% -0.3%

06:45 France CPI, y/y July +0.5% +0.6%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June +0.7% +0.6%

08:30 United Kingdom Average Earnings, 3m/y June +0.3% -0.1% -0.2%

08:30 United Kingdom Claimant count July -36.3 -29.7 -33.6

08:30 United Kingdom Claimant Count Rate July 3.1% 3.0%

08:30 United Kingdom ILO Unemployment Rate June 6.5% 6.4% 6.4%

The U.S. dollar traded mixed to higher against the most major currencies. Investors continue to monitor geopolitical tensions in Iraq and Ukraine.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar rose against the U.S. dollar after the strong Westpac Melbourne Institute Index of Consumer Sentiment for Australia. The index climbed 3.8% in August, after a 1.9% gain in July.

Australia's Wage Price Index increased 0.6% in the second quarter, missing expectations for a 0.8% rise, after a 0.7% gain in the first quarter.

On a yearly basis, the Wage Price Index in Australia rose 2.6% in the second quarter, after a 2.6% increase in the first quarter.

The Japanese yen traded mixed against the U.S. dollar after the disappointing data from Japan. Japan's preliminary gross domestic product dropped 1.7% in the second quarter, in line with expectations, after a 1.5% gain in the first quarter. The first quarter figure was revised down from a 1.6% rise.

The decline of GDP was driven by the tax hike in April.

On a yearly basis, Japan's preliminary gross domestic product slid 6.8% in the second quarter, after a 6.1% rise in the first quarter. The first quarter figure was revised down from a 6.7% increase.

The Bank of Japan released minutes from the BoJ's meeting on July 14 and 15. The central bank said that the country's economic recovery remains on track. The BoJ added that it will continue with the quantitative and qualitative monetary easing, aiming to achieve the inflation target of 2%.

EUR/USD: the currency pair decreased to $1.3360

GBP/USD: the currency pair fell to $1.6799

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

09:00 Eurozone Industrial production, (MoM) June -1.1% +0.5%

09:00 Eurozone Industrial Production (YoY) June +0.5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 0.1

09:30 United Kingdom BOE Inflation Letter Quarter III

09:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Retail sales July +0.2% +0.2%

12:30 U.S. Retail sales excluding auto July +0.4% +0.4%

13:05 U.S. FOMC Member Dudley Speak

14:30 U.S. Crude Oil Inventories August -1.8

22:30 New Zealand Business NZ PMI July 53.3

22:45 New Zealand Retail Sales, q/q Quarter II +0.7% +1.0%

22:45 New Zealand Retail Sales ex Autos, q/q Quarter II +0.8%

23:50 Japan Core Machinery Orders June -19.5% +15.5%

23:50 Japan Core Machinery Orders, y/y June -14.3%

-

09:31

United Kingdom: Average earnings ex bonuses, 3 m/y, June +0.6%

-

09:31

United Kingdom: Average Earnings, 3m/y , June -0.2% (forecast -0.1%)

-

09:30

United Kingdom: Claimant count , July -33.6 (forecast -29.7)

-

09:30

United Kingdom: ILO Unemployment Rate, June 6.4% (forecast 6.4%)

-

09:30

United Kingdom: Claimant Count Rate, July 3.0%

-

08:39

DAX 9,134.07 +64.60 +0.71%, CAC 40 4,189.48 +27.32 +0.66%, EUROFIRST 300 1,325.21 +2.09 +0.16%, FTSE 100 6,634.36 +1.94 +0.03%

-

07:44

France: CPI, m/m, July -0.3% (forecast -0.2%)

-

07:44

France: CPI, y/y, July +0.6%

-

07:00

Germany: CPI, m/m, July +0.3% (forecast +0.3%)

-

07:00

Germany: CPI, y/y , July +0.8% (forecast +0.8%)

-

06:31

China: Fixed Asset Investment, July +17.0% (forecast +17.4%)

-

06:30

China: Retail Sales y/y, July +12.2% (forecast +12.5%)

-

06:30

China: Industrial Production y/y, July +9.0% (forecast +9.1%)

-

06:29

Options levels on wednesday, August 13, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3451 (4592)

$1.3408 (645)

$1.3385 (39)

Price at time of writing this review: $ 1.3363

Support levels (open interest**, contracts):

$1.3337 (1832)

$1.3293 (3263)

$1.3261 (4979)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 52591 contracts, with the maximum number of contracts with strike price $1,3400 (4592);

- Overall open interest on the PUT options with the expiration date September, 5 is 56311 contracts, with the maximum number of contracts with strike price $1,3100 (6096);

- The ratio of PUT/CALL was 1.07 versus 1.10 from the previous trading day according to data from August, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.7101 (1514)

$1.7002 (2458)

$1.6905 (1577)

Price at time of writing this review: $1.6801

Support levels (open interest**, contracts):

$1.6696 (2925)

$1.6598 (1767)

$1.6499 (1845)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 24572 contracts, with the maximum number of contracts with strike price $1,7000 (2458);

- Overall open interest on the PUT options with the expiration date September, 5 is 29346 contracts, with the maximum number of contracts with strike price $1,6800 (3993);

- The ratio of PUT/CALL was 1.19 versus 1.33 from the previous trading day according to data from August, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:26

Nikkei 225 15,156.5 -4.81 -0.03%, Hang Seng 24,682.52 -6.89 -0.03%, Shanghai Composite 2,223.63 +2.03 +0.09%

-

02:30

Australia: Wage Price Index, q/q, Quarter II +0.6% (forecast +0.8%)

-

02:30

Australia: Wage Price Index, y/y, Quarter II +2.6%

-

01:30

Australia: Westpac Consumer Confidence, August +3.8%

-

00:50

Japan: GDP, y/y, Quarter II +2.0%

-

00:50

Japan: GDP, q/q, Quarter II -1.7% (forecast -1.7%)

-