Notícias do Mercado

-

23:53

Japan Money Supply M2+CD (YoY) came in at 2.9% below forecasts (3.3%) in December

-

23:50

Japan Foreign Investment in Japan Stocks climbed from previous ¥-265.1B to ¥-199.1B in December 30

-

23:50

Japan Foreign Bond Investment: ¥566.8B (December 30) vs ¥-459.5B

-

23:38

EUR/JPY Price Analysis: Juggles around 140.00 after a vertical sell-off

- The formation of Double Top amid less buying interest led to a sheer fall in the Euro bulls.

- EUR/JPY is hovering around the critical support at 140.00 and an absence of follow-up buying indicates the Japanese Yen’s strength.

- A bear cross, represented by the 20 and 50-EMAs, adds to the downside filters.

The EUR/JPY pair is displaying back-and-forth moves in a narrow range of 140.00-140.40 in the early Asian session. The cross has turned sideways after a perpendicular downside move amid escalating chatters that the Bank of Japan (BoJ) is aiming to exit from its decade-long ultra-loose monetary policy.

After expanding the range of 10-year Japan Government Bonds (JGBs)’s yields TO +-50 basis points (bps), the BOJ is reviewing the side-effects of easy policy, which indicates that Japanese officials are looking to change their monetary policy approach in parallel with Western nations.

EUR/JPY witnessed a steep fall after failing to extend gains above the horizontal resistance placed from December 28 high around 142.94 amid the absence of sheer buying interest while refreshing a two-week high. This led to the formation of a Double Top chart pattern on an hourly scale, which indicates a bearish reversal.

The asset has dropped to near the demand zone around 140.00 and the unavailability of a follow-up recovery indicates weakness in the Euro bulls.

A bear cross, represented by the 20-and 50-period Exponential Moving Averages (EMAs) at around 142.00, adds to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped into the bearish range of 20.00-40.00, which indicates more weakness ahead.

EUR/JPY may display more weakness if it drops below the crucial support of 140.00, which will drag the asset towards December 20 low at 138.80 followed by January 3 low at 137.39.

On the flip side, a breakout above the Double Top chart pattern around 143.00 will drive the cross towards December 20 high at 145.84. A breach above the latter will expose the asset for more upside towards December 15 high at 146.71.

EUR/JPY hourly chart

-638091634203879056.png)

-

23:36

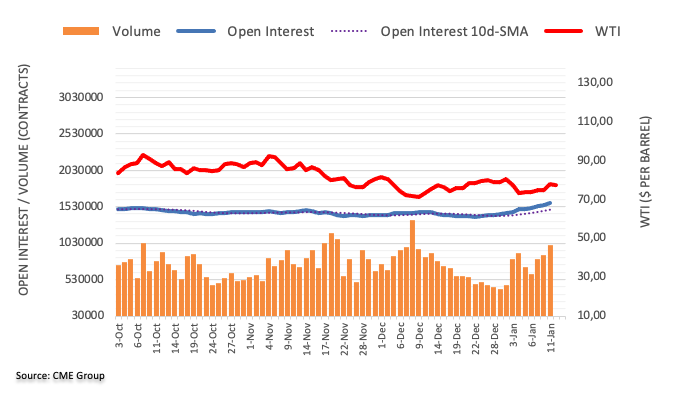

WTI Price Analysis: Bearish Doji probes Oil buyers around $78.50

- WTI struggles to extend four-day uptrend around weekly top.

- Gravestone Doji joins overbought RSI to probe energy bulls.

- Three-week-old horizontal support zone, 200-SMA challenge bears.

- Bulls could aim for $81.10 during further upside.

WTI crude oil seesaws around $78.50 as energy bulls take a breather after a four-day winning streak. That said, the black gold’s latest weakness, or inability to rise further, could be linked to a bearish candlestick formation on the four-hour chart, as well as the overbought RSI (14).

That said, the Gravestone Doji candlestick at the weekly top teases WTI sellers to revisit the $77.00-76.90 support zone comprising multiple lows marked since December 20. However, the 200-SMA level surrounding $76.75 could challenge the commodity’s further downside.

In a case where the quote remains bearish past $76.75, multiple hurdles around $75.00 could test the oil bears before highlighting an upward-sloping support line from December 09, close to $73.35 at the latest.

Alternatively, WTI crude oil prices need to cross the immediate top of $79.35 to defy the downside bias posed by the bearish candlestick.

However, a three-week-old horizontal region surrounding $80.95-81.10 could challenge the oil buyers afterward.

It’s worth noting, however, that the WTI crude oil’s run-up beyond $81.10 will need validation from the monthly high surrounding $81.55 to aim for the previous month’s peak of $83.30.

To sum up, WTI crude oil is likely to witness a pullback but the bears have a bumpy road ahead before retaking control.

WTI: Four-hour chart

Trend: Pullback expected

-

23:18

NZD/USD fades US inflation-inspired gains below 0.6400 ahead of China trade data

- NZD/USD retreats from one-month high even as market sentiment remains firmers.

- Softer US inflation fuelled calls for slower rate hikes even as Fed policymakers tried to defend restrictive monetary policy.

- Expectations of easy RBNZ move seem to weigh on Kiwi pair amid light calendar at home.

- China trade numbers for December, preliminary readings of US Michigan CSI for January eyed for fresh impulse.

NZD/USD prints mild losses around 0.6390-85 as it consolidates the US inflation-led gains during a sluggish Asian session on early Friday. In doing so, the Kiwi pair also portrays the traders’ anxiety ahead of China’s trade numbers for December and the first prints of the US Michigan Consumer Sentiment Index (CSI) for January.

It’s worth noting that the softer US Consumer Price Index (CPI) for December propelled expectations of easy rate hikes and drowned the US Dollar the previous day. However, the recent chatters that the Fed’s easy move could also push the Reserve Bank of New Zealand (RBNZ) to retreat from hawkish bias seemed to have weighed on the NZD/USD prices.

That said, the US CPI matched 6.5% YoY forecasts for December, versus 7.1% prior. More importantly, CPI ex Food & Energy also proved the market consensus of 5.7% YoY figure right, compared to 6.0% previous readings. It’s worth noting that the CPI MoM marked the first negative figure since June 2020 while marking a -0.1% figure for the stated month, versus 0.0% forecast and 0.1% prior.

After the CPI announcements, the Fed Fund Futures tied to the policy rate implied a nearly 100% chance of a 0.25% Fed rate hike in February while the odds favoring a 50 bps rate hike in the said month slumped to 8.0%.

It should be noted that Federal Reserve Bank of Philadelphia President Patrick Harker was the first to flag easy rate hikes after the US CPI and weighed on the US Dollar. On the same line, Richmond Federal Reserve President Thomas Barkin mentioned that it "makes sense" to steer more deliberately as the Fed works to bring inflation down. However, St. Louis Federal Reserve leader James Bullard also said that the most likely scenario is inflation remaining above 2%, so the policy rate will need to be higher for longer.

Amid these plays, Wall Street managed to close in the green while the US 10-year and two-year Treasury bond yields refreshed monthly lows. It should be noted that the S&P 500 Futures print mild gains while the US 10-year Treasury yields remain pressured around 3.44% at the latest.

Given the lack of major data/events at home, NZD/USD may remain sidelined ahead of the key statistics from China and the US. Should the scheduled figures manage to impress policy hawks in Beijing and Washington, the Kiwi pair could extend the latest weakness.

Technical analysis

Although a two-week-old ascending trend line restricts the immediate upside of the NZD/USD pair around 0.6440, sellers need validation from the 21-DMA level of 0.6333 to take entries.

-

23:10

EUR/GBP struggles to sustain above 0.8880 as focus shifts to UK economic data

- EUR/GBP is facing pressure in printing fresh highs above 0.8880 ahead of UK economic data.

- A further slowdown in UK economic activities might trim inflation projections.

- ECB Villeroy sees the central bank reaching to terminal rate by the summer.

The EUR/GBP pair is facing barriers in shifting its auction profile above the critical resistance of 0.8880 in the early Tokyo session. The cross is likely to remain on tenterhooks as investors have shifted their focus toward the release of the United Kingdom economic data, which is scheduled for Friday.

The cross is demonstrating signs of exhaustion in the upside trend, however, it would be early to call it a bearish reversal as will require approvals from more filters.

On the economic docket front, UK’s annual Industrial Production and Manufacturing Production (Nov) are expected to contract by 3.0% and 4.8% respectively. Apart from them, monthly Gross Domestic Product (GDP) is expected to contract by 0.3%. Overall weakness in UK production activities is likely to add to the already economic contraction, which will also impact inflation projections. A drop in inflation projections might delight the Bank of England (BOE) ahead.

Meanwhile, economists at MUFG Bank expect that the UK economy will be more stable this year. A note from the bank stated that we may have reached “peak pessimism” for the UK and the Pound. Much greater political stability this year than last is one factor here and we can very likely assume that PM Sunak will bring greater credibility after the turmoil of 2022. “Another consequence of having Rishi Sunak at No. 10 is the prospect of better relations with the EU and with that a possible deal to break the deadlock regarding the Northern Ireland Protocol.”

On the Eurozone front, European Central Bank (ECB)'s governing council member and French central bank governor Francois Villeroy de Galhau said on Wednesday, the central bank should aim to reach the terminal rate by the summer. He further added that the ECB needs to be pragmatic about the pace of rate hikes.

-

22:54

AUD/JPY Price Analysis: Licks its wounds above 89.85-75 demand zone

- AUD/JPY stabilizes around key support zone after falling the most in three weeks.

- 100-SMA, multiple levels marked in one week carve out 89.85-75 as important support.

- Clear break of 50-SMA, bearish MACD signals favor sellers.

- 50% Fibonacci retracement level guards immediate upside, bulls could regain confidence on breaking 91.00.

AUD/JPY pares the biggest daily loss in three weeks around 90.20 after failing to break the key 89.85-75 support zone the previous day. Even so, the cross-currency pair remains on the bear’s radar during early Friday in Asia.

That said, a downside break of the 50-SMA and the bearish MACD signals keep the quote as the bear’s favorite despite the latest consolidation.

However, a convergence of the 100-SMA and an eight-day-long horizontal support zone, around 89.85-75, appears a tough nut to crack for the AUD/JPY bears before they can extend the ruling.

Also acting as a downside filter is December 22, 2022, low near 89.30 and the 89.00 round figure.

Following that, the monthly low 87.41 and the previous month’s bottom surrounding 87.00 will be in the spotlight.

Alternatively, the 50% Fibonacci retracement level of the pair’s December 13-20 downturn, near 90.20, guards the immediate upside of the AUD/JPY before highlighting the 50-SMA hurdle of 90.35.

Even if the quote manages to stay beyond 90.35, the 61.8% Fibonacci retracement, also known as the “Golden ratio”, could challenge the AUD/JPY bulls around 90.95. It should be noted that the pair buyers may seek confirmation from the 91.00 threshold.

AUD/JPY: Four-hour chart

Trend: Further downside expected

-

22:50

IMF's Georgieva: BoJ pursuing appropriate review of monetary policy but should keep it accommodative

International Monetary Fund (IMF) Managing Director Kristalina Georgieva crossed wires, via Reuters, during early Friday morning in Asia while suggesting an accommodative policy stand for the Bank of Japan (BOJ). IMF leader also said, “The IMF is not expected to downgrade its forecast for 2.7% growth in 2023.”

Additional comments

Not expecting to downgrade October forecast for 2.7% global growth in 2023.

Inflation remains stubborn and central banks must continue to press for price stability.

Downside risk of spiking oil prices did not materialize, labor markets remain vibrant.

Expects global economy to 'bottom out' toward end of 2023, early 2024, barring unexpected surprises.

Important for China to 'stay the course' in reversing earlier zero-covid policy.

Biggest risk to 2023 outlook is possible spilllover from Russia's war in Ukraine, social unrest.

IMF's projection for 4.4% growth in china depends on transition away from zero-covid policy.

Any US Recession would be mild, China to become net contributor to global economy by mid-year.

FX implications

The news should help put a floor under the USD/JPY prices after the US inflation-led slump. That said, the Yen pair was last seen licking its wounds around 129.35, up 0.11% intraday by the press time.

-

22:42

USD/CHF Price Analysis: Drops below 0.9300, extends its losses beneath the 20-DMA

- USD/CHF seesawed in a 100-pip range but finished Thursday’s session with losses of 0.44%.

- The USD/CHF remains downward biased, but it needs to drop below 0.9200 to challenge the 0.9167 YTD low.

- It would turn bullish above the 20-day EMA nearby 0.9300.

After attempting to clear 0.9300, the USD/CHF resumed its downtrend due to the release of a softer inflation report in the United States (US), which spurred a repricing for a less aggressive Federal Reserve (Fed); consequently, the US Dollar weakened. Therefore, the USD/CHF erased its earlier gains and dived beneath 0.9280 as the Asian session began. At the time of writing, the USD/CHF is almost unchanged, around 0.9270.

USD/CHF Price Analysis: Technical outlook

Following the release of the US CPI, the USD/CHF seesawed in the 0.9265/0.9360 range before stabilizing around 0.9270, 30 pips below the 20-day Exponential Moving Average (EMA) at 0.9294. Oscillators like the Relative Strength Index (RSI) pointing downwards and the Rate of Change (RoC) almost flat suggests sellers are gathering momentum. However, to further extend its downtrend, USD/CHF bears need to decisively break below 0.9265 to aim towards the 0.9200 mark and wall of support.

On the other hand, if USD/CHF buyers reclaim the 20-day EMA, that will immediately expose 0.9300, followed by the current week’s high of 0.9360, on its way north to 0.9400.

USD/CHF Key Technical Levels

-

22:41

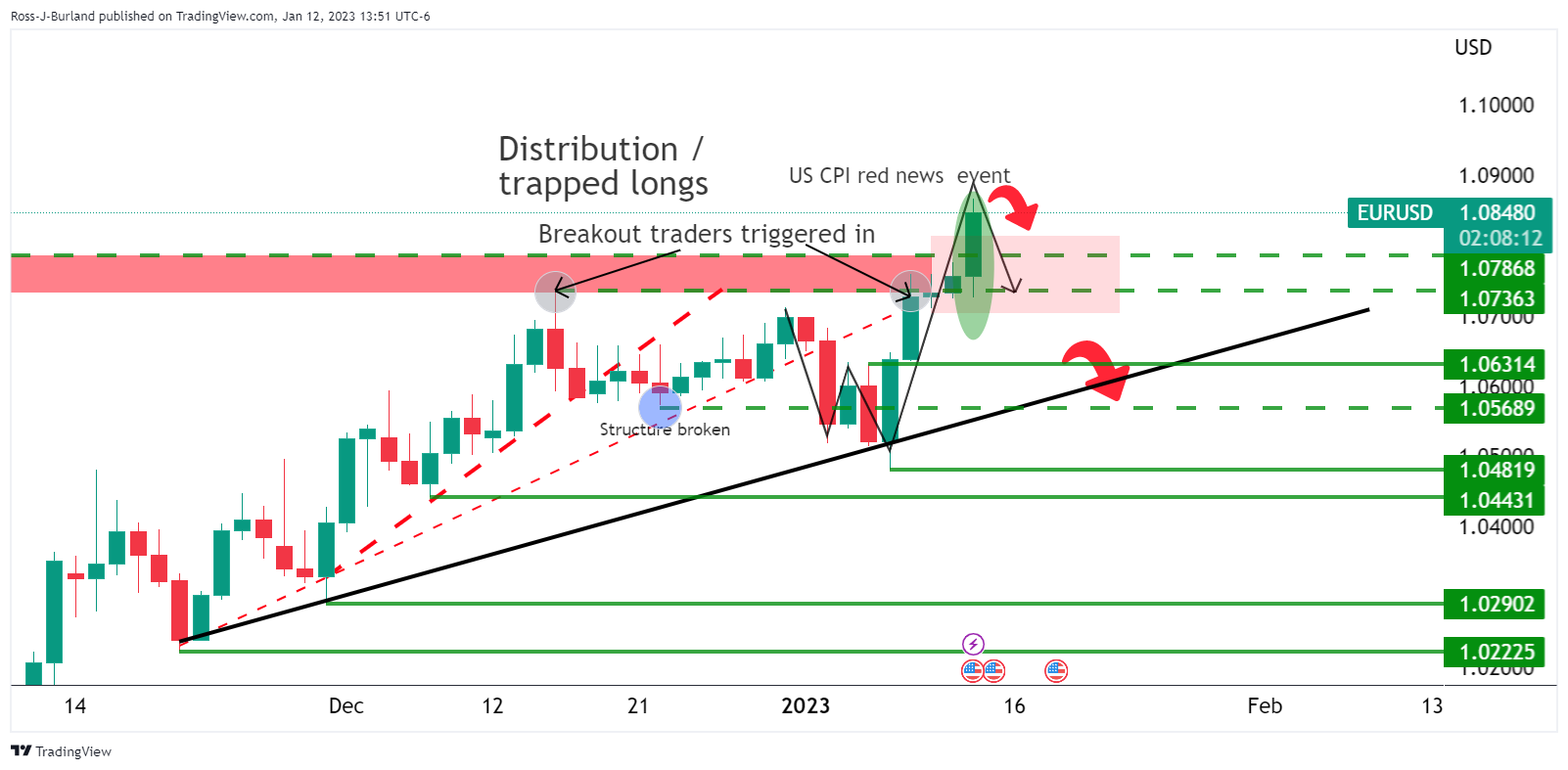

EUR/USD Price Analysis: Marches towards 50% Fibo retracement around 1.0950

- EUR/USD is looking to recapture a 50% Fibo retracement at 1.0946 amid an upbeat market mood.

- The 10-period EMA is acting as a major cushion for the Euro bulls.

- Bullish momentum seems triggered as the RSI (14) has shifted into the 60.00-80.00 range.

The EUR/USD pair has turned sideways after failing to extend its upside journey above the immediate resistance of 1.0860 in the early Tokyo session. The major currency pair is likely to display a rangebound profile as a bumper rally is generally followed by a lackluster performance.

Investors’ risk appetite has improved dramatically after the United States inflation was trimmed in line with the consensus. This led to the end of the third consecutive bullish trading session of the S&P500 as it is highly likely that the Federal Reserve (Fed) will not continue higher interest rates for longer than expected. The US Dollar refreshed a seven-month low at 102.86.

EUR/USD is marching toward the 50% Fibonacci retracement (placed from the 8 January 2021 high at 1.2349 to the 30 September 2022 low at 0.9536) at 1.0946 on a weekly chart. The 10-period Exponential Moving Average (EMA) at 1.0544 has acted as a major support for the Euro bulls. Also, advancing 20-EMA at 1.0400 indicates that the upside bias is solid.

The Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00 after a long period of time, which indicates that bullish momentum is active now.

For further upside, EUR/USD needs to surpass Thursday’s high at 1.0869, which will drive the major currency pair towards April 21 high at 1.0936 followed by the psychological resistance at 1.1000.

On the flip side, a breakdown of the January 10 low at 1.0712 will drag the asset toward January 4 high at 1.0635. A slippage below the latter will expose the asset for more downside toward January 3 low at 1.0519.

EUR/USD weekly chart

-638091600582309715.png)

-

22:30

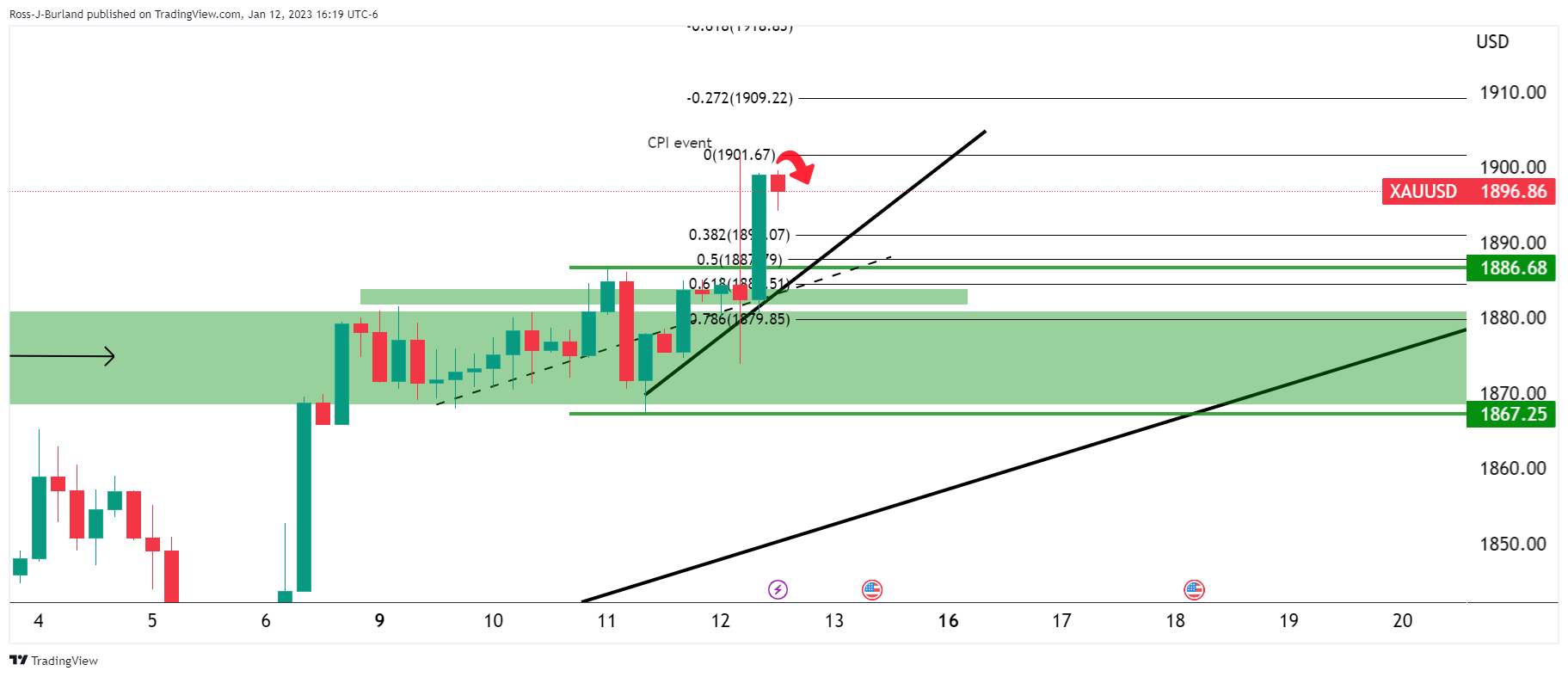

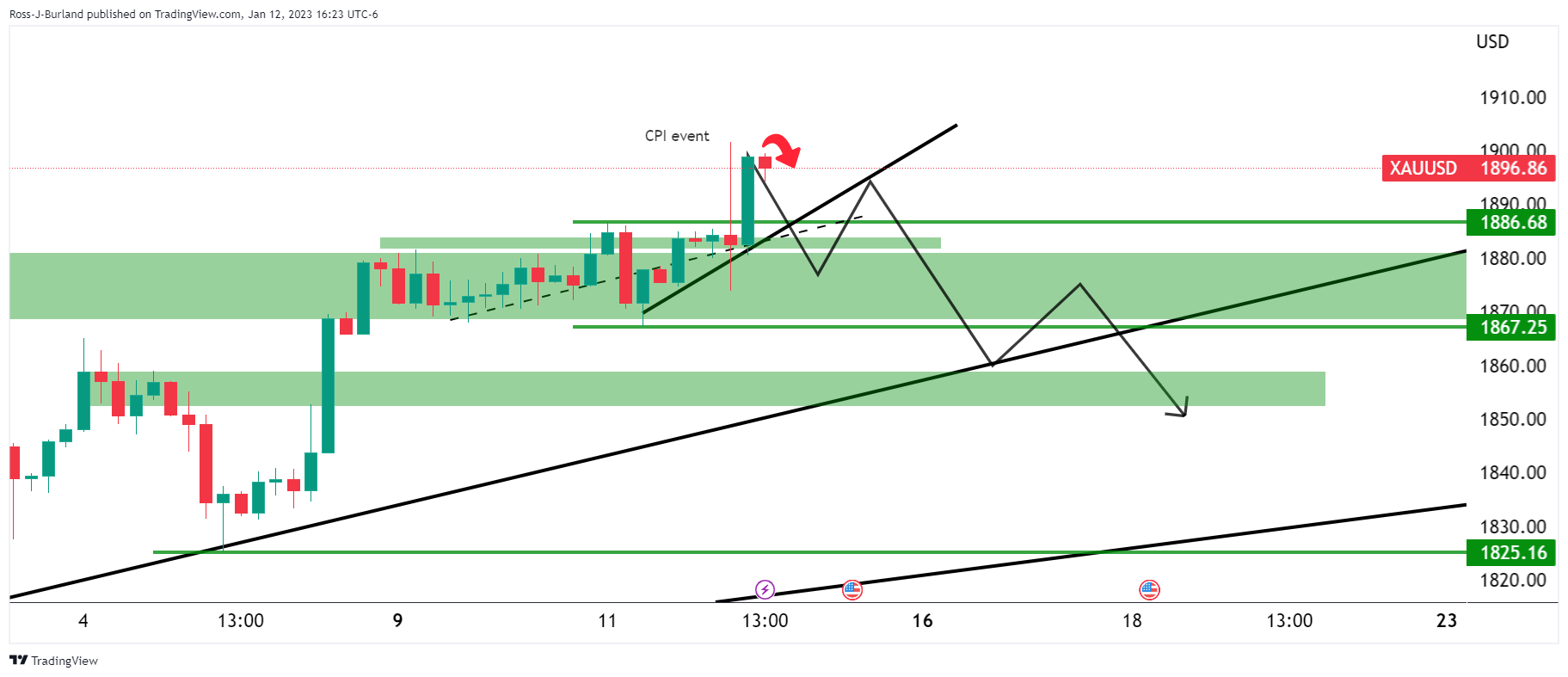

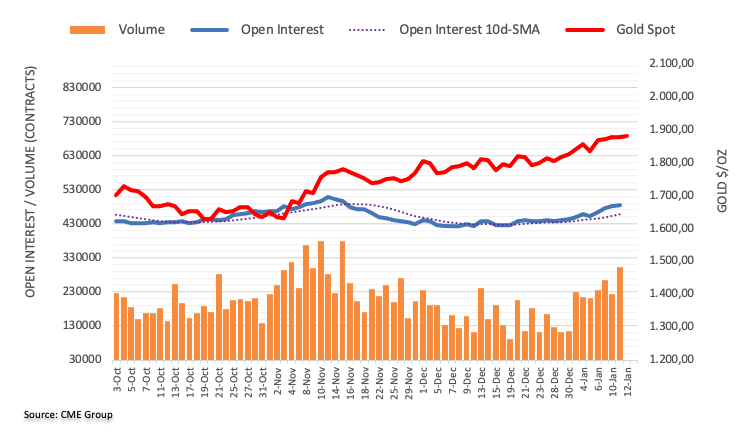

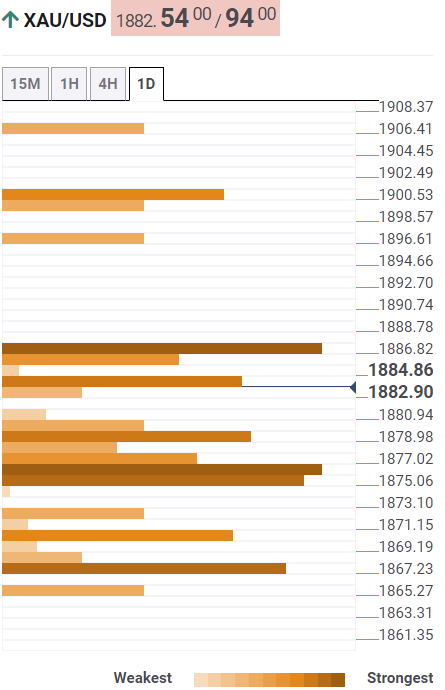

Gold Price Forecast: XAU/USD bulls move into a trap after Consumer Price Index rally?

- Gold price moves into fresh bull cycle highs on the Consumer Price Index.

- Federal Reserve speakers have come out with mixed comments.

- Some analysts argue that the market is underestimating the risks of a higher for longer Federal Reserve interest rate path.

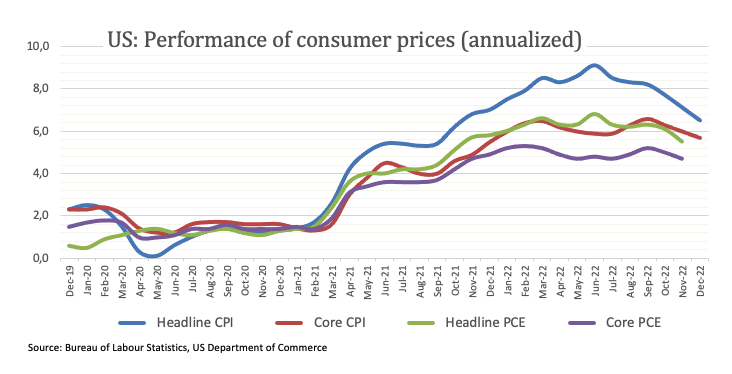

Gold price rallied on Thursday following the Consumer Price Index, CPI, data that came in as expected on th2e whole. The US Dollar fell heavily and is licking its wounds into Friday's early Asian trade down at weekly lows. At the time of writing, Gold price is trading at $1,897.00 and higher by some 1.15%. Gold price rallied from a low of $,1873.91 to a high of $1,901.67.

Gold price rallies on United States Consumer Price Index

The year-over-year Consumer Price Index, CPI, print landed at 6.5% or 0.6 of a percentage point cooler than the November number. The one exception was a positive surprise. On a monthly basis, the headline number actually decreased by a nominal 0.1% instead of remaining unchanged, as analysts expected. The data has raised the bar for a higher pace of rate hikes by the Federal Reserve (Fed) and this was bolstered by less aggressive Federal Reserve speakers such as Philly-Fed’s Patrick Harker who said he favours hikes of 25bp going forward. A weaker US Dollar as a result of a less hawkish Fed saw investor appetite for the precious metal rise.

Federal Reserve speaker comments after Consumer Price Index

However, St. Louis Federal Reserve leader James Bullard, following today's Consumer Price Index, stated that the most likely scenario is inflation remaining above 2%, so the policy rate will need to be higher for longer. Richmond Federal Reserve President Thomas Barkin said the last three months' inflation prints have been a "step in the right direction," but cautioned that while the average has dropped the median has stayed high.

Moreover, analysts at Brown Brothers Harriman argued that ''core Personal Consumption Expenditures, PCE, has largely been in a 4.5-5.5% range since November 2021 and we think the Fed needs to see further improvement before even contemplating any sort of pivot.''

''WIRP suggests a 25 bp hike February 1 is fully priced in, with nearly 30% odds of a larger 50 bp move. Another 25 bp hike March 22 is fully priced in, while one last 25 bp hike in the second quarter is nearly 45% priced in that would take the Fed Funds rate ceiling up to 5.25%. However, the swaps market continues to price in an easing cycle by year-end and we just don’t see that happening.''

Gold price technical analysis

The immediate bearish outlook for Gold price as illustrated in the prior day's analysis was invalidated leading into the Consumer Price Index event:

Instead, we got a burst through the head of the head and shoulders as follows:

However, what is important to note is that Gold price breakout traders are triggered as follows:

Gold price is now treading water above the summer 2022 highs of near $1,880. This will have added to net longs in the market and therefore, a rebalancing of shorts would be expected to emerge over the coming days. This leaves scope for a significant correction, trapping longs on the wrong side of the market:

On the 4-hour chart, Gold price is already decelerating on the bid and a 50% mean reversion could be on the cards for the coming sessions to test back below $1,890. This will pressure the Gold price micro-supporting trendline. A break of the trendline will open significant downside risks towards a test of $1,870 and the more dominant trendline:

-

22:21

USD/CAD steadies around multi-day low under 1.3400 amid US inflation-led blow to USD, firmer Oil price

- USD/CAD holds lower ground after dropping to seven-week low.

- Downbeat US CPI fuelled talks of Fed’s policy pivot and weighed on the US Dollar.

- WTI crude oil cheered softer USD, hopes of more energy demand.

- Risk catalysts, China trade balance and US Michigan CSI are important to watch for fresh impulse.

USD/CAD bears are taking a breather at the lowest levels in almost two months around 1.3365, following the biggest daily slump in a week, as traders seek more clues to extend the US inflation-led south-run. That said, the Loonie pair dropped heavily after the US Consumer Price Index (CPI) fuelled expectations of a softer Fed rate hike in December and drowned the US Dollar, which in turn allowed the WTI crude oil to print a four-day uptrend and refresh weekly top.

On Thursday, US Consumer Price Index (CPI) matched 6.5% YoY forecasts for December, versus 7.1% prior. More importantly, CPI ex Food & Energy also proved the market consensus of 5.7% YoY figure right, compared to 6.0% previous readings. It’s worth noting that the CPI MoM marked the first negative figure since June 2020 while marking a -0.1% figure for the stated month, versus 0.0% forecast and 0.1% prior.

Following the inflation readings, Futures tied to the Fed policy rate implied a nearly 100% chance of a 0.25% Fed rate hike in February while the odds favoring a 50 bps rate hike in the said month slumped to 8.0%.

The same should have allowed Federal Reserve Bank of Philadelphia President Patrick Harker to mention that it was time for future Fed rate hikes to shift to 25 basis points increments. Further, St. Louis Federal Reserve leader James Bullard also said that the most likely scenario is inflation remaining above 2%, so the policy rate will need to be higher for longer. Recently, Richmond Federal Reserve President Thomas Barkin mentioned that it "makes sense" to steer more deliberately as the Fed works to bring inflation down.

As a result, the US Dollar Index (DXY) dropped the most in a week to refresh the seven-week low.

On the other hand, WTI crude oil renewed its weekly high around $79.35 before ending Thursday near $78.50. Even so, the black gold managed to print a four-day winning streak as broad-based US Dollar weakness joined the recent optimism surrounding China that suggests higher energy demand from the world’s biggest commodity user. It should be noted that Canada’s reliance on crude oil exports as the major earner make the Canadian Dollar (CAD) susceptible to Oil prices.

Against this backdrop, Wall Street managed to close in the green while the US 10-year and two-year Treasury bond yields refreshed monthly lows.

Looking forward, China trade numbers for December can offer immediate directions to the USD/CAD pair ahead of the preliminary readings of the US Michigan Consumer Sentiment Index (CSI) for January. Also important will be the news surrounding China and Fed moves.

Technical analysis

Sustained trading below the 100-day EMA, around 1.3430 by the press time, joins bearish MACD signals and downbeat RSI line to keep USD/CAD bears hopeful of visiting November 2022 low near 1.3230.

-

22:07

AUD/USD aims to test 0.7000 as US Inflation softens

- AUD/USD is aiming to kiss the psychological resistance of 0.7000 amid a decline in US CPI data.

- Lower gasoline and used car prices have softened the United States price index.

- Rising Australian inflation might compel the RBA to sound hawkish in its February monetary policy meeting.

The AUD/USD pair is struggling to extend its upside journey above the critical resistance of 0.6980 in the Asian session. The Aussie asset is expected to surpass the 0.6980 hurdle amid the risk appetite theme and may recapture the psychological resistance of 0.7000 ahead.

S&P500 ended on a positive note and recorded three consecutive bullish trading sessions on hopes of further deceleration in the pace of interest rate hikes by the Federal Reserve (Fed) after softening of United States Consumer Price Index (CPI) data. The 10-year US Treasury yields weighed down heavily to near 3.4% as US inflation trimmed in line with expectations.

The US Dollar Index (DXY) renewed its seven-month low at 102.86 as lower US inflation claims that the Fed is in the right direction and effectively fighting against stubborn inflation. Thanks to the lower gasoline prices and prices of used cars, which led to a meaningful fall in the price index. It is highly likely that the Fed will now consider further hiking will smaller rates, which might also provide a cushion to the slowdown in economic activities.

On the Aussie front, rising inflation is still causing worry for the Reserve Bank of Australia (RBA). Monthly inflation (Nov) climbed to 7.3% and retail demand has remained strong, which might force RBA Governor Philip Lowe to sound hawkish in its upcoming monetary policy scheduled in February.

Meanwhile, the recovery in Chinese economic growth after the reopening of the economy is providing strength to the Australian Dollar. It is worth noting that Australia is a leading trading partner of China and a recovery in Chinese economic prospects will also support the Australian Dollar.

-

21:42

GBP/USD Price Analysis: Bounces around the 20/200-DMAs, back above 1.2200

- GBP/USD reclaimed two daily moving averages, the confluence of the 20 and 200-day EMAs.

- A daily close of the GBP/USD above the 200-day EMA could open the door for further gains.

- Otherwise, the GBP/USD would be exposed to selling pressure, which might tumble to the 50-day EMA.

The GBP/USD soars above 1.2200, snapping two-consecutive days of losses, and gains 0.48%, as Wall Street finished Thursday’s session in the green. Therefore, the GBP/USD is trading at 1.2215, above its opening price, after hitting a daily low of 1.2084.

GBP/USD Price Analysis: Technical outlook

Thursday’s session witnessed the GBP/USD bouncing off the confluence of the 20 and 200-day Exponential Moving Averages (EMA) around 1.2095/1.2109, late in the New York session. Although a break of the 200-day EMA is supposed to shift the bias of an asset, at least three daily closes would cement the previously mentioned. Also, as long as the GBP/USD stays below last month’s high of 1.2443, the major would be exposed to some selling pressure.

Oscillators like the Relative Strength Index (RSI) remain in bullish territory, poised for further upside, while the Rate of Change (RoC) confirms volatility levels remain depressed.

If the GBP/USD would resume its uptrend, firstly needs to clear the 1.2300 figure. Once done, the next test would be the 1.2400. As an alternate scenario, if the GBP/USD dives below the 20-day EMA at 1.2094, that will put in play the 50-day EMA at 1.1987, but firstly, sellers will need to reclaim 1.2000.

GBP/USD Key Technical Levels

-

21:07

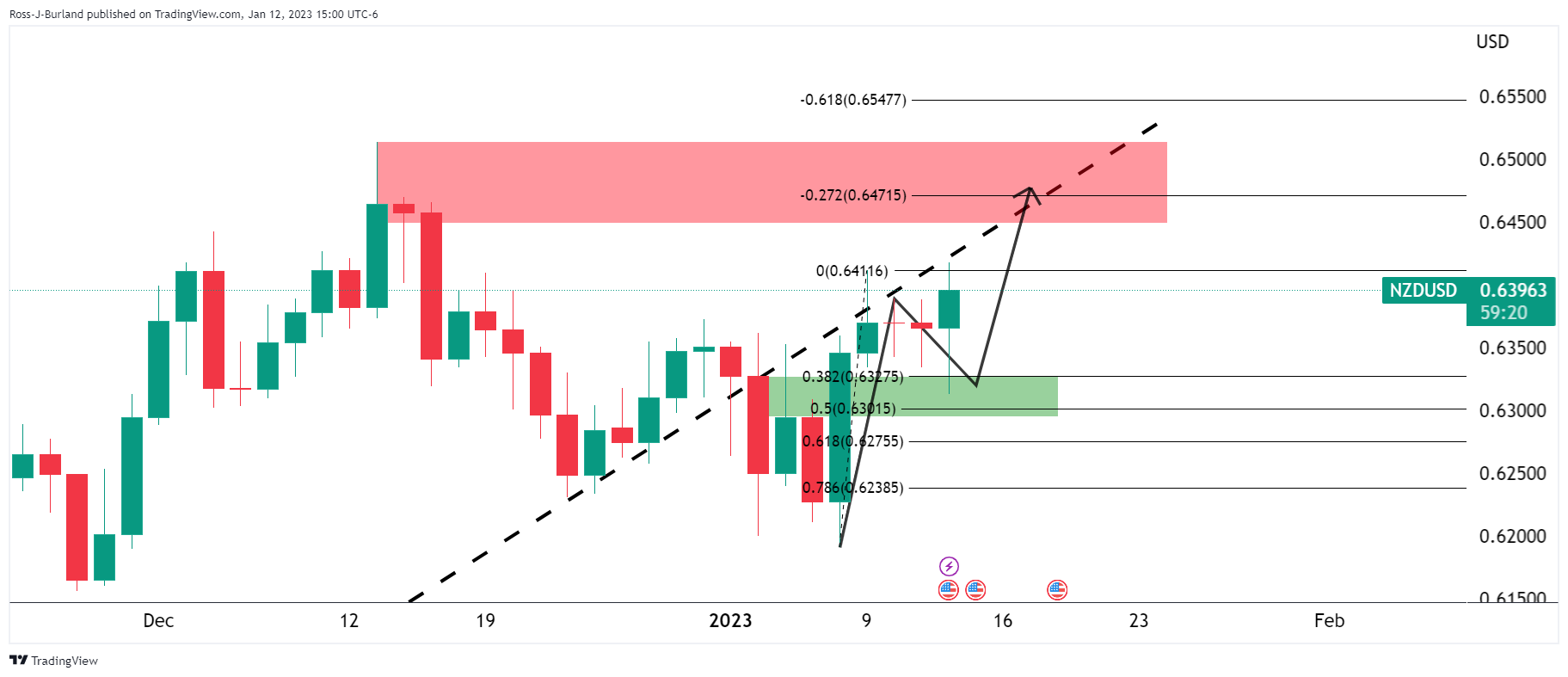

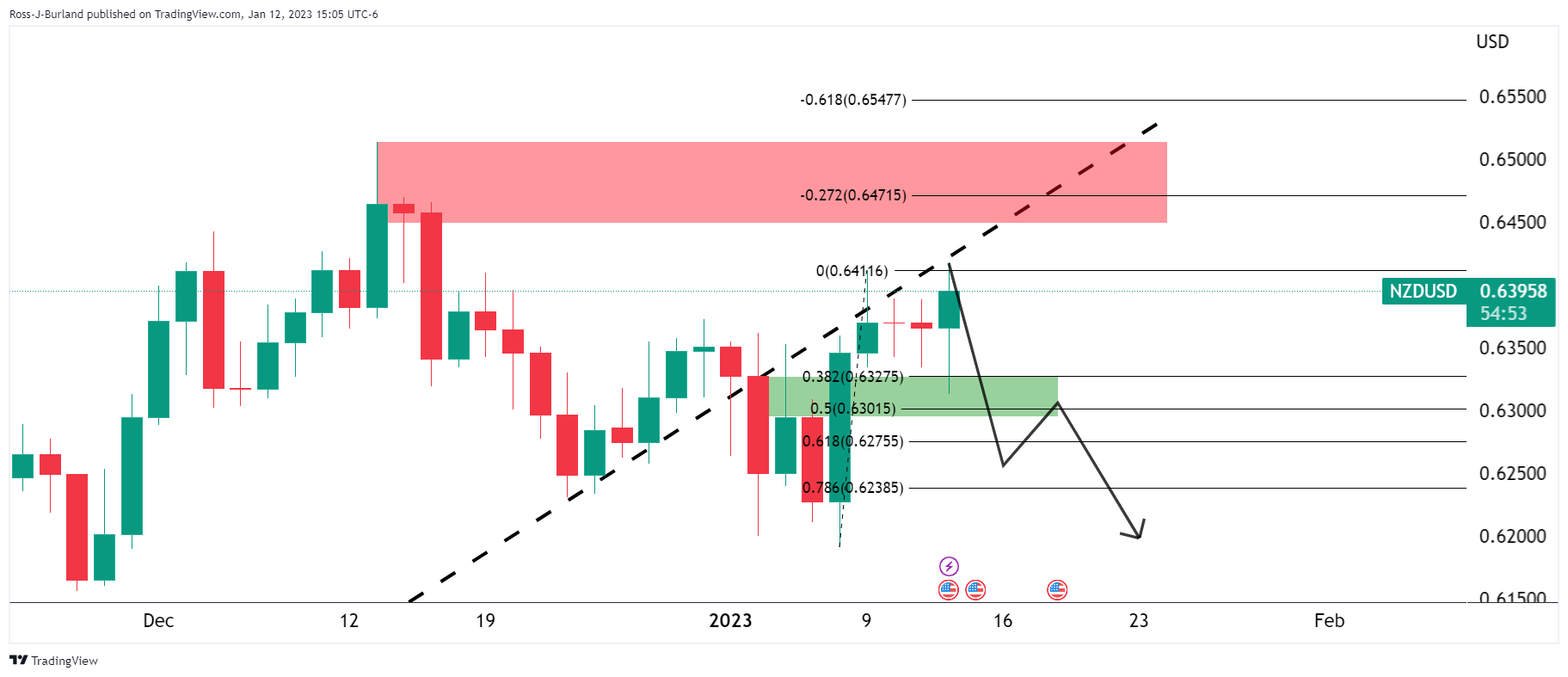

NZD/USD bulls take on 0.64 territories after US CPI event

- NZD/USD bulls move in on the countrterndline and 0.64 the figiure.

- US CPI sends the US Dollar lower, supporting risk appetite and NZD.

NZD/USD is ending the day some 0.5% higher after rallying from a low of 0.6304 to a high of 0.6417 on the day where sellers came in and faded the move back to test below 0.64 the figure. The US Dollar fell on the back of the Consumer Price Index data that came in as expected on the whole.

The data have helped cement expectations for a 25bp Fed hike next month, and the resulting drop in US bond yields has weighed on the greenback. The year-over-year CPI print landed at 6.5% or 0.6 of a percentage point cooler than the November number. The one exception was a positive surprise. On a monthly basis, the headline number actually decreased by a nominal 0.1% instead of remaining unchanged, as analysts expected.

''While this latest Kiwi rally is logical in that context, NZ policy expectations are fading too as markets ask can the Reserve Bank of New Zealand deliver another 75bp in February if the Fed only delivers 25bp, which may create NZD headwinds,'' analysts at ANZ Bank explained. ''It’s all part and parcel of what could be a messy year of non-synchronised global cycle turning points.''

NZD/USD technical analysis

The price pulled in breakout traders on the move below last month;'s lows that are now being squeezed and moving out of their shorts. This leaves scope for a continuation to the upside with the trendline and horizontal resistances eyed. However, the bears could be encouraged to move in data discount and 0.6190 guards against a bearish breakout.

Nearer term, the price is supported by a 38.2% ratio and the neckline of the W-formation and the bulls eye the prior highs near 0.6470 and 0.6500 targets:

However, should the countertrend line resist and the CPI data prove to be only a temporary distraction from what some analysts argue a far more hawkish reality at the Fed, then a break of 0.6300 could be a significant bearish development for the weeks ahead:

Analysts at Brown Brothers Harriman argued that ''core PCE has largely been in a 4.5-5.5% range since November 2021 and we think the Fed needs to see further improvement before even contemplating any sort of pivot.''

''WIRP suggests a 25 bp hike February 1 is fully priced in, with nearly 30% odds of a larger 50 bp move. Another 25 bp hike March 22 is fully priced in, while one last 25 bp hike in Q2 is nearly 45% priced in that would take the Fed Funds rate ceiling up to 5.25%. However, the swaps market continues to price in an easing cycle by year-end and we just don’t see that happening.''

-

21:00

South Korea Export Price Growth (YoY) below expectations (5.6%) in December: Actual (3.1%)

-

21:00

South Korea Import Price Growth (YoY) registered at 9.1% above expectations (8.9%) in December

-

20:27

Argentina Consumer Price Index (MoM) climbed from previous 4.9% to 5.3% in December

-

20:25

United States 30-Year Bond Auction up to 3.585% from previous 3.513%

-

20:25

United States 4-Week Bill Auction increased to 4.37% from previous 4.1%

-

20:03

EUR/USD prints fresh bull cycle highs, on course for 5-day rally

- EUR/USD bulls take on fresh bull cycle highs but bears are lurking.

- US CPI weakened the outlook for the US Dollar but a cohort of Fed speakers remain hawkish.

- Breakout traders could be feeling the heat of a sizeable correction in the coming sessions.

EUR/USD has popped to a fresh bull high following the day's Consumer Price Index data that inspired a breakout in the US Dollar to the downside. At the time of writing, EUR/USD is up by some 0.8% at the time of writing. The Single Currency has rallied from a low of 1.0726 to a high of 1.0867 so far.

Consumer Price Index data came in as expected on the whole, besides the one exception on a monthly basis in the headline number. The year-over-year CPI print landed at 6.5% or 0.6 of a percentage point cooler than the November number. The one exception was a positive surprise. On a monthly basis, the headline number actually decreased by a nominal 0.1% instead of remaining unchanged, as analysts expected.

However, St. Louis Federal Reserve leader James Bullard, following today's Consumer Price Index, stated that the most likely scenario is inflation remaining above 2%, so the policy rate will need to be higher for longer. Richmond Federal Reserve President Thomas Barkin said the last three months' inflation prints have been a "step in the right direction," but cautioned that while the average has dropped the median has stayed high.

EUR/USD correction on the cards?

While the move in the US Dollar has been strong, there are prospects of a correction and that spells danger for the in-the-money-EUR/USD longs. After all, today's data does not mean monetary policy can stop tightening just yet. Following the release of the latest inflation data, Philadelphia Fed President Patrick Harker said the central bank [Federal Reserve] should lift rates at 0.25% increments. The next Federal Reserve Rate announcement occurs on February 1. ''Several Federal Reserve officials have indicated they would like to see rates slightly above 5.0% which indicates a further three 25bp lifts,'' analysts at ANZ Bank noted.

Analysts at TD Securities said that they continue to think that the market is too optimistic on the pace of the decline in inflation, although they argued that ''an on-consensus print does not change the bigger picture narrative of a USD struggle. We are at a different point of the Fed and inflation cycle that makes USD upside a fade.''

On the other side of the spectrum, analysts at Brown Brothers Harriman argued that ''core PCE has largely been in a 4.5-5.5% range since November 2021 and we think the Fed needs to see further improvement before even contemplating any sort of pivot.''

''WIRP suggests a 25 bp hike February 1 is fully priced in, with nearly 30% odds of a larger 50 bp move. Another 25 bp hike March 22 is fully priced in, while one last 25 bp hike in Q2 is nearly 45% priced in that would take the Fed Funds rate ceiling up to 5.25%. However, the swaps market continues to price in an easing cycle by year-end and we just don’t see that happening.''

EUR/USD technical analysis

Breakout traders are triggered in and while there is scope for the upside, a correction could be on the cards that will tap into the in-the-money-longs and potentially ignite a capitulation of the bulls.

This puts the downside thesis into play as follows:

The W-formation, while overextended, is still within the parameters of being bearish and that puts the 1.0720s in focus for the meanwhile. A break there opens risk to the trendline support further ahead.

-

19:49

Forex Today: US Dollar collapses amid Fed seen hiking rates by 25 bps from now on

What you need to take care of on Friday, January 13:

Financial markets spent the first half of the day extending their previous consolidative phase, finally exploding with the release of the United States Consumer Price Index (CPI). The US CPI rose at an annual pace of 6.5% as expected in December, while core price pressures were up by 5.7%, in line with the market forecast. On a monthly basis, inflation contracted 0.1%, while the core reading met expectations, up 0.3%.

Signs of easing price pressures in the world’s largest economy coupled with comments from US Federal Reserve officials.

The first one was US Federal Reserve Bank of Philadelphia President Patrick Harker, saying that “the worst of the inflation spike is likely past now,” adding that the time of super-sized rate hikes has passed, and it’s time to switch to 25 basis points (bps) increments. The Greenback sunk with his comments as Wall Street soared, although volatility dominated the American session.

Then, St. Louis Federal Reserve leader James Bullard spoke and noted that the most likely scenario is inflation remaining above 2%, so the policy rate will need to be higher for longer. Finally, Richmond Federal Reserve President Thomas Barkin said that it "makes sense" to steer more deliberately as the Fed works to bring inflation down.

Market ignored other positive news, but were there to support the optimism. During Asian trading hours, the Bank of Japan (BoJ) announced it would investigate the consequences of its ultra-easy policy. Market players read it as a potential shift in the central banks’ monetary policy. Additionally, China re-started imports from Australian coal, after banning them in the early stages of the COVID-19 pandemic. Later in the day, market talks suggested the United Kingdom and the Euro Zone will start talks to end the Brexit clash and reach a final deal.

The EUR/USD pair trades around 1.0840, while GBP/USD stands at 1.2210, not far below fresh multi-month highs. Commodity-linked currencies also rallied, with AUD/USD now changing hands at 0.6970 and the USD/CAD pair down to 1.3350. Finally, USD/JPY hovers around 129.30, after bottoming at a fresh multi-month low of 128.86.

Spot gold flirted with the $1,900 level, ending the day at around $1,896 a troy ounce. Crude oil prices were also up, with WTI settling at $78.70 a barrel.

Crypto crimes hit eye-popping numbers, $20 billion worth of cryptocurrencies lost to hacks and exploits

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:29

GBPJPY Price Analysis: Rejected around 161.00, nosedives towards 158.00

- GBP/JPY collapsed at the confluence of two resistance levels, around 161.00.

- GBP/JPY Price Analysis Remains downward biased, and it could test 155.00 once it reclaims the YTD low of 155.35.

The GBP/JPY dropped to fresh weekly lows of 157.72 after a cooler-than-expected US inflation report, which spurred safe-haven flows in the FX space amidst an upbeat market sentiment. From a technical perspective, the GBP/JPY stalled around the 20-day Exponential Moving Average (EMA) at 160.75 and dropped some 300 pips. The GBP/JPY is trading at around 158.00

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY remains downward biased. After registering four days of successive days trading with gains, a fundamental news catalyst and solid resistance at the 20-day EMA around 160.75 triggered a fall. Oscillators like the Relative Strength Index (RSI) at bearish territory and continuing to aim lower support a possible test of YTD lows of 155.36. Also, the Rate of Change (RoC) shows that volatility has not picked up yet, which could refrain traders from opening new shorts positions in the GBP/JPY pair.

However, if the GBP/JPY continued to fall, its next support would be 157.00. A breach of the latter will expose the January 4 daily low of 156.49, followed by the YTD low of 155.35, and then the September 22 low of 152.54.

On the flip side, the GBP/JPY first resistance would be the January 4 daily high of 160.16, followed by the 20-day EMA at 160.76, and then the current week’s high of 161.21.

GBP/JPY Key Technical Levels

-

19:00

United States Monthly Budget Statement came in at $-85B below forecasts ($-70B) in December

-

18:35

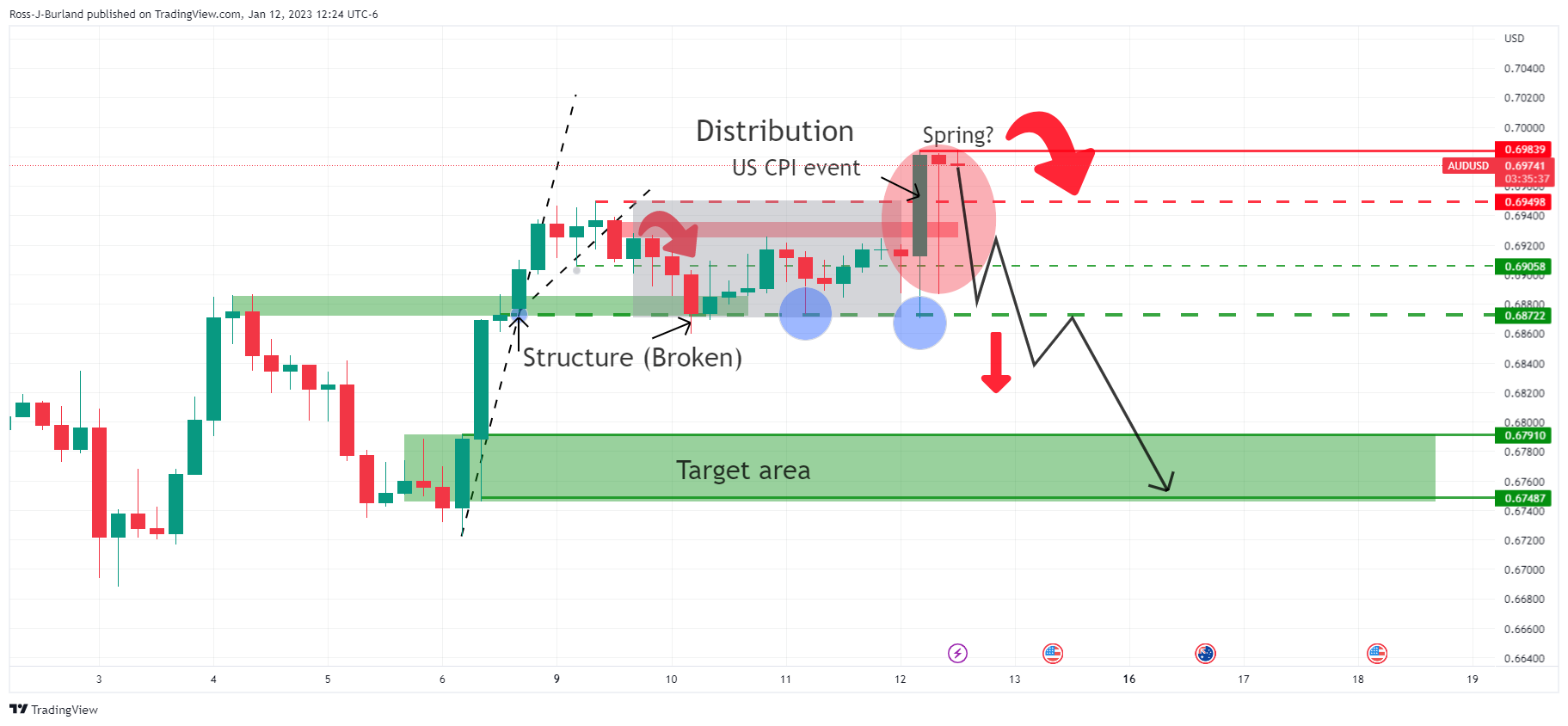

AUD/USD Price Analysis: Distribution and spring set, or bullish continuation?

- AUD/USD breakout traders target 0.70 the figure and above.

- Failures to hold in 0.7000 could lead to the capitulation of the bulls.

As per the prior analysis, AUD/USD Price Analysis: Distribution could be playing out into US CPI critical event, a thesis for the downside was illustrated leading up to the US Consumer Price Index event for a three-day set-up that had the downside-eyed should the bears crack the critical 0.68070 support structure and DXY move through key 103.00 and on to test the 103.50 equal highs.

AUD/USD prior analysis

It was stated that a move higher in the greenback would cement the bearish themes for a run towards 0.6750:

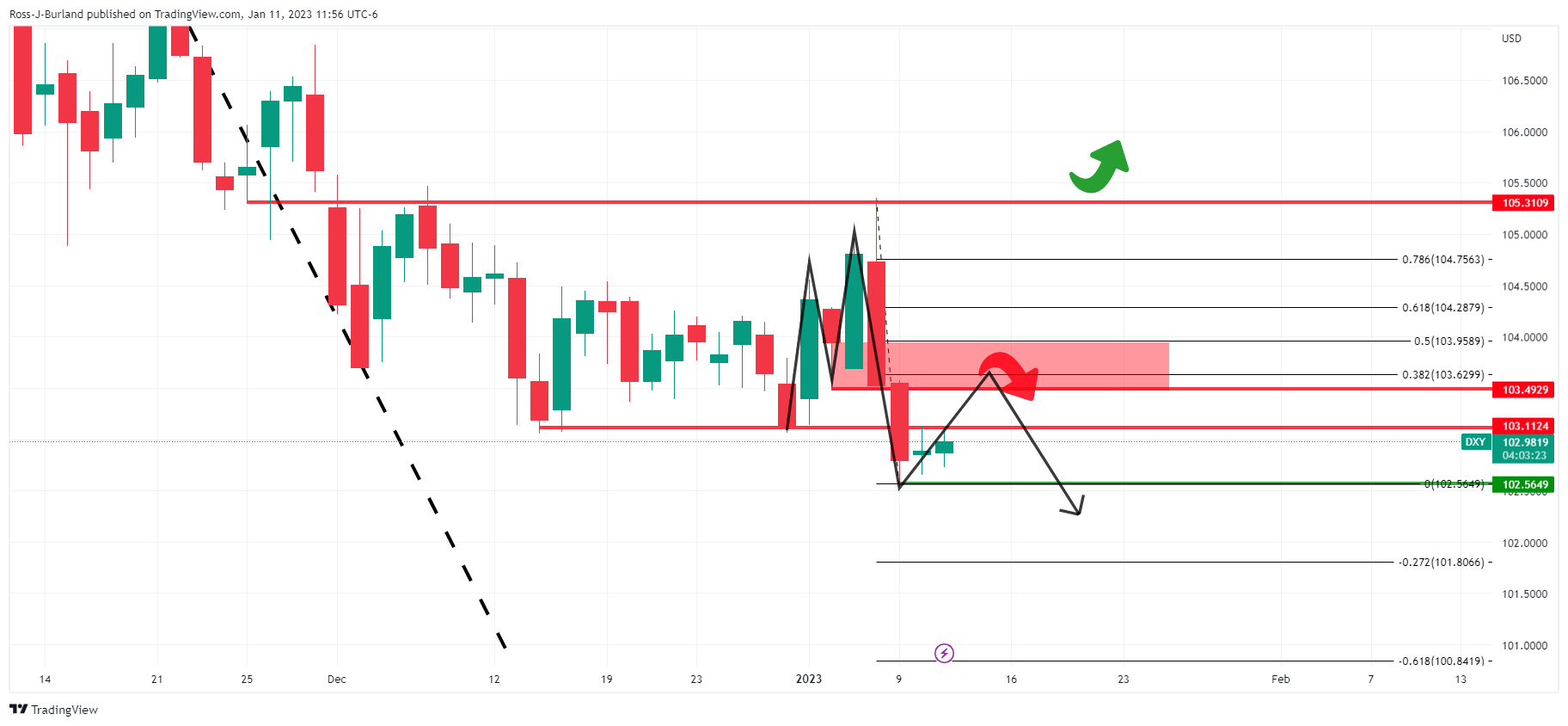

However, it was also warned that while the US Dollar's decline had been decelerating after moving to the backside of the bearish trendline, while below 105.31, the dominant bias was bearish:

AUD/USD and DXY update

The question now is whether or not what we are seeing is a bearish continuation in the greenback and bullish in AUD, or, from a technical perspective and applying the Wycoff / smart money concepts onto the charts, if this move today is the 'spring' and part of a wider schematic.

Looking at the AUD/USD schematic, while there is scope for a test of 0.7000, a valid case for the downside can also be made given the net length in the market vs.shorts. A pairing back of in-the-money-longs could be envisaged resulting in a retest to the trendline support as follows:

(AUD/USD H4 charts)

If this were the case, then the CPI volatility could be argued as being the spring of the distribution schematic:

The trapped higher time frame breakout traders would be squeezed, forced to cut positions and adding to a fast capitulation of the bulls and leading to a downside breakout below 0.6870 key structure.

Such a move could even see a continuation towards last week's lows:

-

17:59

Bank of England's Mann: Underlying UK inflation dynamic looks pretty robust

Bank of England policymaker Catherine Mann said on Thursday that the underlying UK inflation dynamic looks pretty robust.

More to come...

-

17:57

WTI climbs but stalls at $79.00 amidst a soft US Dollar after US inflation data

- WTI got bolstered by a soft US Dollar, though it struggled to break above solid resistance.

- The deceleration in US Consumer Price Index (CPI) and expectations for a Fed pivot can underpin WTI prices.

- WTI Price Analysis: Faces a wall of resistance around $79.00.

Western Texas Intermediate (WTI), the US crude oil benchmark, advanced 0.98% on Thursday and extended its gains to two consecutive days, though it is clashing around technical indicators after releasing crucial US inflation data. At the time of writing, WTI is trading at around $78.40 per barrel.

The US Consumer Price Index (CPI) for December dipped 0.1%, as reported by the Department of Labor (DoL), suggesting that the US Federal Reserve (Fed) could slow down the pace of rate increases, a headwind for the greenback. Therefore, oil prices increased, as a weaker US Dollar would benefit crude buyers.

Another factor that bolstered WTI is China’s reopening after authorities removed Covid-19 zero-tolerance policies.

Sources cited by Reuters commented that a soft landing in the US and maybe worldwide, combined with China’s economic rebound, could make for a much better year than feared by most street analysts. Hence, oil demand could rise, and WTI prices would remain elevated unless the output is increased.

Oil traders are also bracing for an additional curb on Russian oil supply, as sanctions over its invasion of Ukraine are pending to begin. The EU ban on importing petroleum products from Russia will start on February 5, and according to the US EIA office, “it could be more disruptive than the EU ban on importing crude oil from Russia.”

WTI Price Analysis: Technical outlook

From a daily chart perspective, WTI is neutral to downward biased, albeit extending its gains to almost $4 in the last couple of days. WTI’s inability to crack the confluence of a two-month-old downslope trendline and the 50-day Exponential Moving Average (EMA) around $79.00 could exacerbate a retracement, at least to the 20-day EMA at $76.79. However, if WTI breaks above the former, it can rally toward $80.00. On the flip side, once it clears $78.00, that could pave the way toward the $76.00 figure.

-

17:54

Fed's Barkin: Cautions that while the average CPI has dropped the median has stayed high

Richmond Federal Reserve President Thomas Barkin said on Thursday, that it "makes sense" to steer more deliberately as the Fed works to bring inflation down.

His comments are coming through following today's Consumer Price Index data that came in as expected on the whole, besides the one exception on a monthly basis in the headline number.

''The last three months' inflation prints have been a "step in the right direction," he said. But he cautions that while the average has dropped the median has stayed high.

US Dollar update

The US Dollar is falling to the lowest levels for several months and is printing a fresh low for the session following the CPI event.

-

17:12

Fed's Bullard: Policy rate will need to be higher for longer

St. Louis Federal Reserve leader James Bullard, following today's Consumer Price Index data that came in as expected on the whole, besides the one exception on a monthly basis in the headline number, stated that the most likely scenario is inflation remaining above 2%, so the policy rate will need to be higher for longer.

Key comments

Looks like we had above-trend rate of economic growth in Q4 2022.

US households still remain flush.

That should support consumption spending this year.

Better global prospects this year than just a few weeks ago.

Global growth prospects have brightened in last few weeks.

Hard to see how unemployment is going to go up; labor market is strong.

Inflation remains extremely high even after today's CPI data.

It is still well above fed's target but it is moderating.

Fed's policy has kept inflation expectations under control.

I expect inflation to move down as we go forward; our policy has been the right one.

Fed needs to avoid repeat of the 1970s, must maintain rates at high enough levels to make sure inflation moves down.

Something north of 5% lowest level fed could use to credibly restrict inflation.

My preference is that if we are shooting for north of 5%, should get there as soon as possible.

Tactics aren't that don't matter that much in macro terms though.

Possibly too much optimism inflation will come easily back to 2%.

Core cpi has moderated but not as much as headline figure.

Dallas mean measure gives indication of how hard it will be to get inflation down to 2% in a reasonable time frame.

Today's cpi data was encouraging though that we are heading in right direction.

Most likely scenario is inflation number will remain above 2% and so policy rate will need to be higher for longer

We are really moving into an era of higher norminal interest rates for quite a while moving forward to get inflation back to target.

Measures of financial stress remain at relatively low levels.

Recession risks has receded some over the last 3 months.

Prospects for a soft landing have improved.

We will have to stay higher for longer to avoid repeat of 1970s.

I like frontloading policy.

I don't see purpose in dragging things out.

Direct correlations between money growth and inflation not strong enough to rely on.

However is a good, indicative sign.US Dollar update

The US Dollar has dropped on the back of the CPI data. The year-over-year CPI print landed at 6.5% or 0.6 of a percentage point cooler than the November number. The one exception was a positive surprise. On a monthly basis, the headline number actually decreased by a nominal 0.1% instead of remaining unchanged, as analysts expected.

-

16:53

Fed: Even if FOMC delivers a downshift, it will continue tightening past the February meeting – Wells Fargo

The inflation numbers released on Thursday in the US increased expectations that the Federal Reserve will shift from 50 basis points rate hikes to 25 bps hikes. Analysts at Wells Fargo warn that despite the fact that inflation has clearly slowed from its pace earlier in 2022, they doubt the FOMC is ready to declare mission accomplished.

A trend, but not mission accomplished

“Headline inflation has fallen by 2.6 percentage points since June, and the annualized run rate over the past three months is just 1.8%, demonstrating further slowing is still to come in the year-ago change. Additional progress should be made in the coming months as goods inflation remains soft and the lagged effect of slower housing cost growth eventually flows through to the CPI data. As a result, the days of 75 bps rate hikes from the FOMC appear to be well in the rearview mirror.”

“While Fed officials have acknowledged the recent progress and should welcome this report, like us, they remain skeptical that inflation will easily settle back down to 2% past the correction in goods and housing. The increasingly compelling evidence of slowing inflation brought by today's report ups the chance that the FOMC will hike the fed funds rate by just 25 bps at its next meeting, but with the trend in inflation still above target, we expect that even if the FOMC delivers a downshift in pace, it will continue tightening past its next meeting.”

-

16:45

US: December CPI should give the Fed confidence to downshift to a 25bp hike – ABN Amro

Data released on Thursday in the US confirmed a slowdown in inflation, with the annual CPI rate falling to 6.5%, the lowest level since October 2021. Bill Diviney, Sr. Economist at ABN – AMRO points out that falling inflation paves way for a 25bp Federal Reserve interest rate hike, instead of a 50 bps hike.

Key quotes:

“The fall was driven largely by further pass-through from lower oil prices to petrol prices, but continued falls in used car prices, and weak medical services inflation, were also a drag. Shelter inflation, and other components of services inflation in contrast remained elevated, as expected.”

“Inflation continues to trend lower in line with our base case, and this should give the Fed the confidence to further downshift to a 25bp hike when the FOMC next meets in early February. In the near term, we expect a renewed drag on headline inflation from falling utility gas prices – reflecting the mild winter and falling wholesale gas prices.”

“For core inflation, while annual inflation should continue to decline, we may see some near term pickup in m/m price growth, as a significant drag in recent months has come from falling wholesale prices for used cars, which for now looks to have stabilized.”

-

16:40

USD/CAD dives below the confluence of the 20-DMA and 1.3400 after soft US CPI

- USD/CAD drops towards fresh seven-week lows around 1.3340s after US CPI data.

- US CPI was lower than expected, while Initial Jobless Claims continued to show a robust labor market.

- The US Dollar continued to weaken across the board, dropping to 6.5-month lows.

USD/CAD erases some of its losses spurred by a cooler-than-expected US inflation report that dragged the major towards its current weekly low of 1.3347, though it has recovered some ground at the time of typing. Hence, the USD/CAD is trading at 1.3397, below its opening price by 0.34%.

USD/CAD extended its downtrend to four consecutive days

US equities wobbled following the release of US inflation data. The US Bureau of Labor Statistics (BLS) revealed the Consumer Price Index (CPI) for December ticked lower at -0.1% MoM, below estimates of 0%, while annually based dropped to 6.5% from November’s 7.1%. The so-called core CPI, which excludes volatile items like food and energy, was aligned with estimates of 0.3% MoM, while year-over-year data dipped to 5.7% YoY, below the 6% foreseen.

After the headline crossed newswires, the US Dollar (USD) tumbled across the board due to growing speculations that the Federal Reserve further slowdown the pace of interest rate hikes. Therefore, the USD/CAD dived toward its daily/weekly low at 1.3350

At the same time, the Bureau of Labor Statistics (BLS) revealed that Initial Jobless Claims for the last week came softer at 205K, less than the 215K petitions expected by analysts, showing the labor market resilience.

Elsewhere, Philadelphia’s Fed President Patrick Harker said that 25 bps would be appropriate going forward after the release of the US CPI report. Harker commented that the time for super-size rate hikes has passed and expects a few more rate increases this year.

USD/CAD Key Technical Levels

-

16:38

USD/MXN Price Analysis: Mexican Peso hits fresh multi-year highs, starts looking at 18.50

- US Dollar extends slide versus Emerging Market currencies.

- Mexican Peso is at the highest level since February 2020.

- USD/MXN to remain under pressure below 18.90, despite oversold readings.

The USD/MXN is falling for the seventh time out of the last eight trading days and trades at the lowest level since February 2020, under 19.00. The pair bottomed at 18.81, before rebounding modestly.

A weaker US Dollar pushed USD/MXN further lower. Technicals also played a role in sending it to the downside. The pair was able to consolidate under the strong support (now resistance) area of 19.00/05.

Technical indicators, like the RSI below 30, are indicating oversold conditions. Despite that, the signs point to further losses. The next support area is seen at 18.75 and then comes the 2020 low near 18.50. A rebound, while contained under 19.15, should not change the current bearish bias for USD/MXN.

USD/MXN daily chart

-638091376749819412.png)

-

16:10

Silver Price Analysis: XAG/USD rejected again from above $24.00

- US Dollar tumbles and then soars after US CPI numbers.

- Volatile session across financial markets, US stocks back in positive ground.

- XAG/USD trims daily gains after being unable to hold above $24.00

Silver prices soared after the release of US inflation data but then pulled back amid a recovery of the US Dollar. XAG/USD peaked at $24.17, the highest level in a week and then pulled back all the way down to the $23.60 zone. It is hovering around $23.75, positive for the day but off highs.

The US Consumer Price Index fell in December 0.1% and the annual rate slowed to 6.5% from 7.1%, reaching the lowest level since October 2021. The number came in line with expectations and contribute to anchor expectations for shift in Federal Reserve rate hike to 25 basis points increments.

US yields tumbled after the report boosting Gold prices that helped also Silver. Following Wall Street’s opening bell market sentiment deteriorated and yields rebounded, triggering a retreat in XAU/USD and XAG/USD.

Silver prices again were rejected from above $24.00. A consolidation above that area could open the doors to further gains. The next resistance is at $24.20 followed by $24.55 (Jan 3 high).

Initial support emerges at the 20-day Simple Moving Average (SMA), near $23.60; below an uptrend line emerges around $23.35. A break below $23.30 could trigger a bearish acceleration, exposing $23.00.

Silver 4-hour chart

-638091365728549139.png)

-

16:00

AUD to be well supported this year on the back of Australian economy resilience – Rabobank

Australia will steer clear of recession in the foreseeable future, in the view of economists at Rabobank. Thus, the Aussie is expected to be resilient this year.

GBP/AUD to drop under 1.70 over coming months

“We expect the AUD to be well supported this year on the back of a relatively good growth outlook and have been targeted a move by GBP/AUD below 1.70 on a 12-month view. However, Australian/Chinese relations are likely to remain a dicey subject.”

“While the Australian economy is expected to slow overall this year, recessionary risks appear low. This should increase the resilience of the AUD and provide insulation against headwinds implied by forecasts of a slowdown in global growth.”

“Weaker global growth is traditionally a bearish factor for the AUD given its links with commodity prices. That said, we view the AUD as less likely to be swayed by speculative flows given that Australian no longer had a current account deficit and given that the narrowing of interest rates spreads between Australian and US interest rates.”

-

15:32

EUR/CHF could extend its advance back to levels between 1.02 and 1.04 – MUFG

EUR/CHF climbs back above parity. Economists at MUFG Bank believe that the pair could climb as high as 1.04.

SNB is becoming more tolerant of a weaker CHF

“The SNB has confirmed that it has been intervening to support the Franc recently to prevent a sharper move lower from reinforcing upside inflation risks. Yesterday’s move higher could then encourage speculation that the SNB is becoming less concerned by upside inflation risks and more tolerant of a weaker CHF.”

“The favourable growth developments should encourage the ECB to keep tightening policy at a faster pace at upcoming policy meetings when we expect the policy rate to reach 3.00% by the end of Q1. It leaves room for EUR/CHF to extend its advance back to levels recorded in the 1H of last year when it was trading between 1.0200 and 1.0400.”

-

15:30

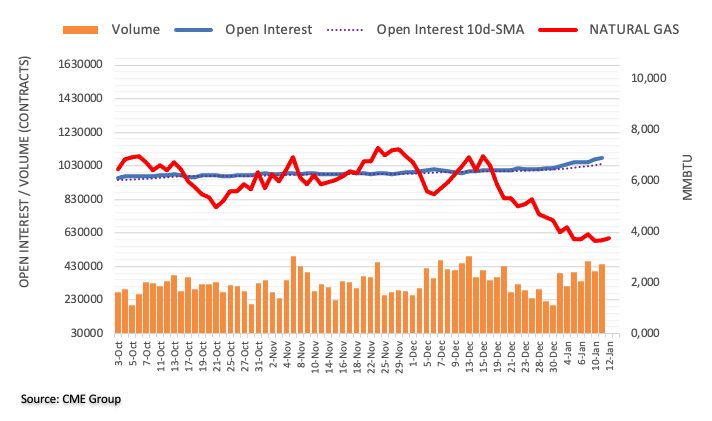

United States EIA Natural Gas Storage Change registered at 11B above expectations (-13B) in January 6

-

15:06

GBP/USD turns negative from four-week highs as Dollar erases US CPI losses

- US Dollar tumbles after CPI data, trims losses after Wall Street opening bell.

- Inflation confirms slowdown in the US, Fed’s Harker expects 25 bps hikes now.

- GBP/USD reveres sharply, drops below 1.2100.

On a volatile session for FX, the US Dollar has reversed sharply during the last hour and turned positive across the board. The GBP/USD peaked after the release of US inflation data at 1.2244, the highest level in four weeks and as of writing, it is trading below 1.2100, at the lowest since Monday.

Dollar tumbles then soars

Inflation data triggered a decline of the US Dollar that then recovered as equity prices in Wall Street dropped following the opening bell. The US Consumer Price Index fell in December 0.1% and the annual rate slowed to 6.5% from 7.1%, reaching the lowest level since October 2021.

Following the inflation numbers, Patrick Harker, President of the Federal Reserve Bank of Philadelphia, said it was time for future Fed rate hikes to shift to 25 basis points increments. His comments added fuel to the decline of the greenback as US yields sank.

Equity prices in Wall Street turned negative after the opening. The deterioration in market sentiment was accompanied by a rebound in US yields. The US Dollar reversed its course and rose sharply, erasing all US CPI-losses.

The GBP/USD is struggling to hold above 1.2100 as markets continue to digest CPI numbers and the Dollar keeps looking for a direction. The Pound also weakened during the last hour versus the Euro, with EUR/GBP surging to 0.8890, the highest level since late September.

Technical levels

-

15:05

S&P 500 Index: Break above 4020 to open up 4218 – SocGen

S&P 500 has carved out a higher trough at 3765 as compared to the one in October at 3490. A break past 4020 could open up additional gains towards the 4128 mark, economists at Société Générale report.

First support aligns at 3875

“Multi month trend line at 4020 is first potential hurdle. Overcoming this can lead to an extended rebound towards 4120 and perhaps even towards the bearish gap last August near 4218.”

“Upper end of recent consolidation at 3875 is first support.”

-

15:03

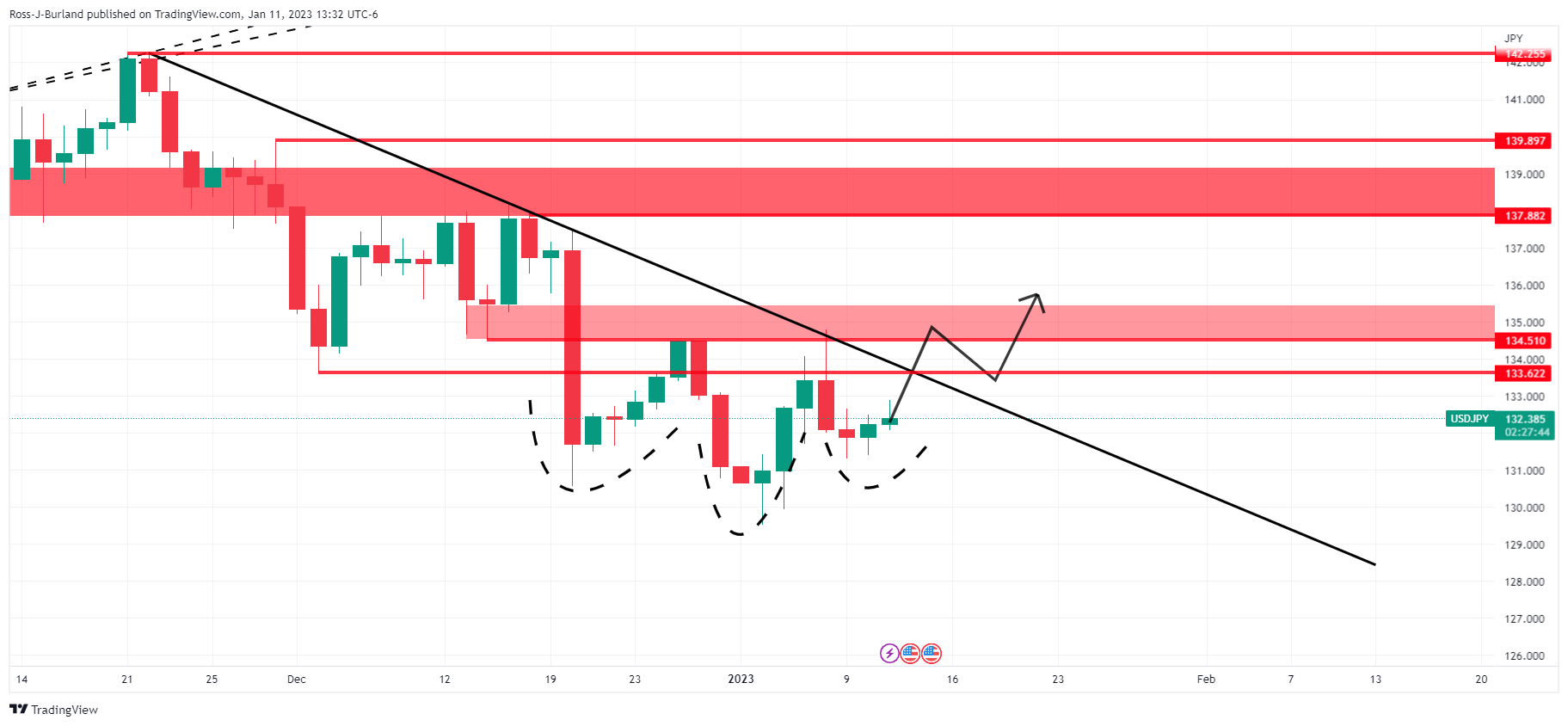

USD/JPY tumbles after the release of US CPI, down at 130.40s

- US inflation cools down, sending the US Dollar tumbling across the board.

- Claims for unemployment in the US were less than estimates, portraying a robust labor market.

- Fed’s Harker: Time for the Fed to rate increases at a smaller size.

The USD/JPY snaps two days of gains and stumbles more than 200 pips on Thursday, following the release of US inflation data, which cooled down, while claims were lower than estimates. Hence, the USD/JPY is trading at 130.44.

The US Department of Labor revealed that headline inflation, also known as the Consumer Price Index (CPI) for December, decelerated as expected to 6.5% YoY from 7.1% in November. Meanwhile, the month-over-month data showed inflation reading at -0.1%, lower than the 0% estimated. In the meantime, excluding volatile items inflation data, so-called core CPI came at 5.7% YoY, below the 6% foreseen.

Once data was released, the USD/JPY dropped sharply, as data justified US Federal Reserve (Fed) downshift to 25 bps rate hikes as the Fed scrambles to curb high inflation. At the same time, the Bureau of Labor Statistics (BLS) revealed that Initial Jobless Claims for the last week came softer at 205K, less than the 215K petitions expected by analysts, showing the labor market resilience.

Aside from this, Philadelphia’s Fed President Patrick Harker said that 25 bps would be appropriate going forward after the release of the US CPI report. Harker commented that the time for super-size rate hikes has passed and expects a few more rate increases this year.

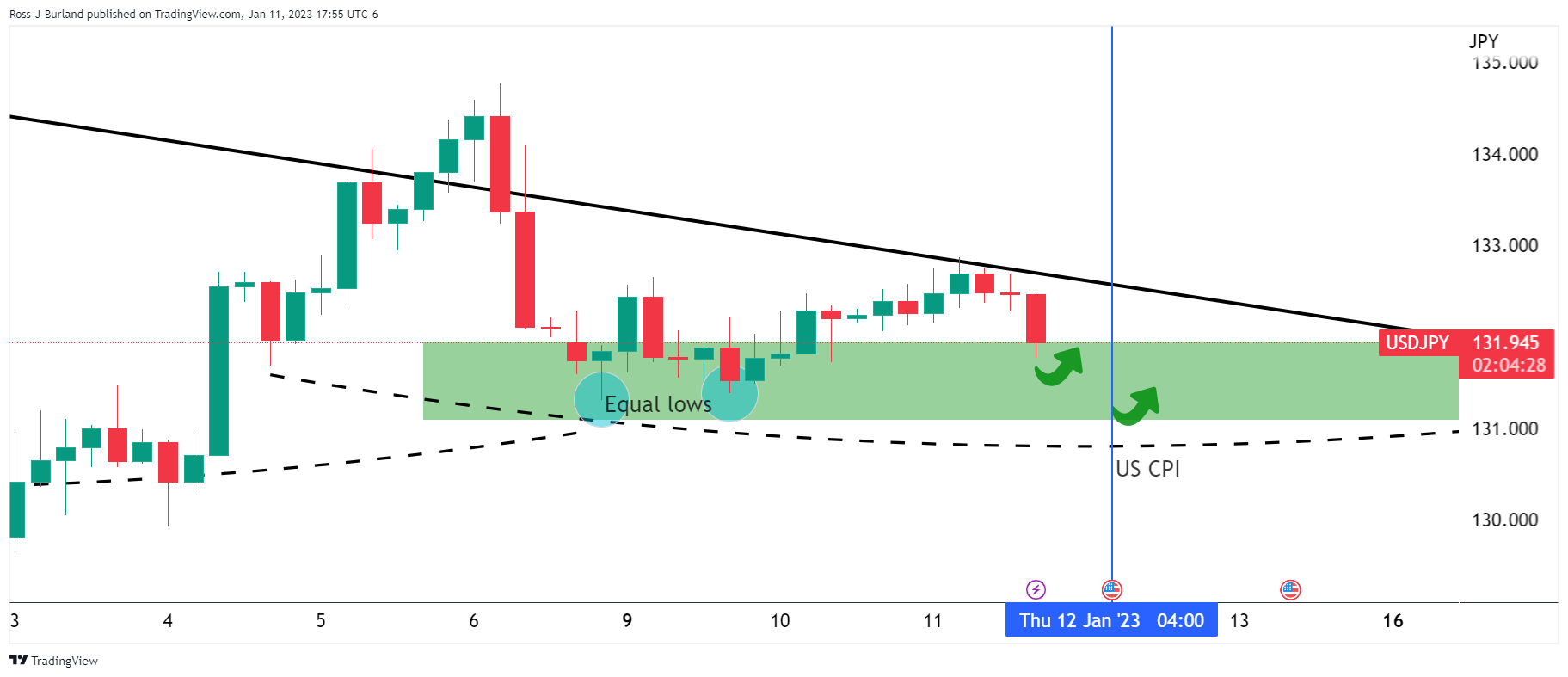

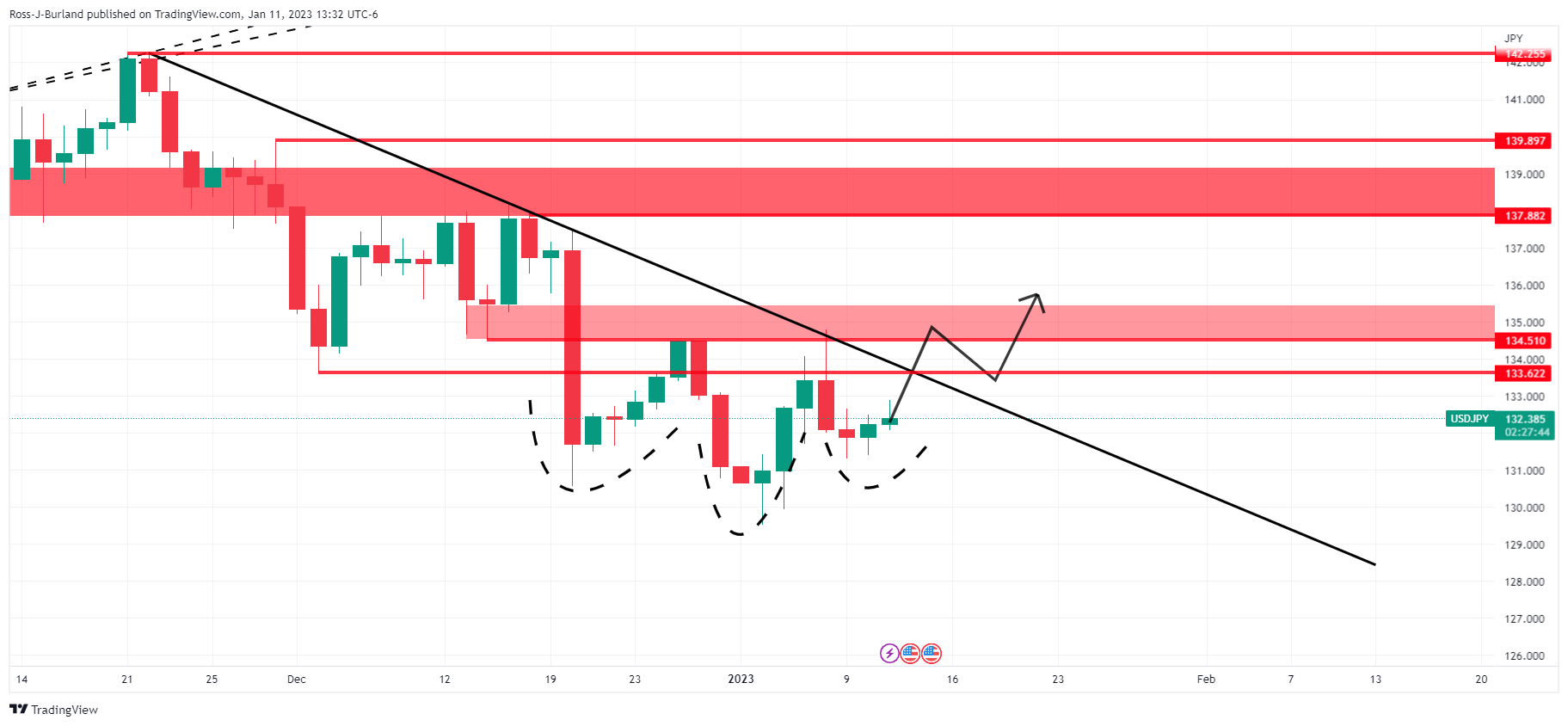

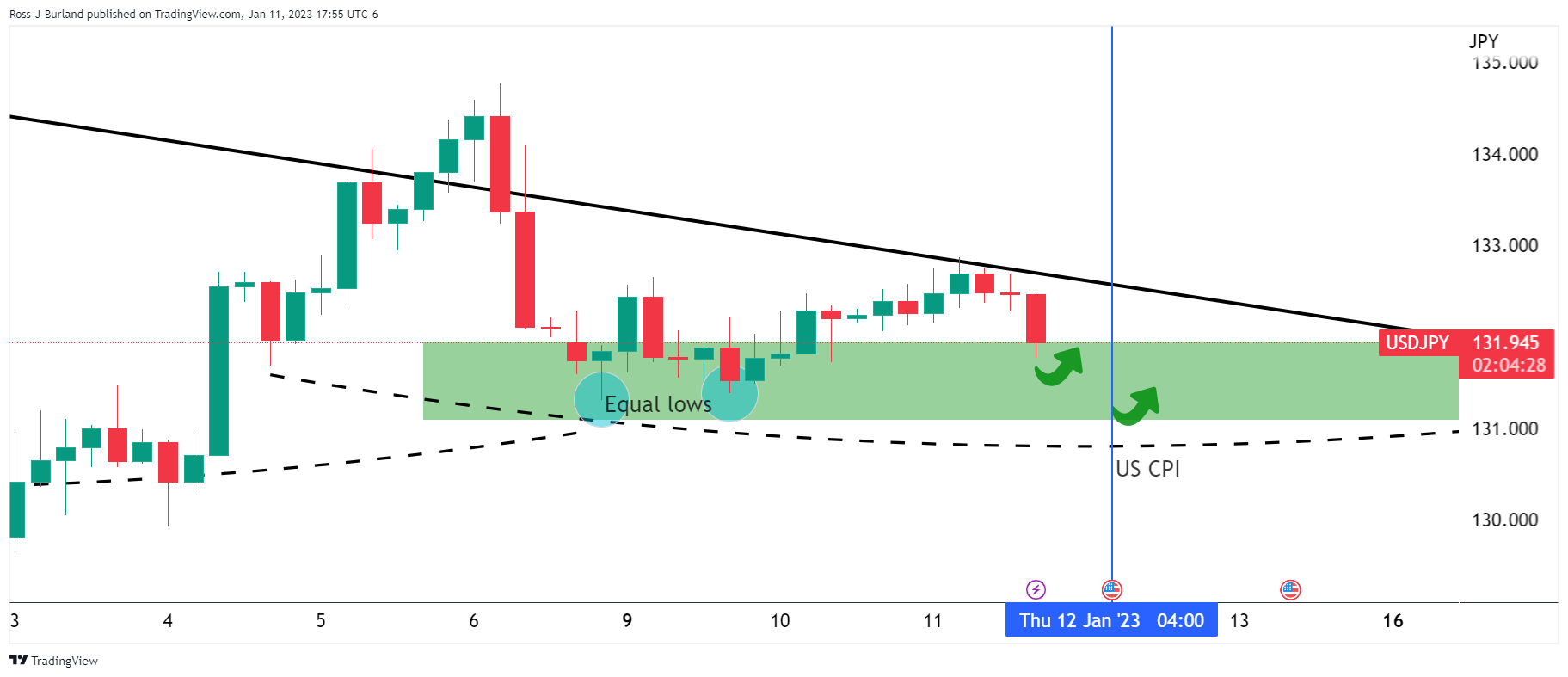

USD/JPY Price Analysis: Technical outlook

The USD/JPY 1-hour chart portrays the pair’s reaction to US data. On the release, it tested the YTD low of 129.50, though it resumed to the upside, but readings at the Relative Strength Index (RSI) and the Rate of Change (RoC), confirm that sellers are in charge. Hence, the USD/JPY might resume its downtrend.

The USD/JPY key support levels lie at 130.00, followed by the January 12 low of 129.49. On the flip side, the USD/JPY first resistance level is 131.00, followed by the 20-EMA at 131.26.

-

14:56

USD Index looks weaker, drops to 7-month lows near 102.30

- The index drops well south of the 103.00 mark on Thursday.

- US disinflation remained well in place in December.

- US yields extend the decline post-US CPI.

The USD Index (DXY), which measured the greenback vs. a bundle of its main rival currencies, gathers extra downside pressure and revisits the 102.30 region for the first time since early April.

USD Index breaches 103.00 on US inflation

The index exacerbates its decline after US inflation figures extended the decline in December. In fact, the headline CPI rose 6.5% over the last twelve months and the Core CPI rose 5.7% from a year earlier, clinching the sixth consecutive monthly pullback.

The dollar derives extra selling pressure from the initial drop in US yields, although the belly and the long end of the curve manage to trim part of that knee-jerk so far.

Another month with lower inflation figures reinforces investors’ perception of an imminent pivot in the Fed’s tightening cycle, which also morphed into increasing bets of a 25 bps rate hike at the February 1 event.

Additional results in the US calendar saw weekly Claims increase by 205K in the week to January 7, bettering initial estimates and sustaining the view of a (still) healthy labour market.

What to look for around USD

The dollar remains under pressure and looks to rebound from post-US CPI lows in multi-month lows in the 102.35/30 band.

Another soft prints from US inflation figures in December prop up the idea of a probable pivot in the Fed’s policy in the next months, which also comes in contrast to the hawkish message from the latest FOMC Minutes and recent rate-setters, all pointing to the need to remain within a restrictive stance for longer, at the time when the likelihood any interest rate reduction in the current year remains near zero.

On the latter, the tight labour market and the resilience of the economy are also seen supportive of the firm message from the Federal Reserve and its hiking cycle.

Key events in the US this week: Inflation Rate, Initial Jobless Claims, Monthly Budget Statement (Thursday) – Flash Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is retreating 0.10% at 103.15 and the breach of 102.32 (monthly low January 9) would open the door to 101.29 (monthly low May 30) and finally 100.00 (psychological level). On the other hand, the next up barrier comes at 105.63 (monthly high January 6) followed by 106.38 (200-day SMA) and then 107.19 (weekly high November 30).

-

14:47

USD/JPY: Stability through H1, scope for modest Yen gains in H2 – Scotiabank

The Japanese Yen was one of the worst performing major currencies overall last year. Economists at Scotiabank forecast USD/JPY at 130 by the end of 2023.

Break below 129.50 could open up 121.45

“Our forecast for USD/JPY is consistent with the current Bloomberg consensus estimate for 2023 (130 in Q4) and the trend we expect to unfold reflects the broader outlook we have for the USD against the JPY’s major currency peers. In other words, stability close to current levels through H1, with scope for modest JPY gains developing through H2 as the Fed take its foot off the monetary brakes.”

“The long-term charts highlight 134.80/00 as resistance and 138.00/10 as major resistance above that point.”

“Support is 129.50, with a drop to 127.25 (50% Fibonacci retracement of the 2021/22 rally) or possibly 121.45 (61.8% retracement) below there.”

-

14:16

Gold Price Forecast: Too early to fade the XAU/USD rally – TDS

Gold jumps to a fresh eight-month high following the release of the US consumer inflation figures. In the TD Securities strategists' view, it is too early to fade the rally.

Too early to fade Gold?

“Price action in Gold continues to trade consistently with a strengthening uptrend, whereas our tracking of positioning for the top ten traders in China also continues to highlight an uninterrupted accumulation of Gold.”

“Further, the bar is low for price action to spark a subsequent CTA buying program. We still don't see signs that the underlying bid is abating, but will look for continued buying activity following Chinese New Year celebrations as the first milestone to single-out the cause behind these massive purchases.”

“Gold may well be overbought, but price action and its underlying drivers still suggest that it is too early to fade the rally.”

-

13:52

EUR/USD advances through 1.0800 post US CPI

- EUR/USD picks up extra pace and leaves behind 1.0800.

- The dollar drops to multi-month lows when tracked by the DXY.

- US inflation figures extended the decline in December.

EUR/USD sees its upside accelerated to levels last seen back in late April 2022 north of 1.0800 the figure on Thursday.

EUR/USD rose to 9-month peaks above 1.0800

EUR/USD advances for the fifth consecutive session to trade in levels past the 1.0800 barrier on the back of the increasing selling pressure in the dollar, particularly exacerbated following the release of US inflation figures during December.

On the latter, the headline CPI rose at an annualized 6.5% in December and 5.7% YoY when it comes to the Core CPI, which excludes food and energy costs. Headline consumer prices therefore retreat for the sixth consecutive month so far and add to the rising perception of Fed’s pivot in the not-so-distant future.

Additional releases in the US calendar saw Initial Jobless Claims rise 205K in the week to January 7, surpassing consensus.

In the wake of the publication of the US CPI, the probability of a 25 bps rate hike at the next Fed event climbed to 82% according to CME Group’s FedWatch Tool.

What to look for around EUR

EUR/USD finally breaks above the key 1.0800 barrier to print new 9-month peaks on Thursday.

Price action around the European currency continues to closely follow dollar dynamics, as well as the impact of the energy crisis on the region and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: France final Inflation Rate, Germany Full Year GDP Growth, MEU Balance of Trade/Industrial Production (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is advancing 0.43% at 1.0803 and faces the next up barrier at 1.0815 (monthly high January 12) followed by 1.0900 (round level) and finally 1.0936 (weekly high April 21 2022). On the other hand, the breach of 1.0481 (monthly low January 6) would target 1.0443 (weekly low December 7) en route to 1.0424 (55-day SMA).

-

13:50

Germany Current Account n.s.a. registered at €16.9B above expectations (€4.7B) in November

-

13:48

Fed's Harker: Time for future Fed rate hikes to shift to 25 bps increments

Federal Reserve Bank of Philadelphia President Patrick Harker said on Thursday that it was time for future Fed rate hikes to shift to 25 basis points increments, as reported by Reuters.

Additional takeaways

"Fed is likely to raise rates a few more times in 2023."

"Not seeing a recession but GDP should slow to 1% this year."

"Time of super-sized rate hikes has passed."

"Once hikes end, Fed will need to hold steady for a bit."

"Core inflation is likely to moderate to 3.5% in 2023, hit Fed 2% target in 2025."

"Worst of inflation surge is now likely over."

"Labor market remains in excellent shape."

"Unemployment to fall back to 4% after rising this year."

"Unemployment likely to tick up to 4.5% this year from current 3.5%."

"Concerned about commercial real estate."

Market reaction

The US Dollar stays under constant selling pressure following these remarks and the US Dollar Index was last seen losing 0.6% on the day at 102.66.

-

13:46

Gold Price Forecast: XAU/USD jumps to $1,900 neighbourhood, fresh multi-month top post-US CPI

- Gold price touches a fresh multi-month high following the release of the US inflation figures.

- The crucial US CPI report cements bets for smaller Fed rate hikes and boosts the XAU/USD.

- The risk-on impulse might hold back bulls from placing fresh bets and cap gains for the metal.

Gold price reverses an early North American session dip to the $1,873 area and jumps to a fresh eight-month high following the release of the US consumer inflation figures. The XAU/USD is currently placed just below the $1,900 mark, up over 1.0% for the day, and seems poised to appreciate further.

The US Dollar bounces off a seven-month low in reaction to mostly in-line US Consumer Price Index (CPI) data, which, in turn, acts as a headwind for the dollar-denominated Gold price. The US Bureau of Labor Statistics reported that the headline US CPI declined 0.1% in December as compared to estimates for a flat reading. The yearly rate, however, matched expectations and decelerated to 6.3% from 7.1% in November. Furthermore, core inflation, which excludes food and energy prices, edge up by 0.3% in December and fell to 5.7% on yearly basis from 6.0% in November.

The mixed data, meanwhile, reaffirms market expectations for a less aggressive policy tightening by the Federal Reserve (Fed) and keeps the US Treasury bond yields depressed. In fact, the yield on the benchmark 10-year US Treasury note languishes near a multi-week low amid rising bets for smaller Fed rate hikes going further. This, in turn, caps the attempted USD recovery and provides a fresh lift to the non-yielding Gold price. That said, a generally positive tone around the equity markets might turn out to be the only factor capping gains for the safe-haven XAU/USD.

Nevertheless, the fundamental backdrop remains tilted firmly in favour of bullish traders. The positive outlook is reinforced by the emergence of some dip-buying in the last hour. This, in turn, supports prospects for a further near-term appreciating move for the Gold price, though it will be prudent to wait for a sustained strength beyond the $1,900 mark before placing fresh bullish bets.

Technical levels to watch

-

13:44

US: Weekly Initial Jobless Claims decline to 205K vs. 215K expected

- Initial Jobless Claims in the US decreased by 1,000 in the first week of 2023.

- US Dollar Index stays deep in negative territory below 103.00.

There were 205,000 initial jobless claims in the week ending January 7, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 206,000 and came in better than the market expectation of 215,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.1% and the 4-week moving average was 212,500, a decrease of 1,750 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending December 31 was 1,634,000, a decrease of 63,000 from the previous week's revised level," the DOL noted.

Market reaction

The US Dollar Index stays deep in negative territory below 103.00 after this data but the US Dollar weakness seems to have been caused by the soft inflation data rather than jobless claims.

-

13:32

United States Initial Jobless Claims came in at 205K, below expectations (215K) in January 6

-

13:31

United States Continuing Jobless Claims came in at 1.634M, below expectations (1.705M) in December 30

-

13:31

United States Consumer Price Index Core s.a climbed from previous 300.07 to 300.97 in December

-

13:30

United States Consumer Price Index ex Food & Energy (MoM) meets forecasts (0.3%) in December

-

13:30

United States Consumer Price Index ex Food & Energy (YoY) meets expectations (5.7%) in December

-

13:30

Breaking: US annual CPI inflation drops to 6.5% in December as expected

The US Bureau of Labor Statistics reported on Thursday that inflation in the US, as measured by the Consumer Price Index (CPI), declined to 6.5% on a yearly basis in December from 7.1% in November. This reading came in line with the market expectation. On a monthly basis, the CPI declined by 0.1% following November's increase of 0.1%.

Further details of the publication revealed that the Core CPI, which excludes volatile food and energy prices, edged lower to 5.7% on a yearly basis from 6% as expected. Finally, Core CPI rose by 0.3% on a monthly basis.

Follow our live coverage of the market reaction to US inflation data.

Market reaction

The US Dollar Index edged slightly higher with the initial reaction but seems to be having a difficult time gathering recovery momentum. As of writing, the index was down 0.2% on the day at 103.05.

-

13:30

United States Consumer Price Index n.s.a (MoM) registered at 296.797 above expectations (296.701) in December

-

13:30

United States Consumer Price Index (MoM) below expectations (0%) in December: Actual (-0.1%)

-

13:30

United States Initial Jobless Claims 4-week average down to 212.5K in January 6 from previous 213.75K

-

13:30

United States Consumer Price Index (YoY) in line with forecasts (6.5%) in December

-

13:14

EUR/USD: Building pressure for an extension of the rally to the 1.10 area – Scotiabank

On Wednesday, EUR/USD touched its highest level in nearly eight months at 1.0777. Economists at Scotiabank expect the pair to extend its race higher toward the 1.10 region.

Intraday price action is leaning potentially bearish

“Spot gains continue to pressure the mid-1.07 zone – key retracement resistance – which suggests building pressure for an extension of the EUR rally to the 1.10+ area.”

“Intraday price action is leaning potentially bearish, however, with the early European peak at 1.0775 marking a small outside range session on the six-hour chart.”

“We think the EUR will need to trade well below 1.07 to negate solid, underlying bull moment from a short-term point of view, however.”

-

13:03

NZD/USD remains on the defensive around mid-0.6300s ahead of US consumer inflation

- NZD/USD comes under some selling pressure on Thursday, though lacks follow-through.

- Bets for smaller Fed rate hikes, sliding US bond yields weigh on the USD and lend support.

- Investors also seem reluctant to place aggressive bets ahead of the crucial US CPI report.

The NZD/USD pair edges lower on Thursday and remains on the defensive through the mid-European session, through lack follow-through selling. The pair is currently placed around the mid-0.6300s as traders keenly await the release of the latest US consumer inflation figures.

The crucial US CPI report will influence the Federal Reserve's rate-hiking path, which, in turn, will drive the US Dollar demand and provide a fresh directional impetus to the NZD/USD pair. The market anxiety ahead of the key macro data benefits the greenback's relative safe-haven status and is seen undermining the risk-sensitive Kiwi.

That said, rising bets for smaller Fed rate hikes, along with a positive risk tone, weigh on the USD and help limit the downside for the NZD/USD pair. Market players seem convinced that the US central bank will soften its hawkish stance amid initial signs of easing inflationary pressure, which is evident from sliding US Treasury bond yields.

In fact, the yield on the benchmark 10-year US Treasury note languishes near a multi-week low and keeps the USD depressed near a seven-month low touched earlier this week. This makes it prudent to wait for strong follow-through selling before confirming that the NZD/USD pair has topped out in the near term and positioning for any meaningful corrective slide.

Technical levels to watch

-

13:00

Russia Central Bank Reserves $: $577.5B vs previous $581.7B

-

12:53

EUR/USD Price Analysis: Bullish bias unchanged above 1.0540

- EUR/USD remains bid near the 1.0780 region on Thursday.

- Extra gains likely above the immediate support line near 1.0540.

EUR/USD seems to have met solid resistance in the area of recent peaks around 1.0780.

In case bulls remain in control, the breakout of the January high at 1.0776 (January 11) could put the May 2022 top at 1.0786 (May 30) back on the radar ahead of the round level at 1.0800.

While above the short-term support line near 1.0540, the pair should maintain its bullish outlook.

In the longer run, the constructive view remains unchanged while above the 200-day SMA at 1.0308.

EUR/USD daily chart

-

12:43

USD/CAD retreats from weekly high, holds above 1.3400 ahead of US consumer inflation

- USD/CAD surrenders its modest intraday gains and is pressured by a combination of factors.

- Rising oil prices underpin the Loonie and exert some pressure amid sustained USD selling.

- Investors now look forward to the crucial US CPI report before placing fresh directional bets.