Notícias do Mercado

-

22:45

Currencies. Daily history for Feb 12'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $ 1,3592 -0,38%

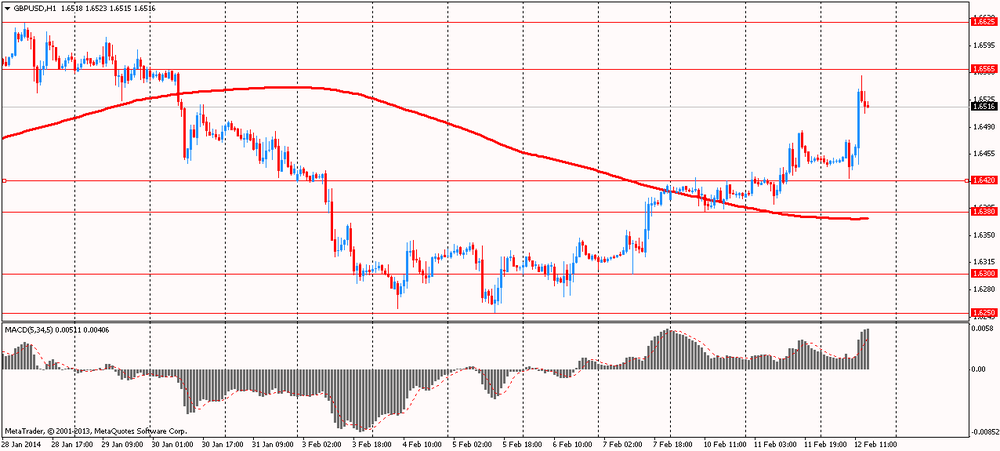

GBP/USD $ 1,6595 +1,18%

USD/CHF Chf 0,9006 +0,44%

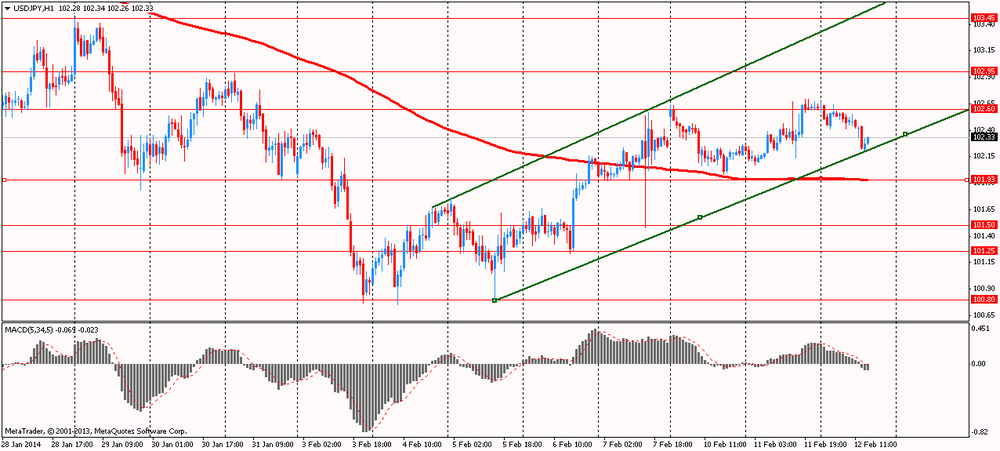

USD/JPY Y 102,53 +0,27%

EUR/JPY Y 139,35 -0,12%

GBP/JPY Y 170,12 +1,43%

AUD/USD $ 0,9025 +0,85%

NZD/USD $ 0,8319 +0,65%

USD/CAD C$ 1,1001 -0,49%

-

22:26

Schedule for today, Thursday, Feb 13’2014:

00:00 Australia Consumer Inflation Expectation February +2.3%00:01 United Kingdom RICS House Price Balance January 56% 59%

00:30 Australia Unemployment rate January 5.8% 5.9%

00:30 Australia Changing the number of employed January -22.6 15.3

01:25 Australia RBA Assist Gov Debelle Speaks

07:00 Germany CPI, m/m (Finally) January -0.6% -0.6%

07:00 Germany CPI, y/y (Finally) January +1.3% +1.3%

08:15 Switzerland Producer & Import Prices, m/m January 0.0% -0.1%

08:15 Switzerland Producer & Import Prices, y/y January -0.4% -0.3%

09:00 Eurozone ECB Monthly Report February

10:05 Australia RBA Assist Gov Kent Speaks

13:30 Canada New Housing Price Index December 0.0% +0.2%

13:30 U.S. Retail sales January +0.2% 0.0%

13:30 U.S. Retail sales excluding auto January +0.7% +0.2%

13:30 U.S. Initial Jobless Claims February 331 331

15:00 U.S. Business inventories December +0.4% +0.4%

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

21:45 New Zealand Food Prices Index, m/m January -0.1%

21:45 New Zealand Food Prices Index, y/y January +1.5%

-

19:20

American focus : the euro fell markedly against the U.S. currency

The euro exchange rate dropped significantly against the U.S. dollar , which was mainly due to the statements Benoit Kerr, a member of the ECB Governing Council , regarding the fact that the ECB is "seriously " considering lowering the overnight interest rate , charged by banks on deposits to negative territory. However, he does not expect a significant effect of this measure .

" This is what we are discussing very seriously. But do not expect too much from it , "- said Kerry , referring to the effects of negative interest rates on deposits for the economy.

Kerra repeated for several months that the central bank still has room for action to stimulate recovery in the euro against the background of weak growth and low inflation . These actions may include the purchase of assets in the secondary market and reducing deposit rates to negative territory , which will lead to the fact that a bank will take a percentage of the deposit of their funds at the ECB .

This measure, which is almost without precedent in the eurozone, could encourage banks that hold funds on deposit with the ECB's current interest rate of 0.0 % , to redirect the excess liquidity in the euro-zone economy . But it will also increase the costs of banks that may impact on their customers, making loans more expensive.

Also influenced the course of trading words the Federal Reserve Bank of St. Louis , James Bullard , who noted that the unexpectedly rapid decline rates b / d to 6.6 % last month should soon push the FOMC to return to the framework of a more " traditional" strategy of monetary policy.

Rate b / d in the U.S. reached nearly 6.5 % target level set by the Central Bank as a threshold value for which the monetary authorities can target in terms of start raising rates . Bullard called FOMC changes to a "statement of intent " and " give more quantitative estimates " on monetary policy , abandoning the threshold levels.

Pound has risen considerably against the U.S. dollar after the Bank of England has made changes to the policy of transparency. According to the Bank of England inflation report , published today , the Central Bank is going to keep rates at a record - low of 0.5 % , at least for another year, even if the unemployment rate / p fall to 7% threshold that, according to expectations occur in Q1 2014 . Bank of England pointed out that the British economy will grow even before the Bank to raise rates . But it is worth noting that the increase will be gradual and not to such a high level , which was celebrated before the crisis.

"The consequences of the financial crisis and the availability of economic obstacles indicate that some time rates should be kept at a low level , - the report says . - Even when the economy returns to a normal level of production capacity , and inflation closer to the target level , the bank rate will be significantly lower than 5 % ( level set before the crisis ) . "

MPC predicts that in the last quarter of 2013 Britain's GDP to grow by 0.9 % against the previous estimate of 0.7 %. As for the remainder of 2014 , the Central Bank expects to rise by 3.4 % versus 2.8 % November forecast . As for inflation , according to expectations, in the 2nd quarter of 2015 its growth will slow to 1.7% , and then accelerate again in 2016 and will reach 1.9%.

Bank of England Governor Mark Carney , speaking at a press conference after the release of the report , noted that Britain's economic recovery is underway, but it "still is neither stable nor balanced ." He defended the policy of transparency , noting that it has helped reduce the rate hike expectations .

The yen traded slightly higher against the dollar , though lost some previously won positions . Little impact on the bidding had words BOJ board member Takahide Kiuchi , who reported that an extra dose of easing monetary policy to prevent a potential recession caused by the expected introduction of a sales tax in April , could do more harm than good.

Of the nine members of the Board of Directors Kiuchi among those most concerned about the downside risks and is known pessimistic regarding the economic prospects of the country. He fears that the slowdown in the emerging economies of the world will cause drop in exports and that sluggish wage growth will slow consumer spending. And another round of additional easing could lead to the fact that the market may take longer , said Kiuchi .

"It's hard to say how much additional attenuation affect the rise in prices," - he added. Monetary policy " is designed to create an environment in which the Japanese economy can reach its full potential ," - said Kiuchi , warning against heavy reliance on monetary policy as an economic tool . He stressed the importance of strengthening the economy through growth strategies and structural reforms.

-

19:00

U.S.: Federal budget , January -10.4 (forecast -28.2)

-

15:30

U.S.: Crude Oil Inventories, February +3.3

-

13:46

Option expiries for today's 1400GMT cut

USD/JPY Y101.90, Y102.00, Y102.20/25/30, Y102.50, Y102.80, Y103.00, Y104.00

EUR/JPY Y141.00

EUR/USD $1.3500, $1.3550, $1.3650

GBP/USD $1.6200, $1.6400, $1.6425

EUR/GBP stg0.8200, stg0.8445

AUD/USD $0.8900, $0.8985, $0.9000, $0.9050

AUD/JPY Y91.75

NZD/USD $0.8150, $0.8350

USD/CAD C$1.0900, C$1.0915, C$1.0930, C$1.0950, C$1.1000, C$1.1030, C$1.1100

-

13:15

European session: the euro fell

08:15 Switzerland Consumer Price Index (MoM) January -0.2% -0.2% -0.3%

08:15 Switzerland Consumer Price Index (YoY) January +0.1% +0.1% +0.1%

10:00 Eurozone Industrial production, (MoM) December +1.6% Revised From +1.8% -0.2% -0.7%

10:00 Eurozone Industrial Production (YoY) December +2.8% Revised From +3.0% +1.8% +0.5%

10:30 United Kingdom Bank of England Quarterly Inflation Report Quarter I

10:30 United Kingdom BOE Gov Mark Carney Speaks

Тhe euro fell sharply against major currencies on the comments of the ECB representative Coeur introducing negative rates. ECB Coeur , said today that the Central Bank is "very seriously" considering the introduction of negative rates. His comments collapses the euro, which has lost more than 50 pips . against the dollar in a matter of minutes .

Previously, the pressure on the single currency had a report on industrial production in the eurozone. As shown by recent data on Wednesday statistical office Eurostat, industrial production in the euro area grew considerably slower pace in December , the growth rate fell short of economists' expectations .

Industrial production growth fell to 0.5 percent in December from a revised down 2.8 percent in the previous month . Economists forecast that growth will weaken to 1.8 percent from November 3 percent initially announced .

Production of energy fell by 1.9 percent compared to December 2012 . Consumer non-durable goods and durable consumer goods fell by 0.9 percent and 1.2 percent respectively. Meanwhile, the production of intermediate goods increased by 3.6 percent .

Among the EU Member States the largest increase was registered in Portugal , Romania , the Czech Republic and Slovenia. The largest decrease was recorded in Malta, Ireland, Estonia and Finland.

On a monthly measurement of industrial production fell by 0.7 percent in late 2013 , after a gain of 1.6 percent in November , which was revised downward from 1.8 percent . Production is projected should have been reduced by 0.2 percent.

The British pound appreciated sharply against the U.S. dollar on a background of the quarterly report of the Bank of England and the speech of the Central Bank of Carney . According to the Bank of England inflation report , published today , the Central Bank is going to keep rates at a record - low of 0.5 % , at least for another year, even if the unemployment rate / p fall to 7% threshold that, according to expectations occur in Q1 2014 . Bank of England pointed out that the British economy will grow even before the Bank to raise rates . But it is worth noting that the increase will be gradual and not to such a high level , which was celebrated before the crisis.

"The consequences of the financial crisis and the availability of economic obstacles indicate that some time rates should be kept at a low level , - the report says . - Even when the economy returns to a normal level of production capacity , and inflation closer to the target level , the bank rate will be significantly lower than 5 % ( level set before the crisis ) . "

MPC predicts that in the last quarter of 2013 Britain's GDP to grow by 0.9 % against the previous estimate of 0.7 %. As for the remainder of 2014 , the Central Bank expects to rise by 3.4 % versus 2.8 % November forecast .

As for inflation , according to expectations, in the 2nd quarter of 2015 its growth will slow to 1.7% , and then accelerate again in 2016 and will reach 1.9%.

Bank of England Governor Mark Carney , speaking at a press conference after the release of the report , noted that Britain's economic recovery is underway, but it "still is neither stable nor balanced ." He defended the policy of transparency , noting that it has helped reduce the rate hike expectations .

Carney also commented on the rapid drop in rates b / d to reach 7% , explaining the reduction of the total number of those citizens who do not have full employment. At the same time , he pointed out that the number of citizens with underemployment rose to historic highs .

Thus, under the policy of transparency , the Bank of England will consider a number of indicators , such as an index of manufacturing activity , working hours , labor productivity and wages . Size asset purchase program will continue to be £ 375 billion , at least until the first rate increase.

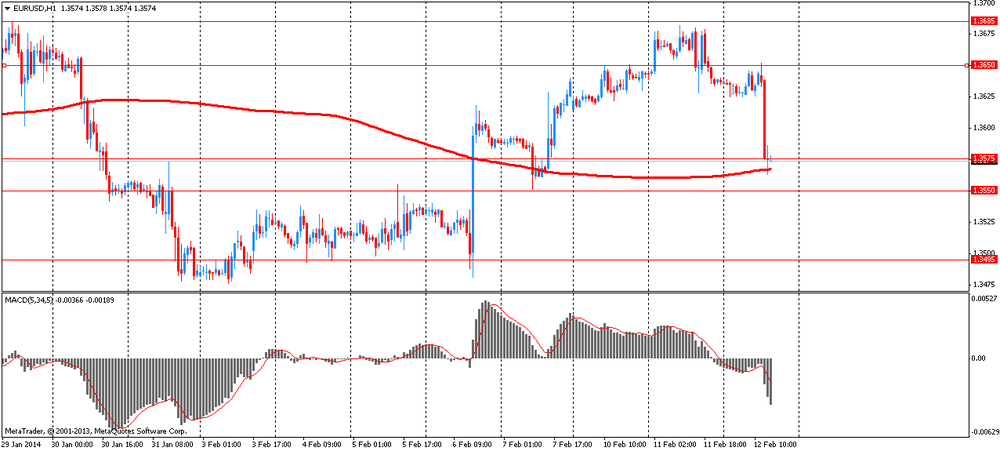

EUR / USD: during the European session, the pair fell to $ 1.3563

GBP / USD: during the European session, the pair rose to $ 1.6556

USD / JPY: during the European session, the pair dropped to Y102.21

At 18:00 GMT the U.S. is deploying 10 - year bonds . At 19:00 GMT the United States will submit a monthly report on the budget . At 21:30 GMT New Zealand will release the index of business activity in the manufacturing sector of Business NZ in January .

-

13:00

Orders

EUR/USD

Offers $1.3735/50, $1.3690/700, $1.3680/85

Bids $1.3600, $1.3560/50

GBP/USD

Offers $1.6600/10, $1.6545/55

Bids $1.6505/495, $1.6480, $1.6465/60

AUD/USD

Offers $0.9150, $0.9100

Bids $0.9025/20, $0.9000, $0.8960/50

EUR/GBP

Offers stg0.8300/05

Bids stg0.8225/20, stg0.8165/60, stg0.8150

EUR/JPY

Offers Y141.00, Y140.50, Y140.20

Bids Y139.55/50, Y139.00, Y138.50

USD/JPY

Offers Y103.50, Y102.90/00, Y102.65/70

Bids Y102.20, Y102.00, Y101.55/50

-

10:20

Option expiries for today's 1400GMT cut

USD/JPY Y101.90, Y102.00, Y102.20/25/30, Y102.50, Y102.80, Y103.00, Y104.00

EUR/JPY Y141.00

EUR/USD $1.3500, $1.3550, $1.3650

GBP/USD $1.6200, $1.6400, $1.6425

EUR/GBP stg0.8200, stg0.8445

AUD/USD $0.8900, $0.8985, $0.9000, $0.9050

AUD/JPY Y91.75

NZD/USD $0.8150, $0.8350

USD/CAD C$1.0900, C$1.0915, C$1.0930, C$1.0950, C$1.1000, C$1.1030, C$1.1100

-

10:00

Eurozone: Industrial production, (MoM), December -0.7% (forecast -0.2%)

-

10:00

Eurozone: Industrial Production (YoY), December +0.5% (forecast +1.8%)

-

08:15

Switzerland: Consumer Price Index (MoM) , January -0.3% (forecast -0.2%)

-

08:15

Switzerland: Consumer Price Index (YoY), January +0.1% (forecast +0.1%)

-

06:23

Asian session: The dollar held

02:00 China Trade Balance, bln January 25.6 24.2 31.9

The dollar held declines against most of its major counterparts before a report tomorrow forecast to show U.S. retail sales stalled last month. U.S. retail sales stagnated in January after a 0.2 percent gain the month before, according to the median estimate of economists surveyed by Bloomberg News before the U.S. Commerce Department reports the data tomorrow. The Labor Department said on Feb. 7 hiring in the U.S. rose by 113,000 in January, fewer than the 180,000 gain forecast by economists.

The Bloomberg Dollar Spot Index was near the lowest in almost a month after Federal Reserve Chairman Janet Yellen said yesterday the recovery in the U.S. labor market is “far from complete.” Yellen told the House Financial Services Committee yesterday that policy makers would continue to scale back stimulus in “measured steps,” and repeated the Fed’s statement that asset purchases aren’t on a “pre-set course.”

Australia’s currency rose to a four-week high after China trade surged. In China, imports climbed 10 percent last month from a year earlier, topping every estimate in a Bloomberg economist poll. Exports gained 10.6 percent, also exceeding all forecasts. The data comes after the Lunar New Year holiday between Jan. 31 and Feb. 6.

Bank of Japan Governor Haruhiko Kuroda told parliament today that markets have maintained trust in Japan’s finances, and fiscal consolidation is necessary to keep it. Policy board member Takahide Kiuchi said in an interview with Japan’s Nikkei newspaper that additional monetary easing to offset the effect of a sales tax increase in April may have negative side effects.

European Central Bank President Mario Draghi will deliver the keynote address at a conference in Brussels today.

EUR / USD: during the Asian session the pair fell to $ 1.3625

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6440-55

USD / JPY: on Asian session the pair fell to Y102.40

There is a full calendar again Wednesday, although again data is largely second tier and appearances by central bankers will again dominate. The European

calendar gets underway at 0745GMT, with the release of the French December current account data. At 0815GMT, Swiss January CPI data will cross the wires. ECB Governing Council member Ewald Nowotny will take part in the ECB/BNB Conference, in Brussels. Luc Coene speaks at the same event from

0900GMT. EMU December industrial output data will be released at 1000GMT. The German government issues its annual economic report, including updated forecasts, in Berlin at 1100GMT. At the same time, ECB Executive Board member Peter Praet will speak on "Banking faces the 21st century", in Madrid. Appearances by central bank heads continues at 1530GMT when ECB President Mario Draghi delivers a speech at ECB/BNB conference, in Brussels. At

1830GMT, ECB Executive Board member Benoit Coeure will give a keynote speech at reception for the German-Asian business circle, in Bad Homburg, Germany. Sovereign issuance will see Germany sell a new 2-year benchmark issue -- Mar 2016 Schatz for up to E5bln and Italy issue a new 12-month BOT, maturing Feb 13, 2015 for E8bln. The main UK event comes at 1030GMT, when the Bank of England releases the February Quarterly Inflation Report and Governor Mark Carney faces the press.

The US calendar gets underway at 1200GMT, with the release of the MBA Mortgage Index for the February 7 week. At 1345GMT, St. Louis Federal Reserve Bank President James Bullard will sit on a panel discussing the economic outlook, in New York. The EIA Crude Oil Stocks data for the Feb 8 week will

cross the wires at 1530GMT. Late US data sees the release of the January Treasury Statement at 1800GMT.

-

06:03

Japan: Prelim Machine Tool Orders, y/y , January +39.6%

-

02:12

China: Trade Balance, bln, January 31.9 (forecast 24.2)

-