Notícias do Mercado

-

22:55

Currencies. Daily history for Feb 13'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3679 +0,64%

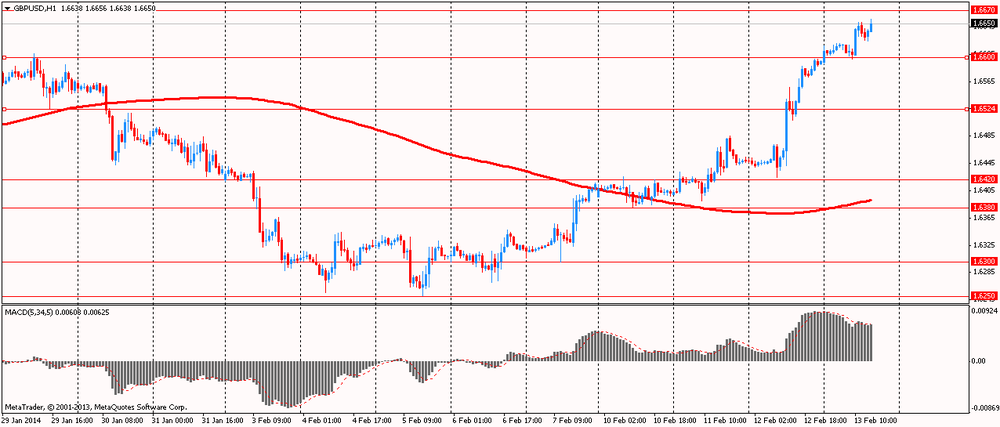

GBP/USD $1,6656 +0,37%

USD/CHF Chf0,8932 -0,83%

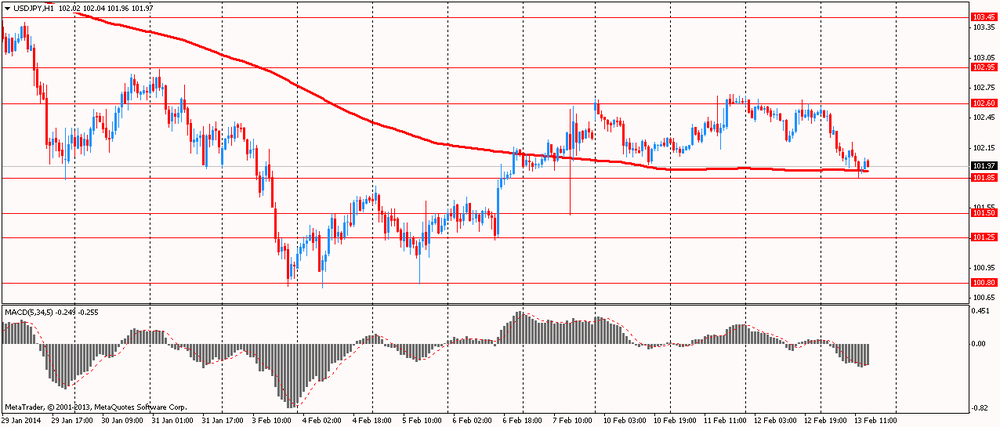

USD/JPY Y102,16 -0,36%

EUR/JPY Y139,75 +0,29%

GBP/JPY Y170,16 +0,02%

AUD/USD $0,8977 -0,53%

NZD/USD $0,8340 +0,25%

USD/CAD C$1,0975 -0,24%

-

22:45

Schedule for today, Friday, Feb 14’2014:

01:30 China PPI y/y January -1.4% -1.6%01:30 China CPI y/y January +2.5% +2.4%

06:30 France GDP, q/q (Preliminary) Quarter IV -0.1% +0.2%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.2% +0.6%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.3% +0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.1% +1.3%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.1% -0.1%

10:00 Eurozone Trade Balance s.a. December 16.0 14.5

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.2%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV -0.4% +0.4%

13:30 Canada Manufacturing Shipments (MoM) December +1.0% +0.3%

13:30 U.S. Import Price Index January 0.0% -0.1%

14:15 U.S. Industrial Production (MoM) January +0.3% +0.2%

14:15 U.S. Capacity Utilization January 79.2% 79.4%

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 81.2 80.6 %

-

19:20

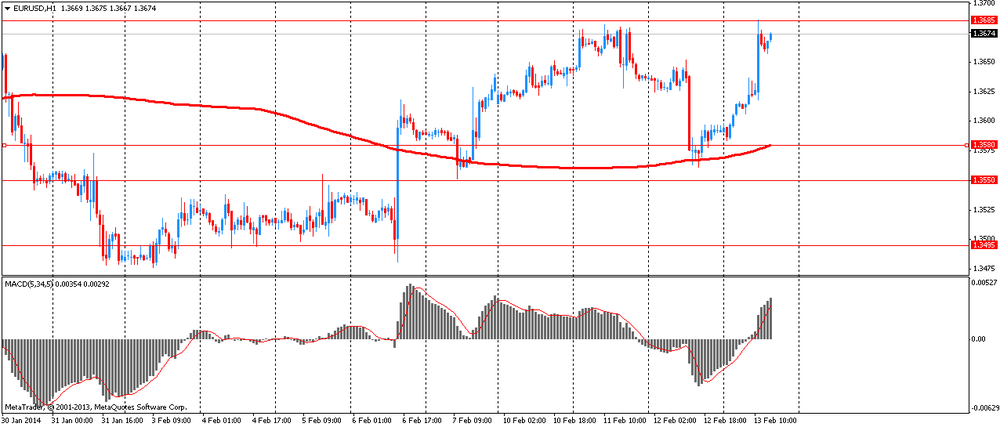

American focus : the euro has appreciated significantly against the U.S. dollar

The euro exchange rate has risen considerably in relation to the U.S. dollar , which was mainly due to the publication of the ECB's Monthly Report and inflation data for Germany. Note that in his February report ECB hinted that inflation in the euro area should remain low for an extended period of time before it starts to gradually recover to the target of 2%. " Comparison with the monetary analysis confirms the reduced prices in the euro area in the medium term ," said the ECB.

According to a study of professional forecasters , forecast HICP in 2014 was revised to 1.1 % from 1.5% previously . Forecast for 2015 was lowered to 1.4 % from 1.6 % in Q4 . , The forecast for 2016 was 1.7 %.

With respect to data for Germany , inflation, agreed by EU standards , remained unchanged in January, according to preliminary estimates . These are the latest data from the Federal Statistical Office. Harmonized index of consumer prices (HICP) increased by 1.2 percent per annum in January , the result was unchanged compared with the growth rate in December . Outcome corresponded to preliminary estimates . HICP fell by 0.7 percent compared to December , when it recorded a growth of 0.5 percent . Monthly changes are also consistent with preliminary estimates .

Also had little impact on the U.S. data , which showed that retail sales fell 0.4 percent last month , led by a drop in car sales . Sales fell by a revised 0.1 percent in December . Economists had forecast that retail sales will be unchanged in January after rising 0.2 percent in December , which was reported earlier.

Meanwhile, another report showed that the number of initial claims for unemployment benefits , a measure of layoffs, increased by 8000 and amounted to a seasonally adjusted 339,000 in the week ended February 8. The result was slightly higher than the 331,000 projected by economists. Meaning last week 331,000 remained without revision.

Pound rose moderately against the dollar , helped by a positive report on Britain. Monthly survey , which was presented today by the Royal Institution of Chartered Surveyors showed that house prices continued to rise last month, which was due to inventory homes near four-year low . According to the balance housing prices fell in January to 53 percent from 56 percent for December . Recall that the house price balance is calculated by subtracting the number of respondents who reported a fall in prices , and those who said that house prices rose .

The survey also showed that the average number of homes for sale through a real estate agency in January fell to the level of 59 units ( the lowest level since mid-2009 ) , compared with 60.4 units in December. It was also reported that respondents continue to expect prices to rise over the next year , which is also confirmed by other indicators of the housing market . Add that average prices were below the pre-crisis peak in 2007 , but they are moving fast towards this level.

Staying vigilant about the housing market , economists and politicians , however, argue that the "bubble" in the housing market is not a threat at the moment.

The Canadian dollar rose against the U.S. dollar , which was associated with the release of data on Canada. As it became known , Canadian prices for new homes rose slightly in December , while the increase at an annual rate showed the slowest 12-month increase in nearly four years .

Prices for new homes across the country increased by 0.1 % on a monthly measurement in December. Note that prices for new homes in the previous month showed zero change . 12 -month basis , prices rose by 1.3% , which corresponded to the market consensus forecast and represented the weakest 12-month gain since February 2010 . Rising prices in monthly terms led the Greater Toronto, where the cost of a new home rose 0.2%, the largest increase since July. In 2013, the average annual increase in the price of new homes was 1.8 % , compared with 2.4 % in the previous year , and became the smallest increase since 1999.

-

15:02

U.S.: Business inventories , December +0.5% (forecast +0.4%)

-

13:47

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y102.00, Y103.00

EUR/USD $1.3475, $1.3525, $1.3600

GBP/USD $1.6350-60, $1.6500

EUR/GBP stg0.8400

AUD/USD $0.9000, $0.9050

AUD/JPY Y92.00

USD/CAD C$1.1000, C$1.1100

-

13:32

U.S.: Retail sales, January -0.4% (forecast 0.0%)

-

13:32

U.S.: Retail sales excluding auto, January 0.0% (forecast +0.2%)

-

13:31

U.S.: Initial Jobless Claims, February 339 (forecast 331)

-

13:30

Canada: New Housing Price Index , December +0.1% (forecast +0.2%)

-

13:15

European session: the euro rose

07:00 Germany CPI, m/m (Finally) January -0.6% -0.6% -0.7%

07:00 Germany CPI, y/y (Finally) January +1.3% +1.3% +1.2%

08:15 Switzerland Producer & Import Prices, m/m January 0.0% -0.1% 0.0%

08:15 Switzerland Producer & Import Prices, y/y January -0.4% -0.3% -0.3%

09:00 Eurozone ECB Monthly Report February

The euro rose against the U.S. dollar on a background of the ECB Monthly Report and data on inflation in Germany .

ECB in its February report indicated that inflation in the euro area should remain low for an extended period of time before it starts to gradually recover to the target of 2%. " Comparison with the monetary analysis confirms the reduced prices in the euro area in the medium term ," said the ECB.

According to a study of professional forecasters , forecast HICP in 2014 was revised to 1.1 % from 1.5% previously . Forecast for 2015 was lowered to 1.4 % from 1.6 % in Q4 . , The forecast for 2016 was 1.7 %.

With respect to data for Germany , inflation, agreed by EU standards , remained unchanged in January, according to preliminary estimates . These are the latest data from the Federal Statistical Office. Harmonized index of consumer prices (HICP) increased by 1.2 percent per annum in January , the result was unchanged compared with the growth rate in December . Outcome corresponded to preliminary estimates . HICP fell by 0.7 percent compared to December , when it recorded a growth of 0.5 percent . Monthly changes are also consistent with preliminary estimates .

Statistical Office also reported that consumer price inflation fell to 1.3 percent in January from 1.4 percent in December , according to initial estimates . Moderation in inflation mainly reflects a downward trend in prices for mineral oil products. In contrast, the cost of electricity and solid fuel increases. In monthly terms, the consumer price index fell by 0.6 percent in early 2014. This followed an increase of 0.4 percent in December .

The British pound strengthened against the U.S. dollar. Published data on the UK housing market , according to which in January house price balance of RICS ( Royal Institution of Surveyors ) fell to 53 %, compared with 56 % earlier in December. Recall that the index is calculated as the proportion of subtraction of respondents who reported a decline in prices, the share of those who reported an increase in prices.

Nevertheless , it is worth noting that the demand for homes remains strong. " It's no secret that we have seen a rise in prices in many parts of the country due mainly lack of objects represented in the market. Given the fact that more people are now attuned to buying a home than at any time in recent years , the number of objects is simply not enough to meet demand. The result is a rise in prices in many areas , and it seems to continue for the foreseeable future "- says Peter Bolton King of the RICS.

The survey also showed that the evaluators continue to expect prices to rise over the coming year .

EUR / USD: during the European session, the pair fell to $ 1.3686

GBP / USD: during the European session, the pair rose to $ 1.6656

USD / JPY: during the European session, the pair dropped to Y101.86

At 13:30 GMT , Canada will release the housing price index on the primary market in December. In the U.S. at 13:30 GMT will change in the volume of retail trade , the change in retail sales excluding auto sales , the change in volume of retail trade turnover , excluding sales of cars and fuel for January to 15:00 GMT - change in stocks in commercial warehouses for December .

-

13:00

Orders

EUR/USD

Offers $1.3770/80, $1.3735/50, $1.3720, $1.3690/700

Bids $1.3625/20

GBP/USD

Offers $1.6745/50, $1.6690/700

Bids $1.6600, $1.6570/65, $1.6555/50

AUD/USD

Offers $0.9050, $0.9000, $0.8980/85

Bids $0.8910/00, $0.8880, $0.8850, $0.8825/20

EUR/GBP

Offers stg0.8300/05

Bids stg0.8165/60, stg0.8150, stg0.8120

EUR/JPY

Offers Y140.95/00, Y140.50, Y140.20, Y140.00, Y139.80

Bids Y139.00, Y138.50, Y138.25/20

USD/JPY

Offers Y102.90/00, Y102.65/70, Y102.35/40

Bids Y101.55/50, Y101.00

-

10:31

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y102.00, Y103.00

EUR/USD $1.3475, $1.3525, $1.3600

GBP/USD $1.6350-60, $1.6500

EUR/GBP stg0.8400

AUD/USD $0.9000, $0.9050

AUD/JPY Y92.00

USD/CAD C$1.1000, C$1.1100

-

08:18

Switzerland: Producer & Import Prices, m/m, January 0.0% (forecast -0.1%)

-

08:18

Switzerland: Producer & Import Prices, y/y, January 0.0% (forecast -0.3%)

-

07:00

Germany: CPI, m/m, January -0.7% (forecast -0.6%)

-

07:00

Germany: CPI, y/y , January +1.2% (forecast +1.3%)

-

06:18

Asian session: The dollar headed

00:00 Australia Consumer Inflation Expectation February +2.3% +2.3%

00:01 United Kingdom RICS House Price Balance January 56% 59% 53%

00:30 Australia Unemployment rate January 5.8% 5.9% 6.0%

00:30 Australia Changing the number of employed January -23.0 Revised From -22.6 15.3 -3.7

01:25 Australia RBA Assist Gov Debelle Speaks

The dollar headed for its biggest drop in more than a week versus the yen before a report today forecast to show U.S. retail sales stalled. U.S. retail sales stagnated in January, according to the median estimate of economists surveyed by Bloomberg News before the U.S. Commerce Department reports the data today. That follows a 0.2 percent gain the month before, when winter clothing sales increased while auto demand dropped owing to the harsh weather.

The yen strengthened versus its most-traded counterparts as declines in Asian equities boosted demand for the perceived safety of Japan’s currency.

Australia’s dollar fell as much as 1.1 percent versus the greenback after the government said unemployment jumped to a 10-year high. In Australia, employment unexpectedly shrank by 3,700 last month. Economists polled by Bloomberg forecast a 15,000 gain. The jobless rate rose to 6 percent, the highest since July 2003, according to a Bloomberg economist poll.

Federal Reserve Chair Janet Yellen’s testimony to the Senate Banking Committee, scheduled for today, will be postponed because of a storm forecast to dump heavy snow on the U.S. East Coast. The latest storm has left thousands without electricity across the U.S. South, snarled ground and air traffic from Atlanta to New York, and spurred weather alerts from Louisiana to Maine. Washington may get 8 inches (20 centimeters) of snow, according to the National Weather Service.

EUR / USD: during the Asian session, the pair rose to $ 1.3615

GBP / USD: during the Asian session, the pair rose to $ 1.6625

USD / JPY: on Asian session the pair fell to Y102.05

A somewhat slower calendar in Europe Thursday, although there is some important data on the schedule in the US. The European calendar starts at 0700GMT, when the German January final HICP numbers are set to be published. At 0830GMT, Dutch December retail sales numbers and the January HICP numbers will be released. Also due at 0830GMT is the latest interest rate from Sweden's Riksbank. The ECB will release the February monthly report at 0900GMT, although it is expected to mirror ECB President Mario Draghi's opening statement at the recent press conference. ECB borad member Benoit Coeure speaks in Brussels at 1000GMT. On Thursday, Italy conducts its regular mid-month medium-long auctions - 1 day ahead of Moody's review of Italy's sovereign rating.

-

00:32

Australia: Changing the number of employed, January -3.7 (forecast 15.3)

-

00:31

Australia: Unemployment rate, January 6.0% (forecast 5.9%)

-