Notícias do Mercado

-

19:20

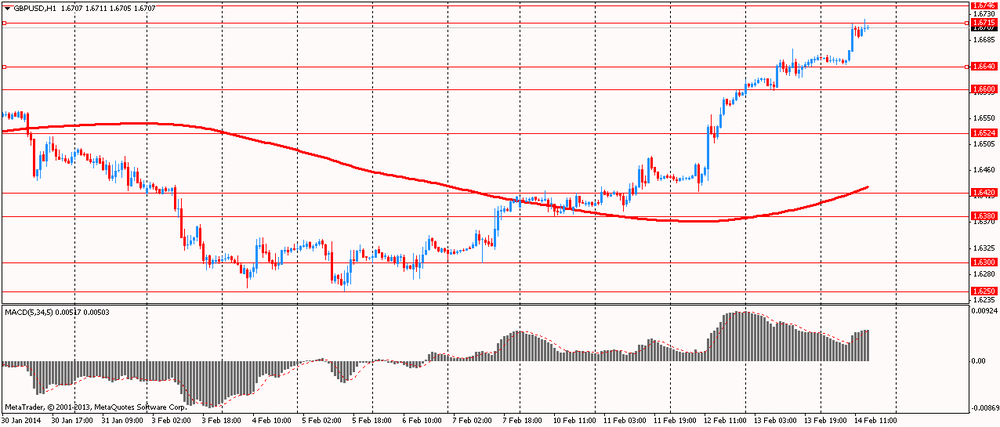

American focus : the pound has appreciated strongly against the U.S. dollar

Rate of the euro retreated from the maximum values against the dollar, which was achieved after the release of Eurozone GDP , but continues to trade with a slight increase . Pressure on the currency was the U.S. data , which showed that import prices rose a second straight month in January by 0.1 percent after increasing 0.2 percent in December. In January, higher non-fuel prices offset lower fuel prices . Export prices also rose in January by 0.2 percent after rising 0.4 percent in December . January's growth was accompanied by higher non-fuel prices , while the increase in December was due to rising fuel prices . Despite the increase , the overall import prices decreased by 1.5 percent for the year ending in January.

In addition , the decline was due to the publication of the preliminary results of the study, which were presented to Thomson-Reuters and the Michigan Institute . They showed that in February, U.S. consumers feel about the economy and how it was recorded last month. According to preliminary February consumer sentiment index remained at the final reading of 81.2 in January . It is worth noting that according to the average estimates of experts , the index was down compared to the January to reach a value of 80.6 .

Pound was up against the U.S. dollar , reaching maximum values in nearly two years . Most of the rally pound associated with expectations that the Central Bank will raise rates sooner than previously thought. Strategists note that departure from the Bank of England " transparency policy " allowed to revise forecasts for rate increase for shorter periods . However, next week is expected to publish the IFA protocol , which will reflect a unanimous vote, and the CPI at the target level of 2% as a reminder that needed a lot of time ( experts remain forecast Q3 . 2015 with increasing risk in the 1st half of 2015 ) . In the labor market , the focus will be price increases on wages as a leading indicator of future inflation . Anemic wage growth may also reduce rate hike expectations .

The Canadian dollar fell sharply against the U.S. dollar after data showed that Canadian supply industry in the manufacturing sector fell unexpectedly in December , showing the biggest monthly decline in eight months , amid weak demand for aircraft , vehicles and metals. This was reported by Statistics Canada on Friday .

Industrial sales fell 0.9 % on a monthly basis to 49.87 billion Canadian dollars ( $ 45.55 billion ) , while market expectations were at 0.3% growth . In volume terms, the shipments index fell 1.9 % , the largest decline during the year.

Meanwhile, data on industrial supplies for November were revised downward and now showed that sales rose by only 0.5 % per month, or half the original estimates an increase of 1.0%.

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, February 81.2 (forecast 80.6)

-

14:15

U.S.: Industrial Production (MoM), January -0.3% (forecast +0.2%)

-

14:15

U.S.: Capacity Utilization, January 78.5% (forecast 79.4%)

-

13:46

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y101.50, Y101.80, Y102.00, Y102.40-50, Y103.00

EUR/USD $1.3500, $1.3550, $1.3625, $1.3710, $1.3720-25, $1.3770

GBP/USD $1.6600, $1.6650, $1.6700

EUR/GBP stg0.8100, stg0.8200, stg0.8280, stg0.8300, stg0.840

USD/CHF Chf0.9150

EUR/NOK Nok8.3516

AUD/USD $0.8900, $0.8950, $0.9000, $0.9025, $0.9040-45, $0.9100

NZD/USD $0.8200

USD/CAD C$1.0900, C$1.0940, C$1.0950-55, C$1.0990, C$1.1000, C$1.1135-50

-

13:31

Canada: Manufacturing Shipments (MoM), December -0,9% (forecast +0.3%)

-

13:31

U.S.: Import Price Index, January +0.1% (forecast -0.1%)

-

13:15

European session: the euro rose

06:30 France GDP, q/q (Preliminary) Quarter IV -0.1% +0.2% +0.3%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.2% +0.6% +0.8%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.3% +0.3% +0.4%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.1% +1.3% +1.4%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.1% -0.1% +0.1%

10:00 Eurozone Trade Balance s.a. December 16.0 14.5 13.7

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.2% +0.3%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV -0.4% +0.4% +0.5%

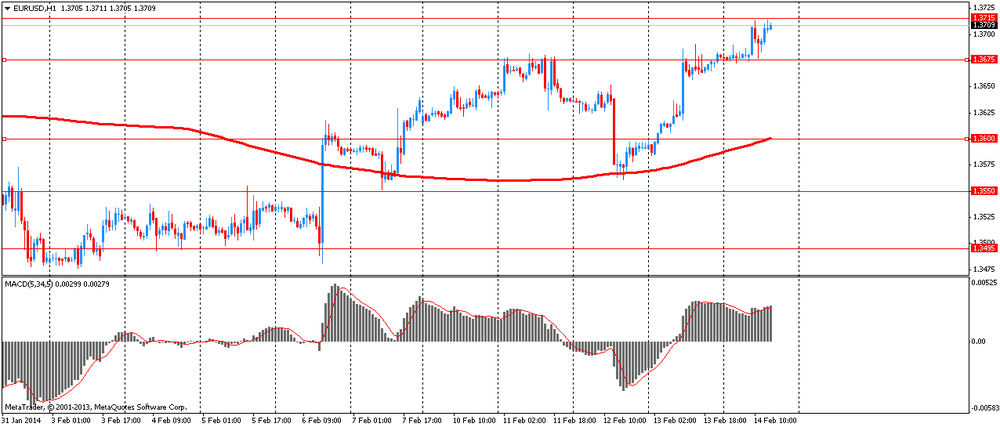

The euro rose to almost three-week high against the U.S. dollar after the rate of economic growth in Germany, France and the euro area slightly exceeded expectations. Eurozone economic growth accelerated in the fourth quarter, more than expected , according to preliminary estimates by Eurostat . Gross domestic product grew by 0.3 percent on a quarterly measurement that was faster than the growth of 0.1 percent posted in the third quarter and above economists' forecast of 0.2 percent . GDP grew the third consecutive quarter in late 2013 . In annual terms the economy grew by 0.5 percent , breaking the trend of declining by 0.3 percent in the third quarter . Projected growth of 0.4 percent. For the entire 2013 , GDP fell by 0.4 percent in the euro area and rose by 0.1 percent in the 28 countries of the European Union.

German growth accelerated in the fourth quarter , due to the positive contribution of foreign trade and investment , according to preliminary data from the Federal Statistical Office . Gross domestic product grew by 0.4 per cent compared with the previous quarter ago , while it was expected that he would remain stable at 0.3 percent.

According to preliminary calculations consistent growth in exports of goods and services was significantly higher than import growth . In terms of the expenditure side , government spending remained at the level of the previous quarter , while household spending on final consumption was slightly lower . Positive contribution was recorded in part of fixed capital formation , which was significantly higher in the sector of machinery and equipment , and construction. Nevertheless , stocks declined significantly , which slowed economic growth. Calendar adjusted GDP increased by 1.4 percent year on year , which is also faster than the growth of 0.6 per cent , which is seen in the third quarter and higher than economists expected 1.3 percent growth.

The French economy grew at the end of 2013 after stagnating in the third quarter , helped by the improvement in external demand , data showed the European statistical office Insee. Gross domestic product grew by 0.3 percent in the fourth quarter , after zero growth in the third quarter . The expenditure breakdown of GDP shows that as household spending and government spending accelerated in the fourth quarter , to 0.5 percent and 0.4 percent respectively. Investment rose for the first time since the end of 2011 , 0.6 percent in the fourth quarter . Exports grew by 1.2 per cent , 1.6 per cent drop changing ago quarter . Meanwhile, import growth slowed to 0.5 percent from 0.8 percent.

The Australian dollar rose after the publication of positive inflation data from China. Today, the National Bureau of Statistics in Beijing stated that in January consumer price index rose at the same pace as in December , by 2.5 % compared with the same period a year earlier. Producer price index fell by 1.6% in line with expectations . Recall that China is the largest trading partner of Australia and New Zealand .

EUR / USD: during the European session, the pair rose to $ 1.3714

GBP / USD: during the European session, the pair rose to $ 1.6722

USD / JPY: during the European session, the pair dropped to Y101.71

At 13:30 GMT , Canada will release the change in volume production shipments in December. In the U.S. at 13:30 GMT will import price index for January to 14:15 GMT - capacity utilization , change in industrial production for January to 14:55 GMT - consumer sentiment index from the University of Michigan in February.

-

10:29

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y101.50, Y101.80, Y102.00, Y102.40-50, Y103.00

EUR/USD $1.3500, $1.3550, $1.3625, $1.3710, $1.3720-25, $1.3770

GBP/USD $1.6600, $1.6650, $1.6700

EUR/GBP stg0.8100, stg0.8200, stg0.8280, stg0.8300, stg0.840

USD/CHF Chf0.9150

EUR/NOK Nok8.3516

AUD/USD $0.8900, $0.8950, $0.9000, $0.9025, $0.9040-45, $0.9100

NZD/USD $0.8200

USD/CAD C$1.0900, C$1.0940, C$1.0950-55, C$1.0990, C$1.1000, C$1.1135-50

-

10:00

Eurozone: GDP (QoQ), Quarter IV +0.3% (forecast +0.2%)

-

10:00

Eurozone: GDP (YoY), Quarter IV +0.5% (forecast +0.4%)

-

10:00

Eurozone: Trade Balance s.a., December 13.7 (forecast 14.5)

-

07:45

France: Non-Farm Payrolls, Quarter IV +0.1% (forecast -0.1%)

-

07:00

Germany: GDP (QoQ), Quarter IV +0.4% (forecast +0.3%)

-

07:00

Germany: GDP (YoY), Quarter IV +1.4% (forecast +1.3%)

-

06:30

France: GDP, q/q, Quarter IV +0.3% (forecast +0.2%)

-

06:30

France: GDP, Y/Y, Quarter IV +0.8% (forecast +0.6%)

-

06:15

Asian session: The Dollar Index was set for the lowest close in more than a month

01:30 China PPI y/y January -1.4% -1.6% -1.6%

01:30 China CPI y/y January +2.5% +2.4% +2.5%

The Dollar Index was set for the lowest close in more than a month as a winter storm swept across the U.S. and amid signs of weakness in retail sales, manufacturing and employment. Retail sales in the U.S. fell 0.4 percent in January after a revised 0.1 percent drop the prior month, according to the Commerce Department. The median forecast of 86 economists surveyed by Bloomberg called for no change.

The yen strengthened versus all of its major counterparts as Japanese equity declines boosted demand for the perceived safety of the currency.

Australia’s dollar rallied after consumer prices increased in China, the nation’s biggest trading partner. Data in China showed consumer prices increased 2.5 percent in January from a year earlier, compared to a 2.4 percent increase estimated by economists in a Bloomberg News survey. The producer price index fell 1.6 percent, in line with economists’ forecasts.

New Zealand’s dollar rose versus most of its major peers as Asian stocks extended gains and food prices in the nation rebounded. In New Zealand, food prices increased 1.2 percent in January from the prior month, when it slid 0.1 percent, Statistics New Zealand reported today in Wellington.

China is the biggest trading partner of both Australia and New Zealand.

EUR / USD: during the Asian session, the pair traded in the range of $1.3670-90

GBP / USD: during the Asian session, the pair traded in the range of $1.6640-60

USD / JPY: on Asian session the pair fell to Y101.65

Friday sees a full data calendar to start the week, with the release of the main euro area flash GDP numbers for the fourth quarter the stand out feature. Also Friday. ratings agency Moody's could issue a review on Italy, while DBRS could issue an update on the UK. The European data calendar kicks off at 0630GMT, with the release of the French Q4 GDP data, followed by the German Q4 data at 0700GMT. French data continues at 0730GMT, with the release of the Bank of France retail trade data, the fourth quarter employment numbers and the Q4 job creation data. At 0800GMT, the Spanish January final HICP numbers will cross the wires. There is further data scheduled for release at 1000GMT, including the Italian flash Q4 GDP data and the Eurozone December trade balance.

-

01:36

China: PPI y/y, January -1.6% (forecast -1.6%)

-

01:35

China: CPI y/y, January +2.5% (forecast +2.4%)

-