Notícias do Mercado

-

23:57

NZD/USD struggles to defend recovery past 0.6200 amid mixed options market signals

NZD/USD treads water around 0.6215-20 amid early Thursday, following its rebound from a three-week low. In doing so, the Kiwi pair struggles for clear directions, while justifying the mixed options market signals, after snapping a two-day losing streak on Wednesday.

That said, a one-month risk reversal (RR) of the NZD/USD price, a gauge of the spread between the call and put options, printed a mild daily gain to +0.070 by the end of Wednesday’s North American session. With that, the daily RR marked the first positive print in three.

However, the weekly RR still snaps the four-week uptrend with a -0.035 figure at the latest.

It should be noted, though, that the monthly options market signals are well in support of the NZD/USD bulls as the RR prints positive figures for the third consecutive month so far, up to 0.015 by the press time.

Also read: NZD/USD rebounds on risk-on sentiment amidst mixed US inflation data

-

23:50

AUD/JPY Price Analysis: Limited upside expected as Australia employment data looms

- AUD/JPY prints five day winning streak, prints mild gain of late.

- Upbeat MACD signals, sustained bounce off three-week-old support favor buyers.

- Multiple hurdles towards the north, downbeat expectations from Aussie employment report prod bulls.

- Bears need validation from 88.45 and Australia jobs data to retake control.

AUD/JPY portrays mild gains around 89.20 as bulls keep the reins for the fifth consecutive day ahead of Australia’s monthly employment report, up for publishing on early Thursday.

In doing so, the cross-currency pair extends the previous week’s rebound from an upward-sloping support line from March 24, as well as the 21-DMA. Adding strength to the upside bias are the bullish MACD signals.

However, a likely increase in the Aussie Unemployment Rate, as well as downbeat Employment Change, for March joins multiple technical hurdles towards the north to challenge the AUD/JPY buyers.

Among them, a six-week-old descending resistance line near 89.50 and the 90.00 round figure are the initial challenges for the pair buyers.

Following that, the previous support line from late December 2020, around 90.25, will precede a seven-month-old descending trend line, close to 91.10 at the latest, to act as the last defense of the AUD/JPY bears.

Meanwhile, pullback moves remain elusive unless the quote stays beyond the 88.45 support confluence comprising the 21-DMA and a three-week-long rising trend line.

In a case where AUD/JPY bears manage to conquer the 88.45 support, multiple rest-points near 87.40-35 and 87.00 may prod the downside moves before highlighting the latest bottom of around 86.05 for the sellers.

AUD/JPY: Daily chart

Trend: Limited upside expected

-

23:35

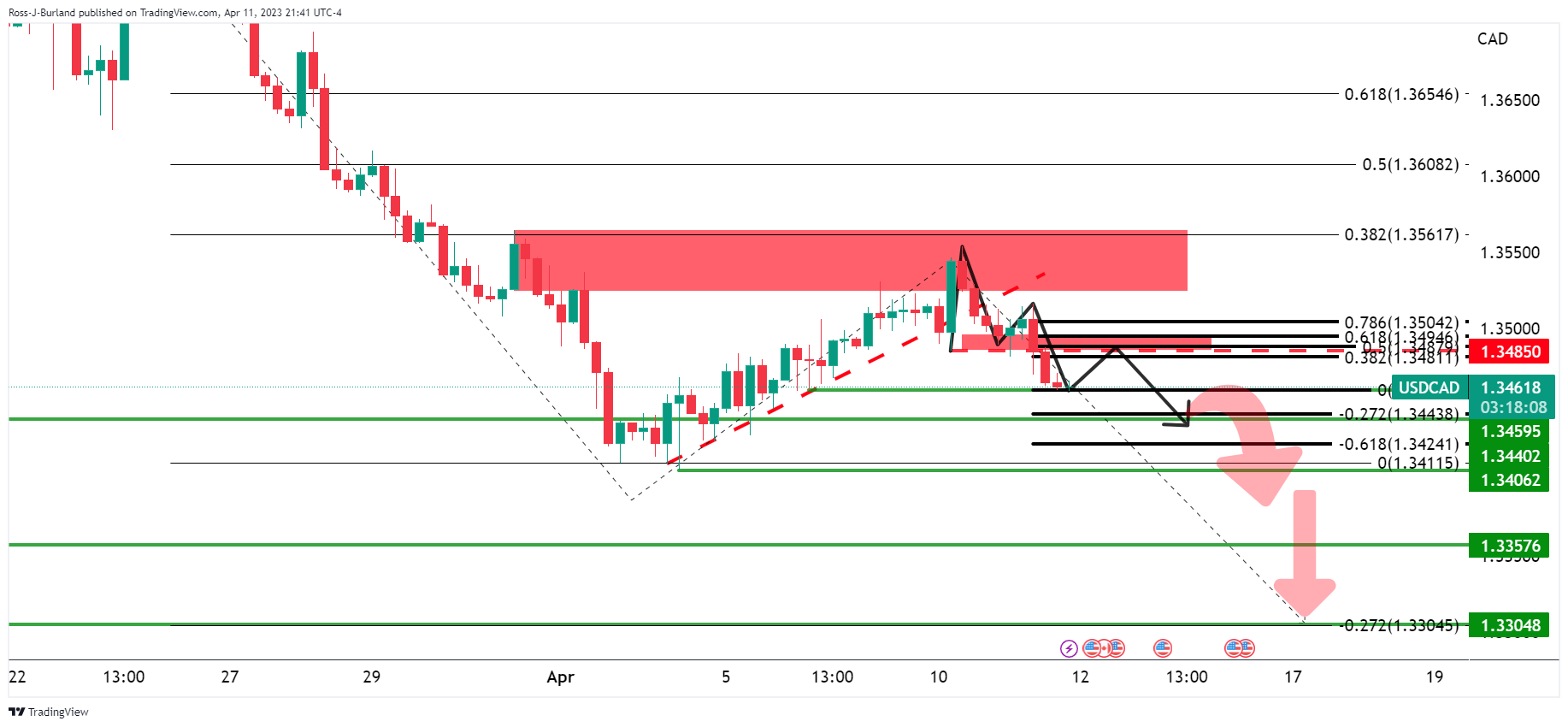

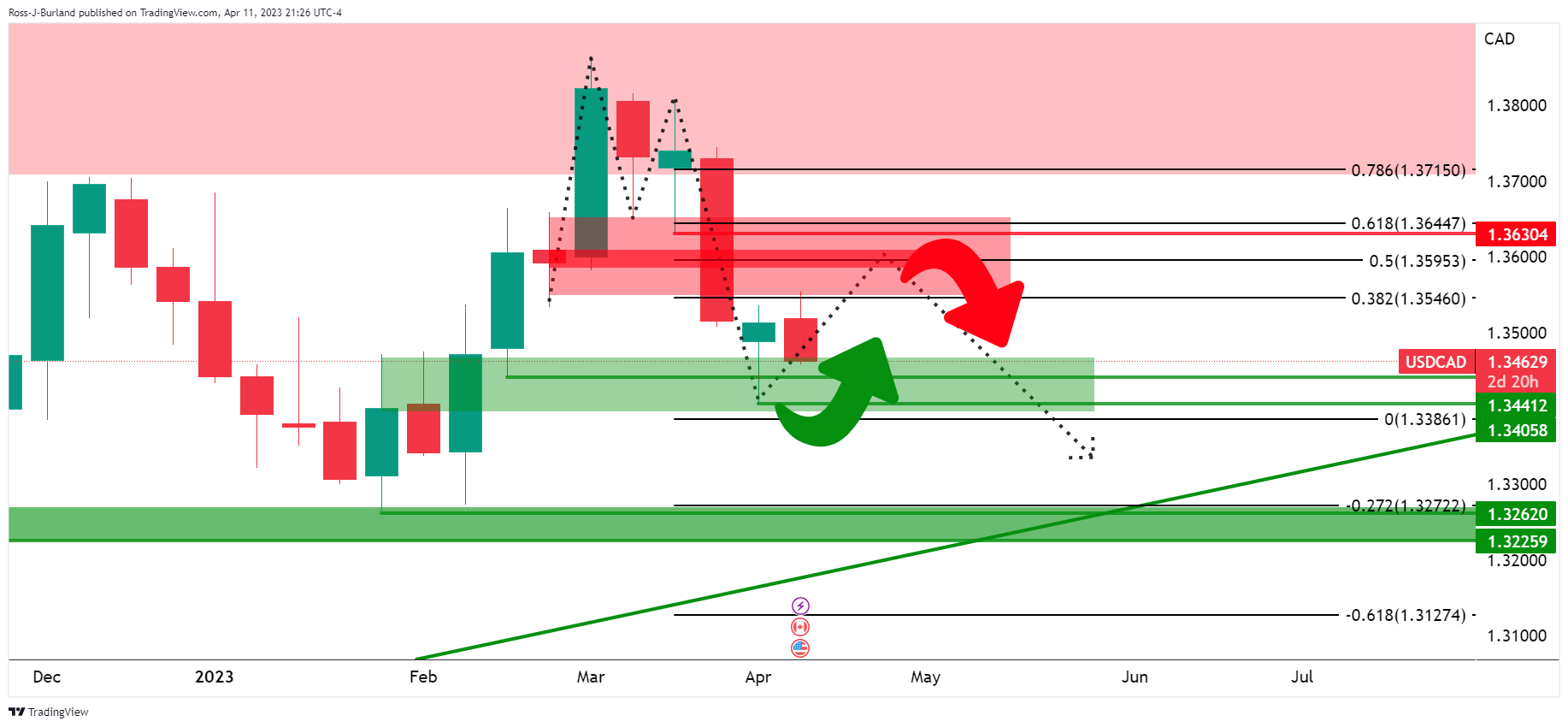

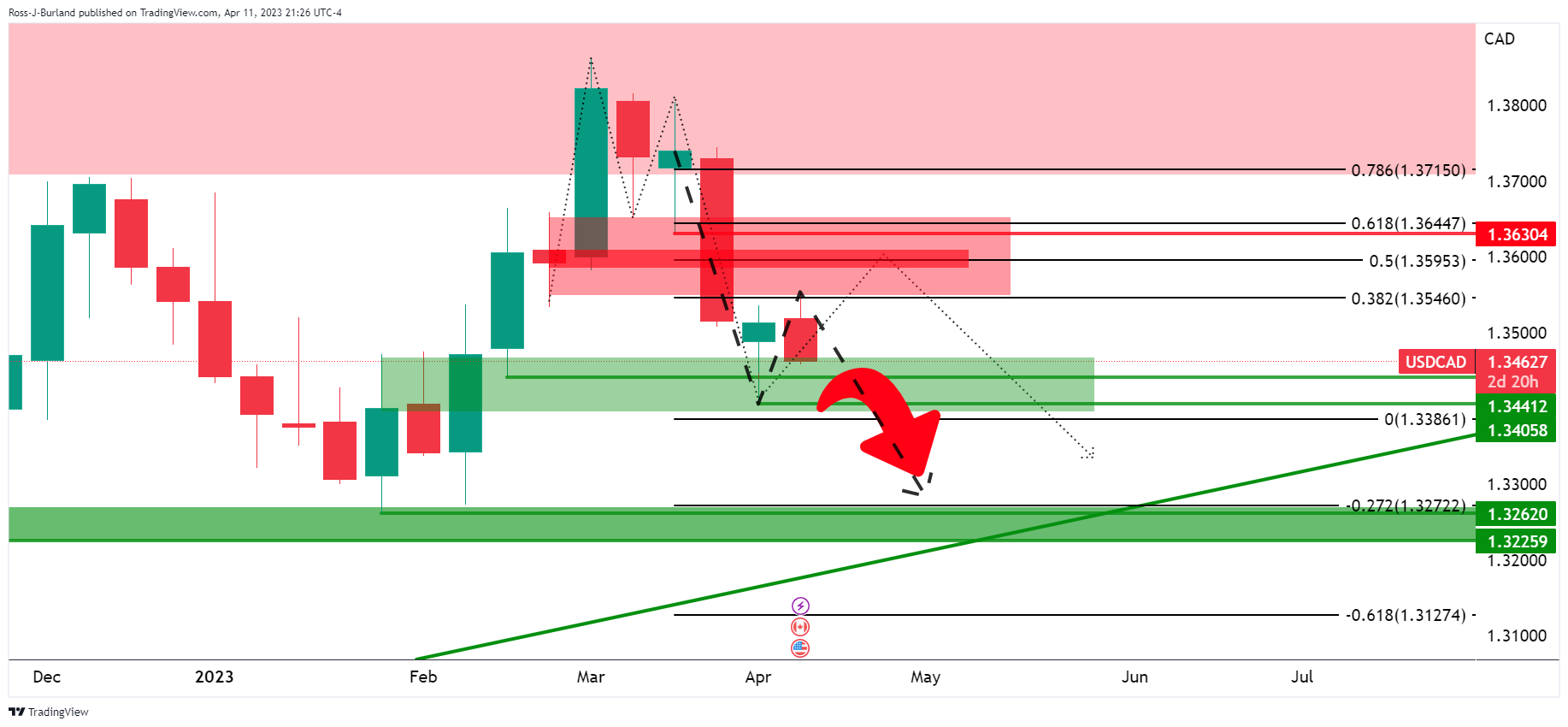

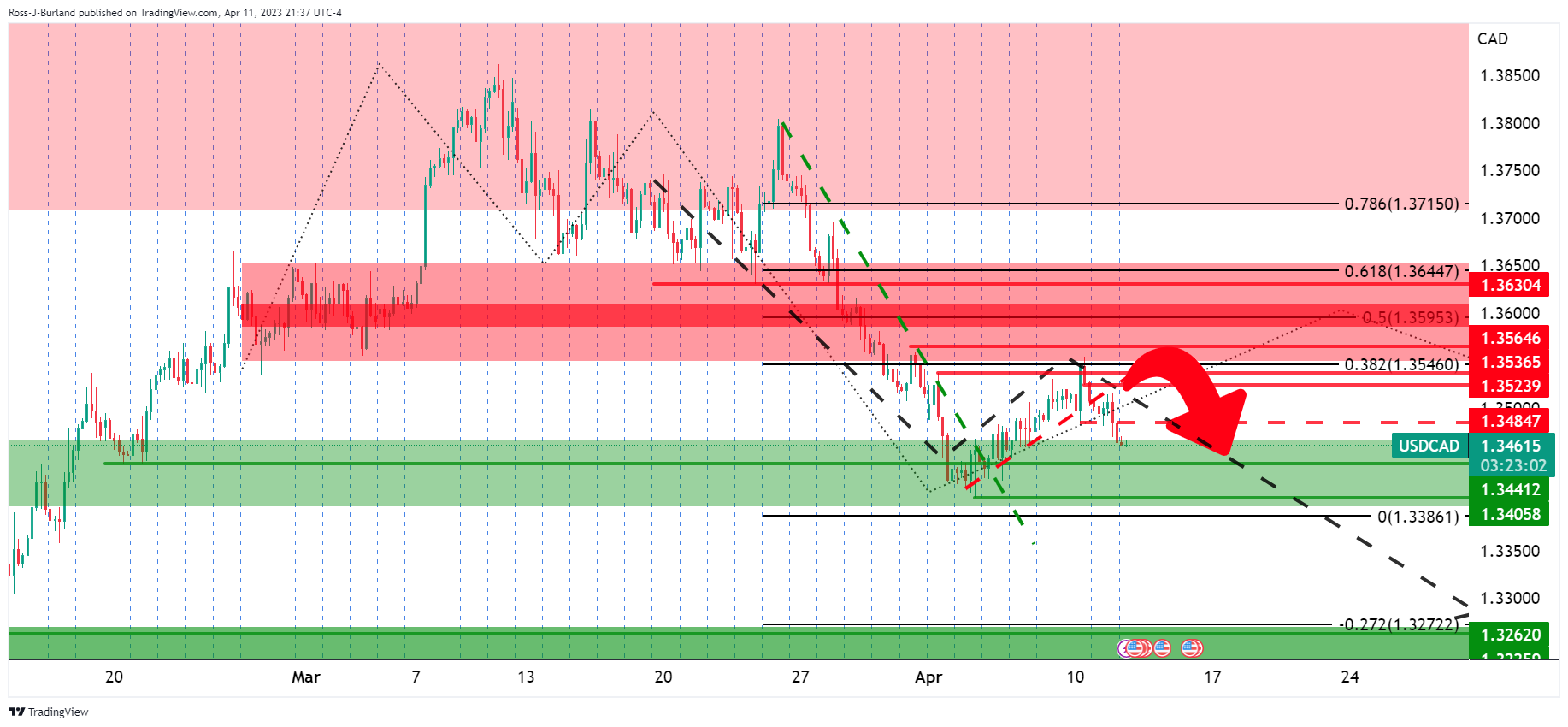

USD/CAD looks vulnerable around 1.3440 as Fed to pause rates sooner, oil above $83.00

- USD/CAD is struggling to keep its auction around 1.3440 as USD Index is eyeing more losses.

- Fed Daly believes that the central bank is at a point where a rate hike in each meeting is not necessary.

- The Canadian Dollar has registered a three-day losing streak despite the BoC Governor keeping interest rates steady at 4.5%.

The USD/CAD pair is struggling to sustain its auction around 1.3440 in the early Tokyo session. Downside bets for the Loonie asset are escalating as softened US Inflation and dovish Federal Reserve (Fed) policymakers are weighing heavily on the US Dollar. Also, higher oil prices amid weakness in the US Dollar are supporting the Canadian Dollar.

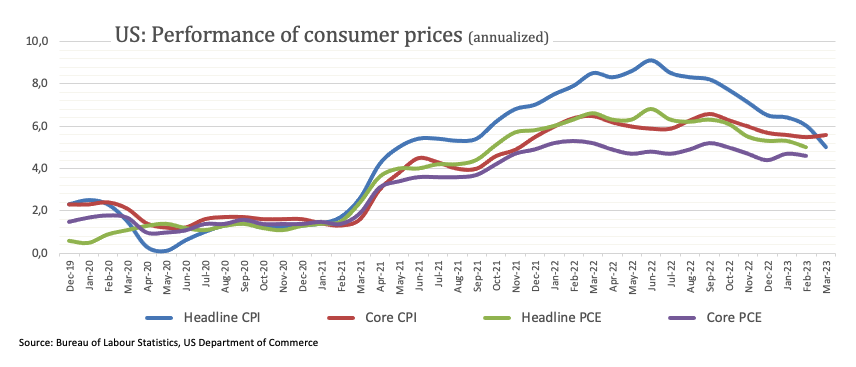

The USD Index is declining toward its two-month low of 100.82 as the United States Consumer Price Index (CPI) has softened beyond expectations to 5.0% due to weaker gasoline prices. However, core inflation rebounded to 5.6% but remains akin to consensus due to persistent rent prices.

The release of the Fed minutes for the March monetary policy meeting conveys that a 50 basis point (bp) rate hike move was in consideration but didn’t get life due to banking turmoil. Also, Fed policymakers are expecting a mild recession at the end of the year. Fears of mild recession joined anxiety over US quarterly earnings and weighed on S&P500. Meanwhile, the 500-US stocks basket futures have generated more losses in early Asia, portraying an asset-specific action.

San Francisco Fed Bank President Mary Daly believes that the Fed is at a point where a rate hike in each meeting is not necessary. However, she refrained from forecasting the end of a tightening cycle.

The Canadian Dollar has registered a three-day losing streak despite Bank of Canada (BoC) Governor Tiff Macklem keeping interest rates steady at 4.5%. BoC’s Governing Council considered the likelihood that rates may need to remain restrictive for longer to return inflation to the 2% target, however, the tight labor market could force the central bank to reconsider its neutral policy stance.

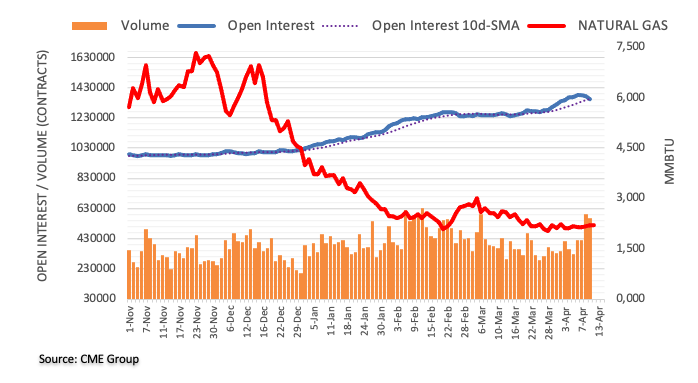

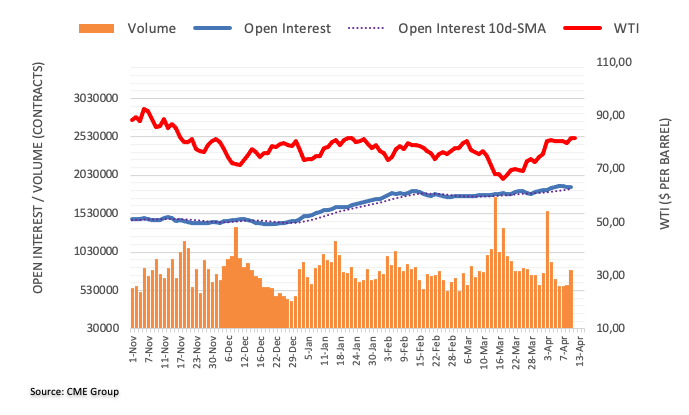

On the oil front, oil prices have shifted their business above the critical resistance of $83.00 amid weakness in the US Dollar and softening inflation expectations. The oil price ignored a mild build-up of inventories by 0.597 million barrels against the expectations of a drawdown for the week ending April 07, as reported by US Energy Information Administration (EIA). It is worth noting that Canada is the leading exporter of oil to the US and higher oil prices would strengthen the Canadian Dollar.

-

23:27

Silver Price Analysis: XAG/USD cracks to new YTD high as bulls' eye $26.00

- Once XAG/USD reaches around $25.60, it could aim toward $26.00.

- XAG/USD could fall to $25.00 if a retracement below $25.13 occurs.

Silver price rose to fresh 12-month highs at around $25.66 after cracking the previous YTD high of $25.13, as inflation data from the United States (US) decelerated. Also, the latest FOMC meeting minutes provided clues that the Fed considered pausing its tightening cycle. Therefore, the USD Dollar weakened and bolstered the white metal. At the time of writing, the XAG/USD is trading at $25.47 as the Asian session begins.

XAG/USD Price Action

Following a brief period of consolidation, the XAG/USD broke the top of the range capped at $25.13 and rallied above $25.60. While the XAG/USD aims to test $26.00, it may consolidate between $25.45-$25.60 before reaching April 2022 high at $25.87. Subsequently, it could target the $26.00 figure. Contrarily, if XAG/USD retraces below $25.13, it would exacerbate a fall toward $25.00. Downside risks remain at an April 6 low of $24.63, followed by a dip toward the 20-day Exponential Moving Average (EMA) at $24.06.

Oscillators-wise, the Relative Strength Index (RSI) is in overbought territory, suggesting that Silver could consolidate or reverse its course before posing a threat to the $26.00 mark. Conversely, the Rate of Change (RoC) suggests buyers are losing momentum; therefore, a pullback is expected.

XAG/USD Daily Chart

XAG/USD Technical Levels

-

23:25

Japan FinMin Suzuki: G7 policy guidance on supply chains is not necessarily aimed specifically at China

“Group of Seven (G7) policy guidance on supply chains is not necessarily aimed specifically at china,” said Japan’s Finance Minister (FinMin) Shunichi Suzuki said on early Thursday.

Additional comments

-

23:16

GBP/USD bulls attack 1.2500 as US inflation, FOMC Minutes signal Fed policy pivot, UK data dump eyed

- GBP/USD grinds near the highest levels in 10 months, marked in the last week.

- US inflation, Core inflation numbers favor Fed’s 0.25% rate hike in May.

- FOMC Minutes offered no new information and keeps US Dollar, yields depressed.

- More clues of US inflation, UK monthly GDP and Industrial Production eyed for clear directions.

GBP/USD remains sidelined around 1.2480-85 during the early hours of Thursday’s Asian session, following a two-day winning streak to refresh the weekly top. In doing so, the Cable pair portrays the trader’s cautious mood ahead of the UK’s data dump for March while cheering the downbeat signals from the US of late.

An absence of any major positive surprise from the US inflation and the latest Federal Open Market Committee (FOMC) Monetary Policy Meeting exerted downside pressure on the US Treasury bond yields and the US Dollar, which in turn favored the GBP/USD bears. In doing so, the Cable pair also cheered upbeat comments from Bank of England (BoE) Governor Andrew Bailey while paying little heed to Brexit chatters as US President Joe Biden travels to Northern Ireland.

On Wednesday, the US inflation measure, per the Consumer Price Index (CPI), dropped to the lowest level since May 2021, to 5.0% YoY in March from 6.0% prior and versus 5.2% market forecasts. However, the annual Core CPI, namely the CPI ex Food & Energy, improved to 5.6% YoY during the said month while matching forecasts and surpassing 5.5% prior.

On the other hand, FOMC Minutes signaled that the expectations for rate hikes were scaled back due to the turmoil in the banking sector, which in turn offered no fresh information and raised doubts on the hawkish Fed moves, apart from May’s 0.25% rate hike. “Several Federal Reserve policymakers last month considered pausing interest rate increases after the failure of two regional banks and a forecast from Fed staff that banking sector stress would tip the economy into recession,” mentioned Reuters.

Following the data, San Francisco Federal Reserve Bank President Mary Daly said that they had good news on inflation but added that she doesn't want to forecast the end of the tightening cycle. On the same line, Richmond Federal Reserve President Thomas Barkin said on Tuesday, in an interview with CNBC, that inflation certainly has peaked but warned that there are still ways to go.

With this, the US Dollar Index (DXY) dropped to a one-week low and the Treasury bond yields marked their first daily loss of the week. Further, the CME’s FedWatch Tool suggests a nearly 65% chance of the Fed’s 0.25% rate hike in May versus 72% marked the previous day.

At home, BoE’s Bailey ruled out fears of a banking crisis while adding, “Shouldn't `aim off' rates decision due to crisis.”

On a different page, US President Biden’s Northern Ireland visit promoted the Brexit deal but refrained from any major signals of the US-UK trade pact. “U.S. President Joe Biden said on Wednesday a deal between Britain and the European Union to simplify post-Brexit trade rules would lead to significant investment in Northern Ireland from "scores" of major U.S. companies,” said Reuters.

Looking forward, GBP/USD traders should pay attention to the UK’s monthly Gross Domestic Product (GDP) and Industrial Production (IP) data for immediate directions amid receding hawkish bets of the BoE’s next move. Following that, the US Producer Price Index (PPI) will be eyed for a clear guide.

Technical analysis

Unless providing a daily close below a three-week-old ascending support line, GBP/USD is well set to challenge May 2022 top surrounding 1.2665.

-

23:02

EUR/USD kisses 1.1000 as US Inflation softens further, focus shifts to US Retail Sales

- EUR/USD has touched the psychological resistance of 1.1000 as US Inflation has softened as expected.

- S&P500 settled Wednesday’s session on a negative note as the minutes from the Fed’s March meeting have flagged recession fears.

- Monthly Retail Sales data would contract by 0.4%, at a similar pace to the prior contraction.

The EUR/USD pair has kissed the psychological resistance of 1.1000 in the early Asian session for the first time in more than two months. The major currency pair is facing barricades in extending its rally above the same, however, the upside is still solid as the United States inflation has softened as expected by the market participants.

The US Dollar Index (DXY) has dropped perpendicularly to near 101.53 on hopes that the Federal Reserve (Fed) would consider an early pause in the policy-tightening spell. The USD Index is expected to slip further below its weekly low of 101.42.

Meanwhile, S&P500 settled Wednesday’s session on a negative note as the minutes from the Federal Reserve’s March meeting have flagged recession fears for later this year. Fed policymakers expect a mild recession led by the banking crisis. Also, anxiety over the quarterly result season forced investors to take caution. The market has turned asset-specific where equities are expected to witness sheer volatility while risk-sensitive currencies are getting traction.

As expected, headline inflation accelerated by merely 0.1% as weaker oil prices offered gasoline at cheaper rates. The annual headline inflation softened beyond expectations to 5% from the prior release of 6%. However, core inflation that strips off oil and food prices accelerated to 5.6% vs. 5.5% released earlier. The catalyst that fueled blood into core inflation is the persistent rent prices.

However, Fed policymakers are confident that US inflation will soften further to the middle of 3% by this year and will go down to desired levels in 2024.

Going forward, Friday’s US Retail Sales data will be keenly watched. Monthly Retail Sales data would contract by 0.4%, at a similar pace to the prior contraction. This might bolster the need to pause rates by Fed chair Jerome Powell.

On the Eurozone front, more rate hikes from the European Central Bank (ECB) are in the pipeline as inflation is extremely stubborn. Shortage of labor has been a major constraint of persistent inflation and now higher oil prices could elevate inflation further.

-

23:00

Bank Of Japan Governor Kazuo Ueda: Consumer inflation is currently around 3% but likely to slow ahead

Bank Of Japan Governor Kazuo Ueda told G7 that the BoJ will continue monetary easing until the price target is stable and sustainably achieved.

He said that Japan's consumer inflation is currently around 3% but likely to slow ahead.

More to come...

-

22:57

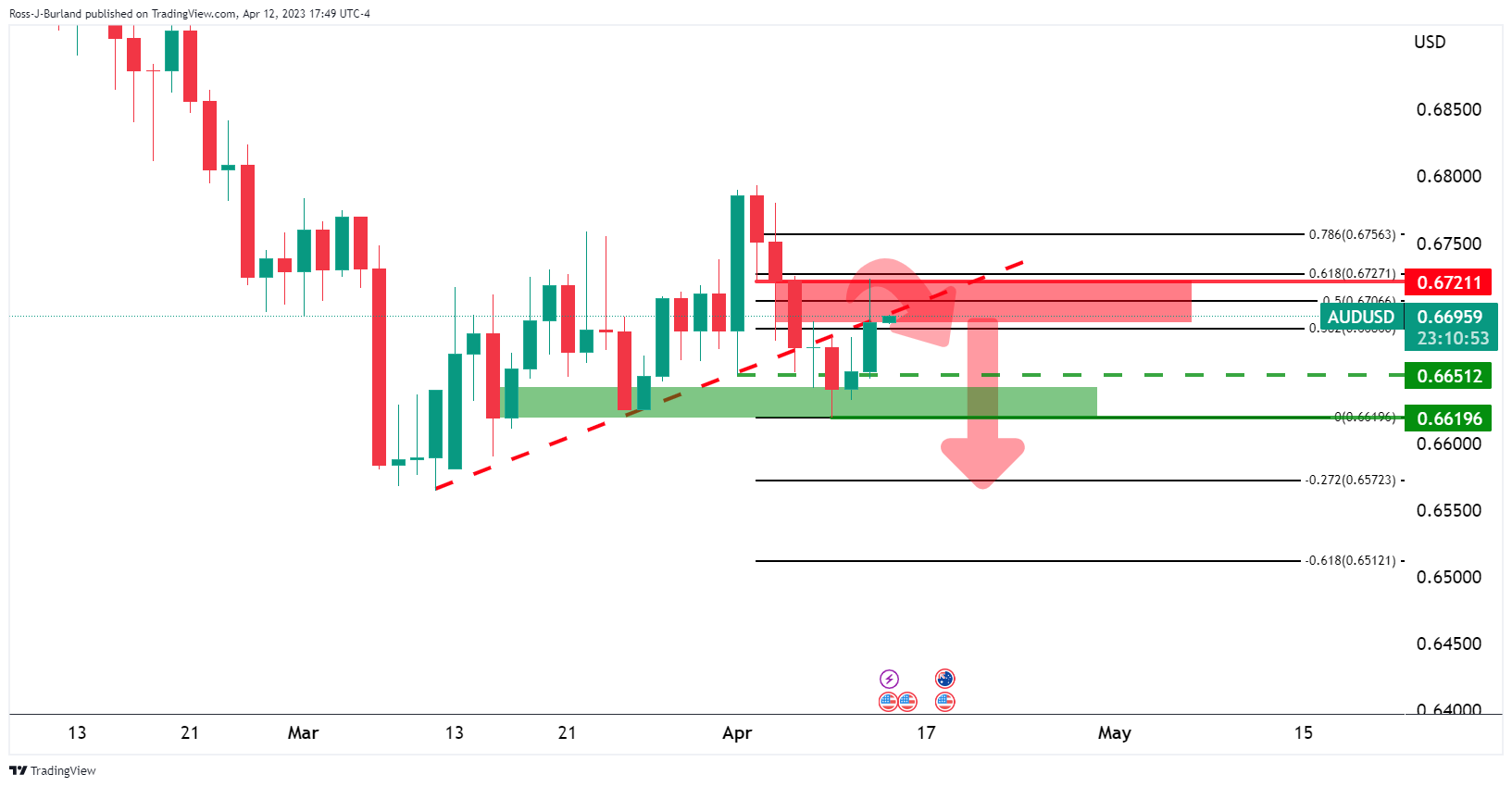

AUD/USD Price Analysis: Bears eye a break of key support structures

- AUD/USD´s 0.6720s on the upside are key.

- A break of 0.6670s and then the 0.6650s opens risk to the 0.6620s as the last defense for a significant run lower.

The Australian Dollar was not far from four-month lows touched in March in mid-week trade while investors weigh the monetary policy outlook domestically and abroad and US-China tensions. However, AUD/USD is poised bearish on the chart as the following technical top-down analysis illustrates:

AUD/USD H1 chart prior analysis

It was stated in the prior analysis, that AUD/USD had pulled back into the neckline of the M-formation in a 50% mean reversion of the hourly impulse. This area was anticipated to act as resistance ´´and lead to an eventual break of the trendline support and then 0.6650.´´

AUD/USD updates

This particular analysis played out as illustrated above. Over the course of the days, the price continued lower:

This is significant in relation to the overall bearish thesis as outlined in the prior analysis on the daily chart:

AUD/USD daily chart update

Cleaning up the chart a touch and zooming in, we can see when drawing the Fibonacci measurement tool on the correction´s length, the -272% ratio aligns with the targetted 0.6500s.

Cleaning up the chart even more so, we can see the break of the support structure, pull back into a 61.8% resistance area, and restest of the counter trendline. A premium has been given to the bears looking to get in on the break of structure who are targeting a significant downside breakout of the geometrical pattern towards 0.6500:

AUD/USD H4 chart

Meanwhile, there are a number of key levels and market structures as illustrated on the 4-hour chart. 0.6720 on the upside is key and should this fend off the bulls, then a break of the 0.6670s and then the 0.6650s opens risk to the 0.6620s as the last defense for a significant run lower towards 0.6550 and 0.6500 thereafter.

-

22:45

USD/CHF Price Analysis: Hits fresh lows on the back of weak US Dollar, with bears lurking around 0.8950

- USD/CHF dropped on mixed news about the United States economy, which weakened the US Dollar.

- USD/CHF bears lurk as support levels threaten to crumble below 0.8950.

- Bulls remain hopeful as resistance levels are within striking distance, at around 0.9000.

The USD/CHF tumbled to 22-fresh monthly lows at 0.8943 after fundamental news from the United States (US) weakened the US Dollar (USD), even though chances for another rate hike by the Fed remained high. As the Asian session begins, the USD/CHF Is trading at 0.8956, printing minuscule gains of 0.03%.

USD/CHF Price Action

Following a break of a support trendline drawn from March 13 lows around 0.9070, the USD/CHF exacerbated its fall and broke to a new YTD low since the first day of April. Although the pair braced for the 0.9050 area, it posted two days of 60-plus pips back-to-back losses, dragging prices to levels last seen since June 2021.

If USD/CHF breaks below 0.8950, that would expose the 2023 YTD low at 0.8943. Once cleared, the USD/CHF could tumble toward the June 9 low at 0.8926, followed by the 0.8900 figure. On the other hand, if the USD/CHF reclaims the 0.9000 mark, upside risks lie at the April 12 high at 0.9035, followed by 0.9050, ahead of testing the 20-day EMA at 0.9106.

USD/CHF Daily Chart

USD/CHF Technical

-

22:07

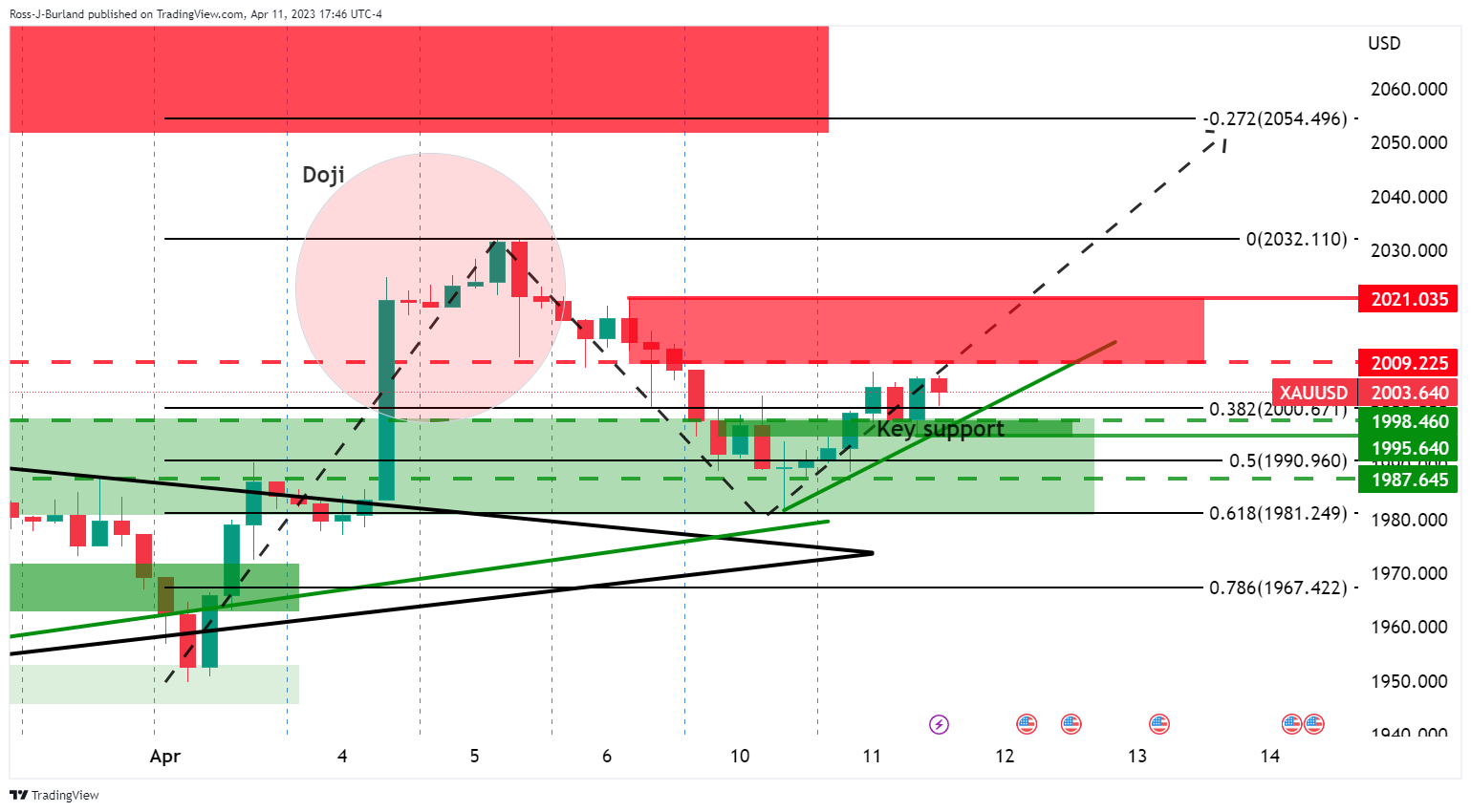

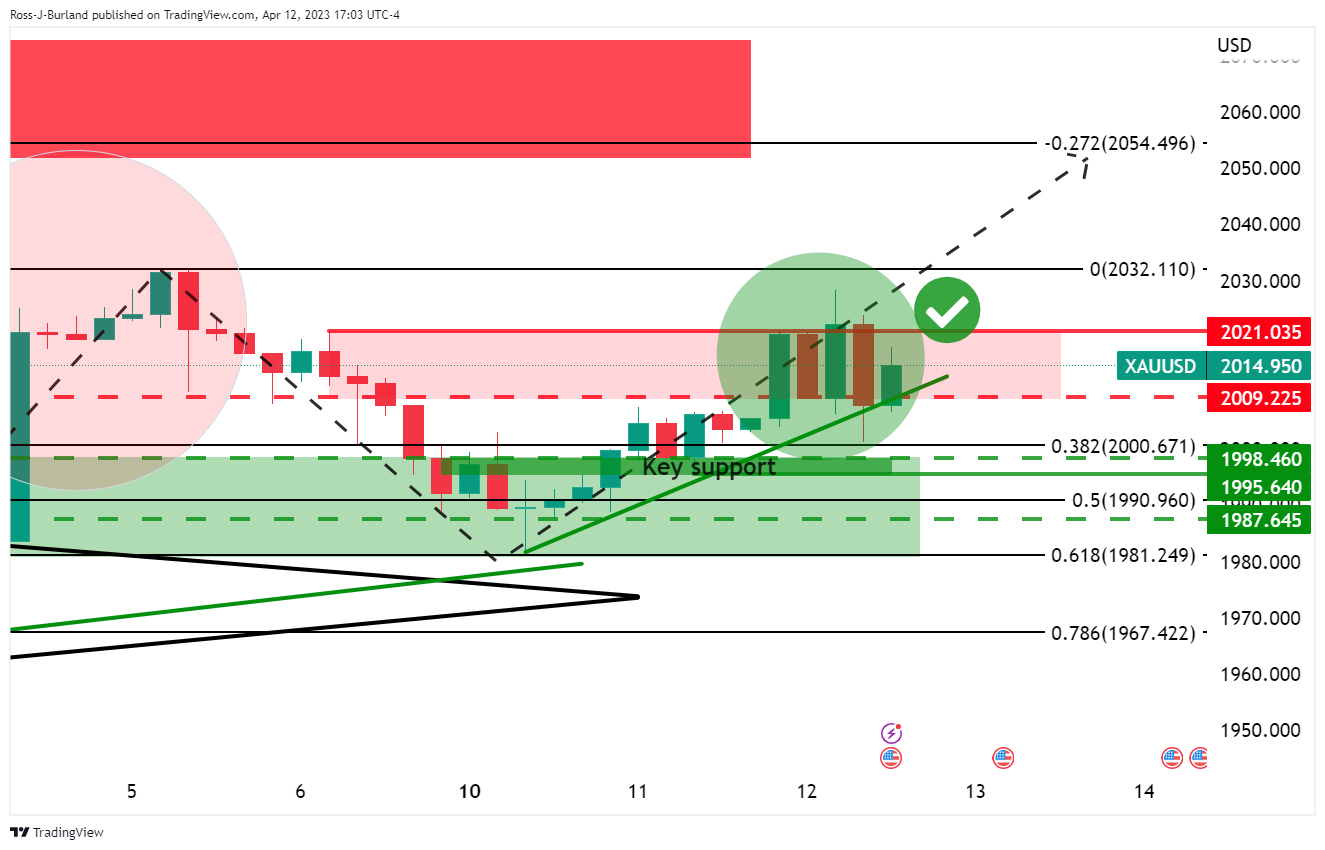

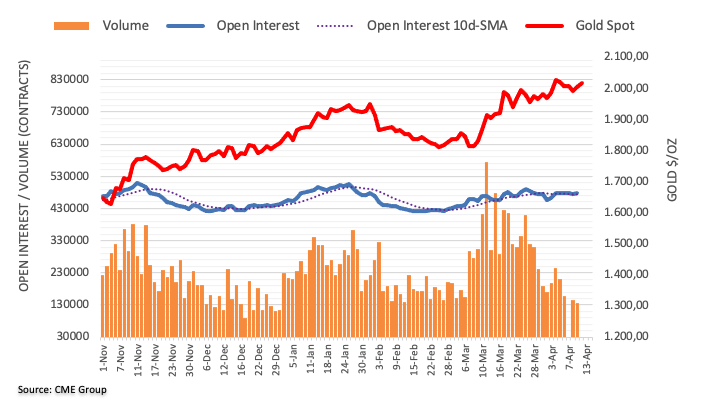

Gold Price Forecast: XAU/USD bulls take on resistance, eye $2,050

- Gold price bulls stay in the market on a weaker US Dollar.

- Federal Reserve bets are driving the Gold price with US CPI and FOMC minutes digested.

Gold price has been drawing its strength on Wednesday from a slide in the US Dollar and benchmark US yields as signs of cooling inflation bolstered bets that a pause in US rate increases was imminent. Gold price has traveled from a low of $2,001.22 to a high of $2,028.40 following both the latest US Consumer Price Index data and the minutes from the Federal Open Market Committee´s March 21-22 meeting whereby the rate hike was widely viewed as dovish.

Firstly, the Consumer Price Index (CPI) climbed 0.1% in March after advancing 0.4% in February, compared with a forecast of 0.2% gain in a Reuters poll. But in the 12 months through March, the core CPI gained 5.6%, after rising 5.5% on the same basis in February. That core measure strips out volatile food and energy prices and was posting a month-on-month gain of 0.4%.

Nevertheless, despite a hot core reading, Fed funds futures traders are pricing in 69% probability that the Fed will raise rates by an additional 25 basis points at its May 2-3 meeting, down from around 76% before the data. This is sending the US Dollar lower on the day and into technical support and has benefitted the Gold price as higher rates to tame rising price pressures have otherwise weighed on the non-yielding asset's appeal. Traders have positioned for one more hike in May followed by 2-to-1 bets of a pause in June.

´´While the miss on this morning's CPI report is giving the yellow metal a lift higher, the strong labour market trends and sticky core services inflation suggest a 25bp hike at the May FOMC meeting is still in the cards,´´ analysts at TD Securities have argued.

´´However, if the market increasingly feels the May hike could be the last of the cycle, with cut timing also top of mind, it could be the catalyst needed to see gold challenge the highs yet again. With that said, CTAs could add fuel to the fire with the next upside trigger sitting at $2,064,´´ the analysts added.

As for the Federal Reserve Open Market Committee minutes, they showed that the staff at the Committee are forecasting a mild recession later in 2023.

Key quotes from the FOMC minutes:

"Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years."

"In assessing the economic outlook, participants noted that since they met in February, data on inflation, employment, and economic activity generally came in stronger than expected. They also noted, however, that the developments in the banking sector that had occurred late in the intermeeting period affected their views of the economic and policy outlook and the uncertainty surrounding that outlook."

"Participants agreed that the labor market remained very tight."

"Some participants noted that given persistently high inflation and the strength of the recent economic data, they would have considered a 50 basis point increase in the target range to have been appropriate at this meeting in the absence of the recent developments in the banking sector. However, due to the potential for banking-sector developments to tighten financial conditions and to weigh on economic activity and inflation, they judged it prudent to increase the target range by a smaller increment at this meeting."

"Members concurred that the U.S. banking system is sound and resilient. They also agreed that recent developments were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation, but that the extent of these effects was uncertain. Members also concurred that they remained highly attentive to inflation risks."

Gold price technical analysis

Gold price H4 chart

In the prior Gold price analysis, it was stated that ´´the Gold price four-hour chart shows that the bulls are holding the fort at key support with $2,010/20 now eyed as the next major Gold price resistance area guarding $2,050. ´´

Gold price update

As illustrated, the price is making headway, but it is some way off still and is yet to crack the $2,020s resistance.

-

22:00

South Korea Import Price Growth (YoY) below expectations (-0.5%) in March: Actual (-6.9%)

-

22:00

South Korea Export Price Growth (YoY) registered at -6.4%, below expectations (-2.4%) in March

-

21:44

Forex Today: Dollar under pressure after US CPI, eyes on Australian employment

The March Australian Employment is the key report of the Asian session. China will release trade balance data. More US inflation data is coming on Thursday with the Producer Price Index. The US Dollar Index is under pressure and posted on Wednesday the lowest daily close since early February.

Here is what you need to know on Thursday, April 13:

The US Consumer Price Index (CPI) rose 0.1% in March, below the 0.3% increase expected, and the annual rate slowed to 5%, the smallest since May 2021. However, the Core rate edged higher from 5.5% to 5.6% YoY. Despite the persistence in Core inflation, the bond market continues to bet on rate cuts late in 2023 while still seeing some potential for another rate hike at the May FOMC meeting (the last one). The decline in US yields weighs on the US Dollar.

The US Dollar Index dropped to 101.50 and posted the lowest daily since February. More US inflation data is due on Thursday with the Producer Price Index. The weekly Jobless Claims report is also due.

EUR/USD jumped to the 1.1000 area but could not break above, while EUR/GBP rose above 0.8800. Expectations of more rate hikes from the European Central Bank (ECB) continue to offer support to the common currency.

GBP/USD gained ground for the second day in a row, and is back near the 1.2500 area, with a bullish outlook. UK GDP data and Industrial Production and Trade Balance are due on Thursday.

USD/JPY ended a positive streak and bottomed at 132.70. It rebounded during the American session above 133.00 but the short-term outlook remains bearish.

AUD/USD peaked at 0.6723 and then pulled back below 0.6700. Australia will release employment data on Thursday; market consensus is for an increase of 20,000 in jobs during March.

The Bank of Canada, as expected, kept interest rates unchanged at 4.5%, offering no significant changes in its forward guidance. BoC Governor Macklem said they are not forecasting a major contraction. He will speak again on Thursday at the International Monetary Fund Spring meetings. USD/CAD dropped for the second day in a row, falling below 1.3450, as it continues to move toward April lows.

NZD/USD rose modestly and retook 0.6200 as the Kiwi lags again. AUD/NZD rose above 1.0750, to weekly highs.

Bitcoin peaked above $30,500 after US CPI data but then pulled back, retreating to $29,800. Gold price peaked near $2,030 and then pulled back to $2,000 to end a volatile session around $2,015. Finally, silver broke decisively above $25.00.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:36

NZD/USD rebounds on risk-on sentiment amidst mixed US inflation data

- NZD/USD advanced after the US CPI dipped, despite the core CPI remaining unchanged.

- FOMC minutes showed that the banking crisis in the US put into the table a pause in the tightening cycle.

- NZD/USD Price Analysis: The upside could be capped by daily EMAs, but once cleared, it can rally to 0.6300.

The NZD/USD made a U-turn and climbs after the latest FOMC minutes flashed that Fed officials were eyeing a pause on their tightening campaign. Also, US inflation figures mixed keep investors leaning towards a riskier asset, as shown by Wall Street about to finish with minimal gains. At the time of writing, the NZD/USD is trading at 0.6217.

FOMCs gave mixed signals, on a pause and a larger hike

During the recent Federal Reserve monetary policy meeting, officials discussed the possibility of holding rates unchanged following the failure of two regional banks. This decision was motivated by concerns that further tightening could cause financial stress. Despite this, participants agreed that the Fed’s measures had helped ease worries in the banking sector. These measures were similar to those the Bank of England took after the bond turmoil resulting from former Prime Minister Liz Truss’s mini-budget. Against this backdrop, the Fed’s latest meeting supported a 25 basis point rate hike.

Participants commented that inflation is still above the 2% goal and that inflation pressures were “abating at a pace sufficient to return inflation to 2% over time.” Some Fed members noted that they considered a 50-basis point increase if there was not a banking crisis. Furthermore, Fed policymakers observed, “that inflation remained much too high and that the labor market remained too tight.”

Earlier, an inflation report from the US revealed that headline CPI dropped from 6% in February to 5% annually. However, core inflation, which excludes food and energy, remained at 5.6% YoY, unchanged.

NZD/USD Technical Analysis

The NZD/USD snapped two days of consecutive losses and is forming a bullish engulfing candlestick pattern. Although the pattern suggests that further upside is expected, the NZD/USD needs to clear a busy resistance area, with the 20, 100, and 50-day EMAs, at 0.6235, 0.6240, and 0.6246, respectively. Once that area is cleared, the NZD/USD could rally toward the February 14 high at 0.6389.

-

20:32

BoE´s Bailey: Banking crisis `testing' institutional structures

Bank of England Governor Andrew Bailey earlier said in a speech on Wednesday to the Institute of International Finance in Washington where he is attending International Monetary Fund meetings that he did not believe ´´we face a systemic banking crisis."

In recent trade, further comments have crossed the wires:

We watch QT very carefully, we do not want it to have detrimental impact on markets.

We are not seeing any concerning signs in markets due to QT.

I do not see makings of a repeat of 2007-08 crisis.Shouldn't `aim off' rates decision due to crisis.

Will take financial conditions into account.

"I do not see the evidence that we've got on our hands what I would call ... the makings of a 2007/8 financial crisis. I really don't see that," Bailey said when asked about recent instability in the banking sector.

"The system is in a much more robust condition," he added.

GBP/USD update

The Great British Pound rose towards $1.25 vs. the US dollar, moving closer to a ten-month high of $1.2525 touched on April 4th.

The Pound Sterling is getting a boost from the softer-than-expected US Consumer Price Index data that solidified that sentiment that the Federal Reserve will likely pause its rate hiking cycle soon.

-

20:26

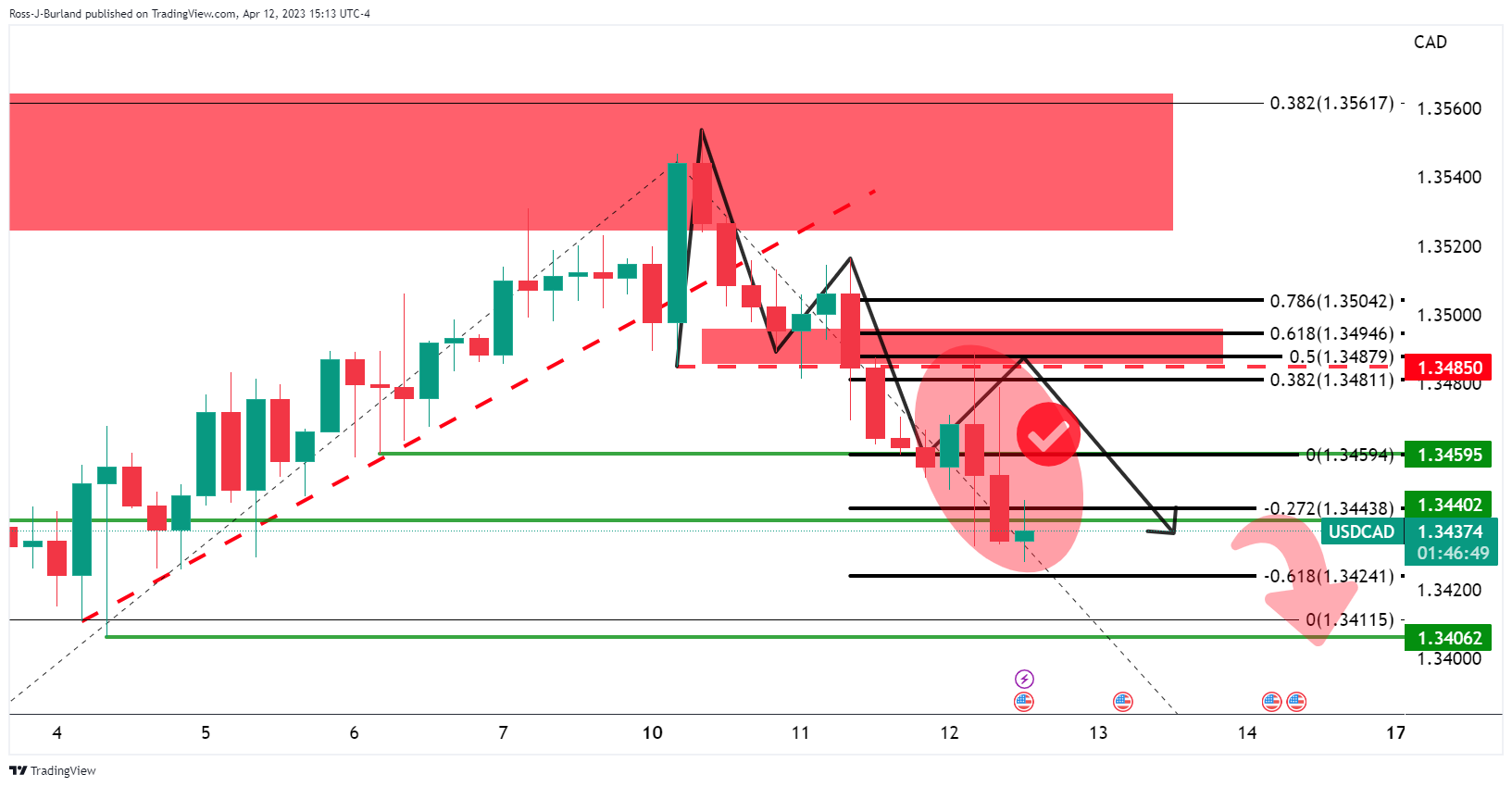

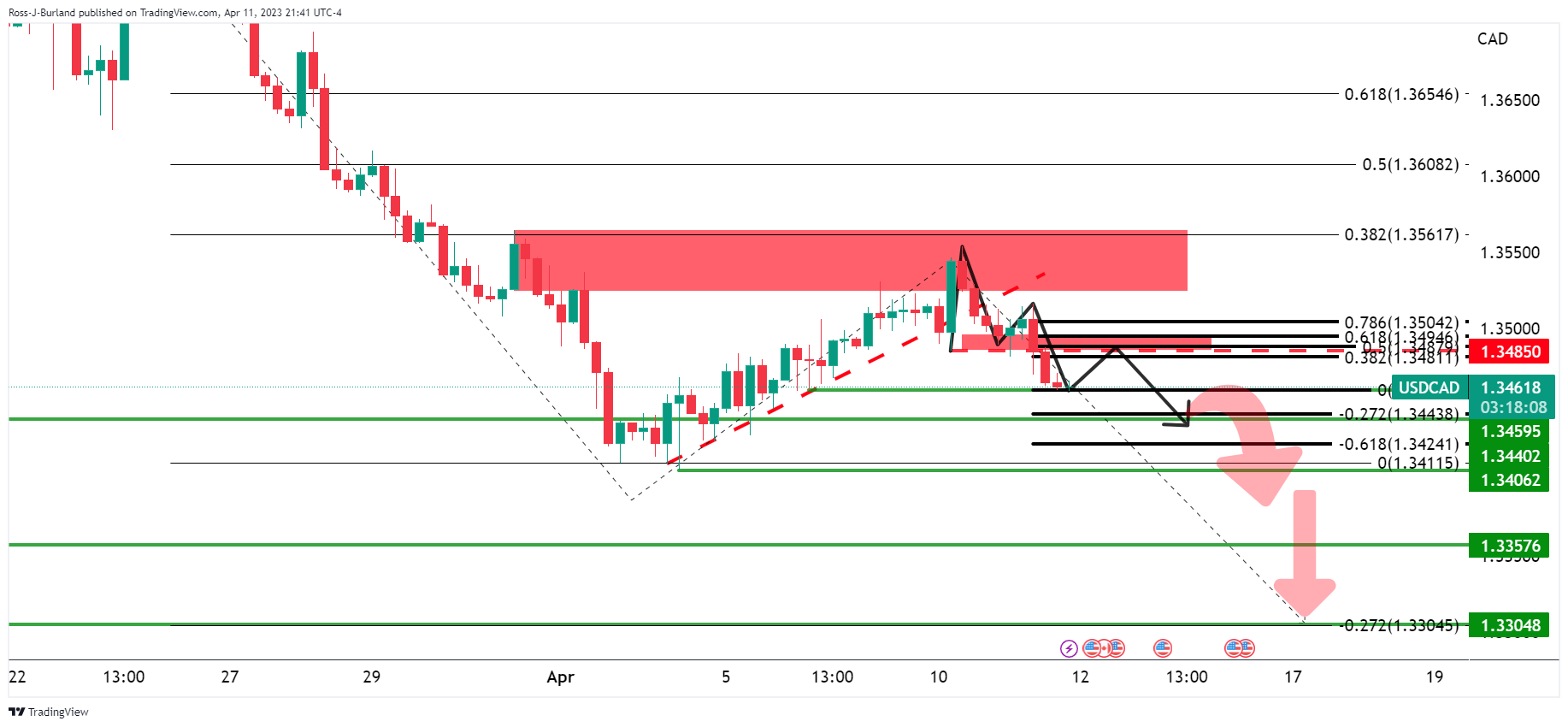

USD/CAD Price Analysis: Bears are in the market and eye test of 1.3400

- USD/CAD bears lurking below a 38.2% Fibonacci retracement area.

- Bears look to the target area of the 1.3400s.

As per the prior USD/CAD analysis, USD/CAD Price Analysis: Bears are in control and target a break of daily lows, the price dropped accordingly and the bears are in the clear for a run to test 1.3400.

USD/CAD prior analysis

It was argued that ´´the bears will stay the course and break below the recent lows for a bearish extension.´´

When moving down to the 4-hour chart, it was stated that ´´the price was meeting resistance very close to the daily 38.2% Fibonacci ... breaking 4-hour structure to the downside, as illustrated below:

The price is on the back side of the prior 4-hour bullish trend/correction, and the M-formation can be regarded as a topping pattern. The neckline of the pattern might act as resistance on a pullback and lead to a subsequent lower low to target the 1.3440-50s.´´

It was also argued that a break below 1.3440 opened the risk to test 1.3400 prior lows and bearish extensions as per the weekly chart, as illustrated at the beginning of the prior top-down analysis.

USD/CAD update, live charts

The price has come in a stone's throw´s distance from 1.3400, reaching a low of 1.3428 so far on the day. We are likely to see consolidation at this juncture, however.

USD/CAD H1 chart

On the hourly chart, we can see that the price is being rejected at old support again. A 38.2% Fibonacci retracement aligns with prior support that would be expected to act as resistance on a restest while the bears commit to the front side of the bearish trend. This in turn could lead to an additional push lower and into the target area of the 1.3400s.

-

19:48

G7 reaffirms financial system is resilient

The G7 Communique has been reported to reaffirm that the financial system is resilient and it has reiterated the determination to maintain economic and financial stability. The .communique also states that central banks remain strongly committed to achieving price stability.

US Dollar update

At 101.50 DXY, the US Dollar was being pressured on Wednesday following the Consumer Price Index (CPI) that increased in March at a slower-than-expected pace and minute from the FOMC´s March 21-22 meeting whereby the rate hike was widely viewed as dovish. DXY has dropped from a high of 102.15 to a low of 101.449 on the day so far.

-

19:38

US: Budged deficit hits $1.1 trillion in first half of FY 2023

The US government recorded a $378 billion budget deficit in March. The Treasury Department informed that total receipts in March totalled $313 billion and outlays jumped to $691 billion.

In the same month last year, the deficit was $193 billion. So far, during the fiscal year 2023, the fiscal deficit is $1.1 trillion, 65% higher from a year earlier. The total deficit in FY 2022 was $1.3 trillion.

-

19:33

GBP/USD sees gains after Fed discussed a possible pause on its tightening cycle

- GBP/USD stays positive, aiming towards testing the 1.2500 figure.

- FOMC’s minutes showed that participants expected to raise 50 bps, but the banking crisis, put a possible pause on the table.

- US Inflation dipped, but core CPI remained at the prior’s month levels.

The GBP/USD advances after the release of the US Federal Reserve Open Market Committee (FOMC) minutes for the last meeting showed that officials discussed a possible pause in their tightening campaign. Therefore, the GBP/USD is trading at 1.2489 after hitting a daily low of 1.2398.

FOMC’s minutes flashed a pause and a 50 bps rate hike

In the latest Fed monetary policy reunion, officials considered a pause after the failure of two regional banks amidst fears that further tightening could cause financial stress. Nevertheless, those participants and others agreed that actions taken by the Fed calmed worries in the banking sector. The measures taken by the Fed were similar to those of the Bank of England (BoE) after the bond turmoil due to the ex-PM Liz Truss’s mini-budget, given the backdrop, that supported a 25 bps rate hike by the Fed at their latest meeting.

Participants commented that inflation is still above the 2% goal and that inflation pressures were “abating at a pace sufficient to return inflation to 2% over time.” Some Fed members noted that they considered a 50-basis point increase if there was not a banking crisis. Furthermore, Fed policymakers observed, “that inflation remained much too high and that the labor market remained too tight.”

Earlier, an inflation report from the US revealed that headline CPI dropped from 6% in February to 5% annually. However, core inflation, which excludes food and energy, remained at 5.6% YoY, unchanged.

GBP/USD Technical Analysis

After snapping on Tuesday, four days of straight losses, the GBP/USD is poised to test the 1.2500 figure in the near term. Even though the 100-day EMA remains below the 200-day EMA, it’s about to cross over, cementing the case for the GBP bullish bias. Though a decisive break of 1.2500, the GBP/USD pair could rally and test the June 9 high at 1.2599, ahead of clearing 1.2600.

-

19:23

US Dollar testing key support after FOMC minutes

- FOMC minutes, US CPI events are weighing on the US Dollar.

- US Dollar bears are in the market and eye a break of temporary support.

- Bulls look for commitments for a correction from support.

At 101.469 DXY, the US Dollar is being pressured on Wednesday following the Consumer Price Index (CPI) that increased in March at a slower-than-expected pace and minute from the FOMC´s March 21-22 meeting whereby the rate hike was widely viewed as dovish. DXY has dropped from a high of 102.15 to a low of 101.449 on the day so far.

The FOMC minutes showed that the staff at the Committee are forecasting a mild recession later in 2023 but also noted that wage growth was still well-above rates consistent with the 2% inflation target.

Key quotes from the minutes:

"Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years."

"In assessing the economic outlook, participants noted that since they met in February, data on inflation, employment, and economic activity generally came in stronger than expected. They also noted, however, that the developments in the banking sector that had occurred late in the intermeeting period affected their views of the economic and policy outlook and the uncertainty surrounding that outlook."

"Participants agreed that the labor market remained very tight."

"Some participants noted that given persistently high inflation and the strength of the recent economic data, they would have considered a 50 basis point increase in the target range to have been appropriate at this meeting in the absence of the recent developments in the banking sector. However, due to the potential for banking-sector developments to tighten financial conditions and to weigh on economic activity and inflation, they judged it prudent to increase the target range by a smaller increment at this meeting."

"Members concurred that the U.S. banking system is sound and resilient. They also agreed that recent developments were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation, but that the extent of these effects was uncertain. Members also concurred that they remained highly attentive to inflation risks."

US CPI core stays hot

As for the inflation data, the report showed the prices urban consumers pay for a basket of goods and services increased by 0.1% from the previous month and 5.0% year-on-year, landing below consensus expectations of 0.2% and 5.2%, respectively.

But the core measure came in hot. This measure strips out volatile food and energy prices and was posting a month-on-month gain of 0.4%, and 5.6% on an annual basis, 10 basis points hotter than the February print.

Nevertheless, Fed funds futures traders are pricing in 69% probability that the Fed will raise rates by an additional 25 basis points at its May 2-3 meeting, down from around 76% before the data. This is sending the US Dollar lower on the day and into technical support as follows:

US Dollar technical analysis

Daily chart

The bias is to the downside while the index is on the front side of the bearish trend and considering the strong daily bearish impulse from the 78.6% Fibonacci retracement level.

H1 chart

However, there are prospects of a correction on the lower time frames from the support area as illustrated above.

-

19:06

FOMC minutes: Staff’s projections included a mild recession starting later this year

The Federal Open Market Committee (FOMC) released the minutes of the March 21-22 meeting, spurring little action across the FX board. According to the document, staff’s projections included a “mild recession starting later this year, with a recovery over the subsequent two years”.

In March, the Federal Reserve (Fed) raised the key interest rates by 25 basis points to 4.75% - 5.0%, as expected amid banking turmoil. Since the meeting, banking concerns eased and inflation data released on Wednesday showed the Consumer Price Index slowed to 5% in March, the lowest since May 2021; however, the Core rate edged higher to 5.6%. The minutes showed that some Fed officials would have considered a 50 basis point rate hike in the absence of the developments in the banking sector.

Key quotes from the minutes:

"Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years."

"In assessing the economic outlook, participants noted that since they met in February, data on inflation, employment, and economic activity generally came in stronger than expected. They also noted, however, that the developments in the banking sector that had occurred late in the intermeeting period affected their views of the economic and policy outlook and the uncertainty surrounding that outlook."

"Participants agreed that the labor market remained very tight."

"All participants agreed that it was appropriate to raise the target range for the federal funds rate 25 basis points to 4¾ to 5 percent. All participants also agreed that it was appropriate to continue the process of reducing the Federal Reserve’s securities holdings."

"Several participants noted that, in their policy deliberations, they considered whether it would be appropriate to hold the target range steady at this meeting. They noted that doing so would allow more time to assess the financial and economic effects of recent banking-sector developments and of the cumulative tightening of monetary policy. However, these participants also observed that the actions taken by the Federal Reserve in coordination with other government agencies helped calm conditions in the banking sector and lessen the near-term risks to economic activity and inflation."

"Some participants noted that given persistently high inflation and the strength of the recent economic data, they would have considered a 50 basis point increase in the target range to have been appropriate at this meeting in the absence of the recent developments in the banking sector. However, due to the potential for banking-sector developments to tighten financial conditions and to weigh on economic activity and inflation, they judged it prudent to increase the target range by a smaller increment at this meeting."

"Members concurred that the U.S. banking system is sound and resilient. They also agreed that recent developments were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation, but that the extent of these effects was uncertain. Members also concurred that they remained highly attentive to inflation risks."

Market reaction:

The US Dollar remains at session lows, with the Dollar Index headed toward the lowest close since early February, down 0.65%. EUR/USD rose to test the 1.1000 area. US yields held steady, with the US 10-year around 3.43% and the 2-year slightly below 4%.

-

19:00

United States Monthly Budget Statement below forecasts ($-302B) in March: Actual ($-378B)

-

18:55

USD/JPY Price Analysis: Dips as it faces resistance at the 200-DMA, post-US CPI

- The USD/JPY retraced after hitting a daily high of 134.00, though solid resistance pressured USD Bulls.

- USD/JPY Price Analysis: Downside expected as it remains below 133.77; otherwise, once reclaiming 134.00, 135.00 would be up for grabs.

The USD/JPY remains downward pressured, following a release of inflation figures in the United States (US) dipped, though core inflation stood unchanged for two straight months. At the time of typing, the USD/JPY is trading at 133.33, snapping four days of gains after hitting a high of 134.04.

USD/JPY Price Action

From a technical perspective, the USD/JPY is trapped within the 200 and 50-day EMAs at 133.70 and 133.09. the USD/JPY peaking on Tuesday at around 133.80 was difficult to surpass, as shown by Wednesday’s price action. Nonetheless, the USD/JPY needs a daily close below the 200-day EMA to cement the case for a neutral-to-downward biased, exerting selling pressure on the USD/JPY pair.

If USD/JPY achieves that scenario, the next support would be the 133.000 figure. A breach of the latter will expose the 20-day EMA at 132.70, followed by the 132.00 mark. On the other hand, a USD/JPY resumption above the 200-day EMA will exacerbate a recovery above the confluence of the 100-day EMA and the 134.00 figure. Once cleared, the USD/JPY could threaten January’s 6 high at 134.77, before reaching the 135.00 figure.

USD/JPY Daily Chart

USD/JPY Technical Levels

-

18:51

EUR/USD traders getting set for FOMC minutes finale

- EUR/USD bulls eye the 1.1020s into the FOMC after US CPI.

- Bears eye a pull back into test 1.0970.

EUR/USD reached 1.0999, the highest since February 2, and was last at 1.0995, up 0.79% on the day with the US Dollar index, DXY last at 101.51, down 0.62% on the day.

The short covering in EUR continues into the middle of the week as the US Dollar dropped sharply on Wednesday after data showed US Consumer Price Index rose less than expected in March. Traders are of the mind that the Federal Reserve is going to stop raising rates after a possible increase in May and potentially pivot before the end of the year.

CPI rose just 0.1% last month, below economists’ expectations for a 0.2% gain, and down from a 0.4% increase in February. In the 12 months through March, the CPI increased 5.0%, the smallest year-on-year gain since May 2021. The CPI rose 6.0% on a year-on-year basis in February. Excluding the volatile food and energy components, the CPI increased 0.4% last month after rising 0.5% in February. However, stubbornly high rental prices continued to drive core CPI.

The data comes ahead of the Federal Open Market Committee minutes at the top of the hour and US Retail Sales data on Friday. The minutes will be from the FOMC´s March 21-22 meeting whereby the rate hike was widely viewed as dovish.

´´The distribution of the March dot plot for 2023, however, suggested a more hawkish sentiment across the FOMC. With banking stress now appearing to be somewhat contained, the minutes for this meeting might emphasize this hawkish sentiment given continued elevated inflationary pressures,´´ analysts at TD Securities explained.

Meanwhile, ahead of the minutes, Fed funds futures traders are pricing in 69% probability that the Fed will raise rates by an additional 25 basis points at its May 2-3 meeting, down from around 76% before the data.

EUR/USD technical analysis

H4 charts

H1 chart

With 1.1020s on the radar for the bulls, should the bears commit, however, then there will be prospects of a correction back into support near 1.0970. The FOMC minutes could be the catalyst either way.

-

18:05

United States 10-Year Note Auction dipped from previous 3.985% to 3.455%

-

17:44

USD/MXN falls as Mexican Peso gains momentum on mixed US CPI

- USD/MXN reached a daily low shy of cracking 18.00 as a reaction to US CPI data.

- Sentiment shifted mixed as US core CPI was unchanged, cementing the case for a Fed rate hike in May.

- Federal Reserve officials remain committed to tackling inflation, even though it causes a recession.

The Mexican Peso (MXN) continued to strengthen against the US Dollar (USD), following contradictory US inflation data, which cemented the case for another rate hike by the US Federal Reserve (Fed) at the upcoming May meeting. The USD/MXN is trading at around 18.08, below its opening price by a half percent.

Inflation in the United States dropped, except for core CPI

US equities are fluctuating following an important March inflation report. The Consumer Price Index (CPI) rose 5% YoY, below estimates of 5.3% and lower than February’s 6%, showing that Fed’s tightening is indeed working. Nonetheless, excluding volatile items like food and energy, the so-called core CPI rose 5.6% YoY, unchanged compared to the consensus and the prior’s month data.

Given that core CPI remains stickier than expected, the Federal Reserve (Fed) is expected to raise rates by 25 bps at the May meeting. The CME FedWatch Tool shows odds for a 25 bps hike at 66.5%, below Tuesday’s 72.9%.

The USD/MXN edged lower as an initial reaction to the headline, with the USD/MXN pair reaching a new weekly low of 18.0187, before rebounding and stabilizing around current exchange rates. The greenback weakened, as shown by the US Dollar Index (DXY), down 0.59%, at 101.535, weighed by falling US bond yields.

At a certain point, the US 2-year bond yield dropped 14 bps, but so far has erased some of those losses and is back above 4%, down 2 bps.

Meanwhile, Federal Reserve officials posted mixed comments, led by Minnesota’s Fed Neil Kashkari, who commented on Wednesday that tighter monetary conditions and difficult credit conditions could have caused the Silicon Valley Bank (SVB) crisis. But he emphasized, “We need to get inflation down. ... If we were to fail to do that, then your job prospects would be really hard.”

Later the Richmond Fed President Thomas Barkin said that the US inflation report was as expected but added that although inflation has peaked, “there is still some way to go.” Furthermore, he said that before the May meeting, the PCE and the ECI would be crucial to assess his stance at the upcoming meeting.

At around 18:00 GMT, the Federal Reserve Open Market Committee (FOMC) will reveal its latest monetary policy meeting minutes. The minutes are expected to show discussions of the latest meeting after the defaults of Silicon Valley Bank and Signature Bank.

USD/MXN Technical Analysis

The USD/MXN is downward biased, though facing solid support. For a bearish continuation, the USD/MXN pair needs to crack 18.00, to pave the way for a re-test of the YTD low at 17.8968. Otherwise, the emerging market currency could weaken, exposing the 20-day EMA at 18.2533, which USD/MXN buyers would test. Break above, and the USD/MXN could rally to the 50-day EMA at 18.4526.

-

17:33

Fed's Daly: There's a lot more in the pipeline of monetary policy tightening

San Francisco Federal Reserve Bank President Mary Daly said that they had good news on inflation but added that she doesn't want to forecast the end of the tightening cycle, as reported by Reuters.

Key takeaways

"Bank stresses have stabilized."

"We have tools for monetary policy, financial stability and they don't compete with each other."

"I expect inflation to end 2023 a little above 3%."

"Inflation expectations are anchored, allowing us to take a couple of years to bring down inflation."

"Policy tightening is at a point now where we don't expect to continue to raise rates every meeting."

"There is a sense we will get rates up to a level and stay."

"Will look in CPI inflation to see if core services ex-housing are coming down."

"We are getting signs of cooling in labor market, but not there yet."

"There's a lot of uncertainty about how long it takes for rate hikes to impact the economy."

"There's a lot more in the pipeline of monetary policy tightening."

"When credit conditions tighten, it puts brakes on the economy so Fed doesn't have to tighten more."

"Bank lending will contract."

Market reaction

These comments failed to help the US Dollar find demand and the US Dollar Index was last seen losing 0.6% on the day at 101.52.

-

17:13

Russia Consumer Price Index (MoM) above expectations (0.2%) in March: Actual (0.4%)

-

17:10

Fed's Daly: Strength of economy, elevated inflation suggest more work to do on rate hikes

San Francisco Federal Reserve Bank President Mary Daly said on Wednesday that the strength of the US economy and elevated inflation suggests that they have more work to do on rate hikes, as reported by Reuters.

Key takeaways

"Prudent Fed policy requires calibrating decisions based on all the data."

"Good reasons that economy may keep slowing even without further rate hikes."

"We are committed to ensuring all deposits are safe."

"Fed is prepared to use all tools for any size bank to keep system safe and sound."

"Economy remains strong, labor market extremely tight."

"Fed must monitor tightening credit conditions in determining path of rates."

"Committed to 2% inflation goal."

"Global headwinds, lagging impact of Fed rate hikes are also factors in setting policy."

Market reaction

The US Dollar showed no immediate reaction to these comments and the US Dollar Index was last seen losing 0.6% on the day at 101.55.

-

16:46

Fed: One more rate hike coming – Wells Fargo

Analysts at Wells Fargo see one more interest rate hike coming from the Federal Reserve, following Wednesday’s US Consumer Price Index report. According to them, inflation remains too hot for Fed’s liking.

Key quotes:

“The core CPI has been above 5% on a year-over-year basis for 16 consecutive months, and over the first three months of 2023, core consumer prices have risen at an equally hot 5.1% annualized rate. This is not to say there has been no progress towards taming inflation. Energy prices have outright fallen over the past year, food inflation is slowing and prices for certain goods that surged during the pandemic, such as used vehicles, have declined. But, directional progress should not be confused with mission accomplished.”

“We expect another 25 bps rate hike from the FOMC at the conclusion of its next meeting on May 3.”

“We think the May 3 rate hike will be the last of the tightening cycle. Our view is that the FOMC will hold the target range for the federal funds rate at 5.00%-5.25% for the foreseeable future in order to assess the effectiveness of their accumulated policy tightening.”

-

16:24

BoC's Macklem: We are not forecasting a major contraction

Bank of Canada (BoC) Governor Tiff Macklem comments on the policy outlook following the BoC's decision to leave its policy rate unchanged at 4.5% in April.

Key takeaways

"We need a period of weak growth."

"Outlook for growth has not changed very much."

"We are not forecasting a major contraction."

"You can't rule out that there's going to be a couple quarters of small negatives."

"Our baseline forecast is for a positive but weak growth and declining inflation."

"The implied expectation in the market that we're going to be cutting our policy rate later in the year. That doesn't look today like the most likely scenario to us."

-

16:18

Gold Price Forecast: XAU/USD crawls higher amid mixed US inflation data

- Gold price extended its gains on mixed US economic data.

- US CPI cooled down, but Core CPI was unchanged, indicating sticky inflation.

- XAU/USD Price Analysis: Likely to remain bullish, but a drop below $2,000 would pave the way to $1,950.

Gold price resumes to the upside after hitting a low of $2001, following a mixed US inflation report. Furthermore, recent Fed officials’ mixed comments about overtightening monetary policy keep the American Dollar (USD) pressured. At the time of typing, the XAU/USD is trading at $2,005.34, above its opening price by a minuscule 0.11%.

US CPI cools down, though core CPI remains stickier

The US Bureau of Labor Statistics (BLS) revealed that March’s Consumer Price Index (CPI) rose less than the 5.2% expected, tumbling from 6% to 5% YoY, in figures revealed ahead of the Wall Street open. Nevertheless, not everything is positive news, as the Core CPI, which excludes volatile items, was unchanged at 5.6% YoY.

The yellow metal reacted upwards, reaching a new daily high at $2,028.32. It has retreated some of those gains as it meanders shy of the $2,010 area. Contrarily, the US Dollar (USD) extended its downtrend to two straight days of losses, as shown by the US Dollar Index (DXY), which measures the performance of six currencies against the USD. The DXY exchanges hands at 101.546, down 0.58%, threatening to dip below the 101.000 mark.

Another reason for Gold’s jump was that US Treasury bond yields dropped sharply, with the 2-year bond yield collapsing 14 bps, before erasing some of those losses. Nevertheless, traders' bets that the US Federal Reserve (Fed) would continue to tighten monetary conditions stood tall at 67.2% for a 25 bps rate hike, compared to Tuesday's 72.9%.

Of late, the Richmond Fed President Thomas Barkin said that the report was aligned with expectations but added that although inflation has peaked, “there is still some way to go.” Furthermore, he said that before the May meeting, the PCE and the ECI would be crucial to assess his stance at the upcoming meeting.

Gold Technical Analysis

Even though XAU/USD prints minuscule gains on Wednesday, price action forms an inverted hammer preceded by an uptrend, usually a bearish candle. Oscillators remain bullish, but the Relative Strength Index (RSI) stopped its uptrend and is sideways, while the Rate of Change (RoC) is almost neutral. For an XAU/USD bullish resumption, buyers need to crack the high at $2,028.32, so they could pose a threat to the YTD high at $2,032.13. Contrarily, the XAU/USD would extend its losses, past the $2,000 figure, with the 20-day EMA being the first demand zone at $1,974.00, followed by February’s 2 high at $1,959.74.

-

16:11

BoC: Announcement reaffirms that risks in 2023 skew towards more tightening – TDS

The Bank of Canada, as expected, left the key interest rate unchanged at 4.50%. USD/CAD moved modestly to the downside. Analysts at TD Securities look for the BoC to remain at 4.50% for all of 2023.

BoC is playing wait-and-see

“Forward guidance was not materially changed, but the communique leaned on the hawkish side with the Bank acknowledging that returning to 2% inflation could prove difficult.”

“We still look for the Bank to remain at 4.50% for all of 2023, as we do expect growth to slow markedly in Q2. That said, if the expected softening in the labour market does not emerge, the BoC may have little choice but to tighten again. With markets likely to give the BoC a pass in June, we see more risk for rate hikes in the July and September meetings.”

“There’s isn’t much for CAD to latch on regarding the BoC announcement. The tone of the statement underscores more of a hawkish hold scenario, which has likely helped USDCAD nudge lower. USDCAD HFFV sits below 1.34, suggesting that the pair is trading rich to macro drivers. We continue to like 1.33/1.37 range and look to fade the extremes of that range.”

-

16:07

BoC's Macklem: Governing Council discussed whether it had raised rates enough

Bank of Canada (BoC) Governor Tiff Macklem comments on the policy outlook following the BoC's decision to leave its policy rate unchanged at 4.5% in April.

Key takeaways

"Governing Council discussed whether it had raised rates enough."

"The work of monetary policy - the full impact of previous rate hikes - is not done."

"Governing Council considered likelihood that rates may need to remain restrictive for longer to return inflation to 2% target."

"Bank is encouraged that inflation is declining."

"The Canadian economy remains in excess demand."

"With inflation still well above target, the bank continues to be more concerned about upside risks to forecast."

-

15:56

Gold Price Forecast: XAU/USD’s rally has further to run in the quarters ahead – UBS

Gold has been a strong performer so far this year. Economists at UBS expect the yellow metal to extend its race higher in the coming quarters.

Gold shines with growth concerns in focus

“In the near term, prices are likely to remain sensitive to shifts in investor risk sentiment and interest rate expectations. But we think Gold's rally has further to run in the quarters ahead.”

“First, further safe-haven flows are likely as uncertainty about the economic growth outlook continues. Second, we think the US Dollar looks set to weaken further. Gold tends to rise in periods when the US currency is depreciating, and downside risks to the greenback have risen alongside money market pricing of Federal Reserve rate cuts.”

-

15:47

Fed’s Barkin: We are past peak inflation

Richmond Federal Reserve President Thomas Barkin said on Tuesday, in an interview with CNBC, that inflation certainly has peaked but warned that there are still ways to go.

The Consumer Price Index rose 0.1% in March, with the annual rate slowing to 5%, the smallest since May 2021. Barkin said those numbers were “pretty much” as expected. Barkin mentioned he sees signs that demand is cooling.

Market reaction

The US Dollar is falling sharply on Wednesday, after extending losses following the US CPI report. The DXY is down by 0.60%, trading at 101.50, near the April low.

-

15:42

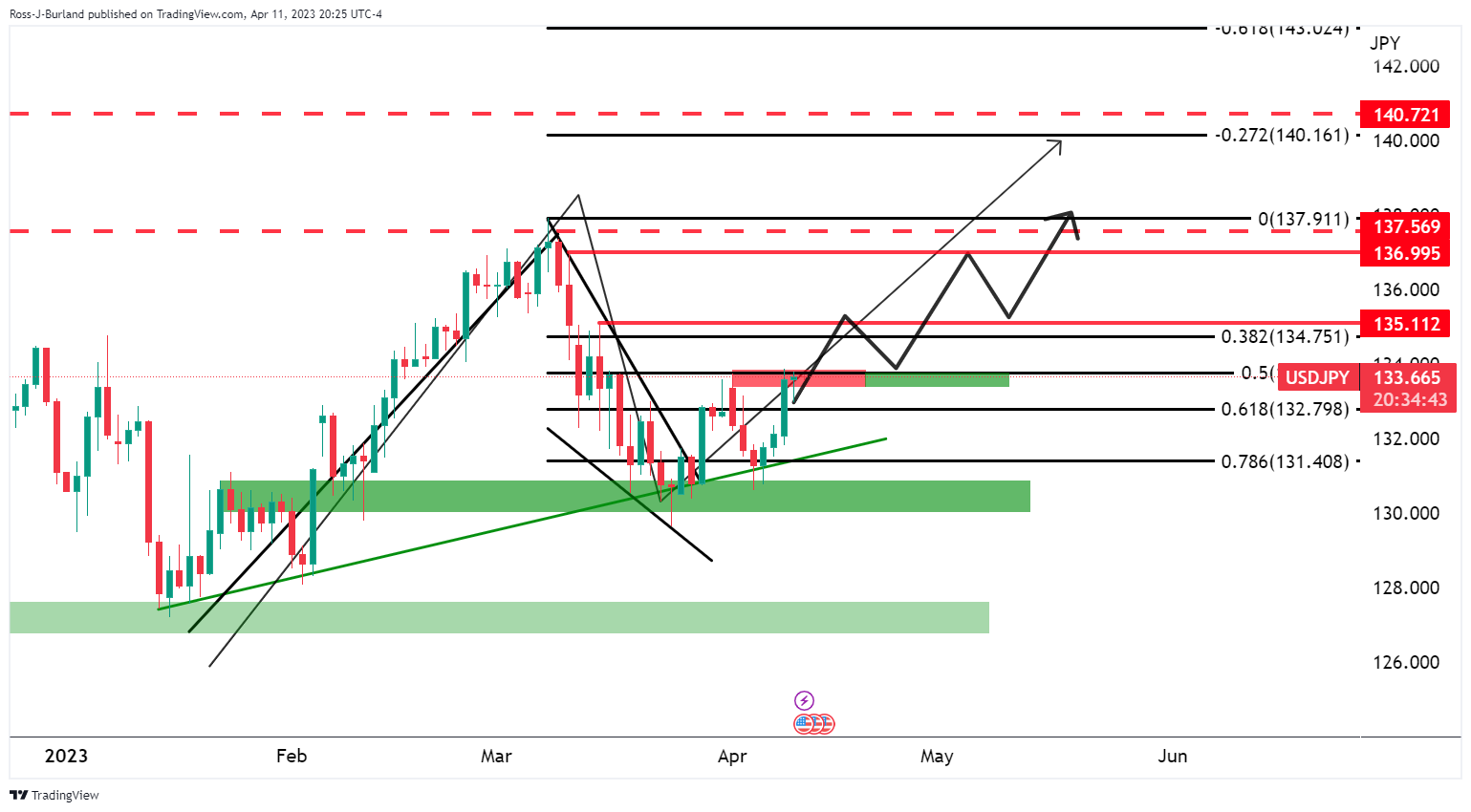

USD/JPY to plummet toward 120 by year-end on a US recession – ING

USD/JPY still trades above 130. Nevertheless, economists at ING forecast the pair at 120 by the end of the year.

USD/JPY will again prove the best vehicle to hedge a US recession

“FX markets currently price a 30% chance that the USD/JPY pair trades at 120 at, or even before, the end of the year.”

“120 is our year-end forecast and is premised on the United States going into recession and the Federal Reserve cutting rates by 100 basis points later this year.”

-

15:31

United States EIA Crude Oil Stocks Change came in at 0.597M, above forecasts (-0.583M) in April 7

-

15:31

MAS Preview: Forecasts from five major banks, continuing with policy normalisation

The Monetary Authority of Singapore (MAS) is expected to release its Monetary Policy Statement (MPS) on Friday, April 14 and as we get closer to the release time, here are the expectations forecast by the economists and researchers of five major banks.

MAS is expected to tighten monetary policy settings.

ANZ

“We expect the MAS to increase the slope of the policy band by 100 bps to 3% per annum, while keeping the midpoint and width unchanged. This is a less aggressive move than last year when there were three consecutive upward re-centrings that total 550 bps. Within our Taylor Rule, there is no difference between a 100 bps increase in the slope versus a 100 bps upward re-centring of the midpoint. However, a slope increase is less aggressive than an upward re-centring, which we view as more appropriate at this juncture given that core inflation is expected to moderate, and also in light of the additional uncertainty in the global economic outlook.”

BBH

“While it doesn’t have an explicit inflation target, easing headline readings and the slowing economy should allow the MAS to keep policy steady this week. It will be a close call and there are risks of a hawkish surprise given the continued rise in core inflation. Singapore’s GDP growth will come in below trend in 2023, and downside risks have intensified. At the same time, MAS Core Inflation is expected to remain elevated over the next few quarters, with risks still tilted to the upside. MAS has assessed that, on balance, a further tightening of monetary policy is needed to help ensure that price pressures are dampened over the next few quarters.”

Standard Chartered

“We maintain our call for the MAS to keep policy unchanged in April. A hawkish risk is if and when the MAS adjusts policy for potentially higher long-term inflation. Finance Minister Lawrence Wong indicated in the recent budget that global inflation may settle at a higher trend than before. The SGD NEER slope, at +1.5% per annum, may need to be adjusted higher (to 2% per annum), in our view, should inflation stay high medium-term. That said, the MAS appears to be more focused on near-term inflation, and given the uncertain environment, we think it may opt to wait to calibrate policy settings for the long term. At the same time, we do not expect the MAS to take its focus away from inflation, given that inflation risks remain tilted to the upside.”

TDS

“We expect the MAS to steepen the slope of the S$NEER band by 50 bps and no changes to the midpoint and width of the band. Core inflation remains too high and sticky for MAS to consider a pause. SGD should benefit from a further tightening of monetary policy settings and we suggest selling USD/SGD on rallies up to around 1.34. Expect USD/SGD to fall to 1.30 by Q4.”

Citi

“3 reasons why the MAS may entertain a final but ‘gentler’ slope steepening than a more aggressive upward re-centering of the band this week – (1) The expected 2H23 pickup in the Singapore growth outlook supports a further tightening of financial conditions. However, the extent to which the expected 2H23 pickup is challenged by tighter global financial conditions may see a more prudent approach from the MAS to steepen the 12- month NEER slope rather than an upward re-centering; (2) Job market tightness is likely easing more slowly than expected (if at all), with labor costs expected to add to core inflation over the medium term. Analysis of 4Q22 job market data therefore, suggests thresholds for slope steepening have been met rather than for upward re-centering; (3) Singapore’s core CPI to stay above “target” after peaking in 1Q23 – milder core inflation surprises in 1Q23 and gentler trajectory of core CPI is also historically more consistent with steeper slope. We expect Singapore’s core CPI to be 50-70 bps higher than MAS forecast in 2023, implying a gentler slowdown than MAS had forecast.”

-

15:16

USD/CAD slides below 1.3450 as BoC keeps rates unchanged as expected

- Bank of Canada keeps rates unchanged as expected.

- Loonie rose modestly after the announcement.

- USD/CAD moving toward daily lows, under 1.3450.

The USD/CAD weakened after the decision of the Bank of Canada (BoC) and is moving toward daily lows, trading under 1.3440.

The BoC announced on Wednesday that it left the key interest rate unchanged at 4.5% following the April policy meeting, as expected. BoC Governor Tiff Macklem will be delivering his comments on the policy outlook and respond to questions at a press conference starting at 1500 GMT.

The loonie rose modestly across the board after the decision, but it is still lagging among G10 currencies. The worst performer is the US Dollar which tumbled after the US Consumer Price Index (CPI) and amid an improvement in market sentiment.

The USD/CAD is moving with a bearish bias and is about to test the daily low at 1.3430. Below attention would turn to the 1.3400 zone (April low). While under 1.3500, the short-term outlook is biased to the downside.

Technical levels

-

15:08

Gold Price Forecast: XAU/USD should benefit from negative real yields in Q2 – Erste Group

Gold price rose by +8% in USD in the first quarter. Economists at Erste Group Research expect the yellow metal to advance nicely in the second quarter on the back of negative real yields.

Real yields will remain in negative territory in Q2

“Real yields will remain negative in Q2 2023. This favours a rising Gold price.”

“After the very strong increase in Q1, the Gold price should rise only moderately in the second quarter. We expect the price to rise to around $2,080 in Q2.”

-

15:00

Breaking: Bank of Canada leaves policy rate unchanged at 4.5% in April as expected

The Bank of Canada (BoC) announced on Wednesday that it left the benchmark interest rate unchanged at 4.5% following the April policy meeting. This decision came in line with the market expectation. BoC Governor Tiff Macklem will be delivering his comments on the policy outlook and respond to questions at a press conference starting at 1500 GMT.

In its policy statement, the BOC said that the Governing Council will continue to assess whether monetary policy is sufficiently restrictive and added that they remain prepared to raise rates if needed.

Market reaction

With the initial reaction, USD/CAD edged lower and was last seen losing 0.1% on the day at 1.3450.

Key takeaways from the policy statement

"Getting inflation down to 2% could be hard because inflation expectations are coming down slowly, service price inflation and wage growth remain elevated."

"In Canada, demand is still exceeding supply and labor market remains tight; wage growth still elevated relative to productivity growth."

"Inflation in many countries is easing in face of lower energy prices, normalising supply chains and tighter monetary policy."

"BoC expects inflation to fall quickly to around 3% in mid-2023 and then decline more gradually to 2% target by end-2024."

"Will continue the policy of quantitative tightening."

"As more households renew mortgages at higher rates and restrictive monetary policy starts to work it way through economy, 2023 consumption is expected to moderate."

-

15:00

Canada BoC Interest Rate Decision meets forecasts (4.5%)

-

14:55

EUR/USD Price Analysis: The 1.1000 level is just around the corner

- EUR/USD picks up pace and approaches the 1.1000 zone.

- Next relevant target emerges at the YTD peak near 1.1030.

EUR/USD extends the bullish performance and prints new monthly highs around 1.0990 on Wednesday.

The likelihood of extra advances appears favoured for the time being. Against that, the immediate target now appears at the key 1.1000 mark back followed by the 2023 top at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0360.

EUR/USD daily chart

-

14:54

EUR/CHF: SNB wants a 0.98-1.00 range near term – ING

EUR/CHF has traded in a reasonably narrow range of 0.9850-1.000 over recent weeks. Economists at ING note that the Swiss National Bank (SNB) prefers a 0.98-1.00 range near term.

SNB to remain in control

“Probably limiting the topside at 1.00 has been the SNB. Here, the SNB increasingly tells us it has been selling FX reserves to keep CHF stable – largely in line with monetary rather financial stability priorities. The SNB sold CHF27bn of FX in the fourth quarter of 2022.”

“Last year we had felt that the SNB would want a lower EUR/CHF to help fight inflation. It is still threatening another hike – we look for a final move in the policy rate to 1.75% in June. But the financial stress and weaker economic outlook probably mean the SNB prefers a 0.98-1.00 range near term.”

-

14:47

Silver Price Analysis: XAG/USD retreats from one-year peak amid overbought RSI

- Silver gains strong positive traction on Wednesday and touches a fresh one-year top.

- The RSI on the daily chart is flashing overbought conditions and capping the upside.

- The technical setup still supports prospects for a further near-term appreciating move.

Silver catches aggressive bids near the $25.00 psychological mark during the early North American session and spikes to a fresh one-year high in the last hour. The white metal, however, surrenders a major part of its intraday gains and is currently placed around the $25.20-$25.15 area, still up over 0.50% for the day.

The Relative Strength Index (RSI) on the daily chart is holding above the 70.00 mark and points to extremely overbought conditions. This, in turn, is holding back bullish traders from placing fresh bets around the XAG/USD and keeping a lid on any further gains, at least for the time being. The positive technical setup, however, supports prospects for an extension of the recent appreciating move witnessed over the past month or so.

Sustained strength and acceptance above the $25.00 mark add credence to the near-term positive outlook. Some follow-through buying beyond the daily swing high, around the $25.65 region, will be seen as a fresh trigger for bullish traders and set the stage for a move towards reclaiming the $26.00 mark. The XAG/USD could climb further towards the $26.40-$26.50 intermediate resistance en route to the 2022 top, just ahead of the $27.00 mark.

On the flip side, any meaningful pullback might continue to attract fresh buyers near the $25.00 psychological mark. This should help limit the downside for the XAG/USD near the $24.30-$24.40 resistance breakpoint, now turned support. That said, a convincing break below could make the commodity vulnerable to weaken below the $24.00 mark and test the $23.60-$23.55 support before dropping to the $23.15 zone en route to the $23.00 mark.

Silver 4-hour chart

Key levels to watch

-

14:33

USD/BRL: Positive underlying tone in Real trade over the coming days – Commerzbank

USD/BRL trades around 5.00 again. This indicates that the outlook for the Brazilian Real is improving, economists at Commerzbank report.

Promising framework for BRL

“The market received the new fiscal plan positively. What was decisive for the market, for now, was that the government-linked spending curbs to the development of revenue and the targets of the primary balance, i.e. actually measurable variables, which should reduce the risk of escalating national spending.”

“Short-term, we see a high likelihood that BRL will establish itself at high levels, in particular as President Lula da Silva will today set off on his long-awaited visit to China. The hopes for deeper economic ties and further Chinese investments in Brazil point towards a positive underlying tone in BRL trade over the coming days.”

-

14:22

AUD/USD soars above 0.6700 after US CPI

- US Dollar under pressure after US March CPI data.

- Later on Wednesday, the Fed will release the FOMC minutes.

- AUD/USD breaks key resistance levels, outlook positive.

The AUD/USD jumped to 0.6723, reaching a one-week high after the release of the US inflation numbers. The US Dollar tumbled across the board and stocks rose.

Inflation slows, Wall Street cheers

The US Consumer Price Index rose 0.1% in March, below the 0.4% increase of February and smaller than the 0.3% of market consensus. The CPI rose 5% in the year through March, the slowest in almost two years. The Core CPI rose by 0.4% in line with expectations, and the annual rate climbed 5.6%, above the 5.5% of the previous months. Later on Wednesday, the Federal Reserve (Fed) will release the minutes from its latest monetary policy meeting.

After the numbers, Treasury bond rallied and the US Dollar sank. The US 10-year dropped to 3.34% and the 2-year to 3.90%. Wall Street futures are up, with main indexes gaining 0.60% on average.

In Australia, the key report of the week will be on Thursday with the March Employment figures. In the US, market participants will get fresh inflation data with the Producer Price Index.

AUD/USD back above 0.6700

The AUD/USD retake the 0.6700 area and climbed to 0.6723. It is holding firm, with the price above key moving averages in the four-hour chart.

More gains could face resistance at 0.6725/30, and above the next target stands at 0.6755. A slide back below 0.6675 would weaken the outlook for the Aussie.

-638169024990412756.png)

-

14:13

US inflation continues to fall, things are moving in the right direction for the Fed – Commerzbank

US inflation declines to 5%. From the perspective of the Fed, the data thus point in the right direction, economists at Commerzbank report.

The March report shows declining inflationary pressure

“US inflation continued to fall significantly in March, from 6.0% to 5.0%. Not only did volatile energy prices fall noticeably, but there was also some slowing in the important shelter category.”

“The March inflation report should calm the Fed's nerves somewhat. Most price categories show an easing of price pressures, and this is even the case for rents. Moreover, a further decline in rent inflation can be expected in the coming months.”

“The Fed is now likely to focus its attention more on supporting the emerging positive trend. A more aggressive approach is probably no longer necessary in view of the progress made. The Fed nears its interest rate peak; we expect only two more rate hikes of 25 bps each.”

-

14:11

When is the BoC monetary policy decision and how could it affect USD/CAD?

BoC Monetary Policy Decision – Overview

The Bank of Canada (BoC) is scheduled to announce its monetary policy decision this Wednesday at 14:00 GMT. The Canadian central bank is widely expected to leave the overnight interest rate unchanged at 4.5% for the second straight meeting. Most analysts say the central bank will need more time to assess how the economy responds to the eight rate hikes it has delivered over the past year. Hence, the focus will be on the accompanying monetary policy statement, which will also include the updated economic projections,

and the post-meeting press conference at 15:00 GMT.Dhwani Mehta, Senior Analyst and Asian Session Manager at FXStreet, explains: The BoC’s view to stay on hold this month is backed by cooling inflation. The country’s annual Consumer Price Index (CPI) rate fell to 5.2% in February, marking the second month in a row inflation came in lower than forecast, as supply chains recover and commodity prices moderate. It’s worth noting that the monthly data shows inflation is actually closing on the Bank’s inflation target of 2%.

How Could It Affect USD/CAD?

The USD/CAD pair gains some positive traction on Wednesday and moves back closer to the 1.3500 psychological mark amid some repositioning trade ahead of the key central bank event risk. Given that the markets are already expecting the BoC to keep rates unchanged, the announcement is unlikely to provide any meaningful impetus to the major and is likely to be overshadowed by the US CPI-inspired volatility. That said, the near-term policy outlook should influence the Canadian Dollar and allow traders to grab some meaningful opportunities.

From a technical perspective, any subsequent recovery beyond the 1.3500 mark is likely to confront some resistance near the 1.3525-1.3530 region. A convincing breakthrough the latter will trigger a short-covering move and assist the USD/CAD pair to reclaim the 1.3600 round-figure mark. Spot prices could climb further to the next relevant hurdle near the 1.3660-1.3665 horizontal support breakpoint, now turned resistance.

On the flip side, bearish traders need to wait for a sustained break below an upward sloping trend-line extending from the August 2022 swing low. This is closely followed by the very important 200-day Simple Moving (SMA), currently around the 1.3400-1.3390 region. Some follow-through selling will confirm a fresh breakdown and make the USD/CAD pair vulnerable to accelerate the fall towards the 1.3315 intermediate support en route to the 1.3300 mark and the 1.3270-1.3265 horizontal zone.

Key Notes

• Bank of Canada Preview: Sitting on the sidelines amid looming recession risks

• BoC Preview: Forecasts from eight major banks, staying on the sidelines

• USD/CAD Analysis: Holds above ascending trend-line, 200 DMA ahead of key data/event risks

About the BoC Interest Rate Decision

BoC Interest Rate Decision is announced by the Bank of Canada. If the BoC is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the CAD. Likewise, if the BoC has a dovish view on the Canadian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

-

14:05

US Dollar should weaken later in the year – Erste Group

Fed will lower interest rates earlier than the ECB, arguing for continued weakening of the USD later in the year , in the opinion of economists at Erste Group Research.

EUR/USD to move sideways for the time being