Notícias do Mercado

-

23:48

Silver Price Analysis: Toppish formation around $25.15 prods XAG/USD bulls

- Silver price remains sidelined after rising the most in a week, prods bearish chart formation on hourly play.

- Sustained trading beyond key HMAs, upbeat RSI favor XAG/USD buyers.

- Fortnight-old ascending support line acts as an extra filter towards the south.

- Silver buyer can aim for April 2022 peak on clear break of $25.15.

Silver price (XAG/USD) seesaws around $25.00 after posting the biggest daily gains in a week the previous day. In doing so, the bright metal braces to reject the “Double top” bearish chart formation on the hourly play.

It’s worth noting that the quote’s sustained trading above the 100 and 200 Hourly Moving Averages (HMAs) join firmer RSI (14), not overbought, to keep the Silver buyers hopeful of breaking the double tops near $25.15 and reject the bearish chart pattern.

Following that, a run-up toward April 2022 high near $26.25 can’t be ruled out. However, the RSI may turn overbought afterward and can prod the Silver buyers before they approach the previous yearly top surrounding $27.00.

Meanwhile, the 100-HMA and a two-week-old ascending trend line, respectively near $24.90 and $24.70, restrict the short-term downside of the XAG/USD price.

Should the quote breaks the $24.70, the previous Thursday’s low of $24.60 and the 200-HMA level of near $24.35 will be crucial as a break of which can direct Silver price toward the sub-$24.00 zone.

Overall, the Silver price is likely to remain firmer but the quote’s further upside hinges on a clear break of $25.15.

Silver price: Hourly chart

Trend: Further upside expected

-

23:45

New Zealand Electronic Card Retail Sales (YoY) registered at 15.5% above expectations (9.5%) in March

-

23:45

New Zealand Electronic Card Retail Sales (MoM) below expectations (1.5%) in March: Actual (0.7%)

-

23:38

GBP/USD Price Analysis: Gathers strength for a breakout of Falling Channel above 1.2460

- GBP/USD is making efforts for a breakout of the Falling Channel pattern.

- An absence of anxiety among investors ahead of US CPI conveys that they have digested expectations of the Fed’s rate hikes.

- Wednesday’s inflation data carries higher value as it will be the last inflation data before Fed’s May meeting.

The GBP/USD pair has rebounded to near 1.2430 in the early Asian session after defending the round-level support of 1.2400. The Cable is gathering strength for extending its rally amid an upbeat market mood ahead of the release of the United States inflation. An absence of anxiety among investors ahead of the US Consumer Price Index (CPI) indicates that investors have digested expectations of consecutive 25 basis points (bps) rate hike from the Federal Reserve (Fed).

Despite knowing the fact that Wednesday’s inflation data carries higher value as it will be the last inflation data before May’s monetary policy meeting, investors are hammering the US Dollar Index. The USD Index has turned sideways after a corrective move from 102.30 and is expected to test the critical support of 102.00.

Apart from the US inflation data, the speech from Bank of England (BoE) Governor Andrew Bailey will be keenly watched. BoE Bailey is expected to provide guidance about the likely monetary policy action ahead. A hawkish guidance is expected from BoE Bailey amid an absence of evidence of United Kingdom inflation softening.

GBP/USD is gathering strength to deliver a breakout of the Falling Channel formed on an hourly scale. The Cable is hovering near the edge of the upper portion of the aforementioned chart pattern. The asset looks confident above the 20-period Exponential Moving Average (EMA) at 1.2420 as it indicates that the short-term trend is bullish.

Meanwhile, the Relative Strength Index (RSI) (14) is eyeing a decisive break above 60.00 for activation of the bullish momentum.

For an upside move, the Cable needs to surpass April 11 high at 1.2457, which will trigger short coverings and will drive the major toward the psychological resistance of 1.2500 followed by April 04 high at 1.2525.

On the flip side, a break below the round-level support of 1.2400 will expose the asset to April 10 low at 1.2344 and March 30 low at 1.2294.

GBP/USD hourly chart

-

23:26

AUD/USD struggles near 0.6650, RBA’s Bullock, US inflation and Fed Minutes eyed

- AUD/USD eases near one-month low after snapping five-day downtrend.

- Cautious mood ahead of the key catalyst, mixed sentiment challenge Aussie pair buyers.

- Upbeat Aussie data, barley deal supersede price-negative catalysts surrounding China to keep buyers hopeful.

- RBA’s Bullock needs to follow Lowe’s footsteps to defend AUD/USD rebound.

AUD/USD retreats to 0.6650, after bouncing off the lowest level in one month, as traders await the top-tier data/events during early Wednesday. In doing so, the Aussie pair portrays the market’s cautious mood even as upbeat catalysts at home joined US Dollar weakness to lure the bull previously.

That said, Australia’s Westpac Consumer Confidence for April rallied to the highest levels since June 2022, printing 9.4% figure versus 0.8% expected and 0.0% prior. Further, the National Australia Bank’s (NAB) Business Conditions matched the forecast figure of 16.0, versus 17.0 prior, whereas NAB Business Confidence eased to -1.0 versus 0.0% expected and -4.0% previous readings.

On the same line, Australia's Foreign Minister Penny Wong said on Tuesday, "We reached an agreement with China to settle the dispute over Australian barley.” “China agreed to review the duties levied on Australian barley,” Wong added.

Further, China’s ending of military strikes near Taiwan and mixed comments from the US Federal Reserve (Fed) officials also allowed the AUD/USD bulls to remain firmer. However, the market’s receding optimism towards the further rate hikes and mixed comments from the International Monetary Fund (IMF), as well as softer China inflation, to prod the AUD/USD.

However, downbeat China inflation numbers prod the AUD/USD bulls as headline inflation numbers for March, namely the Consumer Price Index (CPI) and Producer Price Index (PPI), came in 0.7% YoY and -2.5% YoY versus 1.0% and -1.4% respective priors.

Recently, Philadelphia Fed President Patrick Harker said on Tuesday that the Federal Reserve will continue to look closely at available data to determine what, if any, additional actions they may need to take. Before him, Federal Reserve (Fed) Bank of New York President John Williams said that if inflation comes down, we will have to lower rates. Furthermore, Chicago Fed President Austan Goolsbee, said on Tuesday that they need to be cautious about raising interest rates after recent development in the banking sector.

On the other hand, Reuters said that China ended three days of military drills around Taiwan on Monday saying they had tested integrated military capabilities under actual combat conditions, having practiced precision strikes and blockading the island that Beijing views as its own.

Elsewhere, IMF revised down global real Gross Domestic Product (GDP) growth forecast for 2023 to 2.8% from 2.9% in January's report. However, the global lender kept growth estimations for China intact as 5.2% for 2023 and 4.5% for 2024.

Amid these plays, Wall Street closed with minor gains and the yields also marked mild run-up while the US Dollar Index (DXY) snapped four-day uptrend on Tuesday.

Moving on, RBA Assistant Governor (Financial System) Michele Bullock could offer immediate directions to AUD/USD pair ahead of the key US CPI and the Fed Minutes.

Also read: US CPI Preview: US Dollar on the back foot and poised to fall further

Technical analysis

AUD/USD recovery remains elusive unless it bouncing back beyond the one-month-old previous support line, around 0.6700 by the press time.

-

23:06

ECB’s Villeroy: Eurozone inflation at risk of getting entrenched

"Euro zone inflation is at risk of getting entrenched above 2% so the European Central Bank will keep fighting excessive price growth, even as its policy response is shifting gears," said French central bank chief Francois Villeroy de Galhau late Tuesday per Reuters.

Additional comments

We now face the risk of entrenched inflation, which lies in the underlying or ‘core’ component.

Inflation has become more widespread, and potentially more persistent.

Monetary policy was most effective in tackling underlying or core inflation.

I expect price growth back at around the ECB's 2% target by the end of 2024 or the end of 2025.

We at the ECB are now moving from a 'sprint' to a 'long-distance race'.

Inflation outlook, underlying inflation readings and the effectiveness of policy transmission will be the key factors in the next decisions.

EUR/USD grinds higher

EUR/USD holds onto the previous day’s recovery moves from a one-week low to 1.0915 by the press time.

-

23:04

Fed’s Harker: Fed to closely look data to see if more rate hikes are needed

Philadelphia Fed President Patrick Harker said on Tuesday that the Federal Reserve will continue to look closely at available data to determine what, if any, additional actions they may need to take.

Additional comments

Full impact of monetary policy actions can take 18 months to be felt.

Already seeing promising signs that the Fed's actions are working.

Fed is fully committed to 2% inflation.

'Disappointing' that recent readings show disinflation is proceeding slowly.

US banking system is sound and resilient.

We have to be a little careful what we don't overdo it.

Bank stress is not over, but has calmed down.

Don't think there should be a blanket increase in fdic insurance caps.

Primary tool for financial stability is not monetary policy.

There's a high bar for using monetary policy for financial stability.

US Dollar stays pressured

Given the recently mixed comments from various Fed policymakers, US Dollar Index (DXY) remains pressured around 102.10 by the press time, after snapping a four-day winning streak the previous day.

-

23:04

EUR/USD rebounds from 1.0900 as investors ignore US Inflation-inspired anxiety

- EUR/USD has demonstrated a recovery move from 1.0900 as investors seem not worried about the US inflation release.

- S&P500 remained choppy on Tuesday as technology stocks dragged on expectations of weaker revenue guidance.

- The European Central Bank will keep on hiking rates despite evidence of a decline in retail demand.

The EUR/USD pair has shown a recovery move after a minor correction to near the round-level support of 1.0900 in the early Asian session. The major currency pair is looking to extend its recovery above the immediate resistance of 1.0928 as investors don’t seem anxious ahead of the release of the United States Inflation data.

S&P500 remained choppy on Tuesday as technology stocks dragged on expectations of weaker revenue guidance. Investors are hoping for weak guidance from tech-savvy stocks amid higher rates from the Federal Reserve (Fed). Also, recent banking turmoil could impact the quarterly result of the banking sector, portraying a cautious market mood.

The US Dollar Index (DXY) has dropped to near 102.15 after failing to extend its recovery above 102.30. The USD Index is likely to extend its downside below the 102.00 support as investors have digested expectations of more rate hikes from the Federal Reserve (Fed).

Meanwhile, the commentary from Chicago Fed President Austan Goolsbee has also weighed on the US Dollar. Fed policymakers have advised a cautious approach as the combination of tight credit conditions and further restrictive monetary policy can hit sectors and regions differently than if monetary policy was acting on its own.

For further guidance on the US Dollar, US Consumer Price Index (CPI) will be keenly watched. Analysts at Danske Bank expect “While lower energy prices will ease March headline inflation to around +0.2% MoM, we expect core inflation to remain elevated at +0.4%.”

On the Eurozone front, monthly Retail Sales contracted by 0.8% as expected by investors. And, annual Retail Sales contracted by 3.0% while the street was anticipating more contraction to 3.5%. However, the European Central Bank (ECB) will keep on hiking rates despite evidence of a decline in retail demand.

ECB Governing Council member Francois Villeroy de Galhau warned that “Inflation is becoming more prevalent and potentially more persistent.” He further added, “The impact of rate hikes will be amplified in the coming months.”

-

22:50

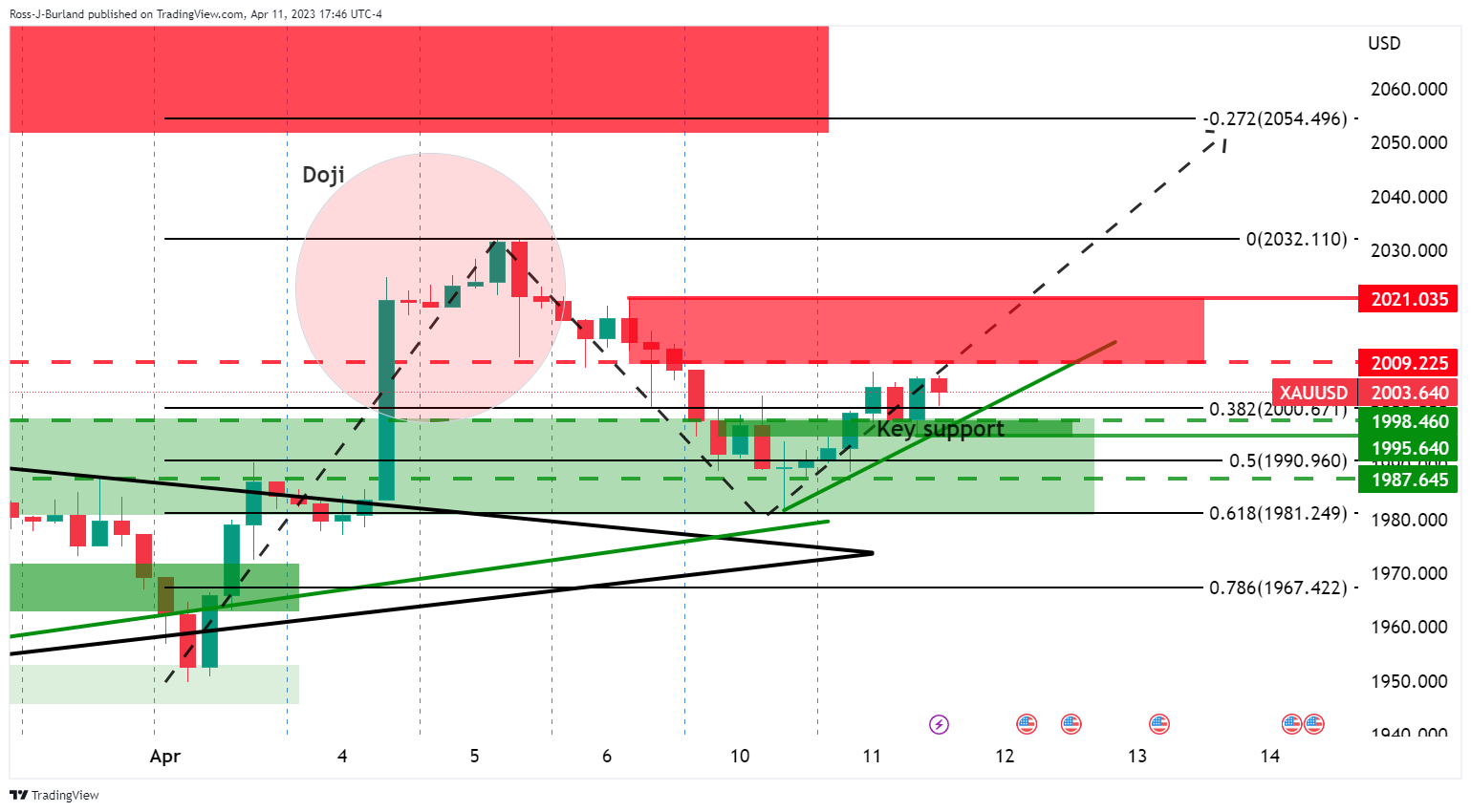

Gold Price Forecast: XAU/USD bulls move in at key H4 support

- Gold price bulls holding the fort at a critical support area.

- Gold price bulls eye a break of $2,020 for prospects to $2,050.

- Gold price traders eye US Consumer Price Index for the next clues with regard to Federal Reserve interest rates.

Gold price finished the day on Tuesday tailing off from the New York session highs that were put in on a soft US Dollar ahead of Wednesday's US inflation report. Holiday markets made for a mixed day as traders wait in anticipation of the main event for the week making for uneven price action across the asset classes.

The Greenback gave back the bulk of Easter Monday's gains after the robust Nonfacr Payrolls report released on the Good Friday holiday cemented the notion that the Federal Reserve has one more rate hike left in its toolbox. The job numbers showed that employers added 236,000 jobs while the unemployment rate fell to 3.5%. This has led the market to believe that the Federal Reserve will hike rates by an additional 25 basis points at its May 2-3 meeting, before pausing in June. Markets are also pricing for the Fed pivot where a rate cut by year-end could be on the cards to combat the risks of a recession.

US Consumer Price Index will be key

In this regard, the March Consumer Price Index inflation data will be closely watched to see if it is near the 6% annualized rate reported in February, which would likely mean higher interest rates are coming from the central bank. However, analysts at TD Securities argued that core prices likely cooled off modestly in March, with the index still rising a strong 0.4% MoM, as they look for recent relief from goods deflation to turn into inflation this month. ´´Shelter prices likely remained the key wildcard, while slowing gas prices and softer food-price gains will likely dent non-core inflation,´´ they said. ´´Our MoM forecasts imply 5.1%/5.6% YoY for total/core prices.´´

We will also get the minutes of the Federal Open Market Committee, FOMC, on Wednesday and the analysts at TD Securities explained that the rate hike at the March FOMC meeting was widely viewed as dovish.´´ The analysts added that ´´the distribution of the March dot plot for 2023, however, suggested a more hawkish sentiment across the FOMC. With banking stress now appearing to be somewhat contained, the minutes for this meeting might emphasize this hawkish sentiment given continued elevated inflationary pressures.´´

Overall, with the June Federal Open Market Committee, FOMC, meeting remaining in play for a final 25bp rate increase, investors will have lightened their exposure to the Gold price in anticipation of profit-taking. However, as the analysts at TDS argued, ´´with Wednesday´s CPI print top of mind, the market has been unwilling to convincingly break lower, with CTAs needing to see prices below $1980/oz to further reduce length.´´

As for Federal Reserve chatter, the officials continue to stress that the central bank's policy path will depend on incoming data. For instance, Chicago Fed President Austan Goolsbee said the Fed should be cautious about raising rates in the face of recent banking stress. Meanwhile, New York Fed President John Williams explained that the prospect of the Fed raising its benchmark interest rate only once more and in a 25 basis point increment is a useful starting point.

Gold price technical analysis

In a series of analyses for Gold price tracking the live Gold price market, it stated the following:

´´The Gold price doji is a stalling candle and it could be followed by a bearish engulfment on Thursday that could give way to the prospects of a move lower in the Gold price as the bias. However, so long as the Gold price bulls stay committed, this bullish cycle will have further to run for the Gold price.´´

Gold price update, live chart

We are seeing the Gold price bulls commit to the support area with the $2,050s on the radar.

Gold price H4 chart

The Gold price four-hour chart shows that the bulls are holding the fort at key support with $2,010/20 now eyed as the next major Gold price resistance area guarding $2,050.

-

21:52

Forex Today: Dollar weakens before key US inflation data

During the Asian session, Japan will release the Producer Price Index and RBA’s Bullock will participate in a panel. The key event on Wednesday will be US consumer inflation data. Later, the Federal Reserve will publish the minutes of the latest FOMC meeting. The Bank of Canada will have its monetary policy meeting. The Dollar looks weak ahead of busy hours.

Here is what you need to know on Wednesday, April 12:

The US Dollar Index dropped after rising for four days on the day before the release of the March US Consumer Price Index (CPI). Also on Wednesday, the minutes of the latest FOMC will be published. The economic figures and the minutes could have large implications for markets and monetary policy expectations.

US CPI Preview: US Dollar on the back foot and poised to fall further

US yields rose on Tuesday but did not help the Greenback. The US 10-year yield reached levels above 3.45% and the 2-year peaked at 4.08%. Stocks in Europe finished higher after Easter Monday and Wall Street posted mixed results. The International Monetary Fund downwardly revised its global growth forecast for 2023 to 2.8%.

USD/JPY erased losses during the American session rising back to the 133.70 zone. Bank of Japan’s Ueda signaled they are not in any hurry to change the current stance of monetary policy. Japan's Producer Price Index is due on Wednesday.

EUR/USD rebounded on Tuesday, retaking 1.0900; the move higher was capped by 1.0930. The pair looks bullish supported by a weaker US Dollar and expectations of another rate hike from the European Central Bank (ECB). The Euro outperformed most of its major rivals.

GBP/USD rose on Tuesday after four days of losses, ending above 1.2400. Market participants continue to see a new rate hike from the Bank of England in May.

NZD/USD extended the slide from last week's spike and broke below 0.6200, to the lowest level in two weeks. The Kiwi was the worst G10 performer. New Zealand Credit Card spending data is due on Wednesday. EUR/NZD rose above 1.7600, to the highest level since November 2020.

AUD/USD peaked at 0.6680 and then pulled back to 0.6650. The short-term bias point to the downside ahead of the Australian Employment report due on Thursday.

USD/CAD resumed the downside on Tuesday and dropped toward 1.3450. On Wednesday, the Bank of Canada will announce its decision on monetary policy. No change in rates is expected. The focus will be on projections and the presser.

Gold rose above $2,000 despite higher yields, and Silver above $25.00. Bitcoin reached $30,000 for the first time since June of last year.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:47

USD/JPY bulls take on 133.80 resistance ahead of critical US CPI

- USD/JPY bulls stay in the market on interest rate differentials.

- All eyes turn to the US CPI data on Wednesday.

USD/JPY bull has stayed with the course despite an initial drop in the European session and in Asia´s start of the day. The price recovered from late London's lows of 132.97 and printed a high of 133.80 in New York´s midday trading and despite some dovish comments from US central bank officials that weighed on the DXY index.

USD/JPY remains bid as the Greenback remains supported on the interest rate differentials with higher T-note yields on Tuesday weighing on the yen, along with news that Japan’s March machine tool orders posted their biggest decline in 2-1/2 years. Japan Mar machine tool orders fell -15.2% YoY, the third consecutive monthly drop and the largest decline in 2-1/2 years. Additionally, Bank of Japan Governor Kazuo Ueda signaled no hurry to dial back its massive stimulus.

All eyes on US CPI and Fed sentiment

Meanwhile, the Consumer Price Index on Wednesday is expected to show that headline inflation rose by 0.2% in March, while core inflation rose 0.4%. This follows a series of data leading up to the event on Wednesday, including Friday´s Nonfarm Payrolls that have added to expectations that the Federal Reserve will complete one more rate hike. The data showed that employers added 236,000 jobs while the unemployment rate fell to 3.5%.

Consequently, The Federal Reserve is expected to hike rates by an additional 25 basis points at its May 2-3 meeting, before pausing in June. Markets are also pricing for the Fed pivot where a rate cut by year-end on could be on the cards to combat the risks of a recession. Nevertheless, Fed officials have stressed that the central bank's policy path will depend on incoming data. Chicago Fed President Austan Goolsbee said the Fed should be cautious about raising rates in the face of recent banking stress. Meanwhile, New York Fed President John Williams explained that the prospect of the Fed raising its benchmark interest rate only once more and in a 25 basis point increment is a useful starting point.

-

21:43

United States API Weekly Crude Oil Stock increased to 0.377M in April 7 from previous -4.346M

-

21:01

NZD/USD bears hammer back the bulls and print fresh lows

- NZD/USD bears are still in the market, taking on fresh cycle lows.

- The US Dollar is a touch softer heading into the US CPI data.

NZD/USD was trying to recover some ground after falling to as low as 0.6193 the prior day and reached a high of 0.6233 before collapsing yet again to mark a fresh low of 0.6184.

Despite a soft across most other currencies, the Kiwi took the brunt of the selling on Tuesday with little rhyme nor reason behind the moves other than the escalating US-China tensions over Taiwan. China simulated precision strikes against key targets on and around Taiwan on Monday, the 2nd day of exercises near the island.

Domestically, the Reserve Bank of New Zealand said in its latest meeting minutes that it is expecting to see a further easing in domestic demand as well as a slowdown in core inflation and inflation expectations. However, last week, the central bank delivered a larger 50bps rate hike amid overheated inflation and employment and shattered market consensus of a 25bps rise. The central bank also said in its April monetary meeting minutes that there is no material conflict between lowering inflation and maintaining financial stability in New Zealand. The RBNZ called out a larger inflationary impact from the cyclone rebuild and upside risks to the fiscal outlook and does not want to see any fall in lending rates.

US CPI eyed as key event

For the day ahead on Wednesday, the focus will be on US core and headline Consumer Price Index inflation which is expected to increase by 0.5% MoM in March. Some may argue that there have been signs of inflation intensifying again and labour market conditions remain too tight for the Fed. However, analysts at TD Securities said ´´core prices likely cooled off modestly in March, with the index still rising a strong 0.4% MoM,´´ as they look for recent relief from goods deflation to turn into inflation this month. ´´Shelter prices likely remained the key wildcard, while slowing gas prices and softer food-price gains will likely dent non-core inflation. Our m/m forecasts imply 5.1%/5.6% YoY for total/core prices,´´ the analysts explained.

Meanwhile, solid jobs data in the Nonfarm Payrolls on Friday for March added to expectations that the Federal Reserve will complete one more rate hike. The data on Friday showed employers added 236,000 jobs while the unemployment rate fell to 3.5%. The central bank is expected to hike rates by an additional 25 basis points at its May 2-3 meeting, before pausing in June. Markets are also pricing for the Fed to pivot by year-end on an expected recession.

-

19:55

WTI bulls move back in to test the recent production cut highs

- WTI jumps to test resistance again as US Dollar retreats.

- Production cuts keeps the black gold better bid.

WTI oil prices climbed over 2% to $81.55 a barrel on Tuesday while investors get set for data that may show further declines in US oil and fuel inventories. Additionally, a weaker US Dollar ahead of potentially cooling inflation data on Wednesday has been bullish for energy prices.

The US reports its Consumer Price Index on Wednesday and analysts at TD Securities argued that ´´core prices likely cooled off modestly in March, with the index still rising a strong 0.4% MoM.´´ Ebbing price pressures are diminishing the prospects of further Federal Reserve interest rate hikes. Markets are pricing for the Fed to cut rates by year-end on an expected recession and a softer US Dollar, as a consequence, makes oil cheaper for non-Dollar denominated investments, helping to support higher oil. Also, tightness in global oil supplies is supporting crude prices with the continued halt of 400,000 bpd of Iraqi crude oil exports.

Looking to core fundamentals, a Wall Street Journal survey is forecasting that tomorrow's weekly Energy Information Administration report will show a 600,000-barrel decline in crude-oil stockpiles and a 1.7M-barrel fall in gasoline inventories. This would mark an eighth consecutive decline in gasoline inventories and will put crude inventories at their lowest since early February.

Meanwhile, The Energy Information Administration on Tuesday raised its price forecast for Brent crude oil by 2.5% in the agency's influential monthly Short-Term Energy Outlook following OPEC's decision earlier this month to reduce production by around 1.1 million barrels per day to support prices and lower global oil inventories. The agency raised its forecast for Brent crude, the global benchmark, to US$85.00 per barrel from its prior US$83.00 target on lower supply.

On the flip side, a bearish factor for crude was the International Monetary Fund, IMF, said that five years from now, global growth is expected to be around 3% — the lowest medium-term forecast in a World Economic Outlook for over 30 years.

-

19:01

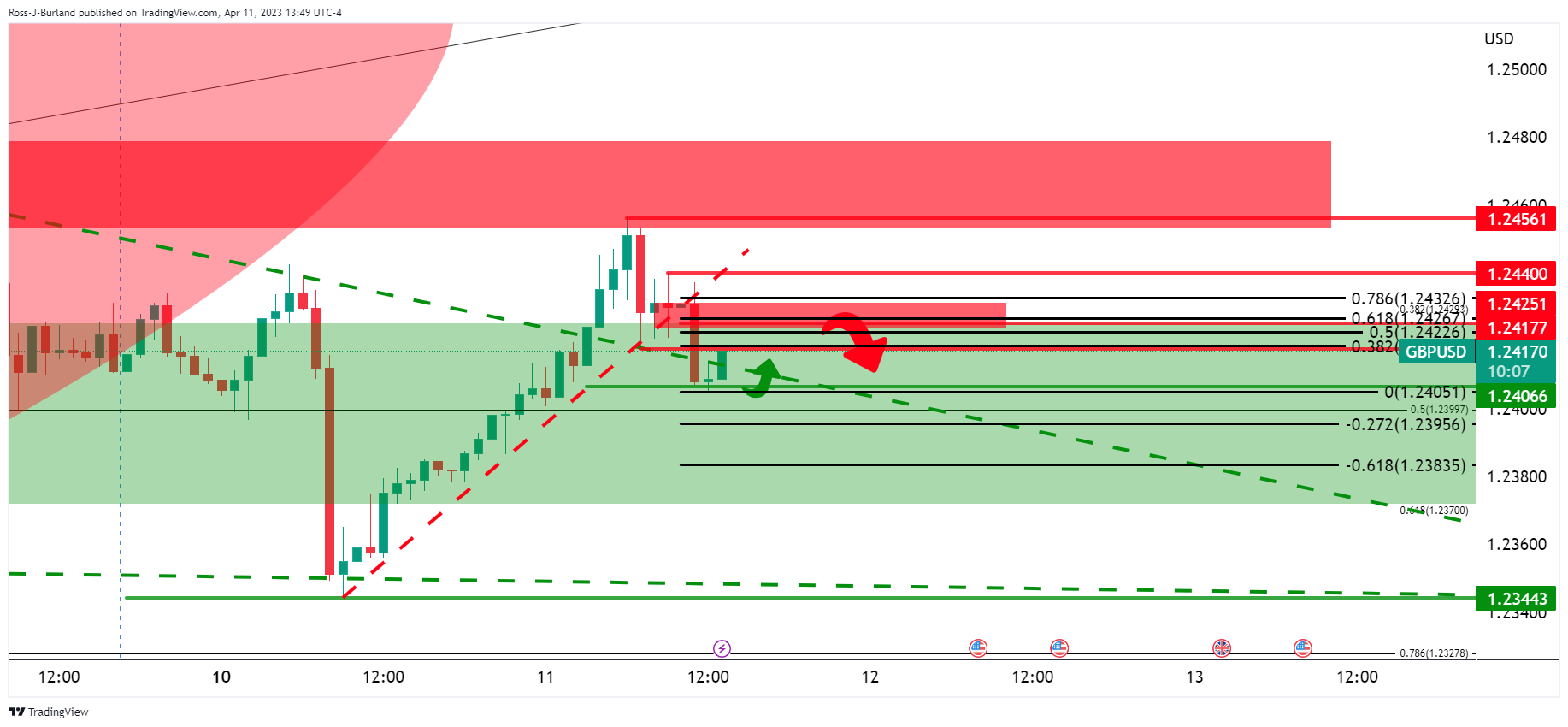

GBP/USD bulls hope US prices have cooled, eye break of 1.2520

- GBP/USD bulls are stepping in at a key structure area on the charts.

- All eyes will be on the US inflation data on Wednesday in the main.

GBP/USD has traveled within a range of 1.2379 and 1.2456 on the day and is up around 0.3% currently at 1.2420.

The British pound has found solid ground in a key support area amidst improved risk sentiment, helping to keep sterling towards the 10-month high it reached last week as traders bet that interest rates would soon peak and come down later this year.

Domestically, the Bank of England Governor Andrew Bailey is scheduled to speak on Wednesday and could give clues on the future path for monetary policy, but attention is on the US Consumer Price Index also. Analysts at TD Securities argued that core prices likely cooled off modestly in March, which could result in an even softer US dollar leading to higher Cable.

Meanwhile, the following illustrates the technical landscape leading into tomorrow´s events:

GBP/USD technical analysis

GBP/USD is trading within the right-hand shoulder of a massive inverse head and shoulders pattern, testing the neckline.

GBP/USD bullish/bearish scenario

The price had dropped for four consecutive days and retraced over 70% of the prior bullish impùlse. Bulls are moving in following a close above the 61.8% Fibonacci retracement measure which is bullish. A higher high could be on the cards for this bull cycle. However, the price is on the backside of the bull trendline which means the bull cycle has been decelerating. If bears commit heavily to the next bullish thrust, a period of distribution could unfold. 1.2270s will be key in this regard ahead of 1.2190. However, the above thesis is meanwhile bullish:

GBP/USD H1 chart

On the lower time frames, such as this hourly chart, we can see the price is testing 1.2400 structure but so long as this holds, given the break of the trendline to the upside, a break of 1.2450 will likely leave the bulls in control for a run to test the 1.2520s.

If on the other hand, considering the break of the prior bullish trendline, if bears commit below 1.2450, then a bearish thesis will be in play to break below 1.2400:

GBP/USD bullish scenario

However, the bullish thesis will be in play while above support and 1.2350 as per the above daily chart. All will depend on the US consumer Price Index outcome for the US session and beyond ahead.

-

18:42

Fed’s Goolsbee: We need to asses potential impact of financial stress on the economy

Federal Reserve Bank of Chicago President Austan Goolsbee, said on Tuesday that they need to be cautious about raising interest rates after recent development in the banking sector. He mentioned that the central bank needs to assess the potential impact of the financial stress on the real economy.

Speaking at the Economic Club of Chicago, Goolsbee said that they should gather further information and be careful about raising rates “too aggressively” until they see how much work the headwinds are doing for the central bank in getting inflation down. According to him, markets and financial issues should not drive actions from the Fed.

Market reaction

The US Dollar Index is falling on Tuesday, ending a four-day positive streak. It is hovering around 102.20, down 0.32% for the day. US bond yields are higher, with the 2-year yield at 4.06%, the highest in a week.

-

18:02

United States 3-Year Note Auction: 3.81% vs previous 4.635%

-

16:39

EUR/USD prints fresh daily highs, but remains limited below 1.0930

- US Dollar drops across the board despite higher yields.

- A better mood in equity markets weighs on the Greenback.

- EUR/USD holds firm above 1.0900, further away from Monday's weekly lows.

The EUR/USD rose to 1.0928, reaching the highest level since last Thursday, and then pulled back. The Euro holds a bullish tone but remains unable to break above 1.0930.

The short-term technical bias favors the Euro, particularly while above 1.0900. Below, the next support stands at 1.0880. Above daily highs, more gains seem likely, but the common currency faces many horizontal levels until 1.0955.

DXY down, yields up

The US Dollar Index is falling on Tuesday, erasing most of Monday's gains. The DXY is approaching 102.00 and is ending a 4-day positive streak.

Federal Reserve (Fed) Bank of New York President John Williams said on Tuesday that they need to stay in "data-dependent mode," and added that if inflation comes down, they will have to lower interest rates.

US yields are modestly higher on Tuesday, with the 10-year Treasury yield at 3.43% and the 2-year at weekly highs at 4.04%. European yields are also higher, as market participants fully price in a 25 basis point rate hike from the European Central Bank at their next meeting in May.

Data from the Eurozone showed a decline of 0.8% in Retail Sales in March, in line with expectations. With no relevant reports from the US om Tuesday, the focus is on the Consumer Price Index due on Wednesday.

Technical levels

-

16:01

US CPI: Banks Preview, inflation softening, good news on the horizon?

The US Bureau of Labor Statistics (BLS) will release the most important inflation measure, the US Consumer Price Index (CPI) figures, on Wednesday, April 12 at 12:30 GMT. As we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming United States inflation print for the month of March.

The annual inflation is expected to have risen by 5.2% year-on-year after increasing by 6% in February. The core reading, however, is foreseen at 5.6%, up from 5.5% previously. On a monthly basis, the CPI is forecast at 0.3%, while the Core CPI is expected at 0.4%.

Danske Bank

“While lower energy prices will ease March headline inflation to around +0.2% MoM, we expect core inflation to remain elevated at +0.4%.”

ANZ

“We expect both core and headline CPI inflation to have risen by 0.5% MoM in March.”

Commerzbank

“Statisticians are likely to report a drop in the inflation rate from 6.0% in February to 5.3% in March. However, the March decline is entirely due to the fact that prices are now being compared with those in March 2022, when energy prices in particular had already risen significantly due to the Ukraine war. Indications of the underlying trend are more likely to be provided by the core rate, which excludes the volatile prices for energy and food. Here we expect an increase from 5.5% to 5.7%. The MoM rates also show that inflation is hardly calming down. Compared with February, prices across all goods and services probably rose by 0.3%, excluding energy and food by as much as 0.5%.”

ING

“Markets are increasingly doubtful that the Fed will be able to hike rates much further, but that could yet change after the upcoming CPI report. Another 0.4% MoM figure on core CPI, more than double the rate required over time to take the US back to the 2% YoY inflation rate target, could nudge expectations for the upcoming FOMC meeting higher. We still think the Fed would prefer to raise rates at least once more should financial conditions allow, but we see a strong probability that it reverses course and cuts rates by 100 bps later in the year as ever-tighter lending conditions, high borrowing costs, weak business sentiment and a deteriorating housing market all weigh on growth and rapidly dampen price pressures.”

Deutsche Bank

“We expect core inflation to come off a bit to +0.39%, although that would still leave the year-on-year change up a tenth at +5.6%. For headline inflation, we see a lower rate of +0.24%, taking the YoY rate down to +5.2%. Remember this month that there’ll be unusually large base effects at play, since the March 2022 surge in energy prices after Russia’s invasion of Ukraine will be dropping out of the annual comparisons.”

TDS

“Core prices likely cooled off modestly in March, with the index still rising a strong 0.4% MoM, as we look for recent relief from goods deflation to turn into inflation this month. Shelter prices likely remained the key wildcard, while slowing gas prices and softer food-price gains will likely dent non-core inflation. Our MoM forecasts imply 5.1%/5.6% YoY for total/core prices.”

NBF

“The energy component may have had a negative impact on the headline index as prices likely fell in both the gasoline and natural gas segment. Expected gains for shelter and used vehicles could still result in a 0.2% monthly increase in headline prices. The core index, for its part, could have increased 0.4% MoM, which would translate into a one-tenth increase in the annual rate to 5.6%.”

CIBC

“Core CPI likely decelerated to 0.4% MoM, in line with flagging consumer demand as excess savings have dwindled and the labor market has slowed, but that’s still too hot of a pace to achieve on-target inflation. Although private measures of used car prices have increased recently, the weight of that component in the CPI index has fallen sharply, and other measures of goods prices, including the PPI for finished core consumer goods, suggest that pressure in core goods prices could have been limited. Adding food and energy prices back into the mix likely showed more modest price pressures of 0.2% MoM for the total CPI, as prices at the pump fell in seasonally-adjusted terms. We’re nearly in line with the consensus expectation, which should limit market reaction.”

Wells Fargo

“After rising 0.4% in February, we look for the CPI to moderate to a 0.2% gain in March. With the initial surge in oil/gasoline prices stemming from Russia’s invasion of Ukraine a full year behind us, CPI when measured on a year-over-year basis should fall to 5.1% in March from 6.0% in February. However, another elevated reading in the core CPI is likely to indicate that the recent trend in inflation is little improved. Excluding food and energy, we look for the CPI to rise 0.4% and remain close to 5% on a three-month annualized basis. A further slowdown in core inflation is likely coming as the year progresses, but we doubt it will be evident in this CPI release.”

Citi

“We expect an increase in core CPI in March that is on the border between 0.4% and 0.5% MoM, but at 0.456% the forecast would again round to 0.5% MoM with risks tilted towards the upside for most components though with modest downside risks for the largest subcomponent of shelter prices. Most forecasts over the next few months will likely be factoring in a gradual slowing in shelter prices that has long been expected (a large one-month drop is possible, but unlikely).”

-

15:50

Gold Price Forecast: XAU/USD to hit $2,100 by year-end – UBS

Gold breached the psychological $2,000 barrier last week for the first time since the war in Ukraine broke out last year. Economists at UBS forecast the yellow metal at $2,100 by the end of the year.

Downside risks to the USD have risen alongside money market pricing of Fed rate cuts

“Gold tends to rise in periods when the US Dollar is weakening, and downside risks to the greenback have risen alongside money market pricing of Federal Reserve rate cuts.”

“While volatility can be expected in the near term, we now expect the precious metal to hit $2,100 by year-end, and $2,200 by March 2024.”

-

15:27

USD/JPY to drop toward 128 by end-June – ING

Economists at ING expect steady outperformance of the Yen through the year and forecast USD/JPY at 128 by the end of June.

The Bank of Japan can add to the Yen’s appeal

“A lower USD/JPY is becoming the market’s conviction call. It covers both the potential for a sharp Fed easing cycle and frailty in the US financial system. Also, there is the wild card risk event of a change in BoJ policy.

“At the 16 June meeting, we think the BoJ could shorten its yield curve target to 5-year from 10-year JGB yields. 10-year JGB yields would rise sharply, and the Yen would rally. That’s why we target 128 for USD/JPY in end-June.”

“One risk we see to the bearish USD/JPY call is energy prices. Our team is calling Brent to $110/bbl by year-end – a Yen negative.”

-

15:07

USD may see some further near-term strength, deeper correction expected in the months ahead – TDS

The US Dollar slid for the fourth consecutive week last week, losing approximately 10% from its peak last year. In the weeks ahead, economists at TD Securities anticipate data to remain a critical determinant of the USD.

Short-term rallies should be met with skepticism

“The USD's downtrend could stall a bit in the short-term, aided by the expectations of another Fed hike next month. However, much will hinge on the near-term data releases, especially the March CPI print.”

“We continue to expect a deeper USD correction in the months ahead, so would use any rallies as opportunities to resell it.”

-

15:02

USD/BRL will struggle to sustain a move below 5.00 – ING

USD/BRL is pressing 5.00 and the Real has been one of the better EM FX performers over the last month. However, economists at ING expect the pair to stay above the 5.00 level.

New fiscal framework delivers a brief lift

“Helping the Real has been the positive reception of the new fiscal framework announced at the end of March. Having done its part, the government will now be leaning on the central bank to cut rates. So far, the central bank is still sounding hawkish given that inflation expectations are heading in the wrong direction.”

“BRL is enjoying a short honeymoon, but renewed pressure on the central bank or poor fiscal developments can easily end the rally.”

“We favour USD/BRL returning to the middle of a 5.00-5.50 range.”

-

14:58

AUD/USD holds steady above mid-0.6600s amid positive risk tone, weaker USD

- AUD/USD attracts some buying on Tuesday and snaps a five-day losing streak to a multi-week low.

- A generally positive risk tone undermines the safe-haven USD and benefits the risk-sensitive Aussie.

- Rising US bond yields limit the USD losses and keep a lid on any meaningful upside for the major.

The AUD/USD pair sticks to its intraday gains through the early part of the North American session and is currently placed around the 0.6660-0.6655 region, up nearly 0.25% for the day.

The US Dollar (USD) meets with some supply and stalls a four-day-old recovery trend from over a two-month low touched last week, which, in turn, is seen pushing the AUD/USD pair higher. A generally positive tone around the equity markets is seen as a key factor undermining the Greenback's relative safe-haven status and lending some support to the risk-sensitive Aussie.

The upside for the AUD/USD pair, however, remains capped amid signs that the post-COVID economic recovery in China was losing steam. The concerns were fueled by softer Chinese data, which showed that consumer inflation hit an 18-month low and producer price inflation contracted at a steady pace. This, in turn, acts as a headwind for the China-proxy Australian Dollar.

Apart from this, speculations that the Federal Reserve (Fed) may continue raising interest rates, for now, seem to have put a floor under the US Treasury bond yields. In fact, the current market pricing indicates a greater chance of another 25 bps lift-off at the next FOMC meeting in May. This lends some support to the USD and contributes to capping the AUD/USD pair, at least for now.

Traders also seem reluctant to place aggressive bets ahead of the release of the latest US consumer inflation figures and the FOMC meeting minutes on Wednesday. Investors this week will also confront the release of monthly jobs data from Australia on Thursday, followed by the US monthly Retail Sales on Friday, which should provide a fresh impetus to the AUD/USD pair.

Technical levels to watch

-

14:44

GBP/USD may bounce around in a 1.20-1.25 range in Q2 – ING

Economists at ING have been surprised by Sterling's strength in March. What now? GBP/USD may bounce around in a 1.20-1.25 range.

GBP/USD will struggle to sustain a move above 1.25 in the second quarter

“Based on our EUR/USD view for the second quarter, we suspect GBP/USD may bounce around in a 1.20-1.25 range. Events in the US, however, give us greater conviction that it trades at 1.28/1.30 later in the year as the Fed pushes through with easing.”

“An early pause from the BoE in May could also support the view that GBP/USD will struggle to sustain a move above 1.25 in the second quarter.”

-

14:30

Malaysia: Foreign Portfolio inflows rose to multi-month highs – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest portfolio results in Malaysia.

Key Takeaways

“Foreigners bought more MYR-denominated debt securities in Mar at MYR6.6bn (Feb: +MYR4.3bn), which helped to offset another month of net selling in equities (Mar: -MYR1.4bn, Feb: -MYR0.2bn). In 1Q23, foreigners piled up MYR11.4bn worth of Malaysian debt securities, the largest quarterly net purchases in two years with flows concentrating in Malaysian Government Securities (MGS, MYR9.7bn) and Government Investment Issues (GII, MYR4.6bn).”

“Bank Negara Malaysia (BNM)’s foreign reserves rose by USD1.2bn m/m to USD115.5bn as at end-Mar. This marks the highest FX reserves level since Mar 2022. It is sufficient to finance 5.1 months of imports of goods and services and is 1.1 time of total short-term external debt. BNM’s net short position in FX swaps narrowed for the first time in 15 months by USD0.3bn m/m to USD26.3bn (or 23.0% of FX reserves) as of Feb 2023.”

“Despite global banking sector turmoil easing and financial conditions stabilizing, we expect risk sentiment to remain cautious in the near term as markets continue to keep tabs on US data and market developments. Persistent repricing of Fed rate trajectory according to upcoming data points and news flows as well as China’s recovery momentum will continue to affect portfolio reallocation decision across regions including Malaysia.”

-

14:16

Fed's Williams: If inflation comes down, we will have to lower rates

Federal Reserve (Fed) Bank of New York President John Williams said on Tuesday that they need to stay in "data-dependent mode," as reported by Reuters.

Key takeaways

"We see some slowing in demand for labor, but still high."

"Job growth is still quite strong."

"Inflation still way above our 2% goal, seeing it coming down mostly in goods and commodities."

"Some core services inflation ex-housing hasn't budged yet so we have our work cut out for us."

"Too soon to see changes in credit conditions and availability, not seeing strong signs of those effects happening yet."

"We've gotten policy to a restrictive stance, now we need to watch the data on retail sales, CPI and others."

"We will see what we need to do on hikes by assessing the data."

"We are somewhat restrictive on policy right now."

"I expect economy to grow at a modest rate this year."

"Bank failures have added to uncertainty in the outlook."

"One more rate hike is a reasonable starting place but we will be driven by the data."

"We really need to see underlying inflation come down."

"If inflation comes down, we will have to lower rates."

"Banking system has really stabilized after recent stresses."

Market reaction

The US Dollar stays on the back foot following these comments and the US Dollar Index was last seen losing 0.42% on the day at 102.10.

-

14:14

EUR/USD to rise sustainably in H2 toward 1.15 by year-end – ING

A further Dollar decline looks likely this year, although economists at ING suspect this is more a story for the second half when the Fed can declare that the inflation battle is won.

A case of when, not if the Dollar declines

“The collapse of two regional banks in the US has seen the Fed take action to address financial stability, while at the same time tightening rates to address monetary stability. We expect these two positions to collide in the second half of this year, where tighter credit conditions and greater evidence of a hard landing could see the Fed cut rates 100 bp in 4Q23. It is a question of when not if the Dollar declines.”

“We favour a 1.05-1.10 range over coming months. But the European financial sector looks better positioned than the US. Higher for longer European Central Bank rates target EUR/USD at 1.15 by year-end.”

-

14:12

EUR/USD Price Analysis: Next on the upside aligns 1.0973

- EUR/USD reverses part of the recent decline and retakes 1.0900.

- Further rebound could see the April high near 1.0973 revisited.

EUR/USD leaves behind two consecutive sessions with losses and advances past 1.0900 the figure on Tuesday.

The likelihood of extra advances appears favoured for the time being. Against that, the pair needs to clear the April high at 1.0973 (April 4) to put the key 1.1000 mark back on the radar and then challenge the YTD peak at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0356.

EUR/USD daily chart

-

14:10

IMF Forecasts: 2023 global real GDP growth at 2.8% vs 2.9% in January forecast

The International Monetary Fund said in its latest World Economic Outlook report that it revised the global real Gross Domestic Product growth for 2023 to 2.8% from 2.9% in January's report, per Reuters.

Additional takeaways

"IMF forecasts 2024 global growth at 3.0% vs 3.1% in January forecast."

"Plausible alternative scenario of more moderate lending pullback would cut growth by 0.3 percentage point from baseline."

"Banking system turmoil appears contained but further tightening of financial conditions would reduce growth."

"Severe tightening of financial conditions sparked by deeper banking system turmoil would slash 2023 global growth by 1.8 percentage points from baseline."

"IMF forecasts 2023 US growth at 1.6% vs 1.4% in January; 2024 growth seen at 1.1%."

"IMF forecasts Germany GDP to contract 0.1%, UK to contract 0.3% in 2023."

"IMF forecasts 2023 Eurozone growth at 0.8% vs 0.7% in January; 2024 output seen at 1.4%."

"IMF forecasts China 2023 growth at 5.2%, 2024 growth at 4.5%, both unchanged from January forecasts."

"IMF says forecasts 2023 Japan growth at 1.3% vs 1.8% in January due to slow Q4 2022 performance."

"Forecasts assume average oil price of $73/barrel in 2023; unclear if latest price of $85/barrel will be sustained."

"Inflation still too elevated compared to central bank targets, monetary policy should focus on bringing it down."

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen losing 0.4% on the day at 102.15.

-

14:10

USD/CAD steadily moves back above 1.3500 mark, lacks follow-through buying

- USD/CAD reverses an intraday dip and climbs back above the 1.3500 mark.

- Softer Oil prices undermine the Loonie and act as a tailwind for the major.

- A positive risk tone weighs on the safe-haven USD and might cap the upside.

The USD/CAD pair attracts some buyers near the 1.3480 region on Tuesday and for now, seems to have stalled the overnight retracement slide from over a one-week high. Spot prices climb back above the 1.3500 psychological mark during the early North American session, albeit the intraday uptick lacks bullish conviction.

Crude Oil prices languish near a one-week low, which, in turn, is seen undermining the commodity-linked Loonie and lending some support to the USD/CAD pair. Data released earlier today showed China's consumer inflation hit an 18-month low and producer price inflation contracted at a steady pace. This suggested that a post-COVID recovery in the world's second-largest economy was losing steam and raised concerns about a recovery in fuel demand.

The upside for the USD/CAD pair, however, remains capped amid the emergence of fresh selling around the US Dollar (USD). A generally positive tone around the equity markets dents the Greenback's relative safe-haven status, though speculations that the Federal Reserve (Fed) may continue raising interest rates should help limit the downside. In fact, the markets are now pricing in a greater chance of another 25 bps lift-off at the next FOMC meeting in May.

The bets were lifted by the mostly upbeat US monthly employment details (NFP) released on Friday, which, for the time being, puts a floor under the US Treasury bond yields and could act as a tailwind for the USD. This, in turn, supports prospects for the resumption of the USD/CAD pair's recent recovery move from the 1.3400 mark, or its lowest level since February 16 touched last week. Traders, however, seem reluctant ahead of this week's key event/data risks.

The Bank of Canada (BoC) is scheduled to announce its monetary policy decision on Wednesday, which will be accompanied by the release of the latest consumer inflation figures from the US. The market focus, meanwhile, will remain glued to the FOMC meeting minutes, also due on Wednesday. This, along with the US monthly Retail Sales data on Friday, will play a key role in influencing the USD and provide a fresh directional impetus to the USD/CAD pair.

Technical levels to watch

-

14:03

GBP/USD: Short covering and seasonal factors could keep Cable in the ascendancy this week – SocGen

Sterling carried over positive momentum from Q1 to April, resulting in GBP/USD crossing 1.25 for the first time since last June. Economists at Société Générale expect the pair to extend its race higher.

Further uptrend likely

“Hedge funds trimmed short GBP positions to 6.5% of OI last week, the lowest since the end of December. Short covering and seasonal factors could keep Cable in the ascendancy this week provided US CPI does not surprise to the upside.”

“Next potential hurdles are at projections of 1.2610 and 1.2750.”

“Defending last week's low at 1.2270 is crucial for persistence in up move.”

-

14:01

India: RBI paused its hiking cycle – UOB

Head of Research at UOB Group Suan Teck Kin, CFA, assesses the latest interest rate decision by the RBI.

Key Takeaways

“The Reserve Bank of India (RBI) at its latest Monetary Policy Committee (MPC) meeting unexpectedly decided to pause its year-long rate hike campaign, keeping its benchmark repo rate at 6.50% while the market and we had expected potentially a final 25 bps hike.”

“The latest decision came amidst a backdrop of slower growth and persistent inflation pressures, with banking stresses in the US and Europe adding to the mix of uncertainty and volatility. While noting the need to assess the progress of its tightening so far, the RBI remarked that the pause is only for this meeting, and it is still focused on withdrawal of its accommodative policy.”

“Outlook – While the possibility of further rate increases remains on the table, we see a high likelihood of the RBI maintaining its rate pause, for now, at 6.50%. Incoming data, particularly consumer prices, as well as developments in the external environment will be the main factors of consideration for the upcoming decisions. The next MPC meeting is scheduled for 6-8 Jun 2023.”

-

13:55

India CPI Preview: Forecasts from three major banks, inflation likely eased below 6% in March

India will release March Consumer Price Index (CPI) data on Wednesday, April 12 at 12:00 GMT and as we get closer to the release time, here are forecasts from economists and researchers of five major banks regarding the upcoming inflation data.

Inflation is expected at 5.8% year-on-year vs. 6.44% in February. If so, inflation would be the lowest since December and back within the 2-6% target range.

ANZ

“We expect both headline and core inflation at 5.9% YoY, or below 6% – the upper end of the official target range. This follows two months of inflation breaching the target range. Base effects turned favourable in February and became larger in March. We expect food inflation to have eased below 6% last month, although food prices likely rose in sequential terms. Overall, helped by base effects, it is likely that inflation will now average below 6% in Q2.”

Standard Chartered

“CPI inflation likely eased to 5.6% from 6.4% in February, on favourable base effects and a correction in food prices. However, core inflation likely stayed sticky at 6% on price pressures in Gold (and the broader personal care sub-segment) and communication (mobile tariff hikes), among others. Going forward, we expect inflation to remain in a broad range of 5-5.6% in FY24; inflation is likely to remain at sub-5% in April-June, albeit driven by favourable base effects. We believe the repo rate has peaked, following the surprise on-hold decision by the Monetary Policy Committee (MPC) in April. The MPC is unlikely to see the need to hike further unless inflation once again moves above or closer to the upper threshold of the mandated band of 2-6% (with 4% the medium-term target).”

SocGen

“India’s March 2023 CPI likely decelerated by 0.70%, as we are entering a period of high statistical base effect that will last for the next eight months. While average prices are still moving up, headline CPI inflation likely dropped to 5.7% YoY from 6.4% in February. Food prices appear to have come down due to sharply moderating vegetable prices. Spice and cereal prices remain high, though both appear to have peaked too. Despite the sharp disinflation, core inflation likely saw only a modest decline. Although goods price inflation has peaked, prices continue to rise despite aggregate domestic demand being weak. We continue to maintain that rising GST rates and a high level of corporate concentration will ensure that goods prices do not drop off sharply despite weak demand. Compared to goods inflation, service inflation appears modest. The other driver of core inflation is residential building and land prices.”

-

13:55

USD Index Price Analysis: Corrective decline could extend to 101.40

- DXY fades part of the recent multi-day recovery and revisits 102.00.

- Further south now comes the monthly low near 101.40.

DXY gives away some of its recent marked gains and retreats to the boundaries of the 102.00 region, where initial contention appears to have emerged so far.

If the correction gathers extra steam, the index could then put the April low at 101.43 (April 5) to the test in the near term, while the breach of this level should open the door to a probable slide towards the 2023 low around 100.80 (February 2).

Looking at the broader picture, while below the 200-day SMA, today at 106.45, the outlook for the index is expected to remain negative.

DXY daily chart

-

13:55

United States Redbook Index (YoY) declined to 1.5% in April 7 from previous 3.7%

-

13:49

USD/IDR faces a strong support at 14,830 – UOB

Further downside in USD/IDR should meet firm contention around 14,830, according to Market Strategist Quek Ser Leang at UOB Group.

Key Quotes

“We highlighted last Monday (03 Apr, spot at 14,995) that ‘while conditions remain oversold, the weakness in USD/IDR has not stabilized’. We added, ‘barring a break above 15,230, USD/IDR could drop to 14,925 before stabilization is likely’. The anticipated USD/IDR weakness exceeded our expectations as it plummeted to 14,875 before closing on a soft note at 14,910 (-0.53%).”

“The weakness has yet to stabilize and USD/IDR could weaken further. However, February’s low of 14,830 is likely out of reach this week. Resistance is at 14,965; a break of 15,005 would indicate that the weakness has stabilized.”

-

13:30

GBP/USD eases from daily peak, still well bid above 1.2400 amid broad-based USD weakness

- GBP/USD gains strong positive traction on Tuesday and snaps a four-day losing streak.

- A positive risk tone prompts some selling around the safe-haven USD and lends support.

- Bets for more Fed rate hikes should help limit the USD losses and cap any further gains.

The GBP/USD pair catches fresh bids on Tuesday and snaps a four-day losing streak to over a one-week low, around the 1.2345 region touched the previous day. The pair sticks to its strong intraday gains heading into the North American session and trades around the 1.2435-1.2440 area, just a few pips below the daily high.

The US Dollar (USD) meets with some supply and stalls a four-day-old recovery trend from over a two-month low touched last week, which, in turn, is seen pushing the GBP/USD pair higher. A generally positive tone around the equity markets is seen as a key factor undermining the Greenback's relative safe-haven status, though speculations that the Federal Reserve (Fed) may continue raising interest rates should help limit losses.

. In fact, the current market pricing indicates a greater chance of a 25 bps lift-off at the next FOMC monetary policy meeting in May and the bets were lifted by the mostly upbeat US employment details (NFP) released on Friday. This, for the time being, puts a floor under the US Treasury bond yields, which should further act as a tailwind for the buck and keep a lid on any further gains for the GBP/USD pair, at least for time being.

Furthermore, the recent mixed signals from the Bank of England (BoE) members over the next policy move might also hold back traders from placing aggressive bullish bets around the British Pound. Investors might prefer to move to the sidelines ahead of this week's release of the latest US consumer inflation figures and the FOMC meeting minutes, both scheduled on Wednesday, followed by the US Retail Sales data on Friday.

In the absence of any relevant market-moving economic releases on Tuesday, either from the UK or the US, the broader risk sentiment could play a key role in influencing the USD price dynamics. Apart from this, the broader risk sentiment, which tends to drive the demand for safe-haven assets, including the buck, might allow traders to grab short-term opportunities around the GBP/USD pair.

Technical levels to watch

-

13:11

GBP/USD: Broader uptrend is set to resume – Scotiabank

GBP/USD rebounds firmly from early week low. The pair is set to enjoy further gains, economists at Scotiabank report.

Bull trend persists

“Solid, short-term gains for Cable give the intraday charts a positive look.”

“GBP/USD gains through the low 1.24 zone break the short-term trend decline in the Pound off of last week’s high and suggest the broader uptrend in spot is set to resume.”

“Support is 1.2400/10. Resistance is 1.2515.”

See: GBP/USD may struggle to sustain a break above 1.25 this quarter – ING

-

13:00

Mexico Industrial Output (YoY) above forecasts (2.7%) in February: Actual (3.5%)

-

13:00

Brazil IPCA Inflation came in at 0.71% below forecasts (0.78%) in March

-

13:00

Mexico Industrial Output (MoM) above forecasts (0.2%) in February: Actual (0.7%)

-

12:47

USD/CAD: A low close today should see as softer USD tone follow – Scotiabank

USD/CAD holds little changed around 1.35. But the pair’s price action looks positive for the Loonie, economists at Scotiabank report.

Firm resistance seen at 1.3520/25

“Trading volumes might be light but yesterday’s USD gains peaked and stalled fight around the 55-DMA via a ‘doji’ candle on the daily chart, implying a stall and (possibly) reversal in recent USD gains.”

“Intraday price action adds to the soft look, with the USD easing below the base of the rising channel (bear flag) that has supported USD gains off the Mar 4 low just above 1.34. A low close today should see as softer USD tone follow.”

“USD/CAD resistance is firm at 1.3520/25.”

-

12:25

EUR/JPY Price Analysis: Sustained gains seen above 145.67

- EUR/JPY adds to the ongoing rally beyond 145.00.

- Next on the upside comes the 2023 high near 145.70.

EUR/JPY advances for the fourth session in a row and breaks above the key barrier at 145.00 on Tuesday.

The continuation of the recovery should encourage the cross to challenge the 2023 top at 145.67 (March 31). The surpass of this level could put a potential test of the December 2022 high near 146.70 (December 15) back on the radar in the not-so-distant future.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 141.89.

EUR/JPY daily chart

-

12:18

US Dollar loses strength ahead of key US CPI data

- US Dollar weakens against its major rivals following the Easter holiday.

- EUR/USD holds above key support despite the latest pullback.

- March CPI data from US could significantly impact US Dollar’s valuation.

The US Dollar (USD) stays on the back foot on Tuesday and weakens against its major rivals as investors gear up for the highly anticipated March Consumer Price Index (CPI) data from the US. The US Dollar Index, which closed the previous four trading days in positive territory, retreats toward 102.00, reflecting the lack of demand for the currency.

Ahead of the weekend, the USD gathered strength as investors started to price in a 25 basis points (bps) US Federal Reserve (Fed) rate hike in May on the back of the upbeat March jobs report. With trading conditions normalizing after a long weekend, however, US Treasury bond yields started to push lower, making it difficult for the USD to continue to outperform its peers. Moreover, the improving risk mood seems to be putting additional weight on the USD’s shoulders.

Daily digest market movers: US Dollar struggles to remain attractive

- Nonfarm Payrolls in the US rose by 236,000 in March, slightly below the market expectation of 240,000. February’s print of 311,000 got revised higher to 326,000 from 311,000.

- Wage inflation in the US, as measured by Average Hourly Earnings, declined to 4.2% on a yearly basis from 4.6% in February. The Unemployment Rate ticked down to 3.5% with the Labor Force Participation Rate improving to 62.6% from 62.5%.

- The CME Group FedWatch Tool shows that markets are pricing in a 67% probability of a 25 bps Fed rate increase in May, compared to 73% on Monday.

- Federal Reserve Bank of Atlanta’s GDPNow model’s estimate for the first-quarter real Gross Domestic Product Growth (GDP) in the US rose to 2.2% from 1.5% on April 10.

- NY Fed President John Williams argued on Monday that the pace of Fed rate increases was not behind the issues surrounding the two collapsed banks back in March.

- NY Fed’s latest consumer survey revealed that the one-year inflation expectation climbed to 4.7% in March from 4.2% in February.

- Minneapolis Fed President Neel Kashkari, Philadelphia Fed President Patrick Harker and Chicago Fed President Austan Goolsbee will be delivering speeches on Monday.

- Inflation in the US, as measured by the Consumer Price Index (CPI) is forecast to decline to 5.2% in March from 6% in February. The Core CPI, which excludes volatile food and energy prices, is expected to rise by 0.4% on a monthly basis, compared to the 0.5% increase recorded in February.

Technical analysis: US Dollar turns bearish against Euro

EUR/USD closed in negative territory in the previous two trading days and touched its lowest level in a week at 1.0830 late Monday. The pair, however, managed to regain its traction on Tuesday and rose above the 1.0900 area. The pair’s near-term technical outlook remains bullish with the Relative Strength Index (RSI) indicator on the daily chart holding above 50. Moreover, EUR/USD has reversed its direction after coming in within a touching distance of the 20-day Simple Moving Average, which currently aligns as immediate support at 1.0830.

In case EUR/USD stabilizes above 1.0900, it is likely to face resistance at 1.0950 (static level) before targeting 1.1000 (end-point of the latest uptrend, psychological level) and 1.1035 (multi-month high set in early February).

On the downside, 1.0830 (20-day SMA) aligns as first support before 1.0800 (psychological level), 1.0740 (50-day SMA) and 1.0700 (100-day SMA).

How does Fed’s policy impact US Dollar?

The US Federal Reserve (Fed) has two mandates: maximum employment and price stability. The Fed uses interest rates as the primary tool to reach its goals but has to find the right balance. If the Fed is concerned about inflation, it tightens its policy by raising the interest rate to increase the cost of borrowing and encourage saving. In that scenario, the US Dollar (USD) is likely to gain value due to decreasing money supply. On the other hand, the Fed could decide to loosen its policy via rate cuts if it’s concerned about a rising unemployment rate due to a slowdown in economic activity. Lower interest rates are likely to lead to a growth in investment and allow companies to hire more people. In that case, the USD is expected to lose value.

The Fed also uses quantitative tightening (QT) or quantitative easing (QE) to adjust the size of its balance sheet and steer the economy in the desired direction. QE refers to the Fed buying assets, such as government bonds, in the open market to spur growth and QT is exactly the opposite. QE is widely seen as a USD-negative central bank policy action and vice versa.

-

12:16

USD Index: Downtrend persists, may not take much encouragement to resume below 102 – Scotiabank

USD trades broadly lower. The US Dollar Index (DXY) could accelerate its decline on a break under the 102 mark, economists at Scotiabank report.

Resistance aligns at 103.00/10

“While the USD is better offered, investors may not want to lean too hard on the currency ahead of the US CPI report tomorrow. The report could bring mixed news – clear progress in taming headline inflation but signs of stickier core inflation which may provide the USD some anchoring in the short run.”

“Technically, the sell-off in the DXY looks to have paused after a week or so of modest gains. The downtrend persists from a broader point of view, however, and may not take much encouragement to resume (below 102 on the index).”

“Resistance for the DXY is 103.00/10.”

-

12:11

EUR/USD: A push to 1.10 remains the objective – Scotiabank

EUR/USD rises steadily from Monday’s low to regain the 1.09 area. Economists at Scotiabank still expect the world’s most popular currency pair to push above the 1.10 handle.

EUR/USD to retest mid-1.09 on sustained gains through 1.09 today

“Short-term trends look flat for EUR/USD but solid gains off the early week low for spot confers a slightly more positive spin on prospects and the longer run technical patterns remain bullish-leaning.”

“Sustained gains through 1.09 today should see the mid-1.09 are retested. A push to 1.10+ remains the objective for this move.”

-

12:02

USD/JPY: Any Yen weakness on the back of maintaining policy settings unlikely to prove sustainable – MUFG

Paring back of speculation over more immediate BoJ policy shift weighs on the Japanese Yen. However, the USDJPY is set to struggle at between 135 and 137, key resistance levels, economists at MUFG Bank report.

BoJ will abandon yield curve control this year

“The paring back of expectations for a more immediate shift to BoJ policy settings under new Governor Ueda will take some of the wind out the Yen’s sails, and make it harder for the JPY to extend its advance ahead of the BoJ’s policy meeting later this month. We are still of the view though that the BoJ will abandon yield curve control this year so any Yen weakness on the back of maintaining current policy settings is unlikely to prove sustainable.”

“Furthermore, with US yields having peaked out, it should help dampen upside potential for USD/JPY in the near-term with important resistance levels coming in between 135.00 and 137.00.”

-

12:00

South Africa Manufacturing Production Index (YoY) below forecasts (-2.15%) in February: Actual (-5.2%)

-

11:51

USD/INR: Ruppe strength through the end of this year and into 2024 – Wells Fargo

With the RBI on hold and the Fed likely to deliver another 25 bps hike in May, economists at Wells Fargo expect the Rupee to continue moving sideways in the short-term. Over the longerterm, an aggressive Fed easing cycle and broad-based USD depreciation should lead to INR strength.

Stable Rupee through Q2-2023

“With the RBI on hold and the Fed likely to deliver one last 25 bps hike in May, diverging paths for Fed-RBI monetary policy combined with lingering uncertainties should result in a stable Rupee through Q2-2023. We forecast the USD/INR exchange rate to hover near 82.25 through the end of the second quarter.”

“We believe the Federal Reserve is likely to lower interest rates at an aggressive pace starting in Q4 of this year, which should result in broad-based US Dollar weakness. This greenback depreciation should facilitate Indian Rupee strength over the medium-to-longer term, and we target a USD/INR exchange rate of 81.00 by the end of 2023 and 79.50 by the middle of 2024.”

-

11:47

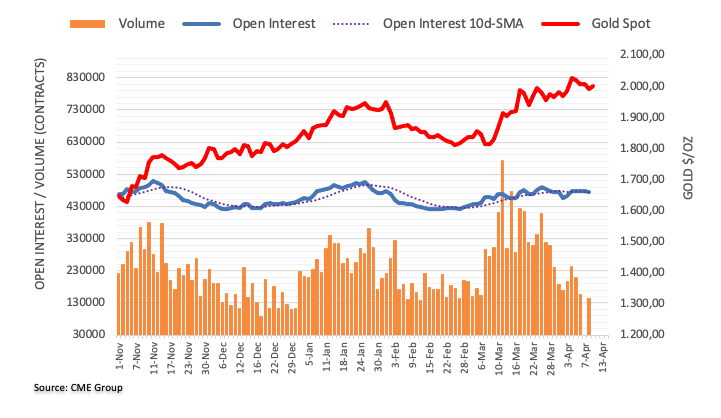

Gold Price Forecast: XAU/USD clings to gains just above $2,000 amid weaker US Dollar

- Gold price regains positive traction on Tuesday amid the emergence of fresh US Dollar selling.

- Bets for more rate hikes by the Federal Reserve could cap any meaningful gains for the metal.

- Traders also seem reluctant ahead of the US CPI report and the FOMC minutes on Wednesday.

Gold price attracts fresh buying on Tuesday and snaps a two-day losing streak to the $1,982-$1,981 region, or a three-day low touched the previous day. The XAU/USD sticks to its intraday gains through the first half of the European session and is currently placed just above the $2,000 psychological mark, near the top end of the daily trading range.

Weaker US Dollar helps Gold price to regain positive traction

The US Dollar (USD) meets with some supply and stalls a four-day-old recovery trend from over a two-month low touched last week amid some repositioning trade ahead of the latest consumer inflation figures from the United States (US) on Wednesday. This, in turn, is seen as a key factor that benefits the US Dollar-denominated Gold price and remains supportive of the intraday positive move. That said, any meaningful upside seems elusive amid speculations that the Federal Reserve (Fed) may continue raising interest rates.

Rising bets for additional rate hikes by Federal Reserve could cap gains

In fact, the current market pricing indicates a greater chance of another 25 basis points (bps) lift-off at the next Federal Open Market Committee (FOMC) monetary policy meeting in May. The bets were lifted by the mostly upbeat US monthly employment details, popularly known as the Nonfarm Payrolls (NFP) report, released last Friday. This, for now, seems to have put a floor under the US Treasury bond yields, which should act as a tailwind for the Greenback and cap any further gains for the non-yielding Gold price.

Investors await CPI report from United States and FOMC minutes

Hence, the market focus will remain glued to the FOMC meeting minutes, due on Wednesday, which will be preceded by the release of the crucial US Consumer Price Index (CPI) report on Wednesday. This might influence market expectations about the Fed's next policy move, which, in turn, will drive the USD demand and provide some meaningful impetus to Gold price. Traders this week will further take cues from the release of the US monthly Retail Sales data on Friday to determine the near-term trajectory for the XAU/USD.

Gold price technical outlook

From a technical perspective, any subsequent move up is likely to face stiff resistance near the $2,020 horizontal zone. This is followed by over a one-year high, around the $2,032 area touched last week, which if cleared will be seen as a fresh trigger for bullish traders. Gold price could then accelerate the momentum towards the $2,048-$2,050 intermediate hurdle en route to the all-time high, around the $2,070-$2,075 region.

On the flip side, the $1,990-$1,980 zone now seems to have emerged as an immediate strong support. A convincing break below should pave the way for a slide towards the $1,955-$1,950 region before the Gold price eventually drops to the next relevant support near the $1,935-$1,934 area. The corrective decline could get extended further towards the $1,918-$1,917 horizontal zone en route to the $1,900 round-figure mark.

Key levels to watch

-

11:25

USDK/KRW: BoK's pause will do little to help Won, but weakness will be short-lived – TDS

The Bank of Korea (BoK) kept its policy rate on hold at 3.50%. Economists at TD Securities believe that the Won weakness will be short-lived as the USD/KRW pair faces stubborn resistance at its 200-Day Moving Average.

BoK maintains hawkish bias despite pause

“The BoK maintained its policy rate at 3.50% in an unanimous decision. In the accompanying statement, BoK didn't give any sense it would consider easing soon, seeing a ‘restrictive stance as warranted for considerable time’ and keeping open the option to hike further.”

“We think the BoK will see the 300 bps of hikes in its current cycle as sufficient to slow inflation going forward as the economy weakens, without needing to hike further. We maintain our bigger than consensus expectation of 75 bps easing in Q4 this year, with markets only pricing in a small probability of cuts.”

“Today's outcome will do little to help KRW, though we continue to believe its weakness will be short-lived as US yields fall back.”

“Strong resistance for USD/KRW is likely around its 200-DMA at 1,323.73.”

-

11:19

USD/MYR: Further range bound remains on the table – UOB

Market Strategist Quek Ser Leang at UOB Group suggests USD/MYR is likely to face extra consolidation between 4.3930 and 4.4350 in the near term.

Key Quotes

“Last week, we expected USD/MYR to trade in a range between 4.38 00 and 4.4350.”

“Our view for USD/MYR to trade in a range was not wrong even though USD/MYR traded in a narrower range than expected (4.3920-4.4310). Further range trading appears likely, expected to be between 4.3930 and 4.4350.”

-

11:11

CFTC data point towards the CAD for those who want to buy an unloved currency – SocGen

Kit Juckes, Chief Global FX Strategist at Société Générale, analyzes CFTC data, highlighting the Canadian Dollar as an attractive currency.

Long EUR/USD may be a frustrating ride

“There isn’t much wrong with being a Dollar bear – relative monetary policy prospects and the high historic Dollar valuation are both going to help – but long EUR/USD (in spot) may be a frustrating ride as positioning causes frequent pullbacks.”

“The speculative market’s still short GBP and CHF, so maybe those are better bets, though the extent of divergence from the EUR/USD trend will be limited. For those who want to buy a currency which is properly unloved, the CFTC data point towards the CAD.”

-

11:00

United States NFIB Business Optimism Index down to 90.1 in March from previous 90.9

-

10:55

EUR/USD: Sideways shuffle and subdued volatility until the May ECB and FOMC meetings – SocGen