Notícias do Mercado

-

17:14

Reserve Bank of Australia Governor Glenn Stevens wants the exchange rate of the Australian dollar at about USD0.75

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said in an interview with The Australian Financial Review that the exchange rate of the Australian dollar should be closer to about USD0.75.

Stevens noted that the economic growth, jobs and inflation were running close to RBA's forecasts.

-

16:42

Foreign exchange market. American session: the U.S. dollar after the mixed U.S. economic data

The U.S. dollar traded mixed against the most major currencies after the mixed U.S. economic data. The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 93.8 in December from a final reading of 88.8 in November, exceeding expectations for an increase to 89.6. That was the highest level since January 2007.

The U.S. producer price index dropped 0.2% in November, missing expectations for a 0.1% fall, after a 0.2% increase in October.

On a yearly basis, the producer price index increased 1.4% in November, missing expectations for a 1.6% gain, after a 1.5% rise in October.

The producer price index excluding food and energy was flat in November, missing forecasts of a 0.1% increase, after a 0.4% gain in October.

On a yearly basis, the producer price index excluding food and energy climbed 1.8% in November, exceeding expectations for a 1.5% increase, after a 1.8% gain in October.

The euro traded higher against the U.S. dollar. Industrial production in the Eurozone rose 0.1% in October, missing expectations for a 0.2% gain, after a 0.5% rise in September. September's figure was revised down from a 0.6 increase.

On a yearly basis, Eurozone's industrial production increased 0.7% in October, beating expectations for a 0.6% rise.

The British pound traded mixed against the U.S. dollar. UK's construction output fell 2.2% in October, after a revised 2.2% gain in September. September's figure was revised up from a 1.8% rise.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback after the weak Business NZ performance of manufacturing index for New Zealand. The Business NZ performance of manufacturing index (PMI) declined to 55.2 in November from 58.9 in October. October's figure was revised down from 59.3.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie traded mixed against the greenback after the mixed economic data from China and the Reserve Bank of Australia Governor Glenn Stevens' interview. China's industrial production increased 7.2% on year in November, missing expectations for a 7.5% rise, down from a 7.7% gain in October.

Fixed asset investment in China rose 15.8% in November, in line with expectations, down from a 15.8% increase in October.

Retail sales in China climbed 11.7% on year in November, exceeding expectations for a 11.5% increase, after a 11.5% gain in October.

The Reserve Bank of Australia Governor Glenn Stevens said in an interview with The Australian Financial Review that the exchange rate of the Australian dollar should be closer to about USD0.75.

The Japanese yen traded mixed against the U.S. dollar. Japan's final industrial production rose 0.4% in October, faster than the 0.2% growth estimated earlier.

-

16:00

Thomson Reuters/University of Michigan preliminary consumer sentiment index jumped to its highest level since January 2007

The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 93.8 in December from a final reading of 88.8 in November, exceeding expectations for an increase to 89.6. That was the highest level since January 2007.

Hiring and wage growth boosted the U.S. consumer confidence.

-

15:40

China’s industrial production increased 7.2% on year in November

China's industrial production increased 7.2% on year in November, missing expectations for a 7.5% rise, down from a 7.7% gain in October.

Fixed asset investment in China rose 15.8% in November, in line with expectations, down from a 15.8% increase in October.

Retail sales in China climbed 11.7% on year in November, exceeding expectations for a 11.5% increase, after a 11.5% gain in October.

These figures adding to concerns about a slowdown of Chinese economy. Investors speculate that Chinese government will add stimulus measures to bolster growth.

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, December 93.8 (forecast 89.6)

-

14:10

U.S. producer price index dropped 0.2% in November

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index dropped 0.2% in November, missing expectations for a 0.1% fall, after a 0.2% increase in October.

On a yearly basis, the producer price index increased 1.4% in November, missing expectations for a 1.6% gain, after a 1.5% rise in October.

The decline was driven by a decline in oil prices. Wholesale gas prices dropped 6.3%, while food prices fell 0.2%.

The producer price index excluding food and energy was flat in November, missing forecasts of a 0.1% increase, after a 0.4% gain in October.

On a yearly basis, the producer price index excluding food and energy climbed 1.8% in November, exceeding expectations for a 1.5% increase, after a 1.8% gain in October.

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2300(E1.26bn), $1.2325-30(E590mn), $1.2350-60(E823mn), $1.2400(E1.0bn), $1.2500(E527mn)

USD/JPY: Y117.00($1.0bn), Y118.00($500mn), Y119.00($1.2bn), Y120.00-15($5.4bn)

GBP/USD: $1.5800(stg835mn)

USD/CHF: Chf0.9710($450mn), Chf0.9720($490mn), Chf0.9725($225mn)

AUD/USD: $0.8200(A$200mn), $0.8250-55(A$370mn), $0.8450(A$407mn)

NZD/USD: $0.7650(NZ$603mn)

USD/CAD: C$1.1450($222mn), C$1.1470-80($400mn), C$1.1525($295mn)

-

13:37

UK's construction output fell 2.2% in October

The Office for National Statistics (ONS) its construction output for the U.K. UK's construction output fell 2.2% in October, after a revised 2.2% gain in September. September's figure was revised up from a 1.8% rise.

The ONS said the output declined across the construction industry, while only public new work slightly increased.

-

13:31

U.S.: PPI, y/y, November +1.4% (forecast +1.6%)

-

13:30

U.S.: PPI, m/m, November -0.2% (forecast -0.1%)

-

13:30

U.S.: PPI excluding food and energy, m/m, November 0.0% (forecast +0.1%)

-

13:30

U.S.: PPI excluding food and energy, Y/Y, November +1.8% (forecast +1.5%)

-

13:08

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the industrial production data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Industrial Production (MoM) (Finally) October +0.2% +0.2% +0.4%

04:30 Japan Industrial Production (YoY) (Finally) October -1.0% -1.0% -0.8%

05:30 China Retail Sales y/y November +11.5% +11.5% +11.7%

05:30 China Fixed Asset Investment November +15.9% +15.8% +15.8%

05:30 China Industrial Production y/y November +7.7% +7.5% +7.2%

10:00 Eurozone Employment Change Quarter III +0.3% Revised From +0.2% +0.2% +0.2%

10:00 Eurozone Industrial production, (MoM) October +0.5% Revised From +0.6% +0.2% +0.1%

10:00 Eurozone Industrial Production (YoY) October +0.6% +0.6% +0.7%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. producer price index (PPI) data. The U.S. PPI is expected to decline 0.1% in November, after a 0.2% increase in October.

The greenback remained supported by yesterday's better-than-expected U.S. retail sales. The U.S. retail sales climbed 0.7% in November, exceeding expectations for a 0.3% increase, after a 0.5% gain in October. October's figure was revised up from a 0.3% rise.

Retail sales excluding automobiles increased 0.5% in November, beating expectations for a 0.1% gain, after a 0.4% gain in October. October's figure was revised up from a 0.3% increase.

The euro traded higher against the U.S. dollar after the industrial production data from the Eurozone. Industrial production in the Eurozone rose 0.1% in October, missing expectations for a 0.2% gain, after a 0.5% rise in September. September's figure was revised down from a 0.6 increase.

On a yearly basis, Eurozone's industrial production increased 0.7% in October, beating expectations for a 0.6% rise.

The British pound traded lower against the U.S. dollar as construction output in the U.K. declined. UK's construction output fell 2.2% in October, after a revised 2.2% gain in September. September's figure was revised up from a 1.8% rise.

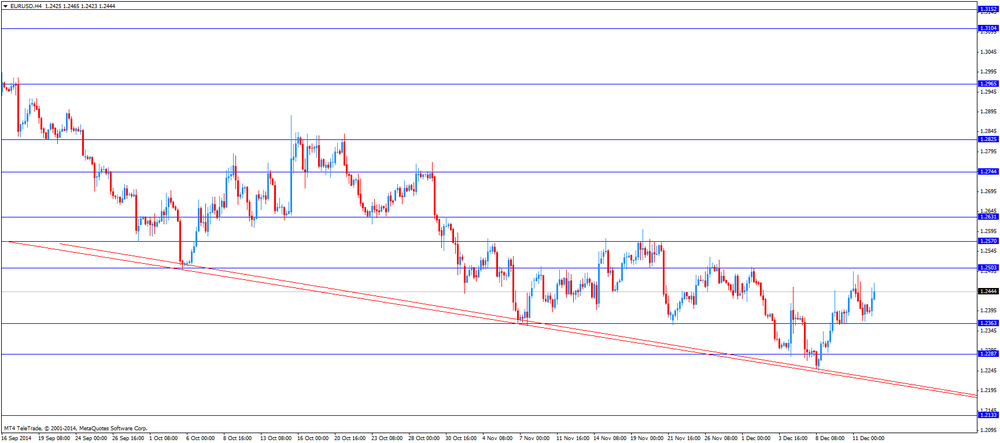

EUR/USD: the currency pair rose to $1.2465

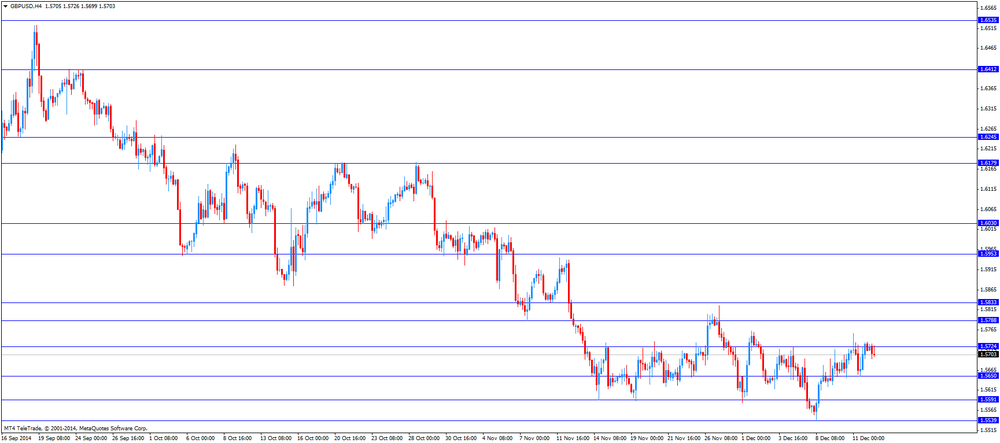

GBP/USD: the currency pair fell to $1.5693

USD/JPY: the currency pair declined to Y118.04

The most important news that are expected (GMT0):

13:30 U.S. PPI, m/m November +0.2% -0.1%

13:30 U.S. PPI, y/y November +1.5% +1.6%

13:30 U.S. PPI excluding food and energy, m/m November +0.4% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y November +1.8% +1.5%

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) December 88.8 89.6

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2570, $1.2530, $1.2505, $1.2465/60

Bids $1.2340, $1.2290/00, $1.2245

GBP/USD

Offers $1.5825, $1.5800, $1.5760/65

Bids $1.5665, $1.5625, $1.5600, $1.5540

AUD/USD

Offers $0.8500, $0.8450, $0.8400, $0.8370

Bids $0.8220, $0.8200, $0.8100

EUR/JPY

Offers Y149.80, Y149.00, Y148.85, Y148.25/30, Y147.95

Bids Y146.40, Y146.00, Y145.50/60

USD/JPY

Offers Y122.00, Y121.80, Y121.00, Y120.00/90, Y119.55

Bids Y118.00, Y117.40, Y117.20, Y117.00, Y116.30

EUR/GBP

Offers stg0.8000, stg0.7980, stg0.7950

Bids stg0.7840, stg0.7830/20, stg0.7800

-

10:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2300(E1.26bn), $1.2325-30(E590mn), $1.2350-60(E823mn), $1.2400(E1.0bn), $1.2500(E527mn)

USD/JPY: Y117.00($1.0bn), Y118.00($500mn), Y119.00($1.2bn), Y120.00-15($5.4bn)

GBP/USD: $1.5800(stg835mn)

USD/CHF: Chf0.9710($450mn), Chf0.9720($490mn), Chf0.9725($225mn)

AUD/USD: $0.8200(A$200mn), $0.8250-55(A$370mn), $0.8450(A$407mn)

NZD/USD: $0.7650(NZ$603mn)

USD/CAD: C$1.1450($222mn), C$1.1470-80($400mn), C$1.1525($295mn)

-

09:20

Press Review: Ahead of election win, Japan's Abe pivots away from painful reforms

REUTERS

Ahead of election win, Japan's Abe pivots away from painful reforms

TOKYO, Dec 12 (Reuters) - Prime Minister Shinzo Abe is signalling that retooling Japan's economy with painful structural reforms must take a back seat to reviving growth, even though he is poised to win a big referendum on his economic policies in an election on Sunday.

In the three weeks since he delayed a sales tax increase and called the election, Abe has shifted the debate from curbing the government's runaway debt to finding ways to stimulate the economy and put more money in voters' hands.

For example, policymakers say they are considering shopping vouchers for lower-income earners that would cover a portion of the cost of goods and services.

Source: http://www.reuters.com/article/2014/12/12/japan-election-economy-idUSL3N0TV3RK20141212

BLOOMBERG

IEA Cuts Global Oil Demand Forecast for 4th Time in Five Months

Global oil demand next year will be weaker than previously estimated and supply from non-OPEC producers will be bigger, theInternational Energy Agency said.

Consumption will expand by 230,000 barrels a day less than estimated in November, the Paris-based adviser to 29 nations said in a report today. Output from nations outside of the Organization of Petroleum Exporting Countries will grow at a faster pace than the agency predicted last month. Production rising faster than demand could strain some nations' ability to store by the middle of next year, it predicted.

The agency cut projections because the economies of producer nations are being hurt by tumbling prices, the IEA said. Most of the reduction in next year's estimate is attributable to Russia, where sanctions are hobbling growth, it said. Brent crude costs that collapsed 43 percent this year are too low for 10 of OPEC's 12 members to balance their budgets, data compiled by Bloomberg show.

BLOOMBERG

Ruble Surrounds Nabiullina With Rotten Choices: Russia CreditThe

Russian central bank Governor Elvira Nabiullina is running out of policy options for stabilizing the ruble without inflicting deeper damage to the economy.

On one side, she wants to support the currency to slow inflation and keep Russians from abandoning the ruble. On the other, the scale of interest-rate increases required to do that would further strangle an economy on the verge of a recession, and pile pressure on companies struggling to refinance debt as sanctions cut them off from international capital markets.

-

07:35

Foreign exchange market. Asian session: the greenback added gains against its major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan Industrial Production (MoM) (Finally) October +0.2% +0.2% +0.4%

04:30 Japan Industrial Production (YoY) (Finally) October -1.0% -1.0% -0.8%

05:30 China Retail Sales y/y November +11.5% +11.5% +11.7%

05:30 China Fixed Asset Investment November +15.9% +15.8% +15.8%

05:30 China Industrial Production y/y November +7.7% +7.5% +7.2%

The greenback traded stronger to mixed against its major peers. The currency was supported by upbeat retail sales figures. The U.S. dollar traded stronger against the euro after 306 banks borrowed 129.84 billion euros in the auction (targeted longer-term refinancing operation (TLTRO)) - about half of the volume offerded by the ECB and on the lower end of analysts expectations. Markets await data on the U.S. PPI and the Reuters/Michigan Consumer Sentiment Index being published later in the day at 13:30 GMT and 14:55.

The Australian dollar traded lower against the U.S. dollar hitting a 4-1/2 year low during the session. RBA Governor Glenn Stevens said in an interview that he would like to see the aussie at 75 U.S. cents but did not mention any interest rates cuts in the near future. Chinese Industrial Production further slowed, reading +7.2% compared to +7.7% in October and below forecast of +7.5%. Fixed Asset Investment was in line with expectations at 15.8%. Retail Sales beat expectations by +0.2% at 11.7%. China is Australia's biggest trade partner.

New Zealand's dollar declined after the currency added gains for three days.

The Japanese yen continued to weaken against the greenback before the upcoming elections this weekend currently trading around USD 118.70. According to a survey Prime Minister Shinzo Abe's Liberal Democratic Party will win more than the seats he needs for a two-thirds majority enabling him to continue his policy of monetary easing and fiscal spending known as "abenomics". Japanese Industrial production beat forecasts reading +0.4% MoM (forecast +0.2%) and -0.8% YoY (-1%).

EUR/USD: the euro declined against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Employment Change Quarter III +0.2% +0.2%

10:00 Eurozone Industrial production, (MoM) October +0.6% +0.2%

10:00 Eurozone Industrial Production (YoY) October +0.6% +0.6%

13:30 U.S. PPI, m/m November +0.2% -0.1%

13:30 U.S. PPI, y/y November +1.5% +1.6%

13:30 U.S. PPI excluding food and energy, m/m November +0.4% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y November +1.8% +1.5%

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) December 88.8 89.6

-

06:31

Options levels on friday, December 12, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2496 (1795)

$1.2461 (356)

$1.2435 (245)

Price at time of writing this review: $ 1.2395

Support levels (open interest**, contracts):

$1.2348 (762)

$1.2317 (1499)

$1.2273 (2440)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 48020 contracts, with the maximum number of contracts with strike price $1,2500 (6951);

- Overall open interest on the PUT options with the expiration date January, 9 is 54561 contracts, with the maximum number of contracts with strike price $1,2000 (7619);

- The ratio of PUT/CALL was 1.14 versus 1.16 from the previous trading day according to data from December, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.6002 (1793)

$1.5904 (1635)

$1.5807 (1561)

Price at time of writing this review: $1.5725

Support levels (open interest**, contracts):

$1.5688 (1358)

$1.5592 (967)

$1.5495 (983)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 18000 contracts, with the maximum number of contracts with strike price $1,5850 (1993);

- Overall open interest on the PUT options with the expiration date January, 9 is 17571 contracts, with the maximum number of contracts with strike price $1,5200 (1692);

- The ratio of PUT/CALL was 0.98 versus 1.05 from the previous trading day according to data from December, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:32

Japan: Industrial Production (YoY), October -0.8% (forecast -1.0%)

-

04:31

Japan: Industrial Production (MoM) , October +0.4% (forecast +0.2%)

-