Notícias do Mercado

-

23:32

Currencies. Daily history for Dec 11’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2410 -0,31%

GBP/USD $1,5730 +0,10%

USD/CHF Chf0,9678 +0,17%

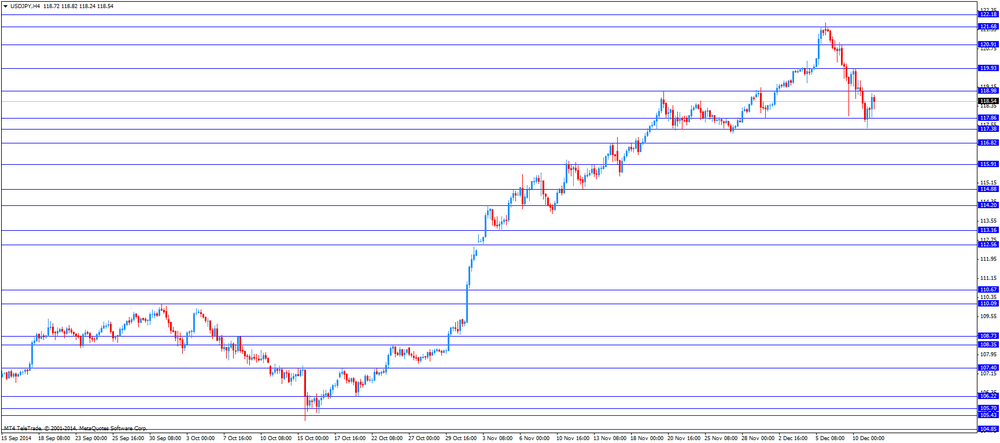

USD/JPY Y118,63 +0,69%

EUR/JPY Y147,22 +0,39%

GBP/JPY Y186,62 +0,80%

AUD/USD $0,8268 -0,59%

NZD/USD $0,7816 -6,41%

USD/CAD C$1,1519 +0,34%

-

23:01

Schedule for today, Friday, Dec 12’2014:

(time / country / index / period / previous value / forecast)

04:30 Japan Industrial Production (MoM) (Finally) October +0.2% +0.2%

04:30 Japan Industrial Production (YoY) (Finally) October -1.0% -1.0%

05:30 China Retail Sales y/y November +11.5% +11.5%

05:30 China Fixed Asset Investment November +15.9% +15.8%

05:30 China Industrial Production y/y November +7.7% +7.5%

10:00 Eurozone Employment Change Quarter III +0.2% +0.2%

10:00 Eurozone Industrial production, (MoM) October +0.6% +0.2%

10:00 Eurozone Industrial Production (YoY) October +0.6% +0.6%

13:30 U.S. PPI, m/m November +0.2% -0.1%

13:30 U.S. PPI, y/y November +1.5% +1.6%

13:30 U.S. PPI excluding food and energy, m/m November +0.4% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y November +1.8% +1.5%

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) December 88.8 89.6

-

16:44

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the better-than-expected U.S. retail sales

The U.S. dollar traded mixed against the most major currencies after the better-than-expected U.S. retail sales. The U.S. retail sales climbed 0.7% in November, exceeding expectations for a 0.3% increase, after a 0.5% gain in October. October's figure was revised up from a 0.3% rise.

Retail sales excluding automobiles increased 0.5% in November, beating expectations for a 0.1% gain, after a 0.4% gain in October. October's figure was revised up from a 0.3% increase.

These figures showed that consumer spending in the U.S. rose in the fourth quarter after slowing in the second quarter.

The number of initial jobless claims in the week ending December 06 in the U.S. fell by 3,000 to 294,000 from 297,000 in the previous week. Analysts had expected the number of initial jobless claims to climb to 299,000.

The U.S. business inventories rose by 0.2% in October, in line with expectations, after a 0.3% gain in September.

The euro fell against the U.S. dollar. 306 banks borrowed 129.84 billion euros in the auction (targeted longer-term refinancing operation (TLTRO)).

Germany's final consumer price index was flat in November.

On a yearly basis, German final consumer price index rose 0.6% in October, higher than the previous reading of 0.5% gain.

France's consumer price inflation declined 0.2% in November, missing expectations for a 0.2% increase, after a flat reading in October.

On a yearly basis, French consumer price index fell to 0.4% in November from 0.5% in October. Analysts had expected the consumer inflation to remain at 0.5%.

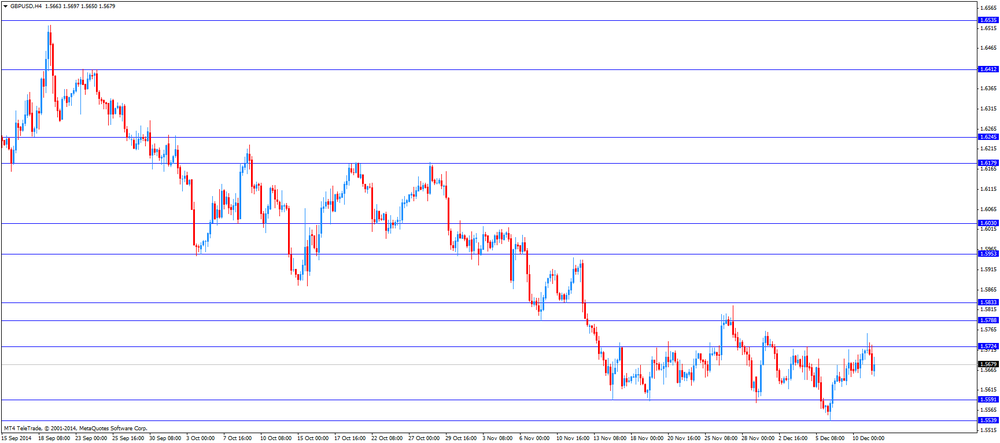

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian new housing price index. New housing price index increased 0.1% in October, missing expectations for a 0.2% gain, after a 0.1% rise in September.

The Swiss franc declined against the U.S. dollar. The Swiss National Bank's (SNB) kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

The SNB reiterated that it will defend the 1.20 francs per euro exchange rate floor. The central bank also said that consumer inflation will decline next year and the risk of deflation has risen.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the Reserve Bank of New Zealand's (RBNZ) interest rate decision. The RBNZ kept its interest rate unchanged at 3.50%. This decision was expected by analysts.

The RBNZ Governor Graeme Wheeler said that interest rate hike "is expected to be required at a later stage" because of the economic growth of around 3% and as New Zealand's jobless rate declines. Monetary policy adjustments "will depend on data", he added.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded mixed against the greenback after the mixed labour market data from Australia. Australia's unemployment rate increased to 6.3% in November from 6.2% in October, in line with expectations.

The number of employed people in Australia rose by 42,700 in November, beating expectations for an increase by 15,200, after a gain by 13,700 in October. October's figure was revised down from an increase by 24,100.

The Melbourne Institute's consumer inflation expectations for Australia decreased to 3.4% in December from 4.1% in November.

The Japanese yen declined against the U.S. dollar. Japan's core machinery orders dropped 6.4% in October, missing expectations for a 1.7% fall, after a 2.9% rise in September.

On a yearly basis, Japan's core machinery orders fell 4.9% in October, after a 7.3% gain in September.

Japan's tertiary industry index fell 0.2% in October, missing expectations for a 0.1% decline, after a 1.3% rise in September. September's figure was revised up from a 1.0% gain.

-

16:12

Bank of Canada Governor Stephen Poloz: global regulatory reform is required

The Bank of Canada Governor Stephen Poloz said today in a speech in New York that it will take two years "before the Canadian economy returns to steady growth". But he added that it is impossible "without vigorous and innovative financial intermediation".

Poloz noted that "global regulatory reform was absolutely essential".

-

15:44

U.S. business inventories rose by 0.2% in October

The U.S. Commerce Department released the business inventories data on Thursday. The U.S. business inventories rose by 0.2% in October, in line with expectations, after a 0.3% gain in September.

Business sales declined 0.8% in October.

Sales by manufacturers rose 0.4%, while sales by wholesalers were up 0.2%.

The business inventories/sales ratio remained unchanged at 1.30 months in October. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

15:19

Canada’s new housing price index increased 0.1% in October

Statistics Canada released its new housing price index on Thursday. New housing price index increased 0.1% in October, missing expectations for a 0.2% gain, after a 0.1% rise in September.

On a yearly basis, the index climbed 1.6% in October.

Prices were unchanged in 10 of the 21 metropolitan areas.

-

15:00

U.S.: Business inventories , October +0.2% (forecast +0.2%)

-

14:58

Swiss National Bank will defend the 1.20 francs per euro exchange rate floor

The Swiss National Bank (SNB) released its interest rate decision today. The SNB kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

The SNB reiterated that it will defend the 1.20 francs per euro exchange rate floor. Introducing of negative rates is not excluded, the central bank said. The central bank also said that consumer inflation will decline next year and the risk of deflation has risen.

The SNB President Thomas Jordan said that the exchange rate cap is the key instrument to avoid a tightening of monetary conditions.

Switzerland's central bank expects "that global economic growth will gradually firm over the course of next year", but "the global economic outlook is still dominated by downside risks".

Inflation forecast was revised down to 0.0% in 2014, to -0.1% in 2015 and to 0.3% in 2016.

The SNB increased gross domestic product (GDP) to 1.5%-2.0% in 2014. Swiss GDP is expected to be about 2% next year.

-

14:34

U.S. retail sales jumped 0.7% in November

The U.S. Commerce Department released the retail sales data on Thursday. The U.S. retail sales climbed 0.7% in November, exceeding expectations for a 0.3% increase, after a 0.5% gain in October. October's figure was revised up from a 0.3% rise.

Retail sales excluding automobiles increased 0.5% in November, beating expectations for a 0.1% gain, after a 0.4% gain in October. October's figure was revised up from a 0.3% increase.

These figures showed that consumer spending in the U.S. rose in the fourth quarter after slowing in the second quarter.

The increase was driven by lower gasoline prices and strong job growth. Gasoline prices declined due to falling oil prices.

Sales at clothing retailers climbed 1.2%, while sales at electronics and appliance stores rose 0.9% in November. Sales at auto dealers gained 1.7%.

-

13:46

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.00 (USD 583m) 118.15 (USD 480m) 119.00 (USD 650m) 120.00 (USD 320m) 120.20 (USD 480m)

EUR/USD 1.2300 (EUR 551m) 1.2350 (EUR 800m) 1.2385 (EUR 453m) 1.2400 (EUR 990m) 1.2415-25 (EUR 740m) 1.2500 (EUR 1.4bln)

GBP/USD 1.5605 (GBP 361m)

USD/CHF 0.9700

AUD/USD 0.8350 (AUD 350m)

USD/CAD none

EUR/GBP 0.7855 (EUR 802m) 0.7890 (EUR 278m) 0.8000 (EUR 1bln)

EUR/CHF 1.2000 (EUR 2bln)

AUD/NZD 1.0755 1.0900 (AUD 500m)

-

13:31

U.S.: Import Price Index, December -1.5% (forecast -1.7%)

-

13:31

Canada: New Housing Price Index , October +0.1% (forecast +0.2%)

-

13:30

U.S.: Retail sales excluding auto, November +0.5% (forecast +0.1%)

-

13:30

U.S.: Retail sales, November +0.7% (forecast +0.3%)

-

13:30

U.S.: Initial Jobless Claims, December 294 (forecast 299)

-

13:01

Foreign exchange market. European session: the Swiss franc traded mixed against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation December 4.1% 3.4%

00:01 United Kingdom RICS House Price Balance November 20% 15% 13%

00:30 Australia Changing the number of employed November +13.7 Revised From +24.1 +15.2 +42.7

00:30 Australia Unemployment rate November 6.2% 6.3% 6.3%

07:00 Germany CPI, m/m (Finally) November 0.0% 0.0% 0.0%

07:00 Germany CPI, y/y November +0.5% +0.5% +0.6%

07:45 France CPI, m/m November 0.0% +0.2% -0.2%

07:45 France CPI, y/y November +0.5% +0.5% +0.4%

08:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

08:30 Switzerland SNB Monetary Policy Assessment

08:30 Switzerland SNB Press Conference

09:00 Eurozone ECB Monthly Report

10:15 Eurozone Targeted LTRO 82.6 129.8

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. retail sales are expected to rise 0.3% in November, after a 0.3% decline in October.

Retail sales excluding automobiles are expected to climbs 0.1% in November, after a 0.3% rise in October.

The number of initial jobless claims in the U.S. is expected to increase by 2,000 to 299,000.

The euro traded mixed against the U.S. dollar after the targeted longer-term refinancing operation (TLTRO) from the Eurozone and consumer price inflation from Germany and France. 306 banks borrowed 129.84 billion euros in the auction.

Germany's final consumer price index was flat in November.

On a yearly basis, German final consumer price index rose 0.6% in October, higher than the previous reading of 0.5% gain.

France's consumer price inflation declined 0.2% in November, missing expectations for a 0.2% increase, after a flat reading in October.

On a yearly basis, French consumer price index fell to 0.4% in November from 0.5% in October. Analysts had expected the consumer inflation to remain at 0.5%.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian new housing price index. Canada's new housing price index is expected to rise 0.2% in October, after a 0.1% gain in September.

The Swiss franc traded mixed against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision. The SNB kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

The SNB reiterated that it will defend the 1.20 francs per euro exchange rate floor. The central bank also said that consumer inflation will decline next year and the risk of deflation has risen.

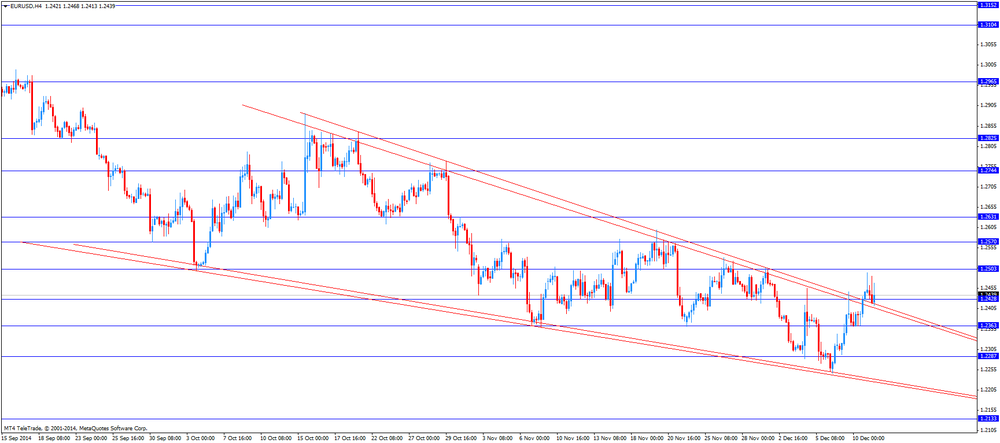

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5650

USD/JPY: the currency pair rose to Y118.88

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index October +0.1% +0.2%

13:30 U.S. Retail sales November +0.3% +0.3%

13:30 U.S. Retail sales excluding auto November +0.3% +0.1%

13:30 U.S. Initial Jobless Claims December 297 299

13:30 U.S. Import Price Index December -1.3% -1.7%

15:00 U.S. Business inventories October +0.3% +0.2%

21:30 New Zealand Business NZ PMI November 59.3

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2570, $1.2530, $1.2505

Bids $1.2375, $1.2340, $1.2290/00, $1.2245

GBP/USD

Offers $1.5825, $1.5800, $1.5760/65

Bids $1.5665, $1.5625, $1.5600, $1.5540

AUD/USD

Offers $0.8500, $0.8450, $0.8400, $0.8370

Bids $0.8260, $0.8220, $0.8200, $0.8100

EUR/JPY

Offers Y149.80, Y149.00, Y148.85, Y148.25/30, Y147.95

Bids Y146.40, Y146.00, Y145.50/60

USD/JPY

Offers Y122.00, Y121.80, Y121.00, Y120.00/90, Y119.50/55

Bids Y117.40, Y117.20, Y117.00, Y116.30

EUR/GBP

Offers stg0.8000, stg0.7980, stg0.7950

Bids stg0.7900, stg0.7840, stg0.7830/20, stg0.7800

-

12:30

Reserve Bank of New Zealand Graeme Wheeler: interest rate hike “is expected to be required at a later stage”

The Reserve Bank of New Zealand (RBNZ) released its interest rate decision on Wednesday. The RBNZ kept its interest rate unchanged at 3.50%. This decision was expected by analysts.

The RBNZ Governor Graeme Wheeler said that interest rate hike "is expected to be required at a later stage" because of the economic growth of around 3% and as New Zealand's jobless rate declines. Monetary policy adjustments "will depend on data", he added.

Wheeler noted that the exchange rate of the kiwi "does not reflect the decline in export prices this year and remains unjustifiably and unsustainably high". "A further significant depreciation" is expected by New Zealand's, he said.

The RBNZ governor pointed out that low interest rates "continue to support domestic demand".

Wheeler expect that dairy prices will recover in 2015.

The central bank revised its inflation and growth forecasts. Inflation is expected to be 1.1% in the 12 months ending March 31, 2015. The RBNZ said that inflation in New Zealand won't reach 2% until the fourth quarter of 2016.

The economic growth in the year ending March 2016 was revised to 3.1% from 2.6%, while the economic growth in the year ending March 2017 was revised to 3.0% from 2.2%.

-

10:27

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.00 (USD 583m) 118.15 (USD 480m) 119.00 (USD 650m) 120.00 (USD 320m) 120.20 (USD 480m)

EUR/USD 1.2300 (EUR 551m) 1.2350 (EUR 800m) 1.2385 (EUR 453m) 1.2400 (EUR 990m) 1.2415-25 (EUR 740m) 1.2500 (EUR 1.4bln)

GBP/USD 1.5605 (GBP 361m)

USD/CHF 0.9700

AUD/USD 0.8350 (AUD 350m)

USD/CAD none

EUR/GBP 0.7855 (EUR 802m) 0.7890 (EUR 278m) 0.8000 (EUR 1bln)

EUR/CHF 1.2000 (EUR 2bln)

AUD/NZD 1.0755 1.0900 (AUD 500m)

-

08:31

Switzerland: SNB Interest Rate Decision, 0.25% (forecast 0.25%)

-

07:45

France: CPI, y/y, November +0.4% (forecast +0.5%)

-

07:45

France: CPI, m/m, November -0.2% (forecast +0.2%)

-

07:30

Foreign exchange market. Asian session: the greenback is trading weaker to steady

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia Consumer Inflation Expectation December 4.1% 3.4%

00:01 United Kingdom RICS House Price Balance November 20% 15% 13%

00:30 Australia Changing the number of employed November +24.1 +15.2 +42.7

00:30 Australia Unemployment rate November 6.2% 6.3% 6.3%

07:00 Germany CPI, m/m (Finally) November 0.0% 0.0% 0.0%

07:00 Germany CPI, y/y November +0.5% +0.5% +0.6%

The greenback traded steady against the euro and the British pound. The common currency previously continued to rally back from a 2 ½ year low at USD1.2246 hit on Monday. Investors continued to sell the U.S. dollar for profit awaiting important U.S. data later in the day.

The Australian dollar traded higher against the U.S. dollar. Consumer Inflation Expectation declined from a previous reading of 4.1% to 3.4% but the number of people employed rose unexpectedly by 42,700 in November, beating estimates of 15,000 by far. The Unemployment Rate stayed at 6.3% in line with expectations.

New Zealand's dollar added gains for a third day. Yesterday the RBNZ kept its benchmark interest rate unchanged at 3.5%. RBNZ Wheeler said that growth is expected to remain at or above trend through 2016 with more jobs being created and inflation pressure is going to stay modest - still further rate increases might be needed in the future. As diary prices keep falling the kiwi's exchange rate is "unjustifiably and unsustainably high", he said.

The Japanese yen lost after 3 days of gains again against the greenback on speculation that Prime Minister Shinzo Abe will win the elections this weekend and continue his "Abenomics" and even extend his stimulus measures - a policy that has weakened the Japanese yen. Japanese Core Machinery Orders declined by -6.4%. Analysts had forecasted a decline of -1.7% for October. Year on year the orders slumped from +7.3% to -4.9%.

EUR/USD: the euro traded steady against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded steady against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France CPI, m/m November 0.0% +0.2%

07:45 France CPI, y/y November +0.5% +0.5%

08:30 Switzerland SNB Interest Rate Decision 0.25% 0.25%

08:30 Switzerland SNB Monetary Policy Assessment

08:30 Switzerland SNB Press Conference

09:00 Eurozone ECB Monthly Report

10:15 Eurozone Targeted LTRO 82.6

13:30 Canada New Housing Price Index October +0.1% +0.2%

13:30 U.S. Retail sales November +0.3% +0.3%

13:30 U.S. Retail sales excluding auto November +0.3% +0.1%

13:30 U.S. Initial Jobless Claims December 297 299

13:30 U.S. Import Price Index December -1.3% -1.7%

15:00 U.S. Business inventories October +0.3% +0.2%

21:30 New Zealand Business NZ PMI November 59.3

-

07:00

Germany: CPI, m/m, November 0.0% (forecast 0.0%)

-

07:00

Germany: CPI, y/y , November +0.6% (forecast +0.5%)

-

06:28

Options levels on thursday, December 11, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2573 (2956)

$1.2532 (1782)

$1.2503 (363)

Price at time of writing this review: $ 1.2440

Support levels (open interest**, contracts):

$1.2388 (761)

$1.2350 (1499)

$1.2298 (2149)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 46593 contracts, with the maximum number of contracts with strike price $1,2500 (6764);

- Overall open interest on the PUT options with the expiration date January, 9 is 54005 contracts, with the maximum number of contracts with strike price $1,2000 (7260);

- The ratio of PUT/CALL was 1.16 versus 1.18 from the previous trading day according to data from December, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.6002 (1564)

$1.5904 (1681)

$1.5807 (1556)

Price at time of writing this review: $1.5709

Support levels (open interest**, contracts):

$1.5592 (966)

$1.5494 (1037)

$1.5396 (838)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 16576 contracts, with the maximum number of contracts with strike price $1,5700 (1796);

- Overall open interest on the PUT options with the expiration date January, 9 is 17377 contracts, with the maximum number of contracts with strike price $1,5200 (1653);

- The ratio of PUT/CALL was 1.04 versus 1.08 from the previous trading day according to data from December, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Australia: Changing the number of employed, November +42.7 (forecast +15.2)

-

00:30

Australia: Unemployment rate, November 6.3% (forecast 6.3%)

-

00:02

United Kingdom: RICS House Price Balance, November 13% (forecast 15%)

-

00:00

Australia: Consumer Inflation Expectation, December 3.4%

-