Notícias do Mercado

-

23:51

Japan: Tertiary Industry Index , October -0.2% (forecast -0.1%)

-

23:50

Japan: Core Machinery Orders, October -6.4% (forecast -1.7%)

-

23:50

Japan: Core Machinery Orders, y/y, October -4.9%

-

23:29

Currencies. Daily history for Dec 10’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2448 +0,61%

GBP/USD $1,5714 +0,31%

USD/CHF Chf0,9662 -0,51%

USD/JPY Y117,81 -1,60%

EUR/JPY Y146,64 -1,00%

GBP/JPY Y185,12 -1,28%

AUD/USD $0,8317 +0,31%

NZD/USD $0,7811 +1,70%

USD/CAD C$1,1480 +0,30%

-

23:01

Schedule for today, Thursday, Dec 11’2014:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation December 4.1%

00:01 United Kingdom RICS House Price Balance November 20% 15%

00:30 Australia Changing the number of employed November +24.1 +15.2

00:30 Australia Unemployment rate November 6.2% 6.3%

07:00 Germany CPI, m/m (Finally) November 0.0% 0.0%

07:00 Germany CPI, y/y November +0.5% +0.5%

07:45 France CPI, m/m November 0.0% +0.2%

07:45 France CPI, y/y November +0.5% +0.5%

08:30 Switzerland SNB Interest Rate Decision 0.25% 0.25%

08:30 Switzerland SNB Monetary Policy Assessment

08:30 Switzerland SNB Press Conference

09:00 Eurozone ECB Monthly Report

10:15 Eurozone Targeted LTRO 82.6

13:30 Canada New Housing Price Index October +0.1% +0.2%

13:30 U.S. Retail sales November +0.3% +0.3%

13:30 U.S. Retail sales excluding auto November +0.3% +0.1%

13:30 U.S. Initial Jobless Claims December 297 299

13:30 U.S. Import Price Index December -1.3% -1.7%

15:00 U.S. Business inventories October +0.3% +0.2%

21:30 New Zealand Business NZ PMI November 59.3

-

20:00

New Zealand: RBNZ Interest Rate Decision, 3.50% (forecast 3.50%)

-

19:00

U.S.: Federal budget , November -56.8 (forecast -79.6)

-

17:21

Bank of Canada Governor Stephen Poloz: the economic recovery has been “frustratingly slow”

The Bank of Canada (BoC) released its Financial System Review (FSR) on Wednesday. The BoC Governor Stephen Poloz said that the economic recovery has been "frustratingly slow", but the nation's economy "is showing the first signs of a broadening recovery".

Poloz pointed out that the recent decline in oil and other commodity prices "raises important risks to this economic outlook".

The BoC governor noted that the current monetary policy is appropriate.

"The overall risk to financial stability in Canada is roughly the same as it was at the time of our June FSR", Poloz underlined.

-

16:43

Foreign exchange market. American session: the euro rose against the U.S. dollar despite the weaker-than-expected trade data from France

The U.S. dollar traded mixed against the most major currencies. Risk aversion by investors weighed on the greenback. The Greek presidential elections next week and restrictions on collateral for short-term loans by Chinese government led to investments in safe-haven assets.

The Greek government announced yesterday that it would hold presidential elections on Dec. 17. Analysts had not expected this decision.

The euro rose against the U.S. dollar despite the weaker-than-expected trade data from France. Industrial production in France declined 0.8% in October, missing expectations for a 0.2% gain, after the flat reading in September.

On a yearly basis, French industrial production dropped 1.0% in October, after a 0.3% decline in September.

Final non-farm payrolls in France decreased 0.3% in the third quarter, missing forecasts of a 0.2% decline, after the flat reading in the second quarter. The second quarter's figure was revised up from a 0.2 fall.

The British pound traded higher against the U.S. dollar despite the weaker-than-expected trade data from the U.K. The U.K. trade deficit fell to £9.6 billion in October from £10. 5 billion in September, missing expectations for a deficit of £9.5 billion. September's figure was revised down from a deficit of £9.8 billion.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand. The Reserve Bank of New Zealand will release its interest rate decision later in the day.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback after the mixed economic data from Australia. Home loans in Australia climbed 0.3% in October, exceeding expectations for a 0.2% rise, after a 0.4% decrease in September. September's figure was revised up from a 0.7% drop.

The Westpac Banking Corporation's consumer sentiment index for Australia fell 5.7% in December, after a 1.9% increase in November.

The Japanese yen rose against the U.S. dollar due to increasing demand for safe-haven yen. In the overnight trading session, the yen also increased against the greenback despite the weak economic data from Japan. Consumer confidence index in Japan declined to 37.7 points in November from 38.9 points in October. Analysts had expected the index to rise to 39.6 points.

The business survey index (BSI) of manufacturers' sentiment declined to 8.1 in fourth quarter from 12.7 in the third quarter, missing expectations for a rise to 13.1.

-

16:14

Japan’s business survey index (BSI) of manufacturers' sentiment fell to 8.1 in fourth quarter

Japan's Ministry of Finance and the Cabinet Office released its quarterly survey on late Tuesday. The business survey index (BSI) of manufacturers' sentiment declined to 8.1 in fourth quarter from 12.7 in the third quarter, missing expectations for a rise to 13.1.

Japan's economy slipped into a recession in the third quarter after a sales tax hike in April this year.

-

15:48

China's consumer price inflation declined to 1.4% in November, the lowest level since November 2009

China's consumer price inflation fell to an annual rate of 1.4% in November from 1.6% in October. Analysts had expected inflation to remain at 1.6%. That was the lowest level since November 2009.

This figure boosted hopes of stimulus measures by Chinese government to boost the economic growth.

Investors also speculate that Chinese government could cut interest rates.

Producer pricing index (PPI) in China declined to -2.7% in November from -2.2% in October, missing expectations for a drop to -2.3%. That was the lowest reading since June 2013.

-

15:30

U.S.: Crude Oil Inventories, December +1.5

-

14:55

Consumer confidence index in Japan fell to 37.7 points in November

Consumer confidence index in Japan declined to 37.7 points in November from 38.9 points in October. Analysts had expected the index to rise to 39.6 points.

That was the fourth straight decline. The index reached its lowest level since April 2014. Japanese government hiked the sale tax in April 2014.

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2300(E1.5bn), $1.2310(E639mn), $1.2315(E233mn), $1.2325(E200mn), $1.2330(E401mn), $1.2332(E240mn), $1.2335(E290mn), $1.2350(E257mn), $1.2390(E404mn), $1.2400(E438mn), $1.2410(E261mn)

USD/JPY: Y118.00($250mn), Y119.50($580mn), Y120.00($300mn)

GBP/USD: $1.5840-50(stg500mn)

EUR/GBP: stg0.7840, stg0.7865

EUR/CHF: Chf1.2000E220mn)

GBP/CHF: Chf1.5340(stg268mn)

NZD/USD: $0.7770(NZ$270mn)

USD/CAD: C$1.1400($253mn), C$1.1425($453mn)

-

13:01

Orders

EUR/USD

Offers $1.2450/55, $1.2505/00, $1.2530, $1.2570/65, $1.2600

Bids $1.2340, $1.2390/00, $1.2245

GBP/USD

Offers $1.5800, $1.5750/60, $1.5725

Bids $1.5625, $1.5600, $1.5540/50, $1.5520

AUD/USD

Offers $0.8500, $0.8450, $0.8400, $0.8370

Bids $0.8260, $0.8220, $0.8200, $0.8100

EUR/JPY

Offers Y149.80, Y149.00, Y148.85, Y148.25/30

Bids Y146.70/80, Y146.00, Y145.50/60

USD/JPY

Offers Y122.00, Y121.80, Y121.00, Y120.00/90

Bids Y117.85, Y117.20, Y117.00, Y116.30

EUR/GBP

Offers stg0.8000, stg0.7980, stg0.7950, stg0.7930

Bids stg0.7840, stg0.7830/20, stg0.7800

-

13:00

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the weaker-than-expected trade data from the U.K

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans October -0.4% Revised From -0.7% +0.2% +0.3%

01:30 China PPI y/y November -2.2% -2.3% -2.7%

01:30 China CPI y/y November +1.6% +1.6% +1.4%

05:00 Japan Coincident Index November 38.9 39.6 37.7

06:30 France Non-Farm Payrolls (Finally) Quarter III 0.0% Revised From -0.2% -0.2% -0.3%

07:45 France Industrial Production, m/m October 0.0% +0.2% -0.8%

07:45 France Industrial Production, y/y October -0.3% -1.0%

09:30 United Kingdom Trade in goods October -10.5 Revised From -9.8 -9.5 -9.6

The U.S. dollar traded mixed against the most major currencies. Risk aversion by investors weighed on the greenback. The Greek presidential elections next week and restrictions on collateral for short-term loans by Chinese government led to investments in safe-haven assets.

The Greek government announced yesterday that it would hold presidential elections on Dec. 17. Analysts had not expected this decision.

The euro traded mixed against the U.S. dollar despite the weaker-than-expected trade data from France. Industrial production in France declined 0.8% in October, missing expectations for a 0.2% gain, after the flat reading in September.

On a yearly basis, French industrial production dropped 1.0% in October, after a 0.3% decline in September.

Final non-farm payrolls in France decreased 0.3% in the third quarter, missing forecasts of a 0.2% decline, after the flat reading in the second quarter. The second quarter's figure was revised up from a 0.2 fall.

The British pound traded mixed against the U.S. dollar after the weaker-than-expected trade data from the U.K. The U.K. trade deficit fell to £9.6 billion in October from £10. 5 billion in September, missing expectations for a deficit of £9.5 billion. September's figure was revised down from a deficit of £9.8 billion.

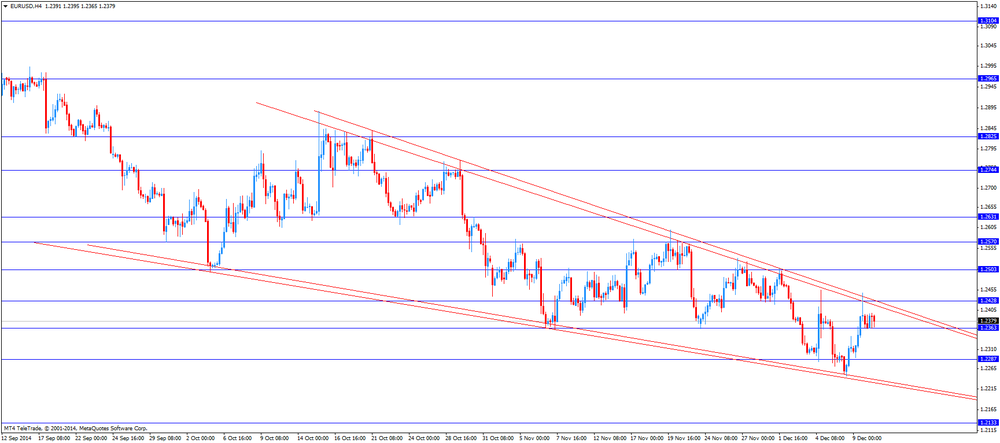

EUR/USD: the currency pair traded mixed

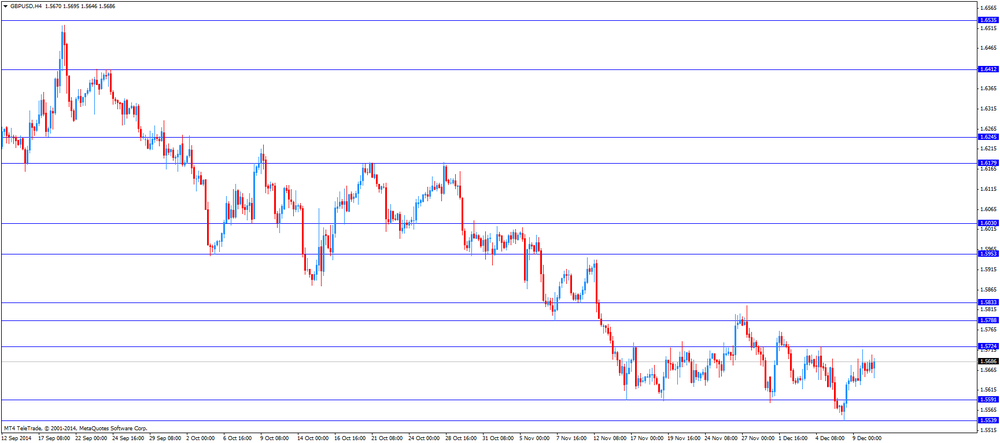

GBP/USD: the currency pair traded mixed

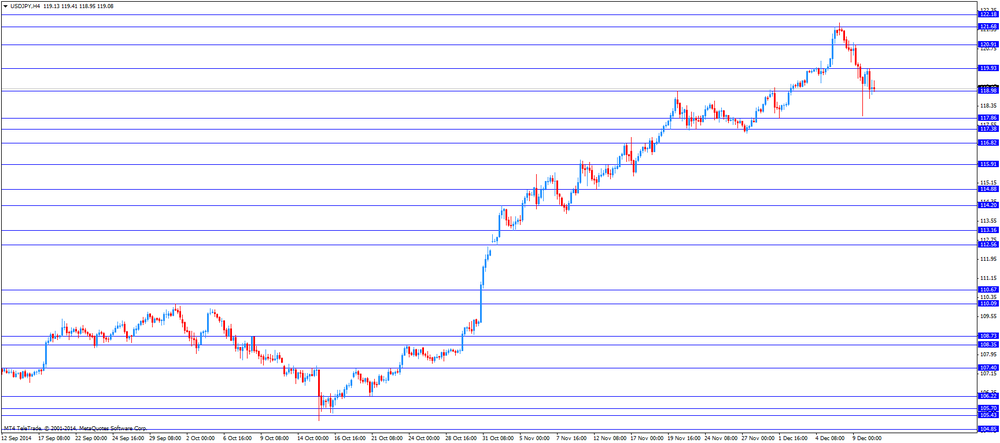

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

16:15 Canada Gov Council Member Wilkins Speaks

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

20:00 New Zealand RBNZ Press Conference

23:50 Japan Core Machinery Orders October +2.9% -1.7%

23:50 Japan Core Machinery Orders, y/y October +7.3%

23:50 Japan Tertiary Industry Index October +1.0% -0.1%

-

12:33

French industrial production dropped 0.8% in October

France's statistics agency Insee released industrial production figures on Wednesday. Industrial production in France declined 0.8% in October, missing expectations for a 0.2% gain, after the flat reading in September.

The decline was driven by falling production of energy, agricultural and food products.

This figure is a sign of the stagnating economy in France.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2300(E1.5bn), $1.2310(E639mn), $1.2315(E233mn), $1.2325(E200mn), $1.2330(E401mn), $1.2332(E240mn), $1.2335(E290mn), $1.2350(E257mn), $1.2390(E404mn), $1.2400(E438mn), $1.2410(E261mn)

USD/JPY: Y118.00($250mn), Y119.50($580mn), Y120.00($300mn)

GBP/USD: $1.5840-50(stg500mn)

EUR/GBP: stg0.7840, stg0.7865

EUR/CHF: Chf1.2000E220mn)

GBP/CHF: Chf1.5340(stg268mn)

NZD/USD: $0.7770(NZ$270mn)

USD/CAD: C$1.1400($253mn), C$1.1425($453mn)

-

09:30

United Kingdom: Trade in goods , October -9.6 (forecast -9.5)

-

09:20

Press Review: ECB’s Praet Says Falling Oil Price May Push Inflation Below Zero

REUTERS

U.S. fracking bonanza to lift GDP by 1 percent by 2040: study

(Reuters) - A surge of oil and gas production will drive the U.S. economy 1 percent higher in 2040 than it would have otherwise grown, and energy exports will only stoke the expansion, an independent study on energy policy concluded on Tuesday.

New drilling technologies such as 'fracking' have unlocked an abundance of fossil fuels from shale deposits and the bounty will both jolt the economy and increase tax receipts, according to the study from the Congressional Budget Office.

Source: http://www.reuters.com/article/2014/12/10/us-usa-energy-economy-idUSKBN0JN2JD20141210

BLOOMBERG

ECB's Praet Says Falling Oil Price May Push Inflation Below Zero

European Central Bank Executive Board member Peter Praet said falling oil prices could push the euro-area inflation rate below zero, just as policy makers prepare to examine options for quantitative easing.

"Given the potency of the current oil-price shock, the risk is that inflation may temporarily fall into negative territory in coming months," Praet said in Washington yesterday. "Normally, any central bank would prefer to look through a positive supply shock. After all, lower oil prices boost real incomes and may lead to higher output in the future. But we may not have that luxury at present."

BLOOMBERG

Russia Set to Raise Main Rate as Ruble Rout Endangers Stability

Russia's central bank will probably raise borrowing costs to avert threats to financial stability as oil prices near the lowest in more than five years and sanctions over Ukraine risk the collapse of the ruble.

The Bank of Russia will increase its key rate to 10 percent from 9.5 percent, according to the median estimate of 27 economists surveyed by Bloomberg. Eleven forecast no change. Fifty of 77 traders polled by brokerage Tradition project a rate increase of between 100 and 400 basis points. The regulator will announce the decision at about 1:30 p.m. tomorrow in Moscow, followed by a news conference.

-

07:45

France: Industrial Production, m/m, October -0.8% (forecast +0.2%)

-

07:30

Foreign exchange market. Asian session: the greenback lost against its major peers

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Westpac Consumer Confidence December +1.9% -5.7%

00:50 Japan BSI Manufacturing Index Quarter IV 12.7 13.1 8.1

00:30 Australia Home Loans October -0.7% +0.2% +0.3%

01:30 China PPI y/y November -2.2% -2.3% -2.7%

01:30 China CPI y/y November +1.6% +1.6% +1.4%

05:00 Japan Coincident Index November 38.9 39.6 37.7

06:30 France Non-Farm Payrolls (Finally) Quarter III -0.2% -0.2% -0.3%

The greenback saw further profit taking after its recent rally fuelled by better-than expected job data last Friday. Investors also closed positions due to risk aversion. The Greek presidential elections next week and restrictions on collateral for short-term loans by Chinese government led to investments in safe-haven assets.

The Australian dollar traded higher against the U.S. dollar for the first time in 10 days after trading at a four year low yesterday. The currency strengthened although data on the Westpac Consumer Confidence Index showed a disappointing -5.7% for December followed by a 0.3% gain in Home Loans. Downbeat Chinese data slowed the currencies rebound. China is Australia's key export destination.

New Zealand's dollar gained for a second day before the RBNZ will meet today to decide on the countries benchmark interest rate. Slumping milk prices weighed on the currency. Milk powder prices declined by almost 56% in the last 12 months.

The Japanese yen strengthened again against the greenback after global stocks declined and Chinese growth slowed as investors are looking for haven assets. Falling oil prices further supported the currency. Japan's BSI Manufacturing Index declined to 8.1 falling short of expectations. Analysts predicted an increase to 13.1 from a previous reading of 12.7.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded weaker against the yen

GPB/USD: The British pound traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Industrial Production, m/m October 0.0% +0.2%

07:45 France Industrial Production, y/y October -0.3%

08:00 China New Loans November 548 660

09:30 United Kingdom Trade in goods October -9.8 -9.5

15:30 U.S. Crude Oil Inventories December -3.7

16:15 Canada Gov Council Member Wilkins Speaks

19:00 U.S. Federal budget November -121.7 -79.6

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

20:00 New Zealand RBNZ Press Conference

21:45 New Zealand Food Prices Index, m/m November 0.0%

21:45 New Zealand Food Prices Index, y/y November +0.9%

23:50 Japan Core Machinery Orders October +2.9% -1.7%

23:50 Japan Core Machinery Orders, y/y October +7.3%

23:50 Japan Tertiary Industry Index October +1.0% -0.1%

-

06:31

France: Non-Farm Payrolls, Quarter III -0.3% (forecast -0.2%)

-

06:28

Options levels on wednesday, December 10, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2515 (2382)

$1.2472 (1485)

$1.2442 (137)

Price at time of writing this review: $ 1.2390

Support levels (open interest**, contracts):

$1.2345 (761)

$1.2315 (1507)

$1.2271 (2307)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 45358 contracts, with the maximum number of contracts with strike price $1,2500 (6628);

- Overall open interest on the PUT options with the expiration date January, 9 is 53475 contracts, with the maximum number of contracts with strike price $1,2000 (7218);

- The ratio of PUT/CALL was 1.18 versus 1.17 from the previous trading day according to data from December, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (1455)

$1.5806 (1565)

$1.5710 (1772)

Price at time of writing this review: $1.5688

Support levels (open interest**, contracts):

$1.5590 (972)

$1.5493 (1022)

$1.5396 (856)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 16181 contracts, with the maximum number of contracts with strike price $1,5700 (1772);

- Overall open interest on the PUT options with the expiration date January, 9 is 17397 contracts, with the maximum number of contracts with strike price $1,5200 (1597);

- The ratio of PUT/CALL was 1.08 versus 1.04 from the previous trading day according to data from December, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:00

Japan: Coincident Index, November 37.7 (forecast 39.6)

-

01:31

China: PPI y/y, November -2.7% (forecast -2.3%)

-

01:30

China: CPI y/y, November +1.4% (forecast +1.6%)

-

00:30

Australia: Home Loans , October +0.3% (forecast +0.2%)

-

00:00

Currencies. Daily history for Dec 9’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2372 +0,45%

GBP/USD $1,5665 +0,09%

USD/CHF Chf0,9711 -0,49%

USD/JPY Y119,69 -0,83%

EUR/JPY Y148,10 -0,33%

GBP/JPY Y187,49 -0,74%

AUD/USD $0,8291 +0,12%

NZD/USD $0,7678 +0,36%

USD/CAD C$1,1445 -0,28%

-