Notícias do Mercado

-

23:50

Japan: BSI Manufacturing Index, Quarter IV 8.1 (forecast 13.1)

-

23:30

Australia: Westpac Consumer Confidence, December -5.7%

-

23:00

Schedule for today, Wednesday, Dec 10’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Home Loans October -0.7% +0.2%

01:30 China PPI y/y November -2.2% -2.3%

01:30 China CPI y/y November +1.6% +1.6%

05:00 Japan Coincident Index November 38.9 39.6

06:30 France Non-Farm Payrolls (Finally) Quarter III -0.2% -0.2%

07:45 France Industrial Production, m/m October 0.0% +0.2%

07:45 France Industrial Production, y/y October -0.3%

08:00 China New Loans November 548 660

09:30 United Kingdom Trade in goods October -9.8 -9.5

15:30 U.S. Crude Oil Inventories December -3.7

16:15 Canada Gov Council Member Wilkins Speaks

19:00 U.S. Federal budget November -121.7 -79.6

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

20:00 New Zealand RBNZ Press Conference

21:45 New Zealand Food Prices Index, m/m November 0.0%

21:45 New Zealand Food Prices Index, y/y November +0.9%

23:50 Japan Core Machinery Orders October +2.9% -1.7%

23:50 Japan Core Machinery Orders, y/y October +7.3%

23:50 Japan Tertiary Industry Index October +1.0% -0.1%

-

16:44

Foreign exchange market. American session: the U.S. dollar fell against the most major currencies due to risk aversion by investors

The U.S. dollar fell against the most major currencies due to risk aversion by investors. The Greek presidential elections next week and restrictions on collateral for short-term loans by Chinese government led to investments in safe-haven assets.

The Greek government announced today that it would hold presidential elections on Dec. 17. Analysts had not expected this decision.

Job openings climbed to 4.83 million in October from 4.69 million in September. September's figure was revised down from 4.74 million. Analysts had expected job openings to rise to 4.82 million.

Wholesale inventories in the U.S. rose 0.4% in October, exceeding expectations for a 0.1% increase, after a 0.4% gain in September. September's figure was revised up from a 0.3% rise.

The euro increased against the U.S. dollar due to the better-than-expected trade data from Germany. Germany's trade surplus climbed to €20.6 billion in October from €18.6 billion in September, exceeding expectations for a decline to €18.1 billion. September's figure was revised up from a surplus of €18.5 billion.

France's trade deficit narrowed to €4.6 billion in October from €4.7 billion in September, missing expectations for a decline to a deficit of €4.5 billion.

The British pound rose against the U.S. dollar despite the weaker-than-expected manufacturing production data from the U.K. Manufacturing production in the U.K. fell 0.7% in October, missing expectations for a 0.2% rise, after a 0.6% gain in September. September's figure was revised up from a 0.4% increase.

On a yearly basis, manufacturing production in the U.K. increased 1.7% in October, missing expectations for a 3.2% gain, after a 2.9% rise in September.

Industrial production in the U.K. decreased 0.1% in October, missing forecasts of a 0.3% rise, after a 0.7% increase in September. September's figure was revised up from a 0.6% increase.

On a yearly basis, industrial production in the U.K. rose 1.1% in October, missing expectations for a 1.8% rise, after a 0.8% gain in September. September's figure was revised down from a 1.5% gain.

The Swiss franc traded higher against the U.S. dollar. Switzerland's unemployment rate declined to 3.1% in November from 3.2% in October. Analysts had expected the unemployment rate to remain unchanged at 3.2%.

The New Zealand dollar increased against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar rose against the U.S. dollar. In the overnight trading session, the Aussie fell against the greenback despite the disappointing economic data from Australia. The National Australia Bank's business confidence index fell to 1 in November from 4 in October.

The Japanese yen climbed against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback due to increasing demand for safe-haven yen.

Japan's preliminary machine tool orders increased to 36.6% in November from 30.8% in October. October's figure was revised down from 31.2%.

-

15:58

Wholesale inventories in the U.S. rose 0.4% in October

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.4% in October, exceeding expectations for a 0.1% increase, after a 0.4% gain in September. September's figure was revised up from a 0.3% rise.

Inventories of durable goods were flat in October, while inventories of non-durable goods climbed by 1.2%.

-

15:35

Job openings increased to 4.83 million in October

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings climbed to 4.83 million in October from 4.69 million in September. September's figure was revised down from 4.74 million.

Analysts had expected job openings to rise to 4.82 million.

The number of job openings was slightly higher for total private, while declined for government in October.

The hires rate was 3.6% in October, unchanged from September.

Total separations rose to 4.82 million in October from 4.81 million in September.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:02

U.S.: JOLTs Job Openings, October 4834 (forecast 4820)

-

15:00

United Kingdom: NIESR GDP Estimate, November +0.7%

-

15:00

U.S.: Wholesale Inventories, October +0.4% (forecast +0.1%)

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2200(E510mn), $1.2250(E353mn), $1.2300(E415mn), $1.2350(E238mn), $1.2375(E202mn), $1.2400(E203mn), $1.2450(E2.3bn)

USD/JPY: Y120.00($350mn), Y120.50($750mn)

GBP/USD: $1.5400(stg300mn), $1.5860(stg300mn)

EUR/GBP: stg0.8000-10(E404mn)

USD/CHF: Chf0.9800($205mn)

AUD/JPY: Y98.35(A$414mn)

NZD/USD: $0.7800(NZ$1.0bn)

USD/CAD: C$1.1250($1.8bn), C$1.1400($1.9bn), C$1.1450-60($1.7bn), C$1.1550($400mn)

-

13:34

-

13:01

Foreign exchange market. European session: the euro climbed against the U.S. dollar after the better-than-expected trade data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BRC Retail Sales Monitor y/y November 0.0% +0.9%

00:30 Australia National Australia Bank's Business Confidence November 4 1

06:00 Japan Prelim Machine Tool Orders, y/y November +30.8% Revised From +31.2% 36.6%

06:45 Switzerland Unemployment Rate November 3.2% 3.2% 3.1%

07:00 Germany Current Account October 22.7 Revised From 22.3 23.1

07:00 Germany Trade Balance October 18.6 Revised From 18.5 18.1 20.6

07:45 France Trade Balance, bln October -4.7 -4.5 -4.6

09:30 United Kingdom Industrial Production (MoM) October +0.7% Revised From +0.6% +0.3% -0.1%

09:30 United Kingdom Industrial Production (YoY) October +0.8% Revised From +1.5% +1.8% +1.1%

09:30 United Kingdom Manufacturing Production (MoM) October +0.6% Revised From +0.4% +0.2% -0.7%

09:30 United Kingdom Manufacturing Production (YoY) October +2.9% +3.2% +1.7%

10:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. job openings figures. Job openings are expected to rise to 4.82 million in October from 4.74 million in September.

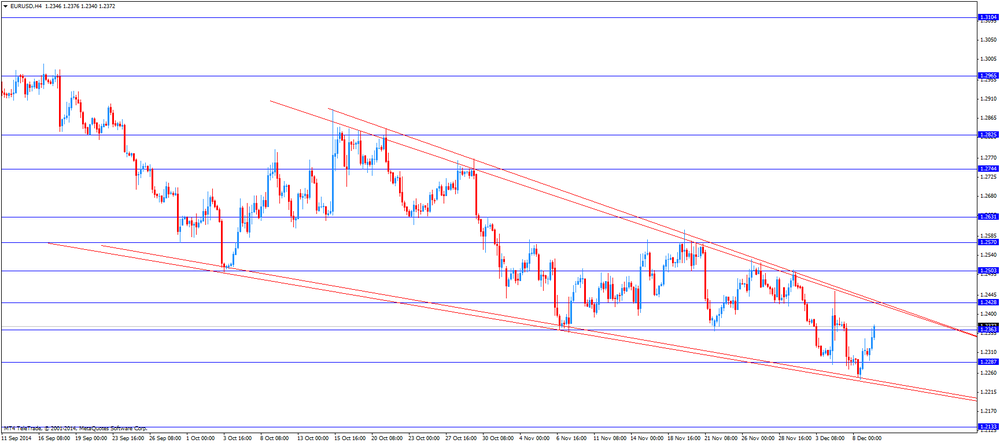

The euro climbed against the U.S. dollar after the better-than-expected trade data from Germany. Germany's trade surplus climbed to €20.6 billion in October from €18.6 billion in September, exceeding expectations for a decline to €18.1 billion. September's figure was revised up from a surplus of €18.5 billion.

France's trade deficit narrowed to €4.6 billion in October from €4.7 billion in September, missing expectations for a decline to a deficit of €4.5 billion.

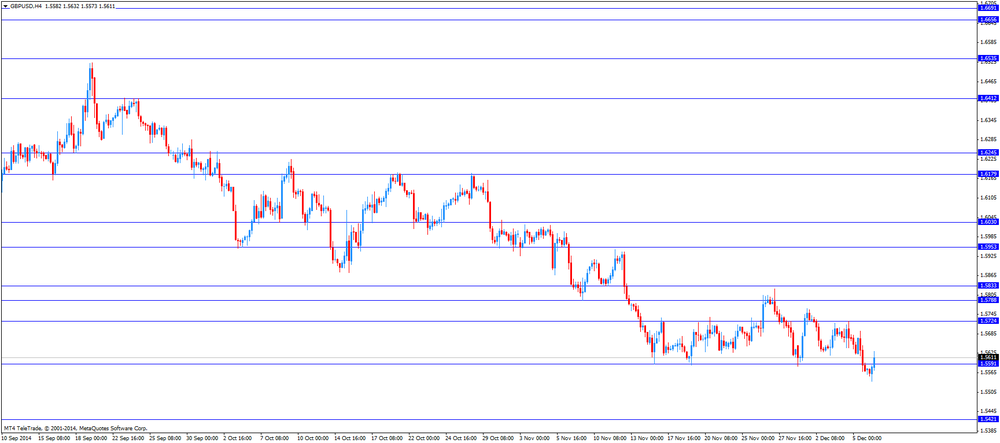

The British pound traded mixed against the U.S. dollar after the weaker-than-expected manufacturing production data from the U.K. Manufacturing production in the U.K. fell 0.7% in October, missing expectations for a 0.2% rise, after a 0.6% gain in September. September's figure was revised up from a 0.4% increase.

On a yearly basis, manufacturing production in the U.K. increased 1.7% in October, missing expectations for a 3.2% gain, after a 2.9% rise in September.

Industrial production in the U.K. decreased 0.1% in October, missing forecasts of a 0.3% rise, after a 0.7% increase in September. September's figure was revised up from a 0.6% increase.

On a yearly basis, industrial production in the U.K. rose 1.1% in October, missing expectations for a 1.8% rise, after a 0.8% gain in September. September's figure was revised down from a 1.5% gain.

The Swiss franc increased against the U.S. dollar. Switzerland's unemployment rate declined to 3.1% in November from 3.2% in October. Analysts had expected the unemployment rate to remain unchanged at 3.2%.

EUR/USD: the currency pair rose to $1.2376

GBP/USD: the currency pair traded mixed

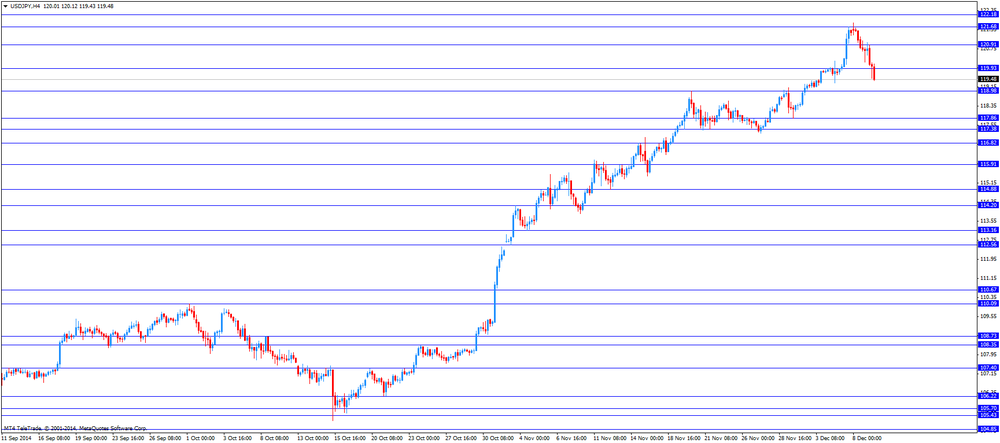

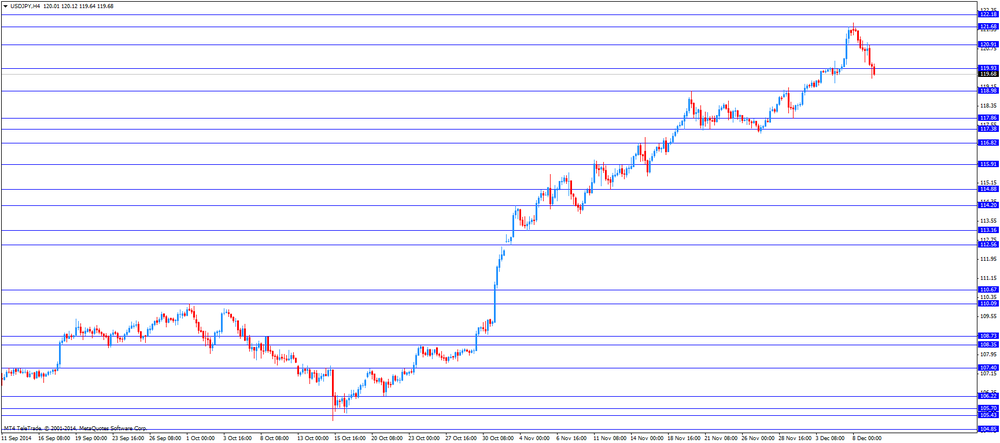

USD/JPY: the currency pair decreased to Y119.53

The most important news that are expected (GMT0):

15:00 United Kingdom NIESR GDP Estimate November +0.7%

15:00 U.S. JOLTs Job Openings October 4735 4820

23:30 Australia Westpac Consumer Confidence December +1.9%

23:50 Japan BSI Manufacturing Index Quarter IV 12.7 13.1

-

12:50

Orders

EUR/USD

Offers $1.2450, $1.2420/10, $1.2400/2390, $1.2350

Bids $1.2245/50, $1.2200

GBP/USD

Offers $1.5780, $1.5760/50, $1.5725/20, $1.5700

Bids $1.5600, $1.5550/40, $1.5520, $1.5500

AUD/USD

Offers $0.8500, $0.8450, $0.8400, $0.8355/45, $0.8300

Bids $0.8200, $0.8100

EUR/JPY

Offers Y150.50, Y150.00, Y149.80, Y149.00/90

Bids Y147.25, Y147.00

USD/JPY

Offers Y122.00, Y121.80, Y121.00

Bids Y119.50/40, Y119.00, Y118.50

EUR/GBP

Offers stg0.8000, stg0.7980, stg0.7950, stg0.7920, stg0.7900

Bids stg0.7830/20, stg0.7800

-

10:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2200(E510mn), $1.2250(E353mn), $1.2300(E415mn), $1.2350(E238mn), $1.2375(E202mn), $1.2400(E203mn), $1.2450(E2.3bn)

USD/JPY: Y120.00($350mn), Y120.50($750mn)

GBP/USD: $1.5400(stg300mn), $1.5860(stg300mn)

EUR/GBP: stg0.8000-10(E404mn)

USD/CHF: Chf0.9800($205mn)

AUD/JPY: Y98.35(A$414mn)

NZD/USD: $0.7800(NZ$1.0bn)

USD/CAD: C$1.1250($1.8bn), C$1.1400($1.9bn), C$1.1450-60($1.7bn), C$1.1550($400mn)

-

09:30

United Kingdom: Industrial Production (MoM), October -0.1% (forecast +0.3%)

-

09:30

United Kingdom: Industrial Production (YoY), October +1.1% (forecast +1.8%)

-

09:30

United Kingdom: Manufacturing Production (YoY), October +1.7% (forecast +3.2%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , October -0.7% (forecast +0.2%)

-

07:45

France: Trade Balance, bln, October -4.6 (forecast -4.5)

-

07:30

Foreign exchange market. Asian session: the greenback traded weaker against the euro, British pound and Japanese Yen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom BRC Retail Sales Monitor y/y November 0.0% +0.9%

00:30 Australia National Australia Bank's Business Confidence November 4 1

06:00 Japan Prelim Machine Tool Orders, y/y November +30.8% Revised From +31.2% +36.6%

06:45 Switzerland Unemployment Rate November 3.2% 3.2% 3.1%

07:00 Germany Current Account October 22.3 23.1

07:00 Germany Trade Balance October 18.5 18.1 20.6

The greenback slipped lower against the euro, the British pound and the yen but keeps being supported by upbeat U.S. employment data from Friday. The U.S. economy added new 321,000 jobs in November, beating forecasts of 225,000 new jobs by far which fuelled expectations that the FED my increase benchmark interest rates rather sooner than later. The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

The Australian dollar delinked sharply after National Australia Bank's Business Confidence dropped from a previous reading of 4 to 1 in November and commodity prices continued to slide. That also weighed the New Zealand dollar further down as both countries heavily depend on sales of raw materials.

The Japanese yen almost recouped Friday's losses trading around USD120.00 again. Japan's Finance Minister Taro Aso welcomed a weak yen in a statement today as it helps to improve the economy and creates jobs. Data on preliminary Machine Tool Orders published earlier today increased to 36.6% in November from +30.8 in October.

EUR/USD: the euro traded stronger against the greenback

USD/JPY: the U.S. dollar weaker stronger against the yen

GPB/USD: The British pound traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Trade Balance, bln October -4.7 -4.5

09:30 United Kingdom Industrial Production (MoM) October +0.6% +0.3%

09:30 United Kingdom Industrial Production (YoY) October +1.5% +1.8%

09:30 United Kingdom Manufacturing Production (MoM) October +0.4% +0.2%

09:30 United Kingdom Manufacturing Production (YoY) October +2.9% +3.2%

10:00 Eurozone ECOFIN Meetings

15:00 United Kingdom NIESR GDP Estimate November +0.7%

15:00 U.S. Wholesale Inventories October +0.3% +0.1%

15:00 U.S. JOLTs Job Openings October 4735 4820

21:30 U.S. API Crude Oil Inventories December -6.5

23:30 Australia Westpac Consumer Confidence December +1.9%

23:50 Japan BSI Manufacturing Index Quarter IV 12.7 13.1

-

07:00

Germany: Trade Balance, October 20.6 (forecast 18.1)

-

07:00

Germany: Current Account , October 23.1

-

06:47

Switzerland: Unemployment Rate, November 3.1% (forecast 3.2%)

-

06:31

Options levels on tuesday, December 9, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2487 (2088)

$1.2437 (1463)

$1.2402 (149)

Price at time of writing this review: $ 1.2337

Support levels (open interest**, contracts):

$1.2284 (1436)

$1.2248 (2186)

$1.2225 (2524)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 43201 contracts, with the maximum number of contracts with strike price $1,2500 (6312);

- Overall open interest on the PUT options with the expiration date January, 9 is 50691 contracts, with the maximum number of contracts with strike price $1,2000 (7176);

- The ratio of PUT/CALL was 1.17 versus 1.20 from the previous trading day according to data from December, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.5904 (1123)

$1.5806 (1314)

$1.5710 (1517)

Price at time of writing this review: $1.5659

Support levels (open interest**, contracts):

$1.5590 (862)

$1.5493 (1071)

$1.5395 (869)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 15136 contracts, with the maximum number of contracts with strike price $1,5700 (1517);

- Overall open interest on the PUT options with the expiration date January, 9 is 15779 contracts, with the maximum number of contracts with strike price $1,5200 (1528);

- The ratio of PUT/CALL was 1.04 versus 1.09 from the previous trading day according to data from December, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:02

Japan: Prelim Machine Tool Orders, y/y , November 36.6%

-

00:30

Australia: National Australia Bank's Business Confidence, November 1

-

00:01

United Kingdom: BRC Retail Sales Monitor y/y, November +0.9%

-