Notícias do Mercado

-

23:50

Japan: BSI Manufacturing Index, Quarter IV 8.1 (forecast 13.1)

-

23:30

Australia: Westpac Consumer Confidence, December -5.7%

-

23:00

Schedule for today, Wednesday, Dec 10’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Home Loans October -0.7% +0.2%

01:30 China PPI y/y November -2.2% -2.3%

01:30 China CPI y/y November +1.6% +1.6%

05:00 Japan Coincident Index November 38.9 39.6

06:30 France Non-Farm Payrolls (Finally) Quarter III -0.2% -0.2%

07:45 France Industrial Production, m/m October 0.0% +0.2%

07:45 France Industrial Production, y/y October -0.3%

08:00 China New Loans November 548 660

09:30 United Kingdom Trade in goods October -9.8 -9.5

15:30 U.S. Crude Oil Inventories December -3.7

16:15 Canada Gov Council Member Wilkins Speaks

19:00 U.S. Federal budget November -121.7 -79.6

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

20:00 New Zealand RBNZ Press Conference

21:45 New Zealand Food Prices Index, m/m November 0.0%

21:45 New Zealand Food Prices Index, y/y November +0.9%

23:50 Japan Core Machinery Orders October +2.9% -1.7%

23:50 Japan Core Machinery Orders, y/y October +7.3%

23:50 Japan Tertiary Industry Index October +1.0% -0.1%

-

17:11

European stocks close: stocks closed lower due to drop of Greek stock index

Stock indices closed lower due to drop of Greek stock index. The Greek ASE Index fell 13% as the Greek government announced today that it would hold presidential elections on Dec. 17. Analysts had not expected this decision. That was the biggest drop since 1987.

Germany's trade surplus climbed to €20.6 billion in October from €18.6 billion in September, exceeding expectations for a decline to €18.1 billion. September's figure was revised up from a surplus of €18.5 billion.

France's trade deficit narrowed to €4.6 billion in October from €4.7 billion in September, missing expectations for a decline to a deficit of €4.5 billion.

Manufacturing production in the U.K. fell 0.7% in October, missing expectations for a 0.2% rise, after a 0.6% gain in September. September's figure was revised up from a 0.4% increase.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,529.47 -142.68 -2.14%

DAX 9,793.71 -221.28 -2.21%

CAC 40 4,263.94 -111.54 -2.55%

-

17:00

European stocks closed in minus: FTSE 100 6,529.47 -142.68 -2.14%, CAC 40 4,263.94 -111.54 -2.55%, DAX 9,793.71 -221.28 -2.21%

-

16:44

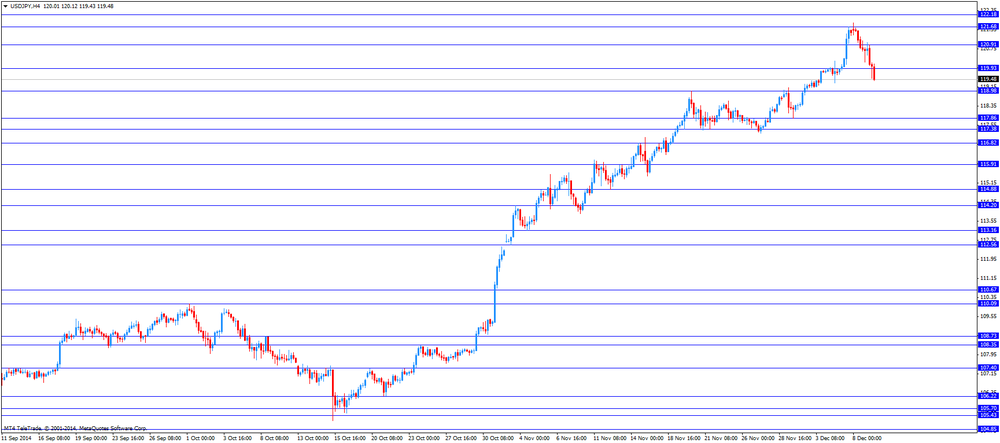

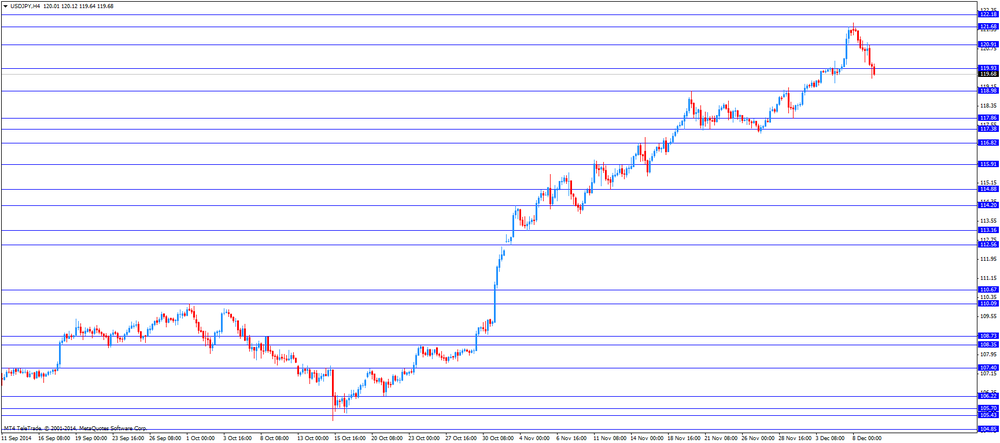

Foreign exchange market. American session: the U.S. dollar fell against the most major currencies due to risk aversion by investors

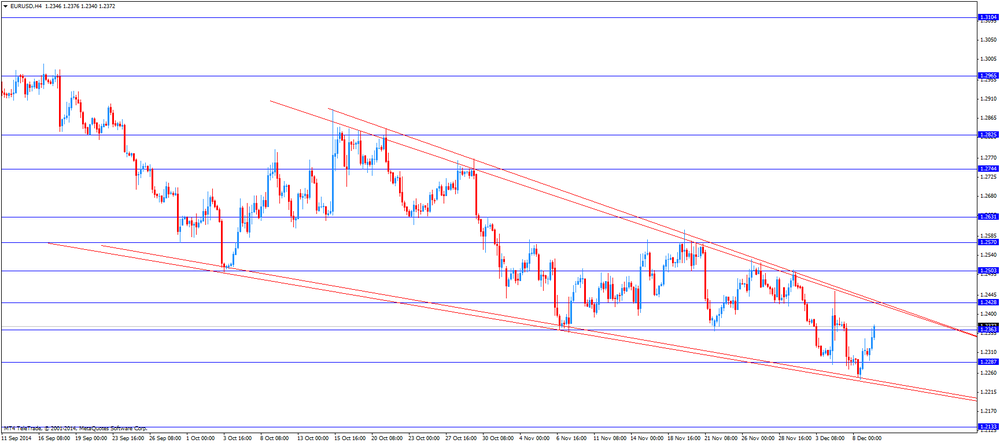

The U.S. dollar fell against the most major currencies due to risk aversion by investors. The Greek presidential elections next week and restrictions on collateral for short-term loans by Chinese government led to investments in safe-haven assets.

The Greek government announced today that it would hold presidential elections on Dec. 17. Analysts had not expected this decision.

Job openings climbed to 4.83 million in October from 4.69 million in September. September's figure was revised down from 4.74 million. Analysts had expected job openings to rise to 4.82 million.

Wholesale inventories in the U.S. rose 0.4% in October, exceeding expectations for a 0.1% increase, after a 0.4% gain in September. September's figure was revised up from a 0.3% rise.

The euro increased against the U.S. dollar due to the better-than-expected trade data from Germany. Germany's trade surplus climbed to €20.6 billion in October from €18.6 billion in September, exceeding expectations for a decline to €18.1 billion. September's figure was revised up from a surplus of €18.5 billion.

France's trade deficit narrowed to €4.6 billion in October from €4.7 billion in September, missing expectations for a decline to a deficit of €4.5 billion.

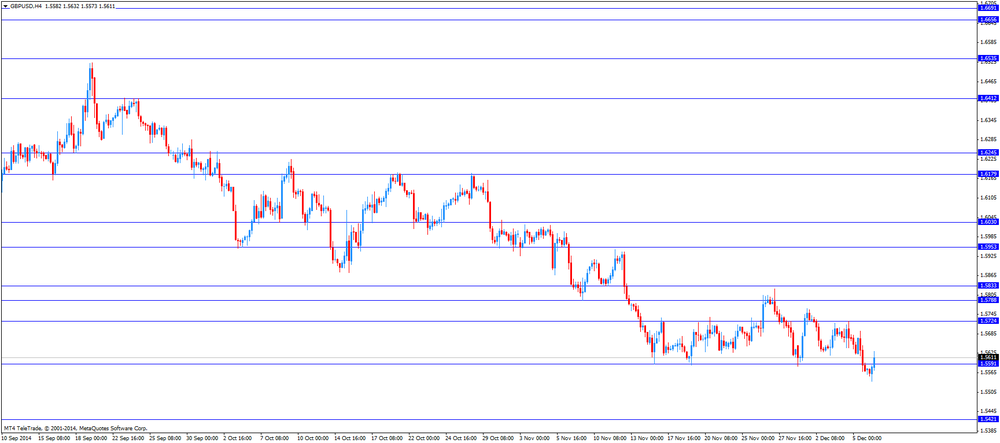

The British pound rose against the U.S. dollar despite the weaker-than-expected manufacturing production data from the U.K. Manufacturing production in the U.K. fell 0.7% in October, missing expectations for a 0.2% rise, after a 0.6% gain in September. September's figure was revised up from a 0.4% increase.

On a yearly basis, manufacturing production in the U.K. increased 1.7% in October, missing expectations for a 3.2% gain, after a 2.9% rise in September.

Industrial production in the U.K. decreased 0.1% in October, missing forecasts of a 0.3% rise, after a 0.7% increase in September. September's figure was revised up from a 0.6% increase.

On a yearly basis, industrial production in the U.K. rose 1.1% in October, missing expectations for a 1.8% rise, after a 0.8% gain in September. September's figure was revised down from a 1.5% gain.

The Swiss franc traded higher against the U.S. dollar. Switzerland's unemployment rate declined to 3.1% in November from 3.2% in October. Analysts had expected the unemployment rate to remain unchanged at 3.2%.

The New Zealand dollar increased against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar rose against the U.S. dollar. In the overnight trading session, the Aussie fell against the greenback despite the disappointing economic data from Australia. The National Australia Bank's business confidence index fell to 1 in November from 4 in October.

The Japanese yen climbed against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback due to increasing demand for safe-haven yen.

Japan's preliminary machine tool orders increased to 36.6% in November from 30.8% in October. October's figure was revised down from 31.2%.

-

16:40

Crude rises from five-year low as dollar declines

West Texas Intermediate and Brent oils climbed from the lowest levels in more than five years as the dollar fell and a technical indicator signaled the market is due for a rebound.

Futures climbed as the U.S. currency dropped from the strongest level in two years versus the euro. A weaker dollar bolsters the appeal of raw materials as a store of value. WTI and Brent are trading in a bear market as the highest U.S. output in three decades exacerbates a global glut.

The 14-day relative strength index for WTI stood at 25.4931 at 10:41 a.m. in New York, according to data compiled by Bloomberg. Investors typically start buying contracts when the reading is below 30. The 14-day RSI for Brent was 21.7609.

"The commodities are popping today because of the break in the dollar's rally," Phil Flynn, senior market analyst at the Price Futures Group in Chicago, said by phone. "The dollar's plunge is giving oil a boost in what's an oversold market."

WTI for January delivery increased 84 cents, or 1.3 percent, to $63.89 a barrel at 11:08 a.m. on the New York Mercantile Exchange. The contract closed at $63.05 yesterday, the lowest settlement since July 2009. Volume for all futures traded was 10 percent above the 100-day average. Prices are down 35 percent this year.

Brent for January settlement rose 63 cents, or 1 percent, to $66.82 a barrel on the London-based ICE Futures Europe. Volume was 4.6 percent above the 100-day average. Prices closed at $66.19 yesterday, the lowest since September 2009. The European benchmark grade traded at a $2.93 premium to WTI. The contract is down 40 percent in 2014.

-

16:20

Gold rose

Gold prices continued to rise, reaching the highest level in almost seven weeks as the weak US dollar and the decline in global stock markets increased the appeal of the precious metal as a safe haven.

Index USD, showing against a basket of major currencies, hit five-year high with the Monday 89.53 to 88.32, down 0.8%.

A weak dollar usually boosts gold's appeal as an alternative asset and reduces the cost of dollar-denominated commodities for buyers in other currencies.

The dollar index against a basket of six major currencies reduced after the article in the Wall Street Journal, that Fed officials think seriously refuse to promise to keep interest rates near zero for a long time. The Fed could announce it at the meeting next week, the article says.

Meanwhile, in Asia, in China Shanghai Composite has fallen by more than 5%, showing the maximum session decline since August 2009, as investors closed their positions amid growing fears over the health of the Chinese economy.

European stock indexes also dramatically reduced. For example, Germany's DAX fell 1.5%, while the Spanish IBEX 35 and the Italian FTSE MIB lost nearly 2%.

Despite recent gains, gold quotes, they are likely to remain vulnerable in the short term amid signs that the strengthening of the US economic recovery may prompt the Federal Reserve to start raising interest rates sooner than expected.

Expectations of growth rates on loans put pressure on gold as a precious metal with difficulty competing with the yield of interest-earning assets at higher rates.

"Gold will be difficult to continue the rally because the increase is due mainly to cover short positions. Fundamentals speaking about economic growth have not changed, and investors are betting on a decrease in quotations, because interest rates could rise soon," - said a trader in Sydney.

The cost of the February gold futures on the COMEX today rose to 1239.0 dollars per ounce.

-

15:58

Wholesale inventories in the U.S. rose 0.4% in October

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.4% in October, exceeding expectations for a 0.1% increase, after a 0.4% gain in September. September's figure was revised up from a 0.3% rise.

Inventories of durable goods were flat in October, while inventories of non-durable goods climbed by 1.2%.

-

15:35

Job openings increased to 4.83 million in October

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings climbed to 4.83 million in October from 4.69 million in September. September's figure was revised down from 4.74 million.

Analysts had expected job openings to rise to 4.82 million.

The number of job openings was slightly higher for total private, while declined for government in October.

The hires rate was 3.6% in October, unchanged from September.

Total separations rose to 4.82 million in October from 4.81 million in September.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:02

U.S.: JOLTs Job Openings, October 4834 (forecast 4820)

-

15:00

United Kingdom: NIESR GDP Estimate, November +0.7%

-

15:00

U.S.: Wholesale Inventories, October +0.4% (forecast +0.1%)

-

14:36

U.S. Stocks open: Dow 17,702.82 -149.66 -0.84%, Nasdaq 4,686.89 -53.80 -1.13%, S&P 2,040.87 -19.44 -0.94%

-

14:28

Before the bell: S&P futures -0.92%, Nasdaq futures -1.02%

U.S. stock-index futures dropped amid concern that Federal Reserve officials may shift their stance on interest rates when they meet next week.

Global markets:

Nikkei 17,813.38 -122.26 -0.68%

Hang Seng 23,485.83 -561.84 -2.34%

Shanghai Composite 2,859.92 -160.34 -5.31%

FTSE 6,566.39 -105.76 -1.59%

CAC 4,302.22 -73.26 -1.67%

DAX 9,865.73 -149.26 -1.49%

Crude oil $63.59 (+0.86%)

Gold $1219.70 (+2.03%)

-

14:15

DOW components before the bell

(company / ticker / price / change, % / volume)

Chevron Corp

CVX

106.79

-0.01%

7.5K

Exxon Mobil Corp

XOM

91.64

-0.07%

52.7K

Walt Disney Co

DIS

93.32

-0.51%

7.4K

Procter & Gamble Co

PG

90.27

-0.54%

4.1K

Travelers Companies Inc

TRV

105.27

-0.54%

0.2K

International Business Machines Co...

IBM

160.94

-0.57%

7.3K

Nike

NKE

97.13

-0.60%

2.6K

E. I. du Pont de Nemours and Co

DD

72.24

-0.61%

0.7K

3M Co

MMM

159.88

-0.65%

2.0K

Home Depot Inc

HD

99.78

-0.65%

2.5K

UnitedHealth Group Inc

UNH

99.27

-0.65%

3.6K

The Coca-Cola Co

KO

42.86

-0.65%

6.7K

Cisco Systems Inc

CSCO

27.05

-0.66%

9.1K

United Technologies Corp

UTX

112.30

-0.66%

1.2K

Wal-Mart Stores Inc

WMT

83.67

-0.66%

4.4K

Johnson & Johnson

JNJ

107.73

-0.73%

4.6K

Visa

V

261.03

-0.79%

0.8K

McDonald's Corp

MCD

91.88

-0.79%

9.6K

American Express Co

AXP

92.74

-0.88%

2.0K

Boeing Co

BA

129.13

-0.88%

1.7K

Caterpillar Inc

CAT

94.38

-0.91%

10.9K

Pfizer Inc

PFE

31.68

-0.91%

11.0K

General Electric Co

GE

25.43

-1.01%

28.7K

Intel Corp

INTC

36.80

-1.08%

20.2K

Goldman Sachs

GS

194.19

-1.24%

4.1K

Microsoft Corp

MSFT

47.09

-1.27%

22.2K

JPMorgan Chase and Co

JPM

61.76

-1.45%

29.1K

AT&T Inc

T

33.20

-2.01%

203.3K

Verizon Communications Inc

VZ

47.63

-2.60%

301.3K

Merck & Co Inc

MRK

59.84

-3.30%

42.9K

-

13:55

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Verizon (VZ) downgraded to Neutral from Outperform at Robert W. Baird, target lowered to $50 from $54

Other:

Travelers (TRW) initiated with a Neutral at JP Morgan, target $100

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2200(E510mn), $1.2250(E353mn), $1.2300(E415mn), $1.2350(E238mn), $1.2375(E202mn), $1.2400(E203mn), $1.2450(E2.3bn)

USD/JPY: Y120.00($350mn), Y120.50($750mn)

GBP/USD: $1.5400(stg300mn), $1.5860(stg300mn)

EUR/GBP: stg0.8000-10(E404mn)

USD/CHF: Chf0.9800($205mn)

AUD/JPY: Y98.35(A$414mn)

NZD/USD: $0.7800(NZ$1.0bn)

USD/CAD: C$1.1250($1.8bn), C$1.1400($1.9bn), C$1.1450-60($1.7bn), C$1.1550($400mn)

-

13:34

-

13:01

Foreign exchange market. European session: the euro climbed against the U.S. dollar after the better-than-expected trade data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BRC Retail Sales Monitor y/y November 0.0% +0.9%

00:30 Australia National Australia Bank's Business Confidence November 4 1

06:00 Japan Prelim Machine Tool Orders, y/y November +30.8% Revised From +31.2% 36.6%

06:45 Switzerland Unemployment Rate November 3.2% 3.2% 3.1%

07:00 Germany Current Account October 22.7 Revised From 22.3 23.1

07:00 Germany Trade Balance October 18.6 Revised From 18.5 18.1 20.6

07:45 France Trade Balance, bln October -4.7 -4.5 -4.6

09:30 United Kingdom Industrial Production (MoM) October +0.7% Revised From +0.6% +0.3% -0.1%

09:30 United Kingdom Industrial Production (YoY) October +0.8% Revised From +1.5% +1.8% +1.1%

09:30 United Kingdom Manufacturing Production (MoM) October +0.6% Revised From +0.4% +0.2% -0.7%

09:30 United Kingdom Manufacturing Production (YoY) October +2.9% +3.2% +1.7%

10:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. job openings figures. Job openings are expected to rise to 4.82 million in October from 4.74 million in September.

The euro climbed against the U.S. dollar after the better-than-expected trade data from Germany. Germany's trade surplus climbed to €20.6 billion in October from €18.6 billion in September, exceeding expectations for a decline to €18.1 billion. September's figure was revised up from a surplus of €18.5 billion.

France's trade deficit narrowed to €4.6 billion in October from €4.7 billion in September, missing expectations for a decline to a deficit of €4.5 billion.

The British pound traded mixed against the U.S. dollar after the weaker-than-expected manufacturing production data from the U.K. Manufacturing production in the U.K. fell 0.7% in October, missing expectations for a 0.2% rise, after a 0.6% gain in September. September's figure was revised up from a 0.4% increase.

On a yearly basis, manufacturing production in the U.K. increased 1.7% in October, missing expectations for a 3.2% gain, after a 2.9% rise in September.

Industrial production in the U.K. decreased 0.1% in October, missing forecasts of a 0.3% rise, after a 0.7% increase in September. September's figure was revised up from a 0.6% increase.

On a yearly basis, industrial production in the U.K. rose 1.1% in October, missing expectations for a 1.8% rise, after a 0.8% gain in September. September's figure was revised down from a 1.5% gain.

The Swiss franc increased against the U.S. dollar. Switzerland's unemployment rate declined to 3.1% in November from 3.2% in October. Analysts had expected the unemployment rate to remain unchanged at 3.2%.

EUR/USD: the currency pair rose to $1.2376

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair decreased to Y119.53

The most important news that are expected (GMT0):

15:00 United Kingdom NIESR GDP Estimate November +0.7%

15:00 U.S. JOLTs Job Openings October 4735 4820

23:30 Australia Westpac Consumer Confidence December +1.9%

23:50 Japan BSI Manufacturing Index Quarter IV 12.7 13.1

-

12:50

Orders

EUR/USD

Offers $1.2450, $1.2420/10, $1.2400/2390, $1.2350

Bids $1.2245/50, $1.2200

GBP/USD

Offers $1.5780, $1.5760/50, $1.5725/20, $1.5700

Bids $1.5600, $1.5550/40, $1.5520, $1.5500

AUD/USD

Offers $0.8500, $0.8450, $0.8400, $0.8355/45, $0.8300

Bids $0.8200, $0.8100

EUR/JPY

Offers Y150.50, Y150.00, Y149.80, Y149.00/90

Bids Y147.25, Y147.00

USD/JPY

Offers Y122.00, Y121.80, Y121.00

Bids Y119.50/40, Y119.00, Y118.50

EUR/GBP

Offers stg0.8000, stg0.7980, stg0.7950, stg0.7920, stg0.7900

Bids stg0.7830/20, stg0.7800

-

12:00

European stock markets mid-session: European indices trading lower – energy stocks slump

European indices continue to fall as energy stocks weigh on the indices as oil prices declined to five-year lows yesterday. The FTSE 100 index lost -1% quoted at 6,605.25 points after Manufacturing production in the U.K. fell to -0.7% in October. Industrial output also declined to -0.1%. France's CAC 40 declined -1.08% trading at 4,328.04 and Germany's DAX 30 declined -0.76% amid disappointing industrial production data published Monday trading at 9,938.47 points, after seeing new record highs on Friday. Germany's Trade Balance improved reading 20.6 beating forecasts of 18.1. Mario Draghi's remarks continue to weigh on European stocks. At last week's ECB meeting he said that the bank will not start quantitative easing right away.

-

12:00

European stock markets mid-session: European indices higher after Tuesday’s selloff

European indices are modestly rebounding after yesterday's losses fuelled by political turmoil in Greece and Chinese government decision to set new restrictions on collateral for short-term loans. Markets are worried about political uncertainty in Greece as it could cause the ECB to postpone further stimulus measures. The FTSE 100 index added +0.13% quoted at 6,537.81 points. France's CAC 40 gained +0.37% trading at 4,279.66 and Germany's DAX 30 rose +0.64 trading at 9,856.14 points.

-

11:20

Oil: Prices recover from early trading lows

Brent crude and West Texas Intermediate recovered from five-year lows reversing earlier losses. Brent Crude gained +0.62% trading at USD66.60 a barrel, and West Texas Intermediate rose +0.86% currently quoted at USD63.59 after yesterday's fall amid a price war between Saudi Arabia and Iraq. Yesterday Iraq reduced its Basrah Light Crude prices to the lowest in 11 years following Saudi Arabia who cut prices for the U.S. and Asia last week. OPEC may call an extraordinary meeting in the first quarter of next year to discuss production levels again after the last meeting in Vienna on September 27th did not yield in output cuts and prices further declined considearably. Both Brent and WTI tumbled 18 percent in November. Crude has traded in a bear market since October amid the fastest pace of U.S. production in three decades, rising output from OPEC and signs of weakening global demand.

-

11:00

Gold edges higher on lower U.S. dollar and declining equities

Gold prices appreciated a second day currently quoted at USD1,205.90 or +0,3% a troy ounce just above the important level of USD1,200 supported by a broadly weaker greenback after losing -1.1% on Friday after the better-than-expected U.S. labour market data.. Declining equity-indices, weighed down by energy shares after the oil prices further declined and disappointing German data further supported the precious metal. In times of economic uncertainty gold becomes more attractive as a protection of wealth. Markets are awaiting the FED's policy meeting next week to assess when the bank is going to increase benchmark interest rates.

GOLD currently trading at USD1,205.90

-

10:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2200(E510mn), $1.2250(E353mn), $1.2300(E415mn), $1.2350(E238mn), $1.2375(E202mn), $1.2400(E203mn), $1.2450(E2.3bn)

USD/JPY: Y120.00($350mn), Y120.50($750mn)

GBP/USD: $1.5400(stg300mn), $1.5860(stg300mn)

EUR/GBP: stg0.8000-10(E404mn)

USD/CHF: Chf0.9800($205mn)

AUD/JPY: Y98.35(A$414mn)

NZD/USD: $0.7800(NZ$1.0bn)

USD/CAD: C$1.1250($1.8bn), C$1.1400($1.9bn), C$1.1450-60($1.7bn), C$1.1550($400mn)

-

09:30

United Kingdom: Industrial Production (MoM), October -0.1% (forecast +0.3%)

-

09:30

United Kingdom: Industrial Production (YoY), October +1.1% (forecast +1.8%)

-

09:30

United Kingdom: Manufacturing Production (YoY), October +1.7% (forecast +3.2%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , October -0.7% (forecast +0.2%)

-

09:25

Press Review: U.S. shale output still surges, to add 103,000 bpd by Jan-EIA

Press Review: U.S. shale output still surges, to add 103,000 bpd by Jan-EIA

REUTERS

U.S. shale output still surges, to add 103,000 bpd by Jan-EIA

(Reuters) - Oil production from the United States' biggest shale plays is poised to keep expanding at the same breakneck pace into early next year, according to new U.S. projections released on Monday that highlighted a slow response to tumbling prices.

Oil production from the three main plays - the Bakken, Eagle Ford and Permian Basin - is set to rise by some 103,000 barrels per day (bpd) in January from December, the U.S. Energy Information Administration said.

That's just a hair below December's 105,000 bpd rise, and a faster rate than most months this year.

Source: http://www.reuters.com/article/2014/12/09/us-oil-shale-predictions-idUSKBN0JN02L20141209

BLOOMBERG

Tesla Tumbles as Gas Price Slide Spurs Demand Concerns

Tesla Motors Inc. (TSLA)'s shares have dropped 14 percent in seven trading days on growing concern that the cheapest gasoline in more than four years will damp consumer enthusiasm for the company's luxury electric cars.

A disappointing forecast of Tesla's November U.S. sales by the industry website InsideEVs.com fed the decline yesterday.

Consumers paying less at the pump may have diminished the need for vehicles that run on an electric charge and can cost as much as $100,000. Gasoline prices in the U.S. have fallen for 68 days to an average of $2.67 per gallon, according to the motoring club AAA.

BLOOMBERG

Bullion Board Seen by Council as Way to Manage India Gold Demand

India, the world's largest gold consumer after China, should start a bullion board to regulate trade and a spot exchange to offer uniform prices across the country, the World Gold Council said.

The board should manage imports, encourage exports and boost infrastructure for the industry, while the spot bourse would create a national pricing structure derived from the London fixing, the council said today in a joint report with the Federation of Indian Chambers of Commerce and Industry, an industry group.

India's bullion imports surged this financial year as tax increases and a rule linking shipments to re-exports failed to curb demand among jewelry buyers and investors. The solution to meeting Indians' enduring appetite for the precious metal lies in making better use of the gold already in the country and not restricting shipments, according to P.R. Somasundaram, managing director for the council in India.

-

09:00

European Stocks. First hour: European indices decline sharply

European indices dropped in early trading. Weak German data from yesterday and falling oil prices weigh on the markets - energy stocks are under pressure. Data showed yesterday that German industrial production rose only 0.2% in October, while September's figure was revised down to 1.1% from 1.4% previously. Mario Draghi's remarks further weighed on European stocks. At last week's ECB meeting he said that the bank will not start quantitative easing right away. The FTSE 100 index is currently trading -1.06% lower quoted at 6,601.14 points, Germany's DAX 30 lost -0.87% at 9,928.14 and France's CAC 40 dropped -1.18%, currently trading at 4,323.95 points. France's trade balance improved in October to -4.6 from -4.7. Analyst's expected the balance to improve to -4.5. Markets await U.K's Industrial- and Manufacturing production and later in the session Eurozone's ECOFIN meetings.

-

08:00

Global Stocks: Global indices trading lower

U.S. markets closed significantly lower. The DOW JONES lost -0.59% closing at 17,852.48 points and the S&P 500 declined -0.73%, its biggest loss since October with a final quote of 2,060.31 points. The slump in oil prices weighed on the energy sector. Markets see profit taking after the recent rally as we are approaching the end of the year.

Hong Kong's Hang Seng is trading -2.45% at 23,458.39. China's Shanghai Composite closed at 2,859.92 points, a loss of -5.31%. After a very volatile trading session with very high volumes the index saw its biggest decline since 2009. After the recent rally and questions raising about its sustainability the markets see a lot of profit taking.

Japan's Nikkei lost -0.68% closing at 17,813.38, as the yen recouped losses and traded around USD120 after Friday's new lows as exporters declined and energy shares lost due to a five-year low in oil-prices.

-

07:45

France: Trade Balance, bln, October -4.6 (forecast -4.5)

-

07:30

Foreign exchange market. Asian session: the greenback traded weaker against the euro, British pound and Japanese Yen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom BRC Retail Sales Monitor y/y November 0.0% +0.9%

00:30 Australia National Australia Bank's Business Confidence November 4 1

06:00 Japan Prelim Machine Tool Orders, y/y November +30.8% Revised From +31.2% +36.6%

06:45 Switzerland Unemployment Rate November 3.2% 3.2% 3.1%

07:00 Germany Current Account October 22.3 23.1

07:00 Germany Trade Balance October 18.5 18.1 20.6

The greenback slipped lower against the euro, the British pound and the yen but keeps being supported by upbeat U.S. employment data from Friday. The U.S. economy added new 321,000 jobs in November, beating forecasts of 225,000 new jobs by far which fuelled expectations that the FED my increase benchmark interest rates rather sooner than later. The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

The Australian dollar delinked sharply after National Australia Bank's Business Confidence dropped from a previous reading of 4 to 1 in November and commodity prices continued to slide. That also weighed the New Zealand dollar further down as both countries heavily depend on sales of raw materials.

The Japanese yen almost recouped Friday's losses trading around USD120.00 again. Japan's Finance Minister Taro Aso welcomed a weak yen in a statement today as it helps to improve the economy and creates jobs. Data on preliminary Machine Tool Orders published earlier today increased to 36.6% in November from +30.8 in October.

EUR/USD: the euro traded stronger against the greenback

USD/JPY: the U.S. dollar weaker stronger against the yen

GPB/USD: The British pound traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Trade Balance, bln October -4.7 -4.5

09:30 United Kingdom Industrial Production (MoM) October +0.6% +0.3%

09:30 United Kingdom Industrial Production (YoY) October +1.5% +1.8%

09:30 United Kingdom Manufacturing Production (MoM) October +0.4% +0.2%

09:30 United Kingdom Manufacturing Production (YoY) October +2.9% +3.2%

10:00 Eurozone ECOFIN Meetings

15:00 United Kingdom NIESR GDP Estimate November +0.7%

15:00 U.S. Wholesale Inventories October +0.3% +0.1%

15:00 U.S. JOLTs Job Openings October 4735 4820

21:30 U.S. API Crude Oil Inventories December -6.5

23:30 Australia Westpac Consumer Confidence December +1.9%

23:50 Japan BSI Manufacturing Index Quarter IV 12.7 13.1

-

07:00

Germany: Trade Balance, October 20.6 (forecast 18.1)

-

07:00

Germany: Current Account , October 23.1

-

06:47

Switzerland: Unemployment Rate, November 3.1% (forecast 3.2%)

-

06:31

Options levels on tuesday, December 9, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2487 (2088)

$1.2437 (1463)

$1.2402 (149)

Price at time of writing this review: $ 1.2337

Support levels (open interest**, contracts):

$1.2284 (1436)

$1.2248 (2186)

$1.2225 (2524)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 43201 contracts, with the maximum number of contracts with strike price $1,2500 (6312);

- Overall open interest on the PUT options with the expiration date January, 9 is 50691 contracts, with the maximum number of contracts with strike price $1,2000 (7176);

- The ratio of PUT/CALL was 1.17 versus 1.20 from the previous trading day according to data from December, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.5904 (1123)

$1.5806 (1314)

$1.5710 (1517)

Price at time of writing this review: $1.5659

Support levels (open interest**, contracts):

$1.5590 (862)

$1.5493 (1071)

$1.5395 (869)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 15136 contracts, with the maximum number of contracts with strike price $1,5700 (1517);

- Overall open interest on the PUT options with the expiration date January, 9 is 15779 contracts, with the maximum number of contracts with strike price $1,5200 (1528);

- The ratio of PUT/CALL was 1.04 versus 1.09 from the previous trading day according to data from December, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:02

Japan: Prelim Machine Tool Orders, y/y , November 36.6%

-

02:32

Nikkei 225 17,888.5 -47.14 -0.26%, Hang Seng 23,833.34 -214.33 -0.89%, Shanghai Composite 3,005.11 -15.14 -0.50%

-

00:30

Australia: National Australia Bank's Business Confidence, November 1

-

00:01

United Kingdom: BRC Retail Sales Monitor y/y, November +0.9%

-