Notícias do Mercado

-

19:22

American focus : the yen has risen considerably against the U.S. dollar

The dollar rose slightly against the euro due to sales of European institutional investors . According to analysts, in the coming days will determine the dynamics of markets is one important factor - this is how investors will regard the consequences of weak data on the U.S. labor market , released last week. In particular, many observers believe that it calls into question the willingness of the Fed to continue to decline in program QE.

In addition, we add that the course of trade affected comments Atlanta Fed President Dennis Lockhart , who said that if the economy will confirm his expectations probably is expected to continue reducing the bond buyback program during the next months.

Saying that the economy seems to be busy to grow in 2014 , Lockhart said that "if the positive forecast is realized , then I would support such steps to reduce the redemption of bonds during the year ." He pointed to the broad expectations of continuing decline in bond redemption during the year . In December, reducing bond buyback program was launched - it was reduced from 85 to 75 billion dollars.

Lockhart is generally regarded as a centrist leaders of the Fed , and it was confirmed , as in speech , he noted that the Fed does not have a predetermined course of action , but will determine how well things are going , at each meeting, FOMC, for a decision on what will be the further measures . He also said that the Fed's policy is now " very challenging " and " adequate ." Currently Lockhart is not a voting member of the Federal Committee on Peacekeeping Operations on the open market .

He reported a cautious stance on the recent changes in the labor market , noting that " there is reason to expect further progress in the labor market ", but " although we have made significant progress , we are far from satisfactory situation."

Lockhart described the data on employment in December as " surprisingly weak" , but given the normal review process , he examines figures last month as "preliminary" . Lockhart noted that the apparent rapid improvement of data on unemployment , now at 6.7% repositories exaggerating progress in the labor market .

It is also concerned that inflation remains below the Fed's target level of 2%. Lockhart expects to return inflation to the target level of the Fed , in general , as inflation expectations remain stable .

The Canadian dollar strengthened against the dollar ahead of the release of the Bank of Canada survey , but almost no reaction to the publication itself . We add that the Bank of Canada survey data on the prospects of the business was , in general , more encouraging in expectations for economic growth than they could see the fear . The survey does not show a significant improvement in expectations, but also to reduce their effects were noted.

The survey results also showed that participants rely on export growth and investment, which leads us to expect from this side support for economic growth instead factor in consumer spending . Bank of Canada and used to say about the positive signs , so another confirmation of this position is not affected by a significant decrease in expectations to reduce interest rates by the Bank of Canada.

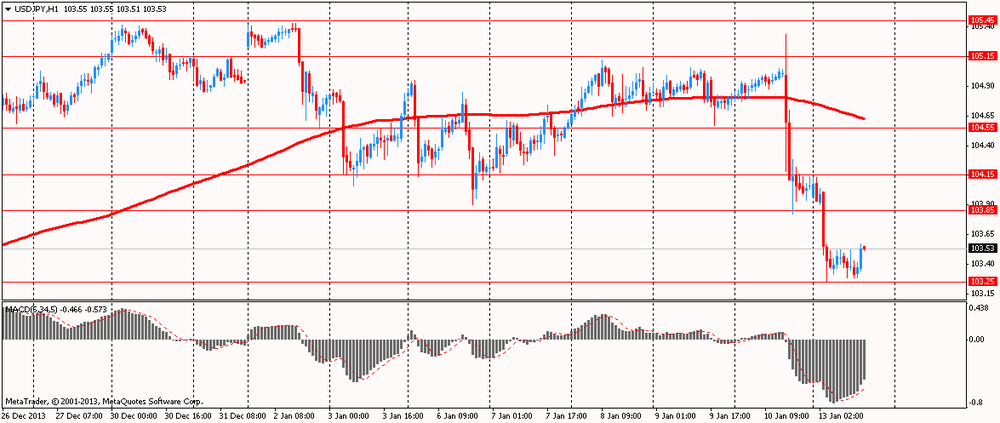

The yen has risen considerably against the U.S. dollar , which is probably a reaction to the publication on Friday employment report in the U.S., which came after the close of Asian markets last week. We also add that many analysts pointed to a lower Treasury yields after data on employment as a sign of a deeper decline of the dollar against the yen.

Recall that in December, the number of non-farm payrolls increased by only 74 thousand , compared with an increase of 241 thousand in the previous month , which was revised up from 203 thousand add that this was the lowest monthly increase in within three years. In addition, the Department of Labor reported that the unemployment rate fell to 6.7 % from 7% , although this decline was largely the result of reducing the number of workforce. Economists had expected the number of people employed in December to increase by 194 thousand and the unemployment rate will remain unchanged - at around 7.0%.

-

19:00

U.S.: Federal budget , December 53.2 (forecast 44.3)

-

15:30

Canada: Bank of Canada Senior Loan Officer , Quarter IV -10.8

-

15:30

Canada: Bank of Canada business outlook future sales, Quarter IV 29

-

13:41

Option expiries for today's 1400GMT cut

EUR/USD $1.3540, $1.3550, $1.3600, $1.3625, $1.3700

USD/JPY Y102.00, Y102.50, Y103.50, Y103.75, Y104.00, Y105.00, Y105.45, Y106.00

АUD/JPY Y95.00

GBP/USD $1.6400

EUR/GBP stg0.8270

EUR/CHF Chf1.2370

USD/САD C$1.0795

-

13:19

European session: the euro fell moderately

The euro is trading with a moderate decrease against the U.S. dollar Friday after adjusting for growth of employment data . Investors assess the prospects for further minimize incentives in the U.S. before the performances of a number of heads of the Federal Reserve this week. So , on Monday would be the head of the Federal Reserve Bank ( FRB ) of Atlanta Dennis Lockhart , Tuesday - Charles Plosser of the Philadelphia Fed and Richard Fisher of the Dallas Fed - both in 2014 are entitled to vote on matters of monetary policy on the Committee on the Fed's operations on the open market . And on Thursday deliver a report the U.S. central bank chairman Ben Bernanke , his speech will be devoted to the general difficulties of central banks , and it is not clear whether it will affect the folding theme incentives. The next Fed meeting will be held January 28-29 .

Recall that the U.S. dollar declined against most major currencies on Friday after the U.S. in December, was created only 74,000 jobs , that is, was recorded the weakest growth since early 2011 . The unemployment rate , meanwhile, fell to 6.7 % compared with 7.0% in the previous month - the lowest level since October 2008 . But the decline seemed to occur mainly because more people left the work force. Economists had expected an increase of jobs in non-agricultural area at 193,000 while maintaining unemployment at 7.0 % in December.

The Australian dollar reached a one-month high against the dollar after the volume of mortgage lending in Australia increased in November. Total number of mortgages in Australia rose a seasonally adjusted 1.1 percent in November compared with the previous month, the Australian Bureau of Statistics reported on Monday, and was 52 912.

The main indicator coincided with economists' forecasts , after rising 1.0 percent in October.

Total number of loans for the construction of new homes rose by 2.3 percent to 5686 .

Credits for the purchase of new homes fell 4.3 percent to 2856, while loans to purchase housing on the secondary market rose by 1.4 percent to 44,370 .

The volume of loans rose to 1.7 percent , remaining unchanged from the previous month and totaled 26.934 billion Australian dollars .

Investment lending rose by 1.5 percent for the month and amounted to 10.383 billion Australian dollars , slowing from growth of 8.5 percent in October.

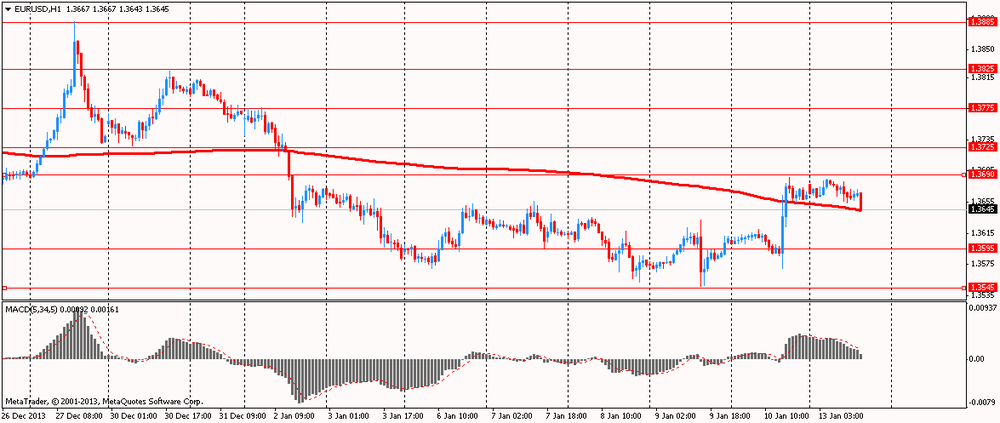

EUR / USD: during the European session, the pair fell to $ 1.3643

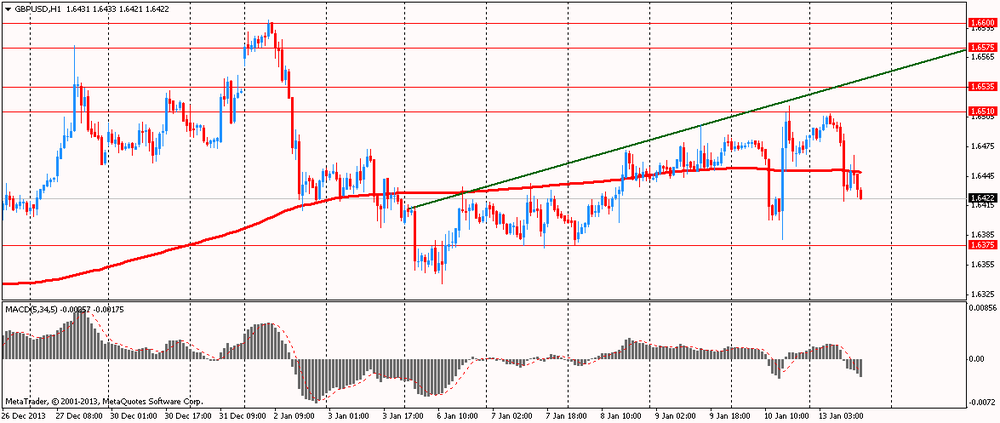

GBP / USD: during the European session, the pair fell to $ 1.6420

USD / JPY: during the European session, the pair rose to Y103.57

At 15:30 GMT , Canada will release indicator of expectations in the field of credit and financial institutions , according to the Bank of Canada , the light of the expected growth of trade (Review sentiment in the business environment of the Bank of Canada ) for the 4th quarter . At 19:00 GMT the United States will be released monthly budget execution report for December. At 21:00 GMT New Zealand is to publish house price index from REINZ, changing housing sales from REINZ for December sentiment indicator from the NZIER business environment for the 4th quarter . At 23:50 GMT , Japan will release the overall current account balance , total adjusted current account surplus in November.

-

10:18

Option expiries for today's 1400GMT cut

EUR/USD $1.3540, $1.3550, $1.3600, $1.3625

USD/JPY Y102.00, Y102.50, Y103.50, Y105.00, Y106.00

GBP/USD $1.6400

EUR/GBP stg0.8270

EUR/CHF Chf1.2370

-

09:59

Asia Pacific stocks close

Asian stocks rose after slower growth in U.S. payrolls eased concern the Federal Reserve will accelerate cuts to stimulus.

Nikkei 225 Closed

Hang Seng 22,884.98 +38.73 +0.17%

S&P/ASX 200 5,292.08 -20.31 -0.38%

Shanghai Composite 2,009.56 -3.73 -0.19%

Newcrest Mining Ltd., a Australia gold producer, advanced 6.1 percent as the precious metal climbed after the U.S. jobs data.

Dongbu Steel Co. jumped 15 percent, heading for the highest closing level in seven months, after the Maeil Business newspaper reported companies are interested in buying one of its factories and a stake in Dongbu Metal Co.

Hyundai Motor Co. climbed 3.6 percent in Seoul as consumer discretionary firms posted the largest gains among the 10 industry groups on the regional benchmark index.

-

07:06

Asian session: The yen touched the strongest in three weeks

00:30 Australia ANZ Job Advertisements (MoM) December -0.8% -0.7%

00:30 Australia Home Loans November +1.0% +1.1% +1.1%

The yen touched the strongest in three weeks after bearish bets slid to a six-week low and as investors weigh the outlook for a reduction in Federal Reserve monetary stimulus before policy makers speak this week.

The Bloomberg Dollar Spot Index dropped on Jan. 10 by the most in almost three months after U.S. jobs rose less than the most pessimistic projection in a Bloomberg News survey. A 74,000 increase in December payrolls lagged behind the 197,000 advance estimated by economists and compared with the most pessimistic forecast for 100,000. Labor Department figures showed last week that the unemployment rate declined to 6.7 percent, the lowest since October 2008, as more people left the workforce.

Japan’s currency rose against the euro, adding to a two-week advance, before data economists say will show Italian industrial output growth slowed. In Italy, industrial output growth slowed to 0.3 percent in November from 0.5 percent the prior month, a separate poll of economists shows before national statistics office Istat releases the figures today. The nation is the euro region’s biggest economy after Germany and France.

Australia’s dollar touched a one-month high against the greenback after home-loan growth exceeded expectations and before an employment report this week. Home loan approvals climbed 1.1 percent in November from the previous month, faster than the median forecast for a 1 percent increase, a report today showed. The nation’s statistics bureau may say on Jan. 16 that employers added 10,000 jobs last month after boosting positions by 21,000 in November, according to the Bloomberg median. The unemployment rate probably held at 5.8 percent, the survey showed.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3660-85

GBP / USD: during the Asian session, the pair rose to $ 1.6505

USD / JPY: on Asian session the pair fell to Y103.25

-

05:58

Schedule for today, Monday, Jan 13’2013:

00:30 Australia ANZ Job Advertisements (MoM) December -0.8% -0.7%

00:30 Australia Home Loans November +1.0% +1.1% +1.1%

15:30 Canada Bank of Canada business outlook future sales Quarter IV 31

15:30 Canada Bank of Canada Senior Loan Officer Quarter IV -7.3

19:00 U.S. Federal budget December -135.2 44.3

21:00 New Zealand NZIER Business Confidence Quarter IV 38

23:50 Japan Current Account (adjusted), bln November -59.3 -55.6

-