Notícias do Mercado

-

23:19

Currencies. Daily history for March 13'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3870 -0,23%

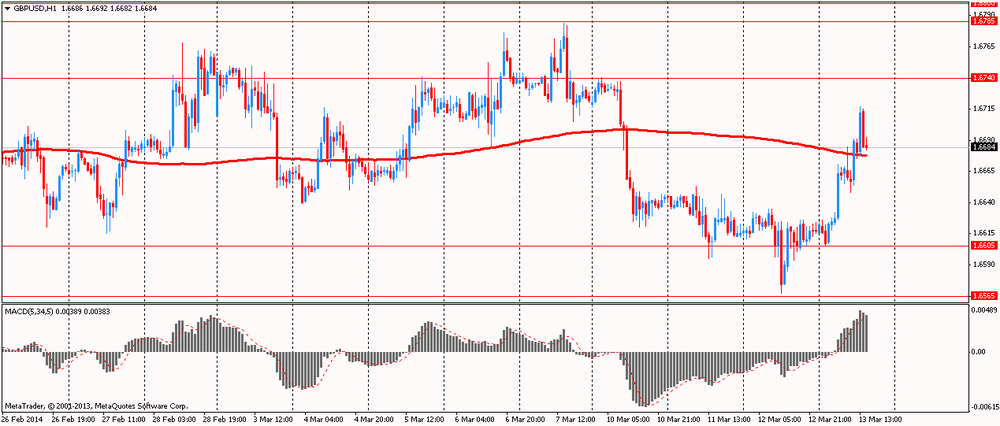

GBP/USD $1,6622 +0,03%

USD/CHF Chf0,8741 +0,02%

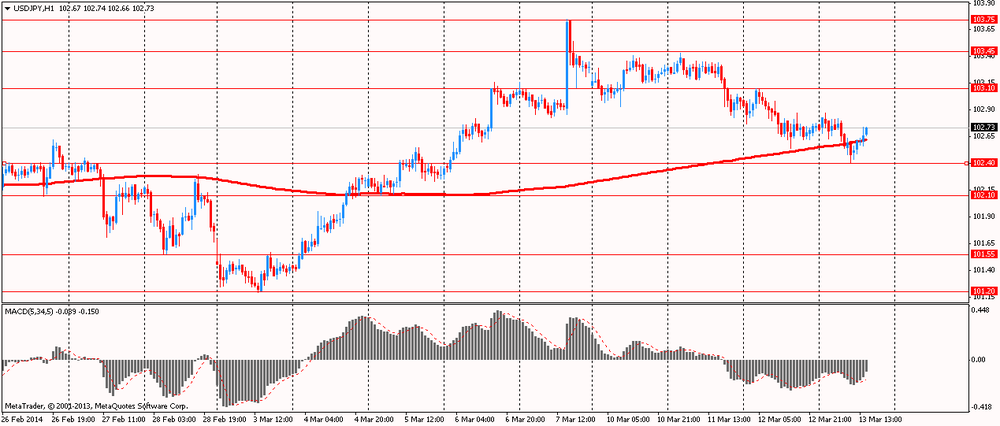

USD/JPY Y101,87 -0,86%

EUR/JPY Y141,29 -1,10%

GBP/JPY Y169,32 -0,83%

AUD/USD $0,9037 +0,55%

NZD/USD $0,8440 -0,95%

USD/CAD C$1,1067 -0,47%

-

22:59

Schedule for today, Monday, March 14’2014:

(time / country / index / period / previous value / forecast)

04:30 Japan Industrial Production (MoM) (Finally) January +4.0% +4.0%

04:30 Japan Industrial Production (YoY) (Finally) January +10.6% +10.6%

07:00 Germany CPI, m/m (Finally) February +0.5% +0.5%

07:00 Germany CPI, y/y (Finally) February +1.2% +1.2%

08:15 Switzerland Producer & Import Prices, m/m February 0.0% +0.3%

08:15 Switzerland Producer & Import Prices, y/y February -0.3% -0.4%

09:30 United Kingdom Trade in goods January -7.7 -8.7

12:30 U.S. PPI, m/m February +0.2% +0.2%

12:30 U.S. PPI, y/y February +1.2% +1.1%

12:30 U.S. PPI excluding food and energy, m/m February +0.2% +0.1%

12:30 U.S. PPI excluding food and energy, Y/Y February +1.3%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) March 81.6 81.9

-

18:20

American focus : the euro dropped significantly against the U.S. dollar

The dollar rose sharply against the euro amid falling risk appetite during the U.S. session , when the stock markets fall , despite strong U.S. data . Note that one of the reports showed that initial applications for unemployment benefits fell by 9,000 and amounted to a seasonally adjusted 315,000 in the week ended March 8. The result was the lowest since late November. Number of references to the previous week were revised slightly higher. Economists had forecast 334,000 new claims will be filed last week.

It was also reported that retail sales rose a seasonally adjusted 0.3% in February from January . Retail sales excluding auto purchases grew at the same pace . Economists had forecast a 0.3 % increase in total sales last month and an increase of 0.2 % excluding autos . Sales rose by a modest 1.5% compared with a year earlier . Changes showed that retail sales fell 0.6 % in January compared with the originally voiced by -0.4 %.

Also had a noticeable impact statements of the head of the ECB Draghi, who said that the ECB is preparing to take extra steps to protect the eurozone from deflation as the strong euro " crushes " on prices. He also noted that the risk of deflation were " very limited " , but the longer inflation remains at a low level , the greater the likelihood of developing deflationary risks. "That's why the ECB is preparing additional non-standard measures of monetary policy to protect against such accidents and is ready to take further decisive action if necessary ," said Draghi .

The Canadian dollar rose against the U.S. currency due to improved relative to risk and strengthening currencies of New Zealand and Australia. The Canadian dollar was supported by the growth of the Australian and New Zealand dollars, which tend to be closely linked with the Canadian currency, after increasing by 25 basis points rate Reserve Bank of New Zealand and surprisingly strong report on the number of jobs in Australia in February. Interbank trading and interest in investment funds supported the Canadian dollar currency in the London session . Slight weakening of the Canadian dollar was noted after the news that U.S. retail sales rose 0.3 % in February, but quickly regained those losses .

The yen has appreciated strongly against the U.S. dollar amid falling risk appetite . Couple became under pressure when the stock market in the United States moved into negative territory . Growth of the yen also help data released today in Japan , which suggests that the company at least , do not expect a cruel blow. This is good news for abenomiki that in recent months , it seems , began to fizzle out as the promised recovery of exports has not materialized . Strong investment companies talk about what lies ahead - news gets even better . Basic orders for machinery and equipment - a leading indicator of investment in six months - in January jumped by 13.4 % compared with the previous month . It is the second largest growth in the current series of data , which was launched in 2005. He says that the company seems more confident than expected, that the economy can withstand the increase of the sales tax . Another positive sign is the strength of orders in the manufacturing sector , which in recent months lagged nonproductive orders.

-

18:00

U.S.: Federal budget , February -193.5 (forecast -223.2)

-

14:00

U.S.: Business inventories , January +0.4% (forecast +0.4%)

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.70, Y102.85, Y103.10, Y103.15, Y103.25, Y103.65, Y104.00

EUR/USD $1.3800, $1.3900, $1.3910, $1.3930, $1.3950

GBP/USD $1.6670, $1.6700, $1.6725

EUR/GBP stg0.8200, stg0.8275, stg0.8300

AUD/USD $0.8960, $0.9000, $0.9005, $0.9040/50, $0.9155, $0.9175

USD/CAD C$1.0970, C$1.1000, C$1.1050, C$1.1190

-

13:15

European session: the euro rose

07:45 France CPI, m/m February -0.6% +0.4% +0.6%

07:45 France CPI, y/y February +0.7% +1.1% +1.1%

09:00 Eurozone ECB Monthly Report March

12:30 Canada New Housing Price Index January +0.1% +0.3% +0.3%

12:30 U.S. Retail sales February -0.6% Revised From -0.4% +0.3% +0.3%

12:30 U.S. Retail sales excluding auto February -0.3% Revised From 0.0% +0.2% +0.3%

12:30 U.S. Import Price Index February +0.4% Revised From +0.1% +0.6% +0.9%

12:30 U.S. Initial Jobless Claims March 324 Revised From 323 334 315

The euro has risen sharply against the U.S. dollar in the absence of significant macro-statistics . Secondary data came from information on inflyatsii.Vo France French measure of inflation, agreed by EU standards , accelerated in February, slightly faster than expected, data showed on Thursday statistical office INSEE. Harmonized index of consumer prices , or HICP, rose 1.1 percent year on year , after rising 0.8 percent in January . Economists had expected the rate of inflation will be 1 percent . On a monthly measurement of the harmonized index of consumer prices rose 0.6 percent in February , replacing a similar decline in January. Monthly data were in line with expectations of economists.

HICP growth in February came mainly from the end of the winter sales and its effect on the prices of clothing and footwear , and to a lesser extent on the price of industrial products.

In turn, the consumer price index rose by 0.9 percent a year in February , after a 0.7 percent gain in the previous month . Economists forecast the inflation rate of 1 percent . Core inflation rose to 0.7 per cent compared with January unusually low level of 0.1 percent. The monthly increase was 0.5 percent in February compared with 0.4 percent in the previous month . On a monthly basis, the CPI rose by 0.6 per cent , offsetting the decline of similar size in the previous month . Economists had expected a gain of 0.5 percent.

Also today published a monthly report by the ECB. In its March bulletin of the ECB Governing Council reiterated that rates will be kept low for a long period of time , according to the downward revision of inflation associated with the continued weakness of the eurozone economy and " high level of spare capacity , and reducing the growth of money and credit " .

Yet a moderate recovery in the region takes place in accordance with the forecasts of the ECB, and the current outlook for prices and the economy confirms the need to continue accommodative policy , as it is necessary to maintain recovery.

The Governing Council of the ECB expects that " in 2014, the annual HICP growth will be 1.0% , in 2015 - 1.3% , and in 2016 - 1.5% ," adding that "in the last quarter of 2016 the annual rise is expected to be + 1.7 %. " As for GDP growth , the Bank expects that in 2014 it will be 2% , in 2015 - 1.5 %, and in 2016 - 1.8%.

Finally, the report calls on the National Bank of the governments of member states to increase efforts aimed at " reducing the national debt by implementing financial strategies under the Stability and Growth Pact . Authorities also need to continue structural reforms aimed at reducing the level of unemployment in the region.

The British pound also rose substantially against the dollar on housing data . Rising house prices in the UK slowed in February , showed on Thursday last poll from the Royal Institution of Chartered Surveyors (RICS). House price balance amounted to six minimum score of 45 . The result fell short of forecasts, at 52 , that it would be unchanged compared with the result of January (which was revised down from 53 ) .

Among the individual components of the survey, subindexes price expectations , sales and number of customers continued to increase . Regionally, prices rose at a much faster pace in London and the South East .

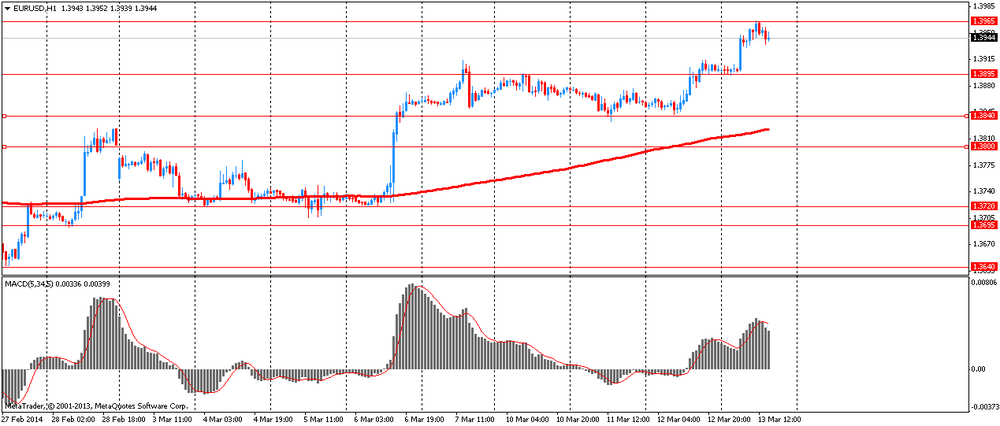

EUR / USD: during the European session, the pair rose to $ 1.3967

GBP / USD: during the European session, the pair rose to $ 1.6717

USD / JPY: during the European session, the pair fell to Y102.41 and stepped

In the U.S. at 14:00 GMT will change in the volume of reserves in commercial warehouses for January. At 21:30 GMT New Zealand will release the index of business activity in the manufacturing sector of Business NZ in February. At 23:50 GMT the meeting minutes will be published on the Bank of Japan's monetary policy .

-

13:00

Orders

EUR/USD

Offers $1.4000, $1.3967/75

Bids $1.3880, $1.3820

GBP/USD

Offers $1.6785/800, $1.6745/55, $1.6720/25, $1.6700/10

Bids $1.6650, $1.6630-10

AUD/USD

Offers $0.9150, $0.9100

Bids $0.9025/20, $0.9000, $0.8950, $0.8910/00

EUR/JPY

Offers Y144.00, Y143.75/80, Y143.45/50, Y143.15/20

Bids Y142.50, Y142.20, Y142.00, Y141.50

USD/JPY

Offers Y103.75/80, Y103.50, Y103.20, Y103.00

Bids Y102.30/20, Y102.00, Y101.50

EUR/GBP

Offers stg0.8435/40, stg0.8415/20, stg0.8390/405, stg0.8380

Bids stg0.8320

-

12:31

U.S.: Retail sales excluding auto, February +0.3% (forecast +0.2%)

-

12:30

U.S.: Initial Jobless Claims, March 315 (forecast 334)

-

12:30

U.S.: Import Price Index, February +0.9% (forecast +0.6%)

-

12:30

Canada: New Housing Price Index , January +0.3% (forecast +0.3%)

-

12:30

U.S.: Retail sales, February +0.3% (forecast +0.3%)

-

09:59

Option expiries for today's 1400GMT cut

USD/JPY Y102.00, Y102.70, Y102.85, Y103.10, Y103.15, Y103.25, Y103.65, Y104.00

EUR/USD $1.3800, $1.3900, $1.3910, $1.3930, $1.3950

GBP/USD $1.6670, $1.6700, $1.6725

EUR/GBP stg0.8200, stg0.8275, stg0.8300

AUD/USD $0.8960, $0.9000, $0.9005, $0.9040/50, $0.9155, $0.9175

USD/CAD C$1.0970, C$1.1000, C$1.1050, C$1.1190

-

07:45

France: CPI, m/m, February +0.6% (forecast +0.4%)

-

07:45

France: CPI, y/y, February +1.1% (forecast +1.1%)

-

06:26

Asian session: The yen held

00:00 Australia Consumer Inflation Expectation March +2.3% +2.1%

00:01 United Kingdom RICS House Price Balance February 52% Revised From 53% 52% 45%

00:30 Australia Unemployment rate February 6.0% 6.0% 6.0%

00:30 Australia Changing the number of employed February 18.0 Revised From -3.7 +15.3 +47.3

01:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

05:30 China Retail Sales y/y February +13.6% +13.5% +11.8%

05:30 China Fixed Asset Investment February +19.6% +19.5% +17.9%

05:30 China Industrial Production y/y February +9.7% +9.5% +8.6%

The yen held a three-day gain versus the dollar before reports in the U.S. and China that come amid concern the world’s largest economies are slowing. Retail spending in the U.S. probably rose 0.2 percent in February from the previous month, when it declined, data due today is predicted to show, according to a separate poll. The Labor Department is forecast to report that initial jobless claims climbed 7,000 to 330,000 in the week to March 8.

Reports today are forecast to show Chinese retail sales grew at a 13.5 percent annual pace, while gains in industrial production slowed to a 9.5 percent rate, according to the median estimates in Bloomberg News surveys.

The kiwi dollar climbed to a record against the currencies of its trading partners as New Zealand became the first developed economy to raise interest rates since 2011. Reserve Bank Governor Graeme Wheeler indicated he will tighten policy further in coming months to damp inflation pressures after today raising the cash rate to 2.75 percent, from 2.50 percent.

Australia’s dollar surged and bonds dropped as employers added the most full-time jobs since 1991. The statistics bureau said employers added 47,300 positions last month, surpassing the 15,000 gain forecast in a Bloomberg survey. Full-time employment increased by the most in more than 22 years. The jobless rate held at a decade-high 6 percent.

EUR / USD: during the Asian session, the pair rose to $ 1.3950

GBP / USD: during the Asian session, the pair rose to $ 1.6670

USD / JPY: on Asian session the pair traded in the range of Y102.60-85

There is a busy schedule on both sides of the Atlantic Thursday, with a full calendar of both data and central bank speakers. The European calendar gets underway at 0745GMT, with the release of the French February HICP data, followed at 0800GMT by the release of the Spanish January retail sales data. At 0815GMT, ECB Executive Board member Benoit Coeure will deliver a speech on an integrated banking union, in Paris. The ECB will release their monthly report at 0900GMT, largely expected to mirror President Draghi's statement at last week's press conference. Italian final February HICP will also be released at 0900GMT. At 1000GMT, the Bundesbank will hold a press conference to discuss the annual financial statement, in Frankfurt. At the same time, German Chancellor Angela Merkel speaks before parliament on the Ukraine situation. Following her appearance in the Reichstag, Merkel and Czech Prime Minister Bohuslav Sobotka will hold a joint press conference, in Berlin at 1215GMT. -

00:32

Australia: Changing the number of employed, February +47.3 (forecast +15.3)

-

00:30

Australia: Unemployment rate, February 6.0% (forecast 6.0%)

-

00:01

United Kingdom: RICS House Price Balance, February 45% (forecast 52%)

-

00:00

Australia: Consumer Inflation Expectation, March +2.1%

-