Notícias do Mercado

-

23:51

Japan: Core Machinery Orders, y/y, January +23.6% (forecast +18.8%)

-

23:51

Japan: Core Machinery Orders, January +13.4% (forecast +7.3%)

-

23:20

Currencies. Daily history for March 12'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3902 +0,31%

GBP/USD $1,6617 +0,01%

USD/CHF Chf0,8739 -0,45%

USD/JPY Y102,75 -0,08%

EUR/JPY Y142,85 +0,09%

GBP/JPY Y170,73 -0,21%

AUD/USD $0,8987 +0,13%

NZD/USD $0,8520 +0,59%

USD/CAD C$1,1119 +0,13%

-

23:00

Schedule for today, Thursday, March 13’2014:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation March +2.3%

00:01 United Kingdom RICS House Price Balance February 53% 52%

00:30 Australia Unemployment rate February 6.0% 6.0%

00:30 Australia Changing the number of employed February -3.7 +15.3

01:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

05:30 China Retail Sales y/y February +13.6% +13.5%

05:30 China Fixed Asset Investment February +19.6% +19.5%

05:30 China Industrial Production y/y February +9.7% +9.5%

07:45 France CPI, m/m February -0.6% +0.4%

07:45 France CPI, y/y February +0.7% +1.1%

09:00 Eurozone ECB Monthly Report March

12:30 Canada New Housing Price Index January +0.1% +0.3%

12:30 U.S. Retail sales February -0.4% +0.3%

12:30 U.S. Retail sales excluding auto February 0.0% +0.2%

12:30 U.S. Import Price Index February +0.1% +0.6%

12:30 U.S. Initial Jobless Claims March 323 334

14:00 U.S. Business inventories January +0.5% +0.4%

17:00 Eurozone ECB President Mario Draghi Speaks

21:30 New Zealand Business NZ PMI February 56.2

23:50 Japan Monetary Policy Meeting Minutes February -

20:00

New Zealand: RBNZ Interest Rate Decision, 2.75% (forecast 2.75%)

-

18:20

American focus : the euro rose substantially against the U.S. dollar

The euro exchange rate has appreciated strongly against the U.S. dollar , reaching maximum values at the same time this month. Growth did not stop even weak data on industrial production in the euro area . As it became known , the volume of industrial production fell 0.2 percent on a monthly basis in January , showing the second consecutive fall. Economists had expected production to grow by 0.6 percent after falling by a revised 0.4 percent in December . Production of energy decreased by 2.5 percent, and the production of durable consumer goods fell by 0.6 percent . Intermediate goods decreased by 0.1 percent. Partially offset this decline is that the release of capital goods rose by 0.9 percent, while production of consumer non-durable goods increased by 0.4 percent. On an annual basis, industrial production growth accelerated to 2.1 percent from 1.2 percent in December. Predicted that the issue will grow by 1.9 per cent .

Experts point out that despite the continuing problems with economic growth in the eurozone, the European single currency showed steady growth, mainly receiving support from the European Central Bank's decision to leave policy unchanged , continuing softening . The ECB has signaled that inflation is not low enough , and the economy is weak enough to take action. Investors gradually resigned to the fact that further action the ECB will probably need to yield more negative economic news.

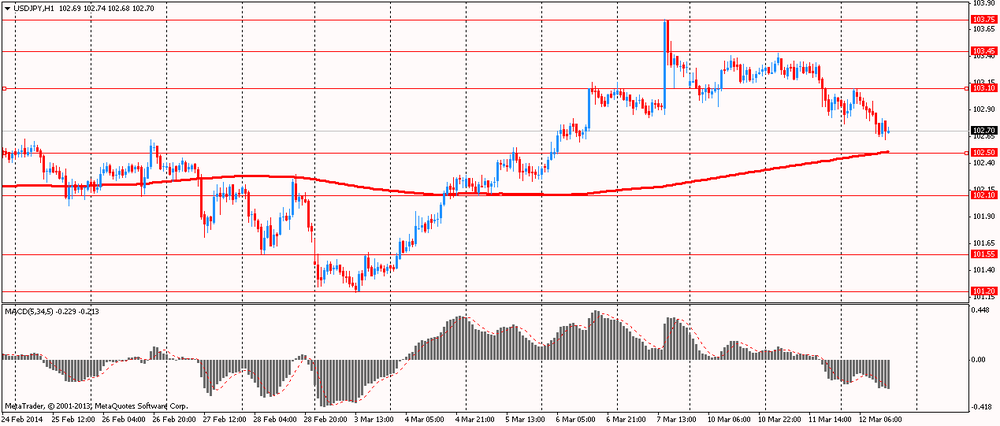

The yen rose moderately against the dollar as signs of slowing economic boosted demand for safe-haven assets . Recall that submitted this month , data showed that in February, China's exports fell by the largest value since the beginning of the financial crisis . Index decreased yoy by 18.1 % , while the experts had expected growth of 7.5%. However, the real picture is quite difficult to evaluate because of the rather long New Year celebrations on the lunar calendar . Holidays in China traditionally distort statistics . Meanwhile, imports grew by 10.1% , resulting in a trade deficit peaked at 2 years.

Frank continued to strengthen against the dollar , breaking with a two-day consolidation, and peaking in the last 28 months. Franc firmed the increased risk aversion amid worries about China and the situation between Russia and Ukraine.

Market participants are waiting for tomorrow's data for China . Economists predict that the Chinese industrial production has increased markedly during the first two months of this year , but the rate of this increase will be less than was recorded in December. It is estimated that industrial production increased by 9.5 percent ( yoy ) in January and February, compared with a gain of 9.7 percent in December. Experts also expect that retail sales rose by 13.5 percent per annum for the first two months of this year , slightly less than 13.6 per cent growth in December. Growth of investment in fixed assets, probably slowed to 19.5 per cent per annum, compared with an increase of 19.6 percent in January .

-

14:30

U.S.: Crude Oil Inventories, March +6.2

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y102.45, Y102.70, Y102.90, Y103.00, Y103.25, Y103.50, Y103.75, Y103.80-85-90, Y104.00

EUR/USD $1.3700, $1.3850, $1.3860-65-70, $1.3900, $1.4000

GBP/USD $1.6500, $1.6520, $1.6545-50, $1.6560-65, $1.6700

EUR/GBP stg0.8200, stg0.8285, stg0.stg0.8290

USD/CHF Chf0.8900

AUD/USD $0.8900, $0.8990, $0.9100, $0.9150

USD/CAD C$1.1000, C$1.1050, C$1.1100, C$1.1120, C$1.1145-50, C$1.1200

-

13:15

European session: the euro rose

10:00 Eurozone Industrial production, (MoM) January -0.4% Revised From -0.7% +0.6% -0.2%

10:00 Eurozone Industrial Production (YoY) January +1.2% Revised From +0.5% +1.9% +2.1%

The euro has risen sharply against the U.S. dollar despite weak data on industrial production in the euro area . Official data showed Eurostat, in the euro zone industrial production fell unexpectedly in January , largely due to reduced production of energy.

Industrial output fell 0.2 percent on a monthly basis in January , showing the second consecutive fall. Economists had expected production to grow by 0.6 percent after falling by a revised 0.4 percent in December .

Production of energy decreased by 2.5 percent, and the production of durable consumer goods fell by 0.6 percent . Intermediate goods decreased by 0.1 percent. Partially offset this decline is that the release of capital goods rose by 0.9 percent, while production of consumer non-durable goods increased by 0.4 percent.

On an annual basis, industrial production growth accelerated to 2.1 percent from 1.2 percent in December . Economists forecast that output will grow by 1.9 per cent .

In light of this release analysts ING Bnak NV commented : " The main reason for poor outcome again was to reduce energy production by 2.5% , but intermediate goods and consumer durables also pointed to the decline in production ... While the benchmark is not met expectations , weak energy component probably overshadowed a slight improvement in the overall indicator. However, to strengthen the eurozone recovery process still requires export growth . "

The yen rose against most currencies on concerns about the state of China's economy. This increases the demand for safe-haven assets , which is the yen . In February, China's exports fell by the largest value since the beginning of the financial crisis . Index decreased yoy by 18.1 % , while the experts had expected growth of 7.5%. However, the real picture is quite difficult to evaluate because of the rather long New Year celebrations on the lunar calendar . Holidays in China traditionally distort statistics . Meanwhile, imports grew by 10.1% , resulting in a trade deficit reached highs for 2 years at $ 23 billion

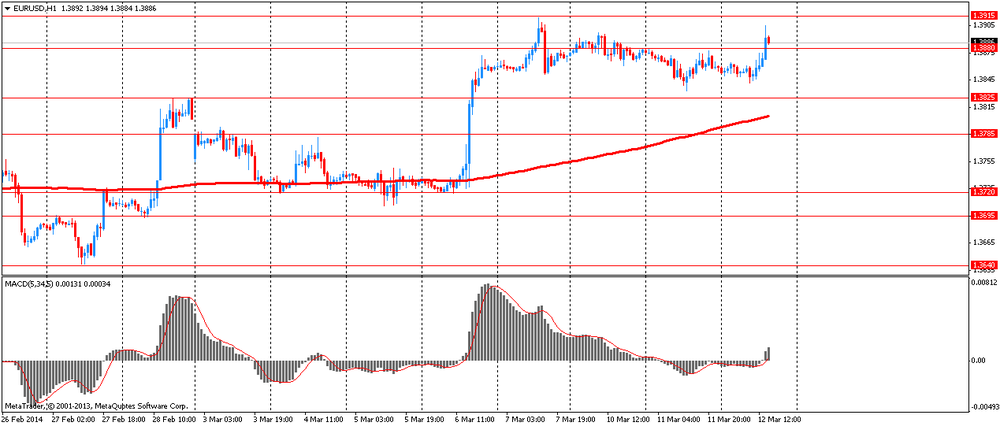

EUR / USD: during the European session, the pair rose to $ 1.3905

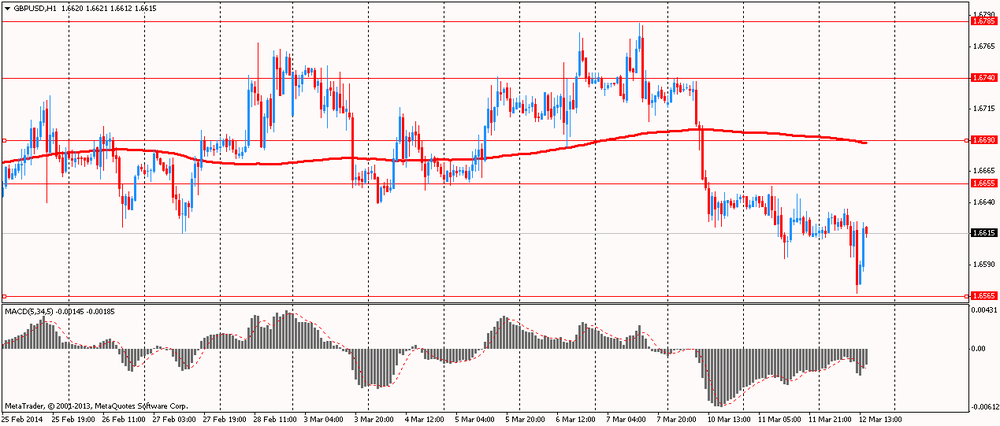

GBP / USD: during the European session, the pair fell to $ 1.6567 and retreated

USD / JPY: during the European session, the pair fell to Y102.62

At 17:01 GMT the United States places the 10 - year bonds . At 18:00 GMT the United States will be released monthly budget execution report . At 20:00 GMT we will know the RBNZ decision on the basic interest rate will be a press conference by the RBNZ will be done RBNZ accompanying statement , the protocol will monetary policy RBNZ . At 23:50 GMT , Japan will publish the change in orders for machinery and equipment in January .

-

13:00

Orders

EUR/USD

Offers $1.3950, $1.3920/25, $1.3900-15, $1.3890

Bids $1.3820, $1.3760/50

GBP/USD

Offers $1.6785/800, $1.6745/55, $1.6720/25, $1.6700/10, $1.6680/85, $1.6650/55

Bids $1.6580, $1.6555/50, $1.6500

AUD/USD

Offers $0.9100, $0.9050, $0.9000

Bids $0.8910/00, $0.8850

EUR/JPY

Offers Y144.00, Y143.75/80, Y143.45/50, Y143.00

Bids Y142.20, Y142.00, Y141.50, Y141.00

USD/JPY

Offers Y103.50, Y103.20

Bids Y102.50, Y102.20, Y102.00

EUR/GBP

Offers stg0.8467, stg0.8435/40, stg0.8415/20, stg0.8400/05, stg0.8370/80

Bids stg0.8320

-

10:00

Eurozone: Industrial production, (MoM), January -0.2% (forecast +0.6%)

-

10:00

Eurozone: Industrial Production (YoY), January +2.1% (forecast +1.9%)

-

09:37

Option expiries for today's 1400GMT cut

USD/JPY Y102.45, Y102.70, Y102.90, Y103.00, Y103.25, Y103.50, Y103.75, Y103.80-85-90, Y104.00

EUR/USD $1.3700, $1.3850, $1.3860-65-70, $1.3900, $1.4000

GBP/USD $1.6500, $1.6520, $1.6545-50, $1.6560-65, $1.6700

EUR/GBP stg0.8200, stg0.8285, stg0.stg0.8290

USD/CHF Chf0.8900

AUD/USD $0.8900, $0.8990, $0.9100, $0.9150

USD/CAD C$1.1000, C$1.1050, C$1.1100, C$1.1120, C$1.1145-50, C$1.1200

-

06:20

Asian session: The yen held gains

00:30 Australia Home Loans January -1.9% +0.8% 0.0%

05:00 Japan BoJ monthly economic report March

05:00 Japan Consumer Confidence February 40.5 40.3 38.3

The yen held gains from yesterday against most peers after a gauge of Chinese economic surprises dropped to a nine-month low, underlining concern about a slump in the Asian economy that’s sent commodity prices tumbling. China’s exports unexpectedly fell 18.1 percent in February from a year earlier, customs data on March 8 showed, compared with a forecast for an increase of 7.5 percent in a Bloomberg News survey. Imports rose 10.1 percent, leaving a trade deficit of $23 billion. Demand for Japan’s haven assets was also bolstered by the standoff over Ukraine’s Crimean peninsula.

The euro traded near its highest level in almost 2 1/2 years before data today that may show an improving outlook for industrial production. Output in the region gained 0.5 percent in January, rebounding from the previous month’s 0.7 percent drop, according to the median forecast in a Bloomberg survey.

The Aussie weakened after a report showed a decline in consumer confidence, following data indicating a drop in business sentiment yesterday.

New Zealand’s currency held a monthly gain as the central bank is predicted to raise interest rates tomorrow.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3850-65

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6610-35

USD / JPY: on Asian session the pair traded in the range of Y102.80-10

There is plenty on the calendar on both sides of the Atlantic Wednesday, although European data is largely second tier. The European calendar gets underway at 0630GMT, with the release of the French fourth quarter job creations data. Early central bank speakers are on deck from 0800GMT, when ECB Governing Council member Luis Linde delivers a lecture in Madrid. At the same time, ECB Executive Board member Peter Praet will give a speech on communication challenges, in Frankfurt. At 0800GMT, Spanish February final HICP is set for release. The UK Trade data was set for release at 0930GMT, but has been delayed until March 14. ECB Executive Board member Benoit Coeure will give a speech on monetary policy challenges, in Frankfurt at 1000GMT. Euro area data also set for release at 1000GMT includes the January industrial output data and the January OECD leading indicator.

Across the Atlantic, the US calendar gets underway at 1100GMT, when the MBA Mortgage Index for the March 8 week will be published. The IMF holds its regular biweekly press briefing in Washington at 1330GMT. Further US data sees the release of the fourth quarter 2014 services data at 1400GMT and the EIA Crude Oil Stocks for the March 7 week at 1430GMT. Treasury Secretary Jack Lew testifies before the Senate Budget Committee on FY2015 budget from 1430GMT, appearing before the House Budget Committee from 1800GMT. Later, the US will sell 421 billion of 10-year paper.

-

05:02

Japan: Consumer Confidence, February 38.3 (forecast 40.3)

-

00:31

Australia: Home Loans , January 0.0 (forecast +0.8%)

-