Notícias do Mercado

-

23:51

Japan: Core Machinery Orders, y/y, January +23.6% (forecast +18.8%)

-

23:51

Japan: Core Machinery Orders, January +13.4% (forecast +7.3%)

-

23:31

Commodities. Daily history for March 12’2014:

(raw materials / closing price /% change)

Gold $1,370.3 +13.10 +0.97%

ICE Brent Crude Oil $108.02 -0.31 -0.29%

NYMEX Crude Oil $98.14 -1.40 -1.41%

-

23:24

Stocks. Daily history for March 12’2014:

(index / closing price / change items /% change)

Nikkei 14,830.39 -393.72 -2.59%

Hang Seng 21,901.95 -367.66 -1.65%

Shanghai Composite 1,997.69 -3.47 -0.17%

S&P 1,868.2 +0.57 +0.03% 449.37m

NASDAQ 4,323.33 +16.14 +0.37%

Dow 16,340.08 -11.17 -0.07%

FTSE 6,620.9 -64.62 -0.97%

CAC 4,306.26 -43.46 -1.00%

DAX 9,188.69 -119.10 -1.28%

-

23:20

Currencies. Daily history for March 12'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3902 +0,31%

GBP/USD $1,6617 +0,01%

USD/CHF Chf0,8739 -0,45%

USD/JPY Y102,75 -0,08%

EUR/JPY Y142,85 +0,09%

GBP/JPY Y170,73 -0,21%

AUD/USD $0,8987 +0,13%

NZD/USD $0,8520 +0,59%

USD/CAD C$1,1119 +0,13%

-

23:00

Schedule for today, Thursday, March 13’2014:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation March +2.3%

00:01 United Kingdom RICS House Price Balance February 53% 52%

00:30 Australia Unemployment rate February 6.0% 6.0%

00:30 Australia Changing the number of employed February -3.7 +15.3

01:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

05:30 China Retail Sales y/y February +13.6% +13.5%

05:30 China Fixed Asset Investment February +19.6% +19.5%

05:30 China Industrial Production y/y February +9.7% +9.5%

07:45 France CPI, m/m February -0.6% +0.4%

07:45 France CPI, y/y February +0.7% +1.1%

09:00 Eurozone ECB Monthly Report March

12:30 Canada New Housing Price Index January +0.1% +0.3%

12:30 U.S. Retail sales February -0.4% +0.3%

12:30 U.S. Retail sales excluding auto February 0.0% +0.2%

12:30 U.S. Import Price Index February +0.1% +0.6%

12:30 U.S. Initial Jobless Claims March 323 334

14:00 U.S. Business inventories January +0.5% +0.4%

17:00 Eurozone ECB President Mario Draghi Speaks

21:30 New Zealand Business NZ PMI February 56.2

23:50 Japan Monetary Policy Meeting Minutes February -

20:00

New Zealand: RBNZ Interest Rate Decision, 2.75% (forecast 2.75%)

-

19:00

Dow -34.97 16,316.28 -0.21% Nasdaq +9.7 4,316.89 +0.23% S&P -2.49 1,865.14 -0.13%

-

18:20

American focus : the euro rose substantially against the U.S. dollar

The euro exchange rate has appreciated strongly against the U.S. dollar , reaching maximum values at the same time this month. Growth did not stop even weak data on industrial production in the euro area . As it became known , the volume of industrial production fell 0.2 percent on a monthly basis in January , showing the second consecutive fall. Economists had expected production to grow by 0.6 percent after falling by a revised 0.4 percent in December . Production of energy decreased by 2.5 percent, and the production of durable consumer goods fell by 0.6 percent . Intermediate goods decreased by 0.1 percent. Partially offset this decline is that the release of capital goods rose by 0.9 percent, while production of consumer non-durable goods increased by 0.4 percent. On an annual basis, industrial production growth accelerated to 2.1 percent from 1.2 percent in December. Predicted that the issue will grow by 1.9 per cent .

Experts point out that despite the continuing problems with economic growth in the eurozone, the European single currency showed steady growth, mainly receiving support from the European Central Bank's decision to leave policy unchanged , continuing softening . The ECB has signaled that inflation is not low enough , and the economy is weak enough to take action. Investors gradually resigned to the fact that further action the ECB will probably need to yield more negative economic news.

The yen rose moderately against the dollar as signs of slowing economic boosted demand for safe-haven assets . Recall that submitted this month , data showed that in February, China's exports fell by the largest value since the beginning of the financial crisis . Index decreased yoy by 18.1 % , while the experts had expected growth of 7.5%. However, the real picture is quite difficult to evaluate because of the rather long New Year celebrations on the lunar calendar . Holidays in China traditionally distort statistics . Meanwhile, imports grew by 10.1% , resulting in a trade deficit peaked at 2 years.

Frank continued to strengthen against the dollar , breaking with a two-day consolidation, and peaking in the last 28 months. Franc firmed the increased risk aversion amid worries about China and the situation between Russia and Ukraine.

Market participants are waiting for tomorrow's data for China . Economists predict that the Chinese industrial production has increased markedly during the first two months of this year , but the rate of this increase will be less than was recorded in December. It is estimated that industrial production increased by 9.5 percent ( yoy ) in January and February, compared with a gain of 9.7 percent in December. Experts also expect that retail sales rose by 13.5 percent per annum for the first two months of this year , slightly less than 13.6 per cent growth in December. Growth of investment in fixed assets, probably slowed to 19.5 per cent per annum, compared with an increase of 19.6 percent in January .

-

17:40

European stock close

European stocks dropped to their lowest level in a month amid stake sales in companies from AP Moeller-Maersk (MAERSKB) A/S to Valeo SA, while Russia and Ukraine continued their standoff over Crimea.

The Stoxx Europe 600 Index declined 1 percent to 328.13 at 4:30 p.m. in London. The gauge has dropped 3 percent from its five-year high on Feb. 25 as Russia’s parliament granted President Vladimir Putin approval to use military force in Ukraine. The Russian-speaking region of Crimea holds a referendum on Sunday on whether to split from Ukraine.

The Group of Seven nations said today that they will not recognize the result of Crimea’s referendum. The U.S., Canada, France, Germany, Italy, the U.K. and Japan said they would take further action if Russia annexs Crimea following the plebiscite. Ukraine says Russia has as many as 19,000 troops on the peninsula. The regional parliament has brought forward to Sunday a planned referendum on whether to leave Ukraine.

The Russian Foreign Ministry said that U.S. aid to the acting government in Kiev would violate American law because the departure of Viktor Yanukovych as Ukraine’s president last month counts as a coup. Ukraine’s interim Prime Minister, Arseniy Yatsenyuk, meets U.S. President Barack Obama and Secretary of State John Kerry in Washington today. Yatsenyuk addresses the United Nations Security Council in New York tomorrow.

A Eurostat report showed that industrial production in the 18-nation euro zone dropped 0.2 percent in January. The average analyst forecast had called for an increase of 0.5 percent. The agency revised the decline in December to 0.4 percent.

National benchmark indexes fell in every western-European market except Luxembourg.

FTSE 100 6,620.9 -64.62 -0.97% CAC 40 4,306.26 -43.46 -1.00% DAX 9,188.69 -119.10 -1.28%

Maersk declined 3.2 percent to 62,850 kroner after the estate of the shipping company’s former chairman sold a 1.4 percent stake. Maersk Mc-Kinney Moller died in April 2012. His estate will use the proceeds of 3.55 billion kroner ($662 million) to pay taxes.

Valeo (FR) lost 2.1 percent to 99.06 euros after Bpifrance Financement SA sold about 1.98 million shares in France’s second-biggest auto-parts maker to institutional investors for 200 million euros ($278 million), according to a statement.

Tod’s dropped 5.1 percent to 94.15 euros after the Italian luxury-goods maker reported net income of 133.8 million euros for 2013. That missed the 138 million-euro average estimate of analysts.

G4S slid 5.3 percent to 232.5 pence. Underlying earnings fell to 14.7 pence a share in 2013 from 15.8 pence in 2012, missing the 16.2 pence average of forecasts.

Gerresheimer AG slid 5.5 percent to 45.49 euros after Goldman Sachs Group Inc. lowered its recommendation on the maker of drug-delivery systems by two grades to sell from buy. The brokerage said the outlook for Gerresheimer’s returns has worsened and the company’s need for capital investment to generate growth will limit its free cash flow.

K+S AG dropped 2.1 percent to 24.52 euros after Europe’s biggest potash supplier proposed cutting its dividend by 82 percent to 25 euro cents a share and using part of the cash to pay for a new plant in Canada. The company, which sank 36 percent last year as potash prices fell, said it plans to return to a payout ratio of 40 percent to 50 percent of earnings.

-

17:00

European stock close: FTSE 100 6,620.9 -64.62 -0.97% CAC 40 4,306.26 -43.46 -1.00% DAX 9,188.69 -119.10 -1.28%

-

15:40

Oil: an overview of the market situation

Oil prices fell markedly today , reaching at this month low (mark WTI), which was associated with the publication of a report on oil reserves in the United States.

Department of Energy data on changes in stocks in the week March 3-9 showed

- Oil reserves rose by 6.18 million barrels to 370.002 million barrels ;

- Gasoline inventories fell by 5.23 million barrels . to 223.766 million barrels . ;

- Distillate stocks fell by 0.533 million barrels . to 113.943 million barrels .

- Refining capacity utilization rate of 86.0 % against 87.4 % a week earlier ;

- Oil terminal in Cushing and decreased by 1.341 million barrels . to 30.791 million barrels .

We also recall that yesterday its inventory report presented Petroleum Institute API: He showed :

- Capacity utilization in the week 86.5% against 86.8%

- Distillate stocks last week -0.839 million barrels

- Gasoline inventories last week -2.15 million barrels

- Oil reserves for the week 2.63 million barrels

Add that control to the U.S. Energy Information (EIA) downgraded several forecasts for growth of oil production in the country for 2014 and 2015 . Consumption of raw materials in the current year that will remain at last year's level, and the next year - will grow by 0.3% , the report said the agency. According to the expectations of EIA, the average production volume of "black gold " in the United States in 2014 is 8.39 million barrels a day compared with the previous forecast of 8.42 million barrels . In 2015, production amounted to 9.16 million barrels instead of the expected 9.19 million barrels previously . At the same time , despite the worsening prognosis indicators remain well above last year's level to 7.45 million barrels per day.

Meanwhile , we note that today the organization of Petroleum Exporting Countries (OPEC ) in the second consecutive month raised its forecast for growth in oil demand . At the same time, the cartel still warns of possible negative factors associated with emerging markets .

In its monthly oil market forecast by the cartel raised its forecast for growth in oil demand this year by 50,000 barrels per day. Last month, OPEC raised its forecast in the same way . Now OPEC suggest that oil demand this year will grow by 1.14 million barrels per day largely due to the increase in consumption in North America , as well as due to improved demand in Europe and Africa . Overall demand for oil on the basis of 2014 is estimated at 91.1 million barrels per day . At the same time, a key factor influencing the increase in world oil demand growth will be in developing countries , said the OPEC.

April futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $98.34 a barrel on the New York Mercantile Exchange (NYMEX).

April futures price for North Sea Brent crude oil mixture fell 7 cents to $ 108.27 a barrel on the London exchange ICE Futures Europe.

-

15:20

Gold: an overview of the market situation

Gold prices rose significantly today , while reaching a six-month high, as investors expect that fears of corporate defaults in China and geopolitical confrontation between Russia , Ukraine and the West have a negative impact on the stock market , and increase the attractiveness of the precious metal as a hedge against the risk of .

Concerns regarding China came to the fore after the data were published on China's exports in February. Index decreased by 18.1 % year on year, which was an unpleasant surprise for investors worldwide. Following these data came the news that a small Chinese company Shanghai Chaori Solar Energy, working in the field of solar energy , reported inability to pay its debts and as a result was declared bankrupt . This corporate default became the first in the history of China, but , according to analysts , not the last . The following defaults can occur in industries that are threatened by overproduction (this steel, nonferrous metals , coal mining ) .

Tensions between Russia and Ukraine has also affected the cost. Leaders of the G7 countries urged Russia not to support the holding of a referendum on the status of Crimea. They emphasize that such a referendum would be illegal and that they do not recognize its results. The statement noted that "if Russia annexed the Crimea, it would be a violation of the UN Charter " and a number of Russian- Ukrainian agreements. Furthermore, such a move would entail " further action " against Russia , leaders warn G7.

Market participants also continue to expect the Fed's policy meeting , which is scheduled for March 18-19 . The central bank is likely to announce a further reduction of bond-buying program to $ 10 billion after a series of U.S. economic data showing that growth was limited by difficult weather conditions .

Meanwhile, add that secured by gold exchange-traded funds received inflow of investments in the amount of $ 500 million in February after 13 months of outflows , according to BlackRock. But demand in the physical market fell after the price increase : the Chinese market gold at $ 3 per ounce cheaper than on the spot market in London , while at the beginning of the year, prices in China were $ 20 higher.

The cost of the April gold futures on the COMEX today rose to $ 1365.80 per ounce.

-

14:30

U.S.: Crude Oil Inventories, March +6.2

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y102.45, Y102.70, Y102.90, Y103.00, Y103.25, Y103.50, Y103.75, Y103.80-85-90, Y104.00

EUR/USD $1.3700, $1.3850, $1.3860-65-70, $1.3900, $1.4000

GBP/USD $1.6500, $1.6520, $1.6545-50, $1.6560-65, $1.6700

EUR/GBP stg0.8200, stg0.8285, stg0.stg0.8290

USD/CHF Chf0.8900

AUD/USD $0.8900, $0.8990, $0.9100, $0.9150

USD/CAD C$1.1000, C$1.1050, C$1.1100, C$1.1120, C$1.1145-50, C$1.1200

-

13:38

U.S. Stocks open: Dow 16,284.75 -66.50 -0.41%, Nasdaq 4,285.26 -21.93 -0.51%, S&P 1,858.64 -8.99 -0.48%

-

13:24

Before the bell: S&P futures -0.32%, Nasdaq futures -0.36%

U.S. stock futures dropped amid concern about slowing growth in China as investors awaited developments on the crisis in Ukraine.

Global markets:

Nikkei 14,830.39 -393.72 -2.59%

Hang Seng 21,901.95 -367.66 -1.65%

Shanghai Composite 1,997.69 -3.47 -0.17%

FTSE 6,615.47 -70.05 -1.05%

CAC 4,287.61 -62.11 -1.43%

DAX 9,181.18 -126.61 -1.36%

Crude oil $98.29 (-1.74%)

Gold $1364.90 (+1.35%).

-

13:15

European session: the euro rose

10:00 Eurozone Industrial production, (MoM) January -0.4% Revised From -0.7% +0.6% -0.2%

10:00 Eurozone Industrial Production (YoY) January +1.2% Revised From +0.5% +1.9% +2.1%

The euro has risen sharply against the U.S. dollar despite weak data on industrial production in the euro area . Official data showed Eurostat, in the euro zone industrial production fell unexpectedly in January , largely due to reduced production of energy.

Industrial output fell 0.2 percent on a monthly basis in January , showing the second consecutive fall. Economists had expected production to grow by 0.6 percent after falling by a revised 0.4 percent in December .

Production of energy decreased by 2.5 percent, and the production of durable consumer goods fell by 0.6 percent . Intermediate goods decreased by 0.1 percent. Partially offset this decline is that the release of capital goods rose by 0.9 percent, while production of consumer non-durable goods increased by 0.4 percent.

On an annual basis, industrial production growth accelerated to 2.1 percent from 1.2 percent in December . Economists forecast that output will grow by 1.9 per cent .

In light of this release analysts ING Bnak NV commented : " The main reason for poor outcome again was to reduce energy production by 2.5% , but intermediate goods and consumer durables also pointed to the decline in production ... While the benchmark is not met expectations , weak energy component probably overshadowed a slight improvement in the overall indicator. However, to strengthen the eurozone recovery process still requires export growth . "

The yen rose against most currencies on concerns about the state of China's economy. This increases the demand for safe-haven assets , which is the yen . In February, China's exports fell by the largest value since the beginning of the financial crisis . Index decreased yoy by 18.1 % , while the experts had expected growth of 7.5%. However, the real picture is quite difficult to evaluate because of the rather long New Year celebrations on the lunar calendar . Holidays in China traditionally distort statistics . Meanwhile, imports grew by 10.1% , resulting in a trade deficit reached highs for 2 years at $ 23 billion

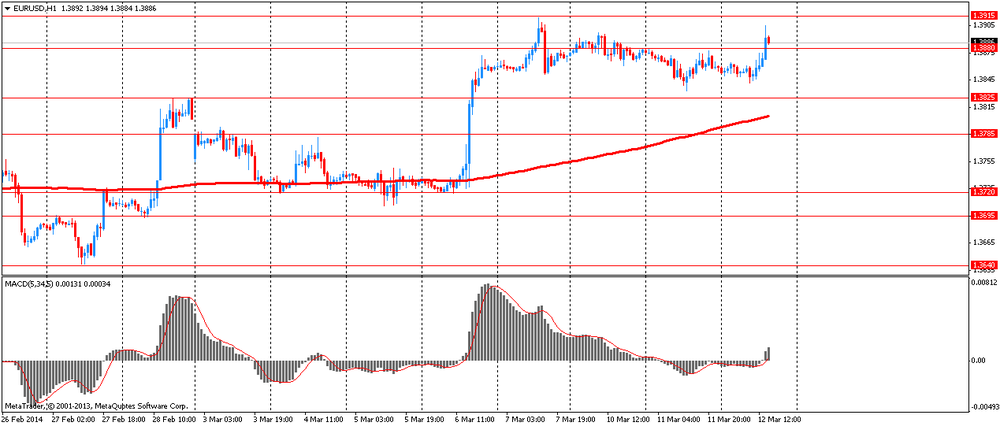

EUR / USD: during the European session, the pair rose to $ 1.3905

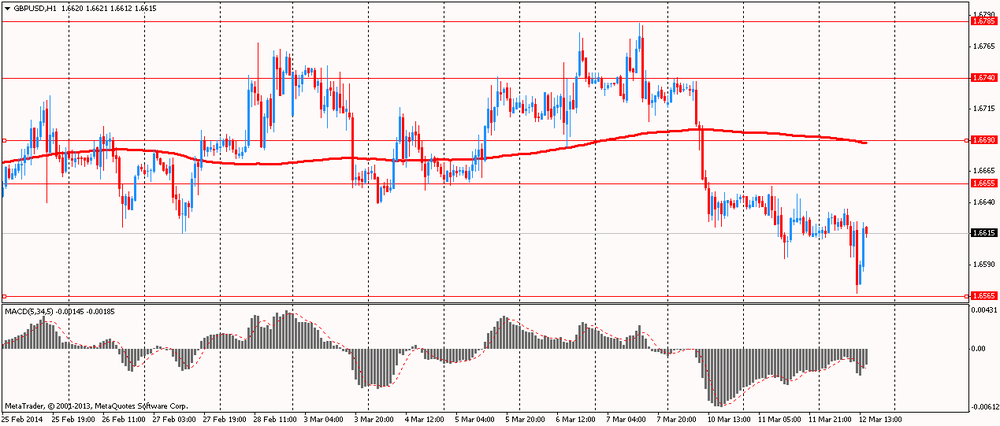

GBP / USD: during the European session, the pair fell to $ 1.6567 and retreated

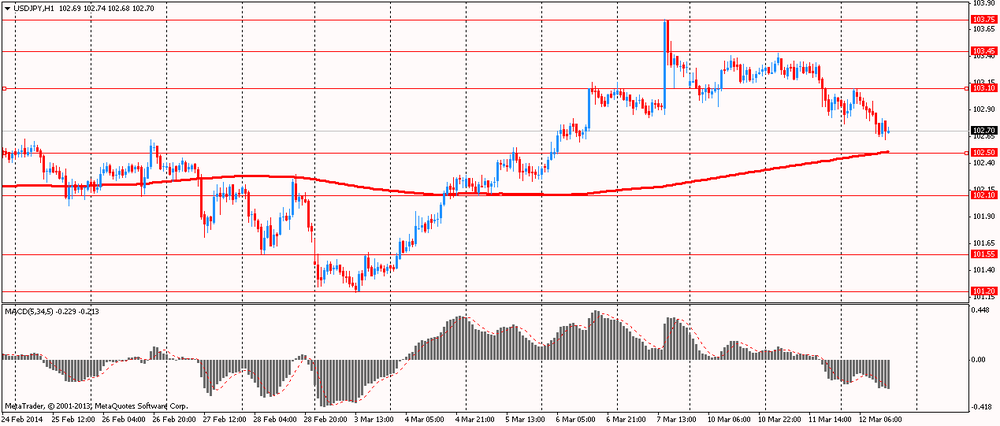

USD / JPY: during the European session, the pair fell to Y102.62

At 17:01 GMT the United States places the 10 - year bonds . At 18:00 GMT the United States will be released monthly budget execution report . At 20:00 GMT we will know the RBNZ decision on the basic interest rate will be a press conference by the RBNZ will be done RBNZ accompanying statement , the protocol will monetary policy RBNZ . At 23:50 GMT , Japan will publish the change in orders for machinery and equipment in January .

-

13:00

Orders

EUR/USD

Offers $1.3950, $1.3920/25, $1.3900-15, $1.3890

Bids $1.3820, $1.3760/50

GBP/USD

Offers $1.6785/800, $1.6745/55, $1.6720/25, $1.6700/10, $1.6680/85, $1.6650/55

Bids $1.6580, $1.6555/50, $1.6500

AUD/USD

Offers $0.9100, $0.9050, $0.9000

Bids $0.8910/00, $0.8850

EUR/JPY

Offers Y144.00, Y143.75/80, Y143.45/50, Y143.00

Bids Y142.20, Y142.00, Y141.50, Y141.00

USD/JPY

Offers Y103.50, Y103.20

Bids Y102.50, Y102.20, Y102.00

EUR/GBP

Offers stg0.8467, stg0.8435/40, stg0.8415/20, stg0.8400/05, stg0.8370/80

Bids stg0.8320

-

11:30

European stocks dropped

European stocks dropped to their lowest level in a month as investors sold shares in companies from AP Moeller-Maersk (MAERSKB) A/S to Valeo SA, while Russia and Ukraine continued their standoff over the region of Crimea. U.S. index futures and Asian shares also fell.

The Stoxx Europe 600 Index declined 0.9 percent to 328.57 at 10:06 a.m. in London. The gauge has dropped 3 percent from its high on Feb. 25 as Russian President Vladimir Putin obtained parliamentary approval to use military force in Ukraine.

Ukraine says Russia has as many as 19,000 Russian troops in the Crimea region. The Crimean parliament has called a referendum on March 16 to decide whether to leave Ukraine and join Russia.

Ukraine’s interim Prime Minister, Arseniy Yatsenyuk, meets U.S. President Barack Obama and Secretary of State John Kerry in Washington today. Yatsenyuk addresses the United Nations Security Council in New York tomorrow. The Russian Foreign Ministry said yesterday that U.S. aid to the acting government in Kiev would violate American law, because the departure of Viktor Yanukovych last month constituted a coup.

A Eurostat report showed that industrial production in the 18-nation euro zone dropped 0.2 percent in January. The average analyst forecast had called for an increase of 0.5 percent. The agency revised the decline in December to 0.4 percent.

Maersk declined 2.6 percent to 63,250 kroner after the estate of the shipping company’s former chairman sold a 1.4 percent stake. Maersk McKinney-Moller died in April 2012. His estate will use the proceeds of 3.55 billion kroner ($659 million) to pay taxes.

Valeo lost 2.1 percent to 99.07 euros after Bpifrance Financement SA sold about 1.98 million shares in France’s second-biggest auto-parts maker to institutional investors for 200 million euros ($277 million), according to a statement.

Tod’s dropped 5.2 percent to 94.05 euros after the Italian luxury-goods maker reported net income of 133.8 million euros for 2013. That missed the 138 million-euro average estimate of analysts surveyed by Bloomberg.

G4S fell 3.8 percent to 236.1 pence. Underlying earnings fell to 14.7 pence a share in 2013 from 15.8 pence in 2012, missing the 16.2 pence average of forecasts compiled by Bloomberg. The world’s biggest provider of security services booked charges of 386 million pounds ($641 million) last year from restructuring and reviews of its contracts, assets and liabilities. The U.K.’s Justice Ministry announced an investigation last May into G4S’s billings under contracts for electronic monitoring that it holds with the department.

FTSE 100 6,616.53 -68.99 -1.03%

CAC 40 4,279.75 -69.97 -1.61%

DAX 9,168.54 -139.25 -1.50%

-

10:00

Eurozone: Industrial production, (MoM), January -0.2% (forecast +0.6%)

-

10:00

Eurozone: Industrial Production (YoY), January +2.1% (forecast +1.9%)

-

09:37

Option expiries for today's 1400GMT cut

USD/JPY Y102.45, Y102.70, Y102.90, Y103.00, Y103.25, Y103.50, Y103.75, Y103.80-85-90, Y104.00

EUR/USD $1.3700, $1.3850, $1.3860-65-70, $1.3900, $1.4000

GBP/USD $1.6500, $1.6520, $1.6545-50, $1.6560-65, $1.6700

EUR/GBP stg0.8200, stg0.8285, stg0.stg0.8290

USD/CHF Chf0.8900

AUD/USD $0.8900, $0.8990, $0.9100, $0.9150

USD/CAD C$1.1000, C$1.1050, C$1.1100, C$1.1120, C$1.1145-50, C$1.1200

-

09:21

Asia Pacific stocks close

Asian stocks fell, with the regional benchmark set for its biggest decline in five weeks, as Japanese equities sank on a stronger yen and mining companies slid amid concern about China’s economic outlook.

Nikkei 225 14,830.39 -393.72 -2.59%

S&P/ASX 200 5,384.2 -29.64 -0.55%

Shanghai Composite 1,997.69 -3.47 -0.17%

Honda Motor Co., a carmaker that gets about 83 percent of sales overseas, dropped 1.9 percent in Tokyo to pace losses among Japanese exporters.

Celltrion Inc. slumped 8.5 percent in Seoul after the drugmaker’s operating profit plunged. Jiangxi Copper Co., China’s biggest producer of the metal, sank 2.6 percent in Hong Kong, on course for a 2 1/2-year low.

Belle International Holdings Ltd., a retailer of women’s shoes that gets almost all its sales from China, plunged 9.9 percent after reporting same-store footwear sales dropped.

-

08:38

FTSE 100 6,645.77 -39.75 -0.59%, CAC 40 4,321.04 -28.68 -0.66%, Xetra DAX 9,258.93 -48.86 -0.52%

-

06:46

European bourses are initially seen trading lower Weds: the FTSE is seen down 0.45%, the DAX down 0.2% and the CAC down 0.3%.

-

06:20

Asian session: The yen held gains

00:30 Australia Home Loans January -1.9% +0.8% 0.0%

05:00 Japan BoJ monthly economic report March

05:00 Japan Consumer Confidence February 40.5 40.3 38.3

The yen held gains from yesterday against most peers after a gauge of Chinese economic surprises dropped to a nine-month low, underlining concern about a slump in the Asian economy that’s sent commodity prices tumbling. China’s exports unexpectedly fell 18.1 percent in February from a year earlier, customs data on March 8 showed, compared with a forecast for an increase of 7.5 percent in a Bloomberg News survey. Imports rose 10.1 percent, leaving a trade deficit of $23 billion. Demand for Japan’s haven assets was also bolstered by the standoff over Ukraine’s Crimean peninsula.

The euro traded near its highest level in almost 2 1/2 years before data today that may show an improving outlook for industrial production. Output in the region gained 0.5 percent in January, rebounding from the previous month’s 0.7 percent drop, according to the median forecast in a Bloomberg survey.

The Aussie weakened after a report showed a decline in consumer confidence, following data indicating a drop in business sentiment yesterday.

New Zealand’s currency held a monthly gain as the central bank is predicted to raise interest rates tomorrow.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3850-65

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6610-35

USD / JPY: on Asian session the pair traded in the range of Y102.80-10

There is plenty on the calendar on both sides of the Atlantic Wednesday, although European data is largely second tier. The European calendar gets underway at 0630GMT, with the release of the French fourth quarter job creations data. Early central bank speakers are on deck from 0800GMT, when ECB Governing Council member Luis Linde delivers a lecture in Madrid. At the same time, ECB Executive Board member Peter Praet will give a speech on communication challenges, in Frankfurt. At 0800GMT, Spanish February final HICP is set for release. The UK Trade data was set for release at 0930GMT, but has been delayed until March 14. ECB Executive Board member Benoit Coeure will give a speech on monetary policy challenges, in Frankfurt at 1000GMT. Euro area data also set for release at 1000GMT includes the January industrial output data and the January OECD leading indicator.

Across the Atlantic, the US calendar gets underway at 1100GMT, when the MBA Mortgage Index for the March 8 week will be published. The IMF holds its regular biweekly press briefing in Washington at 1330GMT. Further US data sees the release of the fourth quarter 2014 services data at 1400GMT and the EIA Crude Oil Stocks for the March 7 week at 1430GMT. Treasury Secretary Jack Lew testifies before the Senate Budget Committee on FY2015 budget from 1430GMT, appearing before the House Budget Committee from 1800GMT. Later, the US will sell 421 billion of 10-year paper.

-

05:02

Japan: Consumer Confidence, February 38.3 (forecast 40.3)

-

00:31

Australia: Home Loans , January 0.0 (forecast +0.8%)

-