Notícias do Mercado

-

23:29

Commodities. Daily history for March 11’2014:

(raw materials / closing price /% change)

Gold $1,346.5 +6.10 +0.46%

ICE Brent Crude Oil $108.40 +0.54 -0.50%

NYMEX Crude Oil $99.52 -1.65 -1.63%

-

23:24

Stocks. Daily history for March 11’2014:

(index / closing price / change items /% change)

Nikkei 15,224.11 +103.97 +0.69%

Hang Seng 22,269.61 +4.68 +0.02%

Shanghai Composite 2,001.16 +2.09 +0.10%

S&P 1,867.63 -9.54 -0.51%

NASDAQ 4,307.19 -27.26 -0.63%

Dow 16,351.25 -67.43 -0.41%

FTSE 6,685.52 -3.93 -0.06%

CAC 4,349.72 -21.12 -0.48%

DAX 9,307.79 +42.29 +0.46%

-

23:19

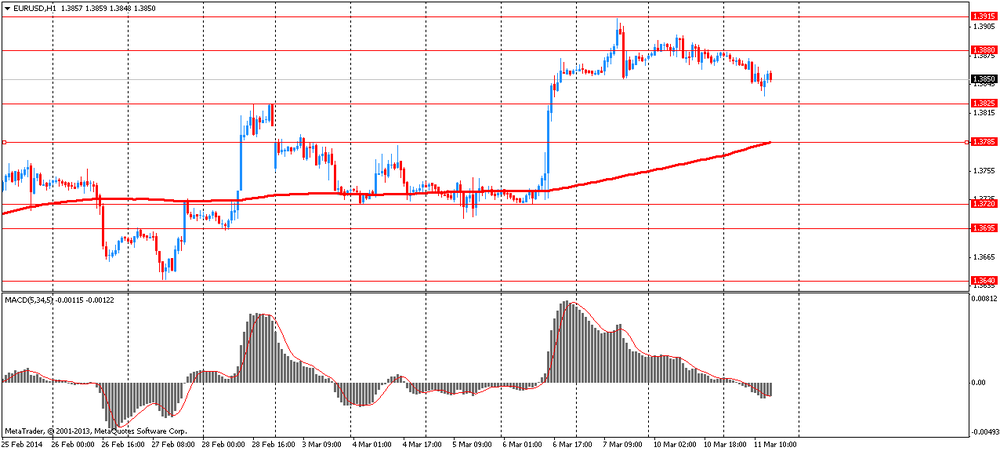

Currencies. Daily history for March 11'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3859 -0,14%GBP/USD $1,6615 -0,17%

USD/CHF Chf0,8778 +0,03%

USD/JPY Y102,83 -0,44%

EUR/JPY Y142,72 -0,42%

GBP/JPY Y171,09 -0,47%

AUD/USD $0,8975 -0,50%

NZD/USD $0,8470 -0,01%

USD/CAD C$1,1104 -0,01%

-

22:59

Schedule for today, Wednesday, March 12’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Home Loans January -1.9% +0.8%

05:00 Japan BoJ monthly economic report March

05:00 Japan Consumer Confidence February 40.5 40.3

09:30 United Kingdom Trade in goods January -7.7 -8.7

10:00 Eurozone Industrial production, (MoM) January -0.7% +0.6%

10:00 Eurozone Industrial Production (YoY) January +0.5% +1.9%

14:30 U.S. Crude Oil Inventories March +1.4

18:00 U.S. Federal budget February -10.4 -223.2

18:00 U.S. Treasury Sec Lew Speaks

20:00 New Zealand RBNZ Interest Rate Decision 2.50% 2.75%

20:00 New Zealand RBNZ Press Conference

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Food Prices Index, m/m February +1.2% -0.2%

21:45 New Zealand Food Prices Index, y/y February +0.9%

23:50 Japan Core Machinery Orders January -15.7% +7.3%

23:50 Japan Core Machinery Orders, y/y January +6.7% +18.8%

-

19:00

Dow -63.45 16,355.23 -0.39% Nasdaq -25.78 4,308.67 -0.59% S&P -9.16 1,868.01 -0.49%

-

18:20

American focus : the yen rose sharply against the U.S. dollar

The dollar traded lower against the euro , but was able to recover most of the previously lost positions . Impact on the dynamics of trade balance data and Germany on wholesale inventories SSCHA .

As it became known , in January German exports grew more than expected , after a decline in December. Exports rose 2.2 percent on a monthly measurement in January , recovering from the 0.9 percent drop in December. Exports are projected to grow had 1.5 percent . In addition , imports expanded by 4.1 percent after falling 1.4 percent a month earlier. Growth rate significantly higher than the increase of 1.4 per cent expected by economists. Due to the marked increase in import trade surplus fell to a seasonally adjusted to 17.2 billion euro in January from 18.3 billion euros in the previous month . In annualized export growth slowed to 2.9 percent from 4.5 percent in December. Similarly , imports increased by 1.5 percent , which is slower than the growth of 2.4 percent in December.

Another report showed that wholesale inventories in the U.S. rose more than expected in January. According to the data , wholesale inventories rose 0.6 percent in January after rising a revised 0.4 percent increase in December. Economists had expected an increase of 0.5 per cent of reserves compared with 0.3 percent growth , which was originally reported in the previous month. On the other hand, the Commerce Department reported : Wholesale sales fell 1.9 percent in January after rising 0.1 percent the previous month.

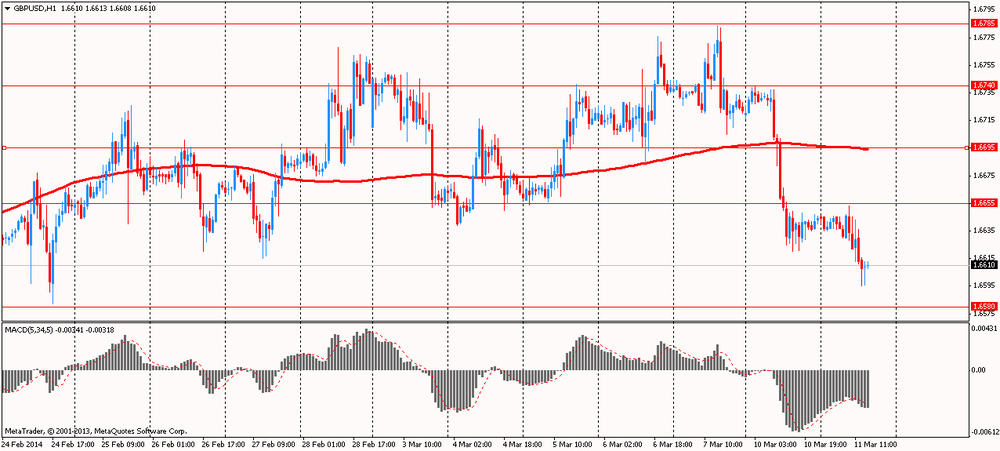

British pound retreated from the values against the dollar, but is still trading lower. The pair continues to lose ground in terms of risk aversion dominating the market earlier this week . Mixed data on industrial production in Britain did not have a pair of support , and it remained in the red zone . Note that the volume of industrial production increased by 0.1 percent compared with December . Issue , according to forecasts, had to expand 0.3 percent after 0.5 percent growth in December. Manufacturing output rose by 0.4 percent, the same as in December and remained above the 0.3 percent growth forecast by economists. The annual increase in industrial output accelerated to 2.9 percent from 1.9 percent ..

The course of trade also influenced words representatives of the Bank of England. Today in the British Parliament held a hearing at which the Bank of England and M. Carney MPC members P. Fisher , D. Miles and M. Weale commented on the February inflation report CB. Recall that last month the Bank has changed its policy of transparency, shifting the emphasis from the target threshold unemployment rate of 7% for a number of other factors that should also serve as guidelines in the decision to raise rates . In particular , we are talking about the spare capacity in the economy, productivity growth and wages. Carney noted that the state of the British economy is improving much faster than in the rest of the world . Carney also said that the Central Bank will start folding QE program only after several rate increases , while it does not require consultation with the Treasury on this issue.

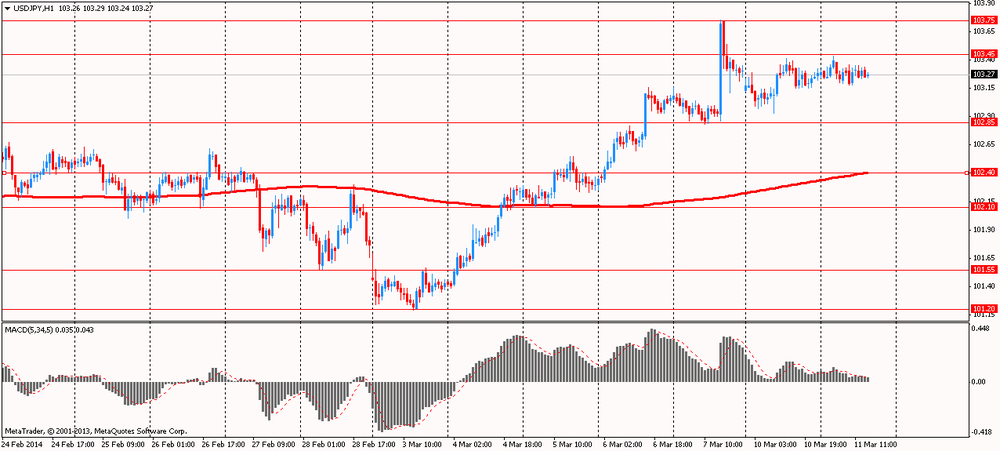

The yen rose sharply against the dollar, while escaping with a narrow range , and reaching high yesterday . Currency appreciation can be explained by the reduced demand for safe-haven assets such as equities and commodities , amid concerns about instability in China's financial system . Besides growth of the yen helped drop in copper prices ( fixed for the third day in a row ) to the lowest level since 2010.

We add that the Japanese currency barely reacted to the decision to leave the Bank of Japan interest rates unchanged at 0.10%. Board members unanimously voted to keep monetary policy unchanged. By the end of next meeting confirmed the intention to maintain the policy of increasing the monetary base in the range of 60-70 trillion yen annually . The Bank of Japan also confirmed buyback of government bonds in the amount of government about 50 trillion yen and corporate bonds at 2.2-3.2 trillion .

-

18:00

European stock close

European stocks were little changed, after swinging between gains and losses, as investors weighed economic data and the growing conflict in Ukraine for their impact on company earnings.

The Stoxx Europe 600 Index added less than 0.1 percent. The equity benchmark has dropped 2.1 percent from a six-year high on Feb. 25 as tensions escalated between Russia and the U.S. over the future of Ukraine.

Benchmark indexes rose in 12 of the 18 markets in western Europe.

FTSE 100 6,678.48 -10.97 -0.16% CAC 40 4,349.55 -21.29 -0.49% DAX 9,297.1 +31.60 +0.34%

Russia showed no signs of yielding in the Crimean standoff as Ukraine bolstered its defenses before its prime minister meets U.S. President Barack Obama tomorrow.

In addition to testing its military’s combat readiness, Ukraine may mobilize 20,000 people to protect borders, Interior Minister Arsen Avakov said. Russia has vowed to defend the ethnic Russian majority in Crimea after an uprising unseated Ukraine’s Moscow-backed leader. It rejects the legitimacy of the new cabinet in Kiev.

African Barrick Gold tumbled 20 percent to 247.2 pence, its biggest retreat since Jan. 8, 2013. Toronto-based Barrick Gold Corp., which held 74 percent of African Barrick, sold 41 million shares for 275 pence each.

Galenica dropped 4.1 percent to 891.5 Swiss francs. The drug retailer said it expects 2014 profit to be at least at the same level as last year. Kepler Cheuvreux SA said the forecast was below its estimate for earnings growth of 5 percent.

Hannover Re declined 1.1 percent to 60.04 euros. The reinsurer said earnings before interest and taxes dropped to 243.3 million euros ($337 million) in the final three months of 2013 because of weakness in life and health reinsurance. Bankhaus Lampe KG said Hannover Re’s operating performance missed analysts’ estimates.

Geberit AG gained 3.2 percent to 287.20 francs. The maker of bathroom fittings and plumbing products said Christian Buhl will take over as CEO from Albert M. Baehny at the beginning of 2015. The company also said net income increased to 435.8 million francs in 2013, or 19 percent of sales. Profitability on that measure was the highest since the company first sold shares to the public in 1999, according to a statement.

UniCredit SpA jumped 6.4 percent to 6.43 euros, the biggest gain since September 2012. The bank, which posted results today, said it will cut jobs and sell assets as part of a five-year plan to strengthen its finances. The move will comfort investors concerned about asset quality, Mediobanca S.p.A. said after the announcement.

Close Brothers Group Plc (CBG) rose 2.4 percent to 1,474 pence. The British financial-services company founded in 1878 increased its interim dividend to 16.5 pence, more that the 16 pence forecast.

-

17:00

European stock close: FTSE 100 6,678.48 -10.97 -0.16% CAC 40 4,349.55 -21.29 -0.49% DAX 9,297.1 +31.60 +0.34%

-

16:00

Oil: an overview of the market situation

Prices for WTI crude oil continued its decline yesterday on speculation that a government report will show an increase in U.S. wholesale inventories of oil up last week. As the price of Brent Brent, they rose moderately .

Analysts predict that crude oil inventories rose by 1.85 million barrels. Gasoline stocks are projected down 2 million barrels. Stocks of distillates , including heating oil and diesel, are expected to have fallen by 450,000 barrels. If the evidence will justify the expectations , then the prices will continue to rise .

While providing support to oil quotations absence of an agreement on the Iranian atom. Last Sunday , the head of EU diplomacy , Catherine Ashton said that to reach a final agreement will be very difficult . Another round of talks "six" and Iran 's nuclear program will be held March 17 in Vienna. From the words of Ashton became clear that a favorable outcome should not hope . Also, it is still possible sanctions against Russia by the EU and the U.S. that support oil prices .

The course of trade is also affected by the situation in Libya . Group of armed men who seized the port of Es Sidr in the east of the country , said that the beginning of their own oil exports . The first batch of oil tanker was sent to North Korea.

An equally important factor is the concern that the escalation of tensions between Ukraine and Russia , the world's largest energy exporter , may disrupt supply . Earlier today, Acting Defense Minister Igor Tenyukh said that the armed forces are given in full readiness and earnings ranges for military exercises .

Meanwhile, adding that concerns about demand growth in the world's two largest oil consumer countries , the U.S. and China , keep the prices under pressure. Recall that the data published at the weekend in China, showed new signs of a slowdown in economic growth in the country . Exports from China in February fell by 18.1% in annual terms - up to 114.1 billion and imports increased by 10.1 % - to 137.1 billion dollars.

Traders also expect a monthly report on demand from OPEC , which will be presented tomorrow and Friday's report from the International Energy Agency.

April futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 100.62 a barrel on the New York Mercantile Exchange (NYMEX).

April futures price for North Sea Brent crude oil mixture rose 40 cents to $ 108.26 a barrel on the London exchange ICE Futures Europe.

-

15:40

Gold: an overview of the market situation

Gold prices rose today, as concerns over slowing growth in China and concern about the crisis in Ukraine undermined risk appetite . Tensions over Ukraine continues to put diplomacy " a dead end" , and the government of the European Union stated that it considered the possibility of sanctions against Russia if it fails to respond positively to the initiative to "calm" the crisis.

Ukraine said it will use the power of the new National Guard in response to Russia's attempts to annex the Crimea, on the next day after Russian troops opened fire when capturing Ukrainian military base.

"The situation in Ukraine in itself led to some purchases of safe havens , and also have a big impact on the stock markets , which in turn caused the movement of funds into gold" , experts say. "If the geopolitical situation worsens, we are likely to see increased risk of trading in the stock markets and the increasing appeal of safer assets such as gold ." Recall that in times of economic and geopolitical uncertainty gold is seen as an alternative investment assets .

Traders expect that gold prices will remain in the range between $ 1330 and $ 1350 on the eve of the meeting of Fed policy , which is scheduled for March 18-19 . The central bank is likely to announce a further reduction of the asset purchase program by 10 billion dollars. We also add that weak Chinese export data for February caused many investors to choose as a safe-haven gold, not stocks .

In a sign that confidence in the precious metal can be revived against the backdrop of global uncertainties , the largest gold exchange-traded fund in the world SPDR Gold Trust said yesterday that the largest influx was seen in the past month - inventories increased by 7.50 tons , amounting to 812 , 70 thousand tons.

The cost of the April gold futures on the COMEX today rose to $ 1346.90 per ounce.

-

15:00

United Kingdom: NIESR GDP Estimate, February +0.8%

-

14:01

U.S.: JOLTs Job Openings, January 3970 (forecast 4030)

-

14:00

U.S.: Wholesale Inventories, January +0.6% (forecast +0.5%)

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y102.25/30, Y102.80/90, Y103.00, Y103.30, Y103.50, Y104.00

EUR/USD $1.3600, $1.3625, $1.3650, $1.3670/80, $1.3700, $1.3770, $1.3800

AUD/USD $0.9070, $0.9075, $0.9200

EUR/GBP stg0.8200, stg0.8300, stg0.8415

USD/CAD Cad1.1000, Cad1.1025, Cad1.1055, Cad1.1120, Cad1.1195, Cad1.1200

GBP/USD $1.6550, $1.6600, $1.6750, $1.6800, $1.6850

USD/CHF Chf0.8780, Chf0.8950

-

13:35

U.S. Stocks open: Dow 16,441.38 +22.70 +0.14%, Nasdaq 4,341.21 +6.76 +0.16%, S&P 1,878.65 +1.48 +0.08%

-

13:19

Before the bell: S&P futures +0.05%, Nasdaq futures +0.16%

U.S. stock futures were little changed as confidence in the strength of the economy offset concern over the Ukraine crisis.

Global markets:

Nikkei 15,224.11 +103.97 +0.69%

Hang Seng 22,269.61 +4.68 +0.02%

Shanghai Composite 2,001.16 +2.09 +0.10%

FTSE 6,684.42 -5.03 -0.08%

CAC 4,356.69 -14.15 -0.32%

DAX 9,303.57 +38.07 +0.41%

Crude oil $100.84 (-0.28%)

Gold $1350.40 (+0.66%).

-

13:15

European session: the euro fell

07:00 Germany Current Account January 21.1 Revised From 23.5 13.0 16.2

07:00 Germany Trade Balance January 18.3 Revised From 18.5 19.3 17.2

07:30 Japan BOJ Press Conference

08:00 China New Loans February 1320

09:30 United Kingdom Industrial Production (MoM) January +0.5% Revised From +0.4% +0.3% +0.1%

09:30 United Kingdom Industrial Production (YoY) January +1.9% Revised From +1.8% +3.0% +2.9%

09:30 United Kingdom Manufacturing Production (MoM) January +0.4% Revised From +0.3% +0.3% +0.4%

09:30 United Kingdom Manufacturing Production (YoY) January +1.4% Revised From +1.5% +3.3% +3.3%

09:30 United Kingdom Inflation Report Hearings Quarter IV

10:00 Eurozone ECOFIN Meetings

Euro fell against the U.S. dollar on the background data on the trade balance of Germany. In January, German exports grew more than expected , after a decline in December showed Tuesday, official data agency Destatis.Eksport rose 2.2 percent on a monthly measurement in January , rebounding from the 0.9 percent drop in December. Exports are projected to grow had 1.5 percent . In addition , imports expanded by 4.1 percent after falling 1.4 percent a month earlier. Growth rate significantly higher than the increase of 1.4 per cent expected by economists.

Due to the marked increase in import trade surplus fell to a seasonally adjusted to 17.2 billion euro in January from 18.3 billion euros in the previous month . In annualized export growth slowed to 2.9 percent from 4.5 percent in December. Similarly , imports increased by 1.5 percent , which is slower than the growth of 2.4 percent in December.

On an unadjusted basis the current account surplus was 16.2 billion euros in January, compared with 10.6 billion euro surplus , which saw in the corresponding period last year.

The British pound was down against the U.S. dollar on a background of mixed data on industrial production . In the UK, industrial production growth slowed in January, more than expected , while growth in the manufacturing industry remained stable compared to December showed Tuesday, official data Office for National Statistics .

The volume of industrial production increased by 0.1 percent compared with December . Issue , according to forecasts, had to expand 0.3 percent after 0.5 percent growth in December. Manufacturing output rose by 0.4 percent, the same as in December and remained above the 0.3 percent growth forecast by economists.

The annual increase in industrial output accelerated to 2.9 percent from 1.9 percent. At the same time , growth in the manufacturing industry increased more than doubled to 3.3 percent from 1.4 percent.

Today in the British Parliament held a hearing at which the Bank of England and M. Carney MPC members P. Fisher , D. Miles and M. Weale commented on the February inflation report CB. Recall that last month the Bank has changed its policy of transparency, shifting the emphasis from the target threshold unemployment rate of 7% for a number of other factors that should also serve as guidelines in the decision to raise rates . In particular , we are talking about the spare capacity in the economy, productivity growth and wages.

Carney suggested today that the amount of spare capacity in the economy should be a little more than 1.5% of GDP , while Wil named a figure of less than 1 %. Carney noted that the state of the British economy is improving much faster than in the rest of the world . Over the past few months increased inflation expectations , he said , and suggested that in the next three years, the Bank may raise rates gradually to reach 3.5 %. Carney said that the Central Bank will start folding QE program only after several rate increases , while it does not require consultation with the Treasury on this issue.

EUR / USD: during the European session, the pair fell to $ 1.3833

GBP / USD: during the European session, the pair fell to $ 1.6595

USD / JPY: during the European session, the pair traded in the range Y103.18 - Y103.36

At 14:00 GMT the United States will vacancy rates and labor turnover from the Bureau of Labor Statistics in January . At 15:00 GMT Britain will publish data on the change in GDP from NIESR February . At 20:30 GMT the United States will change in the volume of crude oil , according to the API. At 23:30 GMT Australia will release the consumer confidence index from Westpac in March . At 23:50 GMT Japan will BSI index of business conditions for large manufacturers , business conditions index (BSI) for large enterprises in all sectors for the 1st quarter , the index of activity in the services sector in January .

-

13:00

Orders

EUR/USD

Offers $1.3950, $1.3920/25, $1.3900-15, $1.3890

Bids $1.3835/25, $1.3800, $1.3770, $1.3760/50, $1.3710/00, $1.3694

GBP/USD

Offers $1.6785/800, $1.6745/55, $1.6720/25, $1.6700/10, $1.6680/85, $1.6655

Bids $1.6585/80, $1.6555/50, $1.6450

AUD/USD

Offers $0.9150, $0.9100

Bids $0.9005/00, $0.8950, $0.8910/00

EUR/JPY

Offers Y144.50, Y144.00, Y143.75/80, Y143.45/50

Bids Y142.50, Y142.20, Y142.00

USD/JPY

Offers Y104.00, Y103.50

Bids Y103.00, Y102.50, Y102.20

EUR/GBP

Offers stg0.8370/80, stg0.8350/55

Bids stg0.8320, stg0.8280/75, stg0.8190-80

-

11:30

European stocks were little changed

European stocks were little changed as investors weighed economic data and the growing conflict in Ukraine for their impact on company earnings. U.S. index futures were also little changed, while Asian shares rose.

The Stoxx Europe 600 Index slipped less than 0.1 percent to 331.27 at 11:06 a.m. in London. The equity benchmark has dropped 2.1 percent from a six-year high on Feb. 25 as tensions escalated between Russia and the U.S. over the future of Ukraine. Futures on the Standard & Poor’s 500 Index lost less than 0.1 percent today, while the MSCI Asia Pacific Index added 0.3 percent.

Data today showed German exports jumped 2.2 percent in January, more than the 1.5 percent increase projected by economists in a Bloomberg survey. That was the biggest month-on-month growth since May 2012. Imports jumped 4.1 percent in the period, also exceeding estimates.

African Barrick Gold tumbled 15 percent to 260.8 pence, its biggest retreat since Jan. 8, 2013. Toronto-based Barrick Gold Corp., which held 74 percent of African Barrick, sold 41 million shares for 275 pence each.

Geberit AG gained 2.5 percent to 285.40 francs. The maker of bathroom fittings and plumbing products said Christian Buhl will take over as CEO from Albert M. Baehny at the beginning of 2015. Baehny will remain chairman. The company also said net income increased to 435.8 million francs in 2013, or 19 percent of sales. Profitability on that measure was the highest since the company first sold shares to the public in 1999, according to a statement.

Close Brothers Group Plc rose 2.7 percent to 1,479 pence. The British financial-services company founded in 1878 increased its interim dividend to 16.5 pence, more that the 16 pence forecast calculated by Bloomberg.

FTSE 100 6,668.87 -20.58 -0.31%

CAC 40 4,353.47 -17.37 -0.40%

DAX 9,286.28 +20.78 +0.22%

-

10:00

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y102.25/30, Y102.80/90, Y103.00, Y103.30, Y103.50, Y104.00

EUR/USD $1.3600, $1.3625, $1.3650, $1.3670/80, $1.3700, $1.3770, $1.3800

AUD/USD $0.9070, $0.9075, $0.9200

EUR/GBP stg0.8200, stg0.8300, stg0.8415

USD/CAD Cad1.1000, Cad1.1025, Cad1.1055, Cad1.1120, Cad1.1195, Cad1.1200

GBP/USD $1.6550, $1.6600, $1.6750, $1.6800, $1.6850

USD/CHF Chf0.8780, Chf0.8950

-

09:47

Asia Pacific stocks close

Asian stocks rose, with the regional benchmark index rebounding after yesterday dropping the most in two weeks, after the Bank of Japan maintained record monetary easing.

Nikkei 225 15,224.11 +103.97 +0.69%

S&P/ASX 200 5,413.84 +2.32 +0.04%

Shanghai Composite 2,001.16 +2.09 +0.10%

Sihuan Pharmaceutical Holdings Group Ltd. climbed 4.2 percent in Hong Kong after the drugmaker reported increased full-year earnings and proposed a bonus share issue.

Vanguard International Semiconductor Corp. jumped 6.9 percent in Taipei after sales increased last month.

Lynas Corp., which operates one of the world’s largest rare-earth processing plants, tumbled 8.5 percent in Sydney after projecting a wider first-half loss and saying it needs additional funding.

-

09:31

United Kingdom: Manufacturing Production (YoY), January +3.3% (forecast +3.3%)

-

09:30

United Kingdom: Industrial Production (MoM), January +0.1% (forecast +0.3%)

-

09:30

United Kingdom: Industrial Production (YoY), January +2.9% (forecast +3.0%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , January +0.4% (forecast +0.3%)

-

08:57

FTSE 100 6,713.6 +24.15 +0.36%, CAC 40 4,385.98 +15.14 +0.35%, Xetra DAX 9,307.65 +42.15 +0.45%

-

07:00

Germany: Trade Balance, January 17.2 (forecast 19.3)

-

07:00

Germany: Current Account , January 16.2 (forecast 13.0)

-

06:43

European bourses are initially seen trading modestly higher Tuesday: the FTSE and DAX up 0.2%, with the CAC up 0.3%.

-

06:23

Asian session: The yen climbed

05:00 Japan Eco Watchers Survey: Current February 54.7 54.3 53.0

05:00 Japan Eco Watchers Survey: Outlook February 49.0 40.0

A gauge of expected future market swings was near the lowest in 15 months as traders assess the rising tension between Ukraine and Russia.

The Swiss franc was near the strongest level in more than two years as Ukraine began military drills while Russian forces tightened their hold on the Crimean peninsula. Ukraine’s armed forces are testing the combat-readiness of troops, the Defense Ministry said today on its website, reiterating the government’s desire for a peaceful end to the standoff in the former Soviet republic’s eastern provinces.

The yen was little changed after the Bank of Japan reiterated at the end of a two-day policy meeting that it will continue its unprecedented monetary stimulus to stoke inflation. The BOJ kept a pledge to expand the monetary base at a pace of 60 trillion to 70 trillion yen ($677 billion) per year, the central bank said in a statement in Tokyo today, in line with all but one of 34 forecasts in a Bloomberg News poll. The bank lowered its view of exports and lifted its assessments of industrial output and investment.

Australia’s dollar dropped against most major peers after China, the nation’s biggest trade partner, said March 8 exports slid. China’s exports unexpectedly fell 18.1 percent in February from a year earlier, customs data showed March 8, compared with a forecast for an increase of 7.5 percent in a Bloomberg News survey. Imports rose 10.1 percent, leaving a trade deficit of $23 billion, the report showed.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3860-80

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6635-45

USD / JPY: on Asian session the pair traded in the range of Y103.20-45

There is a full calendar on both sides of the Atlantic Tuesday, although data is largely second tier. There is also a meeting of the Ecofin Group, with EU finance ministers athering in Brussels for a breakfast meeting. The calendar gets underway at 0700GMT, with the release of the German January trade balance and the fourth quarter labour cost data. Overall exports are seen higher by 1.5% on month after a fall of 1% in December. At 0900GMT, the Italian fourth quarter GDP data will cross the wires, seen up 0.1% on quarter, down 0.8% on year.

-

06:03

Japan: Prelim Machine Tool Orders, y/y , February +26.0%

-

03:05

Japan: BoJ Interest Rate Decision, 0.10% (forecast 0.10%)

-

00:34

Australia: National Australia Bank's Business Confidence, February 7

-

00:01

United Kingdom: BRC Retail Sales Monitor y/y, February -1.0% (forecast +1.6%)

-