Notícias do Mercado

-

23:51

US Commerce Secretary Lutnick says Trump has a plan to balance the budget

US Commerce Secretary Howard Lutnick said late Thursday that the administration will try to balance the budget during the President Donald Trump term.

Key quotes

During President Trump's term, we will try to balance the budget.

We want it to take three years to balance the budget.

When President balances the budget, Trump has suggested he wants to waive taxes for those earning under $150,000. It's aspirational.

No taxes on tips, overtime, or Social Security.Market reaction

At the time of press, the US Dollar Index was down 0.01% on the day at 103.83.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

-

23:45

EUR/USD eases as Trump turns tariff threats to Europe

- EUR/USD fell back 0.3% on Thursday as Europe gets added to Trump’s tariff list.

- Trump plans more tariffs on targeted EU goods after Europe retaliated against steel tariffs.

- US consumer sentiment and inflation expectations dominate Friday’s data docket.

EUR/USD trimmed a bit more of its recent gains on Thursday, falling back around one-third of one percent as Europe gears up for a protracted back-and-forth on trade tariffs with US President Donald Trump. The Trump administration kicked off a global 25% import tax on all steel and aluminum that crosses the border into the US, sparking a wave of retaliatory tariffs from most of the US’s (formerly) closest trading partners. The EU has announced a set of tariffs on key, targeted US products, specifically Harley Davidson motorcycles and US distilled whisky, prompting an irate outburst from President Trump on Thursday.

US President Trump wants to tariff EU wine, reiterates interest in Greenland

Donald Trump threatened to impose a steep 200% tariff on all European wines and champagne via his social media account during Thursday’s early US session, sparking widespread market concerns that the Trump administration is barreling towards a disastrous outcome to its ham-handed trade policies that don’t entirely seem to serve a function or purpose. Now, the US markets pivot to Friday’s consumer confidence and inflation expectations readings, which come at a time when the average US consumer is growing increasingly concerned about the rhetoric leaking out of both the White House and Donald Trump’s social media accounts.

German Harmonized Index of Consumer Prices (HICP) inflation figures from February are due early Friday, however the final, non-preliminary figure is entirely unlikely to turn many heads. Coming up on Friday, the US data docket will close out a relatively packed week with the University of Michigan (UoM) Consumer Sentiment Index as well as UoM’s Consumer Inflation Expectations. Both figures are likely to see some negative influence from President Trump’s tariff tirades, and median market forecasts see the sentiment index declining to 63.1 for March, down from February’s 64.7. At the last print, the average consumer respondent expected 5-year inflation to clock in around 3.5%, implying inflation expectations remain entrenched well above the Federal Reserve’s (Fed) 2% target.

EUR/USD price forecast

EUR/USD looks like its recent bull run is now over, confirming a technical retreat back below 1.0900 just as quickly as it jumped the major handle in the first place. However, Fiber has climbed nearly 7.6% bottom-to-top from the last major swing low near 1.0175, with bulls easily snapping the 200-day Exponential Moving Average (EMA) in the process.

EUR/USD is now running aground of technical resistance from the 1.0900 handle, a technical region that flummoxed Euro bulls the last time around back in October and November of last year.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

-

23:22

USD/JPY Price forecast: Struggles at 148.00, drops on risk aversion

- USD/JPY starts Friday steady near 147.90 following Thursday’s 0.30% drop, pressured by unresolved US trade tensions.

- Pair fails to capitalize on recent bullish ‘tweezers bottom’ pattern near YTD lows, remaining vulnerable below key Tenkan-sen resistance.

- Break below immediate support at 146.54 could spark deeper selling; reclaiming 148.00 may pave way toward 149.79 resistance.

The USD/JPY begins Frida’s Asian session on a higher note, following Thursday’s losses of 0.305, that pushed the exchange rate to close at 147.81 daily. At the time of writing, the pair trades at 147.91, virtually unchanged, as traders continued to digest US President Donald Trump's tariff rhetoric.

USD/JPY Price Forecast: Technical outlook

Even though the USD/JPY formed a ‘tweezers bottom’ two candle chart pattern near the year-to-date (YTD) low of 146.54, two days ago, the pair failed to decisively clear the Tenkan-sen at 148.97, which opened the door for a retracement.

Consequently, the USD/JPY fell beneath 148.00 and continued to drop, aligned with the overall market. If the pair falls below the latter, the next support would be the March 11 swing low of 146.54.

Conversely, if USD/JPY climbs above 148.00 a rally towards testing the Senkou Span A at 149.79 is on the cards.

USDJPY Price Chart: Technical outlook

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

-

23:20

Canada Finance Minister: We agree to maintain dialogue

Canada's Finance Minister Dominic LeBlanc said on Friday tariffs are harmful to both the United States and Canada, adding that moving forward with dialogue is crucial.

Key quotes

It was a long discussion.

Tariffs are harmful on both sides of the border.

There is a chance for a reset here.

There is a mutual understanding that there is an impact on both sides of the border.

Moving forward with dialogue is crucial.

The US side understands.

We talked about making North America more competitive.

We talked about a reset with a new Prime Minister tomorrow.

We changed the channel in my view in looking at opportunities and competition in North America.

Market reaction

At the time of writing, the USD/CAD pair is trading 0.09% lower on the day to trade at 1.4428.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

-

23:02

USD/CAD holds below 1.4450 amid trade uncertainty

- USD/CAD softens to around 1.4430 in Thursday’s late American session.

- US annual PPI inflation declined to 3.2% in February, softer than expected.

- Canada's Finance Minister said the country agreed to maintain dialogue.

The USD/CAD pair weakens to near 1.4430 during the late American session on Thursday, pressured by lower US yields. However, lower crude oil prices might weigh on the commodity-linked Loonie and help limit the pair’s losses. The preliminary Michigan Consumer Sentiment will take center stage on Friday.

The concerns about slowing growth in the US economy from US President Donald Trump's administration's trade policies could exert some selling pressure on the Greenback. Data released by the US Bureau of Labor Statistics on Thursday showed that the US Producer Price Index (PPI) rose 3.2% on a yearly basis in February, compared to the 3.7% increase recorded in January. This figure came in below the market expectation of 3.3%.

Meanwhile, the annual core PPI rose 3.4% in February versus 3.8% in January. On a monthly basis, the PPI was unchanged, while the core PPI declined by 0.1%.Canada's Finance Minister Dominic LeBlanc said on Friday tariffs are harmful to both the United States and Canada, adding that moving forward with dialogue is crucial. Traders will closely monitor the developments surrounding Trump’s tariff policy. Any signs of an escalating trade war could undermine the Canadian Dollar (CAD) against the USD.

On Wednesday, the Bank of Canada (BoC) cut its benchmark interest rate by 25 basis points (bps), bringing it down to 2.75%. This was the BoC’s seventh consecutive interest rate cut. A move that comes just hours after US President Donald Trump issued new steel and aluminum tariffs against Canada.

BoC governor Tiff Macklem said during the press conference that the central bank would "proceed carefully with any further changes," needing to assess both the upward pressures on inflation from higher costs in a trade war and the downward pressures from weaker demand.

Meanwhile, a decline in crude oil prices on the back of steady tariff concerns could weigh on the commodity-linked Canadian Dollar (CAD). It’s worth noting that Canada is the largest oil exporter to the United States (US), and lower crude oil prices tend to have a negative impact on the CAD value.Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

-

22:50

GBP/USD holds steady as markets look elsewhere

- GBP/USD continues to churn near the 1.3000 handle.

- UK data remains strictly low-tier this week as markets focus on geopolitics.

- US inflation data teased lower price pressures, but trade war rhetorics rattles sentiment.

GBP/USD churned chart paper for a second day in a row, holding steady just south of the 1.3000 handle as Cable traders take a breather and watch market headlines broadly sail past the Pound Sterling. US Producer Price Index (PPI) business-level inflation eased faster than expected in February. However, markets never got the chance to experience any joy from the easing inflation figures as US President Donald Trump continues his campaign to spark a global trade war between the US and everybody else. Despite the ongoing geopolitical headlines, Cable markets remain relatively untouched by tariff talk as the UK skates by unnoticed.

US President Trump wants to tariff EU wine, reiterates interest in Greenland

Coming up on Friday, the US data docket will close out a relatively packed week with the University of Michigan (UoM) Consumer Sentiment Index as well as UoM’s Consumer Inflation Expectations. Both figures are likely to see some negative influence from President Trump’s tariff tirades, and median market forecasts see the sentiment index declining to 63.1 for March, down from February’s 64.7. At the last print, the average consumer respondent expected 5-year inflation to clock in around 3.5%, implying inflation expectations remain entrenched well above the Federal Reserve’s (Fed) 2% target.

UK Gross Domestic Product (GDP) growth figures are slated for release during the early Friday market session. However, the monthly figure is unlikely to spark much volatility, as it's backdated to January and any shifts in the UK’s growth model are likely already priced in.

GBP/USD price forecast

The GBP/USD pair is experiencing its second consecutive week of gains, approaching new 18-week highs close to 1.2950. The significant 1.3000 resistance level may limit any additional upward movement, as this key level was previously a notable consolidation point in October and November of 2024.

Currently, demand is strong among buyers, but technical indicators have remained in overbought territory since January, suggesting a potential reversal could happen soon.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

-

21:34

AUD/JPY Price Analysis: Bears take control but pair holds above 92.00

- AUD/JPY was seen trading around the 92.80 zone ahead of the Asian session, pulling back after two consecutive days of gains.

- Despite the decline, the pair remains above the 92.00 threshold, with technical indicators still in negative territory.

- Sideways trading could persist above 92.00 as the market awaits fresh momentum, with resistance at 93.50 and support at 92.00.

AUD/JPY fell on Thursday ahead of the Asian session, reversing some of the gains from earlier in the week. The pair dropped toward the 92.80 area, reflecting renewed bearish momentum after a brief period of buying pressure. While sellers regained control, the pair remains above the key 92.00 threshold, suggesting that a period of consolidation might be ahead.

Looking at technical indicators, the Relative Strength Index (RSI) is declining sharply within the negative zone, indicating weakening bullish strength. Meanwhile, the Moving Average Convergence Divergence (MACD) is printing decreasing red bars, reinforcing the view that downside pressure persists. However, the pair still trades within a broader range, limiting immediate downside risks.

For now, support remains firm at 92.00, a level that has provided a strong floor in recent sessions. A break below could accelerate bearish momentum toward 91.50. On the upside, resistance is seen around 93.50, where sellers have consistently stepped in. If AUD/JPY remains above 92.00, the pair could trade sideways in the near term before finding a clearer directional bias.

AUD/JPY daily chart

-

21:30

New Zealand Business NZ PMI increased to 53.9 in February from previous 51.4

-

21:03

AUD/USD slumps on US Dollar’s strong recovery despite soft PPI data

- The AUD/USD tumbles on Thursday as the US Dollar strengthens amid renewed trade policy concerns.

- Trump’s tariff threats fuel risk aversion, overshadowing softer-than-expected US inflation data.

- US PPI data signals weaker inflation, but investors remain focused on escalating trade tensions.

- Technical indicators suggest further downside with AUD/USD losing key support levels.

The AUD/USD tumbles to near 0.6280 as the US Dollar outperforms on the Trump administration’s tariff agenda. The pair faced sharp selling pressure on Thursday as renewed fears of a global economic slowdown triggered a flight to the US Dollar.

Investors largely ignored softer US CPI and PPI data for February, instead focusing on US President Donald Trump’s aggressive trade stance. His renewed commitment to "America First" policies stoked fears of retaliatory measures, weighing on risk-sensitive assets like the Australian Dollar.

Daily digest market movers: Australian Dollar under pressure as trade fears escalate

- The US Dollar Index (DXY) rebounded sharply, reaching 104.00 after recovering from a four-month low of 103.20. The Greenback gained as traders turned to safe-haven assets amid heightened concerns over trade policy.

- Trump reiterated his protectionist stance, stating that the US does not have “Free Trade” but “Stupid Trade” in a Truth Social post. His comments reinforced expectations of further tariffs on key trading partners.

- New tariffs on European imports further rattled markets. Trump confirmed retaliatory duties on 26 billion Euros worth of Eurozone goods after the EU imposed countermeasures against the 25% universal import duty the US placed on steel and aluminum.

- US inflation data was softer than expected but failed to weaken the US Dollar. The Producer Price Index (PPI) fell to 0.0% in February, well below the 0.3% estimate, while core PPI contracted by 0.1%. Despite weak inflation figures, markets focused on rising geopolitical and trade risks.

- The Australian Dollar struggled amid deteriorating risk sentiment. The currency, which closely reflects Chinese economic performance, faced headwinds as the US maintained 20% tariffs on Chinese imports, raising fears of a further slowdown in Australia’s key trading partner.

- Markets are also monitoring diplomatic developments as US officials visit Russia to discuss a potential ceasefire agreement with Ukraine. However, geopolitical tensions remain elevated, adding further support to the US Dollar.

- Looking ahead, traders will closely watch Australia’s labor market report, due March 20, for insights into the Reserve Bank of Australia’s (RBA) potential policy direction.

AUD/USD Technical Analysis: Downside pressure intensifies as key support breaks

The AUD/USD dropped on Thursday, moving toward the 0.6280 region during the American session, as selling momentum intensified. The pair struggled to find support with trade risks and a stronger US Dollar keeping pressure on the Aussie.

The Moving Average Convergence Divergence (MACD) indicator continues to print flat red bars, signaling fading momentum but maintaining a bearish bias. Meanwhile, the Relative Strength Index (RSI) has dropped to 48, declining sharply into negative territory, reflecting growing downside risks.The pair has lost its 20-day Simple Moving Average (SMA), confirming a deteriorating technical outlook. Further downside could target the 0.6250 region, where stronger demand might emerge. On the upside, resistance is seen around 0.6320, but a break above this level would be needed to shift sentiment toward recovery.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

-

21:00

South Korea Import Price Growth (YoY) declined to 4.6% in February from previous 6.6%

-

21:00

South Korea Export Price Growth (YoY) declined to 6.3% in February from previous 8.5%

-

20:56

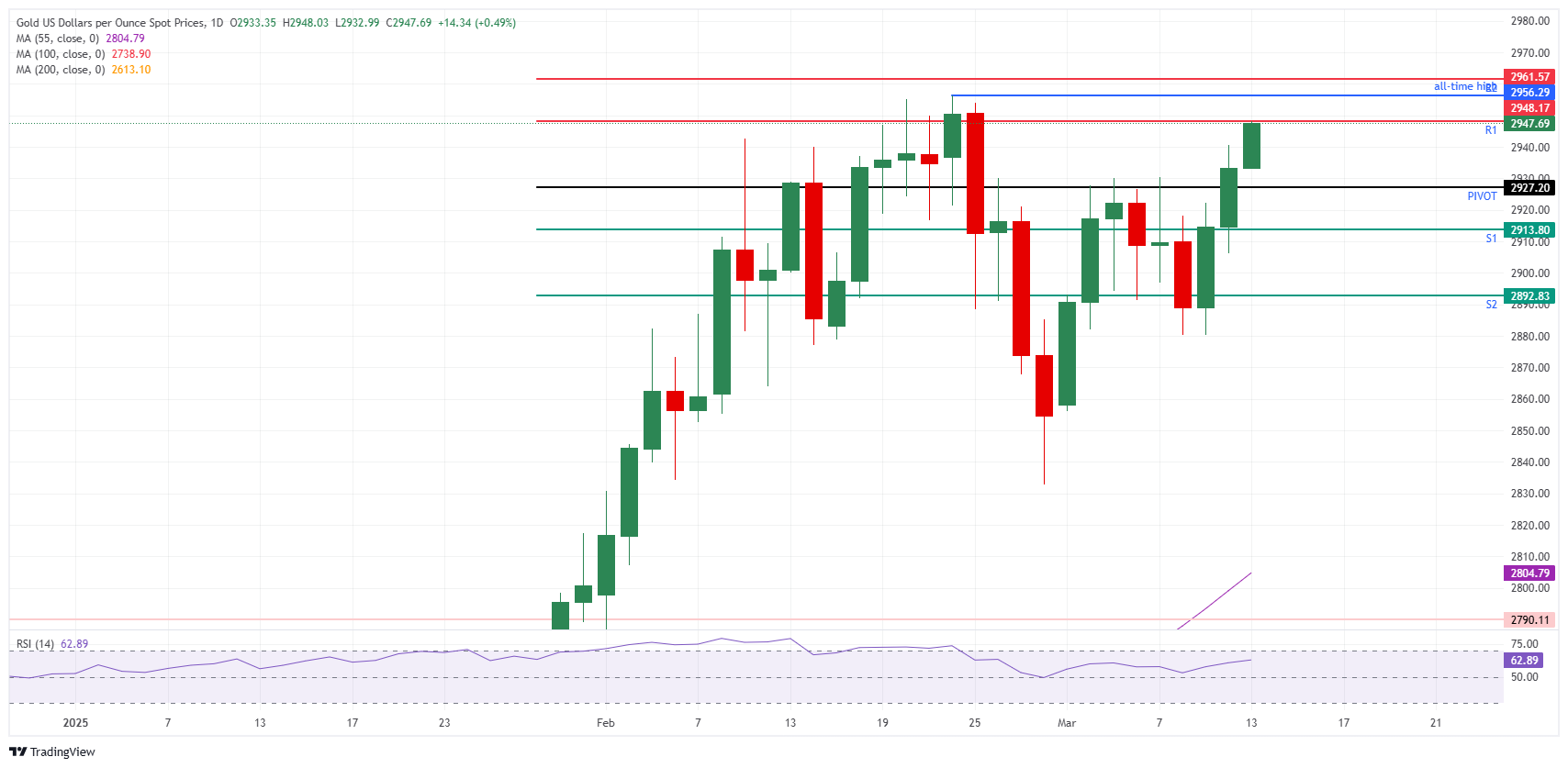

Gold price hit all-time high near $3,000 as trade tensions rock markets

- Gold soars 1.70% to a fresh record of $2,985, driven by uncertainty over US trade policies.

- Mixed signals from Trump administration officials on trade-induced recession fears fuel investor rush into Gold and Japanese Yen.

- Markets focus shifts to the Fed policy decision next week, with rates expected unchanged but crucial hints from new economic projections.

Gold prices skyrocketed on Thursday, with the yellow metal reaching a new record high of $2,989 yet poised to extend the trend towards the $3,000 figure. Uncertainty about the United States' (US) trade policies and increasing odds the Federal Reserve (Fed) would lower interest rates underpin the precious metal. XAU/USD trades at $2,988, up 1.86%.

The yellow metal’s advance is set to continue as US President Donald Trump embarks on a trade war with US allies and adversaries, as he tries to reduce the trade deficit. Fluctuations of imposing and removing duties on imports keep money flocking to Gold’s safe-haven appeal.

Recently, some US officials have not seemed worried about Wall Street’s reaction to Trump’s administration's trade policies. US Treasury Secretary Scott Bessent said that his comments last Friday about a “detox period” did not mean a recession was necessary. In contrast, US Commerce Secretary Howard Lutnick said a recession would be “worth it” to implement the current administration’s policies.

This was a green light for investors, who continued the sell-off in US equities and bought safe-haven assets like Gold and the Japanese Yen (JPY).

Meanwhile, data remains in the backseat, overshadowed by tariffs. Earlier, the US Bureau of Labor Statistics (BLS) revealed that inflation on the producer’s side was mainly unchanged, with a slight decline. At the same time, the number of Americans filing for unemployment benefits last week dipped, revealed the BLS.

Ahead this week, traders eye the University of Michigan (UoM) Consumer Sentiment for March. However, their radar is focused on the Federal Reserve (Fed) monetary policy decision next week. The Fed is expected to keep rates unchanged, update its economic projections, and dictate policy paths using the infamous “dot plot.”

Daily digest market movers: Gold price soars unfazed by a strong US Dollar

- The US 10-year Treasury bond yield erases yesterday’s gains, dropping four and a half basis points to 4.270%.

- US real yields, as measured by the US 10-year Treasury Inflation-Protected Securities (TIPS) yield that correlates inversely to Gold prices, climb one basis point to 1.99%.

- The US Dollar Index (DXY), which tracks the Greenback’s value against six currencies, recovers 0.27% to 103.85.

- The US Producer Price Index (PPI) for February came in softer than expected, rising 3.2% YoY, below the 3.3% forecast and down from 3.7% in January.

- Core PPI, which excludes volatile components, increased 3.4% YoY, falling short of the 3.5% estimate and easing from 3.6% in the prior month.

- Despite recent cooler-than-expected inflation data, economists caution that tariffs on US imports could lead to a renewed inflationary uptick in the coming months.

- Meanwhile, Initial Jobless Claims for the week ending March 8 edged down to 220K, beating forecasts of 225K and improving from the 222K reported previously.

- On Wednesday, 25% US tariffs on steel and aluminum took effect at midnight as US President Donald Trump is battling to reduce the trade deficit by applying duties on imports.

- Money market futures traders had been priced in 74 basis points of easing by the Federal Reserve (Fed) toward the end of the year.

- The Atlanta Fed GDPNow model predicts the first quarter of 2025 at -2.4 %, which would be the first negative print since the COVID-19 pandemic.

XAU/USD technical outlook: Gold price surges toward $3,000

Bullion prices are trading at all-time highs of $2,989 after clearing the previous year-to-date (YTD) high on February 20 at $2,954. Momentum remains exceptionally bullish, with the Relative Strength Index (RSI) slope aiming higher, but with room before turning overbought. With that said, Gold’s next resistance would be $3,000. A breach of the latter would expose $3,050 followed by the $3,100 mark.

Conversely, if XAU/USD drops below $2,950, the next support would be $2,900 ahead of $2,850. The following support will be a February 28 low of $2,832.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

-

20:21

Ukraine President Volodymyr Zelenskyy: Putin is preparing to reject peace deal

President of Ukraine Volodymyr Zelenskyy noted on Thursday that his administration believes that Russian President Vladimir Putin is gearing up to reject a ceasefire proposal that has been closely managed by United States (US) President Donald Trump in recent weeks.

According to President Zelenskyy, Russia's Putin is "scared" to state his ceasefire rejection directly to President Trump and is instead exploring delay tactics to find a structural reason to back away from the deal after spending weeks pushing for it.

The timing of the comments bodes poorly for Trump's administration, which is desperate to broker a deal in the Ukraine-Russia conflict so that President Trump can add it to his list of self-perceived accolades. An envoy of US delegates is meeting with Russian officials in Moscow on Thursday, attempting to smooth over Russia's flexible and frequently-changing demands for a Ukraine ceasefire deal.

-

19:13

US Dollar rebounds after PPI and jobless claims data

- DXY climbs after better-than-expected jobless claims data.

- PPI figures come in softer, raising concerns about weakening demand.

- Markets await updates on US diplomatic talks in Russia over Ukraine ceasefire.

- Trump threatens 200% tariffs on European wines and champagnes.

The US Dollar (USD) bounced back on Thursday, reclaiming the 104.00 level as traders reacted to softer-than-expected Producer Price Index (PPI) data and positive jobless claims figures. The US Dollar Index (DXY) initially jumped following the data release but later pared gains as investors weighed the implications of slowing inflation and potential demand concerns. Meanwhile, United States (US) diplomats arrived in Russia for ceasefire talks over Ukraine, and President Donald Trump escalated trade tensions by threatening a 200% tariff on European wines and champagnes.

Daily digest market movers: Mixed economic signals, geopolitical tensions rise

- The US weekly jobless claims report showed initial claims at 220,000, lower than the expected 225,000. Continuing claims dropped to 1.87 million, below the forecast of 1.90 million.

- The February Producer Price Index (PPI) came in weaker than expected, with the headline monthly figure at 0.0% vs. 0.3% expected, and the core PPI contracting by 0.1%.

- On a yearly basis, the headline PPI eased to 3.2%, below the projected 3.3%, while the core PPI declined to 3.4% from 3.6%.

- Markets initially viewed the softer inflation data as positive for the US dollar, but gains were quickly reversed as traders interpreted weaker PPI figures as a sign of softening demand.

- US stocks moved lower after PPI data, with sentiment further pressured by Trump's latest trade threats targeting European imports.

- The CME FedWatch tool indicates that markets widely expect the Fed to maintain rates in the March 19 meeting, while rate cut probabilities for May and June continue to rise.

DXY technical outlook: Oversold bounce meets resistance

The US dollar index (DXY) recovered from recent multi-month lows, climbing back above 104.00 as traders reassessed oversold conditions. Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicate a short-term correction, though selling pressure remains dominant after last week’s sharp decline. Key resistance stands near 104.50, while support rests at 103.50, with further downside possible if sellers regain control.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

-

18:42

Forex Today: Tariffs, German inflation, and UK GDP gather attention

The Greenback extended its recovery from recent lows, adding to Wednesday’s uptick amid the move lower in yields and intense concerns surrounding the prospects of a global trade war.

Here is what you need to know on Friday, March 14:

The US Dollar Index (DXY) rose to three-day highs and regained the 104.00 barrier helped by higher US yields. The preliminary Michigan Consumer Sentiment takes centre stage across the Atlantic.

EUR/USD extended its correction from recent multi-month tops, receding to three-day lows in the 1.0825-1.0820 band. Germany will be at the centre of the debate with the releases of the final Inflation Rate and Wholesale Prices. In addition, the ECB’s Cipollone is due to speak.

GBP/USD set aside two daily advances in a row and retreated to the low-1.2900s on the back of further recovery in the US Dollar. An interesting UK calendar will feature GDP figures, Industrial and Manufacturing Production, Goods Trade Balance results, Construction Output, and the NIESR Monthly GDP Tracker.

USD/JPY halted its weekly recovery on the back of the resurgence of the appreciation in the Japanese yen, limiting the pair’s upside to the 148.40 zone. Next on tap in Japan will be the Balance of Trade readings and Machinery Orders, all expected on March 19.

Sellers regained the upper hand and forced AUD/USD to resume its downtrend, slipping back to the 0.6270 zone amid further gains in the Greenback. The next key data release will be the labour market report on March 20.

WTI prices resumed their downward bias and eroded two consecutive daily advances on the back of steady tariff concerns and the stronger Dollar.

Prices of Gold added to the weekly rebound and surged to all-time highs past the $2,980 mark per troy ounce. Silver prices gathered extra steam and came close to the $34.00 mark per ounce, levels last traded in late October.

-

18:17

Mexican Peso surges as traders bet on Fed rate cuts

- Mexican Peso appreciates as USD/MXN dives toward 20.00 amid Fed easing expectations.

- Weak Mexican Industrial Production data was overshadowed by improved risk appetite, boosting MXN against the softer Greenback.

- US-Mexico tariff tensions intensify; Mexican officials confirm ongoing discussions ahead of critical April 2 tariff deadline.

The Mexican Peso (MXN) is rallying sharply against the US Dollar (USD) on Thursday as traders seem confident that the Federal Reserve (Fed) could lower interest rates thrice in 2025. Positive inflation and jobs reports in the United States (US) pushed traders to price in additional easing, which weighed on the US Dollar. USD/MXN trades at 20.08, down 0.44%.

Data from Mexico was worse than expected as Industrial Production in January fell. Nevertheless, a mild improvement in risk appetite keeps the Emerging Market (EM) currency appreciating as the Greenback continues to pare earlier losses.

Meanwhile, Mexican Economy Minister Marcelo Ebrard said the Mexican and US governments were having intensive talks over threats to impose a 25% tariff on all goods from its No. 1 trade partner by April 2.

On Wednesday, Mexican Finance Minister Edgar Amador Zamora said the national economy is expanding but shows signs of slowing down linked to trade tensions with the US.

Across the border, US data revealed that factory gate inflation was unchanged primarily, dipping some tenths though Goldman Sachs revealed that some of the measures of inflation used to calculate the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index, could underpin the latter.

Based on CPI and PPI, the US investment bank revealed that February’s Core PCE estimates rose by 0.29%, corresponding to a 2.7% YoY reading.

Other data showed the labor market remains solid, though most economic data continue to be subdued amid US President Donald Trump's trade rhetoric.

Daily digest market movers: Mexican Peso unfazed by dismal Industrial Production data

- Mexico's Industrial Production fell -0.4% MoM in January, below forecasts for a 0.2% expansion. In the twelve months to January, production plunged -2.9% YoY, missed an improvement to -1.8%, worse than December’s -2.7 fall.

- The economy in Mexico is slowing down sharply, as projected by private analysts polled by Banco de Mexico (Banxico), with them expecting growth at 0.81%. The evolution of the disinflation process and a stagnant economy push Banxico to lower borrowing costs at the upcoming March 27 meeting.

- The February US Producer Price Index (PPI) came in softer than expected, rising 3.2% YoY, below the 3.3% forecast and down from 3.7% in the previous month.

- Core PPI, which excludes volatile items, increased 3.4% YoY, missing estimates of 3.5% and easing from 3.6% in January.

- Despite recent cooler-than-expected inflation reports, economists warn that tariffs on US imports could trigger a renewed inflationary uptick in the coming months.

- Meanwhile, Initial Jobless Claims for the week ending March 8 declined slightly to 220K, beating expectations of 225K and improving from the previous 222K reading.

- Money market futures traders had been priced in 74 basis points of easing by the Federal Reserve (Fed) toward the end of the year.

- A Reuters poll showed that 70 out of 74 economists say the risk of recession has risen in the US, Canada and Mexico.

- In the boiler room, trade disputes between the US and Mexico remain front and center. If the countries reach an agreement, it could pave the way for a recovery of the Mexican currency. Otherwise, further USD/MXN upside is seen as US tariffs could trigger a recession in Mexico.

USD/MXN technical outlook: Mexican Peso surges as USD/MXN tumbles below 20.10

USD/MXN shifted from neutral to downward biased, with sellers eyeing a test of the psychological 20.00 figure. A breach of the latter will pave the way to test the 200-day Simple Moving Average (SMA) at 19.63 before dropping to 20.50. On the flip side, a clear break above 20.20 could keep the exotic pair trapped once again within the 20.20 – 20.50 range before buyers can challenge the 20.99 March 4 peak.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

-

17:34

Dow Jones Industrial Average backslides despite flat PPI inflation as trade war ramps up

- The Dow Jones shed 600 points on Thursday, falling 1.45%.

- US PPI inflation hit a soft patch, further easing fears of an inflation reignition.

- Despite easing price pressures, equities still took a hit as Trump threatens more tariffs.

The Dow Jones Industrial Average (DJIA) fell some 600 points on Thursday, declining nearly one and one-half of a percent after United States (US) President Donald Trump and his administration ramped up their trade war rhetoric. President Trump pivoted to threatening new tariffs on targeted goods from the European Union after his tactic of trying to strong-arm Canada into making trade concessions went nowhere earlier this week.

The US Producer Price Index (PPI) cooled faster than expected in February, with core PPI inflation easing to 3.4% YoY versus the expected print of 3.5% and January’s 3.6%. Headline PPI inflation also chilled, falling to 3.2% on an annualized basis compared to the forecast of 3.3%, however January’s headline PPI print was revised higher to 3.7% as revisions continue to be a thorn in the side of preliminary data watchers.

Despite a general easing in this week’s batch of inflation data, the odds of another rate cut from the Federal Reserve (Fed) next week look slim. Inflation metrics are still running well above the Fed’s 2% annual target, and according to the CME’s FedWatch Tool, rate markets are pricing in functionally 100% odds of the Fed holding rates steady after its rate call meeting next week. Rate traders expect the Fed’s next move on rates to be in June, if not later.

US President Donald Trump hit the ground running on Thursday, vowing to impose a stiff 200% tariff on European wines if the EU doesn’t back off from its 50% tariff on US-produced whisky, which was imposed as a retaliatory measure against the US’s global 25% steel and aluminum tariff that went into effect this week. President Trump attempted to strong-arm his Canadian neighbors into not retaliating against his steel import fees.

However, those measures largely fizzled and resulted in no concessions from Canada, and now the Trump administration is shifting its tit-for-tat tariff strategy on Europe. Donald Trump also returned to musing about ‘taking’ Greenland from Denmark as the US president revisits talking points from his campaign trail.

Dow Jones news

A large majority of the stocks listed on the Dow Jones fell back on Thursday, with two-thirds of the index’s securities slipping into the red. Verizon (VZ) rebounded 2.5% to above $43 per share as the telecoms giant recovers from a rout earlier this week. Salesforce (CRM) and Home Depot (HD) both fell over 4%, falling to $271 per share and below $350 per share, respectively. Tech stocks and building suppliers are growing increasingly uneasy in the face of the Trump administration’s trade policies.

Dow Jones price forecast

Losses are beginning to accumulate on the Dow Jones Industrial Average chart, dragging the major equity index into correction territory with the Dow Jones down 2,000 points on the week. The DJIA has shed nearly 10% from last November’s record highs just north of 45,000, and price action is back below the 41,000 handle for the first time in 6 months.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

-

17:03

United States 30-Year Bond Auction down to 4.623% from previous 4.748%

-

15:43

EUR/USD Price Analysis: Buyers take a breather as consolidation phase begins

- EUR/USD was seen trading around the 1.0850 area after the European session, correcting lower after a strong rally.

- Overbought conditions led to a pullback, with the pair possibly consolidating between 1.0800-1.0850 before resuming its uptrend.

EUR/USD retreated after reaching fresh highs, trading near the 1.0850 zone on Thursday after the European session. Following a strong bullish run, buyers appear to be taking a pause, allowing the pair to cool off and digest recent gains. This pullback comes as traders assess whether the next leg higher is imminent or if further consolidation is needed.

From a technical standpoint, the Relative Strength Index (RSI) has pulled back sharply but remains near overbought levels, suggesting that the recent correction is part of a broader consolidation rather than a trend reversal. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram is printing flat green bars, signaling that bullish momentum has stalled but is not yet reversing.

The key support zone stands between 1.0800 and 1.0850, where buyers could step back in to defend the uptrend. On the upside, resistance is located around 1.0900, with a break above potentially reigniting bullish momentum. If the pair holds within the current range, consolidation may continue before another attempt at higher levels.

EUR/USD daily chart

-

15:42

US Treasury Secretary Bessent: Maybe inflation is getting under control.

US Treasury Secretary Scott Bessent his the wires on Thursday, touching on a variety of subjects during an interview on CNBC's "Squawk on the Street" segment, shrugging off a multi-week decline in US equity indexes as "recent volatility".

Key highlights

We are focused on the real economy.

The aim is long-term gains for markets and the American people.

I am not concerned about a little volitity over three weeks.

We are focused over the medium and long-term.

A US government shutdown would be disruptive.

Regarding Trump's threatened 200% tariff on EU alcohol: I am not sure why one or two items from one or two trading blocks is a big deal.

Aside from metals and likely autos, everything else is up for grabs for tariff negotiations.

If trading partners want to ratchet things up, surplus countries will take the biggest hit.

Companies are generally supportive of transition away from government spending.

I am confident Trump tax bill is on track.

Detox is not a euphemism for recession.

We are trying to get tax bill done and controlling expenses.

Regarding the US dollar weakening: A lot was priced in, it is natural to see an adjustment.

We are hoping to get to a tax bill in the coming weeks.

We've had a big unwind in the markets.

I blame democrats for the potential shutdown.

We want to protect strategic industries and jobs.

-

15:32

US President Trump shifts tariff focus on EU, vows steep import fees on EU wine

After flubbing his planned doubling of tariffs on Canada, which saw Canada poised to lash back with stiff increases in the cost of energy exported from the province of Ontario to the US, US President Donald Trump is shifting his tariff focus to the European Union, but maintaining the same playbook.

Donald Trump's brief standoff against Canada saw the US's neighbor to the north make zero concessions. Canada is now on pace to impose a strategic package of tariffs against key US goods in retaliation for the US's steel and import tariffs that went into effect this week, and trade terms under the USMCA trade agreement remain unchanged. Now, President Trump is looking to strong-arm the European Union, which imposed its own retaliatory tariffs on US whisky products in response to the US administration's steel tariffs.

Donald Trump threatened via social media post early Thursday that he would seek to impose his 200% tariff on European wines and champagne. Donald Trump then resumed posting on his Truth Social account, again declaring that eggs, Crude Oil, and interest rates were all "down", while also trying to rebrand the US's "Free Trade" as "Stupid Trade" (sic).

Key quotes

US to shortly place 200% tariff on EU wine.

If the EU tariff is not removed immediately, the US will retaliate.

Egg prices are down, oil down, interest rates are down.

The US doesn't have Free Trade. We have "Stupid Trade." The Entire World is ripping us off.

Canada needs America, America does not need Canada.

-

15:32

United States 4-Week Bill Auction down to 4.225% from previous 4.23%

-

15:31

GBP/USD holds steady near 1.2950 as traders brace for UK GDP data

- GBP/USD remains near 1.2950, cautiously, after US PPI data came slightly below expectations at 3.2% YoY.

- US jobless claims fell to 220K, highlighting labor market resilience despite mixed inflation outlook from recent tariffs.

- Traders anticipate UK GDP report Friday; expected slowdown to 0.1% MoM.

The Pound Sterling stayed firm at nearly 1.2950 against the Greenback on Thursday following the release of economic data from the United States (US). Inflation and jobs figures came in mixed but signaled that the economy remains solid. The GBP/USD trades at 1.2948, down 0.07%.

Mixed US economic signals keep Sterling rangebound; upcoming UK growth report eyed as next catalyst

Data from the US showed that prices paid by producers were mainly aligned with estimates. The US Bureau of Labor Statistics (BLS) revealed that the Producer Price Index (PPI) in February came softer than the 3.3% expected at 3.2% YoY, down from the prior month’s 3.7%. Excluding volatile items, the so-called Core PPI increased by 3.4% YoY, beneath estimates of 3.5% and down from 3.6%.

Even though the latest US inflation reports were cooler than foreseen, tariffs imposed on imports to the US can spark a reacceleration of inflation, with economists estimating that prices will begin to rise in the months ahead.

Other data showed that Initial Jobless Claims for the week ending March 8 dipped from 222K to 220K, below forecasts of 225K.

Across the pond, traders are eyeing the release of Gross Domestic Product (GDP) figures on Friday. The 3-month rollover is estimated at 0.3%, up from 0.1% in the previous report. GDP in January is expected to dip from 0.4% to 0.1% MoM.

In the US, investors would digest the University of Michigan (UoM) Consumer Sentiment report for March.

GBP/USD Price Forecast: Technical outlook

The GBP/USD continues to trade sideways, unable to clear below/above the 1.2900 – 1.2950 range for the last two days. The Relative Strength Index (RSI) is near overbought territory yet almost flat. Therefore, traders are awaiting a fresh catalyst to drive the pair outside of the previously mentioned range.

A bullish continuation would happen once GBP/USD clears 1.2950, opening the door to challenge 1.3000. On the other hand, a drop beneath 1.2900 would clear the path to test the current week’s low of 1.2860, ahead of the 200-day Simple Moving Average (SMA) at 1.2791.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

USD EUR GBP JPY CAD AUD NZD CHF USD 0.28% 0.16% -0.28% 0.20% 0.48% 0.37% 0.28% EUR -0.28% -0.12% -0.58% -0.10% 0.20% 0.11% -0.00% GBP -0.16% 0.12% -0.46% 0.03% 0.32% 0.23% 0.15% JPY 0.28% 0.58% 0.46% 0.46% 0.76% 0.66% 0.61% CAD -0.20% 0.10% -0.03% -0.46% 0.30% 0.19% 0.11% AUD -0.48% -0.20% -0.32% -0.76% -0.30% -0.08% -0.20% NZD -0.37% -0.11% -0.23% -0.66% -0.19% 0.08% -0.05% CHF -0.28% 0.00% -0.15% -0.61% -0.11% 0.20% 0.05% The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

-

14:46

Breaking: Gold reaches record high at $2,966 post US data

Gold price rallies sharply on Thursday and clears the previous record high of $2,954 despite high US Treasury bond yields and a strong US Dollar. At the time of writing, the XAU/USD clears the $2,960 mark, and reached an all time-high of $2960 a troy ounce.

Developing story...

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

-

14:30

United States EIA Natural Gas Storage Change came in at -62B below forecasts (-50B) in March 7

-

14:21

AUD/USD slumps to near 0.6280 on US Dollar’s strong recovery

- AUD/USD tumbles to near 0.6280 as the US Dollar outperforms on Trump’s tariff agenda.

- Trump’s America First policy has prompted global economic risks.

- Soft US CPI and PPI data for February failed to weigh on the US Dollar.

The AUD/USD pair falls sharply to near 0.6280 in North American trading hours on Thursday. The Aussie pair faces a sharp selling pressure as the US Dollar (USD) outperforms amid cautious market mood. Financial market participants have turned to safe-haven bets amid fears that United States (US) President Donald Trump’s “America First” policies will result in a global economic slowdown.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, jumps to near 104.00, after bouncing back from the four-month low of 103.20 posted on Tuesday.

US President Trump reiterates tariff threats from his post on Truth.Social, “The US doesn't have Free Trade. We have "Stupid Trade." The Entire World is ripping us off.”

On Wednesday, Trump also confirmed retaliatory tariffs on Eurozone on their counter-tariffs on 26 billion Euros (EUR) worth of goods against 25% universal import duty by the US on steel and aluminum.

Meanwhile, investors ignore soft US Consumer Price Index (CPI) and Producer Price Index (PPI) data for February amid the storm of Trump’s tariff agenda. The US headline and core PPI rose at a slower-than-expected pace of 3.2% and 3.4%, respectively, in 12 months to February. Month-on-month headline PPI remained flat while the core figure deflated by 0.1%. Soft US inflation data boosts Federal Reserve (Fed) dovish bets.

On the Aussie front, dismal market sentiment has dampened the Australian Dollar’s (AUD) appeal. The outlook of the Aussie Dollar is also uncertain as the US has imposed 20% tariffs on China. The AUD acts as a mirror of Chinese economic growth, given Australia’s strong reliance on exports to China.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

-

13:42

GBP tracks broader USD tone – Scotiabank

The Pound Sterling (GBP) continues to track the broader trend in the USD, absent any major fundamental developments at home, Scotiabank's Chief FX Strategist Shaun Osborne notes.

GBP regains some ground versus EUR

"The RICS House Price Index dropped to a lower than expected 11 in February (vs. 20 forecast); the RICS puts the blame on rising uncertainty and weaker confidence, with recent tax increases and slow progress on cutting rates weighing on sentiment."

"The BoE’s cautious easing approach is supportive for the GBP, however, and may help the GBP regain a little ground on the EUR, with the cross showing signs of steadying around the 0.8450 area after sharp, early March gains."

"A mild loss for the GBP leaves spot trading well within yesterday’s range which stretched GBP gains to just under 1.30— the highest since early November. Trends remain GBP-supportive on the short– and medium-term charts and the GBP should find support on minor dips ahead of 1.2910 support. Resistance is 1.30 ahead of a push on to 1.3125/50."

-

13:39

EUR drifts as spreads widen slightly – Scotiabank

The Euro (EUR) is little changed on the day and continues to consolidate recent gains, Scotiabank's Chief FX Strategist Shaun Osborne notes.

Bullish trend remains intact

"Short-term spreads have corrected a little, helping trim the EUR rally but differentials remain broadly supportive. January Eurozone Industrial Production was flat in the January month, versus expectations of a 0.8% m/m drop. December output was revised up to (a still weak) 1.5% decline."

"EURUSD continues to consolidate. Spot losses are extending for a second day and testing support in the upper 1.08s but the broader, technical undertone remains constructive and dips to the low/mid 1.08 area should remain supported. Key short-term support is 1.0805. Resistance is 1.0950 and 1.10."

-

13:37

CAD resilient despite tariff threats and BoC cut – Scotiabank

The Canadian Dollar (CAD) navigated metals tariffs and the BoC rate cut with relative ease yesterday, Scotiabank's Chief FX Strategist Shaun Osborne notes.

USD looks highly overvalued

"The Bank would not—could not—provide much clarity around the outlook for policy, given the uncertainties for growth and inflation that this trade war will generate. Macklem stressed that the Bank did not want to see first round price increases (from tariffs) having a knock-on effect on other prices. Markets pared a few bps from easing expectations over the balance of the year but were still discounting roughly 45bps of additional cuts through December at the close last night."

"Overall, the CAD looks relatively resilient. The recent narrowing in US/Canada term spreads is providing some anchoring for the CAD despite headwinds from tariffs. In fact, USDCAD is trading two standard deviations above our FV estimate (1.4095), with the USD the most overvalued since 2022 this week. Stretched valuation tilts risks towards a push under the mid-1.43 area at least in the short run."

"Spot trends are tilting a little more bearish for the USD after early week gains were capped in the low 1.45 zone. USD losses yesterday add to the USD-negative look of short-term price action and the picture of strong resistance developing in the low/mid 1.45 area now. USD support sits at 1.4350 still and while the USD looks technically prone to more losses, it continues to enjoy solid, bull momentum on the intraday and daily oscillator studies. That may mean that CAD gains through the 1.4350 zone may be grinding and perhaps limited to the mid/upper 1.42s."

-

13:33

USD regains some ground – Scotiabank

The USD is tracking a little higher so far today but markets appear to be idling as investors await data and developments. Dollar gains are marginal in broad terms but more significant gains have been notched up against the high beta/commodity currencies—AUD, NZD, SEK, NOK—following mixed equity market returns in Asia and flat to mildly weaker trends in US equity futures, Scotiabank's Chief FX Strategist Shaun Osborne notes.

Underlying trends remain bearish

"Investors remain concerned that US reciprocal tariff action due in April may further disrupt risk appetite. Yesterday’s US CPI data brought some mixed news on prices. Headline and core rates of inflation came in lower than forecast. But some of the dampening effects on inflation (lower airfares) may not be reflected in the PCE data and airfare weakness may be a further sign of softer consumer demand."

"While the DXY has picked up a little ground, gains are limited and the market may only be developing a mild technical correction within the confines of what appears to be a still-developing downtrend. Trend momentum signals are aligning bearishly for the index across the short-, medium– and long-term studies which is typically a sign that countertrend rallies or rebounds will be limited in terms of scale and duration."

"Typically, therefore, these sorts of rebounds would be an opportunity to reload or add to short positioning. DXY resistance sits at 103.70, near current levels, and 104.00/05. Recent CFTC data has reflected a reduction in net USD long positioning but investors remain generally long USDs. Other data suggests that active traders have not reduced USD exposure all that much, however."

-

13:00

Russia Central Bank Reserves $ up to $639.1B from previous $632.4B

-

12:48

Silver Price Forecast: XAG/USD sees upside above $33.40 on soft US PPI and CPI, Trump tariff fears

- Silver price aims to break above the key resistance of $33.40 due to multiple tailwinds.