Notícias do Mercado

-

23:58

USD/CHF Price Analysis: Solid above parity, eyeing 2019’s highs above 1.0100

- USD/CHF trades above parity for the second consecutive day, following the US CPI report.

- The major hit a fresh YTD high of 1.0074, though retraced to the current spot price.

- USD/CHF Price Forecast: The uptrend remains intact and could reach 2019 May and April highs; otherwise, it could dive below parity.

The USD/CHF oscillates around parity following Thursday’s volatile session, which witnessed the major hitting a YTD high of 1.0074 before retracing to current exchange rates, despite US inflation data, justifying further Fed tightening. At the time of writing, the USD/CHF is trading at 1.0009, above its opening price by 0.04%.

USD/CHF Price Forecast

The daily chart suggests the pair is upward biased, though price action since mid-September and through October formed an ascending wedge, which by the book, is a bearish pattern. However, it is worth noting that successive series of higher highs/lows suggests the uptrend is intact, but a break below the current week low of 0.9915 could open the door for further losses.

Therefore, support levels are 0.9853, the 20-day EMA, followed by October’s 6 0.9780 swing low, ahead of September’s low at 0.9737.

Contrarily, if the USD/CHF breaks above the YTD high at 1.0074, a test of 1.0100 is on the cards. Once cleared, the next resistance levels would be the high of May 20, 2019, at 1.0121, followed by April 26, 2019, high at 1.0230.

USD/CHF Key Technical Levels

-

23:47

Japan’s Suzuki: G20 summary likely to reaffirm FX commitment

“The Group of 20 key nations (G20) is likely to say many currencies have moved significantly this year with increased volatility, reaffirm fx commitment in Chair Summary,” said Japanese Finance Minister Shunichi Suzuki on Friday.

While speaking from the Washington DC, Japan’s Suzuki also mentioned that G20 chair Indonesia likely to issue summary of this meeting's discussion at a later date.

Additional comments

There was no discussion at G7 on what coordinated steps should be taken to address market volatility.

Want to take appropriate action vs excess fx volatility, when asked whether Japan could intervene to prop up yen.

Sid not hold bilateral meeting with US Treasury Secretary Yellen this time.

Has shown clear understanding toward japan's fx intervention last month.

Market implications

The otherwise unimportant news gained attention of the USD/JPY traders as the yen pair jumped to the fresh high since 1998 the previous day, raising expectations of Japan’s intervention. That said, the quote traders firmer around 147.25 by the press time.

Also read: Forex Today: Dramatic U-turn after US inflation misses expectations

-

23:42

GBP/USD bulls take a breather around 1.1330 with eyes on US Retail Sales, Michigan CSI

- GBP/USD steadies nearly weekly top after rising the most in a fortnight.

- UK politics, US inflation surprisingly favored bulls despite hawkish Fed bets.

- More clarity on the British mini-budget appears necessary to keep buyers on the table.

- Risk-negative headlines and firmer expectations from US consumer-centric data can recall the cable bears.

GBP/USD seesaws near 1.1330 as bulls await fresh catalysts to extend the biggest daily jump in two weeks. In doing so, the Cable pair pauses the two-day uptrend around the weekly top.

A slight clarity on the UK government’s mini-budget, as well as the US dollar’s broad declines, could be linked to the quote’s latest run-up. On the same line were the hopes of the Bank of England’s (BOE) hawkish move.

On Thursday, UK Finance Minister Kwasi Kwarteng told BBC that he is focused on delivering on the mini-budget to get growth going again. On the same line, Prime Minister Liz Truss’ office also confirmed no more U-turns from the mini-budget. It’s worth noting that UK Chancellor Kwarteng’s surprise cancellation of the speech and passing the buck on the BOE if the British markets collapse might have also offered indirect support to the GBP/USD prices.

That said, the quote rallied the most in a fortnight despite the 40-year high print of the US Core Consumer Price Index (CPI). On Thursday, the US CPI rose to 8.2% versus 8.1% market forecasts but eased as compared to the 8.3% prior. The CPI ex Food & Energy, mostly known as the Core CPI, jumped to 6.6% while crossing the 6.5% expectations and 6.3% previous readings.

It’s worth noting that the money markets’ wagers on the 75 bps Fed rate hike and a jump in Wall Street seemed to also have played their role in fueling the GBP/USD prices.

Moving on, the risk catalysts are likely to direct immediate GBP/USD moves as there are more challenges to the latest run-up. Among them are the hawkish Fed bets, fears of UK markets’ collapse and the fresh covid fears.

However, major attention will be given to the US Retail Sales for September, the preliminary readings of the Michigan Consumer Sentiment Index (CSI) and the University of Michigan’s (UoM) 5-year Consumer Inflation Expectations for October.

Also read: US Retail Sales Preview: Positive surprises eyed for dollar bulls to regain poise

Technical analysis

Despite crossing the 21-DMA hurdle, now immediate support around 1.1160, a monthly resistance line, close to 1.1390 by the press time, challenges the GBP/USD buyers.

-

23:27

EU Economy Commissioner Gentiloni: EU inflation connected to energy prices – BBG TV

“EU inflation connected to energy prices,” Said European Union (EU) Economics Affairs Commissioner Paolo Gentiloni during the Bloomberg (BBG) TV appearance.

More to come

-

23:12

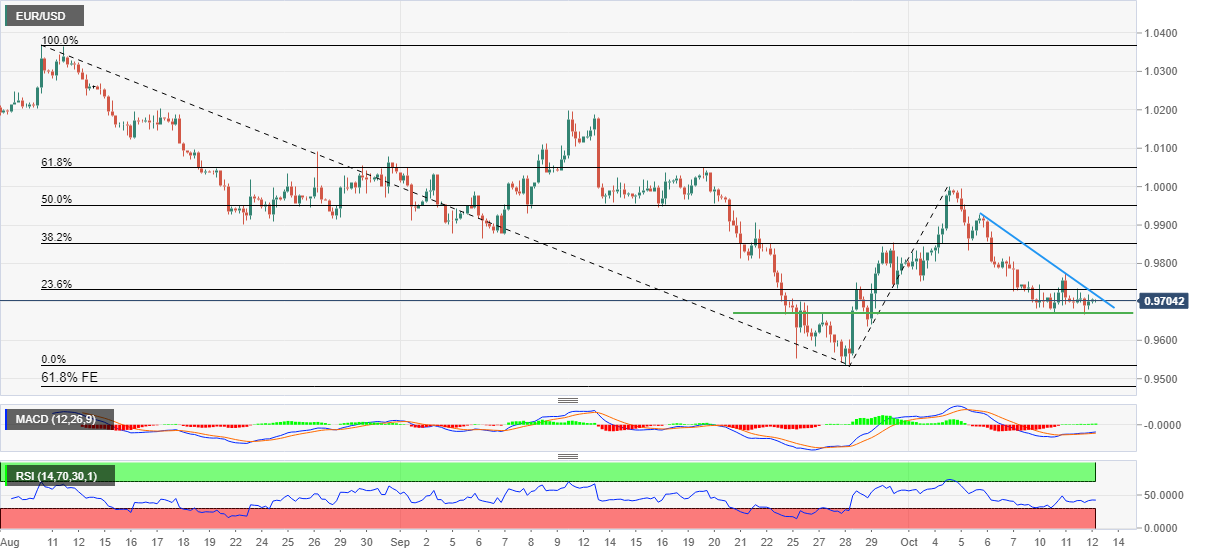

EUR/USD Price Analysis: Oscillates around the 20-day EMA eyeing Friday’s US economic data

- EUR/USD marches firmly towards 0.9800 on broad US dollar weakness, following a hot US inflation report.

- EUR/USD’s failure to crack the 200-EMA in the hourly chart could send the pair diving towards 0.9700; otherwise, expect a test of 0.9900.

The EUR/USD rallied on Thursday, though it faced solid resistance around the 20-day EMA at 0.9788, and finished the session with gains of 0.76% after hitting a daily low of 0.9631. As the Asian Pacific session begins, the EUR/USD is trading at 0.9772, below its opening price, by a minimal 0.02%.

EUR/USD Price Forecast

The EUR/USD technical side depicts the major as downward biased. Since the end of February 2022, the EUR/USD dropped below the 20-day EMA, a dynamic resistance level that traders have been using. Even though the EUR/USD had spans trading above it, most of the time price stalled at the 20-day EMA and retraced to lower price levels. So failure to crack it could open the door for further losses. Therefore, the EUR/USD first support would be the October 13 low of 0.9631, followed by the 0.9600 figure, ahead of the YTD low at 0.9538.

Short term, the one-hour time frame depicts the EUR/USD bias as neutral. Of note, the major tested the 200-EMA during the day, but it could not surpass it. Hence, based on price action, the EUR/USD might consolidate around the 0.9774-0.9800 area, though failure to break the top of the range could pave the way for further losses.

Once the EUR/USD breaks 0.9800, key resistance levels lie at the R1 daily pivot at 0.9840, followed by the 0.9900 figure ahead of parity.

On the other hand, the EUR/USD first support would be the daily pivot point at 0.9740, followed by the confluence of the 50/100-EMAs around d0.9715/16, ahead of 0.9700.

Also read: EUR/USD makes a U-turn, climbing to daily highs nearby 0.9800 after hot US inflation

EUR/USD Key Technical Levels

-

23:09

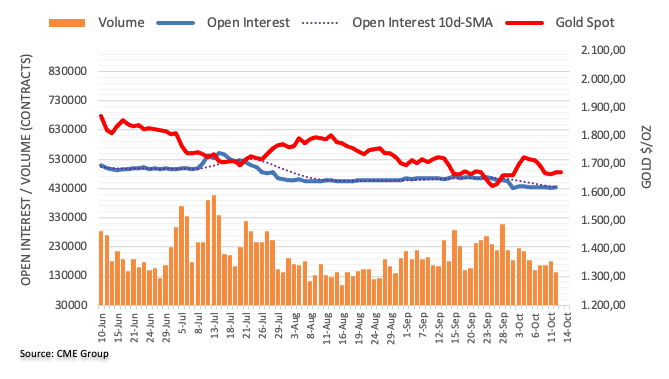

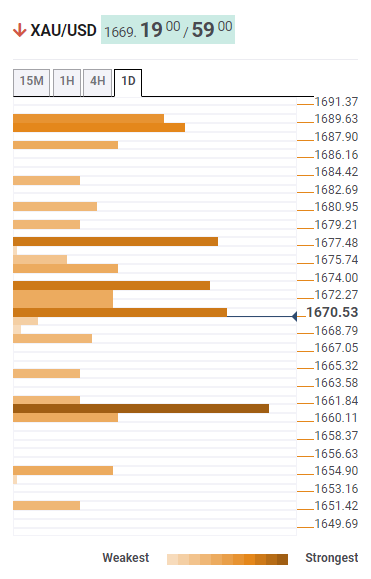

Gold Price Analysis: XAU/USD bulls are moving on for the kill

- Gold bulls move in as the US dollar gives back ground.

- The risk rally has weighed the greenback into the final day of the week and earnings that are due.

Gold ended on Wall Street at around $1,670 and down by over 0.5% on the day in the face of sky-high inflation in the US and on a global scale. XAU/USD travelled between a low of $1642.46 from a high of $1,682.49. However, it was a two-way street for the most part following a suspicious move in the yen that caught the market off guard and subsequently, led to further bizarre price action across asset classes.

The yen strengthened vs.s the dollar by over 100 pips in a matter of a minute in trade following the release of the US Consumer Price Index that firmed the grounds for further strong rate hikes from the Federal Reserve. Wall Street stock indexes made a dramatic recovery as well, closing sharply higher after an earlier sell-off on Thursday while the US dollar gave up the knee-jerk gains. Instead, investors poured back into riskier bets after digesting a red-hot US inflation reading that fueled bets for a big Federal Reserve rate hike next month. The S&P 500 closed the session up 2.6% after declining 5.7% in the previous six sessions. Earlier Thursday it fell 2.3% to its lowest level since Nov. 2020.

US CPI buries Fed pivot sentiment

First off, US inflation eased less than expected in September to 8.2%, and underlying prices excluding energy and food prices accelerated to a new four-decade high.

- US CPI (MoM) Sep: 0.4% (est 0.2%; prev 0.1%).

- US CPI (Y0Y) Sep: 8.2% (est 8.1%; prev 8.3%).

- US CPI Core (M0M) Sep: 0.6% (est 0.2%; prev 0.6%).

- US CPI Core (Y0Y) Sep: 6.6% (est 6.5%; prev 6.3%).

Core CPI gained at its highest annual pace in 40 years, rising 0.6% for the month and 6.6% for the year and Fed funds futures are now pricing in 75 bps in December, up from 50. Moreover, terminal rate expectations rose to 4.85% in March. As a consequence, the 10-year Treasury yield rallied to 4.080% while the 2-year yield was up to 4.535%. As measured by the DXY index, the US dollar dropped by 1% to almost 112.14 as risk sentiment returned to markets. At the time of writing, the DXY index is down by some 0.73% having fallen from a high of 113.92 to a low of 112.147 so far.

Looking forward, the big question is; ''is the risk rally logical, or is it just a short squeeze or a dead cat bounce?''

''It seems the market is embracing aggressive monetary policy and focus is likely to shift to the consequences of such tightening,'' analysts at ANZ Bank argued.

Gold technical analysis

The price is carving out a W-formation that could lead to a move higher for the day ahead, certainly if the US dollar continues to bleed out. The price has already made a 61.8% retracement and is holding near to there while in demand territory.

-

22:39

New Zealand Business NZ PMI came in at 52 below forecasts (52.5) in September

-

22:17

AUD/USD Price Analysis: Bulls have moved in, can they stay the course?

- AUD/USD has found a bid on the back of a sell-off in the US dollar.

- Bulls eye a breakout of 0.6330 recent peak formation highs.

The price has formed a peak formation in the aftermath of the US inflation data which leaves the focus on the upside for the day ahead and on the US Retail Sales data for Friday in the US session. A less-than-encouraging number could be problematic for the US dollar as speculators investors seek out short-term gains elsewhere.

AUD/USD H1 chart

With that being said, the Aussie is high beta to the US stocks markets so it too could struggle in the face of weak data. Nevertheless, the bulls will be back in control on a break of 0.6350 which is above the October 11 peak formation around 0.6330. Beyond 0.6350, the bulls will be eying a move back to 0.6400, 0.6500 and then 0.6550.

-

22:00

South Korea Export Price Growth (YoY) above expectations (8.4%) in September: Actual (15.2%)

-

22:00

South Korea Import Price Growth (YoY) above expectations (20.8%) in September: Actual (24.1%)

-

21:49

AUD/JPY jumps from the 200-DMA, rallies above 92.50 following hot US CPI

- AUD/JPY advances on a risk-on impulse, despite high US inflation.

- Wednesday’s BoJ’s Kuroda dovish commentary weighed on the JPY.

- AUD/JPY’s fall capped at the 200-day EMA at 90.75, from which the pair rallied to 92.83, the day’s high.

The AUD/JPY extends its gains on Thursdays, following the release of US economic data, which initially weighed on most G8 currencies but the greenback, but a risk-on impulse, propelled risk-perceived currencies, namely the Australian dollar. Therefore, the AUD/JPY is trading at 92.68, above its opening price by 0.56%,

US equity indices are set to finish the session with more than 2% gains each. Earlier, US inflation data was reported, with headline CPI rising by 8.2% YoY, less than estimates. The so-called core CPI, which excludes volatile items, surprisingly jumped more than the 6.5% expected YoY, up by 6.6%. Therefore, market participants had priced in a ¾ percent Federal Reserve rate hike at November’s meeting.

The AUD/JPY dived on the news release but bounced off the lows, under 91.00, and staged a comeback above 92.50, a 150 pip rally.

Aside from this, the lack of Aussie economic data leaves AUD/JPY traders leaning on market sentiment dynamics, which favored the AUD/JPY upside. Earlier in the month, the Reserve Bank of Australia decided to raise rates by 25 bps when markets were expecting a 50 bps increase, perceived by a dovish hike, with market participants flying away from the AUD, seeking return.

On the Japanese front, Bank of Japan Governor Haruhiko Kuroda said that one-side moves in the yen driven by speculation are bad for the economy. Kuroda noted “Yen depreciation may have a good impact on the macroeconomy as a whole, but there are some sectors which are suffering.”

Furthermore, Kuroda commented that the BoJ would continue its monetary easing program to achieve the inflation 2% target in a stable and sustained manner.

All that said, the RBA’s dovish hike, and BoJ’s dovish stance, would likely bolster the AUD/JPY. So traders should expect further AUD appreciation after achieving the bearish-flag pattern target, opening the door for further gains.

Next, the Japanese economic calendar will feature M2 Money Supply, while the Aussie’s docket is empty. AUD/JPY traders should also be aware of China’s calendar, which will feature PPI, CPI, and its Trade Balance.

Also read: AUD/JPY Price Analysis: Retraces from around 92.30s on dampened mood

AUD/JPY Key Technical Levels

-

21:07

Forex Today: Dramatic U-turn after US inflation misses expectations

What you need to take care of on Friday, October 14:

US inflation put market players on their toes on Thursday and was behind some wild, volatile moves.

According to the official release, the US Consumer Price Index was up by 8.2% YoY in September, above the 8.1% expected, although easing for a third consecutive month. The core annual inflation, on the other hand, reached a fresh multi-year high of 6.6%. The initial reaction to the news was negative. Wall Street plummeted, yields soared, and the dollar surged. However, markets changed course after the opening bell, and the greenback ended the day with losses against most major rivals.

Fed swaps fully price a 75 bps rate hike in November and a peak policy rate of 4.85% in March 2023. Pretty much the same picture that we had before the release, partially explaining equities comeback. No news was seen as good news after second thoughts.

Additionally, there was again noise coming from the UK. Rumors and back and forth about the United Kingdom’s mini-budget ended, favoring the Pound demand and adding pressure on the American currency. Speculative interest now believes there won’t be tax cuts, while there were market talks pointing out exactly the opposite. Chancellor of the Exchequer, Kwasi Kwarteng, was expected to make an announcement, but he ended up saying there would be more details on the budget on October 31.

On a down note, things between Russia and Ukraine are going no better. Russia said Ukraine's accession to NATO could ignite a third-world war. Also, coronavirus-related restrictions in Shanghai, China, fueled fears of another massive lockdown in the region. Meanwhile, German Health Minister Karl Lauterbach calls for the reintroduction of mask mandates, citing a "sharp increase" in covid cases.

EUR/USD trades around 0.9770, while GBP/USD holds on to substantial gains around 1.1315. Commodity-linked currencies plummeted ahead of Wall Street’s opening but managed to post gains against the dollar. AUD/USD hovers around 0.6300 while USD/CAD is down to 1.3740.

USD/JPY reached a fresh multi-decade high of 147.66. Investors fear a potential BOJ intervention after the pair resumed its advance.

Gold finished the day in the red, despite off its intraday low, now trading around $1,663 a troy ounce. Crude oil prices were up, with WTI now changing hands at around $89 a barrel.

Wall Street was extremely volatile. The Dow Jones Industrial Average added roughly 850 points after trading over 500 points in the red ahead of the US inflation release. The S&P 500 and the Nasdaq Composite added over 2% each.

The Asian session will bring Chinese inflation and trade data, which could affect the market’s sentiment. Later on Friday, the US will publish US Retail Sales.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: The beginning of a crypto winter

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:01

NZD/USD's recovery from 0.5515 low stalls below 0.5655

- The Kiwi retraces previous losses before hitting resistance at 0.5655.

- The dollar loses ground as the impact of the US CPI report wanes.

- NZD/USD: Below 0.5700 more weakness is likely – UOB.

The New Zealand dollar has bounced strongly from session lows near 0.5500 retracing all the ground lost after the release of the US CPI report. The pair turned positive on the daily chart before hitting resistance at the 1.5655 area.

The kiwi picks up with the USD pulling back from highs

The greenback has lost ground through the US trading session, as the market digested the unexpectedly high US inflation figures released in September’s CPI report.

According to the US Bureau of Labor Statistics, consumer inflation accelerated at a 0.4% pace in September, and 8.3% year-on-year, beating expectations of 0.4% and 8,1% respectively. These figures boosted hopes of a 100 basis point hike in November and pushed the US dollar higher across the board.

In New Zealand, the focus is on the release of September’s Business NZ PMI due later today. Business activity is expected to decelerate to 52.5 from 54.9 the month before, probably as a result of the hawkish turn of the Reserve Bank of New Zealand.

NZD/USD could weaken further while below 0.5700 – UOB

According to FX analysts a UOB, however, the pair remains skewed to the downside while below 0.5700: “Despite dropping to a fresh year’s low of 0.5561 earlier this week, downward momentum is not strong. However, as long as the ‘strong resistance’ at 0.5700 is not breached, NZD could weaken further. That said, any further decline is expected to face solid support at 0.5535.”

Technical levels to watch

-

21:00

US dollar bears pile in despite red hot inflation, eyes on 110.00 as the box breaks down

- The US dollar is in the hands of the bears despite US CPI data.

- The market is moving out of a speculative US dollar position.

As measured by the DXY index, the US dollar has been a mixed bag on Thursday, initially rallying on the back of the red-hot US inflation data only to fall into the hands of the bears, dropping by 1% to almost 112.14 as risk sentiment returned to markets. At the time of writing, the DXY index is down by some 0.66% having fallen from a high of 113.92 to a low of 112.147 so far.

Hot US CPI burns Fed pivot sentiment

First off, US inflation eased less than expected in September to 8.2%, and underlying prices excluding energy and food prices accelerated to a new four-decade high.

- US CPI (MoM) Sep: 0.4% (est 0.2%; prev 0.1%).

- US CPI (Y0Y) Sep: 8.2% (est 8.1%; prev 8.3%).

- US CPI Core (M0M) Sep: 0.6% (est 0.2%; prev 0.6%).

- US CPI Core (Y0Y) Sep: 6.6% (est 6.5%; prev 6.3%).

Core CPI gained at its highest annual pace in 40 years, rising 0.6% for the month and 6.6% for the year and Fed funds futures are now pricing in 75 bps in December, up from 50. Moreover, terminal rate expectations rose to 4.85% in March. As a consequence, the 10-year Treasury yield rallied to 4.080% while the 2-year yield was up to 4.535%.

Following the CPI report, the DXY index shot higher to 113.92 but dropped sharply shortly after as the US stock market regained ground. Nevertheless, sky-high inflation shows no signs of easing and investors are now pricing in 91% odds of a fourth straight 75-basis-point hike by the Fed at its meeting next month, with some also pricing in a 9% chance of a 100 bps rise. The possibility of a 100 basis points increase in November has also reared its head, though it's currently seen as unlikely, with only a 9% probability. The bottom line, there are no chances of a near-term dovish pivot from the Fed.

However, some price discovery made its way onto Wall Street with no sellers left as the benchmarks danced around a 50% retracement of the March 2020 bull market. Investors are turning their attention to the third-quarter earnings at the end of the week. At 3.33 p.m. ET, the Dow Jones Industrial Average was up 880 points, or 3.00%, at 30,090 and had recovered from the low of the day down at 28,660.94. The 10-year Treasury yield is still up 1.44% but below the 4.080 highs, around 3.952% and the DXY sags down 0.69% on the day.

US dollar technical analysis

The price is now making a technical case for the downside in a sell-the-fact scenario. The bears are pressing below Tuesday's low, Nonfarm Payroll's high, and trendline support. While below 112.50, there is plenty of space to go until last week's low near 110 the figure.

-

20:07

EUR/JPY Price Analysis: Testing key resistance at 144.00

- EUR/JPY has reached an important resistance area at 144.00.

- The daily chart shows a bullish triangle formation.

The euro appreciates on Thursday for the third consecutive day to retrace last week’s reversal and return to a key resistance area at 144.00, which is being tested at the time of writing.

The pair lies right now at the point where bulls were capped in early October, September 20, and also on June 20, 22, 23, and 28. That resistance line and the bullish trendline support from early August lows are forming an upward triangle pattern.

Furthermore, the 50 and the 10-day moving averages are featuring a bullish crossover, while the RSI shows some room before hitting overbought levels.

This might encourage bulls to break above the mentioned 144.00, aiming for September 12 high at 145.65 ahead of the 2014 high of 149.65.

On the downside, immediate support lies at 140.85 (October 10 low) ahead of trendline support at 140.35. Once below here, bears might take over, pushing the pair towards September lows at 137.30.

EUR/JPY daily chart

Technical levels to watch

-

19:38

USD/CAD Price Analysis: Bears eye 1.3500 key week low

- USD/CAD bears are moving in and eye a run to last week's lows.

- The current 15-min chart's M-formation could be key in this regard.

USD/CAD bears are back in the driver's seat as the market is a wash with US dollar longs that are being squeezed despite the red-hot US inflation data on Thursday. A resurgence in the oil price is also benefitting the loonie in late afternoon trade on Wall Street which has flipped risk-on. The following is a top-down analysis that arrives at a bearish thesis for the days ahead while below last week's highs of near 1.3850.

USD/CAD weekly chart

The price has reached a weekly resistance area and a correction could be on the cards for the meantime before the next move up.

USDCAD daily chart

The daily chart is also encouraging bears to the table, having spiked and pinned out on the day so far. The bears, however, need to get below the horizontal and trendline support around 1.3680.

USD/CAD H1 chart

The hourly chart shows the price at the upper end of a box. Therefore, the path of least resistance is to the downside at this juncture with the market having peaked out on Thursday's CPI rally. The highs and lows of the significant days are plotted on the chart and the break of Friday 7 low will be a significant development.

USD/CAD M15 chart

The price has carved out a 15-minute M-formation and should the price hold below it on a restest, followed preferably by a bearish engulfment of the current bullish correction, then the bears will be on track for further downside before the week is out.

-

19:33

GBP/JPY Price Analysis: Soars more than 300 pips, eyeing 168.00

- GBP/JPY advances sharply, more than 2.20%, hitting a fresh one-month high, though the rally stalled.

- The GBP/JPY is upward biased but might dip to 164.80, as the pair is overbought, as shown by the hourly chart RSI.

The GBP/JPY rallies sharply in the North American session as a risk-on impulse keeps US equities extending their gains after tumbling on a high US inflation report. Also, rumors of a possible U-turn on the UK’s tax-cut budget presented in September keep the British pound buoyant. At the time of writing, the GBP/JPY is trading at 166.56.

GBP/JPY Price Forecast

The GBP/JPY reached a new October high of 167.27 after the pair cleared the 100-day EMA of 163.17 while also clearing 165.71, last week’s high, exacerbating a rally above the 167.00 figure. Nevertheless, the uptrend lost steam as European traders got off their desks. Despite the sharp 300 pip rally, the Relative Strength Index (RSI) is in positive territory, suggesting buyers are getting a respite before challenging 167.94, September’s high.

The GBP/JPY one-hour chart shows the price is overextended, as the Relative Strength Index (RSI) is overbought. Therefore, the pullback from daily highs opens the door for an extended mean reversion move before resuming the uptrend.

Hence, the GBP/JPY first support would be the confluence of a 38.2% Fibonacci retracement and the R2 pivot around 165.38/61, followed by the 50% Fibonacci level at 164.79. A break below will expose the intersection of the 20-EMA and the R1 daily pivot around 164.21/31, from which the cross-currency could rally to challenge 167.94.

GBP/JPY Key Technical Levels

-

19:13

Gold Price Forecast: XAU/USD picks up from lows and returns above $1,670

- Gold bounces up from $1,642 lows and returns to the $1,670 area.

- The US dollar pulls back after the post-CPI rally.

- XAU/USD remains weak, capped below $1.680.

Gold futures are retracing previous losses during Thursday’s US trading session, favored by a broad-based USD pullback. The yellow metal has bottomed at a two-week low of $1,642 before returning to 4 1,670 at the time of writing.

The dollar gives away gains after a post-CPI rally

The greenback is losing ground after the bullish reaction triggered by the release of US CPI data. Consumer prices increased at a 0.4% pace in September, beating expectations of a 0.2% rise, which boosted hopes of a 100 basis point rate hike by the Federal Reserve in November.

Federal Fund Futures priced in a 13% chance that the Federal Reserve could accelerate its hiking pace at the next month’s meeting. The Dollar Index (DXY) rushed higher, to hit a session high right below 114.00, nearing the recent 20-year high of 114.70.

The US dollar seems to have lost steam, as the market confronts the data with the slight dovish tilt observed in September’s FOMC minutes released on Wednesday.

XAU/USD: Upside attempts remain capped below $1,685

The precious metal has reversed losses on Thursday, yet, the near-term bias remains negative, with the pair capped below October 11 high at $1,685. A confirmation above that level might increase bullish momentum, to advance towards $1,730 (September 12 high), ahead of early August highs right above $1,800.

On the downside, initial support lies at $1,650/60 (mid-September lows), and below here, October 3 low at $1,612 and then probably April 2020 low at $1,575.

Technical levels to watch

-

18:46

US stocks are whipsawed around US CPI, benchmarks firmly back in the green

- US stocks rebound in midday trade despite the US CPI print.

- Bulls have stepped in at a bargain on Wall Street.

US stocks are roaring back into positive territory, putting on a short squeeze following the pre-market and opening sell-off that ensued on the back of red-hot Consumer Price Index data. Stocks plunged to lows for the year but bulls moved in at a big discount, sending the Dow Jones and S&P 500 higher by as much as 2% at one point.

Red hot US CPI

Trading was dominated by the release of consumer price figures:

- US CPI (MoM) Sep: 0.4% (est 0.2%; prev 0.1%).

- US CPI (Y0Y) Sep: 8.2% (est 8.1%; prev 8.3%).

- US CPI Core (M0M) Sep: 0.6% (est 0.2%; prev 0.6%).

- US CPI Core (Y0Y) Sep: 6.6% (est 6.5%; prev 6.3%).

Core CPI gained at its highest annual pace in 40 years, rising 0.6% for the month and 6.6% for the year and Fed funds futures are now pricing in 75 bps in December, up from 50. Moreover, terminal rate expectations rose to 4.85% in March. As a consequence, the 10-year Treasury yield rallied to 4.080% while the 2-year yield was up to 4.535%.

The report follows data on Wednesday that showed US producer prices increased more than expected in September and combined with CPI, traders in the money markets are pricing in a near 91% odds of a fourth straight 75-basis-point hike by the Fed at its meeting next month, with some also pricing in a 9% chance of a 100 bps rise.

Nevertheless, some price discovery is coming into the markets ahead of the third-quarter earnings at the end o the week while the indexes trail along the bottom of a 50% correction of the March 2020 rally. At 1.33 p.m. ET, the Dow Jones Industrial Average was up 851 points, or 2.93%, at 30,062 and had recovered from the low of the day down at 28,660.94. The S&P 500 was up 93.80 points to 2.62% while the Nasdaq Composite was up 253 points, or 2.34%%, at 11,037.

S&P 500 weekly chart

At a 50% mark of the March 2020 bull market, the index is carving out an M-formation that would be respected to see the market move in on the neckline with a 50% mean reversion falling in at the month's highs so far near 3,806.

-

18:45

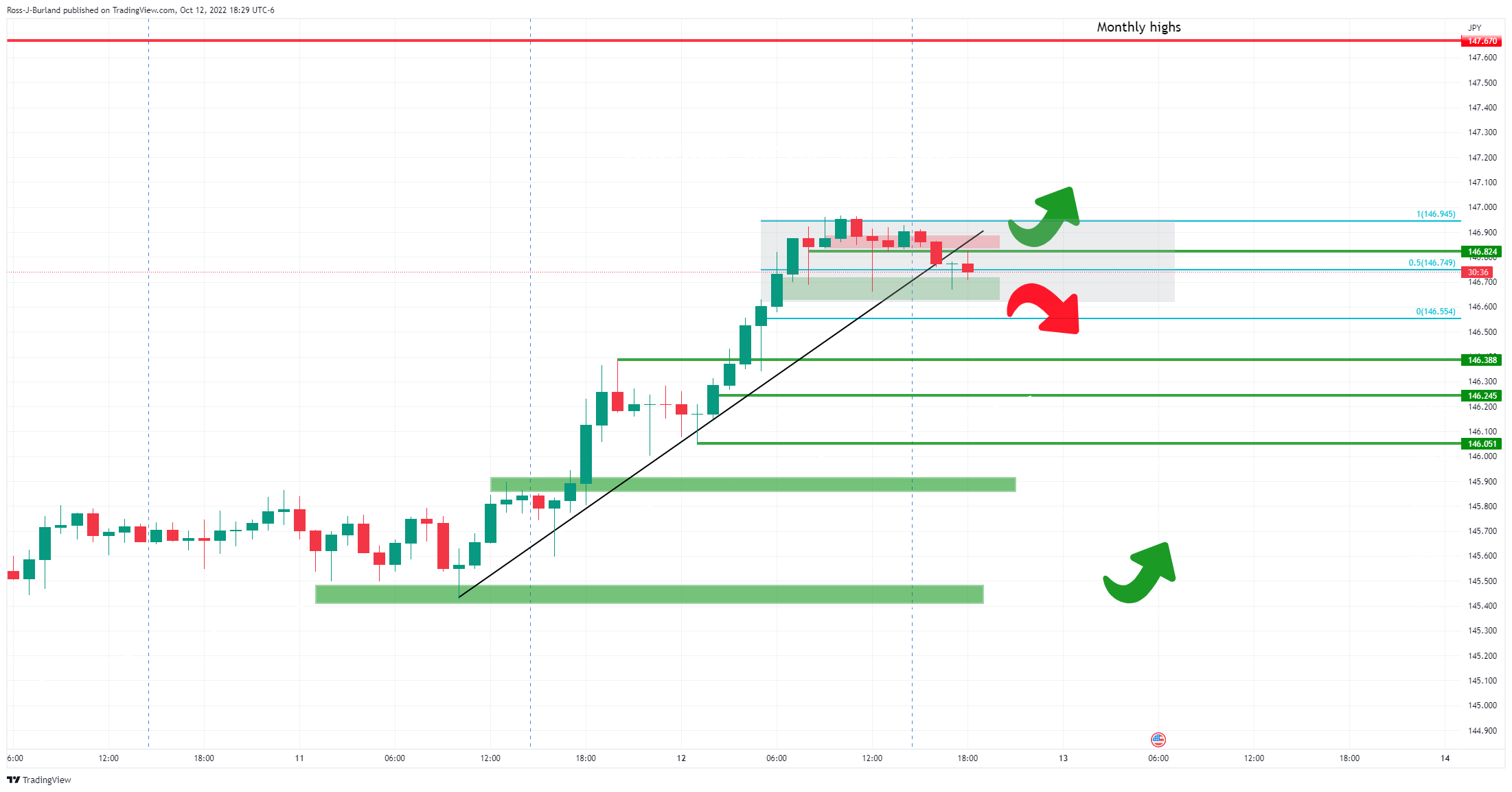

USD/JPY Price Analysis: Retraces from 24-year highs around 147.60s on soft US dollar

- USD/JPY reached a fresh 24-year high at around 147.67 due to US inflation numbers.

- Once the dust settled down, the greenback weakened, so the USD/JPY traded back below 147.00.

The USD/JPY is paring its gains below the 147.00 figure after registering fresh 24-year highs courtesy of US inflation data, sparking a jump in US Treasury yields, as expectations for further Fed tightening increase, with traders fully pricing a 0.75% hike on November. The USD/JPY is trading at 146.88, below its opening price by 0.02%.

On Thursday’s session, the USD/JPY surprisingly edged higher despite verbal interventions by Japanese authorities. In the Asian session, Japanese Finance Minister Shunichi Suzuki commented that he’s worried about recent forex volatility involving the JPY while saying that authorities are focused on FX volatility rather than the USD/JPY exchange rate.

Therefore, USD/JPY traders perceived that as a green light, so the pair surrendered the 147.00 figure.

USD/JPY Price Forecast

The USD/JPY daily chart confirms the pair as upward biased, though price action is beginning to flash signs that it’s overextending. The major printed a daily high at around May 1998 high of 147.67, but the USD/JPY retraced towards current exchange rates on worries of another intervention in the FX markets. USD/JPY traders should know that a break above 147.67 would open the door toward 150.00.

The USD/JPY, one-hour time frame, suggests the pair tested the R1 daily pivot at 147.38 four times, while the Relative Strength Index (RSI) printed a lower high, suggesting that a negative-divergence formed, sending the USD/JPY sliding from the daily high of 147.62 to the 20-EMA at 146.93. That means that as the exchange rate rose, sellers were gathering momentum.

Additionally, the RSI is accelerating toward crossing the central line, further cementing the case for a correction. Therefore, the USD/JPY first support would be the confluence of the 50-EMA and the daily pivot at around 146.49/57. Break below will expose the confluence of the 100-EMA and the S1 daily pivot point at 146.01/06, followed by a fall to the 200-EMA at 145.35.

USD/JPY Key Technical Levels

-

18:24

GBP/USD’s rally from 1.1050 finds resistance right below 1.1400

- The pound hits resistance at 1.1400 after a 300-pip rally.

- News of a U-turn on the UK fiscal plan boost the cable.

- GBP/USD seen between 1.00 and 1.10 over the coming months – UBS.

The pound seems to be taking a breather as the impressive 300-pip rally from the 1.1060 area has found sellers at 1.1380 before pulling back to the lower range of 1.1300. The pound remains positive on daily charts after having appreciated beyond 3% over the last two days.

Hopes of a U-turn on the UK fiscal plan have boosted the pound

News reporting that the UK Government might be discussing increasing corporation tax next year, thus reversing the mini-Budget that roiled markets last month has been welcomed by investors.

Furthermore, the Financial Times reported on Wednesday that the Bank of England might have agreed privately with lenders on the possibility of extending bond purchases beyond Friday, the day announced as the deadline for the emergency plan. This has contributed to ease negative pressure on the cable.

In this backdrop, the market has overlooked the gloomy macroeconomic data released on Wednesday. National statistics data revealed that UK economy contracted at a 0.3% pace in September, against expectations of a flat performance, on the back of a 1.6% slump in Manufacturing production.

GBP/USD seen between 1.00 and 1.10 in the coming months – UBS

From a wider perspective, FX analysts at UBS see the pair capped below 1.10 over the next months: “With markets still concerned about the viability of the government’s fiscal plans, we think the pound will likely remain volatile, trading in a range of 1.00-1.10 against the US dollar over the coming months (…) Worries over the financial stability of the UK is also feeding into broader market risk aversion – which is also positive for the US dollar.”

Technical levels to watch

-

18:02

United States 30-Year Bond Auction climbed from previous 3.511% to 3.93%

-

17:40

AUD/USD regains lost ground an returns to levels near 0.6300

- The aussie bounces up from six-month lows at 0.6170 and returns to 0.6300.

- The US dollar losses ground as the effect of US CPI data ebbs.

- AUD/USD might depreciate below 0.6000 – ING.

The Australian dollar is going through a sharp recovery during Thursday’s US session erasing loses from earlier on the day. The pair has bounced from six-month lows at 0,6170, returning to levels right below 0.6300 and turning positive on the day.

The US dollar retreats from highs

The Aussie pares losses with the US dollar losing ground as the effect of the US inflation report start to settle. Investors might be coming to terms with the idea that a 100 BP rate hike in November is rather unlikely, especially after the moderately dovish tone of September’s FOMC minutes.

According to the US CPI data, prices accelerated at a 0.4% pace in September, well beyond expectations of a 0.2% increase, with the year inflation surging 8.2% higher. These figures triggered hopes that the Federal Reserve could increase borrowing costs at a more aggressive pace in November.

Federal Fund Futures have priced in a 13% chance of a 100 basis points rate hike immediately after the data release and the US dollar surged across the board. The US Dollar Index (DXY) appreciated to a fresh-24-year high at 114.70 to pull down to the 112.00 area at the moment of writing.

AUD/USD might extend losses below 0.6000 – ING

On a longer-term perspective, currency analysts at ING, observe see the Aussie likely to extend its decline to levels below 0.6000: “We remain bearish on AUD/USD into year-end, as risk sentiment fragility, China’s economic (and currency) woes and a strong USD (…). A break below 0.60 this year is entirely possible.”

Technical levels to watch

-

17:31

EUR/USD makes a U-turn, climbing to daily highs nearby 0.9800 after hot US inflation

- EUR/USD dived to a daily low of 0.9631 as a reaction to US inflation, but stages of recovery.

- US core CPI reached a 40-year high at 6.6% YoY, as Fed odds for further tightening increase.

- US jobless claims were higher-than-estimated, flashing signs of the labor market easing.

The EUR/USD is recovering from earlier losses as inflation in the United States rose above estimates, continuing to test Fed members’ patience. Core CPI in the US jumped to a four-decade high, exceeding forecasts, cementing the case for further Fed tightening at November’s meeting. Hence, the EUR/USD is trading at 0.9775, after sliding to 0.9631 daily low, as traders reacted to US data.

US equities are trading in the green as sentiment shifted positively. The US Department of Labor reported that inflation in the US, mainly core CPI, jumped more than estimated by 6.6% YoY, topping August 6.3%. Contrarily, headline inflation edged lower from the previous month’s 8.3% to 8.2%, almost 1% lower than June’s 2022 peak.

The knee-jerk reaction sent the EUR/USD tumbling to its daily low and the S1 daily pivot, but of late, as investors’ mood changed, the shared currency is trading with solid gains of 0.81%.

At the same time, US jobs data was released. Unemployment claims for the past week ending on October 8 rose by 228K, higher than the 225K foreseen by street’s analyst, though US inflation figures overshadowed data.

Elsewhere, money market futures are repricing odds for the Fed’s next move. The CME FedWatch Tool portrays a 99% chance that the Fed will lift rates 75 bps in November and a 62.3% chance of a ¾ of a percent move for the year’s last meeting.

On the EU’s side, the Bundesbank and Belgium’s central bank chiefs, Joachim Nagel and Piere Wunsch, prompted the ECB for more interest rate hikes due to high inflation levels in the Eurozone. During the European session, German inflation figures rose as expected but persisted at high levels, as shown by HICP at 10.9%, while German CPI remained at 10%.

What to watch

The Eurozone economic calendar will feature inflation readings for France, and Spain, alongside the EU’s Trade Balance. On the US front, US Retail Sales, UoM Consumer Sentiment, and further Fed speakers will offer fresh impetus for EUR/USD traders.

EUR/USD Price Forecast

The EUR/USD daily chart shows the pair remains as downward biased, trading below the DMAs. At the time of typing, the exchange rate is testing the 20-day EMA, which, if cleared, could send the EUR/USD toward the 50-day EMA at 0.9956. Nevertheless, it should be noted that unless buyers break above the October 4 daily high at 0.9997, the downtrend is intact; otherwise, it would shift the bias to neutral downwards, opening the door for a test of the 100-day EMA at 1.0170.

-

17:27

US September CPI likely locks another 75 bps rate hike at next FOMC meeting – Wells Fargo

US inflation data released on Thursday triggered sharp moves across financial markets. According to analysts at Wells Fargo, today's report likely locks the Federal Reserve into another 75 basis points rate hike at its next meeting in November. They point out that past November, they are confident that inflation should move discernibly lower in the coming months.

Key Quotes:

“The Consumer Price Index rose 0.4% in September, once again coming in above consensus expectations and demonstrating that inflation continues to bear formidable momentum. Excluding food and energy prices, core CPI inflation rose 0.6% in September and 6.6% over the past year—a fresh cycle high. Lower gasoline prices once again put downward pressure on inflation.”

“Gradually slowing inflation as well as increasingly tight monetary policy should give the FOMC the breathing room it needs to slow the pace of tightening from its current 75 bps per meeting trajectory. However, there are likely to be some bumps along the way that keep the Fed's guard up over the next few months.”

“Lower gasoline prices have been a powerful balm on inflation this summer, but in recent weeks gas prices have again headed higher in a still-fraught geopolitical environment. Moreover, with core CPI running at a 6.0% annualized pace the past three months, there remains a long way to go before the trend in inflation reaches a pace the Fed can live with.”

-

17:15

USD/CAD retreats more than 200 pips from two-year highs

- US dollar reverses sharply across the board, DXY turns negative.

- US CPI comes in above expectations, triggering volatility.

- USD/CAD sharp reversal, if sustainable, could suggest a top.

The USD/CAD jumped dramatically after US CPI data and then pulled back even with more drama, falling almost 250 pips from the peak. The pair hit the highest level in two years near 1.4000 and as of writing, it is hovering around 1.3750.

Reversal all around

The US September Consumer Price Index came in above expectations and triggered a decline in Wall Street, in Treasuries and a rally of the US dollar. All those moves have been reversed. The Dow Jones is up by 1.73% or 505 points, after a 900-point reversal.

The outcome of the US CPI warrants another 75 basis points rate hike from the Fed at the November meeting. Some analysts could even mention the odds of an even larger hike, but it seems unlikely. The news is that inflation is not pulling back in the US.

The reversal of the US dollar across the board could point to an interim top. In the case of USD/CAD, the move takes place after approaching the psychological 1.40 zone. If the pair manages to rise back above 1.3850 a test of 1.40 would be back on the cards.

On Friday, during the Asian session Chinese CPI data is due. Later, is the turn of US September Retail Sales and Canadian Manufacturing Sales.

Technical levels

-

16:51

EUR/GBP approaching 0.8600 as the pound surges on the UK tax U-turn

- The euro dips below 0.8700 to hit 5-week lows near 0.8600.

- Rumors of a U-turn on the UK tax plan boost the sterling.

- Longer-term, the pound will suffer on liquidity concerns – Danske Bank.

The euro is depreciating sharply against a stronger British pound on Thursday. The pair has extended its reversal from week lows near 0.8870 on Wednesday, to levels right above 0.8600, its lowest price since early September.

GBP rallies on rumours about a U-turn on the UK fiscal plan

Unfazed by the impact of the US inflation data, the pound is rallying against most majors, boosted by news that the UK Government might be discussing changes in the mini-Budget that roiled markets last month.

Furthermore, additional reports pointing out the possibility that the Bank of England might extend bond purchases beyond Friday, the day announced as the deadline of the emergency plan earlier this week, have contributed to easing pressure on the cable.

In absence of first-tier macroeconomic indicators in the UK or the Eurozone. The enthusiasm about the fiscal plan seems to have offset the potential negative impact of a series of downbeat UK data released on Wednesday.

According to National Statistics, the UK economy contracted at a 0.3% pace in September, against expectations of a flat reading and following a 0.2% increase over the previous month. Beyond that, manufacturing production slumped at a 1.6% pace also against expectations of a 0% reading.

EUR/GBP seen at 0.89 in the next three months – Danske Bank

Currency analysts at Dnske Bank are showing little confidence on the current GBP recovery as they see the pound suffering on liquidity concerns: “We forecast EUR/GBP at 0.89 in 3M as we expect to see fragile risk appetite, where liquidity concerns weigh on GBP. Further out, we remain cautiously optimistic that the cross will head lower as a global growth slowdown and the relative appeal of UK assets to investors are positive for GBP relative to EUR.”

-

16:32

United States 4-Week Bill Auction up to 3.25% from previous 2.92%

-

16:29

NZD/USD rebounds sharply from two-year lows as USD reverses

- US Dollar jumps after US CPI, loses momentum during last hours.

- US stocks recover after slide, turn positive.

- NZD/USD bottoms slightly above 0.5500, then rebounds sharply.

The NZD/USD tumbled in a few minutes from 0.5630 to 0.5510, reaching the lowest level since March 2020 following the release of US CPI data. Later the pair recovered ground rising back toward 0.5600.

Volatile hours

The greenback rose sharply immediately after the September US CPI that showed higher-than-expected readings. The Consumer Price Index rose 0.2% in September above the 0.1% of market consensus. The annual core rate hit a new decade high at 6.6%.

Those numbers triggered sharp moves that are still taking place. The dollar jumped as US yields soared to fresh multi-year highs. Later a rebound in equity prices in Wall Street weakened the dollar triggering a reversal that pushed NZD/USD back to 0.5600.

The NZD/USD could face resistance at 0.5620 before the daily high at 0.5635/40. If the pair rises above 0.5740 it would alleviate the bearish pressure. A slide back under 0.5760 would expose the recent lows again.

Technical levels

-

16:24

Silver Price Forecast: XAG/USD drops below $19.00 due to hot US CPI, US bond yields rising

- Silver prices tumble from $19.30s daily highs below $18.80.

- US core inflation expanded at a 40-year high, at 6.6% YoY.

- US October’s data so far justifies another 75 bps rate hike by the Fed.

Silver price tumbles below $19.00 on the news reported by the Department of Labor, revealing that inflation in the US remains stubbornly stickier, particularly core figures, surpassing the 6.5% threshold at 4-decade highs. At the time of writing, XAG/USD is trading at $18.81 a troy ounce, down by 1.40%.

XAG/USD tumbles after hot US CPI, as traders brace for further Fed rate hikes

US data revealed in the US showed that inflation per the headline and core measure persists at high levels, with core CPI exceeding estimates at 6.6% YoY, higher than August’s 6.3%, blamed principally on transportation services, medical care, and shelter. In the meantime, headline inflation, namely, the Consumer Price Index, expanded at an 8.2% pace YoY, less than the previous reading, almost 1% down from its peak on June 2022.

The market’s reaction immediately sought safety, propelling US Treasury bond yields higher, with 2s, and 5s, reaching 4.46% and 4.24%, respectively, as traders brace for another jumbo rate hike by the Fed at November’s meeting.

Similarly, the US 10-year benchmark note is yielding 3.98%, down from its 4.08% reached earlier on the release of hot US inflation. The US Dollar Index, a gauge of the buck’s value vs. a basket of peers, is pairing its earlier gains, down 0.03% at 113.169, after hitting a daily high of 113.920.

Elsewhere, US Initial Jobless Claims for the week ending on October 8 came at 228K, above the previous week’s reading, exceeding estimates of 225K. Even though it flashed that the labor market is easing, last week’s US Nonfarm Payrolls report showed the contrary.

Given the backdrop, Federal Reserve odds of a 75 bps rate hike are fully priced in, as shown by the CME FedWatch Tool, at 99%.

Therefore, XAG/USD would likely continue to extend its losses after hitting a daily high at $19.30, to collapse below $18.70, weighed by high US Treasury bond yields. Also, traders should take cues from real yields or use as a proxy, US Treasury Inflation-Protected Securities (TIPS), with the 10-year yielding as high as 1.757%, though stabilized, at the time of press, is around 1.658%.

Source: ReutersNext in the US calendar, further Fed speaking is expected, with Atlanta’s Fed President Raphael Bostic being the first to cross wires, following the US inflation report. On Friday, US Retail Sales and the University of Michigan Consumer Sentiment will update the status of the US economy.

XAG/USD Key Technical Levels

-

16:00

United States EIA Crude Oil Stocks Change came in at 9.88M, above forecasts (1.75M) in October 7

-

15:59

US dollar still has room to rise, but the path will not be lineal – TDS

The US dollar remains best in class. That said, strategists at TD Securities reckon that the next phase of USD resilience will be less linear than it has been this year.

More bad news for the Federal Reserve

“With MoM core CPI showing no ebbing in momentum, the implication is pretty clear here: the Fed has to keep going at 75 bps increments and the USD remains best in class.”

“Until we see a few months of moderation in core MoM CPI, it is going to renege on USD resilience. We have stipulated that we will need at least 2-3 months of evidence of slowing momentum. This print pretty much confirms we will not see that this year and may be a Q1 story at the earliest.”

“There is no alternative to the USD, particularly as a G10-led, and in some cases a self-inflicted (like the UK), balance of payments crisis.”

“There has been speculation about whether USD strength will be too much. But until the stock of global FX reserves – which is a lot – runs down significantly (far from it), there is still runway before we should really be concerned. That said, the next leg up will be a bit more difficult to achieve given concern about market functioning.”

-

15:57

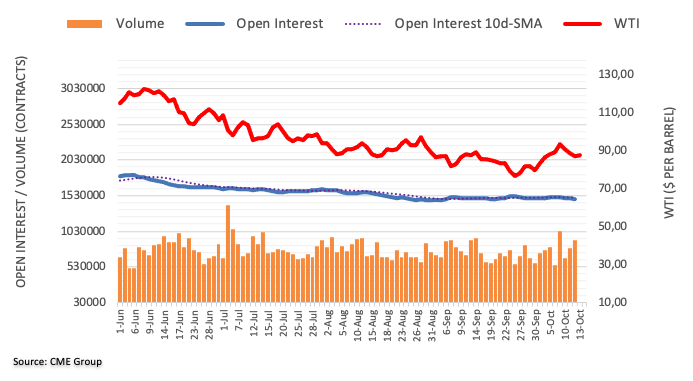

WTI pressured below short term bearish trendline in CPI induced risk-off markets

- WTI presses up against key resistance near $88.00.

- The bulls eye a break of trendline resistance and eye $90.00.

West Texas Intermediate, WTI is under pressure following a hot inflation report in the US that has sent markets into a tailspin. At the time of writing, WTI is down around 0.6% having fallen from a high of $88.02 to a low of $85.58.

Before the CPI print, the price of oil was already under pressure due to the International Energy Agency (IEA) that has warned last week's two-million-barrel-per-day production cut by OPEC+ threatened to tip the global economy into recession. The agency has it lowered its demand forecast for the remainder of this year and 2023. In its influential monthly Oil Market Report, the IEA said OPEC+ supply cuts "may prove the tipping point for a global economy already on the brink of recession."

Meanwhile, analysts at TD Securities have argued that, ''fundamentally, energy supply risks are rising, with an Iran deal off the table, Russian production starting to slump at a faster clip, the US SPR releases set to grind to a halt and EU sanctions on Russian crude coming to effect this December.''

''With diesel cracks at their highest levels in several decades and gasoline cracks soaring, demand has outperformed expectations. Chinese mobility as measured by our tracking of road traffic for the top 15 cities by vehicle registrations also suggests that Chinese demand is firming once more. The right tail in energy prices is still fat.''

US CPI comes in hotter

In the United States reported inflation rose at a higher-than-expected pace in September, with prices climbing by an annualized 8.2% last month, down from August's 8.3% rise but above the consensus analyst forecast for an 8.1% increase.

The data arrived as follows:

- US CPI (MoM) Sep: 0.4% (est 0.2%; prev 0.1%).

- US CPI (Y0Y) Sep: 8.2% (est 8.1%; prev 8.3%).

- US CPI Core (M0M) Sep: 0.6% (est 0.2%; prev 0.6%).

- US CPI Core (Y0Y) Sep: 6.6% (est 6.5%; prev 6.3%).

The report is likely to firm the Federal Reserve's hawkish monetary policy stance and lead to more interest-rate hikes as the central bank looks to slow the US economy, raising recession risks.

WTI technical analysis

The price is trying to break the downside trendline leaving a W-formation behind which is a bearish formation on a downtrend, but it could lead to a bullish breakout if the bulls commit to support, as highlighted in the above chart with eyes on $90.00bbls.

-

15:54

BoE accepts 1.5460 billion GBP of offers in daily long-dated gilt purchase

The Bank of England (BoE) accepted 1.5460 billion sterling of offers in the daily purchase operation of conventional long-dated gilts, compared to 2.3754 billion sterling on Wednesday, Reuters reported on Thursday.

The BoE rejected 297.2 million sterling of offers in the same operation.

Market reaction

The British pound continues to outperform its major rivals following this outcome. As of writing, the GBP/USD pair was trading at 1.1230, where it was up 1.2% on a daily basis. Meanwhile, the 2-year UK gilt yield was last seen losing 4.65% on the day at 3.82%.

-

15:46

USD/CAD could easily surpass the 1.40 level – TDS

The outlook for the loonie is bleak. USD/CAD rallied to 1.3977 after hotter-than-expected US inflation data and could break above the 1.40 mark, economists at TD Securities report.

Dips into 1.3800/50 are a buy

“Even if the next phase of USD strength is not as linear as it has been for much of this year, there is a lot of negative idiosyncratic risk coming the CAD's way with the debt servicing problem for households only in the early days.”

“While we have forecast 1.40 into year-end, it is no ceiling and it could very easily get worse for the CAD.”

“Dips into 1.3800/50 are a buy.”

-

15:37

US inflation still elevated, Fed to continue to raise interest rates sharply – Commerzbank

US inflation was again higher than expected in September. Further significant rate hikes are thus virtually certain, in the opinion of economists at Commerzbank.

Inflation data seal big rate hikes

“Today's figures confirm the Fed top officials' fear that inflation is more stubborn than previously expected. Even if energy prices settle down over the next few months, inflation is likely to fall only slightly and remain far higher than the Fed's 2% target.”

“The minutes of the latest FOMC meeting reflects the Fed's determination to bring inflation back under control. Monetary policy would have to become /appropriately/ restrictive to achieve this, and the Fed would have to maintain this course of action even in the event of a weakening labor market. Further significant rate hikes are thus virtually certain.”

“We continue to expect another large rate hike of 75 bps at the meeting in early November, and we forecast rates to peak at 5%.”

-

15:30

United States EIA Natural Gas Storage Change registered at 125B above expectations (123B) in October 7

-

15:04

USD/CHF marches on as US stocks fall off a cliff following hot US CPI

- USD/CHF bulls tally up fresh highs but market volatility shakes out the weak hands.

- Profit-taking has ensued following the US CPI print.

USD/CHF has rallied on the back of the hotter-than-expected US Consumer Price Index which has sent the US dollar, as per the DXY index, on a tear towards the 114.776 area and bull cycle. However, the markets are volatile and the greenback is falling back under pressure into the first 30 minutes of the cash open on Wall Street, potentially affected by some suspicious activity in USD/JPY.

Meanwhile, the US CPI data arrived as follows:

- US CPI (MoM) Sep: 0.4% (est 0.2%; prev 0.1%).

- US CPI (Y0Y) Sep: 8.2% (est 8.1%; prev 8.3%).

- US CPI Core (M0M) Sep: 0.6% (est 0.2%; prev 0.6%).

- US CPI Core (Y0Y) Sep: 6.6% (est 6.5%; prev 6.3%).

Sea of red after US CPI

The data is a blow to the Federal Reserve as their efforts to tame inflation have yet to show any significant signs that they are moving the needle. Hotter-than-expected US inflation numbers for both the core and headline measures have encouraged US short-term interest-rate traders to price in around one-in-ten chance of a 100-basis point fed rate hike in November, up from zero before the CPI report. Consequently, US benchmarks collapsed wth the Dow touching as low as 28,660 in a strong bearish opening gap from 28,983, around 1.8% lower. However, the Nasdaq Composite was the weakest major index, dropping by 3%, while the S&P 500 fell 2.6%.

No Fed pivot in sight

Forget about a Fed pivot with Fed funds futures now pricing in the odds of a 75 basis points move in December as well as November. ''Traders are now pricing in a rate hike of 64 basis points in December, up from 57 basis points before the data, which essentially implies a greater chance of a bigger hike. The possibility of a 100 basis points increase in November has also reared its head, though its currently seen as unlikely, with only a 9% probability,'' Reuters reported.

-

15:00

GBP/USD could retest multi-decade low in the coming months – RBC Economics

The new UK government’s fiscal plan prompted a sharp sell-off in Gilts and sterling. In the view of economists at RBC Economics, cable could retest its multi-decade low.

Bank of England can still send a message by ratcheting up to a 75 bps hike in November

“Sterling is up from its multi-decade low against the US dollar but we think that level could be re-tested in the coming months. Government energy support will help households but won’t fix the UK’s current account and budget deficits, and some currency adjustment will be needed to attract capital inflows.”

“We think the nearly 6% terminal rate now priced into the market (including moves of at least 100 bps at each of the remaining two meetings this year) is too aggressive.”

“We think the BoE can still send a message by ratcheting up to a 75 bps hike in November before reverting to a 50 bps increase in December. We’ve lifted our terminal Bank Rate forecast to 3.75% from 3% previously.

“While the BoE still plans to begin active QT at the end of October, we think that move could be delayed once again.”

-

15:00

BoE accepts 3.120 billion GBP of offers in index-linked gilt purchase

The Bank of England (BoE) accepted 3.120 billion sterling of offers in the second daily purchase operation of index-linked gilts, Reuters reported on Thursday.

The BoE rejected 56.4 million sterling of offers in the same operation.

Market reaction

The 2-year UK gilt yield is down more than 4% on the day at 3.83% after this development. The GBP/USD pair was last seen trading at 1.1205, rising 0.9%. Meanwhile, market participants keep a close eye on headlines surrounding the potential adjustments to the UK mini-budget.

-

14:47

GBP/USD Price Analysis: Bullish momentum falters near 1.1300 amid resurgent USD demand

- GBP/USD rallies for the second successive day and hits a one-week high on Thursday.

- Talks of a mini-budget U-turn by the UK government boost sterling and offers support.

- The stronger US CPI-inspired broad-based rally caps the pair near the 1.1300 mark.

The GBP/USD pair gains strong positive traction for the second straight day on Thursday and builds on the previous day's goodish rebound from a nearly two-week low. The momentum lifts spot prices to a one-week high, though falter near the 1.1300 mark following the release of hotter US consumer inflation figures.

The British pound gets a strong lift amid talks that the new UK government could reverse its vast tax cuts announced in the mini-budget in September. The intraday positive move, however, runs out of steam amid a strong pickup in the US dollar demand, bolstered by a stronger US CPI report and hawkish Fed expectations.

From a technical perspective, the GBP/USD pair found decent support on Wednesday near the 50% Fibonacci retracement level of the recent strong recovery from an all-time low. A subsequent move beyond the 100-period SMA on the 4-hour chart prompts some technical selling and contributes to the strong intraday move up.

Bulls, however, face rejection near the 200-hour SMA, which is currently pegged near the 1.1300 round figure and should act as a pivotal point. Meanwhile, technical indicators on the daily chart - though have been recovering from the negative territory - are yet to gain any meaningful traction and warrant caution for bulls.

Hence, it will be prudent to wait for a sustained strength beyond the 1.1300 mark before traders start positioning for any further appreciating move. The GBP/USD pair might then accelerate the momentum towards the next relevant hurdle near the 1.1370 region before aiming to reclaim the 1.1400 round-figure mark.

On the flip side, the 1.1120-1.1115 horizontal zone now seems to protect the immediate downside ahead of the 1.1100 level. Any further decline is likely to find decent support near the 1.1085 region (100-period SMA on the 4-hour chart), which is closely followed by the 38.2% Fibo. level, around the 1.1065-1.1060 zone.

A convincing break below the latter will suggests that the two-day-old uptrend has lost steam and shit the bias back in favour of bearish traders.

GBP/USD 4-hour chart

-638012654860732247.png)

Key levels to watch

-

14:39

UK's Kwarteng: Focused on delivering on mini-budget to get growth going again

When asked about reports of possible corporation tax plan reversal, UK Finance Minister Kwasi Kwarteng told BBC on Thursday that he is focused on delivering on the mini-budget to get growth going again, as reported by Reuters.

"It is a very dicey situation globally," Kwarteng added and noted that he speaks to Prime Minister Liz Truss all the time about delivering the growth plan.

Market reaction

These comments don't seem to be having a noticeable impact on the British pound's performance against its major rivals. As of writing, the GBP/USD pair was up 0.75% on the day at 1.1185.

-

14:29

EUR/USD to extend its downward trend amid geopolitical and recessionary risks – KBC Bank

EUR/USD is in a strong downward trend channel since February. Economists at KBC Bank expect the world’s most popular currency pair to remain under pressure.

Geopolitical and recessionary risks are bigger for Europe

“The dollar remains the main beneficiary of rising US (real) yields in a persistent risk-off context.”

“Geopolitical and recessionary risks are bigger for Europe, holding down the single currency as well even as the European Central Bank finally embraced on a tightening cycle.”

“Resistance stands at 0.9950/1.0050. The YTD low stands at 0.9536.”

-

14:29

USD/CAD bulls take control on hotter than expected US CPI

- USD/CAD bulls break key week and month highs.

- US CPI comes in hot and sends markets lower.

USD/CAD rallied to 1.3977 on the back of hotter-than-expected US inflation data in a highly anticipated Consumer Price Index report. The pair has rallied from a low of 1.3777 on the day and is currently 1.00% higher. The DXY index, which measures the greenback vs. a basket of currencies spiked to 113.92 with 114.80 on the radar, a touch above the September 28 highs.

US CPI comes in hot

The data arrived as follows:

- US CPI (MoM) Sep: 0.4% (est 0.2%; prev 0.1%).

- US CPI (Y0Y) Sep: 8.2% (est 8.1%; prev 8.3%).

- US CPI Core (M0M) Sep: 0.6% (est 0.2%; prev 0.6%).

- US CPI Core (Y0Y) Sep: 6.6% (est 6.5%; prev 6.3%).

Once again, hotter-than-expected US inflation numbers for both the core and headline measures are not seen as good news for the Federal Reserve or the US economy and US stocks don't like it. The S&P500 CFD is down some 2% ahead of the cash open at the top of the hour and gathering bearish momentum. The US short-term interest-rate traders see about a one-in-ten chance of a 100-basis point fed rate hike in November, up from zero before the CPI report. Consequently, Wall Street could be a bloodbath in the open and that is set to weigh on high beta currencies such as the dollar block, including CAD.

USD/CAD technical analysis

The bulls have burst through the week and month highs which could be expected to act as support on a retest.

-

14:23

Germany Current Account n.s.a. below expectations (€8.2B) in August: Actual (€0.6B)

-

14:19

Fed’s dovish pivot will have to wait – RBC Economics

A hawkish Federal Reserve and firm US inflation pushed Treasury yields to fresh highs. Economists at RBC Economics now see fed funds rising to 4.50-4.75% early next year.

Yield curve to flatten further in the coming months

“We continue to expect the US economy will slip into recession in the first half of next year with the jobless rate rising to 5% in the second half of 2023 (the Fed’s Q4/23 forecast is just 4.4%).”

“While we think the economy will ultimately fare worse than the Fed is projecting, we see little reason to push back against its near-term tightening plans. So the Fed’s dovish pivot will have to wait.”

“Our forecast now assumes another 75 bps hike in November followed by a 50 bps increase in December and 25 bps in February.”

“The yield curve is likely to flatten further in the coming months with longer-term yields expected to come down amid a softening economic backdrop and easing inflation, while a still-hawkish Fed will keep the front end sticky.”

-

14:11

EUR/USD drops to monthly lows near 0.9630 on US CPI

- EUR/USD loses the grip and retreats to 0.9630.

- US CPI rose more than expected in September.

- The probability of a 75 bps rate hike by the Fed picks up pace.

The single currency quickly abandoned the area of daily highs vs. the dollar and forced EUR/USD to drop to fresh 2-week lows near 0.9630 on Thursday.

EUR/USD sold-off on higher-than-expected CPI

The selling pressure in EUR/USD accelerates after the key US inflation figures came in on the strong side in September, with the headline CPI rising 8.2% YoY and 0.4% MoM. Same trend showed the Core CPI after rising 6.6% vs. the same month of 2021 and 0.6% from a month earlier.

Further data releases showed the usual weekly Claims rose by 228K in the week to October 8, also missing expectations.

Extra strength in the buck came from the jump in US yields across the curve, while the now increased probability of a ¾ point hike by the Fed at the November 2 gathering also collaborated with the decline in spot.

What to look for around EUR

EUR/USD now looks offered and opens the door to a deeper retracement in the short-term horizon, always on the back of the robust sentiment around the dollar.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Following latest results from key economic indicators, the latter is expected to extend further amidst the ongoing resilience of the US economy.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: Germany Final Inflation Rate (Thursday) – EMU Balance of Trade (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is down 0.43% at 0.9659 and a drop below 0.9631 (monthly low October 13) would target 0.9535 (2022 low September 28) en route to 0.9411 (weekly low June 17 2002). On the flip side, the next up barrier emerges at 0.9999 (weekly high October 4) followed by 1.0050 (weekly high September 20) and finally 1.0197 (monthly high September 12).

-

14:07

AUD/USD plummets below 0.6200, lowest since April 2020 amid post-US CPI USD rally

- AUD/USD meets with aggressive supply and dives to its lowest level since April 2020.

- The USD strengthens across the board on stronger US CPI report and exerts pressure.

- The risk-off mood also contributes to driving flows away from the risk-sensitive aussie.

The AUD/USD pair comes under intense selling pressure during the early North American session and dives to its lowest level since April 2020 in reaction to stronger US consumer inflation figures.

In fact, the US Bureau of Labor Statistics reported that the headline CPI rose 0.4% MoM (0.2% expected) and the yearly rate eased to 8.2% from 8.3% in August, though was still higher than the 8.1% estimated. Adding to this, core inflation, which excludes food and energy prices, holds steady at 0.6% during the reported month and accelerates from 6.3% to 6.6% YoY - the highest since August 1982.

This comes on the back of more hawkish cues from the FOMC minutes released on Wednesday and lifts bets for a more aggressive policy tightening by the Fed. In fact, the markets have now started pricing in a small possibility of a 100 bps Fed rate hike move in November. This, in turn, pushes the yield on the benchmark US Treasury note beyond the 4.0% threshold and boosts the greenback.

Apart from this, a fresh wave of the global risk sentiment - as depicted by another round of a sell-off in the equity markets - underpins the safe-haven buck and weighs on the risk-sensitive aussie. Apart from this, technical selling below the previous YTD low, around the 0.6235 region, further aggravated the bearish pressure surrounding the AUD/USD pair and contributes to the steep decline.

That said, slightly oversold conditions on intraday charts hold back bearish traders from placing fresh bets and limit the downside for the AUD/USD pair, at least for the time being. Nevertheless, the fundamental backdrop suggests that any attempted recovery might be seen as a selling opportunity and runs the risk of fizzling out rather quickly amid looming recession risks.

Technical levels to watch

-

14:00

Russia Central Bank Reserves $ increased to $548.7B from previous $540.7B

-

13:54

Gold Price Forecast: XAU/USD pressured on hotter than expected US CPI

- Gold is under pressure on the back of the US CPI beat.

- US yields and the US dollar take off, pressuring gold to the downside.

The gold price has dropped on the back of the main event for the week's outcome in the US Consumer Price Index. The yellow metal has fallen to $1,645 while the high of the day has been $1,682.49. Eyes are on 28 September's lows of $1,614.

The US dollar, as measured by the DXY index has shot to a high of 113.888 from the lows of 112.69. US yields have shot higher as well, with the 10-year Treasury yield touching 4.09%.

US CPI comes in hot

The data arrived as follows:

- US CPI (MoM) Sep: 0.4% (est 0.2%; prev 0.1%).

- US CPI (Y0Y) Sep: 8.2% (est 8.1%; prev 8.3%).

- US CPI Core (M0M) Sep: 0.6% (est 0.2%; prev 0.6%).

- US CPI Core (Y0Y) Sep: 6.6% (est 6.5%; prev 6.3%).

Once again, hotter-than-expected US inflation numbers for both the core and headline measures are not seen as good news for the Federal Reserve or the US economy. US short-term interest-rate traders see about a one-in-ten chance of a 100-basis point fed rate hike in November, up from zero before the CPI report. Consequently, US Dow futures dropped more than 350 points after a hotter-than-expected inflation report.

''Inflation's rising persistence suggests the Fed is unlikely to stop hiking preemptively, which points to a prolonged period of restrictive rates,'' analysts at TD Securities said. ''This suggests traders should ignore gold's siren calls, as a sustained downtrend will likely prevail''

Meanwhile, more data will be coming in from the US tomorrow with US Retail Sales. ''We look for retail sales to gain further momentum in September, following a 0.3% MoM rise in August,'' analysts at TD Securities said. ''Spending was likely boosted by another increase in auto sales and the first gain in gasoline station sales in three months. Importantly, control group sales likely stayed subdued, while those for the restaurants' segment likely slowed to a crawl following a 1.1% jump in August.''

Gold technical analysis

The price is on the way to the bottom of the prior bullish run with the 28 September lows in focus.

-

13:50

US: Weekly Initial Jobless Claims rise to 228K vs. 225K expected

- Initial Jobless Claims in the US rose by 9,000 in the week ending October 8.

- US Dollar Index stays in positive territory above 113.50 after the data.

There were 228,000 initial jobless claims in the week ending October 8, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 219,000 and came in slightly worse than the market expectation of 225,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 211,500, an increase of 5,000 from the previous week's unrevised average.

"The advance number for seasonally adjusted insured unemployment during the week ending October 1 was 1,368,000, an increase of 3,000 from the previous week's revised level," the DOL further reported.

Market reaction

Boosted by the hot September inflation data, the US Dollar Index was last seen rising 0.5% on the day at 113.80.

-

13:46

USD Index rises to 2-week highs and targets 114.00 post-CPI

- The index gathers further pace and approaches 114.00.

- US headline/Core CPI surprised to the upside in September.

- US Initial Jobless Claims rose more than expected last week.

The USD Index (DXY), which gauges the greenback vs. a bundle of its main rival currencies, rapidly advanced to the proximity of the 114.00 mark in the wake of the release of US CPI results.

USD Index in multi-day tops post-inflation data

The index extends further the ongoing upside momentum and approaches the 114.00 barrier after US inflation figures tracked by the CPI came in above estimates in September.

Indeed, the headline CPI rose at an annualized 8.2% during last month and 0.4% MoM. The Core CPI followed suit and rose 6.6% from a year earlier and 0.6% vs. the previous month.

Additional data saw Initial Jobless Claims rise more than expected 228K in the week to October 8.

Following the release of US CPI, CME Group’s FedWatch Tool now sees the probability of a 75 bps rate hike at nearly 97%, from around 50% a month ago.

What to look for around USD

The rally in the dollar gathers renewed traction and now re-focuses on the 114.00 barrier following the release of higher-than-predicted US inflation results.

In the meantime, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Inflation Rate, Initial Jobless Claims (Thursday) – Retail Sales, Flash Michigan Consumer Sentiment, Business Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.46% at 113.78 and faces the next up barrier at 113.88 (monthly high October 13) followed by 114.76 (2022 high September 28) and then 115.32 (May 2002 high). On the other hand, the breakdown of 110.05 (weekly low October 4) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13).

-

13:42

USD/JPY spikes to fresh 24-year peak, around mid-147.00s on stronger US CPI

- USD/JPY catches aggressive bids in reaction to stronger US CPI and hits a fresh 24-year peak.

- The USD rallies across the board after the US consumer inflation figures surpass expectations.

- Intervention speculations might hold back bulls from placing fresh bets and cap the upside.

The USD/JPY pair attracts fresh buying during the early North American session and spikes to a new 24-year peak, closer to mid-147.00s in reaction to hotter US consumer inflation figures.

The US Bureau of Labor Statistics reported that the headline CPI rose 0.4% in September and the yearly rate eased to 8.2% from 8.3% in August. Adding to this, core inflation, which excludes food and energy prices, held steady at 0.6% during the reported month and the yearly rate accelerated to 6.6% from 6.3% previous. The readings were higher than consensus estimates and reaffirms market bets for another supersized 75 bps Fed rate hike move in November.