Notícias do Mercado

-

16:42

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies despite the better-than-expected U.S. retail sales and Reuters/Michigan consumer sentiment index

The U.S. dollar traded mixed to lower against the most major currencies despite the better-than-expected U.S. retail sales and Reuters/Michigan consumer sentiment index. The U.S. retail sales rose 0.3% in October, exceeding expectations for a 0.2% increase, after a 0.3% drop in August.

Retail sales excluding automobiles increased 0.3% in October, beating expectations for a 0.2% increase, after a 0.2% decline in September.

The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 89.4 in November from a final reading of 86.9 in October, exceeding expectations for an increase to 87.3. That was the highest level since July 2007.

The U.S. business inventories rose by 0.3 percent in September, in line with expectations, after a 0.1% gain in August. August's figure was revised down from a 0.2% increase.

The euro rose against the U.S. dollar. Eurozone's consumer price index was flat in October, in line with expectations, after a 0.4% gain in September.

On a yearly basis, Eurozone's consumer price inflation remained unchanged at 0.4% in October, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco fell to an annual rate of 0.7% in October from 0.8% in September.

Eurozone's preliminary gross domestic product (GDP) increased 0.2% in the third quarter, exceeding expectations for a 0.1% rise, after a 0.1% gain in the second quarter.

Germany's preliminary GDP gained 0.1% in the third quarter, in line with expectations, after a 0.1% decline in the second quarter. The second quarter's figure was revised up from a 0.2% drop.

France's preliminary GDP increased 0.3% in the third quarter, beating expectations for a 0.1% gain, after a 0.1% decrease in the previous quarter. The second quarter's figure was revised down from a flat reading.

The British pound traded mixed against the U.S. dollar. The U.K. construction output rose 1.8% in September, after a revised 3.0% drop in August.

The Canadian dollar increased against the U.S. dollar after the better-than-expected Canadian manufacturing shipments. Canadian manufacturing shipments climbed 2.1% in September, exceeding expectations for a 1.3% rise, after a 3.5% drop in August. August's figure was revised down from a 3.3 decline.

The New Zealand dollar climbed against the U.S. dollar in the absence of any major economic reports from New Zealand.

In the overnight trading session, the kiwi traded lower against the greenback.

The Australian dollar was up against the U.S. dollar in the absence of any major economic reports from Australia.

In the overnight trading session, the Aussie traded lower against the greenback after the Reserve Bank of Australia Assistant Governor Christopher Kent said that the RBA has not ruled out the possibility of intervening in the currency markets.

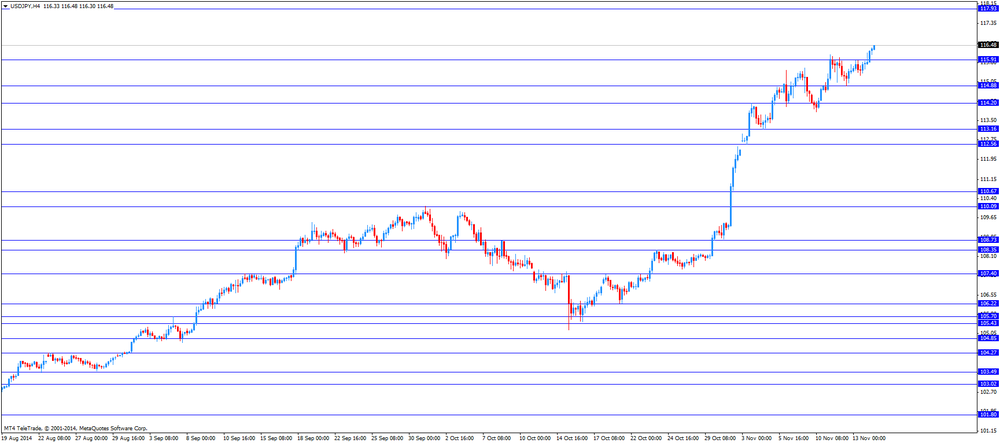

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

In the overnight trading session, the yen traded lower against the greenback as investors expect that Japan's Prime Minister Shinzo Abe will announce next week a delay in the sales-tax increase.

-

15:39

U.S. business inventories rose by 0.3 percent in September

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories rose by 0.3 percent in September, in line with expectations, after a 0.1% gain in August. August's figure was revised down from a 0.2% increase.

Business sales were flat in September.

Sales by manufacturers rose 0.1%, while sales by wholesalers were up 0.6%.

The business inventories/sales ratio remained unchanged at 1.30 months in September. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

15:30

Thomson Reuters/University of Michigan preliminary consumer sentiment index jumped to its highest level since July 2007

The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 89.4 in November from a final reading of 86.9 in October, exceeding expectations for an increase to 87.3. That was the highest level since July 2007.

Job gains and falling gasoline prices boosted the U.S. consumer confidence. It's a good sign to step up holiday spending.

But expectations for income gains remained low despite recent increase.

-

15:15

Reserve Bank of Australia Assistant Governor Christopher Kent: intervention in the currency markets is a possible option

The Reserve Bank of Australia (RBA) Assistant Governor Christopher Kent said in a speech on Thursday that the RBA has not ruled out the possibility of intervening in the currency markets.

He also said that the Aussie "remains above most estimates of its fundamental value, particularly given the substantial declines in commodity prices".

Kent noted that Australia's economic growth is below trend, but it will be above trend by 2016.

The RBA assistant governor pointed out that "the near-term weakness reflects a combination of three forces: a sharper decline in mining investment over the coming quarters than seen to date; the effects of the still high level of the exchange rate; and ongoing fiscal consolidation at state and federal levels".

Low interest rate will support the growth of household expenditure, Kent said.

-

15:00

U.S.: Business inventories , September +0.3% (forecast +0.3%)

-

15:00

U.S.: Mortgage Delinquencies, Quarter III 5.85%

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, November 89.4 (forecast 87.3)

-

14:41

Canadian manufacturing shipments climbed 2.1% in September

Statistics Canada released manufacturing shipments on Friday. Canadian manufacturing shipments climbed 2.1% in September, exceeding expectations for a 1.3% rise, after a 3.5% drop in August. August's figure was revised down from a 3.3 decline.

That was the eighth increase in nine months.

The increase was driven by strong aerospace sales. Aerospace sales climbed 22% in September, while motor vehicle sales gained 4.8%.

Primary metals sales were up 5.9%, shipments of petroleum and coal products fell 5.7%.

New orders jumped 4.6%.

-

14:07

U.S. retail sales rose 0.3% in October

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales rose 0.3% in October, exceeding expectations for a 0.2% increase, after a 0.3% drop in September.

Retail sales excluding automobiles increased 0.3% in October, beating expectations for a 0.2% increase, after a 0.2% decline in September.

The increase was driven by lower gasoline prices and job growth. Gasoline prices declined due to falling oil prices.

Sales at clothing retailers climbed 0.5%, while sales at electronics and appliance stores fell 1.6% in October. Sales at auto dealers gained 0.5%.

-

13:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2355(E405mn), $1.2400(E1.35bn), $1.2450(E986mn), $1.2500(E978mn), $1.2510(E2.3bn), $1.2520(E399mn), $1.2525(E934mn), $12550(E303mn)

USD/JPY: Y116.00($210mn)

USD/CHF: Chf0.9800($830mn)

AUD/USD: $0.8585(A$606mn), $0.8650(A$265mn), $0.8700(A$1.87bn), $0.8775(A$903mn)

NZD/USD: $0.7790(NZ$462mn)

USD/CAD: C$1.1300($550mn), C$1.1325($200mn), C$1.1345($475mn), Y1.1350($247mn), C$1.1365($950mn), C$1.1400($565mn), C$1.1425(230mn)

-

13:30

U.S.: Retail sales, October +0.3% (forecast +0.2%)

-

13:30

U.S.: Retail sales excluding auto, October +0.3% (forecast +0.2%)

-

13:30

Canada: Manufacturing Shipments (MoM), September +2.1% (forecast +1.3%)

-

13:30

U.S.: Import Price Index, October -1.3% (forecast -1.7%)

-

13:04

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:30 France GDP, q/q (Preliminary) Quarter III -0.1% Revised From 0.0% +0.1% +0.3%

06:30 France GDP, Y/Y (Preliminary) Quarter III +0.1% +0.6% +0.4%

07:00 Germany GDP (QoQ) (Preliminary) Quarter III -0.1% Revised From -0.2% +0.1% +0.1%

07:00 Germany GDP (YoY) (Preliminary) Quarter III +0.8% +1.0% +1.2%

07:45 France Non-Farm Payrolls (Preliminary) Quarter III +0.1% +0.2% -0.2%

10:00 Eurozone Harmonized CPI October +0.4% 0.0% 0.0%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) October +0.4% +0.4% +0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y October +0.8% +0.7% +0.7%

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter III +0.1% Revised From 0.0% +0.1% +0.2%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter III +0.8% +0.6% +0.8%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. retail sales and Reuters/Michigan consumer sentiment index. U.S. retail sales are expected to rise 0.2% in October, after a 0.3% decline in September.

Retail sales excluding automobiles are expected to climbs 0.2% in October, after a 0.2% fall in September.

The preliminary Reuters/Michigan consumer sentiment index is expected to increase to 87.3 in November from 86.9 in October.

The euro traded mixed against the U.S. dollar after the economic data from the Eurozone. Eurozone's consumer price index was flat in October, in line with expectations, after a 0.4% gain in September.

On a yearly basis, Eurozone's consumer price inflation remained unchanged at 0.4% in October, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco fell to an annual rate of 0.7% in October from 0.8% in September.

Eurozone's preliminary gross domestic product (GDP) increased 0.2% in the third quarter, exceeding expectations for a 0.1% rise, after a 0.1% gain in the second quarter.

Germany's preliminary GDP gained 0.1% in the third quarter, in line with expectations, after a 0.1% decline in the second quarter. The second quarter's figure was revised up from a 0.2% drop.

France's preliminary GDP increased 0.3% in the third quarter, beating expectations for a 0.1% gain, after a 0.1% decrease in the previous quarter. The second quarter's figure was revised down from a flat reading.

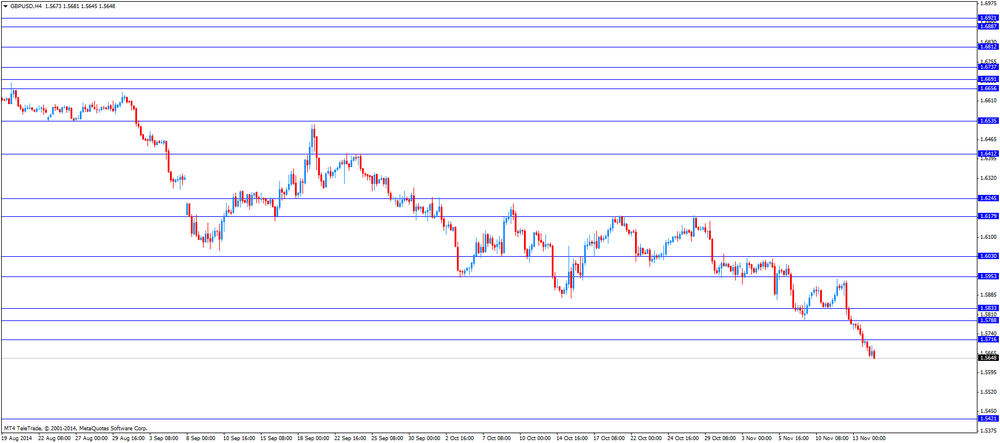

The British pound traded lower against the U.S. dollar after the U.K. construction output. The U.K. construction output rose 1.8% in September, after a revised 3.0% drop in August.

The Canadian dollar traded mixed against the U.S. dollar ahead Canadian manufacturing shipments. Canada's manufacturing shipments are expected to rise 1.3% in September, after a 3.3% drop in August.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5645

USD/JPY: the currency pair climbed to Y116.48

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) September -3.3% +1.3%

13:30 U.S. Retail sales October -0.3% +0.2%

13:30 U.S. Retail sales excluding auto October -0.2% +0.2%

14:45 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) November 86.9 87.3

15:00 U.S. Business inventories September +0.2% +0.3%

15:00 U.S. Mortgage Delinquencies Quarter III 6.04%

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580, $1.2550, $1.2510

Bids $1.2390, $1.2360/50, $1.2300, $1.2250

GBP/USD

Offers $1.5950/60, $1.5905/00, $1.5870, $1.5820, $1.5785

Bids $1.5600, $1.5565, $1.5500

AUD/USD

Offers $0.8850, $0.8800, $0.8760

Bids $0.8660, $0.8600, $0.8520, $0.8500, 0.8450

EUR/JPY

Offers Y146.00, Y145.00

Bids Y143.20, Y143.00, Y142.40, Y142.10/00

USD/JPY

Offers Y117.00, Y116.50

Bids Y114.90, Y114.00, Y113.85, Y113.00, Y112.60

EUR/GBP

Offers stg0.8000, stg0.7950

Bids stg0.7910/00, stg0.7860, stg0.7800, stg0.7700

-

11:40

-

10:25

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2355(E405mn), $1.2400(E1.35bn), $1.2450(E986mn), $1.2500(E978mn), $1.2510(E2.3bn), $1.2520(E399mn), $1.2525(E934mn), $12550(E303mn)

USD/JPY: Y116.00($210mn)

USD/CHF: Chf0.9800($830mn)

AUD/USD: $0.8585(A$606mn), $0.8650(A$265mn), $0.8700(A$1.87bn), $0.8775(A$903mn)

NZD/USD: $0.7790(NZ$462mn)

USD/CAD: C$1.1300($550mn), C$1.1325($200mn), C$1.1345($475mn), Y1.1350($247mn), C$1.1365($950mn), C$1.1400($565mn), C$1.1425(230mn)

-

10:00

Eurozone: GDP (QoQ), Quarter III +0.2% (forecast +0.1%)

-

10:00

Eurozone: GDP (YoY), Quarter III +0.8% (forecast +0.6%)

-

10:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, October +0.7% (forecast +0.7%)

-

09:30

Press Review: Yuan in Hong Kong Snaps Two-Week Drop

BLOOMBERG

Yuan in Hong Kong Snaps Two-Week Drop on Stock Link, Bond Sale

The yuan in Hong Kong snapped two weeks of decline as investors prepared for the start of an equities link with Shanghai that will allow 23.5 billion yuan ($3.8 billion) of daily cross-border transactions.

The Stock Connect will start on Nov. 17, the same day that Hong Kong is due to scrap a 20,000 yuan per day conversion cap for permanent residents. The Ministry of Finance will sell 12 billion yuan of bonds in the city next week. The People's Bank of China raised the currency's reference rate by a total of 0.33 percent from Nov. 7, the most since the five days ended Sept. 12, to 6.1399 per dollar.

BLOOMBERG

Swiss Demand for Currency Automation Seen Reshaping Trading

Switzerland's decision to mandate automated trading of currency is an unprecedented push by a regulator to limit the scope for market manipulation and may accelerate a trend already reshaping the industry.

Switzerland's Financial Market Supervisory Authority, or Finma, directed UBS AG to use electronic platforms to perform at least 95 percent of its foreign exchange trades after finding that employees conspired to rig currency benchmarks.

Source: http://www.bloomberg.com/news/2014-11-14/regulator-call-for-automated-trades-unprecedented-push-correct-.html

-

07:45

France: Non-Farm Payrolls, Quarter III -0.2% (forecast +0.2%)

-

07:30

Foreign exchange market. Asian session: U.S. dollar higher in Asian Trade with new seven-year high against the Japanese yen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

06:30 France GDP, q/q (Preliminary) Quarter III -0.1% [Revised From 0.0%] +0.1% +0.3%

06:30 France GDP, Y/Y (Preliminary) Quarter III +0.1% +0.6% +0.4%

07:00 Germany GDP (QoQ) (Preliminary) Quarter III -0.1% +0.1% +0.1%

07:00 Germany GDP (YoY) (Preliminary) Quarter III +0.8% +1.0% +1.2%

The U.S. dollar traded higher against its peers in during the Asian Trade after some losses due to higher-than-expected jobless claims data of 290.000 individuals filing for initial jobless benefits with a forecast of 282.000. Earlier in the day data was published that Germany's inflation rate rose 0.7% year on-year in October and fell 0.3% on a monthly basis with both figures in line with expectations. Preliminary data published on Friday morning showed that Germany's GDP rose 0.1% in the last quarter, in line with expectations.

The Australian dollar further declined after yesterday's statement of Reserve Bank of Australia Assistant Governor Christopher Kent that an intervention of the bank to weaken the Australian dollar still is a valid option if needed.

The Kiwi is trading lower against the U.S. dollar giving away some of its weekly gains.

The Japanese yen currently trading at USD116.33 traded at a new seven-year low at USD 116.37. Speculations that Prime Minister Abe has decided on holding snap elections in December to postpone a sales tax hike and a rallying Nikkei index weighed on the currency.

EUR/USD: the euro lost against the greenback

USD/JPY: the U.S. dollar traded stronger against the Japanese yen at new seven-year highs

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

07:45 France Non-Farm Payrolls (Preliminary) Quarter III +0.1% +0.2%

10:00 Eurozone Harmonized CPI October +0.4% 0.0%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) October +0.4% +0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y October +0.7% +0.7%

10:00 Eurozone GDP (QoQ)(Preliminary) Quarter III 0.0% +0.1%

10:00 Eurozone GDP (YoY)(Preliminary) Quarter III +0.8% +0.6%

13:30 Canada Manufacturing Shipments (MoM) September -3.3% +1.3%

13:30 U.S. Import Price Index October -0.5% -1.7%

13:30 U.S. Retail sales October -0.3% +0.2%

13:30 U.S. Retail sales excluding auto October -0.2% +0.2%

14:45 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) November 86.9 87.3

15:00 U.S. Business inventories September +0.2% +0.3%

15:00 U.S. Mortgage Delinquencies Quarter III 6.04%

-

07:00

Germany: GDP (QoQ), Quarter III +0.1% (forecast +0.1%)

-

07:00

Germany: GDP (YoY), Quarter III +1.2% (forecast +1.0%)

-

06:36

Options levels on friday, November 14, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2571 (1175)

$1.2538 (261)

$1.2509 (122)

Price at time of writing this review: $ 1.2427

Support levels (open interest**, contracts):

$1.2396 (6402)

$1.2369 (3388)

$1.2337 (5517)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 98754 contracts, with the maximum number of contracts with strike pric $1,3000 (5316);

- Overall open interest on the PUT options with the expiration date December, 5 is 104229 contracts, with the maximum number of contracts with strike price $1,2200 (6552);

- The ratio of PUT/CALL was 1.06 versus 1.07 from the previous trading day according to data from November, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.5904 (682)

$1.5807 (362)

$1.5711 (110)

Price at time of writing this review: $1.5658

Support levels (open interest**, contracts):

$1.5594 (1001)

$1.5496 (902)

$1.5398 (918)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 36814 contracts, with the maximum number of contracts with strike price $1,6000 (1988);

- Overall open interest on the PUT options with the expiration date December, 5 is 39211 contracts, with the maximum number of contracts with strike price $1,5900 (2399);

- The ratio of PUT/CALL was 1.06 versus 1.06 from the previous trading day according to data from November, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:31

France: GDP, Y/Y, Quarter III +0.4% (forecast +0.6%)

-

06:30

France: GDP, q/q, Quarter III +0.3% (forecast +0.1%)

-