Notícias do Mercado

-

23:23

Currencies. Daily history for Nov 13’2014:

(pare/closed(GMT +2)/change, %)

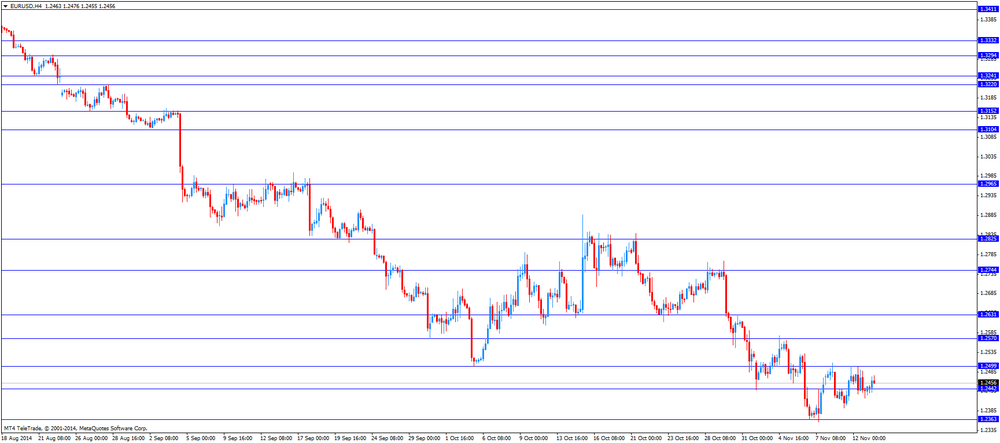

EUR/USD $1,2476 +0,31%

GBP/USD $1,5712 -0,42%

USD/CHF Chf0,9633 -0,31%

USD/JPY Y115,76 +0,24%

EUR/JPY Y144,41 +0,55%

GBP/JPY Y181,84 -0,20%

AUD/USD $0,8720 +0,05%

NZD/USD $0,7880 +0,04%

USD/CAD C$1,1365 +0,42%

-

23:00

Schedule for today, Friday, Nov 14’2014:

(time / country / index / period / previous value / forecast)

06:30 France GDP, q/q (Preliminary) Quarter III 0.0% +0.1%

06:30 France GDP, Y/Y (Preliminary) Quarter III +0.1% +0.6%

07:00 Germany GDP (QoQ) (Preliminary) Quarter III -0.2% +0.1%

07:00 Germany GDP (YoY) (Preliminary) Quarter III +0.8% +1.0%

07:45 France Non-Farm Payrolls (Preliminary) Quarter III +0.1% +0.2%

10:00 Eurozone Harmonized CPI October +0.4% 0.0%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) October +0.4% +0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y October +0.7% +0.7%

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter III 0.0% +0.1%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter III +0.8% +0.6%

13:30 Canada Manufacturing Shipments (MoM) September -3.3% +1.3%

13:30 U.S. Import Price Index October -0.5% -1.7%

13:30 U.S. Retail sales October -0.3% +0.2%

13:30 U.S. Retail sales excluding auto October -0.2% +0.2%

14:45 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) November 86.9 87.3

15:00 U.S. Business inventories September +0.2% +0.3%

15:00 U.S. Mortgage Delinquencies Quarter III 6.04%

-

19:00

U.S.: Federal budget , October -121.7 (forecast -111.5)

-

16:37

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the weaker-than-expected number of initial jobless claims from the U.S.

The U.S. dollar traded mixed against the most major currencies after the number of initial jobless claims from the U.S. The number of initial jobless claims in the week ending November 08 in the U.S. rose by 12,000 to 290,000 from 278,000 in the previous week. Analysts had expected an increase to 282.000.

Job openings in the U.S. declined to 4.73 million in September from 4.85 million in August. August's figure was revised up from 4.84 million. Analysts had expected job openings to remain at 4.85 million.

The euro traded higher against the U.S. dollar after the consumer price indices from Germany and France. Germany's final consumer price index declined 0.3% in October.

On a yearly basis, German final consumer price index rose 0.7% in October, lower than the previous reading of 0.8% gain.

France's consumer price inflation was flat in October, beating expectations for a 0.1% decline, after a 0.4% drop in September.

On a yearly basis, French consumer price index increased 0.5% in October, after a 0.3% rise in September.

The British pound declined against the U.S. dollar in the absence of any major economic reports from the U.K.

The Bank of England's inflation letter released on Wednesday still weighed on the pound. The Bank of England (BoE) lowered its economic growth and inflation forecasts.

The BoE cut its forecasts for economic growth in 2015 to 2.9% from a previous 3.1% gain.

The BoE Governor Mark Carney warned that inflation could fall below 1% in the next six months due to lower commodity prices and a slowdown of global growth. The central bank expects inflation to achieve its 2% target in three years.

The Canadian dollar fell against the U.S. dollar after Canadian new housing price index. Canada's new housing price index increased by 0.1% in September, missing expectations for a 0.2% rise, after a 0.3% gain in August.

The Swiss franc traded slightly higher against the U.S. dollar. Switzerland's producer and import prices declined 0.1% in October, beating forecasts of a 0.2% decrease, after a 0.1% fall in September.

On a yearly basis, producer and import prices decreased 1.1% in October, beating expectations for a 1.4% decline, after a 1.4% drop in September.

The New Zealand dollar traded mixed against the U.S. dollar after the increase in the morning trading session.

In the overnight trading session, the kiwi traded mixed against the greenback after the economic data from New Zealand. The Business NZ Manufacturing Index climbed to 59.3 in October from 58.5 in September. September's figure was revised up from 58.1.

New Zealand's food price index was flat in October, after a 0.8% drop in September.

The Australian dollar traded slightly lower against the U.S. dollar after the rise in the morning trading session.

In the overnight trading session, the Aussie traded lower against the greenback after the economic data from Australia and China. The Melbourne Institute's consumer inflation expectations for Australia increased to 4.1% in October from 3.4% in September.

China's industrial output rose 7.7% in October, missing expectations for a 8.0% rise, after a 8.0% increase.

China's fixed-asset investment increased 15.9% in October, missing forecasts of a 16.0% gain, after a 16.1% rise in September.

Retail sales in China climbed 11.5% in October, missing expectations for a 11.6% rise, after a 11.6% gain in September.

The Japanese yen traded slightly lower against the U.S. dollar.

In the overnight trading session, the yen traded lower against the greenback despite the better-than-expected economic data from Japan. Japan's core machinery orders increased 2.9% in October, beating expectations for a 1.0% decline, after a 4.7% gain in September.

Industrial production in Japan rose 2.9% in September, faster than the 2.7% growth estimated earlier.

-

16:02

U.S. Treasury Secretary Lew warned of “lost decade” in Europe

The U.S. Treasury Secretary Jacob Lew said in a speech at the World Affairs Council in Seattle on Thursday that stimulus measures by the European Central Bank will not be enough to avoid a deeper slowdown of economic growth in Europe.

Lew warned of "lost decade" in Europe. He pointed out that countries should not rely too much on the United States to prop up global growth.

Lew appreciated stimulus measures by the Bank of Japan.

He also said that the U.S. private sector has created more than ten and a half million new jobs.

-

16:00

U.S.: Crude Oil Inventories, November -1.7

-

15:35

Job openings decreased to 4.73 million in September

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report today. Job openings declined to 4.73 million in September from 4.85 million in August. August's figure was revised up from 4.84 million.

Analysts had expected job openings to remain at 4.85 million.

The number of job openings was little changed for total private (3.5 million) and government (2.0 million) in September. The level of job openings fell for arts, entertainment, and recreation.

The hires rate climbed to 5.0 million in September from 4.7 million in August. That was the highest level since December 2007.

Total separations rose to 4.8 million in September from 4.5 million in August.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:01

U.S.: JOLTs Job Openings, September 4740 (forecast 4850)

-

14:18

Canada’s new housing price index rose by 0.1% in September

Statistics Canada released its new housing price index (NHPI) today. The index increased by 0.1% in September, missing expectations for a 0.2% rise, after a 0.3% gain in August.

Prices remained unchanged in 6 of the 21 metropolitan areas.

The new housing price index doesn't include data for condominiums.

-

13:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2350(E1.24bn), $1.2375(E711mn), $1.2400(E1.27bn), $1.2420-25(E1.2bn), $1.2450(E1.19bn), $1.2500(E2.89bn), $1.2505(E456mn), $1.2525(E709mn)

GBP/USD: $1.5800(stg844mn), $1.5850(stg594mn)

USD/CHF: Chf0.9550($520mn), Chf0.9600($200mn)

AUD/USD: $0.8625(A$654mn), $0.8675(A$567mn), $0.8770(A$211mn), $0.8800(A$548mn)

NZD/USD: $0.7795(NZ$275mn)

-

13:31

U.S.: Initial Jobless Claims, November 290 (forecast 282)

-

13:30

Canada: New Housing Price Index , September +0.1% (forecast +0.2%)

-

13:01

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the consumer price indices from Germany and France

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation October +3.4% +4.1%

00:01 United Kingdom RICS House Price Balance October 30% 25% 20%

01:30 Australia RBA Assist Gov Kent Speaks

04:30 Japan Industrial Production (MoM) (Finally) September +2.7% +2.7% +2.9%

04:30 Japan Industrial Production (YoY) September +0.6% +0.6% +0.8%

05:30 China Retail Sales y/y October +11.6% +11.6% +11.5%

05:30 China Industrial Production y/y October +8.0% +8.0% +7.7%

05:30 China Fixed Asset Investment October +16.1% +16.0% +15.9%

07:00 Germany CPI, m/m (Finally) October -0.3% -0.3% -0.3%

07:00 Germany CPI, y/y (Finally) October +0.8% +0.8% +0.7%

07:45 France CPI, y/y October +0.3% +0.5%

07:45 France CPI, m/m October -0.4% -0.1% 0.0%

08:15 Switzerland Producer & Import Prices, m/m October -0.1% -0.2% -0.1%

08:15 Switzerland Producer & Import Prices, y/y October -1.4% -1.4% -1.1%

09:00 Eurozone ECB Monthly Report

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims from the U.S. The number of initial jobless claims in the U.S. is expected to climb by 4,000 to 282,000.

The euro traded higher against the U.S. dollar after the consumer price indices from Germany and France. Germany's final consumer price index declined 0.3% in October.

On a yearly basis, German final consumer price index rose 0.7% in October, lower than the previous reading of 0.8% gain.

France's consumer price inflation was flat in October, beating expectations for a 0.1% decline, after a 0.4% drop in September.

On a yearly basis, French consumer price index increased 0.5% in October, after a 0.3% rise in September.

The British pound fell against the U.S. dollar in the absence of any major economic reports from the U.K.

The Bank of England's inflation letter released on Wednesday still weighed on the pound. The Bank of England (BoE) lowered its economic growth and inflation forecasts.

The BoE cut its forecasts for economic growth in 2015 to 2.9% from a previous 3.1% gain.

The BoE Governor Mark Carney warned that inflation could fall below 1% in the next six months due to lower commodity prices and a slowdown of global growth. The central bank expects inflation to achieve its 2% target in three years.

The Canadian dollar traded mixed against the U.S. dollar ahead Canadian new housing price index. Canada's new housing price index is expected to rise 0.2% in September, after a 0.3% gain in August.

The Swiss franc traded higher against the U.S. dollar. Switzerland's producer and import prices declined 0.1% in October, beating forecasts of a 0.2% decrease, after a 0.1% fall in September.

On a yearly basis, producer and import prices decreased 1.1% in October, beating expectations for a 1.4% decline, after a 1.4% drop in September.

EUR/USD: the currency pair rose to $1.2476

GBP/USD: the currency pair fell to $1.5738

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index September +0.3% +0.2%

13:30 U.S. Initial Jobless Claims November 278 282

15:00 U.S. JOLTs Job Openings September 4835 4850

20:05 Canada Gov Council Member Wilkins Speaks

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580, $1.2550, $1.2510

Bids $1.2390, $1.2360/50, $1.2300, $1.2250

GBP/USD

Offers $1.6000, $1.5950/60, $1.5905/00, $1.5850

Bids $1.5720, $1.5700, $1.5600

AUD/USD

Offers $0.8800, $0.8760, $0.8750

Bids $0.8660, $0.8600, $0.8520, $0.8500, 0.8450

EUR/JPY

Offers Y145.00, Y144.70

Bids Y142.90, Y142.40, Y142.10/00, Y141.55/50, Y141.00

USD/JPY

Offers Y116.50, Y116.10

Bids Y113.85, Y113.00, Y112.60, Y112.00

EUR/GBP

Offers stg0.8000, stg0.7940, stg0.7910

Bids stg0.7860, stg0.7800, stg0.7700

-

10:25

ECB publishes forecasts on lower inflation and less economic growth

ECB expects euro zone inflation of 1% in 2015 and 1.4% in 2016. Previous forecast estimated inflation to be 1.2% in 2015 and 1.5% in 2016. The ECB also lowered its economic growth forecast for 2015 from 1.5% to 1.2% naming falling oil prices and political tensions the main reasons.

-

10:06

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2350(E1.24bn), $1.2375(E711mn), $1.2400(E1.27bn), $1.2420-25(E1.2bn), $1.2450(E1.19bn), $1.2500(E2.89bn), $1.2505(E456mn), $1.2525(E709mn)

GBP/USD: $1.5800(stg844mn), $1.5850(stg594mn)

USD/CHF: Chf0.9550($520mn), Chf0.9600($200mn)

AUD/USD: $0.8625(A$654mn), $0.8675(A$567mn), $0.8770(A$211mn), $0.8800(A$548mn)

NZD/USD: $0.7795(NZ$275mn)

-

09:20

Press Review: Brent Drop From Four-Year Low

BLOOMBERG

Brent Drop From Four-Year Low as OPEC Seen Resisting Cuts

Brent Crude extended losses from a four-year low, trading near $80 a barrel amid signs that OPEC remains unwilling to reduce output to ease concern of a global supply glut. West Texas Intermediate was steady in New York.

Futures slid as much as 0.7 percent in London, declining from the lowest close since September 2010. Saudi Arabia is committed to a stable market and speculation of a price war within the Organization of Petroleum Exporting Countries "has no basis in reality," Oil Minister Ali Al-Naimi said yesterday in Acapulco, Mexico.

Source: http://www.bloomberg.com/news/2014-11-13/oil-extends-drop-to-3-year-low-as-opec-unlikely-to-cut.html

INVESTING.COM

AUD/USD almost unchanged after Australian inflation data

The Australian dollar was almost unchanged against its U.S. counterpart on Thursday, after data showed that inflation expectations in Australia rose last month, while demand for the greenback remained broadly supported.

REUTERS

Global banks entering higher-stake phase of forex probes

The $4.3 billion in civil settlements struck Wednesday between six global banks and U.S. and U.K. authorities over foreign exchange market manipulation sets the stage for negotiations over related ongoing probes that could bear much more severe consequences.Citigroup, UBS, HSBC, Royal Bank of Scotland, JPMorgan Chase and Bank of America agreed to make the payment to settle civil claims they failed to stop traders from trying to rig the foreign exchange market.

Source: http://www.reuters.com/article/2014/11/13/us-banks-forex-settlement-criminal-idUSKCN0IX01H20141113

-

08:15

Switzerland: Producer & Import Prices, m/m, October -0.1% (forecast -0.2%)

-

08:15

Switzerland: Producer & Import Prices, y/y, October -1.1% (forecast -1.4%)

-

07:45

France: CPI, m/m, October 0.0% (forecast -0.1%)

-

07:45

France: CPI, y/y, October +0.5%

-

07:30

Foreign exchange market. Asian session: The U.S. dollar continues the rally against the Japanese yen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia Consumer Inflation Expectation October +3.4% +4.1%

00:01 United Kingdom RICS House Price Balance October 30% 25% 20%

01:30 Australia RBA Assist Gov Kent Speaks

04:30 Japan Industrial Production (MoM)(Finally) September +2.7% +2.7% +2.9%

04:30 Japan Industrial Production (YoY) September +0.6% +0.6% +0.8%

05:30 China Retail Sales y/y October +11.6% +11.6% +11.5%

05:30 China Industrial Production y/y October +8.0% +8.0% +7.7%

05:30 China Fixed Asset Investment October +16.1% +16.0% +15.9%

07:00 Germany CPI, m/m (Finally) October 0.3% -0.3% -0.3%

07:00 Germany CPI, y/y (Finally) October +0.8% +0.8% +0.8%

The U.S. dollar continued its rally against the Japanese yen trading closer to a seven-year high struck at the beginning of this week on Tuesday and trading flat against the euro currently at USD1.2437 after data on European production further softened the euro.

The Australian dollar declined after Reserve Bank of Australia Assistant Governor Christopher Kent stated that an intervention of the bank to weaken the Australian dollar still is a valid option if needed. Consumer Inflation Expectation rose from +3.4% to +4.1%.

The Kiwi was trading higher yesterday after the central banks report on financial stability and is now trading flat against the U.S. dollar.

The Japanese yen currently trading at USD115.79 closer to its seven-year low at USD 116.11 against the U.S. dollar. Speculations that Prime Minister Abe has decided on holding snap elections in December and a rallying Nikkei weighed on the currency.

EUR/USD: the euro gained against the greenback

USD/JPY: the U.S. dollar traded stronger against the Japanese yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

07:45 France CPI, y/y October +0.3%

07:45 France CPI, m/m October -0.4% -0.1%

08:15 Switzerland Producer & Import Prices, m/m October -0.1% -0.2%

08:15 Switzerland Producer & Import Prices, y/y October -1.4% -1.4%

09:00 Eurozone ECB Monthly Report

13:30 Canada New Housing Price Index September +0.3% +0.2%

13:30 U.S. Initial Jobless Claims November 278 282

15:00 U.S. JOLTs Job Openings September 4835 4850

15:30 Canada Bank of Canada Review

16:00 U.S. Crude Oil Inventories November +0.5

19:00 U.S. Federal budget October 105.8 -111.5

20:05 Canada Gov Council Member Wilkins Speaks

-

07:01

Germany: CPI, y/y , October +0.7% (forecast +0.8%)

-

07:00

Germany: CPI, m/m, October -0.3% (forecast -0.3%)

-

06:26

Options levels on thursday, November 13, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2641 (4724)

$1.2575 (3609)

$1.2524 (659)

Price at time of writing this review: $ 1.2443

Support levels (open interest**, contracts):

$1.2394 (3809)

$1.2360 (6442)

$1.2311 (5599)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 97816 contracts, with the maximum number of contracts with strike pric $1,2800 (5232);

- Overall open interest on the PUT options with the expiration date December, 5 is 104922 contracts, with the maximum number of contracts with strike price $1,2200 (6520);

- The ratio of PUT/CALL was 1.07 versus 1.07 from the previous trading day according to data from November, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.6003 (1968)

$1.5905 (703)

$1.5809 (744)

Price at time of writing this review: $1.5774

Support levels (open interest**, contracts):

$1.5693 (1468)

$1.5595 (951)

$1.5497 (854)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 36625 contracts, with the maximum number of contracts with strike price $1,6000 (1968);

- Overall open interest on the PUT options with the expiration date December, 5 is 38969 contracts, with the maximum number of contracts with strike price $1,5900 (2510);

- The ratio of PUT/CALL was 1.06 versus 1.06 from the previous trading day according to data from November, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:30

China: Retail Sales y/y, October +11.5% (forecast +11.6%)

-

05:30

China: Industrial Production y/y, October +7.7% (forecast +8.0%)

-

05:30

China: Fixed Asset Investment, October +15.9% (forecast +16.0%)

-

04:31

Japan: Industrial Production (MoM) , September +2.9% (forecast +2.7%)

-

04:30

Japan: Industrial Production (YoY), September +0.8% (forecast +0.6%)

-

00:01

United Kingdom: RICS House Price Balance, October 20% (forecast 25%)

-

00:00

Australia: Consumer Inflation Expectation, October +4.1%

-