Notícias do Mercado

-

23:51

Japan: Core Machinery Orders, October +2.9% (forecast -1.0%)

-

23:50

Japan: Core Machinery Orders, y/y, October +7.3% (forecast -1.3%)

-

23:27

Currencies. Daily history for Nov 12’2014:

(pare/closed(GMT +2)/change, %)

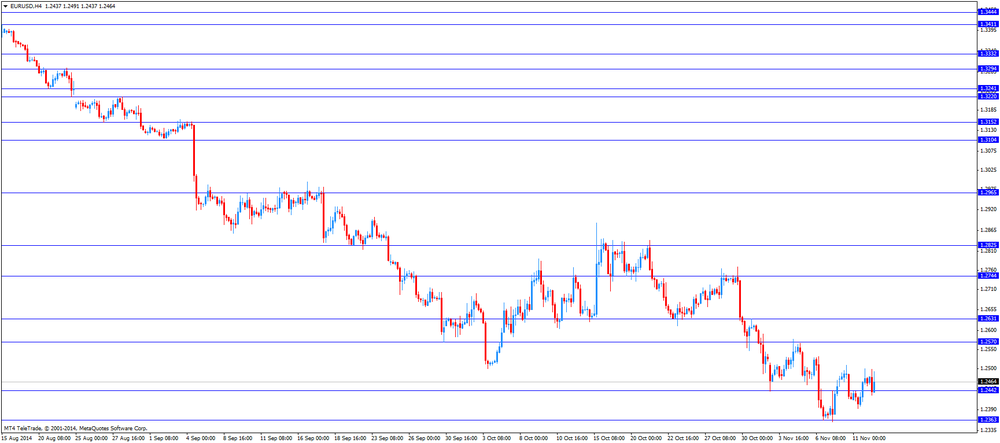

EUR/USD $1,2437 -0,30%

GBP/USD $1,5778 -0,88%

USD/CHF Chf0,9663 +0,20%

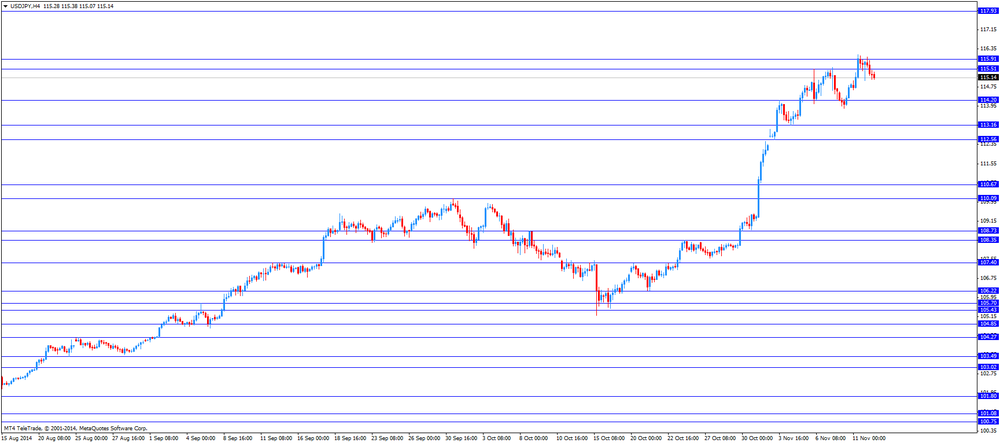

USD/JPY Y115,48 -0,26%

EUR/JPY Y143,62 -0,57%

GBP/JPY Y182,2 -1,13%

AUD/USD $0,8716 +0,36%

NZD/USD $0,7877 +0,89%

USD/CAD C$1,1317 -0,16%

-

23:01

Schedule for today, Thursday, Nov 13’2014:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation October +3.4%

00:01 United Kingdom RICS House Price Balance October 30% 25%

01:30 Australia RBA Assist Gov Kent Speaks

04:30 Japan Industrial Production (MoM) (Finally) September +2.7% +2.7%

04:30 Japan Industrial Production (YoY) September +0.6% +0.6%

05:30 China Retail Sales y/y October +11.6% +11.6%

05:30 China Industrial Production y/y October +8.0% +8.0%

05:30 China Fixed Asset Investment October +16.1% +16.0%

07:00 Germany CPI, m/m (Finally) October -0.3% -0.3%

07:00 Germany CPI, y/y (Finally) October +0.8% +0.8%

07:45 France CPI, y/y October +0.3%

07:45 France CPI, m/m October -0.4% -0.1%

08:15 Switzerland Producer & Import Prices, m/m October -0.1% -0.2%

08:15 Switzerland Producer & Import Prices, y/y October -1.4% -1.4%

09:00 Eurozone ECB Monthly Report

13:30 Canada New Housing Price Index September +0.3% +0.2%

13:30 U.S. Initial Jobless Claims November 278 282

15:00 U.S. JOLTs Job Openings September 4835 4850

15:30 Canada Bank of Canada Review

16:00 U.S. Crude Oil Inventories November +0.5

19:00 U.S. Federal budget October 105.8 -111.5

20:05 Canada Gov Council Member Wilkins Speaks

-

16:42

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies in quiet trade

The U.S. dollar traded mixed to lower against the most major currencies after the U.S. whole sales inventories. Wholesale inventories in the U.S. rose 0.3% in September, in line with expectations, after a 0.6% gain in August. August's figure was revised down from a 0.7% rise.

The euro traded mixed against the U.S. dollar after industrial production from the Eurozone. Industrial production in the Eurozone rose 0.6% in September, in line with expectations, after a 1.4% drop in August. August's figure was revised up from a 1.8 fall.

On a yearly basis, Eurozone's industrial production increased 0.6% in September, beating expectations for a 0.4% decline, after 0.5% fall in August. August's figure was revised up from a 1.9 drop.

The British pound traded mixed against the U.S. dollar. Earlier, the pound dropped against the greenback after the Bank of England's inflation letter. The Bank of England (BoE) lowered its economic growth and inflation forecasts.

The BoE cut its forecasts for economic growth in 2015 to 2.9% from a previous 3.1% gain.

The BoE Governor Mark Carney warned that inflation could fall below 1% in the next six months due to lower commodity prices and a slowdown of global growth. The central bank expects inflation to achieve its 2% target in three years.

The U.K. unemployment rate remained unchanged at 6.0% in the July to September quarter, missing expectations for a decline to 5.9%.

The claimant count decreased by 20,400 people in October, missing expectations for a drop of 24,900 people, after a decrease of 18,600 people in September.

Average weekly earnings, excluding bonuses, climbed by 1.3% in the July to September period. That was the first time in five years that earnings overtook inflation. Inflation in the U.K. declined to 1.2% in September.

Average weekly earnings, including bonuses, rose by 1.0% in the July to September period.

The New Zealand dollar increased against the U.S. dollar. The Reserve Bank of New Zealand (RBNZ) released its Financial Stability Report on late Tuesday. The RBNZ Governor Graeme Wheeler said in the central bank's Financial Stability Report that the exchange rate of the New Zealand dollar is "unjustified and unsustainable". He pointed out that the RBNZ "still thinks the exchange rate's got further to go".

The Australian dollar climbed against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback despite solid economic data from Australia. The Westpac Banking Corporation's consumer sentiment for Australia increased 1.9% in November, after a 0.9% gain in October.

Wage price index in Australia rose by 0.6% in the third quarter, in line with expectations, after a 0.6% increase in the previous quarter.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

The Bank of Japan (BoJ) board member Ryuzo Miyao said on Wednesday that the BoJ could start talking about the end of stimulus measures around the second half of fiscal 2015 if inflation will reach the central bank's 2% target.

-

16:13

Reserve Bank of New Zealand reiterated that the exchange rate of the New Zealand dollar is “unjustified and unsustainable”

The Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler said in the central bank's Financial Stability Report released on Tuesday that the RBNZ will keep the limits on low-deposit home lending. Wheeler added that restrictions on lending have helped to restrain house price inflation.

The RBNZ governor reiterated that the exchange rate of the New Zealand dollar is "unjustified and unsustainable". He pointed out that the RBNZ "still thinks the exchange rate's got further to go".

The central bank also said that "further increases in short-term interest rates may be required in coming years".

-

15:35

Wholesale inventories in the U.S. rose 0.3% in September

The U.S. Commerce Department released wholesale inventories on Wednesday. Wholesale inventories in the U.S. rose 0.3% in September, in line with expectations, after a 0.6% gain in August. August's figure was revised down from a 0.7% rise.

Inventories of durable goods rose 0.8% in September, while inventories of non-durable goods decreased by 0.6%.

-

15:00

U.S.: Wholesale Inventories, September +0.3% (forecast +0.3%)

-

14:28

Bank of England fired its chief currency dealer

The Bank of England (BoE) fired chief currency dealer Martin Mallet after he failed to follow internal policies. Mallet has worked at the central bank for 30 years.

The BoE said that the reason for the dismissal was related to its internal policies and not to the forex scandal.

-

13:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2400(E525mn), $1.2500(E960mn), $1.2540-50(E1.3bn)

USD/JPY: Y113.80($400mn), Y116.50($300mn)

GBP/USD: $1.5835(stg263mn), $1.5900(stg211mn), $1.6000(stg260mn)

AUD/USD: $0.8600(A$829mn), $0.8660(A$257mn)

NZD/USD: $0.7750(NZ$412mn), $0.7820(NZ$305mn), $0.7870(NZ$316mn)

USD/CAD: C$1.1255($275mn), C$1.1280($252mn), C$1.1360($261mn)

-

13:08

Foreign exchange market. European session: the British pound declined against the U.S. dollar after the Bank of England’s inflation letter

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Wage Price Index, q/q Quarter III +0.6% +0.6% +0.6%

00:30 Australia Wage Price Index, y/y Quarter III +2.6% +2.6% +2.6%

08:00 U.S. FOMC Member Charles Plosser Speaks

09:30 United Kingdom Average Earnings, 3m/y September +0.7% +0.8% +1.0%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September +0.9% +1.1% +1.3%

09:30 United Kingdom Claimant count October -18.6 -24.9 -20.4

09:30 United Kingdom Claimant Count Rate October 2.8% 2.8%

09:30 United Kingdom ILO Unemployment Rate September 6.0% 5.9% 6.0%

10:00 Eurozone Industrial production, (MoM) September -1.4% Revised From -1.8% +0.6% +0.6%

10:00 Eurozone Industrial Production (YoY) September -0.5% Revised From -1.9% -0.4% +0.6%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed against the most major currencies. There will be released no major economic reports in the U.S.

The euro traded slightly lower against the U.S. dollar after industrial production from the Eurozone. Industrial production in the Eurozone rose 0.6% in September, in line with expectations, after a 1.4% drop in August. August's figure was revised up from a 1.8 fall.

On a yearly basis, Eurozone's industrial production increased 0.6% in September, beating expectations for a 0.4% decline, after 0.5% fall in August. August's figure was revised up from a 1.9 drop.

The British pound declined against the U.S. dollar after the Bank of England's inflation letter. The Bank of England (BoE) lowered its economic growth and inflation forecasts.

The BoE cut its forecasts for economic growth in 2015 to 2.9% from a previous 3.1% gain.

The BoE Governor Mark Carney warned that inflation could fall below 1% in the next six months due to lower commodity prices and a slowdown of global growth. The central bank expects inflation to achieve its 2% target in three years.

The U.K. unemployment rate remained unchanged at 6.0% in the July to September quarter, missing expectations for a decline to 5.9%.

The claimant count decreased by 20,400 people in October, missing expectations for a drop of 24,900 people, after a decrease of 18,600 people in September.

Average weekly earnings, excluding bonuses, climbed by 1.3% in the July to September period. That was the first time in five years that earnings overtook inflation. Inflation in the U.K. declined to 1.2% in September.

Average weekly earnings, including bonuses, rose by 1.0% in the July to September period.

EUR/USD: the currency pair fell to $1.2429

GBP/USD: the currency pair dropped to $1.5810

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

15:00 U.S. Wholesale Inventories September +0.7% +0.3%

16:25 Canada BOC Deputy Governor Lawrence Schembri Speaks

17:00 U.S. FOMC Member Narayana Kocherlakota

21:30 New Zealand Business NZ PMI October 58.1

23:50 Japan Core Machinery Orders October +4.7% -1.0%

23:50 Japan Core Machinery Orders, y/y October -3.3% -1.3%

-

13:03

United Kingdom: Inflation will fall below 1%

BoE's governor Mark Carney today announced inflation will probably fall below 1% in the next 6 months and is likely to stay under 2% in the next two years. Amid a weaker global outlook the BoE expects economic growth at a 3.5% rate this year followed by 2.9% in 2016.

The U.K. unemployment rate was unchanged at 6.0% in the 3rd quarter. Average weekly earnings rose by 1.3%.

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580, $1.2550, $1.2510

Bids $1.2390, $1.2360/50, $1.2300, $1.2250

GBP/USD

Offers $1.6040, $1.6000, $1.5950/60

Bids $1.5785, $1.5700

AUD/USD

Offers $0.8800, $0.8760, $0.8750

Bids $0.8660, $0.8600, $0.8520, $0.8500, 0.8450

EUR/JPY

Offers Y145.00, Y144.70

Bids Y142.40, Y142.10/00, Y141.55/50, Y141.00, Y140.50

USD/JPY

Offers Y116.50, Y116.10, Y116.00

Bids Y113.85, Y113.00, Y112.60, Y112.00

EUR/GBP

Offers stg0.7900, stg0.7885, stg0.7860

Bids stg0.7795, stg0.7755/45, stg0.7700

-

13:00

Average weekly earnings

BoE's governor Mark Carney today announced inflation will probably fall below 1% in the next 6 months and is likely to stay under 2% in the next two years. Amid a weaker global outlook the BoE expects economic growth at a 3.5% rate this year followed by 2.9% in 2016.

The U.K. unemployment rate was unchanged at 6.0% in the 3rd quarter. Average weekly earnings rose by 1.3%.

-

10:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400(E525mn), $1.2500(E960mn), $1.2540-50(E1.3bn)

USD/JPY: Y113.80($400mn), Y116.50($300mn)

GBP/USD: $1.5835(stg263mn), $1.5900(stg211mn), $1.6000(stg260mn)

AUD/USD: $0.8600(A$829mn), $0.8660(A$257mn)

NZD/USD: $0.7750(NZ$412mn), $0.7820(NZ$305mn), $0.7870(NZ$316mn)

USD/CAD: C$1.1255($275mn), C$1.1280($252mn), C$1.1360($261mn)

-

10:00

Eurozone: Industrial Production (YoY), September +0.6% (forecast -0.4%)

-

10:00

Eurozone: Industrial production, (MoM), September +0.6% (forecast +0.6%)

-

09:31

United Kingdom: Average Earnings, 3m/y , September +1.0% (forecast +0.8%)

-

09:31

United Kingdom: Average earnings ex bonuses, 3 m/y, September +1.3% (forecast +1.1%)

-

09:30

United Kingdom: ILO Unemployment Rate, September 6.0% (forecast 5.9%)

-

09:30

United Kingdom: Claimant Count Rate, October 2.8%

-

09:30

United Kingdom: Claimant count , October -20.4 (forecast -24.9)

-

09:27

Press Review: Regulators fine global banks $3.4 billion in forex probe

REUTERS

Regulators fine global banks $3.4 billion in forex probe

Global regulators imposed penalties totaling $3.4 billion on five major banks, including UBS (UBSN.VX), HSBC (HSBA.L) and Citigroup (C.N) on Wednesday for failing to stop their traders from trying to manipulate foreign exchange markets.

Royal Bank of Scotland (RBS.L) and JP Morgan (JPM.N) were also fined over attempts to rig currency benchmarks in a year-long probe that has put the largely unregulated $5 trillion-a-day market on a tighter leash, with dozens of dealers suspended or fired.

Source: http://www.reuters.com/article/2014/11/12/us-banks-forex-settlement-cftc-idUSKCN0IW0E520141112

REUTERS

Hong Kong to scrap daily yuan conversion limit to boost stock investment

Hong Kong will scrap the daily 20,000 yuan ($3,264) conversion limit for residents from Monday when a landmark scheme to link the city's stock market with Shanghai is launched, facilitating investment flows into China's stock market.

Source: http://www.reuters.com/article/2014/11/12/us-china-hongkong-yuan-idUSKCN0IW0CK20141112

BLOOMBERG

Sanctioned Russian Banks Said to Woo Exporter Dollars

Russian banks cut off from U.S. and European capital markets by sanctions are wooing exporters with higher rates for deposits in euros and dollars, according to three people with knowledge of the situation.

Source: http://www.bloomberg.com/news/2014-11-12/sanctioned-russian-banks-said-to-woo-exporter-dollars.html

-

07:42

Foreign exchange market. Asian session: The U.S. dollar traded weaker against its major peers after profit-taking

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Wage Price Index, q/q Quarter III +0.6% +0.6% +0.6%

00:30 Australia Wage Price Index, y/y Quarter III +2.6% +2.6% +2.6%

The U.S. dollar softened against its major peers after investors seem to sell the greenback for profits after its rally.

The Australian dollar recovered from his four-year low from last Friday and is currently trading positive against the greenback after the release of a strong business conditions survey that improved by the most on record.

The Kiwi was trading higher after the central banks report on financial stability. RBNZ Governor Graeme Wheeler would not comment on a possible intervention but judges the exchange rate of the NZD unjustified.

The Japanese yen currently trading at USD115.36 recovered from yesterday’s new seven-year low against the U.S. dollar after BoJ board member Ryuzo Miyao said the governemnts bond buying program could stop around the second half of 2015.as inflation nears 2%. Speculations about Prime Minister Shinzo Abe postponing the planned sales tax increase and call snap elections are still weighing on the Japanese yen.

EUR/USD: the currency pair rose to USD1.2487

USD/JPY: the U.S. dollar traded weaker against the Japanese yen

GPB/USD: The British pound traded stronger against the U.S. dollar

The most important news that are expected (GMT0):

08:00 U.S. FOMC Member Charles Plosser Speaks

09:30 United Kingdom Average Earnings, 3m/y September +0.7% +0.8%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September +0.9% +1.1%

09:30 United Kingdom Claimant count October -18.6 -24.9

09:30 United Kingdom Claimant Count Rate October 2.8%

09:30 United Kingdom ILO Unemployment Rate September 6.0% 5.9%

10:00 Eurozone Industrial production, (MoM) September -1.8% +0.6%

10:00 Eurozone Industrial Production (YoY) September -1.9% -0.4%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

15:00 U.S. Wholesale Inventories September +0.7% +0.3%

16:25 Canada BOC Deputy Governor Lawrence Schembri Speaks

17:00 U.S. FOMC Member Narayana Kocherlakota

21:30 New Zealand Business NZ PMI October 58.1

21:45 New Zealand Food Prices Index, m/m October -0.8%

21:45 New Zealand Food Prices Index, y/y October-0.1%

23:50 Japan Core Machinery Orders October +4.7% -1.0%

23:50 Japan Core Machinery Orders, y/y October -3.3% -1.3%

-

06:28

Options levels on wednesday, November 12, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2647 (4306)

$1.2586 (1578)

$1.2540 (701)

Price at time of writing this review: $ 1.2489

Support levels (open interest**, contracts):

$1.2420 (3797)

$1.2381 (6534)

$1.2327 (5451)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 97563 contracts, with the maximum number of contracts with strike pric $1,2800 (5293);

- Overall open interest on the PUT options with the expiration date December, 5 is 104271 contracts, with the maximum number of contracts with strike price $1,2200 (6696);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from November, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.6202 (1586)

$1.6103 (902)

$1.6006 (1900)

Price at time of writing this review: $1.5928

Support levels (open interest**, contracts):

$1.5888 (2430)

$1.5791 (879)

$1.5694 (1104)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 36583 contracts, with the maximum number of contracts with strike price $1,6000 (2183);

- Overall open interest on the PUT options with the expiration date December, 5 is 38864 contracts, with the maximum number of contracts with strike price $1,5900 (2430);

- The ratio of PUT/CALL was 1.06 versus 1.06 from the previous trading day according to data from November, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:32

Australia: Wage Price Index, y/y, Quarter III +2.6% (forecast +2.6%)

-

00:30

Australia: Wage Price Index, q/q, Quarter III +0.6% (forecast +0.6%)

-

00:00

Currencies. Daily history for Nov 11’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2474 +0,43%

GBP/USD $1,5917 +0,48%

USD/CHF Chf0,9644 -0,36%

USD/JPY Y115,78 +0,80%

EUR/JPY Y144,44 +1,25%

GBP/JPY Y184,25 +1,26%

AUD/USD $0,8685 +0,74%

NZD/USD $0,7807 +0,77%

USD/CAD C$1,1335 -0,39%

-