Notícias do Mercado

-

23:51

Japan: Core Machinery Orders, October +2.9% (forecast -1.0%)

-

23:50

Japan: Core Machinery Orders, y/y, October +7.3% (forecast -1.3%)

-

23:36

Commodities. Daily history for Nov 12’2014:

(raw materials / closing price /% change)

Light Crude 76.93 -0.32%

Gold 1,161.50 +0.21%

-

23:34

Stocks. Daily history for Nov 12’2014:

(index / closing price / change items /% change)

Nikkei 225 17,197.05 +72.94 +0.43%

Hang Seng 23,938.18 +129.90 +0.55%

Shanghai Composite 2,494.48 +24.80 +1.00%

FTSE 100 6,611.04 -16.36 -0.25%

CAC 40 4,179.88 -64.22 -1.51%

Xetra DAX 9,210.96 -158.07 -1.69%

S&P 500 2,038.25 -1.43 -0.07%

NASDAQ Composite 4,675.14 +14.58 +0.31%

Dow Jones 17,612.2 -2.70 -0.02%

-

23:27

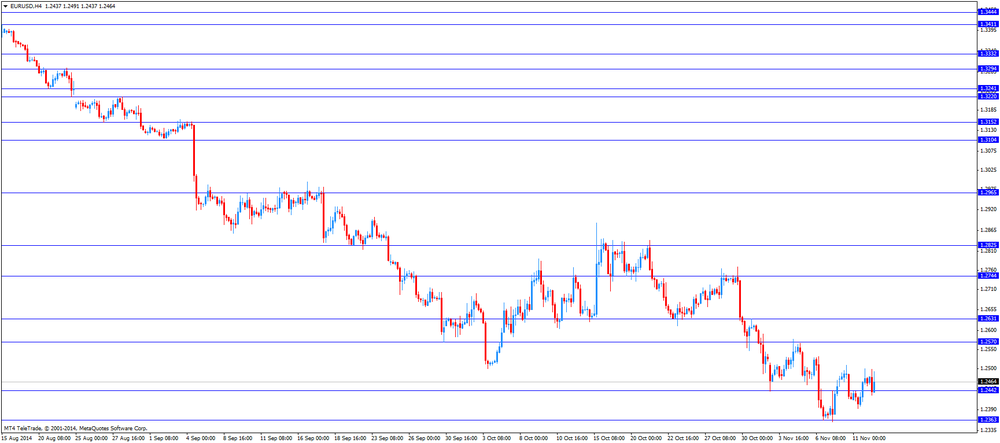

Currencies. Daily history for Nov 12’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2437 -0,30%

GBP/USD $1,5778 -0,88%

USD/CHF Chf0,9663 +0,20%

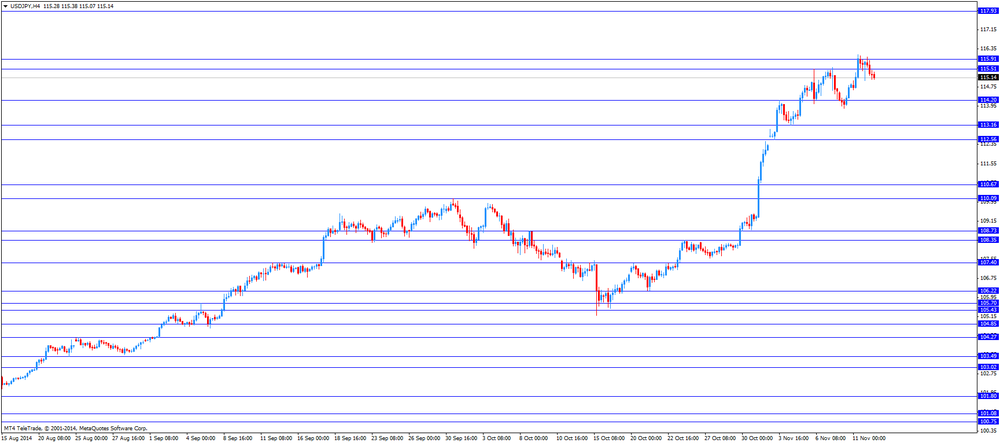

USD/JPY Y115,48 -0,26%

EUR/JPY Y143,62 -0,57%

GBP/JPY Y182,2 -1,13%

AUD/USD $0,8716 +0,36%

NZD/USD $0,7877 +0,89%

USD/CAD C$1,1317 -0,16%

-

23:01

Schedule for today, Thursday, Nov 13’2014:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation October +3.4%

00:01 United Kingdom RICS House Price Balance October 30% 25%

01:30 Australia RBA Assist Gov Kent Speaks

04:30 Japan Industrial Production (MoM) (Finally) September +2.7% +2.7%

04:30 Japan Industrial Production (YoY) September +0.6% +0.6%

05:30 China Retail Sales y/y October +11.6% +11.6%

05:30 China Industrial Production y/y October +8.0% +8.0%

05:30 China Fixed Asset Investment October +16.1% +16.0%

07:00 Germany CPI, m/m (Finally) October -0.3% -0.3%

07:00 Germany CPI, y/y (Finally) October +0.8% +0.8%

07:45 France CPI, y/y October +0.3%

07:45 France CPI, m/m October -0.4% -0.1%

08:15 Switzerland Producer & Import Prices, m/m October -0.1% -0.2%

08:15 Switzerland Producer & Import Prices, y/y October -1.4% -1.4%

09:00 Eurozone ECB Monthly Report

13:30 Canada New Housing Price Index September +0.3% +0.2%

13:30 U.S. Initial Jobless Claims November 278 282

15:00 U.S. JOLTs Job Openings September 4835 4850

15:30 Canada Bank of Canada Review

16:00 U.S. Crude Oil Inventories November +0.5

19:00 U.S. Federal budget October 105.8 -111.5

20:05 Canada Gov Council Member Wilkins Speaks

-

20:00

Dow 17,594.27 -20.63 -0.12%, Nasdaq 4,666.69 +6.13 +0.13%, S&P 500 2,036.28 -3.40 -0.17%

-

17:12

European stocks close: stocks closed lower as bank shares declined

Stock indices closed lower as bank shares declined. Global regulators fined UBS AG, HSBC Holdings Plc, Royal Bank of Scotland, JPMorgan and Citigroup Inc. $3.4 billion for foreign-exchange manipulation.

Industrial production in the Eurozone rose 0.6% in September, in line with expectations, after a 1.4% drop in August. August's figure was revised up from a 1.8 fall.

On a yearly basis, Eurozone's industrial production increased 0.6% in September, beating expectations for a 0.4% decline, after 0.5% fall in August. August's figure was revised up from a 1.9 drop.

The Bank of England (BoE) lowered its economic growth and inflation forecasts.

The BoE cut its forecasts for economic growth in 2015 to 2.9% from a previous 3.1% gain.

The BoE Governor Mark Carney warned that inflation could fall below 1% in the next six months due to lower commodity prices and a slowdown of global growth. The central bank expects inflation to achieve its 2% target in three years.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,611.04 -16.36 -0.25 %

DAX 9,210.96 -158.07 -1.69 %

CAC 40 4,179.88 -64.22 -1.51 %

-

17:00

European stocks closed in minus: FTSE 100 6,611.04 -16.36 -0.25%, CAC 40 4,179.88 -64.22 -1.51%, DAX 9,210.96 -158.07 -1.69%

-

16:42

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies in quiet trade

The U.S. dollar traded mixed to lower against the most major currencies after the U.S. whole sales inventories. Wholesale inventories in the U.S. rose 0.3% in September, in line with expectations, after a 0.6% gain in August. August's figure was revised down from a 0.7% rise.

The euro traded mixed against the U.S. dollar after industrial production from the Eurozone. Industrial production in the Eurozone rose 0.6% in September, in line with expectations, after a 1.4% drop in August. August's figure was revised up from a 1.8 fall.

On a yearly basis, Eurozone's industrial production increased 0.6% in September, beating expectations for a 0.4% decline, after 0.5% fall in August. August's figure was revised up from a 1.9 drop.

The British pound traded mixed against the U.S. dollar. Earlier, the pound dropped against the greenback after the Bank of England's inflation letter. The Bank of England (BoE) lowered its economic growth and inflation forecasts.

The BoE cut its forecasts for economic growth in 2015 to 2.9% from a previous 3.1% gain.

The BoE Governor Mark Carney warned that inflation could fall below 1% in the next six months due to lower commodity prices and a slowdown of global growth. The central bank expects inflation to achieve its 2% target in three years.

The U.K. unemployment rate remained unchanged at 6.0% in the July to September quarter, missing expectations for a decline to 5.9%.

The claimant count decreased by 20,400 people in October, missing expectations for a drop of 24,900 people, after a decrease of 18,600 people in September.

Average weekly earnings, excluding bonuses, climbed by 1.3% in the July to September period. That was the first time in five years that earnings overtook inflation. Inflation in the U.K. declined to 1.2% in September.

Average weekly earnings, including bonuses, rose by 1.0% in the July to September period.

The New Zealand dollar increased against the U.S. dollar. The Reserve Bank of New Zealand (RBNZ) released its Financial Stability Report on late Tuesday. The RBNZ Governor Graeme Wheeler said in the central bank's Financial Stability Report that the exchange rate of the New Zealand dollar is "unjustified and unsustainable". He pointed out that the RBNZ "still thinks the exchange rate's got further to go".

The Australian dollar climbed against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback despite solid economic data from Australia. The Westpac Banking Corporation's consumer sentiment for Australia increased 1.9% in November, after a 0.9% gain in October.

Wage price index in Australia rose by 0.6% in the third quarter, in line with expectations, after a 0.6% increase in the previous quarter.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

The Bank of Japan (BoJ) board member Ryuzo Miyao said on Wednesday that the BoJ could start talking about the end of stimulus measures around the second half of fiscal 2015 if inflation will reach the central bank's 2% target.

-

16:40

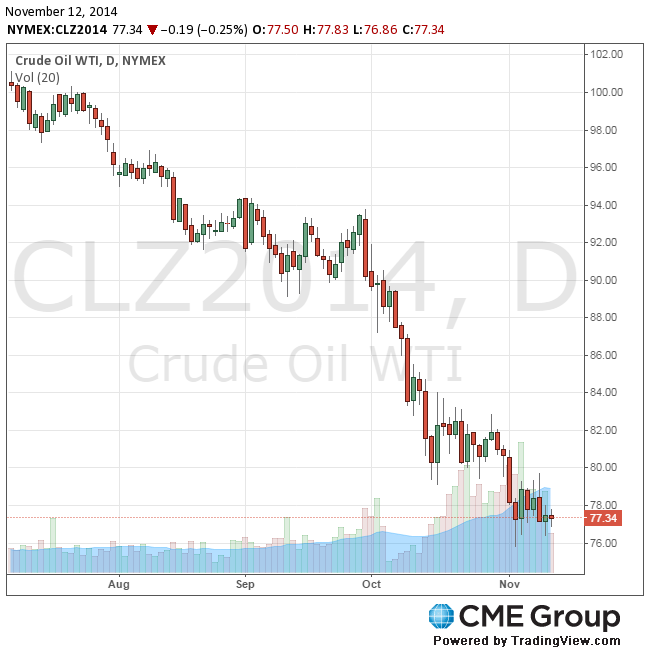

Brent crude near 4-year low

Brent crude traded near its lowest level in four years amid speculation that a drop in OPEC output last month won't eliminate a supply glut.

Futures declined for a third day. The Organization of Petroleum Exporting Countries said its production dropped by 226,400 barrels a day to 30.253 million in October, the largest decrease since March. West Texas Intermediate crude slid on forecasts that U.S. inventories rose for a sixth week.

"That factors that brought us down here are still the main focus," said Gene McGillian, a senior analyst at Tradition Energy in Stamford, Connecticut. "Even though OPEC said it cut production, we continue to have fears that we have a global supply glut. We can see another build in U.S. stockpiles this week."

Brent for December settlement declined 58 cents, or 0.7 percent, to $81.09 a barrel at 9:07 a.m. New York time on the London-based ICE Futures Europe exchange. The contract, which expires tomorrow, closed at $81.67 yesterday, the lowest since October 2010. The more-active January contract was down 0.6 percent at $82.39 a barrel. The volume of all futures was 14 percent below the 100-day average.

WTI for December delivery dropped 72 cents, or 0.9 percent, to $77.22 a barrel on the New York Mercantile Exchange. Volume was 9.1 percent below the 100-day average. The U.S. benchmark crude was at a $3.86 discount to Brent on the ICE.

-

16:20

Gold stabilized

Gold prices stable amid rising dollar to four-year high and outflows of funds backed by gold.

The world's largest reserves of the gold-traded exchange-traded fund SPDR Gold Trust on Tuesday fell 0.12 percent to 724.46 tons of six-year low.

"I see no reason for the growth of gold at the rise of the dollar and the stock price and given the impending rise in interest rates. The gold market is now heavily dependent on the appreciation of the yen against the dollar and the decline should resume soon," - said the precious metals trader in Hong Kong.

On the Shanghai Gold Exchange Wednesday precious metal is trading at $ 02.03 an ounce more expensive than the global benchmark, whereas last week the gold in China is mainly offered at a discount to the standard.

South african producer of gold AngloGold Ashanti plans to cut some employees counting reduce costs.

The cost of December gold futures on the COMEX today is trading in the range 1159.60 - 1169.40 dollars per ounce.

-

16:13

Reserve Bank of New Zealand reiterated that the exchange rate of the New Zealand dollar is “unjustified and unsustainable”

The Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler said in the central bank's Financial Stability Report released on Tuesday that the RBNZ will keep the limits on low-deposit home lending. Wheeler added that restrictions on lending have helped to restrain house price inflation.

The RBNZ governor reiterated that the exchange rate of the New Zealand dollar is "unjustified and unsustainable". He pointed out that the RBNZ "still thinks the exchange rate's got further to go".

The central bank also said that "further increases in short-term interest rates may be required in coming years".

-

15:35

Wholesale inventories in the U.S. rose 0.3% in September

The U.S. Commerce Department released wholesale inventories on Wednesday. Wholesale inventories in the U.S. rose 0.3% in September, in line with expectations, after a 0.6% gain in August. August's figure was revised down from a 0.7% rise.

Inventories of durable goods rose 0.8% in September, while inventories of non-durable goods decreased by 0.6%.

-

15:00

U.S.: Wholesale Inventories, September +0.3% (forecast +0.3%)

-

14:36

U.S. Stocks open: Dow 17,540.30 -74.60 -0.42%, Nasdaq 4,647.00 -13.56 -0.29%, S&P 2,032.29 -7.39 -0.36%

-

14:29

Before the bell: S&P futures -0.39%, Nasdaq futures -0.33%

U.S. stock-index futures declined as investors consider valuations that are the highest since 2009.

Global markets:

Nikkei 17,197.05 +72.94 +0.43%

Hang Seng 23,938.18 +129.90 +0.55%

Shanghai Composite 2,494.28 +24.60 +1.00%

FTSE 6,601.5 -25.90 -0.39%

CAC 4,185.3 -58.80 -1.39%

DAX 9,220.17 -148.86 -1.59%

Crude oil $77.18 (-1.00%)

Gold $1166.90 (+0.34%)

-

14:28

Bank of England fired its chief currency dealer

The Bank of England (BoE) fired chief currency dealer Martin Mallet after he failed to follow internal policies. Mallet has worked at the central bank for 30 years.

The BoE said that the reason for the dismissal was related to its internal policies and not to the forex scandal.

-

14:11

DOW components before the bell

(company / ticker / price / change, % / volume)

Cisco Systems Inc

CSCO

25.01

-0.56%

30.4K

JPMorgan Chase and Co

JPM

60.80

-0.93%

12.7K

Nike

NKE

94.20

-0.72%

0.5K

Intel Corp

INTC

33.15

-0.48%

2.3K

International Business Machines Co...

IBM

162.65

-0.40%

1K

Microsoft Corp

MSFT

48.68

-0.39%

5.6K

General Electric Co

GE

26.28

-0.38%

11.0K

E. I. du Pont de Nemours and Co

DD

70.10

-0.34%

1.3K

Verizon Communications Inc

VZ

50.47

-0.28%

0.4K

United Technologies Corp

UTX

107.41

-0.24%

0.5K

Pfizer Inc

PFE

30.25

-0.23%

9.4K

McDonald's Corp

MCD

94.94

-0.21%

0.4K

The Coca-Cola Co

KO

42.42

-0.21%

3.5K

Walt Disney Co

DIS

89.79

-0.21%

0.3K

Johnson & Johnson

JNJ

108.70

-0.19%

0.4K

Exxon Mobil Corp

XOM

96.25

-0.17%

1.0K

Wal-Mart Stores Inc

WMT

78.90

-0.14%

0.3K

Merck & Co Inc

MRK

59.31

-0.10%

0.2K

Home Depot Inc

HD

98.11

-0.03%

3.4K

Procter & Gamble Co

PG

89.64

-0.03%

1.6K

UnitedHealth Group Inc

UNH

96.10

+0.43%

0.2K

-

14:04

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

JPMorgan Chase (JPM) downgraded to Mkt Perform from Outperform at Bernstein

Other:

Visa (V) initiated at Hold at Topeka Capital Markets, target $261

Home Depot (HD) target raised to $113 from $102 at Jefferies

-

13:50

Option expiries for today's 1400GMT cut

EUR/USD: $1.2400(E525mn), $1.2500(E960mn), $1.2540-50(E1.3bn)

USD/JPY: Y113.80($400mn), Y116.50($300mn)

GBP/USD: $1.5835(stg263mn), $1.5900(stg211mn), $1.6000(stg260mn)

AUD/USD: $0.8600(A$829mn), $0.8660(A$257mn)

NZD/USD: $0.7750(NZ$412mn), $0.7820(NZ$305mn), $0.7870(NZ$316mn)

USD/CAD: C$1.1255($275mn), C$1.1280($252mn), C$1.1360($261mn)

-

13:08

Foreign exchange market. European session: the British pound declined against the U.S. dollar after the Bank of England’s inflation letter

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Wage Price Index, q/q Quarter III +0.6% +0.6% +0.6%

00:30 Australia Wage Price Index, y/y Quarter III +2.6% +2.6% +2.6%

08:00 U.S. FOMC Member Charles Plosser Speaks

09:30 United Kingdom Average Earnings, 3m/y September +0.7% +0.8% +1.0%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September +0.9% +1.1% +1.3%

09:30 United Kingdom Claimant count October -18.6 -24.9 -20.4

09:30 United Kingdom Claimant Count Rate October 2.8% 2.8%

09:30 United Kingdom ILO Unemployment Rate September 6.0% 5.9% 6.0%

10:00 Eurozone Industrial production, (MoM) September -1.4% Revised From -1.8% +0.6% +0.6%

10:00 Eurozone Industrial Production (YoY) September -0.5% Revised From -1.9% -0.4% +0.6%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed against the most major currencies. There will be released no major economic reports in the U.S.

The euro traded slightly lower against the U.S. dollar after industrial production from the Eurozone. Industrial production in the Eurozone rose 0.6% in September, in line with expectations, after a 1.4% drop in August. August's figure was revised up from a 1.8 fall.

On a yearly basis, Eurozone's industrial production increased 0.6% in September, beating expectations for a 0.4% decline, after 0.5% fall in August. August's figure was revised up from a 1.9 drop.

The British pound declined against the U.S. dollar after the Bank of England's inflation letter. The Bank of England (BoE) lowered its economic growth and inflation forecasts.

The BoE cut its forecasts for economic growth in 2015 to 2.9% from a previous 3.1% gain.

The BoE Governor Mark Carney warned that inflation could fall below 1% in the next six months due to lower commodity prices and a slowdown of global growth. The central bank expects inflation to achieve its 2% target in three years.

The U.K. unemployment rate remained unchanged at 6.0% in the July to September quarter, missing expectations for a decline to 5.9%.

The claimant count decreased by 20,400 people in October, missing expectations for a drop of 24,900 people, after a decrease of 18,600 people in September.

Average weekly earnings, excluding bonuses, climbed by 1.3% in the July to September period. That was the first time in five years that earnings overtook inflation. Inflation in the U.K. declined to 1.2% in September.

Average weekly earnings, including bonuses, rose by 1.0% in the July to September period.

EUR/USD: the currency pair fell to $1.2429

GBP/USD: the currency pair dropped to $1.5810

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

15:00 U.S. Wholesale Inventories September +0.7% +0.3%

16:25 Canada BOC Deputy Governor Lawrence Schembri Speaks

17:00 U.S. FOMC Member Narayana Kocherlakota

21:30 New Zealand Business NZ PMI October 58.1

23:50 Japan Core Machinery Orders October +4.7% -1.0%

23:50 Japan Core Machinery Orders, y/y October -3.3% -1.3%

-

13:03

United Kingdom: Inflation will fall below 1%

BoE's governor Mark Carney today announced inflation will probably fall below 1% in the next 6 months and is likely to stay under 2% in the next two years. Amid a weaker global outlook the BoE expects economic growth at a 3.5% rate this year followed by 2.9% in 2016.

The U.K. unemployment rate was unchanged at 6.0% in the 3rd quarter. Average weekly earnings rose by 1.3%.

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580, $1.2550, $1.2510

Bids $1.2390, $1.2360/50, $1.2300, $1.2250

GBP/USD

Offers $1.6040, $1.6000, $1.5950/60

Bids $1.5785, $1.5700

AUD/USD

Offers $0.8800, $0.8760, $0.8750

Bids $0.8660, $0.8600, $0.8520, $0.8500, 0.8450

EUR/JPY

Offers Y145.00, Y144.70

Bids Y142.40, Y142.10/00, Y141.55/50, Y141.00, Y140.50

USD/JPY

Offers Y116.50, Y116.10, Y116.00

Bids Y113.85, Y113.00, Y112.60, Y112.00

EUR/GBP

Offers stg0.7900, stg0.7885, stg0.7860

Bids stg0.7795, stg0.7755/45, stg0.7700

-

13:00

Average weekly earnings

BoE's governor Mark Carney today announced inflation will probably fall below 1% in the next 6 months and is likely to stay under 2% in the next two years. Amid a weaker global outlook the BoE expects economic growth at a 3.5% rate this year followed by 2.9% in 2016.

The U.K. unemployment rate was unchanged at 6.0% in the 3rd quarter. Average weekly earnings rose by 1.3%.

-

12:22

European stock markets mid-session: Banking stocks weigh on European indices

European stock indices are trading lower today despite a strong Japanese market and Eurozone's industrial production within estimates. Bank stocks were under pressure after regulators imposing a total of USD3.4 billion settlement over allegations of price-fixing in the currency markets. UK's unemployment rate was slightly higher at 6.0% and wages growing faster at 1% than the 0.8% predicted by economists. UK's FTSE 100 index is down -0.39% trading at 6,601.672 points. Germany's DAX 30 lost -1.22% trading at 9,254.50 points and France's CAC 40 is down -38.70 points, a loss of -0.91% currently trading at 4,205.40 points.

-

11:37

Oil: Prices further decline

Oil prices declined in today's trading. Brent Crude is currently trading -0.37% at USD81.37 and WTI Crude lost -0.64% trading at USD77.44. Investors are awaiting OPEC's monthly report scheduled for today.

A weakening global demand, a stronger U.S. dollar and no indication on the OPEC to cut output in order to support oil prices are weighing on the market. The next meeting of OPEC oil ministers, whose 12 members supply about 40 percent of the world's oil, is scheduled for November 27th.

-

11:11

Gold trading slightly higher around USD1163.00 per ounce

Gold, currently trading at USD1163.00 an ounce further steadied after Friday's biggest gains in more than a four months period after its 40% loss from the all-time high reached September 2011. Gold price is still under selling pressure as the FED is expected to raise interest rates but found support in a weakening U.S. dollar as investors were taking profits in selling the greenback making the precious metal cheaper for investors using other currencies.

GOLD currently trading at USD1163.00

-

10:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2400(E525mn), $1.2500(E960mn), $1.2540-50(E1.3bn)

USD/JPY: Y113.80($400mn), Y116.50($300mn)

GBP/USD: $1.5835(stg263mn), $1.5900(stg211mn), $1.6000(stg260mn)

AUD/USD: $0.8600(A$829mn), $0.8660(A$257mn)

NZD/USD: $0.7750(NZ$412mn), $0.7820(NZ$305mn), $0.7870(NZ$316mn)

USD/CAD: C$1.1255($275mn), C$1.1280($252mn), C$1.1360($261mn)

-

10:00

Eurozone: Industrial Production (YoY), September +0.6% (forecast -0.4%)

-

10:00

Eurozone: Industrial production, (MoM), September +0.6% (forecast +0.6%)

-

09:31

United Kingdom: Average Earnings, 3m/y , September +1.0% (forecast +0.8%)

-

09:31

United Kingdom: Average earnings ex bonuses, 3 m/y, September +1.3% (forecast +1.1%)

-

09:30

United Kingdom: ILO Unemployment Rate, September 6.0% (forecast 5.9%)

-

09:30

United Kingdom: Claimant Count Rate, October 2.8%

-

09:30

United Kingdom: Claimant count , October -20.4 (forecast -24.9)

-

09:27

Press Review: Regulators fine global banks $3.4 billion in forex probe

REUTERS

Regulators fine global banks $3.4 billion in forex probe

Global regulators imposed penalties totaling $3.4 billion on five major banks, including UBS (UBSN.VX), HSBC (HSBA.L) and Citigroup (C.N) on Wednesday for failing to stop their traders from trying to manipulate foreign exchange markets.

Royal Bank of Scotland (RBS.L) and JP Morgan (JPM.N) were also fined over attempts to rig currency benchmarks in a year-long probe that has put the largely unregulated $5 trillion-a-day market on a tighter leash, with dozens of dealers suspended or fired.

Source: http://www.reuters.com/article/2014/11/12/us-banks-forex-settlement-cftc-idUSKCN0IW0E520141112

REUTERS

Hong Kong to scrap daily yuan conversion limit to boost stock investment

Hong Kong will scrap the daily 20,000 yuan ($3,264) conversion limit for residents from Monday when a landmark scheme to link the city's stock market with Shanghai is launched, facilitating investment flows into China's stock market.

Source: http://www.reuters.com/article/2014/11/12/us-china-hongkong-yuan-idUSKCN0IW0CK20141112

BLOOMBERG

Sanctioned Russian Banks Said to Woo Exporter Dollars

Russian banks cut off from U.S. and European capital markets by sanctions are wooing exporters with higher rates for deposits in euros and dollars, according to three people with knowledge of the situation.

Source: http://www.bloomberg.com/news/2014-11-12/sanctioned-russian-banks-said-to-woo-exporter-dollars.html

-

09:10

European Stocks. First hour: European indices dipped early in the session

European stock indices are trading lower at the start despite new highs in Asia and the U.S.

FTSE 100 index is down -0.42% trading at 6599.69 points, Germany's DAX 30 lost 1.13% currently trading at 9,263.01 points and France's CAC 40 dipped -0.73% trading at 4,213.22 points.

Investors are awaiting data on Industrial production in the Eurozone published at 10:00 GMT.

-

08:35

DAX 9,353.98 -15.05 -0.16%, CAC 40 4,241.8 -2.30 -0.05%, EUROFIRST 300 1,357.49 -1.29 -0.09%, FTSE 100 6,623.77 -3.63 -0.05%

-

08:13

Global Stocks: U.S. Indices trading at all-time highs

The DOW Jones and S&P 500 rose to a fifth consecutive record closing in yesterday's trading session. The DOW Jones closed with a very small plus of 0.01% at 17,614.90, the S&P500 gained +0.07% closing at 2,039.68 points barely adding to the rally. Volume was light due to U.S. Veterans Day holiday.

Hong Kong's Hang Seng was up 0.44% closing at 23,913.24, China's Shanghai Composite gained -1.00% closing at 2,494.28 after a decline in early trading.

Japan's Nikkei closed with a gain of 0.43% at 17,197.05 clsing at new 7-year highs fuelled by expectations that Japan's Prime Minister Shinzo Abe will postpone the scheduled sales tax hike.

-

07:42

Foreign exchange market. Asian session: The U.S. dollar traded weaker against its major peers after profit-taking

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Wage Price Index, q/q Quarter III +0.6% +0.6% +0.6%

00:30 Australia Wage Price Index, y/y Quarter III +2.6% +2.6% +2.6%

The U.S. dollar softened against its major peers after investors seem to sell the greenback for profits after its rally.

The Australian dollar recovered from his four-year low from last Friday and is currently trading positive against the greenback after the release of a strong business conditions survey that improved by the most on record.

The Kiwi was trading higher after the central banks report on financial stability. RBNZ Governor Graeme Wheeler would not comment on a possible intervention but judges the exchange rate of the NZD unjustified.

The Japanese yen currently trading at USD115.36 recovered from yesterday’s new seven-year low against the U.S. dollar after BoJ board member Ryuzo Miyao said the governemnts bond buying program could stop around the second half of 2015.as inflation nears 2%. Speculations about Prime Minister Shinzo Abe postponing the planned sales tax increase and call snap elections are still weighing on the Japanese yen.

EUR/USD: the currency pair rose to USD1.2487

USD/JPY: the U.S. dollar traded weaker against the Japanese yen

GPB/USD: The British pound traded stronger against the U.S. dollar

The most important news that are expected (GMT0):

08:00 U.S. FOMC Member Charles Plosser Speaks

09:30 United Kingdom Average Earnings, 3m/y September +0.7% +0.8%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September +0.9% +1.1%

09:30 United Kingdom Claimant count October -18.6 -24.9

09:30 United Kingdom Claimant Count Rate October 2.8%

09:30 United Kingdom ILO Unemployment Rate September 6.0% 5.9%

10:00 Eurozone Industrial production, (MoM) September -1.8% +0.6%

10:00 Eurozone Industrial Production (YoY) September -1.9% -0.4%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

15:00 U.S. Wholesale Inventories September +0.7% +0.3%

16:25 Canada BOC Deputy Governor Lawrence Schembri Speaks

17:00 U.S. FOMC Member Narayana Kocherlakota

21:30 New Zealand Business NZ PMI October 58.1

21:45 New Zealand Food Prices Index, m/m October -0.8%

21:45 New Zealand Food Prices Index, y/y October-0.1%

23:50 Japan Core Machinery Orders October +4.7% -1.0%

23:50 Japan Core Machinery Orders, y/y October -3.3% -1.3%

-

06:28

Options levels on wednesday, November 12, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2647 (4306)

$1.2586 (1578)

$1.2540 (701)

Price at time of writing this review: $ 1.2489

Support levels (open interest**, contracts):

$1.2420 (3797)

$1.2381 (6534)

$1.2327 (5451)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 97563 contracts, with the maximum number of contracts with strike pric $1,2800 (5293);

- Overall open interest on the PUT options with the expiration date December, 5 is 104271 contracts, with the maximum number of contracts with strike price $1,2200 (6696);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from November, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.6202 (1586)

$1.6103 (902)

$1.6006 (1900)

Price at time of writing this review: $1.5928

Support levels (open interest**, contracts):

$1.5888 (2430)

$1.5791 (879)

$1.5694 (1104)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 36583 contracts, with the maximum number of contracts with strike price $1,6000 (2183);

- Overall open interest on the PUT options with the expiration date December, 5 is 38864 contracts, with the maximum number of contracts with strike price $1,5900 (2430);

- The ratio of PUT/CALL was 1.06 versus 1.06 from the previous trading day according to data from November, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:00

Nikkei 225 17,356.4 +232.29 +1.36%, Hang Seng 23,823.16 +14.88 +0.06%, S&P/ASX 200 5,479 -38.10 -0.69%, Shanghai Composite 2,454.6 -15.07 -0.61%

-

00:32

Australia: Wage Price Index, y/y, Quarter III +2.6% (forecast +2.6%)

-

00:30

Australia: Wage Price Index, q/q, Quarter III +0.6% (forecast +0.6%)

-

00:01

Commodities. Daily history for Nov 11’2014:

(raw materials / closing price /% change)

Light Crude 77.53-0.53%

Gold 1,163.40 +0.03%

-

00:01

Stocks. Daily history for Nov 11’2014:

(index / closing price / change items /% change)

Nikkei 225 17,124.11 +343.58 +2.05%

Hang Seng 23,808.28 +63.58 +0.27%

Shanghai Composite 2,469.67 -4.00 -0.16%

FTSE 100 6,627.4 +16.15 +0.24%

CAC 40 4,244.1 +21.28 +0.50%

Xetra DAX 9,369.03 +17.16 +0.18%

S&P 500 2,039.68 +1.42 +0.07%

NASDAQ Composite 4,660.56 +8.94 +0.19%

Dow Jones 17,614.9 +1.16 +0.01%

-

00:00

Currencies. Daily history for Nov 11’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2474 +0,43%

GBP/USD $1,5917 +0,48%

USD/CHF Chf0,9644 -0,36%

USD/JPY Y115,78 +0,80%

EUR/JPY Y144,44 +1,25%

GBP/JPY Y184,25 +1,26%

AUD/USD $0,8685 +0,74%

NZD/USD $0,7807 +0,77%

USD/CAD C$1,1335 -0,39%

-