Notícias do Mercado

-

18:58

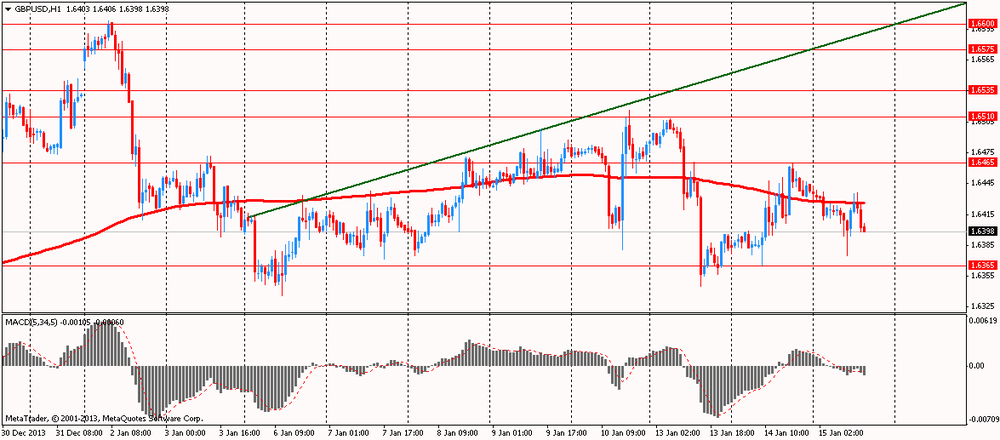

American focus : the pound has fallen markedly against the U.S. dollar

Euro fell against the dollar, which was associated with the release of data for Germany and the revision of global growth forecasts by the World Bank . Report on Germany showed that GDP growth slowed in 2013 due to uncertainty stemming from the eurozone crisis . Germany 's gross domestic product adjusted for inflation increased by 0.4 % in 2013 after rising 0.7 % the previous year . Household consumption in the euro zone 's largest economy in 2013 increased by 0.9 % , while government consumption rose by 1.1%. Export growth was 0.6 % in 2013 , compared with 3.2 % in the previous year .

Meanwhile, adding that the World Bank raised its forecast for global economic growth in 2014-2015 . According to forecasts , this year, the world economy will grow by 3.2% compared to the June forecast growth of 3%. The Bank expects that in 2015 global growth to reach 3.4 % compared with 3.3% projected in June. Prediction for the richest countries was revised to 2.2% from 2% . In the U.S., growth will accelerate to 2.8 % this year , while Japan's GDP will be 1.4 %. This year, the eurozone economy is expected to increase to 1.1% compared with 0.9 % reported by the World Bank in June.

Moreover, we note that a small influence on the bidding had U.S. data , which showed that the producer price index rose a seasonally adjusted 0.4% in November , led by a jump in energy prices. This happened after declining for two consecutive months , and marked the biggest increase since June. However , producer prices for the entire 2013 rose by only 1.2% , it is the smallest annual growth rate since calendar 2008. Main producer prices , which exclude volatile prices for food and energy , increased by 0.3% from November and 1.4 % for the whole 2013 .

Growth last month was lower than the forecast of economists expect an increase in overall prices by 0.5% , while the growth of the base prices was above forecasts of 0.1 %.

Dollar growth expectations also help review publication of the U.S. economy from the Federal Reserve . Today American Central Bank will publish the traditional macroeconomic overview , which is called Beige Book (" Beige Book " ) .

Pound declined significantly against the dollar, which was associated with the release of positive U.S. data . As we learned from the industry survey from the Federal Reserve Bank of New York, business activity in New York rose much more sharply than in recent months. The overall index of business conditions in January rose 10 points to 12.5 , its highest level in more than a year (since May 2012 ) . This month, 35% of respondents reported that conditions have improved over the last month , and 22% - that have deteriorated .

The new orders index rose 13 points to 11.0 - a two-year maximum. Delivery index rose 11 points to 15.5 . Index of orders remained in negative territory, -8.5 . Delivery time index changed little , remaining at -8.5 . Index of stocks rose by 2.4 points to 24 - more than offsetting the sharp decline in the last month . Indices of purchase prices and sales prices have risen significantly , which shows an increase of price pressure . Paid index rose 21 points to 36.6 - the highest value in more than a year, which shows a steady increase in purchase prices . Price Index rose 10 points to 13.4 , indicating that selling prices are also rising . Employment indices indicate an improvement in labor market conditions . Index number of employees rose by 12 points to 12.2 , the index of the average workweek rose to 1.2 .

The course of trading statements also influenced the Bank of England Governor Mark Carney before the Special Committee of the Treasury. Carney and other members of the Committee on Financial Policy to answer questions relating to a recent report on financial stability . In his reply to a question about the problem of bank restructuring Carney stressed the importance of using sheathe economic business model for financial institutions. "Simple disbanding Institute does not guarantee a viable or more competitive structure ", - he said. CB Head also assured that the expiry funding bank lending (FLS), aimed at encouraging lending to households by banks , will not be a problem , and , according to research , " financing conditions for commercial lenders look very favorably ." On the question of the likelihood of a rate hike Central Bank chief said that the sharp increase in the cost of credit should not be expected .

-

15:30

U.S.: Crude Oil Inventories, January -7.7

-

13:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3590, $1.3600, $1.3700, $1.3750, $1.3800

USD/JPY Y103.20, Y104.00, Y104.65, Y104.80, Y105.00/05, Y105.50, Y106.00, Y106.50

EUR/JPY Y143.00

EUR/GBP stg0.8300

USD/CHF Chf0.9050

EUR/CHF Chf1.2370

AUD/USD $0.8925, $0.8950, $0.9000, $0.9075, $0.9120

USD/CAD C$1.0875, C$1.0900

-

13:30

U.S.: NY Fed Empire State manufacturing index , January 12.51 (forecast 3.2)

-

13:30

U.S.: PPI, m/m, December +0.4% (forecast +0.5%)

-

13:30

U.S.: PPI excluding food and energy, m/m, December +0.3% (forecast +0.1%)

-

13:30

U.S.: PPI, y/y, December +1.2% (forecast +0.8%)

-

13:30

U.S.: PPI excluding food and energy, Y/Y, December +1.4% (forecast +1.3%)

-

13:14

European session: the euro fell

08:15 Switzerland Retail Sales Y/Y November +1.6% Revised From +1.2% +2.3% +4.2%

10:00 Eurozone Trade Balance s.a. November 14.3 Revised From 14.5 16.7 16.0

Euro fell against the U.S. dollar under pressure data on the GDP of Germany . German economic growth slowed in 2013 due to uncertainty stemming from the eurozone crisis , the Federal Statistical Office Destatis Wednesday.

Germany 's gross domestic product adjusted for inflation increased by 0.4 % in 2013 after rising 0.7 % in the previous year, said Destatis.

"It seems that the crisis in the euro zone slowed the German economy ," - said President Roderick Destatis Egger at a press conference , adding that domestic demand could not fully compensate for the slowdown .

Household consumption in the euro zone 's largest economy in 2013 increased by 0.9 % , while government consumption rose by 1.1%. Export growth was 0.6 % in 2013 , compared with 3.2 % in the previous year .

Also published data on the trade balance of the eurozone. Eurozone exports fell for the first time in four months in November , showed on Wednesday data published Eurostat. Exports fell by a seasonally adjusted 0.2 percent in the month dimension, followed by zero growth in October. At the same time , lowering the import deepened to 1.3 percent of 1 percent.

While imports fell more than exports , the trade surplus rose to a seasonally adjusted up to 16 billion euros from 14.3 billion euros in October. On the basis of unadjusted trade surplus amounted to 17.1 billion euros, compared with a surplus of 16.8 billion euros in October. Expected surplus in November totaled 16.5 billion euros.

The U.S. dollar strengthened against the major currencies against the fact that the World Bank raised its forecast for global economic growth in 2014-2015 . According to forecasts , this year, the world economy will grow by 3.2% compared to the June forecast growth of 3%. The Bank expects that in 2015 global growth to reach 3.4 % compared with 3.3% projected in June. Prediction for the richest countries was revised to 2.2% from 2% . In the U.S., growth will accelerate to 2.8 % this year , while Japan's GDP will be 1.4 %. This year, the eurozone economy is expected to increase to 1.1% compared with 0.9 % reported by the World Bank in June.

The British pound rose against the U.S. dollar despite the data from the Conference Board. A leading indicator of the UK economy grew fifth consecutive month in November , suggesting that the economy will continue to expand in the coming months .

The index of leading indicators rose 0.5 percent on a monthly measurement to 108.3 in November after rising 0.4 percent in October and 1.6 percent in September. Index currently registered positive growth for the fifth month in a row.

At the same time , the coincident index , which measures the current situation in the economy, increased by 0.2 percent sequentially to 105.7 in November. This followed growth of 0.1 percent in October and 0.5 percent increase in September.

During the six months ended in November , the index of leading indicators recorded a growth of 4.5 percent , while the coincident index remained unchanged.

"Widespread increased production and job growth , along with steady support from monetary policy will contribute to the restoration ," said Conference Board Chief Economist Bart van Ark .

EUR / USD: during the European session, the pair fell to $ 1.3603

GBP / USD: during the European session, the pair fell to $ 1.6375

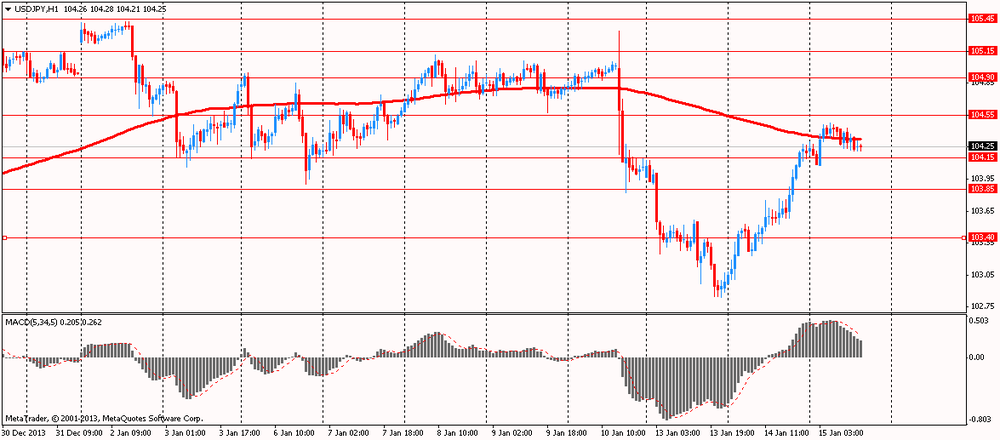

USD / JPY: during the European session, the pair fell to Y104.21

At 13:30 GMT the United States will producer price index, producer price index excluding prices for food and energy in December , Empire Manufacturing manufacturing index for January. At 19:00 GMT the United States will take the Fed's economic survey article by region " Beige Book ." At 23:50 GMT , Japan will release the change in orders for machinery and equipment, the index of activity in the service sector in November.

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3590, $1.3600, $1.3700, $1.3750, $1.3800

USD/JPY Y103.20, Y104.00, Y104.65, Y104.80, Y105.00/05, Y105.50, Y106.00, Y106.50

EUR/JPY Y143.00

EUR/GBP stg0.8300

USD/CHF Chf0.9050

EUR/CHF Chf1.2370

AUD/USD $0.8925, $0.8950, $0.9000, $0.9075, $0.9120

USD/CAD C$1.0875, C$1.0900

-

10:00

Eurozone: Trade Balance s.a., November 16.0 (forecast 16.7)

-

08:15

Switzerland: Retail Sales Y/Y, November +4.2% (forecast +2.3%)

-

07:02

Asian session: The dollar rebounded from a two-week low

00:30 Australia New Motor Vehicle Sales (MoM) December +1.8% +1.7%

00:30 Australia New Motor Vehicle Sales (YoY) December -0.5% +0.1%

02:00 China New Loans December 625 589 483

06:00 Japan Prelim Machine Tool Orders, y/y December +15.4% +28.0%

The dollar rebounded from a two-week low against the euro before the Federal Reserve releases its Beige Book business survey.

The Bloomberg Dollar Spot Index gained yesterday by the most in four weeks after two voting members of the Federal Open Market Committee called for the central bank to continue paring asset purchases even after data on Jan. 10 showed job creation was slower than economists estimated. Philadelphia Fed President Charles Plosser said yesterday he would prefer to end the central bank’s quantitative easing before late 2014. Dallas Fed President Richard Fisher said he would aim to eliminate the program entirely “at the earliest practicable date.”

Their comments followed a government report on Jan. 10 that showed U.S. employers added fewer workers in December than the most pessimistic forecast in a Bloomberg News survey of economists.

Two more regional Fed chiefs, Charles Evans from Chicago and Dennis Lockhart from Atlanta, will speak today. Neither are FOMC voting members this year.

The World Bank raised its global growth forecast yesterday to 3.2 percent this year from a June estimate of 3 percent. The Washington-based lender maintained its projection for the U.S. economy to expand 2.8 percent, a one percentage point acceleration from 2013. “Carry trades will pick up,” said Mitul Kotecha, the global head of currency strategy in Hong Kong at Credit Agricole Corporate & Investment Bank SA. “You’re going to see yield differentials widen further, particularly against the yen, and I think the yen will increasingly be used as a funding currency.”

EUR / USD: during the Asian session the pair fell to $ 1.3625

GBP / USD: during the Asian session the pair fell to $ 1.6410

USD / JPY: during the Asian session, the pair rose to Y104.50

There is a full calendar on both sides of the Atlantic Wednesday, with a string of data and central bank speakers. The European calendar gets underway at 0800GMT, when the German Destatis office will release the 2013 GDP data. Full year GDP is seen higher by 0.5% on year. Further European inflation data is set for release at 0800GMT, when the Spanish final December HICP numbers will cross the wires. At 0815GMT, the Swiss November retail sales numbers will be published. Central bank speakers kick off at 0820GMT, when Bank of Lithuania Gov. Vitas Vasiliauskas speaks in Vienna. At 1000GMT, the EMU November trade balance data will be released, with analysts looking for a E14.8 bn, up from E14.5 bn in October. ECB Executive Board member Yves Mersch will speak on "How bank unit will reinforce the monetary unit", while Bundesbank Board member Carl-Ludwig Thiele to speak on Euro success stories, with the event starting at 1300GMT.

-

06:23

Currencies. Daily history for Jan 14'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3677 +0,04%

GBP/USD $1,6438 +0,34%

USD/CHF Chf0,9023 +0,39%

USD/JPY Y104,20 +1,17%

EUR/JPY Y142,54 +1,23%

GBP/JPY Y171,29 +1,58%

AUD/USD $0,8965 -0,97%

NZD/USD $0,8380 +0,07%

USD/CAD C$1,0945 +0,79%

-

06:01

Japan: Prelim Machine Tool Orders, y/y , December +28.0%

-

06:00

Schedule for today, Wednesday, Jan 15’2013:

00:30 Australia New Motor Vehicle Sales (MoM) December +1.8% +1.7%

00:30 Australia New Motor Vehicle Sales (YoY) December -0.5% +0.1%

02:00 China New Loans December 625 589 483

06:00 Japan Prelim Machine Tool Orders, y/y December +15.4%

08:15 Switzerland Retail Sales Y/Y November +1.2% +2.3%

10:00 Eurozone Trade Balance s.a. November 14.5 16.7

13:30 U.S. PPI, m/m December -0.1% +0.5%

13:30 U.S. PPI, y/y December +0.7% +0.8%

13:30 U.S. PPI excluding food and energy, m/m December +0.1% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y December +1.3% +1.3%

13:30 U.S. NY Fed Empire State manufacturing index January 0.98 3.2

14:15 United Kingdom BOE Gov Mark Carney Speaks

14:15 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

15:30 U.S. Crude Oil Inventories January -2.7

19:00 U.S. Fed's Beige Book January

23:50 Japan Core Machinery Orders November +0.6% +1.2%

23:50 Japan Core Machinery Orders, y/y November +17.8% +11.7%

23:50 Japan Tertiary Industry Index November -0.7% +0.8%

-